-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Global Response To China's Latest Reopening Moves Eyed

Today's European Open contains a summary of the major news stories released over the Christmas break.

EXECUTIVE SUMMARY

- CHINA REOPENS BORDERS TO WORLD IN REMOVING LAST COVID ZERO CURBS (BBG)

- CHINA REOPENING BORDERS LEADS OTHER COUNTRIES TO RESTRICT ENTRY (BBG)

- ECB’S GUINDOS SEES EURO ECONOMY IN A ‘VERY DIFFICULT SITUATION’ (BBG)

- ECB MUST BE READY TO TAKE THE HEAT AND RAISE RATES MORE, SCHNABEL SAYS (RTRS)

- LEADING ECB POLICYMAKER HINTS AT SHARP CLIMB TO PEAK RATES (FT)

- PUTIN BANS RUSSIAN OIL EXPORTS TO COUNTRIES THAT IMPLEMENT PRICE CAP (RTRS)

- TC ENERGY TO RESTART KEYSTONE OIL PIPELINE SEGMENT AFTER REGULATOR APPROVAL (RTRS)

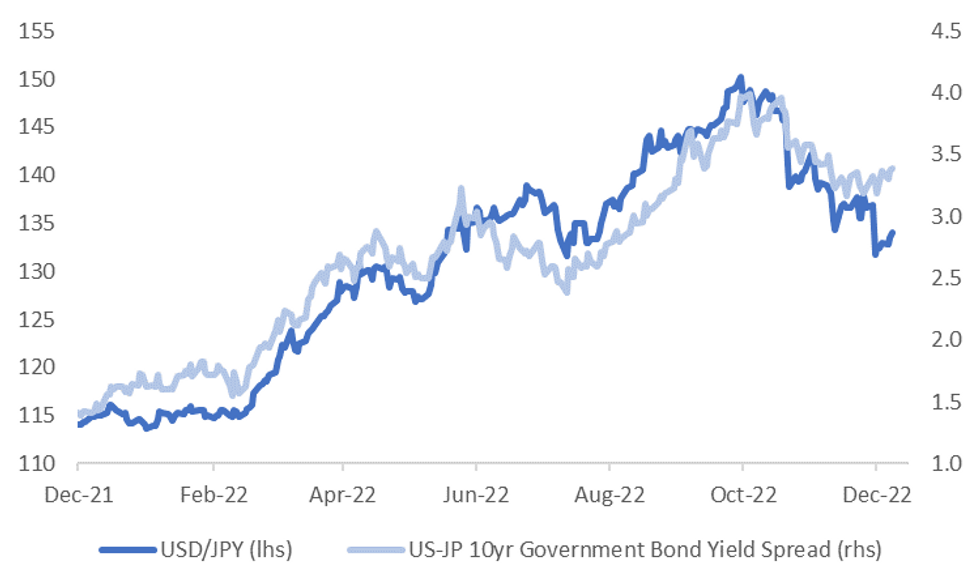

Fig. 1: USD/JPY Vs. U.S./Japan 10-Year Yield Spread

Source: MNI - Market News/Bloomberg

UK

FISCAL/ECONOMY: Jeremy Hunt's tax raid will leave Britain stagnating on the world stage, according to new analysis that shows the Chancellor's attack on aspiration will leave the country languishing behind other economies for the next two decades. (Telegraph)

FISCAL: Middle-class families will be up to £40,000 worse off over the next decade as a result of Jeremy Hunt’s stealth taxes to reduce government borrowing. (The Times)

ECONOMY: More than half of UK companies expect to generate higher revenues next year, a survey by Lloyds Bank suggests. (The Times)

ECONOMY: Rishi Sunak is drawing up plans to woo thousands of “missing” older workers back into the office with a “midlife MoT” in response to fears that Britain’s economic recovery is being held back by people taking early retirement. (The Times)

EUROPE

ECB: The euro area faces a “very difficult economic situation” that will test individuals and businesses, European Central Bank Vice President Luis de Guindos said. (BBG)

ECB: European Central Bank policymaker Isabel Schnabel sees little risk of raising borrowing costs too far at present given that interest rates are still very low after they are adjusted for inflation, she said in an interview published on Saturday. (RTRS)

ECB: A veteran member of the European Central Bank’s rate-setting council believes it has only just passed the halfway point of its tightening cycle and needs to be “in there for the long game” to tame high inflation. After more than a decade of aggressive easing, 2022 was the year when many leading central banks began to raise rates in response to soaring prices. The ECB increased borrowing costs by 2.5 percentage points, capping the year with its fourth rise in a row to leave its benchmark deposit rate at 2 per cent. Klaas Knot, head of the Dutch central bank and one of the governing council’s more hawkish rate-setters, told the Financial Times that, with five policy meetings between now and July 2023, the ECB would achieve “quite a decent pace of tightening” through half percentage point rises in the months ahead before borrowing costs eventually peaked by the summer. (FT)

SPAIN: The Spanish government announced a fresh batch of measures worth €10 billion ($10.6 billion) for 2023 to help ease naggingly-high inflation stoked by the war in Ukraine. (BBG)

U.S.

FISCAL: The U.S. House of Representatives on Friday passed 225 to 201 a $1.7 trillion bill to fund the federal government for the rest of the fiscal year, just in time to beat the midnight deadline to avoid a partial shutdown of federal agencies. (CNBC)

INFLATION: The Trimmed Mean PCE inflation rate over the 12 months ending in November was 4.6 percent. According to the BEA, the overall PCE inflation rate was 5.5 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 4.7 percent on a 12-month basis. (Dallas Fed)

EQUITIES: Billionaire Elon Musk is warning against something he himself has done — borrowing against the value of securities one owns — because of the risk of “mass panic” in the stock market. (BBG)

MARKETS: Cboe Global Markets said it’ll re-open floor trading of options on the Cboe Volatility Index on Wednesday, Dec. 28. (BBG)

OTHER

GLOBAL TRADE: Aiming to reduce its reliance on China for rare earth metals, Japan will begin in 2024 to extract the essential materials for electric vehicles and hybrids from the mud on the deep sea bottom in an area off Minami-Torishima Island, a coral atoll in the Pacific Ocean about 1,900 kilometers southeast of Tokyo. Tokyo plans to begin work to develop extraction technologies starting next year. (Nikkei)

GLOBAL TRADE: The Japanese government has requested insures to take on additional risks to continue providing marine war insurance for liquefied natural gas (LNG) shippers in Russian waters, a senior official at the industry ministry said. (RTRS)

U.S./CHINA: Security concerns over TikTok have led some Biden administration officials to push for a sale of the Chinese-owned company's U.S. operations to ensure Beijing can't harness the app for espionage and political influence, according to people familiar with the situation. (WSJ)

U.S./CHINA: Under the bipartisan spending bill that passed both chambers of Congress on Friday, TikTok will be banned from government devices, underscoring the growing concern about the popular video-sharing app owned by China’s ByteDance. (CNBC)

U.S./CHINA/TAIWAN: China expressed anger on Saturday at a new U.S. defence authorisation law that boosts military assistance for Taiwan, while Taipei cheered it for helping boost the island's security. (RTRS)

CHINA/TAIWAN: China's military said it had conducted "strike drills" in the sea and airspace around Taiwan on Sunday in response to what it said was provocation from the democratically-governed island and the United States. (RTRS)

CHINA/TAIWAN: Taiwan will extend compulsory military service to one year from four months from 2024 due to the rising threat the democratically governed island faces from its giant neighbour China, President Tsai Ing-wen said on Tuesday. (RTRS)

GEOPOLITICS: Chinese Foreign Minister Wang Yi defended what he said was his country’s position of impartiality on the war in Ukraine on Sunday and signaled that China would deepen ties with Russia in the coming year. (AP)

BOJ: Bank of Japan (BOJ) policymakers saw the need to keep ultra-low interest rates but discussed growing prospects that higher wages could finally eradicate the risk of a return to deflation, a summary of opinions at their December meeting showed. (RTRS)

BOJ: Bank of Japan Governor Haruhiko Kuroda on Monday brushed aside the chance of a near-term exit from ultra-loose monetary policy but voiced hope that intensifying labor shortages will prod firms to raise wages. Kuroda said the BOJ's decision last week to widen the allowance band around its yield target was aimed at enhancing the effect of its ultra-easy policy, rather than a first step toward withdrawing its massive stimulus program. (RTRS)

JAPAN: Japan’s health ministry is considering lowering the classification of the coronavirus in spring to the same category as seasonal influenza virus, Nikkei reports, without attribution. (BBG)

JAPAN: Lending units at Japan’s biggest banks including Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group are set to raise home loan rates from Jan. following the central bank’s tweak to its cap on yields, Asahi reports, citing unidentified people. (BBG)

JAPAN: Top executives at Japan’s biggest banks are expecting negative interest rates to linger and see little immediate earnings boost after a surprise move by the nation’s central bank pushed lenders’ shares up by 13% last week. (BBG)

JAPAN: Japanese reconstruction minister Kenya Akiba tendered his resignation to Prime Minister Fumio Kishida on Tuesday, becoming the fourth minister to leave the cabinet appointed by Kishida in August. (RTRS)

NORTH KOREA: North Korean leader Kim Jong Un unveiled new goals for the country's military for 2023 at an ongoing meeting of the ruling Workers' Party, state media reported on Wednesday, hinting at another year of intensive weapons tests and tension. (RTRS)

NORTH KOREA: Five North Korean drones crossed into South Korea on Monday and South Korea responded by scrambling jets and attack helicopters and opening fire to try to shoot down the North Korean aircraft, the South Korean military said. (RTRS)

HONG KONG: International travellers to Hong Kong will no longer need to do a mandatory PCR COVID-19 test on arrival, local broadcaster TVB said on Wednesday citing sources, adding that the city's vaccine pass required to enter most venues would also be scrapped. (RTRS)

ASIA: Japan and five Central Asian nations affirmed on Saturday the importance of the rules-based international order, as concerns are growing that the order could be undermined amid Russia's invasion of Ukraine and China's intensifying military activities in the Indo-Pacific region. (Nikkei)

BRAZIL: Brazil’s outgoing administration of Jair Bolsonaro gave up on plans to extend federal tax cuts on fuel at the request of the incoming government, said Fernando Haddad, picked by Luiz Inácio Lula da Silva to be his finance minister. (BBG)

BRAZIL: Senator Simone Tebet, a former presidential candidate who backed Luiz Inacio Lula da Silva in the October runoff vote, agreed to helm Brazil’s planning ministry, according to the president of her party. Lula and Tebet will have a final talk before the official announcement, Baleia Rossi, the head of the Brazilian Democratic Movement party, said on Tuesday. (BBG)

RUSSIA: President Vladimir Putin claimed that Russia is ready for talks to end the war in Ukraine even as the country faced more attacks from Moscow — a clear sign that peace wasn't imminent. (AP)

RUSSIA: Russian Foreign Minister Sergei Lavrov said Ukraine must surrender or face continued war, even as Moscow’s troops have been forced to retreat in a series of damaging defeats. (BBG)

RUSSIA: Russia's budget deficit could be wider than the planned 2% of GDP in 2023 as an oil price cap squeezes Russia's export income, Finance Minister Anton Siluanov said, an extra fiscal hurdle for Moscow as it spends heavily on its military campaign in Ukraine. (RTRS)

RUSSIA: The latest round of Western sanctions against Russia over its invasion of Ukraine are beginning to pinch the country’s economy. (CNBC)

ENERGY: Europe will inevitably face gas shortages, since its decision to set a price cap on gas and other anti-Russian sanctions provoke a profound long-term crisis and destabilization in the region, Russian Deputy Prime Minister Alexander Novak said in an interview with TASS. (TASS)

ENERGY: Repairing the Nord Stream pipeline is still feasible but it would take time and money, Russian Deputy Prime Minister Alexander Novak said in an interview. (TASSASS)

OIL: President Vladimir Putin on Tuesday delivered Russia’s long-awaited response to a Western price cap, signing a decree that bans the supply of crude oil and oil products from Feb. 1 for five months to nations that abide by the cap. (RTRS)

OIL: Russian crude oil is being shipped to India on tankers insured by western companies, in the first sign Moscow has reneged on its vow to block sales under the G7-imposed price cap. (FT)

OIL: Russian oil exports will grow by 7.5% to 242 mln metric tons in 2022, Deputy Prime Minister Alexander Novak said in an interview with TASS. (TASS)

OIL: Germany’s government is confident that a key refinery that provides Berlin and swaths of the eastern part of the country with fuel is well positioned to keep running even as the nation is set to begin its ban on Russian oil in the coming days. (BBG)

OIL: TC Energy Corp said on Friday a U.S. regulator had approved a restart plan for an idled segment of its Keystone oil pipeline to Cushing, Oklahoma, and it looked to restore service after several days of testing and inspections. (RTRS)

OIL: U.S. oil refiners on Tuesday were working feverishly to resume operations at a dozen facilities knocked offline by a holiday deep freeze, a recovery that in some cases will stretch into January. (RTRS)

CHINA

CORONAVIRUS: China scrapped quarantine requirements for inbound travelers, putting the country on track to emerge from three years of self-imposed global isolation under a Covid Zero policy that battered the economy and stoked historic public discontent. (BBG)

CORONAVIRUS: China will start issuing new passports and Hong Kong travel permits to mainland residents as it removes some of the tourism barriers from three years of strict Covid restrictions. (BBG)

CORONAVIRUS: Chinese people, cut off from the rest of the world for three years by stringent COVID-19 curbs, flocked to travel sites on Tuesday ahead of borders reopening next month, even as rising infections strained the health system and roiled the economy. (RTRS)

CORONAVIRUS: Countries across the globe are implementing or considering measures to test or restrict travelers from China as the country of 1.4 billion abandons its Covid Zero policy and prepares to reopen borders in early January. (BBG)

CORONAVIRUS: ICUs in Beijing are still under stress as community transmission of Omicron has led to increasing severe cases ̶ most of whom are elderly ̶ in a short period of time, the Global Times has learned from experts. (Global Times)

CORONAVIRUS: China's Zhejiang, a big industrial province near Shanghai, is battling around a million new daily COVID-19 infections, a number expected to double in the days ahead, the provincial government said on Sunday. (RTRS)

CORONAVIRUS: The peak of Covid-19 outbreaks is accelerating and sweeping through smaller cities from first-tier cities such as Beijing and Guangzhou, with medical institutions and staff across the country facing unprecedented challenges and pressures, 21st Century Business Herald reported. (MNI)

CORONAVIRUS: People are returning to the streets in China’s capital city as it emerges from a wave of Covid infections. (CNBC)

CORONAVIRUS: Mainland Chinese eager to secure western messenger RNA vaccines rather than domestic jabs are flocking to Macau, where they have booked out the only hospital offering the inoculations to tourists. (FT)

ECONOMY: Though challenges and uncertainties remain, the Chinese economy is expected to see marked growth in 2023 and a rapid recovery is around the corner, Chinese officials and economists said at a forum over the weekend. (Global Times)

ECONOMY: China’s economy continued to slow in December as the massive Covid-19 outbreak spread across the country, with activity slumping as more people stay home to try and avoid getting sick or to recover. (BBG)

ECONOMY: Shanghai, Guangdong and Zhejiang provinces in China's coastal regions have actively rolled out measures to retain workers for ensuring business operation during the upcoming Spring Festival holiday in late January, while planning to hire new workers after the holiday amid expected order growth. (Global Times)

POLICY: China’s top banking watchdog will work to resolve dangerous local government hidden debt and prevent the resurgence of high-risk shadow banking, according to the Shanghai Securities News. The China Banking and Insurance Regulatory Commission (CBIRC) said it would proactively address the risk of deteriorating quality credit assets, and encourage banking institutions to increase the disposal of non-performing assets. (MNI)

POLICY: China’s top banking regulator has established new criteria to assess the operational risk of foreign banks operating in China including the amount of support they receive from their global headquarters, according to Caixin. For operational risk, the CBIRC will evaluate risk management, operational control, compliance and asset quality. (MNI)

POLICY: China's banking and insurance regulator said Tuesday that it would ramp up financial support for businesses in the service sector that had been hammered by Covid-19 outbreaks, in addition to efforts to stimulate domestic consumption. (Dow Jones)

PROPERTY: China’s hi-tech manufacturing hub of Dongguan has removed homebuying restrictions across the entire city, joining several Chinese tier-2 cities in easing curbs to boost the property market amid overall weak sales. (SCMP)

PROPERTY: Chinese listed real estate companies have been actively rolling out refinancing plans over the past month, after the China Securities Regulatory Commission (CSRC) reopened the channel for equity refinancing. (Global Times)

PROPERTY: Country Garden entered into a facility agreement with various lenders for a $280m dual-tranche term loan for a term of 36 months, according to a filing to HKEX. (BBG)

MARKETS: Some Chinese financial institutions are rushing employees back to office as surging absences of traders and other key personnel over the past week amid the nation’s massive Covid-19 outbreak start to disrupt operations. (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY183 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) on Wednesday injected CNY189 billion via 7-day reverse repos, and CNY13 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operation has led to a net injection of CNY183 billion after offsetting the maturity of CNY19 billion reverse repos today, according to Wind Information.

- The operations aim to keep year-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0141% at 9:37 am local time from the close of 1.9531% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 47 on Tuesday vs 46 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9681 WEDS VS 6.9546 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9681 on Wednesday, compared with 6.9546 set on Tuesday.

OVERNIGHT DATA

JAPAN NOV, P INDUSTRIAL PRODUCTION -0.1% M/M; MEDIAN -0.2%; OCT -3.2%

JAPAN NOV, P INDUSTRIAL PRODUCTION -1.3% Y/Y; MEDIAN -1.5%; OCT +3.0%

SOUTH KOREA JAN BUSINESS SURVEY MANUFACTURING 68; DEC 69

SOUTH KOREA JAN BUSINESS SURVEY NON-MANUFACTURING 72; DEC 77

MARKETS

US TSYS: Light Twist Flattening Observed

TYH3 deals +0-02+ at 112-13, in the middle of its narrow 0-05 Asia-Pac range, on limited volume of ~65K.

- Early Asia-Pac trade saw some marginal weakness as the region reacted to Tuesday’s bear steepening.

- Still, that move was limited, as the major cash Tsy benchmarks failed to breach their respective Tuesday yield peaks.

- We then saw a pullback from session cheaps, with the long end leading the move as the curve twist flattened, leaving the major benchmarks 1bp cheaper to 2bp richer, with a pivot around 10s.

- Macro headline flow was subdued at best, with continued focus on the latest wind back of COVID-related restrictions in China.

- Looking ahead, the NY docket will see the release of pending home sales & Richmond Fed m’fing data, with 2-Year FRN and 5-Year Tsy supply also due.

JGBS: Global Core FI Impetus & BoJ Purchases Promote Twist Steepening Of The Curve

Spill over from weakness in core global FI markets triggered a round of unscheduled BoJ purchases in paper out to 10s (in both Rinban and fixed rate varieties), which provided a brief boost for JGB futures, before that particular impulse faded.

- JGB futures then printed through their overnight session base in the latter rounds of morning trade, but the move lacked meaningful follow through, allowing the contract to bounce, printing at unchanged levels ahead of the bell.

- The presence of the aforementioned BoJ purchases provided a twist steepening impulse on the curve, leaving the major benchmarks 2bp richer to 3bp cheaper, with 10s providing the firmest point on the curve as paper beyond that point cheapened.

- The summary of opinions covering the BoJ’s Dec meeting provided fairly run of the mill comments, generally within the confines of the lines of rhetoric that we have witnessed since the surprise YCC tweak.

- Looking ahead, weekly international security flow data headlines Thursday’s thin local docket, with the general direction of travel for wider core global FI markets and the potential for unscheduled BoJ JGB purchases eyed.

AUSSIE BONDS: Early Steepening Holds, Relative Underperformance Extends

ACGBs adjusted cheaper after the Christmas break, softening in lieu of weakness in core global FI markets that came on the back of the latest reopening push in China (with most of the focus on the wind back of international travel restrictions/limitations) and some hawkish ECB speak.

- The space went out just above worst levels, with YM -19.0 & XM -21.5, while wider cash ACGB trade saw 15-21bp of cheapening as the curve bear steepened.

- ACGBs extended their recent run of underperformance vs. their global counterparts, with the AU/U.S. 10-Year yield spread briefly moving out beyond +20bp, before finishing off extremes, albeit still comfortably wider than late Friday levels.

- There wasn’t anything in the way of meaningful domestic/idiosyncratic headline flow.

- The local docket is empty in the time between Christmas and the New Year, which will leave broader macro headlines and spill over from wider cross-market flows at the fore in the coming days.

- Meanwhile, expect volumes and general liquidity to be limited as many participants will take time off between Christmas and NY.

NZGBS: Under Pressure, Payside Swap Flow Noted

NZGBs could never shake off the downward bias established at Wednesday’s open, as catch up to weakness in U.S. Tsys either side of the Christmas break & the latest roll back of Chinese COVID restrictions (most notably re: international travel), as well as some fresh downward impetus for core global FI markets in Asia-Pac hours, all applied pressure.

- That left the major NZGB benchmarks running 9-13bp cheaper across the curve at the bell, with the belly leading the weakness.

- Meanwhile, payside flow in swaps helped apply pressure, with the major swap rates running 14-22bp higher as that curve bear steepened and swap spreads widened.

- There wasn’t anything in the way of meaningful domestic headline flow observed,

- The local docket is empty in the time between Christmas and the New Year, which will leave broader macro headlines and spill over from wider cross-market flows at the fore in the coming days.

EQUITIES: US Tech Weakness Weighs, HSI/H Shares Outperform

Asia Pac equities are mixed, with tech sensitive indices generally underperforming in what is still holiday impacted markets. US futures have tracked a narrow range for much of the session, sitting slightly in positive territory currently (+0.05/0.10%).

- Tuesday's US session saw the Nasdaq underperform as Telsa slumped due to demand/production worries in China.

- This has seen tech sensitive plays weaken in the region. The Kopsi is off by over 2.1%, with offshore investors selling $403mn of local shares. The Taiex is down by 1.23% and the NIkkei 225 by -0.60%.

- The HSI tech sub index has bucked the trend though, up 2.7%, helping the aggregate HSI rise by over 2.1%. The China Enterprise index is also up a solid 2.60%. Mainland shares are more mixed, after +1.5% gains for the CSI 300 across the first two sessions of this week, as Covid restrictions were scrapped further. Today the CSI is down by 0.17%, but the Shanghai Composite is up slightly.

- Other markets are mixed, with overall ranges fairly modest. The JCI in Indonesia is down a by 0.87% though.

GOLD: Down On The Day But Trend Conditions Bullish

MNI (Australia) - Gold prices rose 0.9% on Tuesday on the back of signs of easing US inflation and further reopening of China, which is one of the world’s largest purchasers of gold. Today it is down 0.2% as the DXY is up 0.1% and is currently trading around $1810.75/oz.

- It has been in a tight range with a high of $1814.61 and a low of $1809.66 today. Trend conditions remain bullish for gold.

- There are only secondary data in the US this week. Later today the Richmond Fed index and pending home sales print. The FOMC minutes and the US ISM on January 4 are likely to be the next items of focus.

OIL: Oil Prices Supported By China Quarantine Easing, May End 2022 Higher

MNI (Australia) - Oil prices have been trading in a tight range during the session and are up just 0.1% after rising solidly on Tuesday. WTI is around $79.60/bbl and is just under the 50-day simple MA after a high of $79.92. It is currently above where it began 2022. Brent is about $84.40 after a high of $84.76 earlier.

- Oil markets have been supported by the announcement that arrivals into China will no longer have to quarantine. Increased international travel will boost oil demand.

- Russia has banned exports of crude to nations participating in the oil price cap from February 1, as threatened at the start of December, but it has avoided more extreme measures such as a minimum price.

- Oil and gas production in north America has been impacted by the severe winter storms.

- There is US API and EIA inventory data later today as well as the Richmond Fed index and pending home sales. The FOMC minutes and the US ISM on January 4 are likely to be the next items of focus.

FOREX: USD/JPY Recovery Continues, A$ Outperforms

The main theme today has been yen weakness. USD/JPY has continued to recover, with the pair getting to a high of 134.40 before selling interest emerged. We are now back close to 134.00, still 0.40% weaker for the yen since the open. This has helped keep the USD indices slightly higher, with the other majors tracking tight ranges. The BBDXY was last just under 1254.70.

- Weighing on the yen was the BoJ Opinion Summary from the last policy meeting, which pushed back against any premature moves away from ultra-easy monetary policy conditions. Yield differentials are also tracking in the USDs favor. China's rapid move away from CZS is at risk of being inflationary, which is aiding the US cash Tsy yield move higher.

- Commodities are also generally supported, with oil holding close to recent highs (Brent last near $84.40), while copper has nudged up to $384.20. The A$ has outperformed, up nearly 0.30%, last just off session highs at 0.6745. AUDJPY is back close to 90.50.

- The AUD/NZD cross is back at 1.0760, fresh highs since the start of the month. NZD/USD is near 0.6270, slightly down for the session, but up from earlier lows just under 0.6260.

- Looking ahead, the main focus will be on US data out later, with the Richmond Fed index and pending home sales due.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/12/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/12/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/12/2022 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 28/12/2022 | 1500/1000 | ** |  | US | NAR pending home sales |

| 28/12/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 28/12/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.