-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Japan Oct Real Wages Unchanged Y/Y

MNI ASIA OPEN: Focus on November Jobs Ahead Fed Blackout

MNI ASIA MARKETS ANALYSIS: Consolidation Ahead Nov Jobs Report

MNI EUROPEAN OPEN: Familiar Matters Dominate As U.S. Gears Up To Vote

EXECUTIVE SUMMARY

- FED'S BARKIN - INFLATION WILL TAKE TIME TO LET UP (MNI)

- BIDEN WARNS ON RISK TO DEMOCRACY, TRUMP HINTS AT ANOTHER RUN ON EVE OF MIDTERMS (RTRS)

- ECB MUST BRING INFLATION BACK TO 2%, LAGARDE SAYS (BBG)

- JEREMY HUNT PLANS STEALTH RAID ON UK INHERITANCE TAX IN AUTUMN STATEMENT (FT)

- UK WELFARE AND PENSIONS SET TO RISE WITH INFLATION (TIMES)

- NEW ZEALAND INFLATION EXPECTATIONS SURGE HIGHER

- CHINA STOCK RALLY PAUSES AS COVID CASES SURGE MOST SINCE APRIL (BBG)

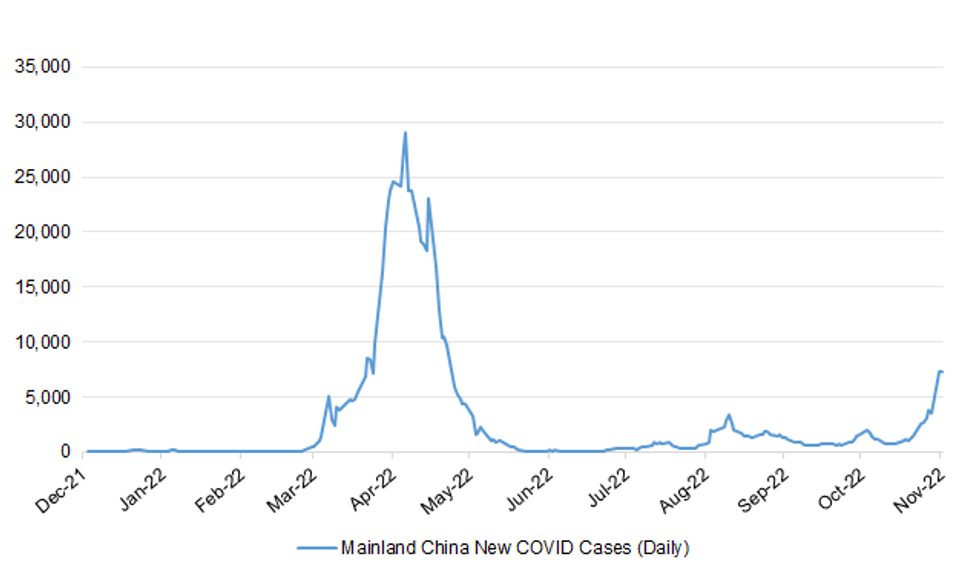

Fig. 1: Mainland China New COVID Cases (Daily)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Jeremy Hunt is planning a stealth raid on inheritance tax in the Autumn Statement as part of the chancellor’s attempt to raise about £54bn through tax rises and spending cuts to fill a hole in the UK public finances. (FT)

FISCAL: Rishi Sunak faces the first major test of his authority this week as he wrangles with the Cabinet over billions of pounds of spending cuts. (The i)

FISCAL: Rishi Sunak is expected to increase pensions and benefits in line with inflation in an effort to ensure the budget is seen as “fair and compassionate”. (The Times)

POLITICS: The Conservatives are on course to lose the next election over their failure to tackle the Channel migrant crisis alone, new polling for The Times has revealed. (The Times)

POLITICS: The latest proposals for a major shake-up of parliamentary constituencies across the UK have been unveiled. (Sky)

ECONOMY: Payments processor Barclaycard said 48% of people it surveyed over Oct. 21-24 plan to spend less this Christmas, with 59% intending to buy less generous gifts and 42% cutting back on socialising. (RTRS)

ECONOMY: In the depths of the pandemic in 2020, the owners of some typical small companies that are the bedrock of the UK economy spelt out their struggles to the Financial Times. On a return visit to the same entrepreneurs at Brickfields, a low-rise building in east London that has 98 offices and workshops, all the businesses the FT had spoken to two years ago were still trading. But some owners were almost as downbeat as in 2020, their post-Covid optimism eroded by rising costs and stuttering demand as the UK enters recession. Some had been hit by the fall in value of sterling and the supply chain disruption caused by the war in Ukraine. (FT)

BREXIT: British firms are yet to see any upside from Brexit, according to one of the UK’s top executives, who urged Prime Minister Rishi Sunak to improve the trade agreement with the European Union to boost growth. (BBG)

EUROPE

ECB: “What we have to do at the moment is difficult,” European Central Bank President Christine Lagarde told Estonian broadcaster ETV in an interview broadcast Monday night. “We have to bring inflation back to 2% in the medium term -- that’s our objective, that’s our primary concern, that’s our compass.” (BBG)

GERMANY: Germany's economic advisory council will recommend the government raise taxes on the wealthy to help finance the multi-billion euro relief packages it has agreed to fight the energy crisis, a German newspaper reported on Monday. (RTRS)

ITALY: Italy’s general government tax revenue expanded by EU41.7b in the first three quarters of the year from the same period year earlier, according to the Ministry of Economy in Rome. (BBG)

SPAIN: Spain has brushed off corporate concerns about its management of billions of euros of EU recovery funds, insisting it has reached “cruising speed” in developing investment plans and would meet strict audit standards to secure its next batch of money. (FT)

GREECE: Greek Prime Minister Kyriakos Mitsotakis on Monday denied media reports that he was behind an alleged round of wiretaps targeting government ministers, business people and journalists. (BBG)

IRELAND: The Irish government received more than enough demand to cover the sale of 8% of its majority stake in Allied Irish Banks (AIB) in an accelerated book build on Monday, one of the joint bookrunners said. (RTRS)

ENERGY: The European Union’s executive signaled it does not see a price cap on imported natural gas as the best tool to rein in an unprecedented energy crisis and instead suggested a plan that would spread the soaring costs over time. (BBG)

U.S.

FED: U.S. inflation will take a while to return to the Federal Reserve’s 2% target despite the central bank’s aggressive interest-rate hikes, Richmond President Thomas Barkin said Monday. (MNI)

FED: U.S. monetary policy is perhaps 225 basis points tighter than the restriction triggered by interest-rate hikes, as market yields were lifted even further by balance-sheet reduction and forward guidance, San Francisco Fed researchers said in a report Monday. (MNI)

POLITICS: U.S. President Joe Biden's public approval rating dipped to 39% in a Reuters/Ipsos poll on Monday, reinforcing nonpartisan election forecasters' expectations that his Democratic party was in for a drubbing in Tuesday's midterm elections. (RTRS)

OTHER

BOJ: Bank of Japan policymakers last month debated the need to examine the side-effects of prolonged monetary easing and the impact of a future exit from ultra-low interest rates, a summary of opinions showed on Tuesday. (RTRS)

BOJ: There will be no immediate changes to the Bank of Japan's easy monetary policy stance after the new governor takes office in April as officials will wait for the release of small firm wage data to assess the broader pace of wage hikes, MNI understands. (MNI)

JAPAN: Japan’s finance ministry stepped in to counter a rapid weakening of the yen just once in September, before escalating its support of the currency to an unprecedented degree last month. (BBG)

JAPAN: Japan is set to spend 1.4 trillion yen ($9.55 billion) in additional fiscal loans in a second extra budget set to be compiled this month, a draft of the spending plan seen by Reuters showed on Tuesday. (RTRS)

JAPAN: Japan may opt to hike taxes on ultra-wealthy individuals with annual incomes of more than 1 billion yen ($6.8 million), according to the tax panel chief of Prime Minister Kishida’s junior coalition partner party Komeito. (BBG)

JAPAN: Japan is delaying plans to revise how it taxes carbon, the Nikkei newspaper reported, potentially slowing efforts to wean itself off fossil fuels. (BBG)

RBNZ: The government has reappointed Adrian Orr for a second five-year term as governor of the Reserve Bank of New Zealand. (RNZ)

NORTH KOREA/RUSSIA: North Korea said on Tuesday it has never had arms dealings with Russia and has no plans to do so, its state media reported, after the United States said North Korea appears to be supplying Russia with artillery shells for its war in Ukraine. (RTRS)

BRAZIL: Brazil’s President-elect Luiz Inacio Lula da Silva delayed the much-awaited announcement of a multibillion-dollar spending plan as his team continues to discuss ways to pay for his main campaign pledges. (BBG)

BRAZIL: President Elect Luiz Inacio Lula da Silva’s transition team wants to combine three tools to open 175b reais in the country’s budget in order to fulfill campaign promises, O Globo newspaper said without informing how it obtained the information. (BBG)

RUSSIA: White House national security adviser Jake Sullivan has been engaged in confidential talks with senior Russian officials aimed at lowering the risk of a broader war over Ukraine, a source familiar with the conversations said on Monday. (RTRS)

RUSSIA: White House spokesperson Karine Jean-Pierre said on Monday the White house was not surprised by comments from a Russian businessman who said he had interfered in U.S. elections and would continue to do so. (RTRS)

RUSSIA: JPMorgan Chase & Co. CEO Jamie Dimon was in the hot seat. Deep into a seven-hour congressional hearing on Sept. 21, Representative Brad Sherman, a Democrat from California, pressed Dimon on whether his bank would sever ties with Russian companies including energy giant Gazprom PJSC. (BBG)

RUSSIA: The European Union will propose on Wednesday a new mechanism to provide €18 billion ($18.1 billion) in financial aid to Ukraine in a more predictable manner after the bloc was slow to provide all the support it promised earlier this year. (BBG)

SOUTH AFRICA: Power utility Eskom says that stage 2 load shedding will be implemented from 09h00 on Tuesday (8 November) and run until further notice. (Business Tech)

ENERGY: Vitol Group is locked in talks with a German state-backed energy firm after the trading house moved to stop deliveries of crucial gas that could inflict around €1 billion ($1 billion) of losses. (BBG)

ENERGY: Rishi Sunak is poised to announce a major gas deal with America after the Cop27 climate change summit, The Telegraph can disclose. (Telegraph)

CHINA

YUAN: China's foreign exchange reserves rose USD23.5 billion to USD3.05 trillion at the end of October on exchange rate conversions and asset price changes after two consecutive months of slight declines, 21st Century Business Herald reported. (MNI)

POLICY: The National Development and Reform Commission has issued a document containing 21 measures to increase support for the development of private investment, China Securities Journal reported. (MNI)

ECONOMY: China will face increased downward pressure on exports as the leading PMI index of major countries weighted by China’s exports has declined rapidly since June, wrote Zhong Zhengsheng, chief economist of Ping An Securities in a commentary published by Caixin. (MNI)

PROPERTY: China’s infrastructure investment will remain strong in 4Q22, underpinned by continued fiscal support, Fitch Ratings says in a new report. However, the property investment decline may widen further on a deeper contraction in land purchases and new construction starts amid lacklustre new home sales and a liquidity crunch for private developers. (Fitch)

CORONAVIRUS/EQUITIES: Chinese stocks halted a recent rally as a jump in Covid infections and official comments defending Covid Zero kept reopening optimism in check. (BBG)

CORONAVIRUS: Macau says it will allow some foreigners who meet specific conditions to enter the city through Hong Kong, Taiwan, or other countries or regions other than China without prior approvals, according to a government statement. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY13 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) on Tuesday injected CNY2 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY13 billion after offsetting the maturity of CNY15 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8000% at 9:35 am local time from the close of 1.7403% on Monday.

- The CFETS-NEX money-market sentiment index closed at 49 on Monday, flat from the close of Friday.

PBOC SETS YUAN CENTRAL PARITY AT 7.2150 TUES VS 7.2292 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.2150 on Tuesday, compared with 7.2292 set on Monday.

OVERNIGHT DATA

JAPAN SEP HOUSEHOLD SPENDING +2.3% Y/Y; MEDIAN +2.6%; AUG +5.1%

JAPAN SEP LABOUR CASH EARNINGS +2.1% Y/Y; MEDIAN +1.7%; AUG +1.7%

JAPAN SEP REAL CASH EARNINGS -1.3% Y/Y; MEDIAN -1.8%; AUG -1.7%

JAPAN SEP, P LEADING INDEX 97.4; MEDIAN 97.8; AUG 101.3

JAPAN SEP, P COINCIDENT INDEX 101.1; MEDIAN 101.1; AUG 101.8

AUSTRALIA OCT NAB BUSINESS CONFIDENCE 0; SEP 5

AUSTRALIA OCT NAB BUSINESS CONDITIONS 22; SEP 23

Conditions remained strong but business confidence weakened in October. By component, trading conditions and employment eased, but remain high alongside ongoing high levels of capacity utilisation. (NAB)

AUSTRALIA NOV WESTPAC CONSUMER CONFIDENCE 78.0; OCT 83.7

Sentiment continues to plumb historic lows. This print of 78.0 is now below the low point of the GFC (79.0) and only slightly higher than when the COVID pandemic first hit in April 2020 (75.6). Prior to that, we need to go back to the deep recession in the early 1990s to find a weaker read. (Westpac)

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 78.7; PREV 79.9

Consumer confidence dropped 1.5% last week as the RBA raised interest rates by 25bp. This was a sixth consecutive weekly decline in confidence, taking the index to levels last seen in early April 2020. Household inflation expectations climbed to 6.8%, its highest level since these data were first collected in April 2010. (ANZ-Roy Morgan)

AUSTRALIA OCT CBA HOUSEHOLD SPENDING INTENTIONS +0.9% M/M; SEP -0.5%

AUSTRALIA OCT CBA HOUSEHOLD SPENDING INTENTIONS +7.4% Y/Y; SEP +14.1%

The CommBank Household Spending Intentions (HSI) Index rose by +0.9%/mth in October 2022, to 116.0. The gains in October were, however, narrowly based and impacted by higher prices in a number of categories. In total, six of the HSI spending categories were up on the month, with six down. (CBA)

NEW ZEALAND Q4 2-YEAR INFLATION EXPECTATIONS +3.62%; Q3 +3.07%

SOUTH KOREA SEP BOP CURRENT ACCOUNT BALANCE +USD1.6112BN; AUG -USD3.0491BN

SOUTH KOREA SEP BOP GOODS BALANCE +USD494.0MN; AUG -USD4.4493BN

UK OCT BRC LIKE-FOR-LIKE SALES +1.2% Y/Y; SEP +1.8%

MARKETS

SNAPSHOT: Familiar Matters Dominate As U.S. Gears Up To Vote

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 362.79 points at 27884.84

- ASX 200 up 25.192 points at 6958.9

- Shanghai Comp. down 22.104 points at 3056.119

- JGB 10-Yr future down 6 ticks at 148.42, yield down 0.6bp at 0.251%

- Aussie 10-Yr future down 14.0 ticks at 95.950, yield up 13.8bp at 4.043%

- U.S. 10-Yr future down 0-03 109-17, yield up 1.48bp at 4.2283%

- WTI crude down $0.35 at $91.44, Gold down $6.46 at $1669.00

- USD/JPY up 15 pips at Y146.80

- FED'S BARKIN - INFLATION WILL TAKE TIME TO LET UP (MNI)

- BIDEN WARNS ON RISK TO DEMOCRACY, TRUMP HINTS AT ANOTHER RUN ON EVE OF MIDTERMS (RTRS)

- ECB MUST BRING INFLATION BACK TO 2%, LAGARDE SAYS (BBG)

- JEREMY HUNT PLANS STEALTH RAID ON UK INHERITANCE TAX IN AUTUMN STATEMENT (FT)

- UK WELFARE AND PENSIONS SET TO RISE WITH INFLATION (TIMES)

- NEW ZEALAND INFLATION EXPECTATIONS SURGE HIGHER

- CHINA STOCK RALLY PAUSES AS COVID CASES SURGE MOST SINCE APRIL (BBG)

US TSYS: Modest Downtick In Asia

Cash Tsys run 0.5-1.5bp cheaper at typing, with intermediates leading the weakness. TYZ2 is -0-02+ at 109-18, 0-04 off the base of its 0-09 range on solid volume of ~95K. TY futures failed to test initial technical support in the form of Friday’s low during Asia dealing.

- Screen-based sales in TY futures helped Tsys to cheapest levels of the session, with the move facilitated by news that Macau is to ease entrance rules for foreigners from Nov. 13.

- Some participants were leaning on the idea that this points towards an eventual loosening of ZCS restrictions in mainland China given recent speculation surrounding that matter. However, some caveats around the Macau headlines that were a little more restrictive than the initial headline suggested limited the move lower in Tsys.

- A fresh downtick in Chinese equities during early afternoon trade (that move was initially aided by another multi-month high for new Chinese COVID cases) allowed Tsys to stabilise off of lows into European hours.

- Antipodean FI dynamics had provided some cheapening pressure earlier in the session.

- Tuesday’s NY slate includes the release of NFIB small business optimism data, as well as 3-Year Tsy supply. Further out, the results from the mid-terms (with opinion polls pointing to the GOP taking the House, and maybe the Senate) and the CPI print provide this week’s key domestic risk events.

JGBS: Light Steepening Pressure, Prefecture Cancels Plans To Issue Long Bond

The major cash JGB benchmarks are mostly little changed on the day, with a slightly more pronounced round of cheapening observed in 20s, resulting in some light steepening of the curve. This came after some pressure for wider core global FI markets on Monday & during Tuesday’s Asia-Pac session. Futures have softened during the afternoon, but remain relatively contained, -10 ahead of the bell.

- BoJ Rinban operations covering 1- to 25-Year JGBs didn’t provide any tangible market impact.

- Fiscal speculation continued in Japan, with source reports doing the rounds re: adjustments to tax structures, alongside continued reports surrounding bond issuance to finance the government’s latest fiscal support package, although these headlines were not market moving.

- Participants also looked through the summary of opinions covering the latest BoJ monetary policy meeting.

- Shizuoka prefecture cancelled its plans to sell 20-Year paper owing to market conditions & the rise in super-long yields This comes after the prefecture cancelled plans to sell 30-Year paper back in September.

- Wednesday’s domestic docket consists of the release of the release of the latest economy watchers survey, BoP data and 30-Year JGB supply.

AUSSIE BONDS: Syndication & Global Forces Weigh

YM finished -14.0, with XM -13.0, as the contracts went out just off their respective late Sydney lows. Cash ACGBs saw 12.5-14.5bp of cheapening, with 5s leading the weakness.

- Futures extended on overnight weakness in early Sydney dealing as Asia-Pac participants reacted to Monday’s cheapening in core global FI markets and made room for today’s ACGB May-34 syndication.

- A$14.0bn of the new ACGB May-34 priced, which was probably a little smaller in size than many expected (there was plenty of demand apparent, with A$42.4bn of orders received at the final clearing price).

- Still, XM futures only saw a modest uptick from lows after hedging flows surrounding the syndication subsided.

- Another multi-month high for new COVID cases in China and a soft round of domestic business and consumer confidence data did little to support the space, with a move higher in NZ inflation expectations spilling over, adding a trans-Tasman dimension to the weakness in ACGBs.

- Bills were 1-12bp softer through the reds, with the front end of the reds leading the weakness.

- Peak cash rate pricing in RBA dated OIS nudged a touch higher today, finishing just above 4.10%.

- Looking ahead to Wednesday, the local docket will be headlined by an address from RBA Deputy Governor Bullock, with the topic of “The Economic Outlook” being discussed in front of the ABE annual dinner.

AUSSIE BONDS: Nov-32 Index-Linked Auction Results

The Australian Office of Financial Management (AOFM) sells A$150mn of the 0.25% 21 November 2032 Indexed Bond, issue #CAIN416:

- Average Yield: 1.6285% (prev. 1.9705%)

- High Yield: 1.6350% (prev. 1.9925%)

- Bid/Cover: 3.3000x (prev. 3.1300x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 50.0% (prev. 80.0%)

- Bidders 46 (prev. 34), successful 12 (prev. 4), allocated in full 10 (prev. 2)

NZGBS: Global Forces & Firmer Inflation Exp. Weigh On NZGBs, RBNZ Pricing Shifts Higher

NZGBs finished 12-13bp cheaper on Tuesday, with Monday’s weakness in core global FI markets, a move higher in domestic inflation expectations and spill over from the presence of notable ACGB supply across the Tasman at the centre of today’s sell off.

- Swap rates mostly tracked the move in NZGBs leaving swap spreads little changed to a touch narrower on the day.

- 2-Year inflation expectations lodged a fresh cycle peak of 3.62%, as the labour market continuing to provide a key source of domestic inflation.

- This print allowed RBNZ dated OIS to move higher, adding to the earlier uptick, with 73bp of tightening priced for this month’s meeting. Pricing for the terminal OCR has moved up to 5.45%, ~20bp above levels seen late on Monday.

- We also saw the reappointment of RBNZ Governor Orr for a second 5-year term, which will start in March ’23. The opposition National Party presented a clear source of dissent, stressing that it was appalled by the fact that the decision was made before the review of the RBNZ was completed.

- Wednesday’s domestic docket will see the release of card spending data, the publication of the RBNZ’s review of monetary policy implementation and an address from RBNZ Assistant Governor Silk (although this comes at the Payments NZ "The Point" conference, with the subject topic limiting the scope for meaningful comments re: monetary policy).

EQUITIES: Mixed Trends, Rising Covid Cases Dampen China/HK Sentiment

Asia Pac equities have been mixed today. Tech sensitive markets have outperformed, while China/HK stocks have faltered somewhat. US equity futures have traded tight ranges overall, currently close to flat across the major indices, ahead of mid-term elections in the US this evening.

- The HSI has tracked sideways for the most part today, struggling to stay in positive territory. Still, we aren't too far from multi-week highs. The tech sub-index is also around flat, just below the 2100.

- The surge in domestic Covid cases onshore in China is likely to push back any dramatic shift in Covid-zero policies in the near term. Today case numbers were above 7.3k, the highest in 6 months.

- The CSI 300 is off by 0.75%, the Shanghai Composite by 0.50% at this stage.

- Tech plays have done better elsewhere in the region. The Nikkei 225 is up close to 1.5%, the Kospi +1.0%. Interestingly, the Kospi is above its 100-day EMA (2383.1, versus 2396 last). This has been a resistance point going back to late September 2021. The Taiex is also higher, adding 1%. These gains are consistent with tech outperformance during the US session overnight.

- The ASX has lagged somewhat, up just under 0.40% at this stage.

OIL: Range Trading As Supply And Demand Forces Offset Each Other

Prices range traded again today as the market continued to be driven by the offsetting forces of tight supply conditions and fears regarding the impact of a global slowdown on oil demand.

- WTI is down about 0.7% from its intraday high and is trading just about $91.50/bbl. It continues to hold above its 10-, 20- and 50-day moving averages. Brent is 0.6% off its high and is now just under $97.70/bbl.

- The market is still working out what the likely impact of the OPEC+ output cuts this month and the upcoming EU sanctions on Russian oil will be in reality. Given the tightness of the market, the latter may be enough to push prices back above $100/bbl. (Bloomberg)

- Given supply concerns, there is likely to be some focus on the US API data out tonight, which last week reported a 6.53mn draw on crude stocks.

- The China National Petroleum Corp. said that the country’s crude demand fell 2.8% y/y in the year to September which has resulted in an inventory build of gasoline and diesel. (Bloomberg) Even a cautious reopening would put further pressure on global oil supplies pushing up prices.

GOLD: Modest Drift Lower Ahead Of Key Event Risks

Gold is currently around the $1673 level, drifting modestly lower through the course of the session, off 0.15% versus NY closing levels. This fits with a slightly firmer tone to the USD through the course of the session.

- The precious metal has stuck to recent ranges since the start of the week. Overnight gains above $1680 couldn't be sustained, but we haven't tested sub $1670 yet.

- We might have seen a break higher if not for the resilient US yield backdrop. Current levels of gold continue to look too high relative to the real 10yr yield.

- ETF gold holdings continue to drift lower.

- The focus will also be upcoming risk event, with the US Mid-Term elections happening tonight, then US CPI prints later in the week.

FOREX: G10 FX Space Sees Little Action With Key U.S. Risk Events Ahead Stealing Limelight

The BBDXY oscillated between gains and losses as most major FX crosses treaded water, with the greenback last sitting atop the G10 pile, virtually on a par with the yen in terms of today's performance. Key U.S. risk events drew nearer, with all eyes on the midterm elections and monthly CPI data.

- The Aussie dollar showed a muted reaction to weak domestic outturns for consumer and business confidence. Westpac Consumer Confidence fell to 78.0 (prev. 83.7), while NAB Business Confidence slipped to 22 (prev. 25) amid higher interest rates and elevated inflation.

- New Zealand's inflation expectations rose across the board in the RBNZ's Q4 Survey of Expectations, cementing the case for continued aggressive monetary tightening. The data saw participants add hawkish central bank bets, with ~71bp worth of OCR hikes priced for this month's monetary policy review. The reaction in NZD/USD was limited to a brief knee-jerk higher.

- AUD/NZD trades slightly below neutral levels, having clawed back the bulk of losses registered on the back of New Zealand's inflation expectations data. AU/NZ 2-Year swap spread was heavy, weighing on spot AUD/NZD.

- Spot USD/CNH is poised for a bullish inside day, as a 6-month high in China's COVID-19 case count applying some pressure to the yuan. The PBOC fix returned to a stronger bias after a pause yesterday.

- EZ retail sales and comments from ECB's Nagel & Wunsch, BoE's Pill & Riksbank's Breman will take focus after Asia-Pac hours.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/11/2022 | 0745/0845 | * |  | FR | Foreign Trade |

| 08/11/2022 | 0745/0845 | * |  | FR | Current Account |

| 08/11/2022 | 0900/1000 |  | IT | Retail Sales | |

| 08/11/2022 | 0900/0900 |  | UK | BOE Pill Panels UBS European Conference | |

| 08/11/2022 | 1000/1100 | ** |  | EU | retail sales |

| 08/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/11/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 08/11/2022 | - |  | US | Legislative Elections / Midterms | |

| 08/11/2022 | - |  | EU | ECB de Guindos at ECOFIN meeting | |

| 08/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/11/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/11/2022 | 1800/1300 | *** |  | US |

US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.