-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Equity Weakness Aids Yen & Dollar

EXECUTIVE SUMMARY

- FED CONTACTS REPORT MODEST PRICE GROWTH- BEIGE BOOK - MNI BRIEF

- FED’S BOSTIC SAYS MANY INFLATION MEASURES MOVING TO TARGET RANGE - BBG

- PBOC TO STRENGTHEN OFFSHORE YUAN MARKETS - MNI BRIEF

- RBA SEES SOME HOUSEHOLDS STRUGGLING, SUGGESTING RATE-HIKE LIMITS - BBG

- NEW ZEALAND GOVERNMENT CUTS TAXES AS BUDGET DEFICIT WIDENS - BBG

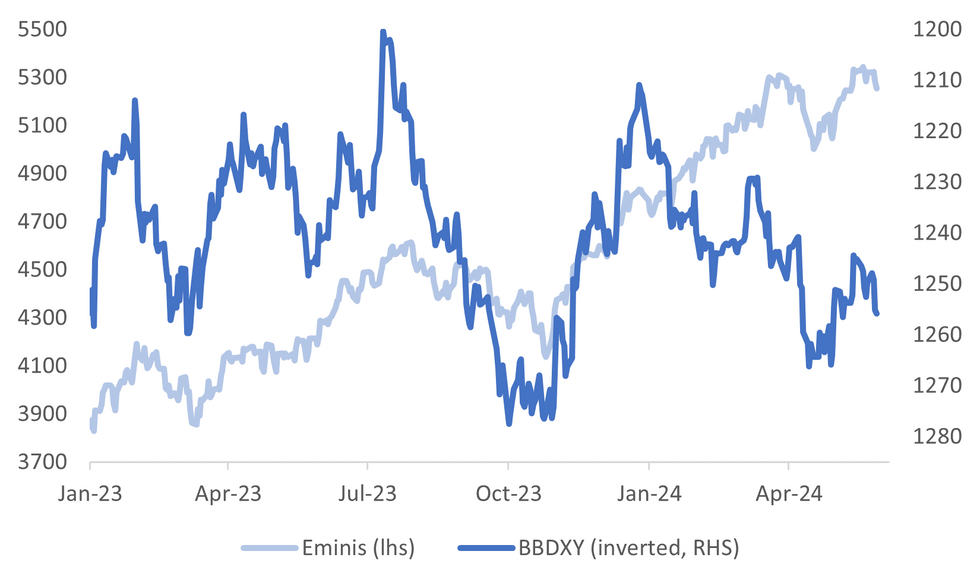

Fig. 1: US Eminis Versus USD BBDXY Index (Inverted)

Source: MNI - Market News/Bloomberg

UK

BUSINESS (BBC): Mining giant BHP has pulled out of its planned takeover of rival Anglo-American in a deal that would have been valued at £38.6bn.

ELECTION (ECONOMIST): Following months of speculation, last week Rishi Sunak, Britain’s prime minister, called a general election for July 4th. On Thursday Parliament will be dissolved. At that point all seats in the House of Commons become vacant. MPs cease to be MPs. Many are retiring; others will fight on the campaign trail to keep their jobs.

EUROPE

SWITZERLAND (BBG): A weaker franc is currently the most likely source of higher Swiss inflation, central bank president Thomas Jordan said, after the currency dropped to its weakest level in more than a year.

BANKING (BBG): The European Union should delay new bank capital rules if the US is seen as doing the same, France’s top central banker said Wednesday.

ELECTION (POLITICO): MEPs from far-right parties look set to outnumber those from European Commission President Ursula von der Leyen’s center-right European People’s Party after next week’s election, polls now suggest. That doesn’t mean the EPP will be beaten into second place, because the fragmented parties on the extreme right will almost certainly be unable to unite.

TRADE (POLITICO): The European Commission may inform companies about import duties on Chinese cars only after the European election, German weekly Der Spiegel reported on Wednesday citing sources at the EU executive.

UKRAINE (POLITICO): The German government is cautiously ditching its reservations about allowing Ukraine to hit military targets inside Russia with donated arms.

US

FED (BBG): Federal Reserve Bank of Atlanta President Raphael Bostic said he’s hopeful that the “explosive” price pressures seen during the Covid-19 pandemic will normalize over the next year.

FED (MNI BRIEF): The U.S. economy and labor market continued growing at a slight to modest pace in recent weeks while prices increased at a modest pace, according to the Federal Reserve's May Beige Book report published Wednesday.

FED (MNI INTERVIEW): The Federal Reserve is likely to face persistent enough inflation over the next year that it will have to consider raising interest rates further in 2025, particularly as fiscal policy will probably remain supportive of growth, former Bank of England Monetary Policy Committee member Adam Posen told MNI.

FED (MNI): The Federal Reserve Bank of Cleveland on Wednesday named former Goldman Sachs executive Beth Hammack to be its next president and CEO after Loretta Mester's retirement. Hammack is set to begin work on Aug. 21 and is a voting member of the FOMC this year, the bank said.

OTHER

MIDEAST (RTRS): Israeli forces have taken control of a buffer zone along the border between the Gaza Strip and Egypt, the country's military said on Wednesday, giving Israel effective authority over the Palestinian territory's entire land border.

AUSTRALIA (BBG): Australia’s inflation is showing persistent strength and weighing heavily on the finances of some households, a senior Reserve Bank official said, highlighting the limits to further interest-rate increases.

NEW ZEALAND (BBG): New Zealand’s new center-right government delivered on its election promise to cut taxes in its first budget even as the Treasury forecast bigger deficits and a delayed return to surplus.

MEXICO (MNI BRIEF): Mexico’s monetary authority will discuss new interest rate cuts at upcoming meetings, the central bank’s governor, Victoria Rodriguez Ceja, said Wednesday, cautioning this does not mean the battle against inflation "has stopped."

SAUDI ARABIA (BBG): Saudi Arabia is preparing to formally launch a secondary offering of shares in oil giant Saudi Aramco as soon as Sunday that could raise more than $10 billion, according to people familiar with the matter.

CHINA

YUAN (MNI BRIEF): The People’s Bank of China will further support the growth of offshore yuan markets and improve cross-border financial infrastructure while making efforts to promote the currency's internationalisation, said Tao Ling, deputy-governor at the central bank, in an interview with Financial News on Thursday.

CHINA/MIDDLE EAST (BBG): Chinese leader Xi Jinping outlined a range of areas including finance and technology in which his nation can enhance cooperation with Arab nations, underscoring Beijing’s push for greater influence in Middle East.

FISCAL (21ST CENTURY BUSINESS HERALD): China’s local governments are rushing to submit their major projects to the central government to get funding from the first batches of special sovereign bonds issued, the 21st Century Business Herald said in a report Thursday.

HOUSING (SECURITIES TIMES): Some Chinese homebuyers wants megacities to roll out more supportive policies to cut taxes related to property transactions, Securities Times said in a report Thursday.

AUTOS (SECURITIES DAILY): Several car parts manufacturers listed on the A-share market, including Zhejiang Songyuan Automotive Safety Systems and CWB Automotive Electronics, announced plans to build factories overseas this week as they seek overseas growth opportunities amid increasing competition at home, according to a Securities Daily report Thursday.

CHINA MARKETS

MNI: PBOC Net Injects CNY258 Bln Via OMO Thurs; Rate Unchanged

The People's Bank of China (PBOC) conducted CNY260 billion via 7-day reverse repo on Thursday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY258 billion after offsetting the CNY2 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9104% at 09:42 am local time from the close of 1.9150% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 41 on Wednesday, compared with the close of 45 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1111 on Thursday, compared with 7.1106 set on Wednesday. The fixing was estimated at 7.2594 by Bloomberg survey today.

MARKET DATA

AUSTRALIA 1Q BUSINESS INVESTMENT RISES 1.0% Q/Q; EST. +0.7%; PRIOR +0.9%

AUSTRALIA 1Q EQUIPMENT, PLANT, MACHINERY INVEST RISES 3.3% Q/Q; PRIOR +0.4%

AUSTRALIA 1Q BUILDINGS, STRUCTURES INVESTMENT FALLS 0.9% Q/Q; PRIOR +1.3%

AUSTRALIA APRIL BUILDING APPROVALS FALL 0.3% M/M; EST. +1.8%; PRIOR +2.7%

NEW ZEALAND APRIL HOME-BUILDING APPROVALS FALL 1.9% M/M; PRIOR -0.2%

MARKETS

US TSYS: Treasury Future Little Changed, Ranges Tight, 10Y JGB Yield Off Highs

- Treasury futures have traded in tight ranges today, the front-end is slightly lower. TU is (- 00.125) at 101-11.625, but still safely above initial support at 101-10.625, while TY is performing slightly better trading (+ 00+) at 107-25 and holds above overnight lows of 107-21+.

- Volumes: TU 14k, FV 21k TY 30k

- Tsys Flows: Block seller of 1.8k FVU4 at 105-11

- Cash treasury curve has reversed the morning steepening and now trades flatter for the day, yields are now flat to 1bps higher with the 2Y +0.8bps to 4.981%, the 10Y +0.4bps at 4.616%.

- Across APAC rates: ACGB yields are 4-8bps higher, curve steeper, NZGB yields are flat to 3bps lower, curve twist-flattening, while JGBs are flat to 1.5bps higher, curve is mixed the 10Y trading at 1.071% post the 2Y auction after earlier hitting 1.098%

JGBS: Market Reverses Direction After A Solid 2Y Auction, Heavy Data Calendar Tomorrow

JGB futures are cheaper but well off the session’s worst level after today’s 2-year supply showed solid demand metrics.

- The low price met dealer expectations and the cover ratio increased to 3.777x from 3.481x in April. The auction tail was unchanged from last month. With today's auction occurring with an outright yield at its highest level since 2009, the current 2-year yield has been sufficient to generate demand in the face of uncertainty surrounding the outlook for BoJ policy.

- Outside of the previously outlined International Investment Flows, there hasn't been much in the way of domestic data drivers to flag.

- Cash US tsys are little changed in today’s Asia-Pac session ahead of Q1 GDP and PCE Deflator, and Weekly Jobless Claims data later today.

- Cash JGBs are mixed, with yield movements bounded by 1.6bps lower (20-year) and 0.7bp higher (3-year). The benchmark 10-year yield is 1.2bps lower at 1.073%, after reaching a fresh cycle high of 1.101% earlier. The market had opened the session with a bear-steepening of the curve.

- The swaps curve has twist-flattened, pivoting at the 3s, with rates +1bp to -2bps. Swap spreads are mostly narrower beyond the 2-year.

- Tomorrow, the local calendar will see Jobless Rate, Job-To-Applicant Ratio, Tokyo CPI, Industrial Production, Retail Sales and Housing Starts data alongside BoJ Rinban Operations for 3-25-year+ JGBs.

AUSSIE BONDS: Cheaper But Off Worst Levels, Nov-29 Supply Tomorrow

ACGBs (YM -3.0 & XM -5.0) are cheaper but off Sydney session lows.

- Outside of the previously outlined Private Capital Expenditure and Building Approvals data, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys are little changed in today’s Asia-Pac session ahead of Q1 GDP and PCE Deflator, and Weekly Jobless Claims data later today.

- Cash ACGBs are 2-5bps with the AU-US 10-year yield differential at -16bps.

- Swap rates are 2-4bps higher, with the curve 3s10s steeper.

- The bills strip has bear-steepened, with pricing -1 to -4.

- (AFR) Traders are once again ramping up bets that the Reserve Bank of Australia will have to lift the cash rate to bring inflation to heel after US bond yields climbed overnight amid mounting global interest rate jitters. (See link)

- RBA-dated OIS pricing is flat to 3bps firmer across meetings. 1bp of easing is priced by year-end from an expected terminal rate of 4.39%.

- Tomorrow, the local calendar sees Private Sector Credit alongside the AOFM’s planned sale of A$700mn of the 2.75% Nov-29 bond.

NZGBS: Richer After The Budget

NZGBs closed with a bull-steepening after yields fell 2-4bps following the release of the NZ Budget.

- The new NZ government presented its first budget and delivered the income tax cuts promised in the 2023 election. Finance minister Willis said that the cuts worth $14.7bn over 4 years would be offset fully by “savings and revenue initiatives” thus not adding to inflationary pressure. Slower growth has contributed to the deterioration in the budget position.

- The timing of measures is important to the RBNZ and the reduction in spending seems to be mainly from FY26, whereas tax policy changes will begin from FY25, which may concern them.

- The Treasury projects net debt to 41.8% of GDP by 2028 vs 37.6% in December. Concurrently, NZ is increasing its bond program by NZ$12 billion over the same period.

- The swaps curve also bull-steepened, with rates 1-4bps lower.

- RBNZ dated OIS pricing closed little changed for meetings out to Nov-24 and 2-5bps softer beyond. A cumulative 17bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty apart from the NZ Treasury’s planned sale of NZ$275mn of the 1.5% May-31 bond, NZ$175mn of the 4.25% May-34 bond and NZ$50mn of the 2.75% Apr-37 bond.

FOREX: Risk Off/Intervention Fears Drive Yen Outperformance

The BBDXY USD index sits off session highs, last just under 1256.10, largely thanks to a modest yen rebound.

- A risk off tone has been evident in the G10 FX space today. US equity futures sit lower, by -0.55% to -0.65%, while all the key regional equity markets are weaker as well.

- A firmer core yield backdrop has weighed on equity sentiment in recent sessions. US cash Tsy yields sit close to unchanged so far today though.

- USD/JPY sits near 157.20 in recent dealings, a yen gain of 0.30% and around session lows. The equity risk off tone is helping outperformance on crosses, with NZD/JPY down around 0.50% at this stage. Late Wednesday highs in USD/JPY came close to suspected intervention levels earlier in the month, so this may have encouraged some trimming of long USD/JPY positions as well.

- NZD/USD is back close to 0.6100, down around 0.20%.

- The NZ budget hasn't impacted FX sentiment, with focus likely to rest on whether announced tax cuts make the RBNZ inflation outlook more challenging.

- AUD/USD is close to unchanged, last around 0.6605/10. Private Capex for Q1 rose 1.0%, slightly above expectations.

- Later the Fed’s Williams and Logan speak. In terms of data, there are revised US Q1 GDP, April trade and jobless claims plus Spain’s May CPI and European Commission May survey.

ASIA STOCKS: China & Hong Kong Equities Lower, Property The Worst Performer

Hong Kong & Chinese equities are mixed today. Hong Kong equities have track US markets lower as rising US yields weigh on market sentiment, Chinese equity markets are faring slightly better today with tech names the top performing, continued effort and policy updates to support the struggling property market don't seem to be helping support equity prices as regional real estate indices are the worst preforming today, although contracted sales look to stabilizing after rising an average 3% sequentially for 48 cities in the first 23 days of May. Elsewhere, Chinese chips stocks are higher after Samsung labor union said they will continue with planned strikes. The local calendar is empty today, Chinese PMI and Hong Kong Retail Sales are expected on Friday.

- Hong Kong equities are lower today, with property indices the worst performing, the Mainland Property Index is down 2.66%, while the HS Property Index is down 2.09%, elsewhere HSTech Index is faring better down just 0.40%, while the wider HSI is down 1.22%, the HSI has now fallen 7.40% from recent highs and has broken below the 20-day EMA, next support is the 50-day EMA at 17,891.

- In China onshore markets, the CSI300 is down just 0.16%, CSI 300 Real Estate Index is down 3%, small cap indices the CSI1000 is unchanged, CSI2000 is down 0.40%, while the ChiNext is up 0.14%

- (MNI): MNI China Press Digest May 30: PBOC, Electric Vehicles, ESG - (See link)

- In the property space, Logan Group faces a crucial deadline to pay or refinance a $1.3 billion loan for The Corniche project in Hong Kong, risking loss of control if it fails. Despite nearly two years of negotiation, the restructuring lacks finalized terms, adding complexity to the process. Additionally, Logan's offshore debt restructuring involves various challenges, including falling property prices and delays in bond repayments, highlighting the broader difficulties in China's real estate sector. Another city has relaxed down payment rules with Tianjin a northern Chinese city adjusting the required down payment for first-time homebuyers to no less than 15% from May 29, while the mortgage interest rate floor has been scrapped.

- Looking ahead: China PMI and Hong Kong Retail Sales of Friday

ASIA PAC STOCKS: Asian Equities Extend Losses As US Yields Head Higher

Asian equities have extended declines as the trading day has progressed and now look on track to mark three straight session of losses following moves made overnight in the US after another weak bond auction saw US treasury yields head higher. South Korean equities are the worst performing today after Samsung fell on reports of union strikes, while in Japan JGB yields continue to creep higher and the yen trades close to where it was suspect the BoJ intervened about a month ago. Earlier, Australia Building Approvals missed estimates, while NZ just released their budget.

- Japanese equities have gapped lower this morning, there has been no major headlines out so far this morning while it is also a quiet day for economic data in the region. Moves are being driven by higher US yields. The Nikkei 225 has tapped the 100-day EMA at 37,679, and now trade just above at 38,089 to be down 1.20% for the day, while the Topix is performing slightly better, the index did earlier break below the 50-day EMA but has managed to trade back above that post the break and currently trades down 0.45% for the day.

- Taiwan equities are lower today, while foreign investor selling hit a 1 month high on Tuesday. The largest contributor to Taiex moves, TSMC is down 1.20% while the Taiex is down about 1% today, although still holds above all major moving averages. The 14-day RSI is out of overbought territory falling to 60 from 75, while the MACD indictor is showing decreasing green bars. Later today we have GDP for 1Q with consensus at 6.50%, down slightly from prior reading of 6.51%.

- South Korean equities are lower today, Samsung is the largest contributor to the fall today after strikes continue to drag on. The Kospi is the worst performing index in the region today, we have broken below the 100-day EMA and trade down 1.30% while the small-cap Kosdaq is faring slightly better trading off just 0.65%.

- Australian equities are lower today although have been slowly grinding higher since the open. Earlier, Private Capital Expenditure for 1Q come in slightly above consensus at 1% vs 0.7%, while Building Approvals were below consensus at -0.3% vs 1.8% for April, and down from a revised 2.7% in March. Australian agriculture stocks are higher on the back of China lifting the ban on Australian beef, while BHP is the largest contributor to the fall today, with The ASX200 is down 0.48% and has just broken below the 100-day EMA.

- Elsewhere in SEA, New Zealand equities are down 1%, the NZ Budget has just been released however there has been little reaction by local markets, Indonesian equities are 1.25% lower, Indian equities are 0.50% lower, Singapore equities are 0.30% lower, Philippines equities are 0.70% lower while Malaysian equities are up 0.15%.

OIL: Crude Range Trading Ahead Of US EIA Data & OPEC Meeting

Oil prices have range traded during today’s APAC session after selling off on Wednesday ahead of today’s EIA data and Sunday’s OPEC meeting. WTI is little changed at $79.24/bbl following a low of $79.09 and high of $79.42. Brent is around $83.63/bbl after a high of $83.77. The USD index is up 0.1% after rising 0.5% yesterday.

- Prices look likely to fall in May and this will probably be taken into account at the June 2 online OPEC+ meeting when it considers whether to extend the full 2mbd output cut into H2. US demand and supply and China’s demand will also be important factors. It is expected to extend the reductions but could still surprise on the details of how long and how much.

- Bloomberg reported a 6.49mn drop in crude inventories, according to people familiar with the API data. Gasoline stocks fell 452k while distillate rose 2.05mn. The official EIA data are released today.

- Later the Fed’s Williams and Logan speak. In terms of data, there are revised US Q1 GDP, April trade and jobless claims plus Spain’s May CPI and European Commission May survey.

GOLD: Weaker Ahead Of Key US Data

Gold is 0.2% lower in the Asia-Pac session, after closing 1.0% lower at $2338.12 on Wednesday.

- Wednesday’s softness can be linked to a bear-steepening of the US Treasury curve as global bonds reacted to higher than expected German CPI.

- Overall, the precious metal continues to consolidate after hitting an all-time high of $2,450 last week ahead of a batch of key US economic indicators including Q1 GDP and Weekly Jobless Claims on Thursday and April’s PCE Deflator, the Fed’s preferred inflation gauge, on Friday.

- According to MNI’s technicals team, the medium-term trend structure remains bullish, and a resumption of gains would open $2452.5 next, a Fibonacci projection. The 50-day EMA, at $2305.8, represents a key support.

- In contrast, silver has edged up by 0.1% today to $32.1/oz, within sight of last week’s 11-year high at $32.5. A break of this level would open $33.887 next, a Fibonacci projection.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/05/2024 | 0600/0800 | *** |  | SE | GDP |

| 30/05/2024 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/05/2024 | 0700/0900 | ** |  | CH | KOF Economic Barometer |

| 30/05/2024 | 0700/0900 | *** |  | CH | GDP |

| 30/05/2024 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 30/05/2024 | 0900/1100 | ** |  | EU | Unemployment |

| 30/05/2024 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/05/2024 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/05/2024 | 0900/1100 | ** |  | IT | PPI |

| 30/05/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 30/05/2024 | 1230/0830 | *** |  | US | GDP |

| 30/05/2024 | 1230/0830 | * |  | CA | Current account |

| 30/05/2024 | 1230/0830 | * |  | CA | Payroll employment |

| 30/05/2024 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 30/05/2024 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 30/05/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 30/05/2024 | 1455/1055 |  | CA | BOC payment director gives speech in Toronto. | |

| 30/05/2024 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 30/05/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 30/05/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/05/2024 | 1605/1205 |  | US | New York Fed's John Williams | |

| 30/05/2024 | 2100/1700 |  | US | Dallas Fed's Lorie Logan |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.