-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: ECB Views Continue To Filter Out, Further Hikes Remains Consensus View

EXECUTIVE SUMMARY

- YELLEN: U.S. BANKS MAY TIGHTEN LENDING AND NEGATE NEED FOR MORE RATE HIKES (RTRS)

- ECB’S LAGARDE SAYS SHE CAN’T IMAGINE U.S. WILL DEFAULT ON DEBT (BBG)

- ECB’S NAGEL: EURO ZONE INFLATION COULD GET STUCK ABOVE TARGET (RTRS)

- ECB’S VILLEROY REPEATS VIEW THAT RATE-HIKING CYCLE NEARING END (BBG)

- ECB’S CENTENO: SHOULD SLOW OR PAUSE RATE HIKES IN MAY (BBG)

- ECB’S REHN: MUST ‘CARRY ON AND ACT CONSISTENTLY’ WITH INTEREST RATE HIKES (CNBC)

- ECB’S WUNSCH: PEAK RATE 3.5-4% GOOD STARTING POINT (MNI)

- ECB’S SIMKUS: CORE INFLATION JUMP NEEDED FOR 50BP (MNI)

- BANK OF ENGLAND'S TENREYRO: PATIENCE NEEDED TO LOWER INFLATION (RTRS)

- BANK OF ENGLAND CONSIDERS MAJOR REFORM OF DEPOSIT GUARANTEE SCHEME (FT)

- GLOBAL REGULATORS SET SIGHTS ON STRICTER BANKING RULES (FT)

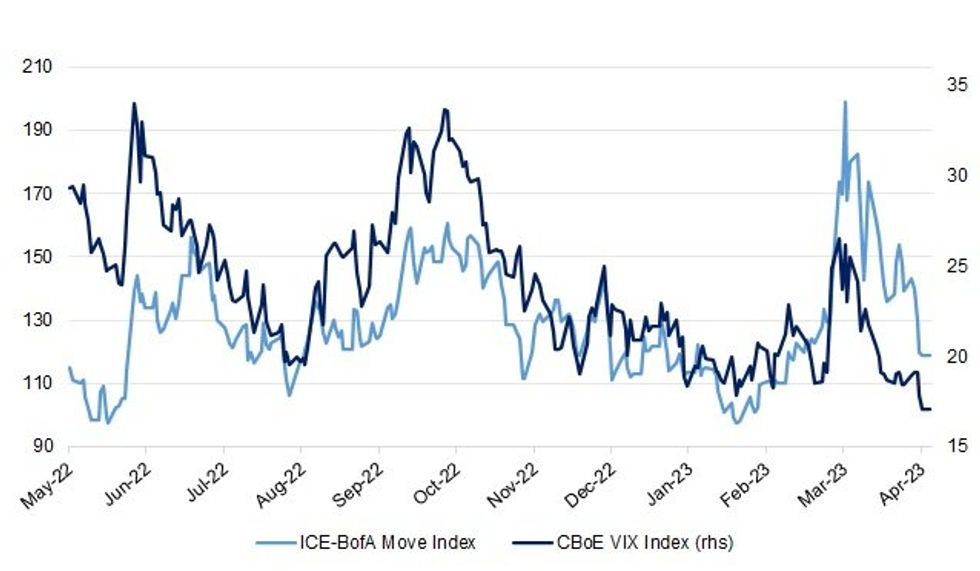

Fig. 1: ICE-BofA Move Index Vs. CBoE VIX Index

Source: MNI - Market News/Bloomberg

UK

BOE: Bank of England policymaker Silvana Tenreyro said on Friday past interest rate rises would take time to bear down on inflation, and that it was important not to over-adjust policy while the impact of these past rate rises was feeding through. (RTRS)

BOE/BANKS: The Bank of England is considering a major overhaul of its deposit guarantee scheme, including boosting the amount covered for businesses and forcing banks to pre-fund the system to a greater extent to ensure faster access to cash when a lender collapses. The UK’s Financial Services Compensation Scheme is being urgently reviewed after the rapid failure of Silicon Valley Bank last month, when billions were withdrawn in panic from SVB’s UK subsidiary overnight, people briefed on the BoE’s thinking told the Financial Times. (FT)

ECONOMY: Chancellor Jeremy Hunt says Britain's economy is "back", and that his strategy for growth has been welcomed at the International Monetary Fund meeting in Washington. (BBC)

ECONOMY: Confidence among finance chiefs at the UK's biggest companies has seen its sharpest rise since 2020. The Deloitte survey of chief financial officers showed sentiment rebounded as their concerns about energy prices and Brexit problems eased. There were 25% more CFOs feeling better about the future than worse, compared to 17% more feeling the opposite three months ago. Not since the Covid vaccine rollout has there been such a swing in confidence. (BBC)

FISCAL/POLITICS: Rishi Sunak is considering cutting the UK’s unpopular inheritance tax ahead of the next general election, people familiar with the matter said, a move senior Conservatives think will give his ruling party a major boost as it tries to overcome a double-digit deficit in opinion polls. (BBG)

FISCAL/POLITICS: Escalating nurse strike action in England by withdrawing protection for emergency hospital care will endanger patient safety, an NHS leader has warned as the government said a "full and final" pay offer had been made to staff. (Sky)

ECONOMY/POLITICS: Royal Mail and union negotiators have reached an agreement which could signal the end of a long-running pay dispute. (BBC)

POLITICS: Overall, however, the advert and the row it triggered seem not to have harmed Labour, which still retains a healthy six-point lead over the Tories on the issue of crime, down just one point a fortnight ago. Labour’s lead is also back up to 14 points, having dipped to a recent low of 11 points last week, with Starmer’s party standing on 42% (up one point on the week) and the Tories on 28% (down two points). (Observer)

POLITICS: With local elections less than three weeks away Rishi Sunak and Sir Keir Starmer are stepping up the “drum beat” of campaigning. (The Times)

POLITICS: Greg Hands, the UK Conservative chair, has warned that his party is expected to lose more than 1,000 seats at the local elections on May 4. (BBG)

EUROPE

ECB: European Central Bank President Christine Lagarde said she doesn’t foresee the US defaulting on its debt, saying such an outcome would have dire consequences around the world. (BBG)

ECB: The European Central Bank needs to keep raising interest rates even if most of its past hikes have yet to feed through to the economy, as rapid price growth was at risk of getting entrenched, German central bank chief Joachim Nagel said on Friday. (RTRS)

ECB: European Central Bank Governing Council member Francois Villeroy de Galhau reiterated his view that the aggressive interest rate hiking cycle needed to tamp down high euro zone inflation is nearing an end. (BBG)

ECB: A quarter-point increase in interest rates is the most the European Central Bank has to deliver at its next meeting, Governing Council member Mario Centeno said, playing down concerns over the strength of underlying inflation. (BBG)

ECB: The European Central Bank must “carry on and act consistently” with interest rate hikes as it continues its efforts to tackle high inflation, policymaker Olli Rehn said Friday. (CNBC)

ECB: Recent market expectations of a peak European Central Bank deposit rate of between 3.5% and 4% look about right, but inflation could remain slightly above the 2% target for some time, Belgian National Bank Governor Pierre Wunsch told MNI, adding that a U.S. hard landing could also influence eurozone monetary policy. (MNI)

ECB: The European Central Bank should raise interest rates by 25 or 50bp at its May monetary policy meeting, the governor of the Central Bank of Lithuania told MNI in an interview, although he added that a larger-than-expected upwards move in core inflation would be needed to justify another half-point hike. (MNI)

ECB: The European Central Bank is set for three more quarter-point increases in interest rates in May, June and July, economists polled by Bloomberg say. That would take the deposit rate to 3.75%, where it would stay through the rest of the year, according to the April 5-13 survey. (BBG)

ECB: Three women are seen as the top contenders to become the European Central Bank's new supervisory chief, with Germany's Claudia Buch considered the clear favorite, conversations with a dozen sources with direct knowledge indicate. (RTRS)

EU: German Finance Minister Christian Lindner called French President Emmanuel Macron’s call for the European Union to strive for strategic autonomy “naive,” especially given “nuclear superpower” Russia’s war in Ukraine. (BBG)

GERMANY: Germany’s BDI industry association expects exports to grow by 2% in 2023, double its forecast in January, its president told the Rheinische Post newspaper in comments published on Saturday. (RTRS)

FRANCE: Emmanuel Macron enacted his controversial pension reform on Saturday after clearing a constitutional hurdle, allowing the French president to try to move past the episode that’s sparked months of protests and dented his popularity. (BBG)

SNB: The Swiss National Bank may need to raise borrowing costs more, according to President Thomas Jordan. “We can’t exclude that we might have to tighten monetary policy again,” Jordan told reporters Friday in Washington, where he’s attending meetings of the International Monetary Fund and World Bank. (BBG)

SNB: The Swiss National Bank will complete its tightening cycle in June before keeping rates constant for more than a year, according to a Bloomberg survey of economists. Officials will round off 225 basis points of interest-rate increases with a final 25 basis-point step, bringing the policy rate to 1.75%, according to the median forecast in the poll conducted April 5-13. After that they will hold through September 2024, when a cut is seen. (BBG)

SWITZERLAND/BANKS: Switzerland’s finance department received two state liability claims from shareholders in the past few weeks in relation to Credit Suisse Group AG, a spokeswoman said in response to questions from Bloomberg News. (BBG)

NORWAY: Workers across several industries in Norway will strike after failing to secure a wage deal with employers in the energy-rich Nordic nation. (BBG)

RATINGS: Sovereign credit rating updates of note from after hours on Friday include:

- Fitch affirmed Croatia at BBB+; Outlook Stable

- Fitch affirmed Portugal at BBB+; Outlook Stable

- DBRS Morningstar confirmed Malta at A (high), Stable Trend

U.S.

FED/ECONOMY: The economy is proving more resilient and inflation more stubborn than economists expected a few months ago, and as a result the Federal Reserve will keep interest rates high for longer, according to The Wall Street Journal’s latest survey of economists. (WSJ)

FED: Federal Reserve Governor Michelle Bowman said on Friday that the recent failures of Silicon Valley Bank and Signature Bank were not an indictment of the bank regulatory landscape, although she conceded that some changes may be warranted. (RTRS)

FED/BANKS: U.S. Treasury Secretary Janet Yellen said banks are likely to become more cautious and may tighten lending further in the wake of recent bank failures, possibly negating the need for further Federal Reserve interest rate hikes. (RTRS)

BANKS: Deposits at U.S. commercial banks rose in early April, continuing a stabilizing trend after large outflows following last month's failure of two large regional banks and worries about the safety of the banking system as a whole. (RTRS)

BANKS/BONDS: Bond investors will pay a lot more attention than usual to the latest US quarterly bank results as they assess the potential hit to economic growth from any slide in lending. (BBG)

ECONOMY: Last month’s upheaval within the banking sector hasn’t pushed America off course from achieving a soft landing, Treasury Secretary Janet Yellen told CNN’s Fareed Zakaria in an exclusive interview Friday. (CNN)

INFLATION: U.S. inflation may be higher than government statistics have shown because of big seasonal adjustments earlier in the year and because those filters haven't properly accounted for the Ukraine war, former Fed staffer and expert on seasonal adjustments Jonathan Wright told MNI. (MNI)

FISCAL: A failure by Congress to raise the U.S. debt ceiling could spark a “manufactured” crisis that derails economic progress, Deputy Treasury Secretary Wally Adeyemo said Friday. (CNBC)

MARKETS: Hedge funds and other parts of the shadow banking system should face greater scrutiny after last month’s upheaval in US government bonds, the country’s top markets regulator has said, reflecting concerns that speculative investors pose a risk to financial stability. (FT)

US TSYS: The U.S. Treasury asked primary dealers Friday again whether it should make debt repurchases to support liquidity and for maturity management, also seeking input about future Treasury bill sales to restore the cash balance after the debt limit issue is resolved in Congress. (MNI)

EQUITIES: Merck & Co. will buy Prometheus Biosciences Inc. for about $10.8 billion, a 75% premium to Friday’s close, in a bid to bolster its research pipeline and strengthen its portfolio of autoimmune drugs. (BBG)

OTHER

GLOBAL TRADE: China is starting to target western interests in the country after five years of snowballing trade and technology restrictions spearheaded by the US under presidents Donald Trump and Joe Biden. (FT)

GLOBAL TRADE: More than 200 companies from myriad sectors have applied for CHIPS Act funding, Commerce Secretary Gina Raimondo told CNBC’s Jim Cramer on Friday, as part of what Raimondo called a mandate to invest ”$50 billion in America’s national security.” (CNBC)

GLOBAL TRADE: The European Union is considering restricting overseas investment by European companies in sensitive fields like artificial intelligence, quantum computing and biotechnology, aiming mainly to keep it out of the hands of China's military. (Nikkei)

GLOBAL TRADE: European Commission Executive Vice President Valdis Dombrovskis said on Friday that the bloc wants to move quickly on a trade agreement with the United States for electric vehicle battery minerals and was optimistic on reaching a green steel and aluminum pact with Washington by October. (RTRS)

GLOBAL TRADE: Taiwan Semiconductor Manufacturing Co. plans to cut its capital expenditure for this year to $28 billion-$32 billion, Taipei-based Economic Daily News reports, citing unidentified people from the industry. (BBG)

GLOBAL TRADE: Unilateral action on trade by European Union member states is unacceptable, the bloc's executive said on Sunday, after Poland and Hungary announced bans on grain and other food imports from Ukraine to protect their local agricultural sectors. (RTRS)

G7: Top diplomats from Group of Seven countries have telegraphed what is likely to be in a joint statement expected to be released at the conclusion of a foreign ministers’ summit Tuesday, with officials stressing the importance of unity amid challenges in Asia as Chinese assertiveness rises, especially around Taiwan, and North Korean missile launches continue. (Japan Times)

U.S./CHINA: China is refusing to let US secretary of state Antony Blinken visit Beijing over concerns that the FBI will release the results of an investigation into the downed suspected Chinese spy balloon. (FT)

U.S./CHINA: Montana became the first US state on Friday to pass legislation banning TikTok on all personal devices, sending a bill to Gov. Greg Gianforte prohibiting TikTok from operating within state lines and barring app stores from offering TikTok for downloads. (CNN)

U.S./CHINA: China's commerce ministry said on Saturday the country "resolutely opposes" the sanctions the United States placed on some Chinese firms over their alleged involvement with Russia, state media reported. (RTRS)

U.S./CHINA/TAIWAN: The U.S. warship USS Milius sailed through the Taiwan Strait on Sunday, in what the U.S. Navy described on Monday as a "routine" transit, just days after China ended its latest war games around the island. (RTRS)

CHINA/TAIWAN: China launched a weather satellite on Sunday as civilian flights altered their routes to avoid a Chinese-imposed no-fly zone to the north of Taiwan which Beijing put in place because of the possibility of falling rocket debris. (RTRS)

EU/CHINA/TAIWAN: The relationship between China and Europe will be determined by Beijing’s behaviour, including what happens with Taiwan, the European Union’s foreign policy chief said on Sunday. (Irish Times)

EU/CHINA/TAIWAN: China's top diplomat Wang Yi "hopes and believes" Germany will support China's "peaceful reunification" with Taiwan, the Chinese foreign ministry said in a statement on Saturday. (RTRS)

EU/CHINA: Germany’s Interior Ministry is examining all Chinese components that are already installed in the country’s 5G network, Minister Nancy Faeser was quoted as saying on Sunday, as Berlin re-evaluates its relationship with top trade partner China. (RTRS)

GEOPOLITICS: Indo-Pacific nations oppose having their futures “dictated by a single major power,” Australian Foreign Minister Penny Wong said, as the region faces an intensifying struggle for influence between the US and China. (BBG)

GEOPOLITICS: Russian President Vladimir Putin held a working meeting with Chinese defense minister Li Shangfu in Moscow on Sunday, Tass news agency cited Kremlin spokesman Dmitry Peskov as saying. (RTRS)

JAPAN: Japan's Prime Minister Fumio Kishida has vowed to boost security as ministers from overseas visit the country, after an apparent smoke bomb was thrown at him. He was evacuated unharmed on Saturday from a public event, with witnesses describing a person throwing an object, followed by smoke and a loud bang. (BBC)

BOJ: If new Bank of Japan Gov. Kazuo Ueda makes any monetary policy changes, careful communication with markets will be key in order to mitigate ripple effects on markets, Tobias Adrian, director of the International Monetary Fund's monetary and capital markets department, told Nikkei. (Nikkei)

RBA: The Reserve Bank of Australia will be forced to hike rates to 4% or higher and then hold them for a substantial period to reduce inflation to target, despite its insistence on seeing evidence of excessive wage growth before further tightening and Governor Philip Lowe’s caution over financial stability risks, former senior RBA officials told MNI. (MNI)

RBA: Australian Treasurer Jim Chalmers said an independent review of the Reserve Bank has made some recommendations that will require changes to the institution’s operating legislation, while adding that he expects to release the report in the next week or so. (BBG)

AUSTRALIA/CHINA: The Australian government is optimistic that punitive trade sanctions imposed by the Chinese government on Australia’s exports could be lifted by the end of this year, after Beijing announced a review of barley tariffs it imposed during a low-point in relations between the two countries. (BBG)

BOK: Bank of Korea sees South Korea’s inflation slowing to a 3% level in 1H, Maeil Business Newspaper says, citing Governor Rhee Chang-yong’s comments made to the press during his visit to the US. (BBG)

BOK: Bank of Korea Governor Chang Yong Rhee said on Friday last year's currency intervention served as a "stabilizer" to rein in the won's sharp depreciation against the dollar, rather than a replacement of sound economic management. (RTRS)

BOK: Bank of Korea Governor Rhee Chang-yong said on Friday the biggest challenge for emerging market central banks could be to deal with a return of secular stagnation and low interest rates, rather than combatting higher inflation. (RTRS)

BOK: South Korea's exports to China are likely to remain weaker than expected for now before recovering in the second half of this year as the benefits of the reopening of the world's no. 2 economy start to filter through, the central bank said on Monday. (RTRS)

SOUTH KOREA: South Korea isn’t considering a supplementary budget for now, Korea Economic Daily says, citing Finance Minister Choo Kyung-ho’s comments made to the press during his visit to the US. (BBG)

NORTH KOREA: A South Korean Navy vessel fired warning shots to drive out a North Korean patrol boat that crossed the western de facto maritime border last week, the South's military said Sunday. (Yonhap)

NORTH KOREA: South Korea, the United States and Japan will stage joint naval missile defence exercises on Monday as they push for greater security cooperation to better counter North Korea's evolving missile threats, Seoul's navy said. (RTRS)

HONG KONG: Hong Kong needs more national security legislation because the current National Security Law is largely focused on issues related to the political protests of 2019, Security Secretary Chris Tang told RTHK. (BBG)

BOC: Bank of Canada Governor Tiff Macklem on Friday suggested quantitative tightening is likely to continue for a while on the current path of allowing maturing securities to roll off the central bank’s books. (MNI)

BRAZIL: Brazil's Planning Ministry announced on Friday a zero primary deficit target for 2024, but stated that 172 billion reais ($35.03 billion) in government spending depend on the approval of a proposed new fiscal framework. (RTRS)

RUSSIA: Heavy fighting gripped the Ukrainian city of Bakhmut Sunday, as Russia claimed small advances while Ukraine said the intensity of the battle had reached its highest level yet. (WSJ)

RUSSIA: A new international economic support package of $115 billion gives Ukraine more confidence that it can prevail in battling Russia's invasion, amid growing recognition that the war could continue for longer than expected, Ukrainian Finance Minister Serhiy Marchenko said on Saturday. (RTRS)

RUSSIA: Ukraine secured promises of $5 billion in additional funding to support its ongoing fight against Russia amid "fruitful meetings" in Washington this week, Ukrainian Prime Minister Denys Shmyhal told reporters on Friday. (RTRS)

RUSSIA: Russia's economy ministry sees oil and gas exports declining by 6.7% in real terms in 2023, the TASS news agency reported. The exports are expected to grow by 2.9% on average in 2024-2026, it added. (RTRS)

RUSSIA: Russia still plans to post a budget deficit of no more than 2% of gross domestic product (GDP) in 2023, Finance Minister Anton Siluanov said in a televised interview on Friday. (RTRS)

SOUTH AFRICA: Power outages in South Africa exceeded 7,001 megawatts last week, placing the country at two stages above the so-called stage 6 blackouts implemented by the state electricity utility, the Sunday Times reported. (BBG)

SOUTH AFRICA: South Africa’s government has requested more information from the state-controlled post office about financial problems that threaten its survival. (BBG)

INDIA: The biggest threats to India’s economic growth would likely come from forces outside the country, Finance Minister Nirmala Sitharaman said, citing the risk of higher oil prices and the impacts from Russia’s war in Ukraine. (BBG)

SOUTH AFRICA: South Africa will not fall into recession this year despite a gloomy International Monetary Fund forecast and a contraction in the last three months of 2022, Finance Minister Enoch Godongwana told Reuters in an interview on Friday. (RTRS)

COLOMBIA: Colombia is looking to issue a green bond before the end of this year, likely in dollars, and could tap traditional credit markets again this year if rates fall, finance minister Jose Antonio Ocampo said on Friday. (RTRS)

PERU: Peru's central bank on Friday projected that annual inflation will continue to trend downward in the coming months, with a return to the bank's target range in the fourth quarter of 2023. (RTRS)

ISRAEL: Benjamin Netanyahu has long cultivated an image as Israel’s “Mr Security”, and the ultranationalist partners in his coalition government campaigned relentlessly on the need for a hardline stance against Palestinian militants. But as the administration faced missiles salvos from Lebanon, Syria and the Gaza Strip during the Passover festival that ended on Wednesday, as well as a series of deadly attacks at home, it came under fire from its own supporters for not mounting a more aggressive response. (FT)

ISRAEL: Prime Minister Benjamin Netanyahu defended the strength of Israel’s democracy after Moody’s lowered the country’s credit outlook because of a planned judicial overhaul that has spurred mass protests. (BBG)

ISRAEL: Israeli Finance Minister Bezalel Smotrich on Sunday said Moody's decision to cut the outlook for Israel's sovereign credit rating was "not a big drama" and that the government's plan to overhaul the judiciary would help the economy. (RTRS)

ISRAEL/IRAN: The long shadow war between Iran and Israel is moving into an unpredictable new phase after one of the Islamic Republic’s most powerful military commanders began rallying allies across the Middle East to launch a fresh wave of attacks on Israeli targets. (WSJ)

ISRAEL/SAUDI ARABIA: A delegation of top officials from the militant Palestinian group Hamas, which rules the Gaza Strip, is headed to Saudi Arabia after years of frosty relations, dealing another setback to Israel’s hope to normalize ties with the Gulf kingdom and isolate Hamas’s patron, Iran. (BBG)

IMF: International Monetary Fund Managing Director Kristalina Georgieva said on Friday debtors and creditors made "tangible progress" on debt restructuring issues this week, but called for early reprofiling of debts for countries facing problems. (RTRS)

IMF: International Monetary Fund Managing Director Kristalina Georgieva said on Friday debtors and creditors made "tangible progress" on debt restructuring issues this week, but called for early reprofiling of debts for countries facing problems. (RTRS)

BANKS: Global regulators are considering stronger rules on smaller banks and requiring all lenders to be prepared for faster runs on deposits after the recent financial turmoil shook confidence in banks and rocked markets on both sides of the Atlantic. (FT)

METALS: China plans to cap domestic steel mills’ 2023 output at 1.018 billion tons, unchanged from last year, to manage the post- pandemic recovery and control oversupply. The planned limit on production will be reviewed in the second half of the year and may be subject to change, Caixin learned from multiple sources. A formal policy document hasn’t been released. (Caixin)

METALS: BHP Group said its iron ore operations in Western Australian were running as normal after cyclone Ilsa made landfall on Friday, a spokeperson said on Monday. (RTRS)

ENERGY: The Group of Seven rich nations have agreed to speed up the transition to clean energy sources and accelerate the phasing out of unabated fossil fuels, the communique released by the group showed on Sunday. (RTRS)

ENERGY: The world "absolutely" needs new gas investment while Russia's war in Ukraine keeps supply risks high, US Assistant Energy Secretary Andrew Light said April 16 as G7 leaders adopted an agreement acknowledging a role for gas over objections that it should be abandoned to slow climate change. (S&P Global)

ENERGY: The world is becoming awash with natural gas, pushing prices lower and creating an overabundance of the fuel in both Europe and Asia — at least for the next few weeks. (BBG)

CHINA

POLICY: China’s economy requires stronger policy guidance to stabilise employment, according to a recent State Council executive meeting chaired by Premier Li Qiang. (MNI)

PBOC: Price stability and financial stability have to be considered in tandem during times of stress, People's Bank of China Governor Yi Gang said in Washington on Saturday. (MNI)

PBOC/YUAN: China is seeking a "level playing field" for use of the renminbi in international trade, PBOC governor Yi Gang said in Washington on Saturday, with households and enterprises free to use other currencies if desired, although he noted that larger investors may prefer to reduce their FX exposure by trading in yuan. (MNI)

FISCAL: Import duty, import value-added tax and consumption tax will be exempted for imported exhibits sold within a duty-free quota during the Canton Fair 2023, China's finance ministry said on Saturday. Goods such as tobacco, alcohol and automobiles will not enjoy the tax breaks at the fair that begins this weekend, the ministry said in a statement. (RTRS)

POLICY: China should combine policies that support domestic demand and deepen supply-side structural reforms to ease the markets deflation concerns, according to Guan Tao, former director of the State Administration of Foreign Exchange. (MNI)

POLICY: China will promote high-quality reforms for the Regional Comprehensive Economic Partnership (RCEP), according to Ye Fujing, director at the China Macro Economy Research Institute. (MNI)

ECONOMY: China needs to ensure sufficient power supplies for the summer as the economy improves, according to an Economic Daily commentary on Monday. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY22 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) conducted CNY20 billion via 7-day reverse repos and CNY170 billion via 1-year MLF on Monday, with the rates unchanged at 2.00% and 2.75%, respectively. The operation has led to a net injection of CNY22 billion after offsetting the maturity of CNY18 billion reverse repos and CNY150 billion MLF today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0339% at 10:05 am local time from the close of 2.0154% on Friday.

- The CFETS-NEX money-market sentiment index closed at 43 on Friday, compared with the close of 50 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8679 MON VS 6.8606 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8606 on Monday, compared with 6.8606 set on Friday.

OVERNIGHT DATA

CHINA MAR NEW HOME PRICES +0.44% M/M; FEB +0.30%

NEW ZEALAND MAR BNZ-BUSINESSNZ PERFORMANCE SERVICES INDEX 54.4; FEB 55.8

Expansion levels for New Zealand’s services sector decreased in March, according to the BNZ-BusinessNZ Performance of Services Index (PSI). The PSI for March was 54.4 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was down 1.4 points from February, but still above the long-term average of 53.6 for the survey. (BusinessNZ)

NEW ZEALAND MAR FOOD PRICES +0.8% M/M; FEB +1.5%

MARKETS

US TSYS: Curve Twist Flattens

Cash Tsys sit ~1bp cheaper to ~1bp richer across the curve into London hours, twist flattening, pivoting around 5s. Tsys ticked away from session cheaps after a lack of follow through on the initial move higher in yields at the cash re-open (which was driven by Asia-Pac reaction to Friday’s news flow and bear flattening), with ranges remaining contained. Note that none of the major cash Tsy benchmarks managed to better their respective Friday yield peaks during the early move. TYM3 is +0-02 at 114-29+, just off the peak of a narrow 0-05 range. Volume in the contract runs at a mundane ~57K.

- Weekend headline flow was dominated by familiar ECB speak and sources of geopolitical tension, in addition to Tsy Secretary Yellen pointing to the potential for less Fed tightening owing to credit conditions. Asia-Pac news flow was particularly light.

- In the background we also flag the latest WSJ survey, which noted that "the economy is proving more resilient and inflation more stubborn than economists expected a few months ago, and as a result the Federal Reserve will keep interest rates high for longer.”

- Empire Manufacturing & NAHB housing market readings will be seen in the NY session. We will also hear from Fed's Barkin, BoE’s Cunliffe & ECB’s Lagarde. Charles Schwab probably presents the highlight of the day’s corporate earnings releases (see our earnings release schedule here).

JGBS: Futures Add To Overnight Losses, Curve Twist Steepens

JGB futures added to the bearish impulse derived from U.S. Tsy price action on Friday, extending through post-Tokyo lows registered ahead of the weekend, printing -30 into the bell, a few ticks off session lows. Wider cash JGB trade has seen some twist steepening, with the major benchmarks running 1.0bp richer to 2.0bp cheaper, little changed to richer through 5s and cheaper beyond that point. Cash 10s trade around 0.48% in yield terms, ~2bp off the BoJ’s YCC cap. Swap spreads are wider across the curve, pointing to payside swap flows adding an extra layer of pressure to the JGB weakness (once again most likely influenced by Friday’s broader price action). Local headline flow has been limited since the re-open.

- The weekend saw a reiteration of rhetoric from the IMF re: the BoJ, with the director of the Fund's monetary and capital markets department telling the Nikkei that “if new Bank of Japan Gov. Kazuo Ueda makes any monetary policy changes, careful communication with markets will be key in order to mitigate ripple effects on markets.”

- Elsewhere, Japanese PM Kishida was subject of an apparent smoke bomb attack at a campaign event on Saturday, he was subsequently evacuated with nothing in the way of meaningful injury sustained.

- A liquidity enhancement auction for off-the-run 5- to 15.5-Year JGBs headlines locally tomorrow.

AUSSIE BONDS: Weaker, Off Worst Levels, US Earnings Watch

ACGBs sit weaker (YM -5.0 & XM -5.0) but off worst levels as US Tsys firm slightly in Asia-Pac trade. Cash ACGB benchmark yields are 4-5bp higher with the AU-US 10-year yield differential -3bp at -14bp.

- Swaps are 5-6bp cheaper with the 3s10s curve 1bp flatter.

- Bills strip is steeper with pricing -2 to -11.

- RBA dated OIS is 3-5bp firmer for meetings beyond June with Feb-24 leading. May meeting has a 24% chance of a 25bp hike.

- The local calendar is light this week with tomorrow’s release of the RBA Minutes for April as the highlight. After the RBA left the cash rate unchanged at 3.6% (the first pause in this tightening cycle) the market will be searching for clues on the near-term path of policy.

- The market will continue to eye US earnings season after US Tsys were guided cheaper in trade ahead of the weekend in part due to higher-than-expected large bank earnings. The US economic calendar is relatively this week.

- Participants will continue to be on alert for the launch of the new ACGB Dec-34 after the AOFM revealed on Friday that it aims to issue the line via syndication at some point this week.

NZGBS: Weaker, Mid-Range, US Earnings Eyed

NZGBs closed with yields flat to 4bp higher but off session cheaps as Asia-Pac participants digested the negative lead from US Tsy ahead of the weekend. NZGBs outperformed the $-Bloc with the NZ/US and NZ/AU 10-year yield differentials respectively -7bp and -4bp.

- Swap rates closed 3-6bp higher, implying wider swap spreads, with the 2s10s curve 3bp flatter.

- RBNZ dated OIS closed with pricing 1-5bp firmer across meetings with Apr-24 leading. 20bp of tightening priced for May with 25bp of easing priced for Nov-23 off a terminal OCR expectation of 5.49% (July).

- The Performance Services Index fell 1.4pts in March but remained in expansion territory. Activity/Sales component rose 2.8pts but New Orders fell 3.2pts. Food Prices rose 0.8% M/M (+12.1% Y/Y) with weather-impacted fruit & vegetables and grocery food as the key drivers.

- March REINZ house sales and price data are scheduled for release tomorrow ahead of Q1 CPI on Thursday.

- In Australia, the RBA Minutes for April are slated for release tomorrow.

- With the US calendar relatively this week, the market will be eyeing US Tsys reaction to US earning season and Fedspeak. US Tsy yields were guided higher ahead of the weekend in part due to higher-than-expected large bank earnings.

EQUITIES: China/HK Outperform, Indian Markets Weaker

The main positives today have been in terms of China and Hong Kong shares, while the trend has been less positive elsewhere, mostly notably Indian stocks, which have been weighed down by the IT sector. US and EU futures are modestly higher, but for Eminis we are slightly down on best levels for the session, last near 4170.

- The HSI is up 0.54% at the break, with the underlying tech index up by a similar amount. The CSI 300 is faring better, up 0.86%, the Shanghai Composite near 1% firmer.

- The 1yr MLF rate was held steady, as expected, at 2.75%, while there was a modest liquidity injection via the 1yr MLF. Tomorrow we also get Q1 GDP and March monthly activity figures, which are expected to show uniform improvement.

- Indian markets are noticeably weaker in the first part of trade, with the Nifty and Sensex benchmarks off by more than 1%. Tech company Infosys has slumped on weak earnings guidance and analyst downgrades. This has weighed on broader tech equity related sentiment.

- The Kospi and Taiex are both down modestly, while offshore investors have sold -$220.4mn of local Korean shares.

- In SEA, Malaysian, Indonesian and Philippine stock indices are lower, with only Thai stocks managing to gravitate higher.

GOLD: Prices Holding Just Above $2000 Following Friday’s Slide

Gold prices are flat during the APAC session today after falling 1.8% on Friday and reaching a low of $1992.44/oz following stronger US consumer confidence and a jump in inflation expectations. The greenback fell and yields rose in response to the data. Currently bullion is trading around $2004.44, up from the intraday low of $1995.52 but well off last week’s high of $2048.74. The USD index is up 0.1%.

- Friday’s move down unwound the week’s gains but support is still at $1981.70, the April 10 low.

- Citigroup increased its average 2023 gold price forecast to $2050/oz, an upward revision of 7.9%, on the back of expectations that the Fed is close to its terminal rate.

- According to Bloomberg, bullish hedge fund positions were reduced in the week to April 11 and purchases of gold-backed ETFs stopped after reaching the highest since late January.

- There is little data scheduled for later but there are a number of central bank speakers outside of the US. ECB President Lagarde will speak, as will Buba President Nagel and BoE’s Cunliffe.

OIL: Prices Stabilise After Rallying On Signs Of Market Tightening

Oil prices have been trading in a narrow range during the APAC session after rising about 0.6% on Friday on growing signs that the market is tightening. WTI is around $82.50/bbl after reaching an intraday low of $82.45 and Brent is about $86.25. Both remain above their 200-day moving averages. The USD index is 0.1% higher.

- The global diesel market is signalling a sharp slowdown in economic activity, which could put downward pressure on crude prices. It is used for heavy machinery and trucks and can be a leading indicator of growth. The number of trucks on China’s highways has fallen recently and Europe’s diesel premium has narrowed, according to Bloomberg. S&P Global says US diesel demand is likely to fall 2% this year. Distillates are also showing softer refining margins.

- Tanker data from Bloomberg showed that Russian shipments fell by 1.24mbd last week.

- There is little data scheduled for later but there are a number of central bank speakers outside of the US. ECB President Lagarde will speak, as will Buba President Nagel and BoE’s Cunliffe.

FOREX: USD Rally Loses Momentum As Yields Can't Breach Friday Highs

The early positive USD impetus lost momentum as US yields failed to break above Friday session highs. The BBDXY did break through Friday's highs, getting close to 1224.60, but we now sit back near 1222.90, around +0.10% above NY closing levels.

- Much of the focus was on the early upward impetus in US yields with the 2yr getting to 4.12%, a continuation from Friday NY trade, which was buoyed by the rise in consumer inflation expectations and hawkish Fed. We couldn't through Friday's highs though and now sit back at around 4.105%.

- There was some NZ data but that didn't move market sentiment (PSI and food prices). NZD/USD sits down slightly, last around 0.6195/00, with some support evident ahead of the 0.6180 level, which is a multi-week low.

- AUD/USD hasn't drifted too far away from 0.6700 (last 0.6705/10), with a chunky option expiry at this level potentially a factor.

- USD/JPY got to a high of 134.13, and we sit just below these levels currently, despite the pull back in US yields from earlier highs. Dips in USD/JPY to 133.60/70 were supported.

- ECB's Nagel stated that core inflation should slow before the summer, but stated the central bank still has work to do on the inflation front. EUR/USD sits slightly lower for the session, last around 1.0985.

- Looking ahead, BoE's Cunliffe will speak, along with ECB President Lagarde. Later on in the US, the Empire manufacturing prints, along with the NAHB index. The Richmond Fed's Tom Barkin is also due to speak.

FX OPTIONS: Expiries for Apr17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0920(E528mln), $1.0935(E931mln), $1.0950-55(E637mln), $1.1050(E2.0bln)

- USD/JPY: Y132.50($1.0bln), Y133.00-11($1.1bln)

- AUD/USD: $0.6700(A$2.3bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/04/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 17/04/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/04/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 17/04/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/04/2023 | 1300/1400 |  | UK | BOE Cunliffe Speech at Innovate Finance Global Summit | |

| 17/04/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 17/04/2023 | 1500/1700 |  | EU | ECB Lagarde Speech at Council on Foreign Relations | |

| 17/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 17/04/2023 | 1645/1245 |  | US | Richmond Fed's Tom Barkin | |

| 17/04/2023 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.