-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: DXY Bid, Tsys Stabilise After Sell Off

- DXY continues to benefit from Tuesday's uptick in U.S. real yields.

- Little to flag in terms of broader macro headline flow.

- Asia-Pac markets await the return of China from LNY holiday.

BOND SUMMARY: U.S. Tsys Regain Some Poise, JGBs Sag

T-Notes recovered from their early Asia lows, after an extension through the late NY trough after the re-open. There was little to support the uptick from lows on the headline front, with the usual talk of light demand from Asia-Pac investors doing the rounds. That leaves T-Notes -0-01+ at 135-23+ on solid volume of ~250K ahead of European hours, with some light bull flattening on the cash Tsy curve after Tuesday's sharp sell off. Comments from U.S. President Biden re: fiscal a matters and China failed to move the needle, representing affirmations of previous rhetoric. Minutes from the latest FOMC decision, 20-Year supply, retail sales data and Fedspeak from Rosengren & Barkin headline the local docket on Wednesday.

- Tokyo trade saw the belly of the JGB curve underperform as the cash space cheapened, with futures closing -28, extending through their recent lows but finishing off worst levels, seemingly driving the broader weakness in the space. Longer dated swap paying was witnessed, dragging super-long swap spreads wider (spreads were generally wider across the curve). There was little in the way of notable headline flow for the space, with participants seemingly focused on the broader narratives and tomorrow's 20-Year JGB auction.

- Little to really flag for the Aussie bond space in terms of idioscyncracies, outside of the latest round of ACGB Dec '30 supply. It looks like the recent cheapening was outweighed by worries re: further extension of the reflation dynamic, which may have kept some participants at bay as the cover ratio printed at (a still healthy) ~4.00x, although the average yield still printed comfortably through mids at the time of supply. Elsewhere, it seems to have been a case of following the broader gyrations in the U.S. Tsy market, with YM -2.0 and XM -8.0 at the close, as the latter recovered from worst levels of the day alongside U.S. paper. Comments from RBA Assistant Governor Kent focused on the AUD and x-ccy basis matters, most of which was known, with markets looking through the address. The state of Victoria lifted its lockdown, in line with its schedule. Some restrictions remain in play in the state, although these are broadly inline with what was seen ahead of the imposition of the lockdown. The monthly labour market report headlines the local docket on Thursday.

BONDS: MNI Analysis: What Next For Japanese Investors Who Look Offshore?

Japanese investors have been net buyers of foreign bonds for 5 consecutive weeks (based on data from the Japanese Ministry of Finance). While the weekly purchase sizes have not been particularly large in outright terms, the direction of net flows is at least consistent. Japanese investors have also been net sellers of foreign equities in 4 of those 5 weeks, pointing to the potential for at least a degree of maintenance re: target asset weights within portfolios among the data.

- Still, even when we adjust for sales of foreign equities, Japanese investors have allotted a net ~Y2.4tn to foreign assets over the aforementioned 5 weeks (per the MoF data), all of which has flowed into bonds.

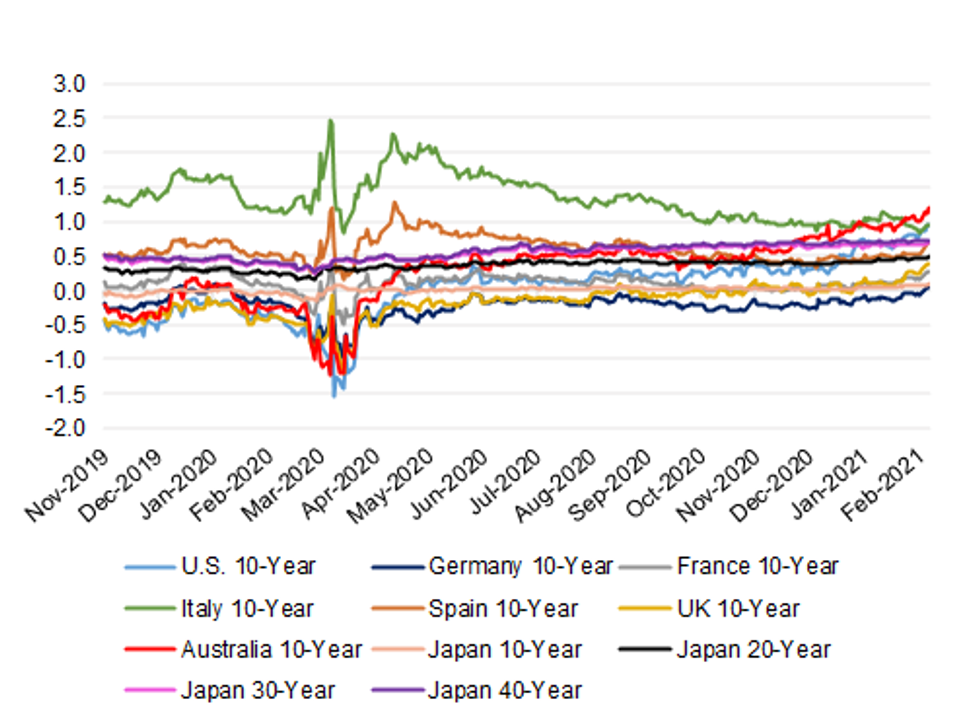

- A quick look at the FX-hedged yield backdrop for Japanese investors shows that the ECB/Draghi inspired decreditisation of BTPs and recent run of momentum behind the reflation trade leaves Australian 10-Year government bonds as a particularly attractive investment vehicle for Japanese investors.

- The same holds true in FX-unhedged terms, which is particularly important given that the sell-side points to widespread FX-unhedged positioning out of Japan when it comes to Australian assets.

Fig. 1: 3-Month Annualised Rolling FX-Hedged Yields From The Perspective Of A Japanese Investor

Source: MNI - Market News

- Available via email now, for more details please contact sales@marketnews.com.

FOREX: USD Stays Afloat Amid Broader Correction

The DXY showed at its best levels in more than a week but eased off highs as U.S. yields corrected Tuesday's surge. BBG trader sources flagged USD purchases by model-based accounts, which reportedly triggered stop-loss orders. The greenback remained one of the best G10 performers in the Asia-Pac session nonetheless, giving way only to the yen. USD/JPY pulled back from four-month highs as its RSI returned below the 70 threshold.

- NZD went offered as New Zealand reported two new Covid-19 cases in the community, although later in the day the gov't announced that the snap lockdown implemented in Auckland will expire at midnight as planned. AUD/NZD resumed gains after snapping an eight-day winning streak yesterday.

- Selling pressure hit NOK as crude oil started the session on a softer footing and the currency failed to shake off its weakness later on, even as oil recovered.

- USD/CNH extended Tuesday's gains and rose to its highest levels since Feb 9 on the last day of China's LNY market closure.

- Focus turns to the minutes from the FOMC's most recent MonPol meeting, UK inflation data, Canadian CPI, U.S. PPI, retail sales & industrial output as well as speeches from Fed's Barkin & Rosengren, BoE's Ramsden & Norges Bank Dep Gov Bach.

FOREX OPTIONS: Expiries for Feb17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000-10(E880mln), $1.2035-40(E611mln), $1.2075(E544mln), $1.2100-05(E654mln), $1.2120-40(E2.4bln-EUR puts), $1.2150-55(E527mln), $1.2170(E699mln)

- USD/JPY: Y105.35-50($735mln)

- EUR/GBP: Gbp0.8700(E781mln-EUR puts), Gbp0.8750(E501mln-EUR puts)

- EUR/CHF: Chf1.0725(E445mln), Chf1.0775(E430mln)

- USD/NOK: Nok8.40($610mln-USD puts), Nok8.50($300mln-USD puts), Nok8.80($560mln-USD puts)

- AUD/USD: $0.7615-25(A$2.1bln), $0.7750(A$759mln), $0.7850-55(A$564mln)

- AUD/JPY: Y80.00(A$636mln), Y81.75-85(A$697mln)

- USD/CAD: C$1.2650($475mln)

ASIA FX: Greenback Flows Push USD/Asia Crosses Higher

The greenback held a bid as US yields rise to the highest level in a year, equity markets in the region receded amid general risk aversion, most USD/Asia FX crosses higher.

- CNH: Offshore yuan weakened, USD/CNH making an impressive turn from lows of 6.4009 yesterday to last trade at 6.4369. Chinese markets and the PBOC will return tomorrow, market participants may be trying to gauge sentiment of the central bank.

- SGD: Singapore dollar weakened, the government announced a budget yesterday that focused support on areas in need, the budget deficit target was cut by 83% for the coming financial year, starting April 1. Elsewhere data showed non-oil domestic exports rose above estimates.

- TWD: Taiwan dollar has strengthened, USD/TWD dipping further below the 28 handle intraday, the Taiex has soared over 4% which has helped support TWD.

- KRW: The won has weakened, but is off its lows, halting a five day rally. The pair gapped higher at the open, but heads into the close at session lows around 1106. Data showed M2 money supply rose 0.4%.

- INR: Rupee opened sharply higher, tracking gains in USD. The rate has pulled back from near the lowest levels since March 2020.

- IDR: USD/IDR bounced off a six-week low Tuesday and has extended gains today. Indonesia moved to facilitate its Covid-19 vaccination scheme by making immunisation mandatory for its citizens and by allowing the private sector to offer jabs

- MYR: Ringgitt is lower, its first loss in six days. The ringgit has failed to draw support from the easing of Covid-19 restrictions in Malaysia amid caveats re: its scope.

- PHP: Peso is lower, BSP Gov Diokno told BBG that it is too early to hike interest rates and "the current policy settings are appropriate."

- THB: Baht is weaker, the BOT MPC added fuel to the fire saying it was ready to use additional policy tools if needed, while a potential no confidence vote in the PM this week also sapped demand.

ASIA RATES: Reflation Trade Keeps Pressure On Bonds

The reflation trade continues as bonds continue to sell off, yields in the US hit the highest levels in a year. A pause in the equity rally amid broad risk aversion wasn't enough to put a bid into fixed income in the region.

- INDIA: Short end saw buying ahead of slated 3-, 6-, 12-month bill auctions. Yields are higher along the rest of the curve. Meanwhile the RBI confirmed. The RBI have confirmed it will conduct simultaneous purchase and sale of government securities, another operation twist, under the banner of OMOs on Feb 25.

- SOUTH KOREA: Futures gapped sharply lower on the open, but have regained some poise as the session wears on. South Korea's finance minister said Tuesday the government is seeking to submit an extra budget bill in early March in a bid to provide targeted support to merchants and businesses hit hard by the pandemic. There is still no indication of increased issuance size to finance the extra budget bill.

- INDONESIA: Bonds fell across the curve in Indonesia after the government sold IDR 30tn against a target of IDR 35tn. Market participants await the BI rate announcement tomorrow where the consensus is for a 25bps rate cut.

GOLD: Sub-$1,800/oz

The combination of an uptick in the USD and U.S. real yields has pressured gold over the last 24 hours, with spot trading sub-$1,800/oz. These two inputs will remain key for the yellow metal, as ever, with bears now looking to the Feb 4 low at $1,785/oz.

OIL: Rally Pauses

Crude futures are broadly flat, but have recovered earlier losses seen on the back of USD strength. Given the scale of the rally in oil, the pullback/pause is seen as a technical correction in an overbought market.

- Though oil has struggled to gain, total US production has fallen by over 30%, the biggest drop ever as central US is plunged into freezing temperatures. Production in the Permian Basin, the biggest oil field in the US, has dropped by 65%.

- As a note, inventory reports from API and DOE have been delayed by one day, meaning they will released on Feb 17 and 18, respectively.

EQUITIES: Stocks Drop In Asia

A negative day for equities in Asia as the recent rally pauses, stock bourses are on track for their first negative day this week. South Korean markets are leading the way lower, pressured by Samsung who sustained losses after announcing its Texas factory would be shut down due to weather in the region. The Nikkei also fell, pulling back from a 30 year high. There is chatter of markets being in overbought territory with RSI rising above 70 in several key indices. Stocks in Taiwan bucked the trend and rallied. The market is playing catch up on its first day back from LNY, most of the strength is derived from upstream Apple suppliers, the total revenue of Apple's major suppliers rose 27.2% Y/Y. Markets in China remain closed for LNY but will return tomorrow. US stocks closed broadly flat yesterday, futures have sustained some small losses early on as yields hold their gains.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.