-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Familiar Risks Dominate Into Christmas

EXECUTIVE SUMMARY

- JOHNSON MAKES LAST-DITCH PUSH FOR BREXIT DEAL WITH MOVE ON FISH (BBG)

- UK AND FRANCE TO SET OUT PLAN TO RESTART FREIGHT

- UK COVID TESTING CAPACITY EXPECTED TO FALL SHORT AS CASES SURGE (FT)

- CONGRESS APPROVES LONG-AWAITED $900 BILLION COVID RESCUE PACKAGE (CNN)

- PFIZER PARTNER BIONTECH READY TO BOOST VACCINE CAPACITY FOR 2021 (BBG)

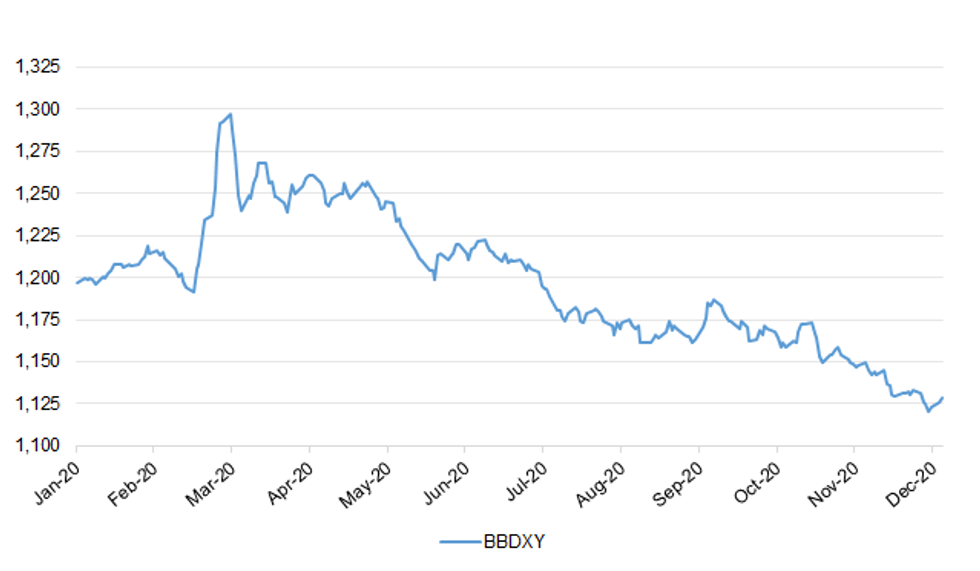

Fig. 1: Bloomberg Dollar Index (BBDXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Boris Johnson has ruled out extending the deadline for reaching a post-Brexit trade deal into 2021, amid a deadlock in talks and a growing Covid crisis. SNP leader Nicola Sturgeon and London mayor Sadiq Khan want the UK to follow EU trading rules beyond 31 December to allow more time for an agreement. But the prime minister said his stance was "unchanged" and the UK would "cope with any difficulties" encountered. (BBC)

BREXIT: Boris Johnson says he believes trading under World Trade Organization terms would be 'entirely satisfactory' for the UK if it fails to secure a deal with the European Union before the Brexit transition period ends on New Year's Day. During an afternoon news conference he says Britain would 'prosper mightily' even if the talks collapsed overnight. 'Not that we don't want a deal,' he adds. (Guardian)

BREXIT: Britain and the EU moved closer to a compromise on fisheries on Monday night as MPs were told to prepare to vote on a potential trade deal on Wednesday next week. The Government tabled an 11th-hour proposal that would see the bloc slash the value of its fishing catch in UK waters by roughly a third over a transition period of five years, it was claimed, down from an initial demand to cut it by 60 per cent over three years. EU negotiators have held out for a reduction of just 25 per cent over a seven-year transition, according to reports. The bloc initially tabled a cut of 18 per cent over 10 years. However, an EU official speaking about the UK's latest offer told The Telegraph: "It's still a no from us." (Telegraph)

BREXIT: MNI SOURCES: UK Fish Offer Improves Chances Of EU Trade Deal

- The UK has moved a long way towards EU demands on fisheries, improving the prospects of a trade deal, although Brussels is expected to hold out for further concessions, according to sources in touch with both sides of the negotiations - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

BREXIT: The European Union is considering a fresh proposal on fishing rights from the U.K. as Prime Minister Boris Johnson aims to secure an 11th-hour trade deal. Both parties had signaled over the weekend that they could make no further compromises, but on Monday the U.K. offered to give further ground if the EU backed down in other areas, according to people familiar with the negotiations. The latest suggestion from Britain would see the EU reduce the value of the fish it catches in U.K. waters by about a third. Last week the U.K. was insisting the EU accept a 60% cut. The EU told negotiators on Friday that a 25% reduction was its final offer and this was already difficult for countries including France and Denmark to accept -- the bloc had initially suggested 18%. (BBG)

BREXIT: Major hurdles remain over fishing in the Brexit talks and Britain's proposals are so far unacceptable to France, French European Affairs junior Minister Clement Beaune said on Monday. The French government said earlier it was sticking to its "red lines" when it came to EU rights to fish in British waters. (RTRS)

CORONAVIRUS: The UK may not have enough coronavirus tests to meet surging demand in the coming weeks, according to an internal government document, as the new strain of Covid-19 sends cases soaring. Demand for the conventional polymerase chain reaction (PCR) tests used by the NHS Test and Trace programme was predicted to outstrip supply in the week to Christmas by up to 50,000 tests a day, according to government calculations made last week and seen by the Financial Times. (FT)

CORONAVIRUS: The toughest coronavirus restrictions must be extended to "get ahead" of infections driven by a new variant, according to the chief scientific adviser. Sir Patrick Vallance said that lesser measures had proved ineffective and a stricter approach was likely. Public health chiefs in the north and Midlands instructed people arriving yesterday from Tier 4 areas in southern and eastern England to self-isolate for ten days in the first such "domestic quarantine" measures. (The Times)

CORONAVIRUS: Boris Johnson is facing intense pressure to impose another national lockdown within days, as more than 40 countries banned arrivals from the UK in an effort to keep out a new fast-spreading variant of coronavirus. Government scientific advisers warned that inaction could cost tens of thousands of lives and risk an "economic, human and social disaster", with the new strain spreading across the UK and overseas. (Guardian)

CORONAVIRUS: Ministers are considering keeping schools closed for all of January amid fears that the new Covid-19 strain is spreading faster among children, The Telegraph understands. (Telegraph)

CORONAVIRUS: Prime Minister Boris Johnson said delays at Dover only affect "human-handled freight" - about 20% of the total going to continental Europe. Speaking at a press conference he reassured the public on food supplies saying: "British supermarkets say supply chains are strong and robust". He added that he understands the concerns of 'our international friends' over the new variant. (BBC)

CORONAVIRUS: Retailers have played down fears of food shortages after France shut its borders to UK hauliers for 48 hours due to the UK's new coronavirus variant. But they warned of "serious disruption" without a resolution, with Tesco and Sainsbury's saying some fresh produce such as lettuce could run short. The prime minister's spokesman said the UK had a "diverse" food supply chain. France's transport minister has said measures to "ensure that movement from the UK can resume" are close. (BBC)

CORONAVIRUS: Boris Johnson is drawing up contingency plans to test all lorry drivers taking goods across the Channel in order to bring an end to the disruption at Britain's ports. Ministers are understood to be preparing "infrastructure" to allow thousands of truckers to be tested for Covid-19 after France insisted hauliers should be cleared as negative before entering the country. On Monday night, Mr Johnson made a personal appeal to Emmanuel Macron, the French president, to reopen the French border after ports were closed in response to the news that a newly-discovered mutant coronavirus strain was "out of control" in London and the South-East. (Telegraph)

CORONAVIRUS: Lorry drivers in Kent have spent a second night sleeping in their vehicles waiting for the border with France to reopen - as politicians thrash out a plan to restart trade and travel. France shut the border for 48 hours on Sunday, leaving 945 lorries stacked-up near Dover amid fears over a new coronavirus variant in the UK. Other European countries are talking about how to coordinate their response. More than 40 countries have now banned UK arrivals due to the mutation. Measures agreed between Prime Minister Boris Johnson and French President Emmanuel Macron will be announced later and come into effect from Wednesday, French Europe Minister Clément Beaune said. European Union member states will meet again in Brussels to discuss a co-ordinated response, including pooling expertise about the dangers posed by the new variant, our Europe correspondent Kevin Connolly said. (BBC)

CORONAVIRUS: The French government could have "helped" Britain tackle the infectious new strain of coronavirus if not for Brexit, France's EU commissioner said as the country demanded tests for lorry drivers to lift its freight ban. (Telegraph)

CORONAVIRUS: Royal Mail has halted deliveries to Europe, except for the Republic of Ireland, due to a UK travel ban triggered by the discovery of a new faster spreading coronavirus strain. (Sky)

CORONAVIRUS: Stormont executive ministers are holding an emergency meeting following a row over whether a travel ban should be introduced. Health minister Robin Swann has recommended issuing guidance advising against non-essential travel between Northern Ireland and Great Britain, and Northern Ireland and the Irish Republic. Mr Swann has also advised that anyone arriving into the region self-isolate for 10 days. It is understood Sinn Fein finance minister Conor Murphy has written to Mr Swann expressing "dismay and astonishment" that he is not moving immediately to instigate a ban on travel between Northern Ireland and Great Britain. (Sky)

CORONAVIRUS: The White House is considering requiring travelers from the United Kingdom to present proof of a negative coronavirus test before arriving in the United States, two administration officials tell CNN. (CNN)

CORONAVIRUS: All three airlines that fly from the U.K. to New York have agreed to test for Covid-19, according to Governor Andrew Cuomo's office. British Airways, Delta and Virgin Airlines all will require passenger testing, Cuomo spokesman Rich Azzopardi said on Twitter. (BBG)

CORONAVIRUS: The US state of Washington will impose stricter requirements on visitors from the UK and South Africa, governor Jay Inslee announced late on Monday. (FT)

ECONOMY: Almost 40,000 retailers in the UK were in "significant financial distress" even before the introduction of tighter restrictions over the weekend forced non-essential shops to shut. Research by the insolvency specialist Begbies Traynor found that 39,232 retailers – both online and bricks and mortar operations – were experiencing severe financial problems in the three months to 9 December. This was up 11% on the previous three months and 24% higher than the same period a year earlier. (Guardian)

GILTS: The UK's Debt Management Office has defended one of its main ways of financing the government's spending after a senior parliamentarian questioned whether it was harming taxpayers. The DMO primarily issues bonds to keep the UK government funded through regularly-scheduled auctions, which are supplemented with more bespoke "syndications" arranged through a club of big banks known as primary dealers. It is the latter process that Mel Stride, a Conservative MP that chairs Parliament's Treasury select committee, highlighted in a public letter earlier this month, questioning whether the pricing of over £300bn of gilts sold through syndications since 2009 had been "keen enough in favour of the taxpayer". Sir Robert Stheeman, who has led the DMO since 2003, has replied that the mix between syndications and auctions "reflects our judgment on the most effective way of delivering the financing requirements as a whole", and defended syndications as an important part in the DMO's toolkit — especially at times of financial stress. (FT)

EUROPE

CORONAVIRUS: If all goes according to schedule, vaccine shipments will leave warehouses on December 26, and European countries could start vaccinating between December 27 and 29 — which Commission President Ursula von der Leyen's declared Europe's vaccinations days. Still, some countries like Denmark said they would vaccinate as soon as the shipments arrive. Others like the Netherlands might have to wait until January due to technical issues. Other countries have not yet made their vaccination plans public. It will be up to each EU country to administer the vaccine and choose priority groups, although the Commission issued recommendations in the fall. (POLITICO)

GERMANY: German total tax revenue, excluding municipal taxes, declines by 7% in November compared with the same month a year earlier, Finance Ministry says in latest monthly report. Tax income -8% y/y in Jan.-Nov. period. Federal income tax revenue -31% y/y in Nov.; -14.7% y/y in Jan.-Nov. period. Federal spending in Jan.-Nov. period +26.9% y/y, income -13.8%. Jan.-Nov. federal financing deficit EU133.6b. "In light of the development of the pandemic, and the measures that are still required to contain them, the economic risks can be assessed as very high". "Due to the pandemic and the necessary containment measures, a significantly weaker economic development is to be expected for the final quarter". (BBG)

NORWAY: Norwegian banks should hold total distributions within a maximum of 25% of the cumulative annual result for the years 2019 and 2020, Financial Supervisory Authority says in a letter to the Finance Ministry published on the FSA's website. (BBG)

U.S.

FED: MNI INTERVIEW: Business Scarring Under Way--Minn. Fed Analyst

- The economy is already scarred by the first nine months of the pandemic even with many firms hopeful adaptations since the first wave will help them them carry on until in-store visits return to normal, Minneapolis Federal Reserve regional outreach director Ron Wirtz told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Congress voted Monday evening to approve a far-reaching $900 billion Covid relief package that promises to accelerate vaccine distribution and deliver much-needed aid to small businesses hit hard by the pandemic, Americans who have lost their jobs during the economic upheaval and health care workers on the front lines of the crisis. The White House has said that President Donald Trump will sign the legislation once it reaches his desk. (CNN)

FISCAL: The $900 billion economic relief plan in Congress carves out a slice for renters and landlords, but some economists and industry experts claim it is not even close to enough. (CNBC)

FISCAL: Yellen pledged to boost CDFI, MDI small business lending. (BBG)

CORONAVIRUS: On Monday California Governor Gavin Newsom announced that many areas of the state would likely see an extension of his 3-week stay-at-home order which is set to expire in Southern California on December 30. "Based upon all the data," said the Governor, "It's very likely that we're going to extend the stay at home order." (Deadline)

CORONAVIRUS: New Jersey Governor Phil Murphy said there's been a 20% increase in cases since Thanksgiving, up to 4,800 a day on average since the holiday. Some of those days have recorded totals of more than 6,000 new cases. He warned New Jerseyans not to travel or gather with those outside immediate family. (BBG)

CORONAVIRUS: Americans are putting aside health risks and flying in increasing numbers during the Christmas holiday season. Sunday was the third day in a row in which more than 1 million people passed through U.S. airport screening, the first time that has occurred since the virus erupted in mid-March, according to Transportation Security Administration data. Airline travel during the Covid-19 pandemic remains well below 2019 levels, however. Even with the recent surge, the number of people flying on Friday through Sunday was only 42% of the equivalent three days last year. (BBG)

CORONAVIRUS: The U.S. recommends that airports and airlines encourage "pre-departure and post-arrival" Covid-19 testing for passengers, according to new guidance issued by three federal agencies. (BBG)

POLITICS: Attorney General Bill Barr told reporters Monday that he sees no reason to name a special counsel to investigate Hunter Biden, there is no basis for the federal government to seize voting machines, and that he agrees with Secretary of State Mike Pompeo's assessment that Russia was behind the massive recent hack of federal agencies. (Axios)

EQUITIES: Apple Inc is moving forward with self-driving car technology and is targeting 2024 to produce a passenger vehicle that could include its own breakthrough battery technology, people familiar with the matter told Reuters. (RTRS)

EQUITIES: Facebook Inc. and Alphabet Inc.'s Google agreed to "cooperate and assist one another" if they ever faced an investigation into their pact to work together in online advertising, according to an unredacted version of a lawsuit filed by 10 states against Google last week. (WSJ)

OTHER

U.S./CHINA: The United States on Monday imposed additional visa restrictions on Chinese officials over alleged human rights abuses, taking further action against Beijing in the final month of U.S. President Donald Trump's term. (RTRS)

U.S./CHINA: The U.S. should return to the Joint Comprehensive Plan of Action as soon as possible and China supports multilateral talks on regional security in the Gulf, the China Daily reported, citing Foreign Minister Wang Yi's speech at a meeting about Iran's nuclear issues. China urges the U.S. to lift pressure and sanctions on Iran, which Wang said will further delay Iran's return to its nuclear commitments even as President-elect Joe Biden shows an interest in rejoining the negotiations. (MNI)

EU/CHINA: China and the European Union are likely to wrap up their investment deal – seven years in the making – "soon", according to Chinese Foreign Minister Wang Yi, who met with ambassadors from the 27 EU nations in Beijing on Monday. Wang is the first senior Chinese official to play up the prospect of a deal, after an agreement in principle was reached between China and the EU, just weeks before the end-of-year deadline. (SCMP)

GEOPOLITICS: The Trump administration on Monday published a list of Chinese and Russian companies with alleged military ties that restrict them from buying a wide range of U.S. goods and technology. (RTRS)

CORONAVIRUS: The number of Americans admitted to hospital with Covid-19 rose to a new high near 115,000, while the pace of new infections eased to its lowest level since the start of December. Hospitalisations have slowed across much of the US Midwest in recent weeks, an encouraging sign after the region emerged as a hotspot for coronavirus early in an autumn resurgence of the disease. However, several states in the north-east, south and west continue to grapple with a rise in admissions for Covid-19. (FT)

CORONAVIRUS: World Health Organization officials said the coronavirus is mutating "at a much slower rate" than seasonal influenza, even as officials in the U.K. announced this weekend that a new mutation of the virus is allowing it to spread more easily. (CNBC)

CORONAVIRUS: President Donald Trump's coronavirus vaccine czar, Dr. Moncef Slaoui, said that he expects Pfizer's and Moderna's Covid-19 shots will be effective against a new mutation of the virus found in the U.K. (CNBC)

CORONAVIRUS: Pfizer Inc. partner BioNTech SE is pursuing all its options to make more Covid-19 vaccine doses than the 1.3 billion the companies have promised to produce next year, according to the German company's chief executive officer. The companies will probably know by January or February whether and how many additional doses can be produced, Ugur Sahin said Monday. "I am confident that we will be able to increase our network capacity, but we don't have numbers yet," he said in an interview. Efficacy results of more than 90% and approvals around the world have set off a race between countries for additional supplies of the precious shots, with the U.S. seeking to exercise an option for a hundred million. Most of the doses anticipated for next year -- enough to immunize 650 million people -- have already been spoken for. (BBG)

CORONAVIRUS: The U.S. National Institutes of Health plans to begin a clinical trial that aims to help doctors "predict and manage" allergic reactions related to the Pfizer Inc.-BioNTech SE Covid-19 vaccine, according to Moncef Slaoui, chief scientific adviser to Operation Warp Speed, the U.S. vaccine program. Slaoui said during a Monday news briefing that the aim of the trial, which will also study the Moderna Inc. shot just authorized for emergency use, will be to pinpoint why the incidents, known as anaphylaxis, are occurring. (BBG)

CORONAVIRUS: Sinovac Biotech Ltd.'s Covid-19 vaccine, which scientists hope can help combat the pandemic in the developing world, has passed the 50% threshold for efficacy in late-stage trials in Brazil, meaning regulators can give it the green light for use, people involved in its development said. Brazil is the first country to complete Phase 3 trials of the Chinese company's CoronaVac vaccine, which is also being tested in Indonesia and Turkey. With Covid-19 largely under control in China, the country's vaccine developers have had to conduct their clinical trials abroad. (WSJ)

CORONAVIRUS: Starpharma has received all necessary approvals to commence its clinical study for Viraleze, according to an ASX statement. (BBG)

AUSTRALIA: Australia's most-populous state reported 8 new local cases of Covid-19 on Tuesday as authorities battled to bring an outbreak in Sydney under control without having to resort to lockdowns over Christmas. Seven of the cases are linked to infections in the Northern Beaches area of the city, bringing that cluster to 90, New South Wales state Premier Gladys Berejiklian told reporters. The other case was a health care worker, who transported infected overseas travelers from Sydney airport to hotel quarantine. (BBG)

AUSTRALIA/CHINA: Australia has requested dispute consultations with China concerning duties imposed by China on Australian barley imports, the World Trade Organization confirmed on its website on Monday. Australia said last week it had launched a formal appeal over China's action, starting a formal 60-day period for discussions between the two countries before an adjudicating panel is formed. The request was officially circulated to WTO members on Monday and published by the Geneva-based body. (RTRS)

SOUTH KOREA: South Korea's coronavirus transmission rate has shown possible signs of easing after the government instituted its toughest social distancing restrictions since the outset of the pandemic. The Korea Disease Control and Prevention Agency reported 869 new Covid-19 infections on Tuesday morning, the second consecutive day case numbers were below 1,000. (FT)

SOUTH KOREA: South Korea will close ski slopes and other tourist attractions during the upcoming holiday season to prevent the spread of the coronavirus, Prime Minister Chung Sye-kyun said Tuesday. The new restrictions will be part of the government's special antivirus measures in effect from Thursday until Jan. 3, Chung said during an interagency meeting on the COVID-19 pandemic response. "We intend to break the force of the third wave with measures that are stronger than those under Level 3 social distancing," he said. The capital area is currently under Level 2.5, the second highest in a five-tier scheme, as authorities continue to weigh the pros and cons of adopting Level 3 rules. (Yonhap)

SOUTH KOREA: Prolonged period of low interest rates has boosted liquidity and may cause side effects such as overheating of asset markets and widening inequality, South Korean Vice Minister Kim Yongbeom says during a meeting. Managing liquidity in a stable manner is an important task for South Korea's economic management. South Korea will strengthen support to help boost investment and exports. (BBG)

CANADA: All of Ontario will move into a lockdown on Boxing Day in a bid to curb climbing COVID-19 case numbers and spare hospitals and their intensive care units from being inundated in January, Premier Doug Ford said Monday. The announcement comes as Ontario recorded 2,123 more COVID-19 cases and new modelling painted a grim picture of intensive care units overwhelmed with coronavirus patients if further restrictions aren't implemented. (CBC)

CANADA/CHINA: TMAC Resources said its sale to Shandong Gold Mining didn't receive Canadian regulatory approval and the transaction will not proceed, according to a statement. TMAC and Shandong are in talks regarding termination of the deal. TMAC expects to have sufficient cash on hand to fund 2021 sealift, but not enough to fully replay maturing debt extended to June 30, 2021. (BBG)

BRAZIL: Brazil's lower house speaker Rodrigo Maia will decide who he will support to succeed him until Dec. 23, he said to reporters in Brasilia. Senate and federal government have no intention to suspend recess to move forward the reform agenda, he said. (BBG)

RUSSIA: Suspected Russian hackers compromised dozens of Treasury Department email accounts and breached the office that houses its top officials, as part of a broad campaign targeting several critical federal government agencies, a senior senator said Monday. The Treasury Department still doesn't know all of the activity the hackers engaged in or precisely what information was stolen, Sen. Ron Wyden (D., Ore.), the ranking Democrat on the Senate Finance Committee, said in a statement to The Wall Street Journal. Mr. Wyden said the hackers had broken into systems in the Treasury Department's Departmental Offices division, home to the highest-ranking officials. It wasn't clear which officials were impacted, but an aide to Sen. Wyden said the Treasury Department doesn't believe Secretary Steven Mnuchin's email account was compromised. The department was notified of the dozens of compromised email accounts by Microsoft, which is investigating the hack, Mr. Wyden said. (WSJ)

RUSSIA: The US Treasury confirmed for the first time on Monday that hackers had gained access to its IT systems, as more details continued to emerge about the massive cyber espionage campaign that came to light last week. US government agencies have been among the casualties of the campaign, which has been taking place over the past nine months and is still ongoing. Steven Mnuchin, Treasury secretary, confirmed reports that his department had been hacked, saying that its unclassified systems had been accessed but its classified systems had not. (FT)

METALS: High iron ore prices are due for a correction in the coming year as Chinese demand for the steelmaking ingredient is expected to ease, though aggressive speculation through iron ore derivative trading could thwart that outcome, according to analysts. After the China Iron and Steel Association (CISA) held talks last week with Australia's Rio Tinto and BHP, two of the world's biggest iron ore miners, over how to control iron ore prices, prices have increased to near their highest levels since 2011, sailing past the US$160 a tonne price point to hit US$161.50 on Monday after a dip to about US$153 a tonne last week. In the short term, despite its trade conflict with China, Australia has seen a small "mining boom" impact on the economy as a result of the high iron ore prices. (SCMP)

OIL: Iran sees Russia as a "strategic partner" and the two countries share close views within the OPEC+ alliance, Oil Minister Bijan Zanganeh was quoted by the Iranian oil ministry's news agency SHANA as saying in Moscow on Monday. "We see Russia as a strategic partner and this partnership will not change with the warm and cold atmosphere in the international arena...The views of both sides were close in talks (about OPEC+ cooperation)," Zanganeh said after meeting Russian Deputy Prime Minister Alexander Novak, SHANA reported. (RTRS)

CHINA

PBOC: China is likely to maintain its current monetary policies into next year, while any withdrawal of pandemic-era stimulus will be done gradually, the Economic Information Daily reported, following the Central Economic Work Conference. China will maintain the stability of the yuan by aligning market rates to the PBOC's moves. China may offer refinancing to micro and small businesses, ensure stable capital flows and prevent policy mismatch, the newspaper said, citing Wen Bin, a researcher from China Minsheng Bank. The PBOC may continue to maintain liquidity through OMO/MLF operations with targeted RRR cuts to manufacturing and microlending to medium enterprises, the newspaper said, citing Tang Jianwei, a researcher with Bank of Communications. (MNI)

OVERNIGHT DATA

JAPAN NOV NATIONWIDE DEPT STORE SALES -14.3% Y/Y; OCT -1.7%

JAPAN NOV TOKYO DEPT STORE SALES -17.8% Y/Y; OCT -4.3%

JAPAN NOV, F MACHINE TOOL ORDERS +8.6% Y/Y; FLASH +8.0%

AUSTRALIA NOV, P RETAIL SALES +7.0% M/M; MEDIAN +2.0%; OCT +1.4%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 109.0; PREV. 111.2

The emergence of a major COVID-19 cluster in Sydney has dampened consumers' otherwise positive sentiment. In Sydney, confidence was down 5.3% in its sharpest weekly drop since July. In the rest of New South Wales, it moderated by 1.9%. Confidence weakened in Victoria (down 2.9%), along with Queensland and Northern Territory. The lockdown of the suburbs around Sydney's northern beaches and the state border closures have reminded people that material downside risks remain. The ongoing trend of higher inflation expectations has the 4-week moving average touching the level last seen in April. As we've noted, this lift is consistent with the likely bottom of inflation. (ANZ)

SOUTH KOREA NOV PPI -0.3% Y/Y; OCT -0.5%

CHINA MARKETS

PBOC NET INJECTS CNY120BN VIA OMOS TUE

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos and CNY120 billion via 14-day reverse repos with rates unchanged on Tuesday. This resulted in a net injection of CNY120 billion given the maturity of CNY10 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain stable liquidity at the end of the year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1281% at 09:25 am local time from 1.9282% at Monday's close.

- The CFETS-NEX money-market sentiment index closed at 38 on Monday vs 33 on Friday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5387 TUE VS 6.5507

The People's Bank of China (PBOC) set the dollar-yuan central parity rate slightly lower at 6.5387 on Tuesday, compared with the 6.5507 set on Monday.

MARKETS

SNAPSHOT: Familiar Risks Dominate Into Christmas

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 249.79 points at 26464.52

- ASX 200 down 70.283 points at 6599.6

- Shanghai Comp. down 8.052 points at 3412.308

- JGB 10-Yr future up 5 ticks at 152.13, yield down 0.1bp at 0.010%

- Aussie 10-Yr future up 1.0 tick at 98.995, yield down 0.6bp at 0.954%

- U.S. 10-Yr future +0-03 at 137-27+, yield down 0.99bp at 0.925%

- WTI crude down $0.36 at $47.61, Gold up $2.30 at $1879.20

- USD/JPY up 10 pips at Y103.42

- JOHNSON MAKES LAST-DITCH PUSH FOR BREXIT DEAL WITH MOVE ON FISH (BBG)

- UK AND FRANCE TO SET OUT PLAN TO RESTART FREIGHT

- UK COVID TESTING CAPACITY EXPECTED TO FALL SHORT AS CASES SURGE (FT)

- CONGRESS APPROVES LONG-AWAITED $900 BILLION COVID RESCUE PACKAGE (CNN)

- PFIZER PARTNER BIONTECH READY TO BOOST VACCINE CAPACITY FOR 2021 (BBG)

BOND SUMMARY: Core FI Lightly Bid In Asia, Familiar Risks Eyed Into Christmas

All in all there was little to report during Asia-Pac trade, with tight ranges in play for U.S. Tsys. T-Notes stuck to the confines of a 0-03 range, last +0-03 at 137-27+, while cash yields sit within 1.0bp of closing levels across the curve, with very modest richening seen. Continued worry surrounding the COVID-19 situation in the UK and a sense of more being needed re: U.S. fiscal support (despite the passage of the latest fiscal support scheme through Congress) blunted any lingering risk appetite in what proved to be a headline light session.

- There was little to rock the boat for the JGB space, with futures mostly sticking to their overnight range, last +4, while cash trades marginally mixed across the curve. The latest liquidity enhancement auction for off-the-run 15.5-39 Year JGBs came and went without much fanfare, but wasn't particularly strong.

- Several desks that we have spoken to pointed to today's record low fixing for 3-Month BBSW as the supportive factor for the shorter end of the Aussie curve during Sydney dealing, and a possible drive of receiver side flows in the swap space, all of which stems from the RBA's ultra-loose monetary policy setting pumping liquidity into the system (surplus funds lodged on E/S accounts at the RBA have moved towards all-time highs in recent days), with 3-Year ACGB yields registering a fresh all-time low in the process, at 0.091% (per BBG generics). YM +1.5, XM +0.5 as result, with the cash ACGB curve twist steepening and swaps generally narrower.

JGBS AUCTION: Japanese MOF sells Y498.2bn of 15.5-39 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y498.2bn of 15.5-39 Year JGBs in a liquidity enhancement auction:- Average Spread: -0.002% (prev. -0.002%)

- High Spread: 0.000% (prev. 0.000%)

- % Allotted At High Spread: 47.0443% (prev. 93.5747%)

- Bid/Cover: 2.637x (prev. 2.330x)

EQUITIES: COVID Worry & Need For More Fiscal Support In The U.S. Seen

The major equity indices were generally biased lower during Asia-Pac dealing, even though the Wall St. benchmarks managed to recover from their intraday lows on Monday.

- Continued worry surrounding the COVID-19 situation in the UK and a sense of more being needed re: U.S. fiscal support blunted any lingering risk appetite in what proved to be a headline light session.

- Mainland China equities managed to lean on the latest liquidity injection from the PBoC, which once again seemed to focus on creating some headroom over the calendar new year period, as opposed to an outright desire to pump liquidity into the system.

- Nikkei 225 -0.6%, Hang Seng -0.1%, Hang Seng +0.1%, ASX 200 -1.1%.

- S&P 500 futures -11, DJIA futures -109, NASDAQ 100 futures +10.

OIL: Tight, But Biased Lower In Asia

WTI & Brent sit ~$0.30 below their respective settlement levels, building on yesterday's losses, which were primarily driven by worry re: the COVID-19 mutation in the UK and the potential knock-on impact re: fuel demand. Still, the benchmarks operate well within the confines of their Monday ranges, owing to the recovery from worst levels that became apparent as we moved through the day (which had no overt headline trigger, but likely centred on hope re: U.S. fiscal matters and the efficacy of existing vaccines re: treating the new COVID strain).

- In terms of crude market specifics, Monday saw focus fall on comments from Russian Energy Minister Novak, who suggested that oil production should be restored to meet rising demand, but any rise in output should not result in oversupply issues. This was followed up by a BBG source report which suggested that "Moscow believes it makes sense to raise output from the Organization of Petroleum Exporting Countries and its allies by 500,000 barrels a day in February, matching the hike already agreed for January." Such a move would represent the maximum increase allowed at the meeting. The comments/source reports were followed up by rhetoric from the Iranian Oil Minister, who noted that the views of both parties (Russia & Iran) are close re: OPEC+ matters.

- The latest round of weekly API crude inventory estimates will hit late on Tuesday.

GOLD: Settling Down After Monday's Chop

Spot has settled around the $1,880/oz mark in Asia-Pac hours.

- Yesterday's broad-reaching choppy price action saw spot gold operate in a ~$50/oz range, after failure to hold above the $1,900/oz mark as U.S. real yields recovered from intraday lows and early risk-off flows reversed, resulting in a sharp pullback for gold, before a bounce from worst levels

- ETF gold holdings have flatlined in December after the pullback from the all-time highs witnessed in October, although the metric remains at historically elevated levels.

- The initial lines in the sand now lie at $1,844.9/oz, the Dec 16 low, which acts as support, while resistance is seen at the 76.4% retracement of the Nov 9-30 dip, located at $1,918.2/oz.

FOREX: Caution Prevails Ahead Of Holiday Season, Sterling Struggles On Familiar Risks

Headline flow was subdued overnight, providing little in the way of major catalysts. The greenback gained on the back of broader cautious feel and demand for USD ahead of the holiday season/year-end, with participants assessing familiar risks.

- GBP traded on a softer footing, with focus on UK Covid-19 matters/Brexit saga. The Telegraph reported that UK MPs have been told to be ready for voting on a Brexit deal next Wednesday, but the article also cited sources from both sides of the English Channel downplaying yesterday's reports re: fresh UK offer on fishing rights. MNI sources noted that the offer improves odds of reaching a deal, yet "Brussels is exp. to hold out for further concessions."

- Antipodean currencies faltered amid sour risk appetite, with most regional equity benchmarks trading in the red. The Covid-19 outbreak in NSW/Sydney continued to undermine sentiment, but an above-forecast flash reading of Australian November retail sales allowed AUD to outperform its cousin from across the ditch. AUD/NZD extended its winning streak to four consecutive sessions and crossed above the NZ$1.0700 mark.

- The PBOC fixed USD/CNY at 6.5387, stronger than yesterday's fix of 6.5507. The PBOC injected CNY 120bn of liquidity, bringing total injections this week to CNY 210bn – observers note the central bank are ensuring ample liquidity into year-end. USD/CNH added ~100 pips, but failed to test Monday highs as of yet.

- USD/Asia mostly edged higher, though TWD bucked the trend and firmed up after a beat in Taiwanese export orders. KRW faltered under pressure from local coronavirus worry, THB struggled as PM Prayuth mulled introducing nationwide Covid-19 restrictions, while IDR was heavy after FinMin Indrawati said Indonesia may experience a deeper econ contraction than exp. Bank Indonesia intervened in FX spot interbank mkt to maintain rupiah stability.

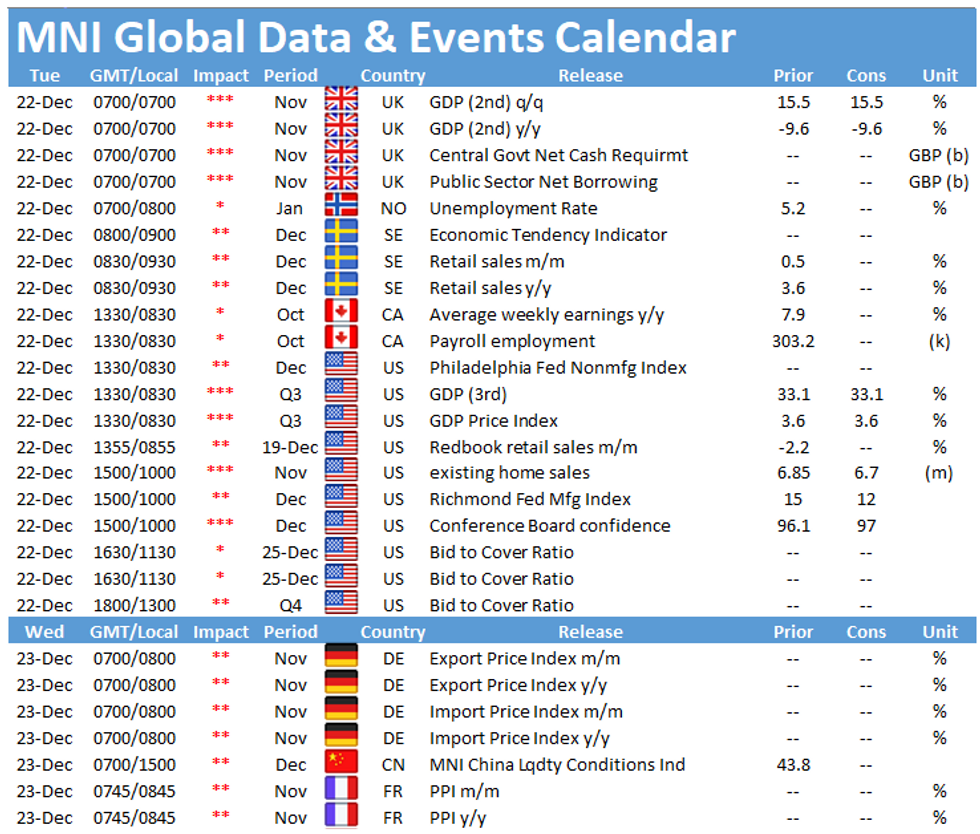

- Final GDP from the UK, Conf. Board Consumer Confidence, existing home sales & third GDP reading out of the U.S. & Swedish retail sales take focus today.

FOREX OPTIONS: Expiries for Dec22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000-02(E1.5bln), $1.2070-75(E538mln), $1.2100(E1.1bln), $1.2120-25(E814mln-EUR puts), $1.2150-55(E1.4bln-EUR puts), $1.2200(E2.3bln), $1.2225-35(E903mln-EUR puts), $1.2250(E410mln-EUR puts), $1.2275(E477mln-EUR puts), $1.2300-10(E1.0bln)

- USD/JPY: Y103.00($1.2bln-USD puts), Y103.50-60($1.1bln), Y103.70-90($1.2bln), Y104.00($550mln), Y104.20-40($639mln), Y105.00-05($807mln)

- EUR/JPY: Y127.10(E598mln-EUR puts)

- EUR/GBP: Gbp0.9000-10(E670mln-EUR puts)

- USD/NOK: Nok8.75($695mln-USD puts)

- AUD/USD: $0.7440-50(A$1.1bln), $0.7500(A$630mln-AUD puts), $0.7530-50(A$711mln-AUD puts), $0.7570-80(A$1.4bln-AUD puts)

- USD/CNY: Cny6.50($1.1bln-USD puts), Cny6.55($536mln-USD puts), Cny6.65($560mln-USD puts)

- USD/MXN: Mxn19.50($673mln), Mxn20.00($1.3bln-USD puts), Mxn20.50($535mln)

UP TODAY (Times Local/GMT)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.