-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - AUD/JPY Finds Bottom on China News

MNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI EUROPEAN OPEN: Familiar Themes Headline In NY, Markets Swing In Asia

EXECUTIVE SUMMARY

- ECB’S LAGARDE SAYS POLICY RATES MUST BE HIGHER TO CURB INFLATION (BBG)

- ECB’S NAGEL SAYS MORE ACTION NEEDED TO CURB PRICE EXPECTATIONS (BBG)

- GERMANY'S FINANCE MINISTER SEES 2023 INFLATION AT 7% (RTRS)

- UK FACES WORST AND LONGEST RECESSION IN G7, SAY ECONOMISTS (FT)

- BANK OF JAPAN WEIGHS RAISING INFLATION FORECASTS CLOSER TO 2% TARGET (NIKKEI)

- XI JINPING ESTIMATES CHINA’S 2022 GDP GREW AT LEAST 4.4%. BUT COVID MISERY LOOMS (CNN)

- STOCK AND BOND MARKETS SHED MORE THAN $30TN IN ‘BRUTAL’ 2022 (FT)

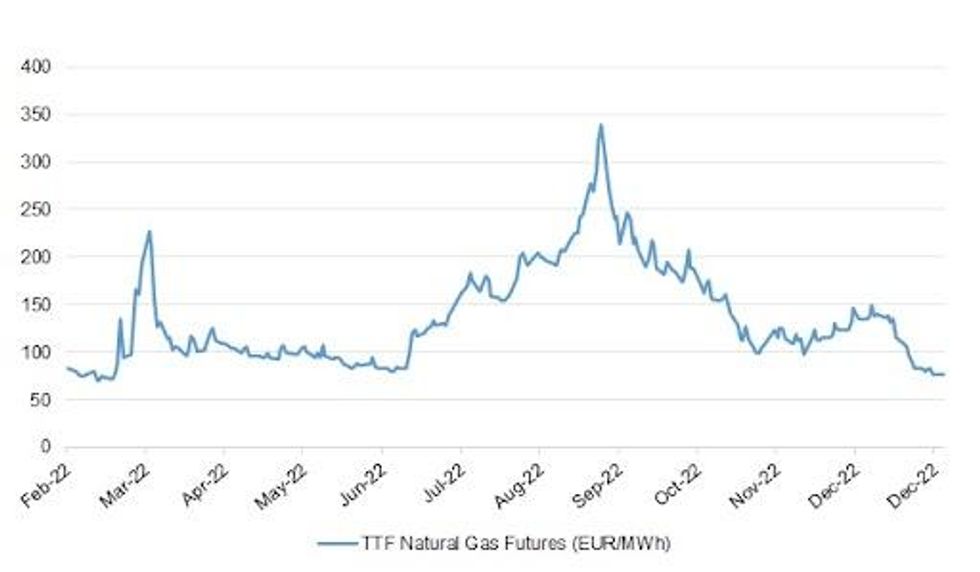

Fig. 1: TTF Natural Gas Futures

Source: MNI - Market News/Bloomberg

UK

POLICY: 2022 was tough and the UK's problems will not go away in 2023, Rishi Sunak has warned in his New Year's message. (BBC)

POLITICS/ECONOMY: Rishi Sunak is considering putting anti-strike laws before MPs for a vote as soon as this month, amid warnings that rail strikes could last until June. (The Times)

POLITICS/ECONOMY: Rishi Sunak’s promised crackdown on trade unions will not take place for at least six months, the Telegraph understands, amid fears 2023 will be plagued by repeated strikes. (Telegraph)

ECONOMY: The UK will face one of the worst recessions and weakest recoveries in the G7 in the coming year, as households pay a heavy price for the government’s policy failings, economists say. (FT)

ECONOMY: Footfall on Britain’s high streets and shopping centres plunged by more than a quarter in the week after Christmas compared with the week before, figures show. (Guardian)

FISCAL: Millions of low-income households in Britain will receive cost-of-living support from the government of up to 900 pounds ($1,084) over the financial year, the country's Department of Work and Pensions said on Tuesday. (RTRS)

FISCAL: In early December, Britain’s defence minister Ben Wallace and the head of the armed forces Admiral Sir Tony Radakin went to see Prime Minister Rishi Sunak at 10 Downing Street with an overarching topic on their minds: the UK military’s need for money. (FT)

BREXIT: Rishi Sunak will be forced by the House of Lords to abandon plans for a bonfire of European Union laws by the end of the year, The Times has been told. (The Times)

BREXIT: Irish Prime Minister Leo Varadkar has said mistakes were made on all sides in the way Brexit was negotiated. Mr Varadkar said he would be "flexible and reasonable" when attempting to solve issues with the Northern Ireland protocol. (BBC)

ENERGY: Many households will see a slight increase in charges this month for gas and electricity as suppliers have been allowed to update their prices. (BBC)

EUROPE

ECB: European Central Bank President Christine Lagarde indicated borrowing costs will increase again, saying this is required to temper soaring consumer-price growth. (BBG)

ECB: European Central Bank Governing Council member Joachim Nagel said additional measures are needed to curb rising expectations of future prices and return inflation to the 2% goal. (BBG)

EUROZONE: European Central Bank President Christine Lagarde said the currency union’s newest member proves that the euro has lasting appeal. (BBG)

EP: Belgian prosecutors have asked the European parliament to lift the legal immunity of another two of its members as the Qatargate corruption scandal continues to spread. (FT)

GERMANY: Germany’s finance minister expects inflation in Europe’s biggest economy to drop to 7% this year and to continue falling in 2024 and beyond, but believes high energy prices will become the new normal. (RTRS)

GERMANY: Chancellor Olaf Scholz urged citizens to continue their energy-saving drive and said Germany’s new floating LNG terminals will make Europe independent of Russian gas for the long term. (BBG)

GERMANY: The number of German jobs reached a post-reunification high in 2022, with the strength of the labour market in the eurozone’s largest economy expected to increase the likelihood of interest rate rises despite the risk of recession. (FT)

FRANCE: French President Emmanuel Macron pledged to push ahead next year with an unpopular overhaul of the country’s pension system that will effectively force people to work longer. (BBG)

ITALY: Italy is the eurozone country most susceptible to a debt crisis as the European Central Bank raises interest rates and buys fewer bonds in the coming months, economists say. Nine out of 10 economists in a Financial Times poll identified Italy as the eurozone country “most at risk of an uncorrelated sell-off in its government bond markets”. (FT)

PORTUGAL: “A process of consulting the market is ongoing for the state to be able to sell part of its stake” in state-owned airline TAP, Portuguese Prime Minister Antonio Costa says at a press conference in Lisbon on Monday. (BBG)

BANKS: Deutsche Bank AG confirmed it faces a higher capital requirement as its main regulator pushes lenders to dial back the risks they face in the lucrative business of leveraged finance. (BBG)

U.S.

POLITICS: A House committee on Friday made public six years of former President Donald Trump's tax returns, which showed he paid relatively little in federal taxes in the years before and during his presidency. (NBC)

POLITICS: Republican Kevin McCarthy is struggling to secure enough support to ensure he wins a vote to become the new Speaker of the House of Representatives. (BBC)

TSYS: The US Treasury market notched a record annual loss in 2022, fueled by inflation pressures that prompted the Federal Reserve to hike its overnight benchmark by more than four percentage points. (BBG)

EQUITIES: Tesla Inc on Monday reported record production and deliveries for fourth-quarter electric vehicles, but it missed Wall Street estimates, under the burden of logistics problems, slowing demand, rising interest rates and fears of recession. (RTRS)

OTHER

GLOBAL TRADE: China's tech supply chain is heading into the new year facing the twin challenges of slumping demand and staffing chaos caused by Beijing's abrupt U-turn on COVID controls. In a sign of the gloomy outlook for consumer electronics, Apple has notified several suppliers to build fewer components for AirPods, the Apple Watch and MacBooks for the first quarter, citing weakening demand, according to Nikkei Asia's supply chain checks with several component suppliers. (Nikkei)

GLOBAL TRADE: Taiwan Semiconductor Manufacturing Co.’s capital expenditure for 2023 could reach nearly $40 billion despite the industry’s inventory adjustment, Taipei-based Economic Daily News reports, citing unidentified person. (BBG)

CORONAVIRUS: Travellers from China to Australia will be required to take a pre-departure COVID-19 test and show evidence of a negative result, the government has announced. China has seen skyrocketing COVID case numbers, and a range of other countries including the United Kingdom, the United States and France have also imposed testing requirements. (ABC)

CORONAVIRUS: European Union government health officials will hold talks on Wednesday on a coordinated response to the surge in COVID-19 infections in China, the Swedish EU presidency said on Monday, after December talks concluded with no decisions on the matter. (RTRS)

CORONAVIRUS: The EU has offered free Covid-19 vaccines to China to help Beijing contain a mass outbreak of the illness following its decision to end strict nationwide pandemic-related restrictions. (FT)

U.S./CHINA: U.S. Secretary of State Antony Blinken said he spoke on Sunday with incoming Chinese Foreign Minister Qin Gang, appointed last week to the post following his role as ambassador to the United States. (RTRS)

U.S./CHINA: Republican congressman who has introduced legislation to ban TikTok in the US has said the sale of the Chinese-owned video-sharing app to an American company would be “one acceptable outcome”. (FT)

TAIWAN/CHINA: Taiwan's President Tsai Ing-wen kicked off 2023 with an olive branch to Beijing, offering assistance to China to tackle its COVID-19 crisis, while reiterating that cross-strait war is not an option. (Nikkei)

HONG KONG/CHINA: Hong Kong is working to resume quarantine-free travel with mainland China by as early as Jan. 8, Chief Secretary Eric Chan Kwok-ki said in a Facebook post on Sunday. (RTRS)

BOJ: The Bank of Japan is considering raising its inflation forecasts in January to show price growth close to its 2% target in fiscal 2024, Nikkei has learned, a move that could provide grounds for a pivot away from ultraloose monetary policy. The proposed changes would show the core consumer price index, or prices excluding fresh food, rising around 3% in fiscal 2022, at least 1.6% but less than 2% in fiscal 2023, and nearly 2% in fiscal 2024, people familiar with discussions at the BOJ said. (Nikkei)

BOJ: The Bank of Japan's purchases of long-term Japanese government bonds exceeded 17 trillion yen ($130 billion) in December, the largest monthly total on record, underpinned by its efforts to curb rising interest rates. This surpassed the previous record of 16 trillion yen from June. (Nikkei)

JAPAN: Price increases are planned in 2023 at the majority of Japanese companies that produce food and other daily necessities, a Nikkei survey finds, with businesses caught between covering surging costs and keeping customers happy. The December survey of 46 leading companies found that 27, or 59%, intend to raise the sticker price of their products or reduce their size, essentially a price hike by other means. (Nikkei)

JAPAN: The Bank of Japan has set out to unwind its decadelong ultra-easing program, putting Japanese government bonds at the gradual risk of a downgrade. If interest rates rise as a result of the BOJ abandoning its yield-curve control (YCC), concerns about the country's public finances would intensify, eventually affecting Japanese banks' ability to acquire foreign currency and Japanese companies from further expanding overseas. (Nikkei)

JAPAN: Japan is planning to sweeten the financial incentive for parents who opt to move out of Tokyo as the government attempts to reverse decades of demographic decline, economic migration and the lure of the world’s biggest metropolis. (FT)

HONG KONG: Hong Kong home sales have fallen 40 per cent year-on-year to their lowest level since the 2008 global financial crisis, data from the local land registry and projections from real estate agencies have shown. (FT)

BOK: Bank of Korea Governor Rhee Chang-yong said the central bank will do its best to coordinate policy with the government to ensure the economy has a soft landing at a time when the country faces an array of headwinds from falling exports to a weakening property market. (BBG)

SOUTH KOREA: South Korea said on Tuesday it plans to offer large tax breaks to semiconductor and other technology companies investing at home to strengthen its supply-chain security while boosting the economy. (RTRS)

NORTH KOREA: North Korean leader Kim Jong Un called for developing new intercontinental ballistic missiles and a larger nuclear arsenal to counter U.S.-led threats, state media said on Sunday, amid flaring tension between the rival Koreas. (RTRS)

NORTH KOREA: The United States is not discussing joint nuclear exercises with South Korea, President Joe Biden said on Monday, contradicting remarks by his South Korean counterpart as tensions flare with North Korea. (RTRS)

CANADA: Plans to host a repeat of the “Freedom Convoy" in the Canadian city of Winnipeg have been called off by one of the antigovernment protest groups. (ABC)

BRAZIL: Luiz Inacio Lula da Silva retook the helm of Latin America’s largest democracy promising to bring back the economic inclusion and prosperity that marked his first two terms as Brazil’s president between 2003 and 2011. (BBG)

BRAZIL: Brazil Finance Minister Fernando Haddad said on Monday that leftist President Luiz Inacio Lula da Silva's government will not accept the "absurd" 220 billion-real ($41.19 billion) primary deficit forecast in this year's budget, indicating it will work to make it smaller. (RTRS)

BRAZIL: Brazil's newly sworn-in President Luiz Inacio Lula da Silva signed a decree on Sunday extending for 60 days an exemption for fuels from federal taxes, a measure passed by his predecessor aimed at lowering their cost. (RTRS)

RUSSIA: Russian President Vladimir Putin devoted his annual New Year's address on Saturday to rallying the Russian people behind his troops fighting in Ukraine and pledging victory over Ukrainian "neo-Nazis" and a West supposedly intent on "destroying Russia". (RTRS)

RUSSIA: Volodymyr Zelenskyy has denounced strikes on Ukraine and accused Vladimir Putin of hiding, as explosions rocked locations across the country on the final day of the year. (Sky)

RUSSIA: Russia is planning a protracted campaign of attacks with Iranian drones to "exhaust" Ukraine, President Volodymyr Zelenskiy said on Monday. (RTRS)

RUSSIA: Russia acknowledged that dozens of its troops were killed in one of the Ukraine war's deadliest strikes, angering Russian nationalists, including lawmakers, and drawing demands for commanders to be punished for housing soldiers alongside an ammunition dump. (RTRS)

SOUTH AFRICA: South Africa’s state-owned power company, Eskom Holdings SOC Ltd., will carry on cutting 2,000 megawatts of electricity from the national grid indefinitely due to the breakdown of five generating units, reversing plans to suspend the outages on New Year’s Eve, the utility said in a text message on Saturday. (BBG)

SOUTH AFRICA: Motorists can expect some reprieve this month following the announcement of a decrease in fuel prices this month. (Independent Online)

MIDDLE EAST: Foreign ministers from Russia, Syria and Turkey will meet in the second half of January after last week holding the highest-level gathering since the Syrian civil war erupted in 2011. (BBG)

IMF: A third of the global economy will be hit by recession this year, the head of the IMF has said, as she warned that the world faces a “tougher” year in 2023 than the previous 12 months. (FT)

MARKETS: Global stocks and bonds lost more than $30tn for 2022 after inflation, interest rate rises and the war in Ukraine triggered the heaviest losses in asset markets since the global financial crisis. (FT)

MARKETS: Pension funds should be “extremely careful” when investing in illiquid assets, as rising interest rates and falling stock markets increase the likelihood of their having to access cash quickly, the OECD has warned. (FT)

ENERGY: Russian President Vladimir Putin allowed natural-gas buyers from “unfriendly” countries to pay debts for fuel in foreign currency, partly lifting a requirement for ruble-only payments. (BBG)

ENERGY: Expert eyes are starting to turn to Christmas 2023, as Europe has kept the lights on through this festive period despite an energy crisis that has gripped the continent for more than a year. (Press Association)

ENERGY: Brussels plans to overhaul the bloc’s electricity market to prioritise cheaper renewable power, the EU’s energy commissioner has said, despite industry warnings that the reforms could stifle investment in wind and solar farms. (FT)

OIL: Workers at Iran’s biggest oil refinery went on strike on Saturday, impacting repairs and safety checks at the facility, according to unconfirmed reports and footage published on social media. (BBG)

CHINA

ECONOMY: China's economy grew at least 4.4% in 2022, according to leader Xi Jinping, a figure much stronger than many economists had expected. But the current Covid wave may hobble growth in the months ahead. (CNN)

ECONOMY: China’s manufacturing, services and property sectors all weakened sharply in the fourth quarter due to Covid disruptions, resulting in a potential contraction in the economy in the final months of the year, a private survey shows. (BBG)

ECONOMY: China’s difficulties in 2022 were greater than anticipated but the economy will rebound in 2023, according to Zhao Chenxin, Deputy Director of the National Development and Reform Commission (NDRC). (MNI)

CORONAVIRUS: President Xi Jinping said tough challenges remain in China’s fight against Covid-19 and acknowledged divisions in society that led to rare spontaneous protests, after weeks of silence on a virus policy pivot that’s infected hundreds of millions and delivered a severe blow to economic activity. (BBG)

CORONAVIRUS: The ruling Chinese Communist party’s attempts to downplay and distract from the worsening health crisis that has followed Xi’s decision to drop almost all Covid restrictions reflect the damage wrought on his credibility at home and abroad, just as he embarks on a third term in power, experts said. (FT)

YUAN: China will use exchange rate policy tools to promote foreign trade, expand foreign capital stock and to manage its FX reserve assets in 2023, according to Pan Gongsheng, director of the State Administration of Foreign Exchange (SAFE). (MNI)

YUAN: China will need to offer more investment options for yuan holders, including expanding its offshore bond market, to support the expected increased use of the yuan in settling oil and gas trade with Gulf countries, but the internationalisation of the currency must be done at a gradual pace that doesn’t threaten the stability of the yuan or the financial system, advisers told MNI. (MNI)

POLICY: Li Qiang, the Chinese Communist Party's new No. 2 official and a close ally of President Xi Jinping, now looks all but certain to take over as premier in March without first serving the usual term as vice premier to gain experience. (Nikkei)

PROPERTY: China’s home sales continued to slump in December, underscoring the challenge to reverse the property downturn amid Covid outbreaks. (BBG)

PROPERTY: China Evergrande Group vowed to repay debt in 2023 after delaying announcements of a much-anticipated restructuring plan again. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY534 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) on Tuesday conducted CNY50 billion via 7- day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY534 billion after offsetting the maturity of CNY5584 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0000% at 9:32 am local time from the close of 2.6782% on Friday.

- The CFETS-NEX money-market sentiment index closed at 47 on Friday vs 48 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9475 TUES VS 6.9646 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9475 on Tuesday, compared with 6.9646 set before New Year holiday.

OVERNIGHT DATA

CHINA DEC CAIXIN MANUFACTURING PMI 49.0; MEDIAN 49.1; NOV 49.4

Both manufacturing supply and demand continued to shrink last month. Fallout from the pandemic was a drag on production and sales, with the subindexes for output and total new orders staying below 50 for the fourth and fifth straight months, respectively. Due to the economic downturn and weak demand overseas, the reading for new export orders also remained in contraction for the fifth straight month. (Caixin)

AUSTRALIA DEC, F JUDO BANK MANUFACTURING PMI 50.2; PRELIM 50.4; NOV 51.3

Australia’s manufacturing sector is slowing down in line with the global trend for weaker manufacturing activity over the second half of 2022, although Australia is holding up better than the US, Europe and Japan. (Judo Bank)

AUSTRALIAN DEC CORELOGIC HOUSE PRICE INDEX -1.2% M/M; NOV -1.1%

MARKETS

US TSYS: Firmer In Volatile Asian Session

TYH3 deals at 112-19+, +0-10, 0-02 shy of the top of its 0-09 range on volume of ~86K.

- Cash Tsys are closed until the London session today due to the observance of a Japanese holiday.

- Tsys futures have see-sawed higher in the Asian session, gapping higher at the open as softer than expected official Chinese PMI data from the weekend added support, before paring gains as e-minis sharply reversed early gains in the limited liquidity environment..

- In the absence of macro headline drivers cross-asset flows continued to dominate. Early weakness in the Hang Seng reversed, spilling over into wider markets, with e-minis trading higher weighing on the USD and allowing Tsy futures to print fresh daily highs.

- The space looked through a marginally weaker than expected Caixin Mfg PMI print from China as well as news of US$ supply from Hong Kong & Kexim Bank

- In Europe today we have German state and national CPI readings. The U.S. highlights of the week include the NFP report, minutes from the December FOMC meeting & monthly ISM surveys.

AUSSIE BONDS: Firmer & Flatter To Start The New Year On Chinese Economic Growth Worry

Aussie bonds failed to better their early Sydney best levels, which came as a product of the vol. that surrounded the re-open of U.S. futures, with the previously alluded to turnaround in fortunes for Hong Kong’s Hang Seng Index seemingly allowing the space to nudge further away from best levels.

- Still, worries surrounding immediate Chinese economic growth prospects seemed to provide a stickier bid for core global FI markets, with the latest batch of Chinese PMIs fanning those flames.

- That left YM +3.0 and XM +5.0 at the bell, while the major cash ACGB benchmarks are 2.5-6.0bp richer, with the early flattening impulse intact throughout.

- EFPs were little changed to a touch wider on the day.

- Lower tier domestic data crossed in the shape of final Judo Bank manufacturing PMI & CoreLogic house prices, with the former revealing the slowest rate of expansion seen since ’20 and the latter providing an expected extension of the recent pull lower in property prices.

- Looking ahead, Thursday’s final Judo Bank services and composite PMI data headline the limited domestic data docket during the remainder of the week. A reminder that details on AOFM issuance plans for the second half of 22/23 will be provided on Friday.

EQUITIES: Sharp Reversal In Hang Seng Noted After Soft Start

Notable swings in the Hang Seng marked the start to ’23 trade, with participants weighing up economic growth headwinds for China (and the degree of policy support required), slumping property sales in both the Chinese mainland & Hong Kong, worries surrounding the restructuring of property giant Evergrande and the PBoC’s drain of year end-related liquidity provisions. The benchmark index shed over 2.0% in early trade, but now sits 1.7% higher on the day.

- Elsewhere, gains for the CSI 300 were much more marginal, last printing +0.2% in afternoon trade.

- Speculation surrounding the need for greater policy support in China seemed to provide the impetus for a recovery at a macro level. Meanwhile, casino names provided a pocket of micro strength.

- Australia’s ASX 200 suffered from worry re: China, shedding more than 1%.

- E-minis were subjected to notable two-way flows, initially more than unwinding early gains, before bouncing alongside the Hang Seng. The major e-mini contracts are ~0.2% higher as we head into London hours.

GOLD: Bullion Reaches Multi-Month High

Gold prices are up 1% from their NY close on Friday to $1841.25/oz after reaching a high of $1843.18 earlier. This was the strongest since late June. The intraday low was $1826.95. Today’s move is consistent with the technical bullish trend. The USD is flat on the day.

- Gold has been supported by the IMF’s warning that a third of the global economy could be in recession this year. It noted that America, the EU and China are “slowing simultaneously”.

- Later today the final December US manufacturing PMI prints. There is further PMI/ISM data over the week but the focus is on Wednesday’s FOMC minutes and Friday’s payroll data for December, which is expected to post a 200k gain (bbg). Any signals of a less hawkish Fed should be good for gold prices.

OIL: Oil Prices Lower As Growth Concerns Back In The Forefront

MNI (Australia) - Oil prices are slightly lower today with WTI down 0.4% on Friday’s NY close to just under $80/bbl, slightly below its 50-day simple moving average. It reached an intraday high of $80.78 and a low of $79.32. Brent is down 0.5% to about $85.50 after a high of $85.96.

- The IMF’s warning that a third of the global economy could go into recession this year fuelled the oil market’s growth fears. It noted that America, the EU and China are “slowing simultaneously”. Demand expectations are also being impacted by the spread of Covid through China and the introduction of some travel restrictions in other countries.

- On the supply-side analysts are watching to see the extent of the impact of sanctions on Russian crude and its reaction. There is also concern that OPEC+ will cut output further as the global economy slows.

- Later today the final December US manufacturing PMI prints. There is further PMI/ISM data over the week but the focus is on Wednesday’s FOMC minutes and Friday’s payroll data for December, which is expected to post a 200k gain (bbg).

FOREX: Cross-Asset Flows In Focus As USD Softens, JPY Tops G10 On BoJ Inflation F’cast Talk

The USD finds itself at the bottom of the G10 FX table as we head into the first full European trading session of ’23.

- This comes as participants return from the festive break and assess softer than expected official PMI data out of China, continued hawkish ECB speak, speculation surrounding a hawkish inflation forecast shift from the BoJ and the continued fallout from the rollback of China’s ZCS.

- FX trade was volatile around the re-open of U.S. FI & equity futures.

- We then saw a soft start for Hong Kong’s benchmark Hang Seng Index lend support to the traditional safe havens (JPY, CHF & USD), although a reversal in the fortune for that index, which allowed the S&P 500 to reverse losses after early, two-way gyrations, changed the tone of the session. This combination supported U.S. Tsy futures, after an early push higher faded a little, applying further weight to the USD.

- Slightly softer than expected Caixin m’fing PMI data did little for markets.

- The JPY sits atop the G10 FX table, with the aforementioned hawkish speculation surrounding the BoJ’s inflation projections lending further support to the JPY. USD/JPY hit a multi-month low of Y129.52, with technical support in the form of the Jun 2 ’22 low (Y129.51) holding. A Tokyo holiday thinned out wider liquidity.

- USD/CNH probed CNH6.8800, as it registered its own multi-month low, with the next level of meaningful technical support in the pair located at the 200-DMA

- Looking ahead, state and national CPI data out of Germany provide the focal points of the broader macro docket on Tuesday.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/01/2023 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/01/2023 | 0855/0955 | ** |  | DE | Unemployment |

| 03/01/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 03/01/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 03/01/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 03/01/2023 | 1300/1400 | *** |  | DE | HICP (p) |

| 03/01/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/01/2023 | 1500/1000 | * |  | US | Construction Spending |

| 03/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 03/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.