-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI EUROPEAN OPEN: Hong Kong/China Equity Rebound Loses Some Momentum

EXECUTIVE SUMMARY

- RESTRICTIVE FED TO WEIGH ON DEMAND - JEFFERSON - MNI BRIEF

- FDIC’S GRUENBERG TO RESIGN AFTER WORKPLACE PROBE - MNI BRIEF

- RBA BOARD CONCERNED STAFF FORECASTS TOO OPTIMISTIC - MNI BRIEF

- AUSTRALIA’S CONSUMER CONFIDENCE EDGES LOWER ON INFLATION FEARS - BBG

- SOUTH KOREA'S EARLY TRADE DATA SHOW EXPORT MOMENTUM RISING - BBG

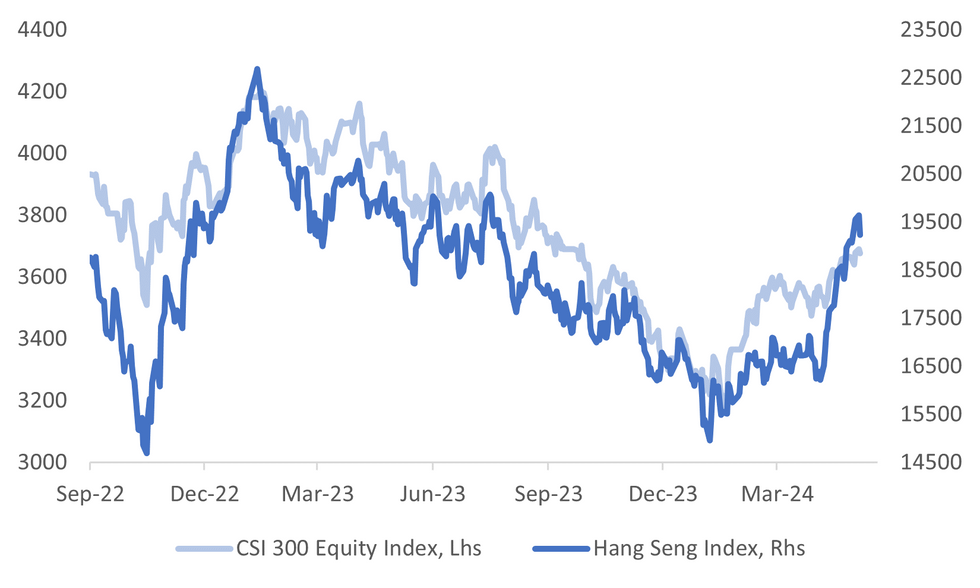

Fig. 1: China & Hong Kong Equity Indices

Source: MNI - Market News/Bloomberg

EUROPE

HUNGARY (MNI INTERVIEW): Hungary’s 2024 budget deficit will exceed its new target unless growth rates improve and the government follows through with plans to trim public spending, the president of the State Audit Office of Hungary told MNI in an interview.

GERMANY (BBG): In an about face, German officials are ready to support a US plan to leverage the future revenue generated from frozen Russian assets — mostly stranded in Europe — to back $50 billion in aid to Ukraine, according to people familiar with the discussions.

UKRAINE (RTRS): Western allies are taking too long to make key decisions on military support for Ukraine, President Volodymyr Zelenskiy told Reuters in an exclusive interview, in Kyiv on Monday. He also said he was pushing partners to get more directly involved in the war by helping to intercept Russian missiles over Ukraine and allowing Kyiv to use Western weapons against enemy military equipment amassing near the border.

ECB (BBG): A leveraged trade that’s worrying regulators worldwide has caught the attention of the European Central Bank, which pointed to signs the strategy is gaining traction in the region.

ISRAEL (POLITICO): While Israeli politicians of all stripes have sharply rebuked the International Criminal Court’s request for arrest warrants for its top officials, European leaders’ reactions are split.

US (POLITICO): Washington could sign off on a sweeping package of economic and security support for Georgia if its government abandons its increasingly anti-Western rhetoric and stops backsliding on human rights.

U.S.

FED (MNI BRIEF): Federal Reserve Vice Chair Philip Jefferson said Monday current U.S. monetary policy is restrictive and will continue to weigh on demand, particularly on interest-sensitive spending.

FED (DJ): Cleveland Fed President Loretta Mester on Monday suggested she was thinking about backing away from her prior expectation that the U.S. central bank will cut interest rates three times this year. As recently as early April, Mester had three rate cuts penciled in for 2024.

FDIC (MNI BRIEF): Federal Deposit Insurance Corporation Chairman Martin Gruenberg announced Monday that he will resign, after a recent probe found a widespread culture of sexual harassment and discrimination at the independent agency.

US/ISRAEL (BBG): Three former U.S. foreign policy officials in Donald Trump's administration met with Prime Minister Benjamin Netanyahu and other public figures in Israel on Monday, according to a person with direct knowledge of the matter.

OTHER

ISRAEL (RTRS): The International Criminal Court's prosecutor said on Monday he had requested arrest warrants for Israeli Prime Minister Benjamin Netanyahu, his defence chief and three Hamas leaders over alleged war crimes. ICC prosecutor Karim Khan said in a statement issued after more than seven months of war in Gaza that he had reasonable grounds to believe the five men "bear criminal responsibility" for alleged war crimes and crimes against humanity.

AUSTRALIAN (MNI BRIEF): The Reserve Bank of Australia will need to alter its forecasts for inflation and employment should its key assumptions on consumption growth, labour market capacity or price rise prove overly optimistic, according to the recently published minutes from the May meeting.

AUSTRALIA (BBG): Australia’s consumer confidence dipped in May as households expressed concern about persistent inflation potentially prompting the Reserve Bank to raise interest rates again, offsetting a boost from last week’s budget.

NEW ZEALAND (BBG): Treasury Dept. comments in Fortnightly Economic Update published Tuesday in Wellington. Indicators continue to point to low demand heading into 2q affecting consumers and businesses alike. A drop in inflation expectations, discretionary spending and normalizing patterns of migration will be welcome news to the RBNZ

SOUTH KOREA (BBG): South Korea’s early trade data showed that exports are continuing to grow at a double-digit clip, boosting the prospects for an acceleration in economic growth this year.

CHINA

MORTGAGE RATES (SHANGHAI SECURITIES NEWS): China’s mortgage rates can fall further even as banks kept the benchmark five-year loan prime rate unchanged, the Shanghai Securities News reported.

LPR (SECURITIES DAILY): Banks may lower the LPR later this year due to China's low inflation, but slower monetary easing in developed economies could delay action, says Mingming, chief economist at CITIC Securities. Wen Bin, chief economist at Minsheng Bank, added banks faced declining net interest margins, making a short-term LPR cut unlikely.

BONDS (SHANGHAI SECURITIES NEWS): Foreign investors may further increase their allocation to China’s bond market, as the yuan faces less depreciation pressure amid weakening overseas economic data and China may have greater easing space in monetary policy, expected to drive short-term yields down, Shanghai Securities News reported citing Xu Zhaoting, general manager at Deutsche Bank’s China Investment Banking Department.

TRADE (YICAI): China will take 30 measures to expand export credit insurance aimed at accelerating international trade, the Ministry of Commerce has announced. Authorities will ensure good use of advance payment insurance and loss compensation to help foreign trade momentum, especially for SMEs, the notice said.

CHINA MARKETS

PBOC Conducts CNY2 Bln Via OMO Tues; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Tuesday, with the rates unchanged at 1.80%. The operation has led to no change to the liquidity after offsetting the CNY2 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8283% at 09:29 am local time from the close of 1.8085% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 55 on Monday, compared with the close of 48 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1069 on Tuesday, compared with 7.1042 set on Monday. The fixing was estimated at 7.2349 by Bloomberg survey today.

MARKET DATA

AUSTRALIA MAY WESTPAC CONSUMER CONFIDENCE FALLS 0.3% M/M; PRIOR -2.4%

AUSTRALIA MAY WESTPAC CONSUMER CONFIDENCE FALLS TO 82.2; PRIOR 82.4

SOUTH KOREA MAY FIRST 20 DAYS TRADE DEFICIT $304M

SOUTH KOREA MAY FIRST 20 DAYS EXPORTS RISE 1.5% Y/Y; PRIOR +11.1%

SOUTH KOREA MAY FIRST 20 DAYS IMPORTS FALL 9.8% Y/Y; PRIOR +6.1%

SOUTH KOREA MAY 1-20 CHIP EXPORTS RISE 45.5% Y/Y

SOUTH KOREA MAY CONSUMER CONFIDENCE FALLS TO 98.4; PRIOR 100.7

SOUTH KOREA 1Q HOUSEHOLD CREDIT FALLS TO KRW1,882.8T; PRIOR KRW 1,885.4T

MARKETS

US TSYS: Treasury Futures Trade Steady Ahead Of Busy Day Of Fed Speaker

- Ranges have been very tight and we trade near overnight lows. The 2Y contract is unchanged at 101-21.375, while the 10Y contract is (- 02) at 109-01.

- Volumes: TU 30k, FV 39k, TY 60k

- Tsys Flows: Block seller of 1.8k FV, Block Steepener 9k TU | 2.5k US

- Looking at technicals, support holds at 108-27+/108-15 (50-day EMA / May 14 low), while resistance holds at 109-31+ (May 16 high)

- The treasury curve is slightly steeper today, yields are flat to 1.5bps lower, the 2Y yield is -1.3bps at 4.835%, 10Y -0.2bp to 4.441%, while the 2y10y +1.093 at -39.783

- Looking across APAC rate markets: ACGBs are 1.5-2bps higher, NZGBs flat to 2.5bps higher, curve is steeper, JGBs yields are flat to 1bps higher

- Rate cut projections have receded vs. this morning's levels (*): June 2024 at -5% w/ cumulative rate cut -1.2bp at 5.318%, July'24 at -20% w/ cumulative at -6.3bp (-7.5bp) at 5.267%, Sep'24 cumulative -19.6bp (-20.9bp), Nov'24 cumulative -27.1bp (-29bp), Dec'24 -41.5bp (-43.9bp).

- Busy day ahead for fed speakers with Barkin, Waller, Williams, Collins, Bostic & Barr all speaking

JGBS: Cash Bonds Little Changed, 40Y Supply Tomorrow

JGB futures are unchanged compared to the settlement levels and sit in the middle of today's range.

- There hasn’t been much in the way of domestic drivers to flag. April Tokyo condominiums for sale are on tap later.

- After yesterday’s modest sell-off, cash US tsys have slightly bull-steepened in today’s Asia-Pac session. The US data calendar is light until mid-week. The focus is on the minutes from the May 1 FOMC on Wednesday.

- Cash JGBs are slightly mixed, with yield movements bounded by +/- 0.7bp. The benchmark 10-year yield is 0.1bp lower at 0.980% after reaching 0.984% earlier, its highest level since 2013, on speculation of further BoJ rate hikes and reduced debt-purchase amounts at operations.

- The breakeven inflation rate for the 10-year CPI-linked bonds rose 2bps to 1.644%.

- The swaps curve has twist-flattened, pivoting at the 3s, with rates 0.4bp higher to 1bp lower. Swap spreads are mixed.

- Tomorrow, the local calendar sees Trade Balance and Core Machine Orders alongside 40-year supply.

AUSSIE BONDS: Cheaper But Off Worst Levels, Jun-54 Supply Tomorrow

ACGBs (YM -2.0 & XM -2.0) sit cheaper but off session cheaps.

- The minutes from the May 7 RBA meeting noted that the data had come in “stronger than expected” but it decided to look through short-term developments to “avoid excessive fine-tuning”.

- As a result, the Board decided to leave rates unchanged but as Governor Bullock said in the press conference a hike was discussed. While the “risks around inflation had risen somewhat”, the general tone of the minutes was neutral demonstrating a strong desire to hold rates thus the bar remains high for a move in either direction.

- (MNI) The RBA will need to alter its forecasts for inflation and employment should its key assumptions on consumption growth, labour market capacity or price rise prove overly optimistic, according to the recently published minutes from the May meeting. (See here)

- Cash ACGBs are 2bps cheaper, with the AU-US 10-year yield differential at -19bps.

- Swap rates are 1-2bps higher.

- The bills strip is cheaper, with pricing -2.

- RBA-dated OIS pricing is 3-4bps firmer for meetings beyond August. A cumulative 10bps of easing is priced by year-end off an expected terminal rate of 4.34%.

- Tomorrow, the local calendar is empty apart from the AOFM's planned sale of A$300mn of 4.75% Jun-54 bond.

NZGBS: Closed Slightly Cheaper Ahead Of The RBNZ Policy Decision

NZGBs closed flat to 2bps cheaper but around the session’s best levels ahead of tomorrow’s RBNZ Policy Decision. Updated staff forecasts will also be released.

- The RBNZ is unanimously expected to leave rates at 5.5% as it is yet to be convinced that inflation will sustainably return to target. We don't expect the tone of the statement or the updated projections to be significantly changed with guidance that “a restrictive monetary policy stance remains necessary” retained.

- Given elevated non-tradeables inflation, the MPC will likely still want to see a couple of quarters of CPI data to determine if domestic price pressures have eased sufficiently. With Q3 CPI not released until October 16 and only one meeting left before year end thereafter, it looks like the RBNZ’s prolonged hold will continue through this year. (See full preview here)

- Swap rates closed 1bp lower to 1bp higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed little changed across meetings. There's a 7% probability priced in for a 25bp hike at tomorrow’s meeting.

- The pricing level of 5.52% for the May meeting also represents the anticipated terminal OCR. By year-end, a cumulative 45bps of easing is factored into the pricing.

FOREX: Dollar Modestly Higher, Weaker Commodities/Lower Equities Weigh On A$

The USD BBDXY index sits higher in the first part of Tuesday trade. We were last near 1247.5 (+0.10% firmer), slightly off session highs just above 1248.0.

- USD gains have been fairly uniform and broad based, albeit modest at this stage. USD/JPY was last around 156.50, this is close to session highs. We aren't too far away from May 14 highs at 156.74.

- AUD/USD is back to 0.6655/60, off close to 0.2%. We have seen some retracement in commodity prices from recent frothy levels, which has likely weighed at the margins. Regional equities are also mostly weaker, led by Hong Kong markets. The RBA mins didn't offer any great surprises relative to policy outcome earlier in May.

- NZD/USD has also weakened last under 0.6100.

- US Tsy futures sit off session highs, but have tracked tight ranges overall. Cash Tsy yields are little changed.

- Later the Fed’s Barkin, Waller, Williams, Bostic and Barr and BoE’s Bailey speak. US Philly Fed non-manufacturing for May and Canadian April CPI print.

ASIA STOCKS: HK & China Equities Head Lower, Tech Forms Double Top

Hong Kong & Chinese equities are lower today, equities are being dragged lower following Li Auto's 19% drop after weaker-than-expected first quarter results, Tech is lower after Tencent shut down new game DNF Mobile within an hour of debut with the HSTech index forming a doble top and now on track for the worst day in this month, while property indices are holding up slightly better than the wider markets. There is little in the way of market data today, focus will turn to FOMC minutes on Wednesday.

- Hong Kong equities are lower today, property is holding up slightly better than the wider markets with the Mainland Property Index down just 1.60% although the Hang Seng Property Index is down 1.79%, the HSTech Index is down almost 3.20%, while the HSI is down 2.05%. In China onshore markets, the CSI300 is trading down 0.40% while the small-cap indices CSI1000 & CSI2000 are down 0.80%, while the ChiNext is down 0.62%

- In the property space, China Vanke is securing more bank loans to enhance liquidity while awaiting government support for builders, the company applied for a 1.2 billion yuan loan from Bank of China for a development project in Changzhou

- Li Auto Inc.'s first-quarter vehicle sales fell short of analyst estimates, with sales reaching 24.25 billion yuan ($3.4 billion) against an expected 26.71 billion yuan. Net income was 1.3 billion yuan, below the forecasted 1.6 billion yuan. The company delivered 80,400 vehicles, including the new MEGA van, whose tepid demand led to a revised delivery target of 76,000-78,000 units, down from 100,000-130,000. Li Auto faces increased competition and a price war in China's EV market. It expects second-quarter revenue of 29.9-31.4 billion yuan, below the forecasted 38.6 billion yuan, and deliveries of 105,000-110,000 units, versus an expected 130,692

- Looking ahead, quiet week for China on the data front

ASIA PAC STOCKS: Asian Equities Head Lower As Investors Take Profit

Asia markets are lower today as investors look to take profits. Japan opened higher following moves made overnight in the US markets, however we have since reversed all those gains as corporate earnings weigh on the tech sector, metals prices continue to edge higher and trade near all-time-highs helping miners, while the Chinese property sector sold off heavily on concerns recent policy announcements will be enough to support the sector, the MSCI Asia Pacific is trading down 0.70%. There was little in the way of economic data in the region today, although the RBA released minutes from their May policy meeting where they resumed a discussion of interest rate hikes.

- Japanese equities opened higher this morning, following moves made in US markets overnight and insurers rose after positive earnings outlooks and buyback announcements, however we have since pared gains and now trade little changed. The Nikkei 225 is down 0.02%, while the Topix is up 0.06%.

- South Korean equities are lower today as local tech stocks slide, Samsung is the largest contributed to the loss. There is little on the calendar today, with PPI and Business Survey Manufacturing due out tomorrow, while focus will be on the BOK Thursday. The Kospi is trading down 0.65%, while the small-cap Kosdaq is down 0.18%.

- Taiwan equities are slightly lower today, regional tech prices are lower which is leading to the weakness in the local market. This week we have the unemployment rate due out tomorrow and Industrial Production on Thursday. The Taiex is down 0.20%.

- Australian equities are lower today, focus has been on the RBA minutes where they discussed interest-rate hikes and that inflations risks had risen somewhat. Financials and Materials are the worst performing sectors, offsetting gains in Consumer Discretionary, Industrials and Tech, the ASX200 is down 0.05%

- Elsewhere in SEA, New Zealand equities are down 0.42%, Singapore equites are down 0.38%, Indonesian equities are down 0.55%, Philippines are down 0.75% & Malaysian equities are down 0.24%.

OIL: Crude Lower On Weaker Risk Sentiment But Still In Recent Ranges

Oil prices have fallen driven by a general pullback in risk with commodities lower and HK equities down sharply. WTI is down 0.6% to $78.84/bbl close to the intraday low. Brent is 0.5% lower at $83.26 but continues to move in a narrow range. Recent geopolitical events have been overlooked by the market. The USD index is up 0.1%.

- Market signals are pointing to an easier crude outlook with the Brent prompt spread at its narrowest since January, according to Bloomberg. Other indications include money managers reducing their longs and the reduction of refining margins.

- With the focus back on fundamentals, US inventory data is being watched closely. Later today the API sourced information will be released.

- Later the Fed’s Barkin, Waller, Williams, Bostic and Barr and BoE’s Bailey speak. US Philly Fed non-manufacturing for May and Canadian April CPI print.

GOLD: Pullback After Reaching A Fresh All-Time High

Gold is 0.5% lower in the Asia-Pac session, after closing 0.4% higher at $2425.31 on Monday. Earlier in yesterday’s session bullion hit a fresh all-time high of $2,450. There was no headline flow of note, with markets generally shaking off weekend political risk.

- China’s bullion imports slowed last month as demand in the world’s biggest consumer begins to buckle in the face of record prices. Overseas purchases of physical gold fell to 136 tons in April, a 30% decline from the previous month and the lowest total for the year, according to the latest customs data (BBG).

- Having traded through resistance at $2431.5 (the Apr 12 high and bull trigger), the focus turns to 2452.5, a Fibonacci projection, according to MNI's technical team.

- Meanwhile, silver outperformed again yesterday, with its price hitting the highest level since end-2012.

- Sights are on $33.887 next for silver, a Fibonacci projection. Short-term pullbacks would be considered a correction. A key support zone lies between $27.229-36.948, the 20- and 50-day EMA values.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/05/2024 | 0600/0800 | ** |  | DE | PPI |

| 21/05/2024 | 0800/1000 | ** |  | EU | Current Account |

| 21/05/2024 | 0900/1100 | ** |  | EU | Construction Production |

| 21/05/2024 | 0900/1100 | * |  | EU | Trade Balance |

| 21/05/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 21/05/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 21/05/2024 | 1230/0830 | *** |  | CA | CPI |

| 21/05/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/05/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/05/2024 | 1300/0900 |  | US | Fed Governor Christopher Waller | |

| 21/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 21/05/2024 | 1545/1145 |  | US | Fed Vice Chair Michael Barr | |

| 21/05/2024 | 1700/1800 |  | UK | BOE's Bailey Lecture at LSE | |

| 21/05/2024 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/05/2024 | 2300/1900 |  | US | Cleveland Fed President Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.