-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: First Republic Deposit Flight Swifter Than Expected

EXECUTIVE SUMMARY

- FIRST REPUBLIC LOST $100 BILLION IN DEPOSITS IN BANKING PANIC (WSJ)

- ECB’S LANE SAYS CURRENT DATA INDICATE A RATE HIKE ON MAY 4 (BBG) (BBG)

- SCHNABEL: ECB HALF-POINT HIKE NEXT WEEK IS ON THE TABLE (BBG)

- VILLEROY: ECB HAS TRAVELLED MOST OF THE WAY TOWARDS HIGHER INTEREST RATES (RTRS)

- ECB'S MAKHLOUF: TOO EARLY TO START PLANNING FOR A PAUSE IN TIGHTENING (RTRS)

- BOJ'S UEDA VOWS TO KEEP RATES LOW FOR NOW, SIGNALS CHANCE OF FUTURE HIKE (RTRS)

- ALLIES RESIST US PLAN TO BAN ALL G7 EXPORTS TO RUSSIA (FT)

- NO MORE ROOM FOR CUTS TO CHINA’S BENCHMARK RATE AS NET INTEREST MARGINS PLUNGE (CBN)

- CHINA ‘URGENTLY STUDYING’ WAYS TO BOOST CONSUMPTION (CSJ)

- LAVROV SEES NO PROGRESS ON RUSSIAN PART OF BLACK SEA GRAIN DEAL (BBG)

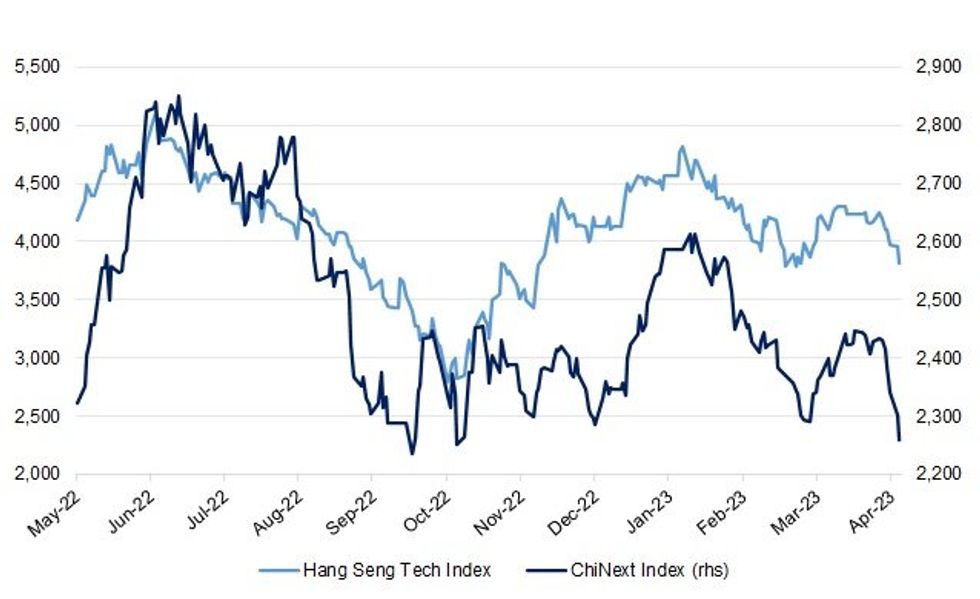

Fig. 1: Hang Seng Tech Index Vs. ChiNext Index

Source: MNI - Market News/Bloomberg

UK

ECONOMY: The number of job seekers in the City of London increased in the first quarter of 2023 even as the number of open positions fell by almost a third, underlining the tough job market for bankers amid economic uncertainty and the threat of redundancies. (BBG)

EUROPE

ECB: ECB: Recent economic figures suggest the European Central Bank should increase interest rates again at its next decision on May 4, Chief Economist Philip Lane told French newspaper Le Monde. (BBG)

ECB: A half-point interest rate increase can’t be ruled out for the European Central Bank’s May 4 meeting, according to Executive Board member Isabel Schnabel. (BBG)

ECB: The European Central Bank has already gone "most of the way" in raising interest rates to tackle inflation, French ECB policymaker Francois Villeroy de Galhau said on Monday, adding any further rate hikes needed to be limited in number and size. (RTRS)

ECB: It is too early for the European Central Bank to start planning for a pause in monetary policy tightening, Irish ECB policymaker Gabriel Makhlouf said on Monday. (RTRS)

FISCAL: The writer is Germany’s minister of finance: Sound public finances are a prerequisite for enabling economic growth in the EU. We need to ensure that we have fiscal buffers for potential future crises. This is particularly true after the past few years, in which all member states have made financial efforts to cope first with the pandemic and then with the consequences of the Russian war of aggression on Ukraine. (FT)

FRANCE: Bank of France Governor Francois Villeroy de Galhau told President Emmanuel Macron that high levels of state spending can’t tame inflation, which is primarily the responsibility of the central bank. (BBG)

BANKS: UBS Group AG on Tuesday reported a 52% slide in profit for the first quarter due to an increase in legal provisions for a legacy litigation matter. (RTRS)

U.S.

POLITICS: The Georgia prosecutor leading an election-interference probe of former President Donald Trump and his allies said Monday she would announce charging decisions in the matter this summer. (CNBC)

BANKS: First Republic said it lost more than $100 billion in customer deposits following Silicon Valley Bank’s collapse. Shares fell more than 20% after hours. (WSJ)

BANKS: First Republic Bank and its auditor KPMG were sued by shareholders over alleged misstatements ahead of last month’s regional-banking crisis. (BBG)

OTHER

GLOBAL TRADE: Russia sees no progress in meeting its demands regarding implementation of the Black sea grain initiative, said Foreign Minister Sergei Lavrov after his talks with United Nations Secretary General Antonio Guterres. (BBG)

GLOBAL TRADE/GEOPOLITICS: The European Union's critical infrastructure is under threat and the EU is working with NATO on a stress test programme to prepare for a 'worst case' outcome, European Commission President Ursula von der Leyen said on Monday. Speaking at a government leaders summit about offshore wind energy in the North Sea, von der Leyen said that the EU and NATO have launched a joint task force to investigate possible threats to key sectors including energy. Results of the study will be presented at an EU leaders meeting in July, she added. (RTRS)

GLOBAL TRADE/GEOPOLITICS: The White House said on Monday that U.S. President Joe Biden and his South Korean counterpart, Yoon Suk Yeol, will announce deals related to climate and cybersecurity cooperation this week. Biden national security adviser Jake Sullivan also said the White House acknowledged South Korea's commitment to helping Ukraine and that economic ties will be a key component of the Korean leader's visit to the White House this week. (RTRS)

U.S./CHINA: Chinese tech giant ByteDance is pushing another social media app in the U.S. — even as its flagship short video app TikTok faces a possible ban stateside. While it could be part of a business strategy for ByteDance, a new product to replace TikTok isn’t the best solution either, analysts told CNBC. (CNBC)

U.S./CHINA/TAIWAN: Virginia Gov. Glenn Youngkin met with the president of Taiwan on Monday to discuss mutual trade and investment initiatives and other business matters, his office said, and he signed an executive order establishing an economic development office in Taipei. (ABC)

EU/CHINA: China Commerce Minister Wang Wentao met with EU Trade Commissioner Valdis Dombrovskis in Brussels Monday, according to a statement from the Chinese Ministry of Commerce. (BBG)

UK/CHINA: James Cleverly, UK foreign secretary, will face down China hawks in his governing Conservative party with a set-piece policy speech calling for a “robust and constructive” new bilateral relationship with Beijing. (FT)

CHINA/TAIWAN: Procuratorate in China’s Wenzhou city has approved the arrest of Taiwanese Yang Zhiyuan on suspicion of secession, the Supreme People’s Procuratorate says on its WeChat. (BBG)

GEOPOLITICS: The U.S., Australia, India and Japan have begun working on how to coordinate the sharing of information on cyberattacks targeting critical infrastructure facilities. Data on attacks will be used to enable each country to quickly prepare defense measures. (Nikkei)

BOJ: Bank of Japan (BOJ) Governor Kazuo Ueda on Tuesday stressed the need to keep monetary policy ultra-loose for now, but signalled the chance of raising interest rates if inflation and wage growth overshot expectations. (RTRS)

BOJ: The Bank of Japan could refrain from commenting on a future monetary policy review in its upcoming April statement, although new Governor Kazuo Ueda, if asked about it at the following news conference, will discuss it then, MNI understands. (MNI)

JAPAN: Japan raised its official assessment of imports for first time in nine months, the government's monthly economic report showed on Tuesday, as the yen's double-digit depreciation from a year earlier puffed up the value of imported goods. (RTRS)

JAPAN: L Catterton, the investment firm backed by French luxury goods giant LVMH, is planning to expand its portfolio in Japan, with hopes of leveraging LVMH's know-how to boost the earnings of target companies. (Nikkei)

NEW ZEALAND: So just how are borrowers coping with those significantly higher interest rates? Not too badly, according to their lenders. Albeit, given the NZ penchant for fixed-term mortgages, some of us are yet to feel the full impact of significantly higher mortgage rates. (Interest NZ)

JAPAN/SOUTH KOREA: Japan will make a “responsible” decision on whether to restore South Korea to its “whitelist” of preferred trading partners after thoroughly discussing the matter, Trade Minister Yasutoshi Nishimura says at a briefing in Tokyo. (BBG)

SOUTH KOREA: South Korea’s Financial Supervisory Service Governor Lee Bokhyun is concerned about increasing risk of losses from investment based on excessive leverage amid widened volatility in stock and bond markets, the financial watchdog says in a statement on Tuesday. (BBG)

BOK: Bank of Korea Governor Rhee Chang-yong said he doesn’t expect currency swap deal to be discussed during upcoming summit meeting between President Yoon Suk Yeol and US President Joe Biden, Korea Economic Daily reports. (BBG)

CANADA: Teck Resources Ltd, which is trying to fend off an unsolicited $22.5 billion takeover offer from Glencore Plc, should remain headquartered in Canada and help the country expand its critical minerals industry, Finance Minister Chrystia Freeland said on Monday. (RTRS)

BOC: The Bank of Canada's interest-rate pause is justified by measures of the money supply and Taylor rule models that could have helped policymakers avoid belated hikes after Covid lockdowns ended, according to an upcoming paper from the C.D. Howe Institute by former central bank researchers. (MNI)

TURKEY: Turkish government extends corporate tax exemption on FX gains and interest income for companies that convert their FX holdings in their 1Q balance sheets to lira through FX-protected deposits, according to decree in Official Gazette. (BBG)

USMCA: The U.S. Trade Representative on Monday said a U.S. complaint over alleged worker rights violations at Unique Fabricating Inc in Mexico has been resolved. (RTRS)

BRAZIL: The Minister of the Institutional Relations Secretariat, Alexandre Padilha , said this Monday (24) that the calendar for voting on economic measures is maintained even if there is a CPMI (Mixed Parliamentary Commission of Inquiry) on the January 8 coup attacks in Congress. (Globo)

BRAZIL: Brazil’s government is planning to elect a chairman and two other members to the board of oil producer Petrobras even though they failed to pass the state-controlled company’s internal audits, according to people familiar with the matter. (BBG)

RUSSIA: The EU and Japan have pushed back against a US proposal for G7 countries to ban all exports to Russia, as part of negotiations ahead of a summit of the world’s most advanced economies. (FT)

RUSSIA: The United States and Western allies took turns slamming Russia for its ongoing war in Ukraine and accused Moscow of trampling the U.N. Charter, during a lengthy Security Council meeting chaired by Russian Foreign Minister Sergey Lavrov. (CNBC)

RUSSIA: Risks of a direct military confrontation between two nuclear powers - Russia and the US - are growing constantly, says Russian Foreign Ministry Non-Proliferation and Arms Control Department Director Vladimir Yermakov. (TASS)

CHILE: Chile will start talks with SQM over its operations in the Atacama “this semester” to convince the world's No. 2 lithium mining company to sign onto a state-led public-private model, aiming to wrap up dialogue during the current government, the economy minister said on Monday. (RTRS)

MARKETS: A global industry group has changed the way derivatives traders should calculate their margin requirements, following concerns by the Bank of England that some market participants risk posting insufficient collateral. (BBG)

OIL: China's increased purchases of April-loading Urals oil and imports of the grade loading from Russia's Baltic and Black Sea ports this month may hit an 11-months high supporting its prices, traders said and Refinitiv Eikon data showed. (RTRS)

OIL: Cenit, a subsidiary of Colombia’s majority state-owned oil company Ecopetrol, reported that the country’s Transandino Pipeline (OTA) was bombed on Sunday. (RTRS)

CHINA

PBOC: Domestic analysts speculate that China is unlikely to cut interest rates in future, after the benchmark rate held steady for an eighth consecutive month in April following strong economic and credit growth in the first quarter of 2023. Net interest margins have also dropped to their lowest levels on record, leaving little rom for depository lenders to further reduce loan rates. (China Banking News)

POLICY: With China’s economic recovery well on track, top leaders will likely turn their policy focus now to boosting business confidence, increasing jobs and strengthening the property market without adding extra stimulus. (BBG)

ECONOMY: The NDRC is “urgently studying” and drafting polices to boost consumption, China Securities Journal reported, citing people it didn’t identify. (BBG)

ECONOMY/PROPERTY: China must expand the use of consumption vouchers and stabilise the property sector to secure the rebound in consumption, according to a report by the China Wealth Management 50 Forum. (MNI)

ECONOMY: Authorities will prioritise youth unemployment this year, as young people will help China’s future development, the Ministry of Human Resources and Social Security said. (MNI)

FISCAL: The government should implement policies to maintain China’s competitive advantage in the new electric vehicle (NEV) market, as global competition heats up, according to Yicai. (MNI)

BANKS: Chinese listed banks may have seen their net interest margin shrink further in the first quarter but their profitability is likely to stabilize this year following recent cuts in deposit rates, Securities Daily reported on Tuesday, citing analysts. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY132 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) conducted CNY170 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY132 billion after offsetting the maturity of CNY38 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable at month end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9541% at 09:34 am local time from the close of 2.0708% on Monday.

- The CFETS-NEX money-market sentiment index closed at 45 on Monday, the same as the close on Friday

PBOC SETS YUAN CENTRAL PARITY AT 6.8847 TUES VS 6.8835 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8847 on Tuesday, compared with 6.8835 set on Monday.

OVERNIGHT DATA

JAPAN MAR SERVICES PPI +1.6% Y/Y; MEDIAN +1.7%; FEB +1.7%

SOUTH KOREA Q1 GDP +0.3% Q/Q; MEDIAN +0.2%; Q4 -0.4%

SOUTH KOREA Q1 GDP +0.8% Y/Y; MEDIAN +0.9%; Q4 +1.3%

SOUTH KOREA MAR RETAIL SALES +6.4% Y/Y; FEB +7.9%

SOUTH KOREA MAR DEPARTMENT STORE SALES +9.5%; FEB +8.6%

SOUTH KOREA MAR DISCOUNT STORE SALES +1.2%; FEB +5.8%

MARKETS

US TSYS: Firmer On Weakness In Chinese Tech Stocks & Sharper Than Expect First Republic Deposit Flight

TYM3 re-tested its early Asia-Pac highs on a downtick in Chinese tech stocks, although failed to break that line. The contract is +0-10 into London hours, 0-01 off the peak of its 0-06 Asia-Pac range, on volume of ~68K. Monday’s break and close above 115-00 eases the bearish technical threat, with bulls now targeting the 14 Apr high (115-23).

- Cash Tsys are 0.5-2.5bp richer, with intermediates leading the bid.

- Weakness in Chinese tech stocks, centred on continued worry re: potential fresh U.S. steps against the Chinese chip space, along with some questions surrounding the longevity of the Chinese consumption boom, supported Tsys overnight.

- That came after support from First Republic’s earnings, published after hours on Monday, faded.

- Warnings from Russia re: the potential for direct conflict with the U.S. also generated some alarm.

- The most notable rounds of flow came via pockets of TY & FFK3 screen buying during the early rounds of Asia-Pac trade.

- ECB & BoE speak will come under the microscope during the London morning. Further out, NY hours will see the release of new home sales data, a couple of the major home price metrics, consumer confidence. services activity indicators from the Philly & Dallas Feds and the Richmond Fed m’fing index. We will also get 2-Year Tsy supply.

JGBS: Curve Twists Flatter, Futures Off Lows

JGB futures recovered from early session lows, alongside a stabilisation in U.S. Tsys, last -7, while cash JGBs are 1bp richer to 1bp cheaper, with 10s underperforming surrounding tenors and the curve twist flattening. The swap curve has twist flattened (20+-Year rates lower on the day), with swap spreads little changed to tighter across the curve, supporting JGBs.

- JGBs looked through comments from BoJ Governor Ueda. RTRS noted that (in answer to a question in his parliamentary address) Ueda said that the “central bank will respond appropriately, such as by raising interest rates, if faster-than-expected growth in inflation and wages warrant tightening monetary policy. At present, however, the BOJ considers it appropriate to maintain its ultra-easy monetary policy, including yield curve control, to sustainably and stably achieve its 2% inflation target.” The initial lines were situational, as opposed to a likelihood, with Ueda also reaffirming the Bank’s well-known views on inflation. Ueda stressed that tightening now could result in a “grave” situation.

- Elsewhere, Finance Minister Suzuki noted that there may be some movements in BoJ policy in the future, which would pose challenges re: maintaining current debt issuance levels. On that front, we also saw a senior MoF official note that Japan will strive to keep debt issuance costs at low levels, reacting to any future BoJ policy moves via maturity alteration and the tweaks to the distribution of JGB issuance.

- 2-Year JGB supply headlines tomorrow.

EQUITIES: China/HK Weakness Continues, South Korean Stocks Down Sharply On Regulator Warning

On-going weakness in China/HK equities remains the main focus in Asia Pac. US futures have been weighed down by these developments, with Eminis and Nasdaq futures last off by a little over 0.3%. South Korean stocks have also sold off sharply following a regulatory warning. Positive Japan sentiment has only provided a modest offset.

- For the US, there wasn’t much reaction in e-minis to First Republic’s earnings, published after hours on Monday. A quick reminder that the bank revealed a sharper than expected round of deposit outflows during the well-documented tumult that got underway in March, although it noted the situation has stabilised in recent weeks. It also removed previous guidance, chose not to answer any questions on its earnings call and disclosed that it is pursuing “strategic options” re: the shape of the firm going forwards. Weakness in China/HK markets weighed more heavily on US trends.

- Geopolitical worry re: potential fresh U.S. action against the Chinese chip sphere have been a key headline driver of the weakness observed over the last couple of sessions. The CSI 300 has continued to correct lower, off a further 0.50% to 3962, well below the index's 200-day MA. Adding pressure was a report that China is 'urgently' studying ways to boost consumption.

- In HK, the HSI is down 1.62% at the break, with the tech index losing close to 3.5% at this stage.

- The Kosdaq, in South Korea is off by 2.4%, the Kospi 1.6%. The FSS chair stated concerns over the Kosdaq overheating and excessive leverage for investments, which weighed heavily on sentiment. Offshore investors have sold $160.3mn of local shares today.

- Japan shares are modestly higher, the Topix +0.25%, with the tech sector higher following a chip subsidy boost.

GOLD: Rebound Stalls Above $2000, As USD Sentiment Stabilizes

Gold was firmer in the first part of trading, but ran out of steam above the $2000 level. This also coincided with USD indices finding some support and recovering from session lows. The precious metal was last near $1992, which is only a touch firmer for the session. We were +0.31% for Monday's session.

- Gold is still broadly following inverse dollar trends, although bullion has lagged somewhat in terms of the recent correction lower in the DXY.

- Fresh equity market headwinds in the region/lower US futures and a slightly weaker US cash Tsy yield backdrop haven't done much to aid gold sentiment today either.

OIL: Holding Monday Gains

Brent crude sits around $82.75/bbl currently, little changed for the session. Earlier highs came in just above $83/bbl, which was right around highs from the NY session on Monday. This move also coincided with USD weakness. Still, as the dollar has stabilized somewhat, downside in oil has been fairly limited. Sessions lows were just under $82.60/bbl. WTI was last around $78.80, having followed a similar trajectory.

- Modest supply concerns may have crept back into the market, with disruptions continuing from Iraqi Kurdistan. There are also concerns over fighting in Sudan, although there is hope of a short term cease fire. API's weekly report on inventories will be eyed later in the US.

- For Brent, a clean break above $83/bbl is needed before higher levels can be eyed. Note the April 19 high came in at $85.15/bbl. Recent lows come in around the $80.50/bbl level.

FOREX: USD Finds Support From Equity Weakness

Early USD weakness had little follow through, as weaker equity sentiment filtered through into dollar support. The BBDXY got close to 1221 early but we now sit back above 1223, not too far off session highs, but around NY closing levels from Monday.

- Carry over from First Republics earning's result boosted US Tsy futures, and this aided a early move in USD/JPY sub 134.00, but this dip was supported. USD/JPY climbed higher into the Tokyo fix and has stayed in a rough 134.20/134.40 range since.

- Comments from BoJ Governor Ueda in parliament were mixed, discussing what conditions would warrant a shift in policy, while also noting tightening now would lower inflation. Overall, these comments didn't shift sentiment a great deal.

- USD/JPY still looks too high relative to the lower US yield backdrop, but prominent sell-side name stated that EUR/JPY demand may be evident from a month end rebalancing standpoint.

- EUR/USD pushed higher today but ran out of steam near 1.1070, but is back to 1.1055 now.

- AUD and NZD ran out of momentum, although AUD saw more downside, moving back to 0.6675/80 in holiday impacted markets, with both AU and NZ markets closed for ANZAC day. NZD/USD is back to 0.6165/70. A$ likely saw great headwinds from weakness in China related equities. The AUD/NZD cross continued to correct, back down to 1.0825/30. Q1 AU CPI prints tomorrow.

- Looking ahead, ECB & BoE speak will then come under the microscope during the London morning. Further out, NY hours will see the release of new home sales data, a couple of the major home price metrics, consumer confidence. Services activity indicators from the Philly & Dallas Feds and the Richmond Fed m’fing index.

FX OPTIONS: Expiries for Apr25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0923-25(E602mln), $1.0937-50(E947mln), $1.1000(E1.2bln), $1.1020-25(E539mln), $1.1050(E1.4bln), $1.1080(E568mln), $1.1100(E2.2bln)

- USD/JPY: Y133.35($724mln)

- GBP/USD: $1.2300(Gbp628mln)

- AUD/USD: $0.6665(A$510mln), $0.6720-35(A$774mln), $0.6750-65(A$519mln), $0.6800(A$616mln)

- NZD/USD: $0.6150(N$817mln)

- USD/CNY: Cny7.00($1.8bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/04/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 25/04/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/04/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/04/2023 | 0800/1000 |  | EU | ECB Supervisory Board Chair Andrea Enria and MNI event | |

| 25/04/2023 | 0900/1000 |  | UK | BOE Broadbent Speech at NIESR | |

| 25/04/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/04/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/04/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/04/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/04/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 25/04/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/04/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 25/04/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 25/04/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.