-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: ECB Split Remains Evident

EXECUTIVE SUMMARY

- COOK: FED'S PATH TO 2% INFLATION COULD BE LONG (MNI)

- US BANK DEPOSITS, LOANS TICKED DOWN IN LATEST WEEK, FED DATA SHOW (RTRS)

- US BANKS ON ALERT OVER FALLING COMMERCIAL REAL ESTATE VALUATIONS (FT)

- ECB’S WUNSCH: TO KEEP RAISING INTEREST RATES UNLESS WAGE GROWTH SLOWS (FT)

- ECB’S STOURNARAS SAYS RATES HAVE REACHED CLOSE TO MAXIMUM (BBG)

- PERSISTENT INFLATION A RISK TO UK, SAYS SIR DAVE RAMSDEN (TIMES)

- BOJ GOV UEDA: WILL CONTINUE MONETARY EASING FOR NOW, WITH INFLATION TO START SLOWING DOWN SOON (DJ)

- BOJ TO REVIEW A QUARTER CENTURY OF UNCONVENTIONAL EASING MEASURES (NIKKEI)

- RUSSIA’S MEDVEDEV SAYS G-7 EXPORT BAN TO TRIGGER GRAIN DEAL EXIT (BBG)

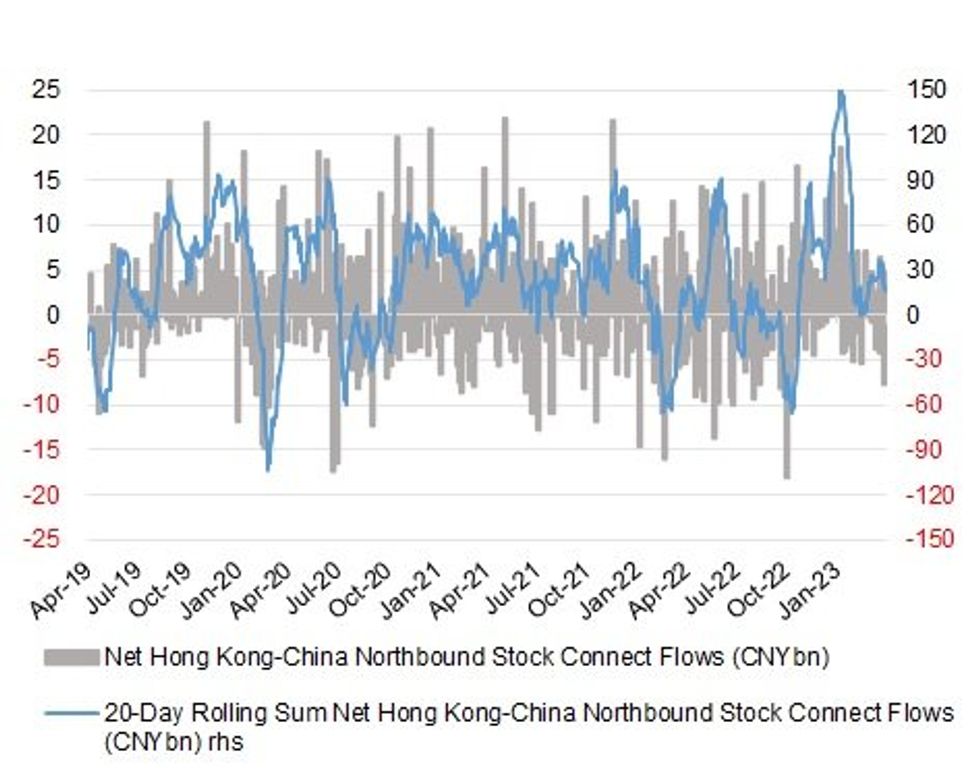

Fig. 1: Daily Net Hong Kong-China Northbound Stock Connect Flows (CNYbn)

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England must stop the risk of high inflation becoming embedded in the economy, its deputy governor has warned after the latest data showed price growth was failing to come down as fast as expected. Sir Dave Ramsden, a member of the Bank’s monetary policy committee which sets interest rates, told The Times that there were still signs of stubbornly high inflation in the economy and the Bank must not get “knocked off course” in its 18-month battle to control prices by raising interest rates. (The Times)

INFLATION: The former chief economist of the Bank of England has predicted that inflation will fall rapidly in the coming months, and advised interest rate setters to consider pausing further increases in borrowing costs. (Guardian)

POLITICS: Rishi Sunak will hold the first of a series of summits with UK corporate leaders on Monday as his ruling Conservative party seeks to repair the damage done by the Brexit years and fend off Labour’s attempts to become the party of business. (FT)

EQUITIES: A surge in profit warnings by technology businesses drove a prolific first quarter for such announcements from UK-listed companies as economic uncertainty led to delayed and cancelled contracts. (FT)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- S&P affirmed the United Kingdom at AA; Outlook revised to Stable

BANKS: Shares in British lenders gave up much of their 2023 gains in the recent upheaval that saw HSBC Holdings Plc rescue Silicon Valley Bank’s UK unit shortly before Credit Suisse Group AG was swallowed by UBS Group AG. Their first-quarter results will be scoured for signs of how the sector weathered the recent turmoil. (BBG)

EUROPE

ECB: Investors are underestimating how high eurozone borrowing costs will rise, the head of Belgium’s central bank has warned, insisting he will only agree to halt interest rate rises once wage growth starts to fall. (FT)

ECB: European Central Bank policymakers should be cautious and avoid making big or small moves in the next rate decisions, according to Governing Council member Yannis Stournaras. (BBG)

GERMANY: German public-sector workers struck a wage deal with employers, capping a confrontational series of negotiations that saw repeated strikes in Europe’s largest economy. (BBG)

FRANCE: Food inflation will continue to hit French consumers until the fall, President Emmanuel Macron said, as the government looks to crack down on big food companies’ high margins. (BBG)

FRANCE: French President Emmanuel Macron’s approval rating dropped to its lowest level in more than four years after signing into law controversial pension reform that sparked widespread protests. (BBG)

GREECE: Greece's president approved a request by Prime Minister Kyriakos Mitsotakis on Saturday to dissolve parliament and hold elections on May 21, as the country gears for a vote that is unlikely to produce an outright winner. (RTRS)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- Moody's upgraded Ireland to Aa3, Outlook Stable

- S&P affirmed Greece at BB+; Outlook revised to Positive

- S&P affirmed Italy at BBB; Outlook Stable

BANKS: Credit Suisse said on Monday 61 billion Swiss francs ($68 billion) left the bank in the first quarter, shedding light on the scale of the bank run that caused the 167-year-old institution to crumble and forced its state-engineered rescue. (RTRS)

U.S.

FED: Federal Reserve Governor Lisa Cook said Friday she's weighing the implications of recent bank turmoil against continued strength in the economy and recent evidence that suggest slower disinflation and a longer path to the Fed's 2% inflation goal. (MNI)

FISCAL: Speaker Kevin McCarthy said that the House will pass his $1.5 trillion debt-ceiling increase plan this week, but he dodged when asked if he has already secured the 218 Republican votes he needs. (BBG)

POLITICS: Americans are souring on the prospect of a 2024 election rematch between President Joe Biden and former President Donald Trump, even as that looks like the most likely scenario at this stage, according to an NBC News poll. (BBG)

BANKS: Deposits at all U.S. commercial banks dropped in the second week of April, though at smaller banks deposits held steady in a sign of stabilization in the financial institutions hardest hit by deposit outflows after last month's failure of two large regional banks. (RTRS)

BANKS: PacWest Bancorp, a regional bank left reeling following the collapse of two rival lenders last month, is exploring a sale of its lender finance arm, according to people familiar with the matter. (BBG)

BANKS: Silicon Valley Bank’s new owner is “fighting” to repair its damaged brand, stem deposit outflows and stop dozens more bankers quitting to join rivals as it attempts to rebuild the US technology bank that collapsed last month, according to one of its top executives. (FT)

BANKS: US banks are becoming increasingly worried about falling commercial property valuations and the risk they pose to lenders’ balance sheets, senior executives said this week. Office valuations in particular have been pummelled by rising interest rates and many employees’ preference for working from home since the coronavirus pandemic. (FT)

BANKS: The panic phase of the past month’s banking crisis may be ending. The big question now is how much of a hit the economy faces from any lending pullback. The answer may not be clear for months. (WSJ)

BANKS: Silicon Valley Bank's failure, along with the demise of Credit Suisse shortly thereafter, blindsided the global financial industry. Despite those shocks, the world is not in a banking crisis, Morgan Stanley Chairman and CEO James Gorman said in an interview. (Nikkei)

BANKS/RATINGS: Moody’s Investors Service downgraded 11 regional lenders Friday, suggesting higher interest rates and recent bank failures have ushered in greater instability. (WSJ)

FINANCIALS: The Biden administration is moving to make it easier to more closely regulate nonbank financial institutions such as hedge funds and money-market funds, Treasury Secretary Janet Yellen said, proposing a rollback of Trump-era procedures. (MNI)

EQUITIES/POLITICS: At least nine members of Congress sold banking stocks before and during market turmoil last month, including a member of the House financial services committee who sold Silicon Valley Bank stock before it failed. (FT)

EQUITIES: The British government is set to introduce legislation within days to establish a new regulator to police the growing dominance of big technology platforms, such as Google, Amazon and Facebook. (FT)

EQUITIES: Johnson & Johnson is poised to begin a roadshow to pitch shares of its consumer-healthcare business, the producer of household names such as Tylenol, in a test for an IPO market that has been in the doldrums for the past year. (WSJ)

EQUITIES: Bed Bath & Beyond Inc., the big-box retailer that for decades provided essential shopping for college dorms, wedding gifts and new homes, will close all of its stores and liquidate inventory over the next two months after its turnaround failed. (BBG)

MARKETS: The Vix — the volatility index popularly known as “Wall Street’s fear gauge” — is going through its biggest shake-up in years with the creation of a new version that will track expectations of short-term market swings. The 1-day Volatility Index — or Vix1d — which will be launched by exchange group Cboe on Monday, is a response to a recent transformation in derivatives markets that had sparked concerns about the effectiveness and relevance of the original Vix. (FT)

OTHER

GLOBAL TRADE: Arm is developing its own chip to showcase the capabilities of its designs, as the SoftBank-owned group seeks to attract new customers and fuel growth following a blockbuster IPO later this year. (FT)

GLOBAL TRADE: The Ministry of Economy, Trade and Industry will subsidize up to half the cost of mine development and smelting projects of important minerals by Japanese companies, Nikkei has learned. (Nikkei)

GLOBAL TRADE: The White House has asked South Korea to urge its chipmakers not to fill any market gap in China if Beijing bans Idaho-based Micron from selling chips, as it tries to rally allies to counter Chinese economic influence. (FT)

GLOBAL TRADE: South Korea and the United States need to bolster corporate exchanges and cooperation in future industry fields and to make joint efforts to ensure stable global supply chains, Seoul's top trade official said Monday. (Yonhap)

GLOBAL TRADE: Companies are expanding production outside of China to reduce the risk from rising geopolitical tensions, but the country’s dominance in world trade makes cutting it out of global supply chains impossible, one of the world’s largest container shipping groups has said. (FT)

GLOBAL TRADE: Eastern Europe countries are looking to widen recently-imposed bans on the domestic sale of Ukraine’s grains to other agricultural products from their war-torn neighbor, including sunflower oil, meat, eggs, milk, and soft fruits. (BBG)

GLOBAL TRADE: Moscow may retaliate if Group of Seven countries proceed with a total ban on most exports to Russia by withdrawing from the safe-transit deal that allows Ukraine to ship grains from Black Sea ports, said Dmitry Medvedev, deputy chair of Russia’s Security Council. (BBG)

EU/CHINA: EU foreign policy chief Josep Borrell called on European navies to patrol the disputed Taiwan Strait, in an opinion piece in a French weekly published on Sunday. (SCMP)

GEOPOLITICS: Prime Minister Giorgia Meloni is getting dragged into the escalating tensions between Washington and Beijing as she tries to disentangle Italy from its close relationship with China. (BBG)

GEOPOLITICS: China's Vice Foreign Minister Sun Weidong has lodged solemn representations with the South Korean ambassador over "erroneous" remarks by the South Korean president about Taiwan, China's foreign ministry said on Sunday. (RTRS)

GEOPOLITICS: China has launched an urgent intervention against the Philippines’ growing military alliance with the US as Asian nations get dragged into the geopolitical rivalry between Beijing and Washington. (FT)

GEOPOLITICS: Australia will seek to project military power further from its shores after a review warned the Australian defence force was structured for “a bygone era” and the security environment was “radically different”. (Guardian)

GEOPOLITICS: China and Singapore will hold joint maritime military exercise from end-April to early-May, according to a statement from China’s Ministry of National Defense. (BBG)

BOJ: Bank of Japan Gov. Kazuo Ueda said Monday that he would continue monetary easing for the time being because he expects inflation to start slowing down soon. (Dow Jones)

BOJ: The Bank of Japan is gearing up for a comprehensive assessment of its monetary moves since 1999, with new Gov. Kazuo Ueda looking to prepare for the future by taking stock of how well its unconventional methods have worked in the past. (Nikkei)

BOJ: The Bank of Japan is planning to review and inspect policies taken over the past decades, kicking off discussions as soon as at a two-day meeting scheduled for April 27 and 28 under newly-appointed Governor Kazuo Ueda, the Sankei newspaper reported Sunday, without attribution. (BBG)

JAPAN: Prime Minister Fumio Kishida's ruling Liberal Democratic Party won four of the five seats contested in Diet by-elections on Sunday, a strong showing likely to lead to calls for him to dissolve the lower house soon. (Nikkei)

JAPAN: Japanese Prime Minister Fumio Kishida said Monday he is not thinking about dissolving the lower house and calling a snap election, a day after his Liberal Democratic Party won parliamentary by-elections in four of five seats. (Kyodo News)

RBA: The long-awaited review of the Reserve Bank, released to the public last Thursday, had few surprises yet had surprising omissions. For a report that recommended profound changes to the central bank, it lacked any evidence that these changes are, in fact, necessary – beyond that other countries do things differently and that Australia should follow suit. (AFR)

RBA: Almost none of the new and current Reserve Bank of Australia board members have the typical qualifications required to serve on a foreign central bank or to set interest rates, according to economists and former bank officials. (AFR)

AUSTRALIA: The finance minister says the government is looking seriously at a recommendation to expand the single-parenting payment to more mothers, acknowledging it is "hard" to live on the current JobSeeker rate. (ABC)

AUSTRALIA/CHINA: An industry delegation from Australia, consisting of about 15 senior business executives across a range of sectors including financial services, healthcare, mining, energy, telecommunication and technology, will head to China this week for a tour, the first of its kind in three years. (Global Times)

NEW ZEALAND: The country's banks are telling the Reserve Bank that they expect mortgage borrowing is going to remain "subdued" over the next six months. (Interest NZ)

SOUTH KOREA: Even after posting the biggest operating loss on record for a South Korean company, the state-owned Korea Electric Power Corp. cannot raise rates amid political pressure from the highest office. (Nikkei)

SOUTH KOREA: South Korea's central bank and financial regulator said Monday that they will conduct a stress test on local banks under the guidelines offered by global banking watchdogs. (Yonhap)

NORTH KOREA: Defense Minister Yasukazu Hamada ordered Japan's Self-Defense Forces Saturday to be at higher readiness for the possibility of a North Korean rocket falling over Japanese territory, with one set to be launched carrying Pyongyang's first reconnaissance satellite. (Kyodo)

NORTH KOREA: South Korea and US have been working on a joint document that outlines the conditions for the US to retaliate with nuclear weapons in the event of a nuclear attack on South Korean territory by North Korea or other countries, DongA Ilbo newspaper reports, without citing anyone. (BBG)

CANADA: Canada’s massive civil service strike is poised to drag into its second week as the federal government and the union representing more than 155,000 federal workers trade barbs amid tense and slow negotiations. (BBG)

MEXICO: Mexican central bank deputy governor Jonathan Heath wrote on Twitter on Friday that inflation in the country is expected to continue trending downward, but the road will be "winding." Mexico's national statistics agency will release data on inflation in the first half of April on Monday. (RTRS)

MEXICO: Mexico President Andres Manuel Lopez Obrador said on Sunday he tested positive for Covid-19 and that his case isn’t serious. AMLO, as the president is known, said on Twitter he suspended a tour in Mexico’s southeast where he was checking on advances on the Train Maya, one of his major infrastructure projects, and that he’d returned to Mexico City. (BBG)

RUSSIA: The European Union is set to propose a ban on many goods transiting through Russia as the bloc attempts to tighten the screws on the enforcement of sanctions imposed over the past year. (BBG)

RUSSIA: The US has warned four European countries about the methods Russia is using to evade sanctions and provided them with a detailed list of the high-value dual-use goods it is trying to acquire, as Washington steps up efforts to stop Moscow procuring weapons for the war in Ukraine. (FT)

RUSSIA: The Russian government is kicking several German diplomats out of the country in an alleged tit-for-tat move, its foreign ministry said on Saturday. (POLITICO)

RUSSIA: French President Emmanuel Macron’s diplomatic efforts to enlist China’s help to intervene in Russia’s war in Ukraine has suffered another blow. (BBG)

CHILE: Chile's central bank said on Friday it will start gradually reducing its forward dollar sales operations program as of next week. (RTRS)

ARGENTINA: Argentine Economy Minister Sergio Massa dedicated his Friday to denying market speculation about President Alberto Fernandez resigning and a currency devaluation, according to a candid audio message he sent on WhatsApp to a group chat as the peso hit record lows. (BBG)

ARGENTINA: Argentine brokerage Max Capital Valores said it “deeply regretted” spreading misinformation over a currency devaluation of the nation’s official exchange rate. (BBG)

BONDS: More countries are exploring issuing new innovative bonds that penalise them for failing to meet climate change targets, in an effort to win over investors wary of issuers’ commitment to sustainability. (FT)

EQUITIES: The global market for initial public offerings is showing signs of life as a rebound in the stock market has emboldened companies to test investor appetite for new listings, particularly in Asia. But a full-fledged recovery looks distant. (BBG)

METALS: China’s largest bank is being sued by Dutch lender ING for losses suffered in a batch of copper deals in a case that highlights the risks of servicing the scandal-plagued world of commodity trading. (FT)

METALS: Fortescue Metals Group shipped a record volume of iron ore in the nine months to the end of March, and is inching closer to achieving long-awaited first shipments from its multibillion-dollar Iron Bridge magnetite project. (AFR)

METALS: Australian diversified miner South32 Ltd on Monday cut output guidance for several operations hit by wet weather and other issues in the third quarter, which sent its shares down nearly 10%. (RTRS)

GOLD: Central bankers who manage trillions in foreign exchange reserves are loading up on gold as geopolitical tensions including the war in Ukraine force them to rethink their investment strategies. (FT)

ENERGY: Russian Deputy Prime Minister Alexander Novak said on Saturday that Russia will continue to accept more payments for energy exports in the country's rouble currency and China's yuan as Moscow works to ditch U.S. dollars and euros. (RTRS)

ENERGY: Germany is seeking to open by early 2024 a controversial LNG terminal linked to infrastructure from Russia’s now-defunct Nord Stream natural gas pipeline network. (BBG)

ENERGY: Ukraine’s state energy company has held talks with ExxonMobil, Halliburton and Chevron about projects in the war-torn country as Kyiv looks to lure back foreign investment into its energy sector. (FT)

OIL: Global oil traders are fixated on the next milestone in China’s economic recovery, when travelers pack their bags and head to the airport for the Golden Week holiday in early May. (BBG)

OIL: India's dependence on Russian oil has increased to account for 30% of its imported total in March, according to a Nikkei analysis of shipping data. (Nikkei)

OIL: US crude transferred from bigger to smaller tankers will contribute to pricing of the world’s most important oil benchmark, removing what traders saw as a stumbling block in a long-planned reform. (BBG)

OIL: Canada's TC Energy on Friday said a 14,000-barrel oil spill from its Keystone pipeline in rural Kansas in December was primarily due to a progressive fatigue crack, which originated during the construction of the pipeline. (RTRS)

CHINA

POLICY: The State Council, China's Cabinet, held its first-ever themed study session on Sunday, presided over by Premier Li Qiang, with the focus on new development philosophy and high-quality development. (China Daily)

POLICY: China will actively satisfy financing demand from small and medium-sized Chinese exporters and importers, Vice Commerce Minister Wang Shouwen said on Sunday. Uncertainty in external demand remains the biggest constraint on Chinese trade, Wang told a media briefing. (RTRS)

POLICY: China has moved to tighten the rules on declaring personal assets and business connections for officials as part of the ongoing battle against corruption. (SCMP)

ECONOMY/INFLATION: China’s economy will not fall into a deflationary spiral, despite recent subdued CPI numbers, as consumption and investment are still in the initial phase of recovery and will gather pace, according to Zhang Bin, deputy director at the Chinese Academy of Social Sciences. (MNI)

ECONOMY/INFLATION: China’s economy remains in early stage of recovery and is not facing any “systematic and sustainable” deflationary pressure, Shanghai Securities News reported on Monday, citing economists. (BBG)

ECONOMY: Guangdong’s GDP grew 4% in Q1 showing "challenges remain to meet annual targets," according to the Guangdong Statistics department. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY95 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) conducted CNY115 billion via 7-day reverse repos on Monday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY95 billion after offsetting the maturity of CNY20 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at month end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0000% at 09:25 am local time from the close of 2.1688% on Friday.

- The CFETS-NEX money-market sentiment index closed at 45 on Friday, compared with the close of 53 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8835 MON VS 6.8752 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8835 on Monday, compared with 6.8752 set on Friday.

OVERNIGHT DATA

UK APR RIGHTMOVE HOUSE PRICE INDEX +0.2% M/M; MAR +0.8%

UK APR RIGHTMOVE HOUSE PRICE INDEX +1.7% Y/Y; MAR +3.0%

MARKETS

US TSYS: A Touch Firmer As Chinese & HK Equities Struggle

Tsys have firmed at the margins in Asia-Pac hours, with TYM3 last +0-03 at 114-18, at the top of its narrow 0-03+ range, on light volume of ~41K. Cash Tsys run 1-2bp richer across the curve, with the intermediate zone outperforming.

- Tsys looked to weakness in Chinese & HK equities (centred on continued worry re: U.S. actions against the tech sector) and BoJ governor Ueda pointing to no imminent change in the Bank’s YCC settings for support.

- E-minis are lower in sympathy with Chinese tech equities, shedding 0.3-0.4%.

- Hawkish rhetoric from ECB’s Wunsch did little to impact the space, given his historical leaning and recent run of such comments.

- A quick reminder that the Fed is now in its pre-FOMC blackout period. Governor Cook offered the final round of Fedspeak ahead of the weekend, but was non-committal re: the May meeting, going over well-trodden areas of debate (banking stress, credit tightening, broad-based inflation and a resilient economy), pointing to a bumpy road when it comes to bringing inflation back down to target.

- Sellers of FVM3 108.00 puts provided the highlight on the flow side overnight, but those particular screen-based flows were comfortably under 10K on the volume side.

- The latest Ifo survey out of Germany and several rounds of ECB speak headline the European docket today. Meanwhile, activity indicators from the Chicago & Dallas Feds provide the highlight of the U.S. data slate.

JGBS: Futures Back To Flat After Gov. Ueda Cools YCC Change Speculation

JGB futures are currently flat to settlement levels but have rebounded from earlier lows after BoJ Governor Ueda's comments in Parliament put an end to speculation of an imminent change to the YCC setting ahead of this week's BoJ policy decision. Governor Ueda responded to a question about the conditions required for the BoJ to consider a tweak to YCC, stating that the BoJ's inflation forecast for the next half-year, year, and year-and-a-half must be strong and close to the target rate of 2%.

- There hasn’t been much in the way of other domestic drivers.

- JBM3 remains comfortably in the range of 147.40-147.92, which it has generally traded in since early April, barring a few probes through the lower limit last week.

- Cash JGB 4-7-year zone has maintained its relative richening versus the 2-year and the 10-40-year zones. The benchmark 10-year yield is 0.2bp lower at 0.470%, below the BoJ's YCC limit of 0.50%.

- Swaps curve twist steepens pivoting in the 20-year zone. Swap spreads are marginally wider across the curve, except for the 2-year and 10-year zones.

- Looking ahead, the local calendar is light until Friday when Tokyo CPI, Retail Sales and Industrial Production data on Friday, ahead of the BoJ Policy Decision on the same day.

- The MoF is scheduled to sell 2-year JGBs on Wednesday.

AUSSIE BONDS: Treads Water Ahead Of Q1 CPI On Wednesday

ACGBs sit little changed (YM -1.0 and XM flat) at or near bests after trading in a narrow range in the Sydney session. With local news flow light ahead of tomorrow’s ANZAC Day holiday, ACGBs have been willing to be guided by US Tsys. US Tsys are marginally richer in Asia-Pac trade.

- Cash ACGBs are flat to 1bp cheaper with the AU-US 10-year yield differential -4bp at -10bp.

- Swap rates are 1bp lower with EFPs 2bp tighter.

- Bills strip is steeper with pricing flat to -4.

- Q1 CPI data is scheduled for release on Wednesday and is expected to confirm that inflation peaked at the end of 2022. According to BBG consensus, annual headline inflation is expected to slow to +6.9% from 7.8% in Q4. Trimmed Mean CPI is expected to print +1.4% Q/Q and +6.7% Y/Y versus +1.7% and +6.9%.

- According to market pricing, however, the deceleration in underlying inflation may not be enough to keep the RBA on hold with a cumulative 22bp of tightening priced by August.

- ACGB futures will trade normal SYCOM hours on either side of tomorrow’s holiday and be guided by a raft of second-tier releases with the Chicago & Dallas Feds, S&P/CS House Prices Index and New Home Sales as the highlights.

NZGBS: Little Changed Ahead Of ANZAC Day Holiday

NZGBs closed flat to 1bp richer after trading in a relatively tight range. In the absence of domestic drivers, the market was content to track US Tsys, which were 1-2bp stronger in Asia-Pac trade after a weaker close ahead of the weekend. NZGBs outperformed US Tsys with the NZ/US 10-year yield differential 3bp narrower than Friday’s local close at +58bp.

- Swap rates are flat to 2bp higher with the 2s10s curve 2bp flatter and short-end implied swap spreads wider.

- RBNZ dated OIS closed little changed with 20bp of tightening priced for the May meeting. Easing expectations for Feb-24, off the expected terminal OCR of 5.52% (July), are currently 46bp.

- The Antipodean markets are closed tomorrow for the ANZAC Day holiday ahead of the release of ANZ Business (Thu) and Consumer Confidence (Fri).

- In Australia, the calendar highlight will be the release of Q1 CPI on Wednesday.

- Ahead of the local market’s opening on Wednesday, the US data docket will see a raft of second-tier releases with the Chicago & Dallas Feds, S&P/CS House Prices Index and New Home Sales as the highlights.

EQUITIES: China/HK Weaker Further, South Korea Shares Continue To Unwind April Gains

Some of the major indices have continued to struggle today as similar themes from late last week impact sentiment. China and Hong Kong markets have weakened further, while there have been some pockets of strength in the region, gains have been modest for the most part. US futures opened weaker and have stayed negative through the Asia Pac session, last -0.30% weaker.

- The CSI 300 is off by a further 0.43% at this stage, leaving the index very close to its 200-day MA (4014.3, versus last levels of 4015.20). Weakness looks to be a carry over from last week, with the threat of further investment curbs from the US weighing, particularly in the tech space. Northbound stock connect flows are negative so far today, -1.54bn yuan. This comes after decent -7.62bn yuan in outflows from last Friday.

- The Golden Dragon Index ended last week on a softer footing, while the HSI is off by 0.63% in the first half of trading today, although the tech sub index is outperforming (+0.2%).

- South Korean shares are underperforming, down 0.83% for the Kospi as we continue to see some unwinding of recent outperformance. The Taiex is faring better, close to flat, despite a negative lead from the SOX on Friday.

- Japan shares are modestly higher, the Topix +0.18, while Australian shares are around flat.

- In SEA, Philippine shares have outperformed, up 0.88%, as markets return from Friday's holiday. Most other markets are in the red though.

GOLD: Better US Data And Fed Hiking Prospects Weigh On Bullion

Gold prices were 1% lower last week after trading in a range of $1969.31 to $2015.09. They fell 1.1% on Friday after optimistic US data. Today they are down slightly to $1980.55/oz and close to the intraday low of $1978.59, as the USD index is up 0.1%. Support is at $1969.30, the April 19 low.

- Bullion has been unable to reverse Friday’s losses during the APAC session, as expectations of further Fed hikes persist. This week there will be important data for the May 3 Fed decision, including Q1 GDP and March core PCE prices.

- The German Ifo survey for April is released later today and also the US Chicago and Dallas Fed Indices. The upbeat April US PMIs on Friday weighed on bullion and so good reads from the Fed indices could also be negative.

OIL: Crude Down During APAC Trading As Demand Worries Dominate

Oil prices have unwound all of Friday’s gains and are down over 1% during the APAC session. WTI is 1.2% lower to $77.02/bbl and Brent -1.0% to $80.82. The USD index is up 0.1%.

- WTI is trading around its intraday low of $76.98. The high was $77.99 earlier. It is holding above its simple 50-day moving average of $76.54 but has just broken through the 100-day moving average of $77.05. Brent is also around its intraday low of $80.75. The high earlier was at $81.87. It is now below its key simple moving averages. Oil prices fell over 5% last week.

- Demand worries drove oil during APAC trading, as Asian refiners threaten to reduce output as margins shrink and US recession concerns persist. But China’s Golden Week holiday starts on the weekend and could boost demand for plane fuel.

- Bloomberg is reporting that Russian refineries have cut output for maintenance and because of official cutbacks.

- The German Ifo survey for April is released later today and also the US Chicago and Dallas Fed Indices. The upbeat April US PMIs on Friday boosted crude and so good reads from the Fed indices today could also be signalling better demand conditions. This week there will be important data for the US growth outlook and May 3 Fed decision, including Q1 GDP and March core PCE prices.

FOREX: Weaker Commodities Continue To Weigh On AUD/USD, USD/JPY Dip Sub 134.00 Supported

The USD has mostly been on the front in the first part of trading this week. We sit close to session highs for the BBDXY, last around 1226.75. This is below highs from late last week (around 1228.70), but the USD has generally been supported on dips. Weaker equities and commodities have aided the USD, with little flow on effects from the pull back in UST yields (-1.0-1.7bps lower across the curve) on the dollar.

- USD/JPY started the session on the back foot, back down through 134.00 but quickly recovered to back in the 134.40/50 region now. New BoJ Governor Ueda spoke in parliament and appeared to push back against any fresh YCC tweaks at Friday's policy meeting. Friday highs in USD/JPY came close to 134.50, so this act as a near term focus point for the market.

- AUD/USD remains on the back foot, down to 0.6675, off by a further 0.25%. This is through Friday session lows. Iron ore has fallen again, down nearly 3% in terms of the active Singapore contract to $105/ton. Oil has also weakened, along with gold.

- NZD/USD is a touch lower, but is outperforming the AUD at the margins. NZD last at 0.6135. Note tomorrow is ANZAC day in AU and NZ, which will leave both markets closed and may have impacted liquidity today.

- EUR/USD is touch lower, last near 1.0980, while GBP/USD steady around 1.2435.

- Looking further ahead, we have the German IFO out later, along with the ECB's Panetta. In the US, the Dallas Fed manufacturing survey is the main focus point from a data standpoint.

FX OPTIONS: Expiries for Apr24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0930-35(E737mln), $1.1000(E574mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/04/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/04/2023 | 0900/1100 |  | EU | ECB Panetta Panels Event by Bruegel Think Tank | |

| 24/04/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/04/2023 | 1330/1530 |  | EU | ECB Panetta Into at ECON Hearing on Digital Euro | |

| 24/04/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 24/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.