-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fixed Income Sell-Off Continues - USD Supported, Equities Weaker

EXECUTIVE SUMMARY

- US EASING VENEZUELA OIL SANCTIONS AFTER ELECTION DEAL - RTRS

- JAPAN SEPT EXPORTS POST FIRST RISE IN THREE MONTHS - MNI BRIEF

- AUSSIE EMPLOYMENT STRONG AT 3.6%, EMPLOYMENT WEAK - MNI BRIEF

- RBNZ TO LOSE DUAL MANDATE WITHIN 100 DAYS - EX STAFF - MNI

- BANK OF KOREA KEEPS POLICY RATE AT 3.5% - PRESS - MNI BRIEF

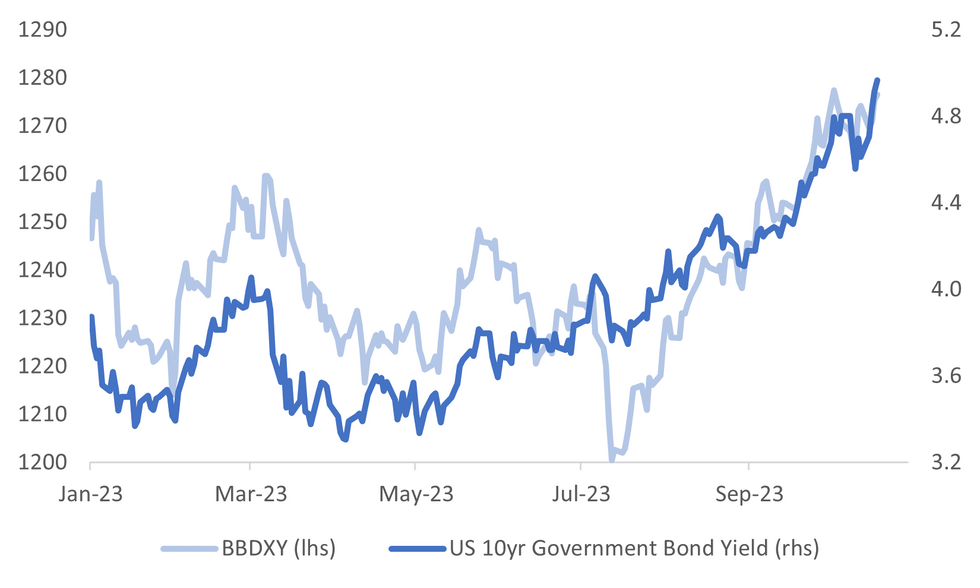

Fig. 1: US Nominal 10yr TSY Yield & BBDXY Index

Source: MNI - Market News/Bloomberg

U.K

ISRAEL (BBG): UK Prime Minister Rishi Sunak on Wednesday evening headed to Israel on a two-day visit to the wider region as part of a procession of foreign leaders visiting the country in an effort to prevent the conflict from widening.

POLITICS (BBG): Labour leader Keir Starmer faces twin tests of the UK opposition party’s popularity, as voters go to the polls to fill two parliamentary seats that were last won comfortably by the ruling Conservatives.

EUROPE

RUSSIA (RTRS): Russian Foreign Minister Sergei Lavrov thanked North Korea for supporting the country's war efforts in Ukraine and pledged Moscow's "complete support and solidarity" for North Korean leader Kim Jong Un, Russia's foreign ministry said.

RUSSIA (BBG): Russia doesn’t currently have plans to ease remaining restrictions on diesel exports, according to Deputy Prime Minister Alexander Novak, indicating that there won’t be additional relief for the tight fuel market.

U.S.

US/VENEZUELA (RTRS): The Biden administration on Wednesday broadly eased sanctions on Venezuela's oil and gas sector in response to a 2024 election deal reached between the Venezuelan government and the country's opposition.

GEOPOLITICS (RTRS): U.S. President Joe Biden's administration is considering $60 billion in assistance for Ukraine and $10 billion for Israel in a supplemental spending request he will send to Congress as soon as Friday, a source familiar with the matter told Reuters on Wednesday.

US/CHINA (BBG): A US congressional committee is targeting Sequoia Capital after starting investigations into several other venture capital firms for their investment in Chinese technology companies.

FED (BBG): Federal Reserve Governor Lisa Cook lauded aspects of the central bank’s maximum-employment goal at a time when the price-stability side of the mandate has garnered more attention.

OTHER

JAPAN (MNI BRIEF): Japan's September exports posted their first y/y rise in three months, up 4.3% following August's 0.8% fall, driven by solid automobile and their parts exports, Ministry of Finance data showed on Thursday.

SOUTH KOREA (MNI BRIEF): The Bank of Korea on Thursday decided to keep its policy interest rate unchanged at 3.50% amid persistent concern over the weaker economy, and despite still elevated headline inflation, for the sixth consecutive meeting, Wowkorea reported.

HONG KONG (Sing Tao): Hong Kong Chief Executive John Lee may announce reducing property stamp duty in his policy address next week, Sing Tao reports, citing unidentified people.

AUSTRALIA (MNI BRIEF): Australia’s unemployment rate fell 0.1 pp to 3.6% in September, stronger than the 3.7% expected, however, employment was softer than anticipated growing by 7,000 – significantly lower than the 20,00 predicted, according to Australian Bureau of Statistics data.

NEW ZEALAND (MNI): New Zealand’s incoming government is likely to drop the Reserve Bank of New Zealand’s dual mandate targeting employment as well as inflation within its first 100 days in power and change the makeup of the Monetary Policy Committee, former Reserve staff and treasury advisors told MNI.

CHINA

ECONOMY (21st Century Herald): China’s implementation of stable macro-economic policy throughout the year has created a solid foundation for a continued recovery in Q4, according to Yao Jingyuan, a special researcher at the State Council and former chief economist at the National Bureau of Statistics.

YUAN (21st Century Herald): The yuan will likely rebound gradually as economic growth continues to improve and the current account maintains a surplus, alongside difficulty for the U.S. dollar index to rise further, said 21st Century Business Herald in a commentary.

BELT & ROAD (Securities Daily): Representatives from 35 countries signed up to the Digital Economy and Green Development Economic and Trade Cooperation Framework during the Belt and Road Forum in Beijing, according to Securities Daily.

CHINA/US (BBG): Chinese investors offloaded the most US bonds and stocks in four years in August, fueling speculation the authorities may have moved to beef up their war chest to defend a weakening yuan.

CHINA MARKETS

MNI: PBOC Injects Net CNY182 Bln Via OMO Thurs; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY344 billion via 7-day reverse repo on Thursday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY182 billion after offsetting the maturity of CNY162 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8859% at 09:53 am local time from the close of 1.9362% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 58 on Wednesday, compared with the close of 49 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Flat At 7.1795 Thursday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate flat at 7.1795 on Thursday. The fixing was estimated at 7.3176 by Bloomberg survey today.

MARKET DATA

JAPAN SEP TRADE BALANCE ¥62.4bn; MEDIAN -¥451.5bn; PRIOR -¥937.8bn

JAPAN SEP TRADE BALANCE ADJUSTED -¥434.1bn; MEDIAN -¥553.7bn; PRIOR -¥553bn

JAPAN SEP EXPORTS Y/Y 4.3%; MEDIAN 3.0%; PRIOR -0.8%

JAPAN SEP IMPORTS Y/Y -16.3%; MEDIAN -12.7%; PRIOR -0.8%

AUSTRALIA SEP EMPLOYMENT CHANGE 6.7k; MEDIAN 20k; PRIOR 63.3k

AUSTRALIA SEP UNEMPLOYMENT RATE 3.6%; MEDIAN 3.7%; PRIOR 3.7%

AUSTRALIA SEP FULL TIME EMPLOYMENT CHANGE -39.9k; PRIOR 7.2k

AUSTRALIA SEP PART TIME EMPLOYMENT CHANGE 46.5k; PRIOR 56.0k

AUSTRALIA SEP PARTICIPATION RATE 66.7%; MEDIAN 67.0% PRIOR 67.0%

SOUTH KOREA BANK OF KOREA POLICY RATE 3.50%; MEDIAN 3.50%; PRIOR 3.50%

CHINA SEP NEW HOME PRICES M/M -0.30%; PRIOR -0.29%

MARKETS

US TSYS: Cheaper On Thursday In Asia

TYZ3 deals at 105-15, -0-13, a 0-13 range has been observed on volume of ~163k.

- Cash tsys sit 2-5bps cheaper across the major benchmarks, the 5s are leading the cheaps.

- TY has continued to tick lower through the session, downside support 105-05+ the 2% DMA Envelope.

- The recent bear steepening impetus extended a touch in Asia. Tsys ticked lower through the session alongside lower US Equity Futures and the USD moving higher.

- The space looked through the Australian Employment Report, and little meaningful macro news flow crossed in the second half of the session.

- In Europe today the docket is thin, further out Fedpseak from Chair Powell headlines we also have Initial Jobless Claims and the Philadelphia Fed Business Outlook.

JGBS: Futures At Session Cheaps, Fresh Cycle High For 10Y Yield, CPI Data Tomorrow

JGB futures push to a fresh session low of 144.56, -41 compared to the settlement levels, in the Tokyo afternoon session.

- According to MNI's technical team, recent weakness has confirmed a resumption of the medium-term downtrend and paved the way for weakness towards 144.15, the Jan 13 low and major support. On the upside, clearance of 146.41, the Sep 4 high would instead highlight a base and a possible short-term reversal.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined trade balance and international investment flow data.

- Accordingly, local participants have likely sought guidance from US tsys. So far in Asia-Pac dealings, US tsys have extended weakness in yesterday’s NY session. Cash US tsys are 2 to 5bps cheaper.

- Cash JGBs are cheaper, with the belly of the curve showing a relatively weaker performance led by the futures-linked 7-year (3.8bps cheaper). The benchmark 10-year yield is 3.4bps higher at 0.843%, just shy of the cycle high of 0.848% set earlier today.

- Swap rates are higher, with the belly also underperforming. Swap spreads are mixed across maturities.

- Tomorrow the local calendar sees National CPI data for September.

AUSSIE BONDS: Cheaper, Employment Data Mixed, Curve Bear Steepens

ACGBs (YM -6.0 & XM -12.0) sit with a bear-steepening of the futures curve. Pricing is slightly weaker after the employment data for September showed mixed results. Employment growth printed lower than expected, while the unemployment rate was better than expected. In trend terms, average new jobs in Q3 were lower than Q2. The trend of slower full-time employment growth and higher part-time continued. Overall, the labour market remains tight but it is showing signs of easing.

- NAB quarterly business confidence next 3-mths printed -1 in Q3 from -4 in Q2, while business conditions next 3-mths showed 16 versus +17 in Q2.

- Local participants have also likely monitored ongoing weakness in US tsys, which has extended into today’s Asia-Pac session. Cash US tsys are 2 to 4bps cheaper.

- Cash ACGBs are 6-12bps cheaper, with the 3/10 curve steeper and the AU-US 10-year yield differential is 1bp lower at -19bps.

- Swap rates are 5-11bps higher, with EFPs tighter.

- The bills strip shows a bear-steepening, with pricing flat to -4.

- RBA-dated OIS pricing is little changed across meetings. A 43% chance of a 25bp hike at the November meeting is priced.

- Tomorrow, the local calendar is empty, with the next release being Judo Bank PMIs on Tuesday.

NZGBS: Curve Twist Steepens As Long End US Tsy Yields Push Higher

NZGBs experienced a noteworthy 12bp twist-steepening of the yield curve. Specifically, the 2-year benchmark closed 1bp richer, contrasting with the 11bp cheapening in the 10-year.

- With no significant domestic events today, the local market's primary focus was the continuation of the overnight weakness in US tsys during the Asia-Pacific session. During yesterday’s NY session, US tsys finished with yields 1 to 8bps higher, with the belly of the yield curve displaying weaker performance. In the ongoing Asia-Pacific session, cash US tsys are 1 to 4bps cheaper, contributing to a steeper yield curve.

- Technical issues within the YieldBroker tendering system prompted the NZ Debt Management to postpone today's bond auction. This development also helped direct focus to international markets. The rescheduled auction is now set to occur between 2:00 p.m. and 2:30 p.m. local time tomorrow.

- Swap rates closed 4-12bps higher, with the 2s10s curve steeper and implied swap spreads sharply wider.

- RBNZ dated OIS pricing closed unchanged across meetings out to Apr’24 and 1-2bps firmer beyond. Nevertheless, pricing remains 4-7bps softer than pre-CPI levels seen earlier in the week. Terminal OCR expectations were steady at 5.65%.

- Tomorrow, the local calendar will see the release of Trade Balance data for September.

FOREX: Antipodeans Pressured In Asia

The Antipodeans are lower in today's Asian session, AUD extended losses after slowing Australian job growth with lower US Equity Futures and regional equities also weighing on sentiment. The US Tsy curve has bear steepened. BBDXY is up ~0.1%.

- AUD/USD is down ~0.6% and sits a touch above the $0.63 handle. Technically the trend outlook is bearish, the pair is supported at $0.6286 low from Oct 3. Resistance is at $0.6445, high from Oct 11.

- Kiwi is also pressured, NZD/USD is ~0.5% and is sitting at a fresh cycle low at $0.5825/36. AUD/NZD ticked away from its 200-Day EMA and now sits marginally above the $1.08 handle.

- Yen is a touch firmer and is the strongest performer in G-10 this morning. USD/JPY is ~0.1% and has ticked away from the ¥150 handle. Resistance in USD/JPY remains at ¥150.16, Oct 3 high and bull trigger. Support is at the 20-Day EMA (¥148.74).

- Elsewhere in G-10 EUR and GBP are lower however ranges are narrow. NOK is down ~0.3% however liquidity is generally poor in Asia.

- The docket is light in Europe today, Fedpseak from Chair Powell headlines on Thursday.

EQUITIES: Asia Pac Equities Slump, China's CSI 300 Close To 2022 Lows

There are few positives in Asia Pac in Thursday trade to date. The major markets are down close to 2%. The combination of carry over from negative US/EU equity moves on Wednesday, coupled with higher US yields, continues to weigh on broader sentiment. US futures have dipped as the session progressed, Eminis now off around 0.20%, last near 4335. Nasdaq futures are off by -0.15%.

- Fresh highs in US yields, with the curve continuing to steepen is aiding USD sentiment and weighing on equity risk appetite. This comes ahead of a Powell speech in NY later on Thursday, which will be closely watched.

- The weakness continues in China equities. The CSI 300 sits off by a further 1.6% at the break, down near 3550 in index terms. Late October 2022 lows just under 3500 are within sight. September house prices fell -0.30% m/m, the same pace as August, although we saw a slightly larger number of cities record falls versus August (54 compared to 52 prior). The HSI is off nearly 2% at the break.

- Japan and South Korean stocks are down sharply. The Kospi -1.80%, slightly away from session lows. Broader tech related headwinds are weighing (offshore investors have sold $201.2mn of local equities so far today). As expected, the BoK held rates steady at 3.50%.

- Taiwan's Taiex is down modestly (-0.15%), outperforming regional trends.

- All markets in SEA are weaker, although losses are less than 1% for the most part (Singapore the exception).

OIL: Crude Lower As Sanctions Lifted On Venezuela, Biden Speaks Later

Oil prices are down slightly but are off their intraday lows. WTI is down 0.3% to $86.99/bbl (Dec contract) after a low of $86.60. Brent is 0.5% lower at $91.05 following a trough of $90.63. Risk appetite deteriorated further today over significant uncertainties in the Middle East. The USD index is 0.1% higher.

- The US has suspended some sanctions on Venezuelan oil but also gas and gold and issued 6-month licenses. They will only be renewed if the country meets its election commitments and releases political prisoners. This should result in an increase of around 25% to over 200kbd but there is uncertainty over how quickly Venezuela can boost production, according to Bloomberg. In 2019, exports to the US were almost 365kbd double what they were last month. The timing is important given rising tensions in the Middle East, sanctions on Russian crude and the 2024 US elections.

- US President Biden is due to speak later on the situation in Israel/Gaza which is likely to be another attempt to prevent the conflict spreading in the region. The oil market remains tight and appears to be in a holding pattern waiting to see if the situation deteriorates.

- Later there are more Fed speakers including Chairman Powell but also Jefferson, Goolsbee, Barr, Bostic, Harker and Logan. On the data front there are US jobless claims, October Philly Fed and September existing home sales.

GOLD: Surges With Geopolitical Risk Despite Higher Yields & USD

Gold is little changed in the Asia-Pac session, sitting close to an eleven-week high, after closing +1.3% at $1947.55 on Wednesday. Haven demand driven by geopolitical risk dominated a further climb for US Treasury yields and renewed USD strength.

- Indeed, higher government bond yields, in the face of rising geopolitical uncertainty, appear to have driven flows into alternative portfolio hedges like gold, which has rebounded more than 8% off the October lows.

- President Joe Biden wrapped up a 7.5-hour trip to Tel Aviv to signal full US backing for Israel but fell short of appeasing Arab leaders, who sided with Hamas-controlled Gaza authorities in blaming Israel for a blast at a hospital that allegedly killed hundreds.

- According to MNI’s technicals team, bullion cleared key resistance at $1953.0 (Sep 1 high) opening up $1965.5 (61.8% retrace of May 4 – Oct 6 bear leg). Indeed, Wednesday’s high of $1962.64 came close to this level before it was helped lower by headlines that Gaza humanitarian aid was being allowed to pass from Egypt.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/10/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 19/10/2023 | 0645/0845 | * |  | FR | Retail Sales |

| 19/10/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 19/10/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 19/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 19/10/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/10/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 19/10/2023 | 1300/0900 |  | US | Fed Vice Chair Philip Jefferson | |

| 19/10/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 19/10/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 19/10/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 19/10/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 19/10/2023 | 1600/1200 |  | US | Fed Chair Jerome Powell | |

| 19/10/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 19/10/2023 | 1720/1320 |  | US | Chicago Fed's Austan Goolsbee | |

| 19/10/2023 | 1730/1330 |  | US | Fed Vice Chair Michael Barr | |

| 19/10/2023 | 2000/1600 |  | US | Atlanta Fed's Raphael Bostic | |

| 19/10/2023 | 2130/1730 |  | US | Philadelphia Fed's Pat Harker | |

| 19/10/2023 | 2240/1840 |  | US | Dallas Fed's Lorie Logan |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.