-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI EUROPEAN OPEN: Equity Sentiment Mostly Positive, But USD Supported On Dips

EXECUTIVE SUMMARY

- HARRIS PROPOSES RAISING CORPORATE TAX RATE TO 28%, ROLLING BACK A TRUMP LAW - NBC

- ECB’S REHN SAYS GROWTH RISKS BOLSTER CASE FOR SEPTEMBER CUT - BBG

- BLINKEN SAYS ISRAEL ACCEPTS GAZA PROPOSAL, URGES HAMAS TO DO SAME - RTRS

- MARKET CASH RATE PRICING OFF - RBA MINUTES - MNI BRIEF

- CHINA’S AUG LOAN PRIME RATE UNCHANGED - MNI BRIEF

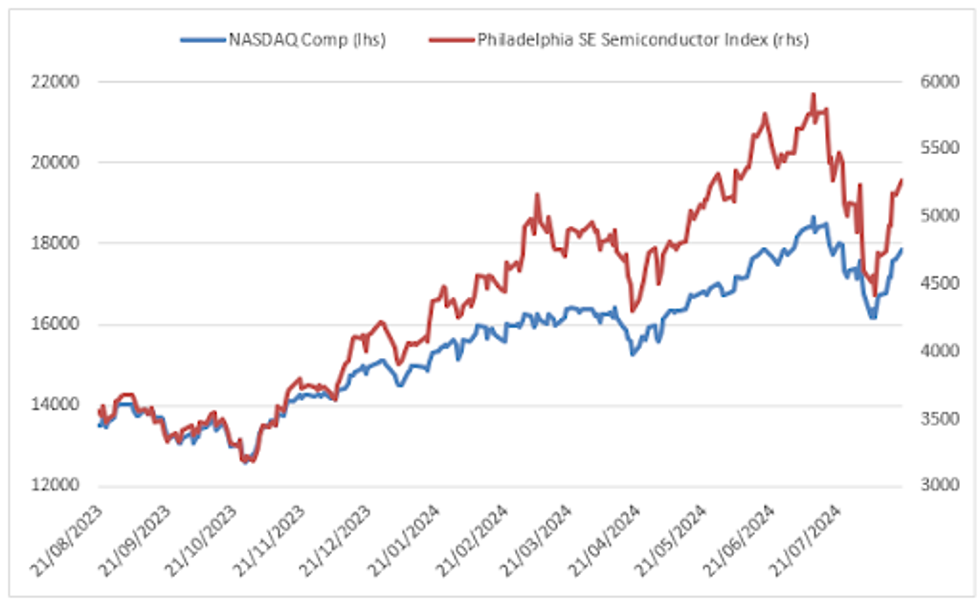

Fig. 1: US Tech Stocks Continue to Rebound

Source: MNI - Market News/Bloomberg

UK

UKRAINE (BBC): “The government’s support for Ukraine is "unwavering", Downing Street has insisted after Ukrainian President Volodymyr Zelensky suggested UK backing had "slowed down". Over the weekend, Mr Zelensky said Ukraine needed partners "who can truly help to step up".

EUROPE

ECB (BBG): “Increasing risks to Europe’s growth outlook have reinforced the case for a policy adjustment when the European Central Bank meets next month, according to Governing Council member Olli Rehn.”

UKRAINE (BBG): “ President Volodymyr Zelenskiy urged Ukraine’s allies to lift restrictions on the use of their weapons to strike inside Russia, saying his army’s two-week incursion into the neighboring country has called into question Vladimir Putin’s threats of retaliation.”

UKRAINE (INDEPENDENT): “A Russian investigator confirmed that Ukraine on Sunday had struck and damaged a third bridge over the River Seym in Russia’s Kursk region.”

US

POLITICS (RTRS): “The founder of the main outside spending group backing Kamala Harris' presidential bid says their own opinion polling is less "rosy" than public polls suggest and warned that Democrats face much closer races in key states.”

POLITICS (NBC): “Vice President Kamala Harris is calling for raising the corporate tax rate to 28%, her first major proposal to raise revenues and finance expensive plans she wants to pursue as president.”

OTHER

MIDDLE EAST (RTRS): “U.S. Secretary of State Antony Blinken said on Monday Israeli Prime Minister Benjamin Netanyahu had accepted a "bridging proposal" presented by Washington to tackle disagreements blocking a ceasefire deal in Gaza, and urged Hamas to do the same.”

AUSTRALIA (MNI BRIEF): The Reserve Bank of Australia board believes market pricing of the cash rate would not see inflation return to the 2.5% mid-point of its target by 2026, noting the rate may need to stay at 4.35% for longer to achieve its CPI goal, according to the minutes of the August meeting published Tuesday.

NEW ZEALAND (BBG): “Treasury Dept. comments in Fortnightly Economic Update published Tuesday in Wellington. Labor market data “revealed the impact of the reduced demand and production that occurred during the June quarter with an increase in the unemployment rate and a drop in hours worked and hours paid”

SOUTH KOREA (BBG): “South Korea’s Financial Services Commission will cut mortgage loan limit for homes in greater Seoul area from Sept. 1, according to an emailed statement from the regulator.”

CHINA

LOAN PRIME RATE (MNI BRIEF): China's Loan Prime Rate remained unchanged on Tuesday according to a People's Bank of China statement, in line with market's expectation, and as the central bank continued to hold the key 7-day reverse repo rate stable.

CHINA/US (YICAI): “The People’s Bank of China and the U.S. Treasury Department agreed to strengthen further China-U.S. financial stability cooperation during a recent Financial Working Group meeting.”

DEPOSIT RATES (FINANCIAL NEWS): "More smaller regional banks have slashed the interest rates they pay for client deposits this month, with the rates on long-term savings at many of those institutions falling below 2%, Financial News reported."

TRAVEL (21st CENTURY BUSINESS HERALD): “China saw 17.2 million foreigners enter the country from January to July this year, up 129.9% y/y, according to the National Immigration Administration. In total, 5.9 million foreign tourists entered Hainan from Hong Kong and Macao using the recently introduced visa-free policy, 21st Century Business Herald reported.”

CHINA MARKETS

The People's Bank of China (PBOC) conducted CNY149.1 billion via 7-day reverse repo on Tuesday, with rate unchanged at 1.70%. The operation has led to a net drain of CNY236.6 billion after offsetting the maturity of CNY385.7 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7555% at 10:15 am local time from the close of 1.7315% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 49 on Monday, compared with the close of 51 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1325 on Tuesday, compared with 7.1415 set on Monday. The fixing was estimated at 7.1349 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND JULY REINZ HOME SALES RISE 14.5% Y/Y; PRIOR -25.6%

NEW ZEALAND JULY REINZ MEDIAN HOUSE PRICE -2.2%; PRIOR -1.3%

NEW ZEALAND JULY TRADE BALANCE -NZ$963M; PRIOR +NZ$699M

NEW ZEALAND JULY 12-MONTHS YTD TRADE DEFICIT NZ$9.29B; PRIOR NZ$9.50B

NEW ZEALAND JULY EXPORTS +14.3% Y/Y; PRIOR -2.3%

NEW ZEALAND JULY IMPORTS +8.5% Y/Y; PRIOR -13.4%

SOUTH KOREA CONSUMER CONFIDENCE AUG 100.8; PRIOR 103.6

SOUTH KOREA HOUSEHOLD CREDIT Q2 KRW1896.2T; PRIOR KRW1882.4T

MARKETS

US TSYS: Tsys Futures Little Changed, Curve Slightly Steeper

- Treasury futures have been largely rangebound today, volumes have been slightly below average. There has been little in the way of headlines today, investors as un the sideway as they await FOMC minutes, jobless claims, PMI & Jackson Hole later in the week.

- The Fed's Bostic will speak on payments later today, while Barr will speak on cybersecurity

- The front-end is out-performing a touch with TUU4 + 00⅛ at 103-04¼, while TYU4 is - 02 at 113-05.

- A bullish theme in tsys remains intact and price continues to trade above support. Moving average studies are in a bull-mode position and this highlights bullish sentiment. The recent breach of 111-01, the Jun 14 high, confirmed a resumption of the uptrend.

- Cash treasury curve has steepened today, yields have traded in a tight range are are +/- 1bp, with the 2yr yield -0.9bp to 4.057%, while the 10yr yield is +0.6bps at 3.794%.

- Fed Fund futures are fully pricing in at least one cut at the September meeting, with futures currently pricing in 32bps of cuts. The FX market could be leaning more towards a 50bps cut with the BBDXY now trading at 1,231.53 after falling 1.32% over the past week to the lowest level since mid March.

- Data and Fed speak remains limited Tuesday, with focus on July FOMC minutes on Wednesday. The KC Fed hosted Jackson Hole economic symposium "Reassessing the Effectiveness and Transmission of Monetary Policy," will be held Aug. 22-24, Fed Chairman Powell speaking 1000ET Friday Morning.

JGBS: Cash Bond Steeper After Lacklustre 20Y Auction

JGB futures are slightly stronger and in the middle of today’s range, +5 compared to the settlement levels.

- Today’s 20-year auction low price met dealer expectations, however, the cover ratio declined to 3.4223x from 3.8016x and the auction tail lengthened.

- As highlighted in the auction preview, today’s auction presented an outright yield that was 20bps lower than July’s level. Additionally, the 10/20 yield curve was slightly flatter, and the 20-year JGB was significantly richer relative to the 10/20/30 butterfly than in July.

- Today, the local calendar will see Tokyo Condominiums for Sale data later.

- Cash US tsys are flat to 1bp cheaper in today’s Asia-Pac session. Attention seems focused on the KC Fed-hosted Jackson Hole economic symposium, which will be held Aug. 22-24. Fed Chairman Powell speaks at 1000ET Friday morning.

- Cash JGBs are little changed out to the 20-year and ~2bp cheaper beyond. The benchmark 10-year yield is 0.8bp lower at 0.898% versus the cycle high of 1.108%.

- Swap rates are ~1bp lower out to the 30-year zone, and 4ps higher beyond. Swap spreads are mixed.

- Tomorrow, the local calendar will see Trade Balance data alongside BoJ Rinban Operations covering 1-10-year JGBs.

AUSSIE BONDS: Cheaper After RBA Minutes Suggest Rates ‘Steady For Longer’

ACGBs (YM -4.0 & XM -3.0) are cheaper, near Sydney session lows and 2-3bps weaker than pre-RBA Minutes levels.

- The August 6 meeting minutes showed that the RBA Board felt that it could achieve the same tightening of financial conditions as a rate hike by holding rates steady longer than the markets had assumed.

- It remains concerned about the slow return of inflation to target and possible upside risks and as a result “it was unlikely that the cash rate target would be reduced in the short term.”

- The Board remains “vigilant” and even more data-dependent given the uncertainty around its forecasts. Rates are likely to be on hold for some time.

- Cash US tsys are flat to 1bp cheaper in today’s Asia-Pac session.

- Cash ACGBs are 3bps cheaper on the day, with the AU-US 10-year yield differential at +6bps.

- Swap rates are 3bps higher.

- The bill strip is -2 to -4 beyond the first contract.

- RBA-dated OIS pricing is flat to 5bps firmer across meetings, with Jun-25 leading. A cumulative 19bps of easing is priced by year-end.

- The local calendar will see the Judo Bank PMI Composite and the Westpac Leading Index tomorrow.

- Tomorrow, the AOFM plans to sell A$800mn of the 3.00% 21 November 2033 bond.

NZGBS: Cheaper, Post-RBNZ Rally Continues To Be Pared

NZGBs closed 1-6bps cheaper and well off the session’s best levels.

- With today’s domestic data drop 2nd tier, the drift away from the best levels in part reflects the digestion of today’s NZ$6bn issue of a new May 2036 bond via syndication. It was issued at a spread of 9bps over the May-35 bond for a yield-to-maturity of 4.365%. Total book size at final price guidance exceeded NZ$22.7bn.

- Nevertheless, with the short-end underperforming, today's price action also reflects profit-taking after the strong post-RBNZ decision rally. Nevertheless, NZGBs remain 2-14bps richer, with the 2/10 curve 12bps steeper.

- NZ Treasury’s Fortnightly Economic Update stated that labour market data “revealed the impact of the reduced demand and production that occurred during the June quarter with an increase in the unemployment rate and a drop in hours worked and hours paid.”

- “Firms are reducing hours but there is a limit to their abilities to maintain employee levels with ongoing wage inflation, pointing to further market softening.” (per BBG)

- Swap rates closed 4-7bps higher, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed 2-14bps firmer across meetings, with mid-2025 leading. A cumulative 69bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty.

FOREX: USD Supported On Dips But Dollar Index Well Below Key EMAs

The USD index made fresh lows back to March of this year in the first part of trade (BBDXY USD index slipping under 1231) before sentiment stabilized. We were last 1233.5. Still, we are a long way from the 20-day EMA, back near 1247.5.

- We have key event risks later in the week in terms of Fed Chair Powell speaking at the Jackson Hole symposium. This may be reducing incentives to extend USD shorts, particularly in light of the recent sell-off.

- USD/JPY got to 145.85 in early dealings, but now sits more than 100pips higher, last near 147.00, close to 0.30% weaker in yen terms. US yields were down a touch in the first part of dealing but sit slightly higher now, so providing some support at the margins.

- A potentially cleaner position slate for USD/JPY (with investors turning more neutral last week per CFTC data) may also be aiding dips in the pair.

- Equity sentiment has mostly remained positive, except for China/HK losses, which were weighed by on-going property market concerns. This has likely weighed on the AUD, although we are down 0.20% for the session. The RBA minutes reiterated on extended hold for the central bank.

- NZD/USD is close to unchanged, last near 0.6115. We had second tier data earlier on trade and house sales, which didn't shift sentiment. The AUD/NZD cross sits off recent highs, last around 1.0980.

- We have Fed speak later (Bostic & Barr), and the August Philly Fed non-manufacturing index prints. The final July euro area CPI and Q2 negotiated wages as well as Canada’s July CPI print will also be in focus.

ASIA PAC STOCKS: Asian Equities Mostly Higher, Tech Stocks Outperform

Asian stocks are mostly higher today, with Japan's Nikkei 225 jumped over 2% after a previous decline, Hong Kong & China benchmarks slipped following the decision to keep lending rates unchanged. Australia's ASX 200 edged up 0.2% as the Reserve Bank of Australia emphasized its focus on controlling inflation, with no immediate rate cuts expected. Meanwhile, U.S. futures are slightly higher after the S&P 500 recorded its longest winning streak since November, nearing its all-time high, while Treasury yields remain steady ahead of Federal Reserve Chair Jerome Powell's upcoming speech at Jackson Hole.

- Japanese equities are higher today, tech is outperforming tracking US tech stocks. The yen's rally has ended for the moment with the USDJPY up 0.25% and is testing 147.00. The Nikkei is up 2.20%, while the Topix is up 1.30% with banks underperforming with the Topix Bank Index up just 0.05%.

- South Korean tech stocks are the top performers today, with SK Hynix (+4%) & Samsung (+1.30%). South Korea's Financial Services Commission will reduce the mortgage loan limit for homes in the greater Seoul area starting September 1, aiming to curb rising household debt amid a rebound in apartment prices. Additional measures under consideration include expanding debt service ratio rules and increasing mortgage loan risk weights for banks. The KOSPI is 0.83% higher, while the KOSDAQ is 0.90% higher.

- Hong Kong & China equities are lower today after the LPR were left unchanged and further weakness in the property market after headlines that local governments were reducing interventions. The Mainland Property Index is down 2%, HS Property is down 1.10%, CSI 300 RE Index is down 1.55%. The HSI is currently trading 0.36% lower, while the CSI 300 is 0.70% lower.

- Taiwan are underperforming today, with the TAIEX 0.10% higher, TSMC which is the largest company in the index trading down 0.10%

- Australian equities are slightly higher today, earlier the RBA released minutes and plans to keep interest rates at a 12-year high of 4.35% for an extended period to ensure inflation returns to its 2%-3% target. Despite global peers easing policies. The ASX200 is currently 0.15% higher. New Zealand equities are down 0.90% following a fall in Utility stocks.

- Asia EM equities continue to benefit from the view of a soft landing in the US, Indonesia's JCI is 0.70% higher, India's Nifty 50 0.45% higher, Singapore's Strait Times is 0.60% higher, Philippines PSEi is 0.90% higher, while Malaysia's KLCI is 0.20% lower,

OIL: Crude Continues Decline As Pressure Builds For Hamas To Accept Proposal

After falling close to 2.5% on Monday, oil prices have continued to slide today with WTI down 0.8% to $73.06/bbl and Brent 0.8% lower at $77.04, close to their intraday lows. The Middle East risk premium is unwinding further after Israel accepted the US’ “bridging proposal” for a ceasefire in Gaza and pressure is building on Hamas to do the same. The USD index is 0.1% higher.

- Benchmarks are now below 50-, 100- and 200-day moving averages.

- While concerns over China’s oil demand continue to weigh on prices, attention is also on the supply side ahead of OPEC’s plans to reduce output cuts from October, which the group has said are flexible. US industry data on inventories is released later today and will be watched for signs of weakness.

- Later the Fed’s Bostic and Barr speak and the August Philly Fed non-manufacturing index is released. Final July euro area CPI and Q2 negotiated wages as well as Canada’s July CPI print.

GOLD: Consolidating At Highs, Awaiting Jackson Hole Symposium

Gold is slightly lower in today’s Asia-Pacific session, following Monday’s fluctuation around the $2,500 mark as it consolidates near all-time highs.

- With little on the data/news flow front, the market’s attention has already turned to the KC Fed-hosted Jackson Hole economic symposium "Reassessing the Effectiveness and Transmission of Monetary Policy," which will be held Aug. 22-24. Fed Chairman Powell speaks at 1000ET Friday morning.

- Before then, the US calendar will see the FOMC minutes, jobless claims and PMI data.

- According to MNI’s technicals team, the technical break above $2483.7, the Jul 17 high and the bull trigger resumes the uptrend. The initial target of note is $2528.4, the 3.00 projection of the Oct 6 - 27 - Nov 13 price swing.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/08/2024 | 0600/0800 | ** |  | DE | PPI |

| 20/08/2024 | 0730/0930 | *** |  | SE | Riksbank Interest Rate Decison |

| 20/08/2024 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/08/2024 | 0900/1100 | *** |  | EU | HICP (f) |

| 20/08/2024 | 0900/1100 | ** |  | EU | Construction Production |

| 20/08/2024 | 1100/0700 | *** |  | TR | Turkey Benchmark Rate |

| 20/08/2024 | 1230/0830 | *** |  | CA | CPI |

| 20/08/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/08/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 20/08/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 20/08/2024 | 1845/1445 |  | US | Fed Governor Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.