-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRiEF: Riksbank Puts Neutral Rate In 1.5 To 3.0% Range

MNI: Japan Govt Keeps Economic Assessment, Ups Imports

MNI EUROPEAN OPEN: Equities Recession Trade Heats Up

EXECUTIVE SUMMARY

- FED SHOULD AVOID RUSHING INTO RATE CUTS- GEORGE - MNI INTERVEIW

- BIDEN PROMISES NETANYAHU ‘NEW US DEFENSIVE MILITARY DEPLOYMENTS’ - BBG

- BANK DELIVERS ‘FINELY BALANCED’ RATE CUT - MNI BOE WATCH

- PBOC FRAMEWORK TO ENHANCE CONTROL, TRANSMISSION CONCERNS - MNI

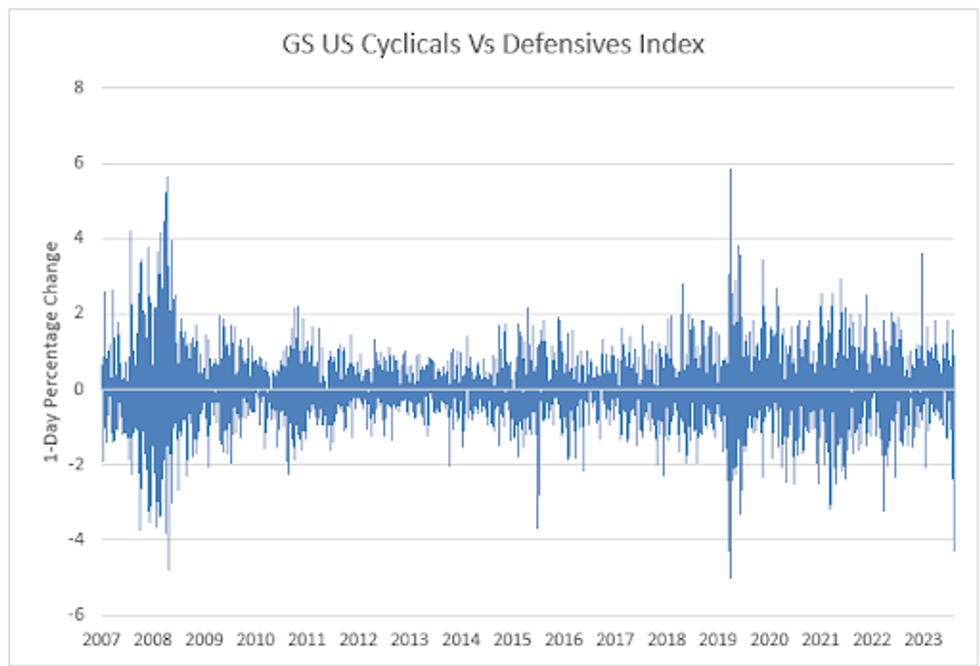

Fig. 1: Equities Recession Trade Heats Up - Goldman Sachs Cyclicals Vs Defensives Index

Source: Goldman Sachs/MNI - Market News/Bloomberg

UK

BOE (MNI BOE WATCH): The Bank of England's Monetary Policy Committee delivered a 25 basis point rate cut at its August meeting on the narrowest of margins, a five-to-four vote in favour, with even some of those who voted for it saying that their decision was "finely balanced."

FISCAL (MNI INTERVIEW): The new UK government can and should aim to balance the current budget and preferably move into surplus, squeeze consumption through higher taxation and raise debt issuance to boost public investment, Dimitri Zenghelis, a former top Treasury economist, told MNI, although he accepted early signs suggest such a strategy is not imminent.

EUROPE

RUSSIA/US (RTRS): “Russia freed U.S. journalist Evan Gershkovich and ex-U.S. Marine Paul Whelan on Thursday as part of the biggest prisoner exchange of its kind since the end of the Cold War.”

GERMANY (BBG): “Germany’s coaltion may have to revisit a contentious compromise over next year’s budget after government advisers flagged potential legal issues with some of the planned measures.”

US

FED (MNI INTERVIEW): Fed Should Avoid Rushing Into Rate Cuts-George

ECONOMY (MNI INTERVIEW): US Manufacturing Faces Hard Landing Risk- ISM

CORPORATE (RTRS): “Intel said on Thursday it would cut more than 15% of its workforce, some 17,500 people, and suspend its dividend starting in the fourth quarter as the chipmaker pursues a turnaround focused on its money-losing manufacturing business.”

OTHER

US/ISRAEL (BBG): “ President Joe Biden promised Israeli Prime Minister Benjamin Netanyahu “new defensive US military deployments” as Israel faces vows to avenge assassinations of leaders from Iran-backed Hamas and Hezbollah.”

JAPAN (BBG): “The Bank of Japan’s big policy shift this week makes another interest rate hike highly likely in October and raises the potential for quarterly increases, according to a former executive director in charge of monetary policy.”

CHINA

POLICY (MNI): PBOC Framework To Enhance Control, Transmission Concerns

STEEL (MNI BRIEF): China’s steel prices will show a limited rebound this month, following prices falling 3.3% in July, as monetary easing and an expansion of the government’s equipment trade-in scheme lends support, a report from Lange Steel, a commodity research firm in Beijing said on Thursday.

EQUITIES (SHANGHAI SECURITIES NEWS): “China’s long-term investment funds, including the national social security fund, pension fund and qualified foreign institutional investors (QFII), adopted the “barbell strategy” in the second quarter, buying tech stocks for growth and increasing holding of energy stocks as defensive plays, reported by the Shanghai Securities News.”

PROPERTY (21ST CENTURY BUSINESS HERALD): “First-tier city Guangzhou has lowered its homebuying threshold by allowing buyers to use provident funds towards property down-payment, 21st Century Business Herald reported. New residents with a few years work experience will benefit most from the new measure, said Li Yujia, chief researcher at the Guangdong Urban & Rural Planning Institute.”

MIGRATION (STATE COUNCIL): “China will cancel migrant urbanisation restrictions in cities of less than 3 million people and comprehensively relax them in cities of between 3 million to 5 million, according to a State Council plan. For cities above 5 million, authorities will improve the settlement system and encourage the cancellation of quota restrictions, the plan said.”

TRADE (MNI): China Will Open Markets To Ease Trade Tensions.

CHINA MARKETS

MNI: PBOC Net Drains CNY356.88 Bln via OMO Friday

The People's Bank of China (PBOC) conducted CNY1.17 billion via 7-day reverse repo on Friday, with rate unchanged at 1.70%. The operation has led to a net drain of CNY356.88 billion after offsetting the CNY358.05 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7046% at 09:38 am local time from the close of 1.7048% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 44 on Thursday, the same as the close on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1376 on Friday, compared with 7.1323 set on Thursday. The fixing was estimated at 7.2444 by Bloomberg survey today.

MARKET DATA

AUSTRALIA Q2 PPI Y/Y 4.8%; PRIOR 4.3%

AUSTRALIA JUNE HOME LOANS VALUE M/M 1.3%; MEDIAN 0.1%; PRIOR -1.7%

JAPAN JULY MONETARY BASE Y/Y 1.0%, PRIOR 0.6%

SOUTH KOREA JULY CPI M/M 0.3%; MEDIAN 0.3%; PRIOR -0.2%

SOUTH KOREA JULY CPI Y/Y 2.6%; MEDIAN 2.5%; PRIOR 2.4%

SOUTH KOREA JULY CPI EX FOOD & ENERGY Y/Y 2.2%; MEDIAN 2.1%; PRIOR 2.2%

MARKETS

US TSYS: Tsys Futures Volumes Surge Ahead Of NFP Later

- Treasury futures edged higher during the morning session and volumes surged, SOFR options have also seen a surge in volumes which start late during the US session as headlines of sirens through Israel were sounding.

- Tsys futures are now trading off the early morning highs, with TUU4 +01⅛ at 103-02 vs 103-04 highs, while TYU4 is + 02+ at 112-26 vs 113 highs.

- Cash treasury curve is slightly steeper today, following moves made during the US session, yields are currently 1-2bps lower with the 10Y yields -1bps at 3.966% after overnight hitting a low of 3.94%.

- Fed funds futures are pricing in 86bps of cuts into year-end from 72.5bps of cuts on Wednesday.

- Nonfarm payrolls are expected to moderate further in July after the slight beat in June was more than offset by large negative revisions to the prior two months. See MNI NFP preview (here)

JGBS: Cash Curve Bull-Flattener Ahead Of US Payrolls

JGB futures remain sharply stronger but are off session highs, +64 compared to settlement levels.

- The local calendar has been light today with only Monetary Base data released.

- This morning’s BoJ Rinban operations saw mixed results, with negative spreads but slightly higher offer cover ratios. In line with the QT taper announcement at Wednesday’s BoJ Policy Decision, sizes were reduced by Y25-50bn than previous operations for the buckets beyond the 1 year.

- Cash US tsys are currently ~1bp richer ahead of US Payrolls data later today, having been as much as 2-3bps richer earlier in the session.

- Nonfarm payrolls are expected to moderate further in July after the slight beat in June was more than offset by large negative revisions to the prior two months. (See MNI US Payrolls Preview here)

- The cash JGB curve has maintained its bull-flattening, with yields 3-8bps lower. The benchmark 10-year yield is 6.2bps lower at 0.979% versus the cycle high of 1.108%.

- The swaps are dealing mixed, with rates 2-3bps lower apart from the 20-30-year zone which is flat. Swap spreads are wider.

- Next week, the local calendar will see the BoJ Minutes of the June Meeting alongside Jibun Bank Composite & Services PMIs on Monday.

AUSSIE BONDS: Richer, Some Profit Taking Ahead Of US Payrolls, RBA Policy Decision Next Tuesday

ACGBs (YM +6.0 & XM +4.0) sit richer but at/near Sydney session lows. Ranges have been relatively narrow, but this comes after solid gains following Wednesday’s lower-than-expected Q2 core CPI data. ACGB benchmarks are 19-24bps richer than pre-CPI levels.

- After an extension of yesterday’s strong gains for cash US tsys early in today’s Asia-Pacific session, local investors opted to lock in some gains ahead of the US payrolls data release later today. Cash US tsys are currently ~1bp richer, having been as much as 2-3bps richer earlier in the session.

- Cash ACGBs are 4-5bps richer with the AU-US 10-year yield differential at +8bps.

- Swap rates are 4-6bps lower, with EFPs slightly tighter.

- The bills strip has bull-flattened, with pricing +1 to +9.

- RBA-dated OIS pricing is flat to 9bps softer across meetings, with 2025 leading. A cumulative 20bps of easing is priced by year-end.

- NSW TCorp priced an A$1.75bn increase of the 4.75% 20 February 2037 benchmark bond.

- The local calendar will see Judo Bank Composite & Services PMI data on Monday, ahead of the RBA Policy Decision, the Statement on Monetary Policy and RBA Governor Bullock’s Media Conference on Tuesday.

- Next week, the AOFM plans to sell A$800mn of the 2.75% 21 June 2035 bond on Wednesday and A$700mn of the 4.75% 21 April 2027 bond on Friday.

NZGBS: Richer Going Into US Payrolls Data

NZGBs closed 3bps richer but in the middle of today’s range. After an extension of yesterday’s strong gains for cash US tsys early in today’s Asia-Pacific session, local investors opted to lock in some gains ahead of the US payrolls data release later today. Cash US tsys are currently ~1bp richer, having been as much as 2-3bps richer earlier in the session.

- Nonfarm payrolls are expected to moderate further in July after the slight beat in June was more than offset by large negative revisions to the prior two months. Hurricane Beryl is likely to have negative impacts on payrolls and hours worked but some upside for AHE growth. (See MNI US Payrolls Preview: Hurricane Beryl To Add A Layer Of Confusion – here)

- The NZ-US 10-year yield differential is 5bps wider at +27bps, with the NZ-AU 10-year differential 2bps tighter at +19bps.

- Swap rates closed 2-5bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing is 2-8bps softer across meetings, with mid-2025 leading. The market gives a 25bp cut in August a 64% probability. A cumulative 80bps of easing is priced by year-end.

- Next week, the local calendar will see ANZ Commodity Price on Monday, ahead of the Q2 Employment Report on Wednesday.

FOREX: USD Off A Touch Despite Equity Falls, Yen Crosses Stabilize

The USD has tracked modestly softer through Friday trade, the BBDXY index off a touch, last near 1257.5.

- Early trends were skewed towards risk off, with JPY and CHF rallying against the likes of AUD and NZD. This reflected sharply lower US equity futures and regional market softness, as tech earnings and US growth slowdown fears hit sentiment.

- However, after both AUD/JPY and NZD/JPY made fresh lows we saw some stability emerge. Both crosses are heavily oversold per technicals, but the market may also be mindful of US payrolls later.

- USD/JPY got to lows of 148.88 before rebounding towards 149.80. We last tracked near 149.40/45, closed to unchanged for the session. There were a number of comments from Japan officials, with FinMin Suzuki stating the authorities are most concerned about the weaker yen boosting imported inflation. The country can also not declare victory over deflation yet.

- AUD/USD has ticked higher, last near 0.6515 (earlier lows were at 0.6487). NZD/USD has lagged somewhat last around 0.5950. Market pricing for an August RBNZ cut sits at 64% (25bps easing). The AUD/NZD is up marginally from recent lows, tracking at 1.0940/45.

- Outside of sharp equity falls and weaker US futures, we have had modest softness in US yields.

- In the commodity space, metals are slightly firmer, but still close to recent lows. Oil is up from Thursday lows but still tracking lower for the week. Gold remains supported.

- Looking ahead, the main focus will be the US NFP report. We also have some BoE speak.

ASIA STOCKS: Asian Equities Plunge On Weak Tech Earnings, Soft US Data & BoJ Hike

Asian markets are experiencing significant declines with the sell-off starting after weak US data and tech earnings. Japanese equities are down sharply as the BoJ's unexpected interest rate hike and stronger yen impact exporters. The HSI has fallen due to tech and real estate stock losses, while Chinese markets are weighed down by economic concerns and weak corporate earnings. Additionally, US economic data from overnight including rising jobless claims and shrinking manufacturing activity, has triggered fears of a hard landing, further dampening investor sentiment across the region the recession trade of selling cyclicals vs buying defensives saw it's largest one-day change since the peak of the covid sell-off.

- Japanese equities have plunged the most since march 2020. Financials sold-off on the back of Daiwa (-21%) missing profit targets, semiconductor stocks have underperformed even the 7.13% sell-off made by the Philadelphia SE Semiconductor Index overnight.

- China and Hong Kong markets are also lower today, although Chinese equities are holding up much better than global peers. In Hong Kong the HSI is 2% lower as tech and real estate stocks suffered losses. Meanwhile, Macau casino stocks dropped by up to 4.2% following revenue growth in July that missed expectations, reflecting ongoing concerns about a crackdown on the gaming industry. In mainland China, the CSI 300 is 0.66% lower, while the Shanghai Composite is down 0.45%.

- Taiwan & South Korea equities have plunged due to the high exposure to tech stocks, Taiex is down 3.68% after TSMC fell 4.90%. The KOSPI is down 3.30% with the likes of SK Hynix, down 9% and Samsung down 3.60%.

- Australian equities have dropped 2.30% today, with the Big Four Banks the worst performing. New Zealand equities have largely escaped the global sell-off with gains in health care stocks somewhat offsetting weakness in other sectors, the NZX 50 is 0.60% lower.

- In the EM space Singapore's Straits Times down is 1.20% lower, Malaysia's KLCI is 0.80% lower, the Philippines PSEi is 1.14% lower, Indonesian JCI is 0.16%.

OIL: Oil Steady During Asia Friday Session, Tracking Lower For The Week

- Oil paired back earlier gains in the week as US economic data showed concerns as to the pace of the slowdown in the US economy were enough to offset concerns as to supply given rising Middle East Tensions.

- Reports stated that President Biden reiterated support for Israel in the face of escalating tensions in the Middle East region, promising ‘New Defensive US Military Deployments’ per BBG.

- WTI fell to $76.24 post the US data release on Thursday. We sit slightly higher at $76.90, in the Friday's Asian afternoon session. Brent moved marginally higher during Asian trading to $80.11.

- Both benchmarks are tracking lower for the week. More so Brent, off close to 1.3%

- OPEC advised overnight that they do not intend to change output targets, targeting adding approximately 500,000 barrels a day to production over the fourth quarter. This should offset supply concerns should Middle East tensions worsen.

- With US and Asian data softening and Middle East tensions rising, oil will have dual forces driving its outcome in the coming days.

- For the week ahead, Saudi Arabia’s official selling prices for September, will be released Monday.

GOLD: Steady Ahead Of US Employment Report

Gold is 0.3% higher in today’s Asia-Pac session, after closing steady at $2446.26 on Thursday.

- Surprisingly, bullion looked past weaker-than-expected ISM manufacturing and jobless claims data, which sent US bond yields and US equities sharply lower.

- Initial jobless claims were notably higher coming in at 249k vs 236k, while continuing claims were 1877k vs 1855k. ISM Mfg was 46.8 vs 48.58, the lowest since November 23, while the largest miss was employment which came in at 43.4 vs 49.2 est. This was the lowest level since the pandemic.

- The markets read the reports as more evidence of a slumping economy, with the downdraft in the ISM employment component as a harbinger of an "unwelcome" decline in employment that Chair Powell said would be a condition for a rate cut.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- US OIS pricing softened a touch with the market fully pricing in one 25bps cut for September and a cumulative 82bps of cuts into year-end.

- The market’s focus now turns to the US Employment Report for July, which is to be released later today.

- According to MNI’s technicals team, this week’s gains are constructive. A continuation higher would expose $2483.7, the Jul 17 high. On the downside, initial support is $2,401.3, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/08/2024 | 0630/0830 | *** |  | CH | CPI |

| 02/08/2024 | 0645/0845 | * |  | FR | Industrial Production |

| 02/08/2024 | 0800/1000 | * |  | IT | Industrial Production |

| 02/08/2024 | 0900/1100 | * |  | IT | Retail Sales |

| 02/08/2024 | 1115/1215 |  | UK | BOE's Pill at National MPC Agency Briefing | |

| 02/08/2024 | 1230/0830 | *** |  | US | Employment Report |

| 02/08/2024 | 1400/1000 | ** |  | US | Factory New Orders |

| 02/08/2024 | 1430/1030 |  | CA | BOC market participants survey | |

| 02/08/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 05/08/2024 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/08/2024 | 0700/0300 | * |  | TR | Turkey CPI |

| 05/08/2024 | 0900/1100 | ** |  | EU | PPI |

| 05/08/2024 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/08/2024 | 2100/1700 |  | US | San Francisco Fed's Mary Daly | |

| 06/08/2024 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 06/08/2024 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 06/08/2024 | 0545/0745 | ** |  | CH | Unemployment |

| 06/08/2024 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/08/2024 | 0630/0830 | ** |  | CH | Retail Sales |

| 06/08/2024 | 0730/0930 | ** |  | EU | S&P Global Final Eurozone Construction PMI |

| 06/08/2024 | 0830/0930 | ** |  | UK | S&P Global/CIPS Construction PMI |

| 06/08/2024 | 0900/1100 | ** |  | EU | Retail Sales |

| 06/08/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 06/08/2024 | 1230/0830 | ** |  | US | Trade Balance |

| 06/08/2024 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/08/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/08/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/08/2024 | 2245/1045 | *** |  | NZ | Quarterly Labor market data |

| 07/08/2024 | 0600/0800 | ** |  | DE | Trade Balance |

| 07/08/2024 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/08/2024 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/08/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/08/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/08/2024 | - | *** |  | CN | Trade |

| 07/08/2024 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/08/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 07/08/2024 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 07/08/2024 | 1730/1330 |  | CA | BOC Minutes (Summary of Deliberations) | |

| 07/08/2024 | 1900/1500 | * |  | US | Consumer Credit |

| 08/08/2024 | 0500/1400 |  | JP | Economy Watchers Survey | |

| 08/08/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 08/08/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/08/2024 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/08/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 08/08/2024 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 08/08/2024 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

| 08/08/2024 | 1900/1500 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.