-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: JAPAN GDP FALLS AT FASTEST PACE SINCE COVID

EXECUTIVE SUMMARY

- JAPANS ECONOMY SHRINKS AT FASTEST PACE SINCE HEIGHT OF COVID PANDEMIC - MNI

- 19TH STRAIGHT MONTHLY FALL FOR JAPANESE REAL WAGES - MNI

- OIL REMAINS ON COURSE FOR LONGEST WEEKLY LOSING STREAK SINCE 2018 - BBG

- SUNAK FIGHTING TO AVOID BECOMING LATEST TORY LEADER CONSUMED BY INTERNAL STRIFE - BBG

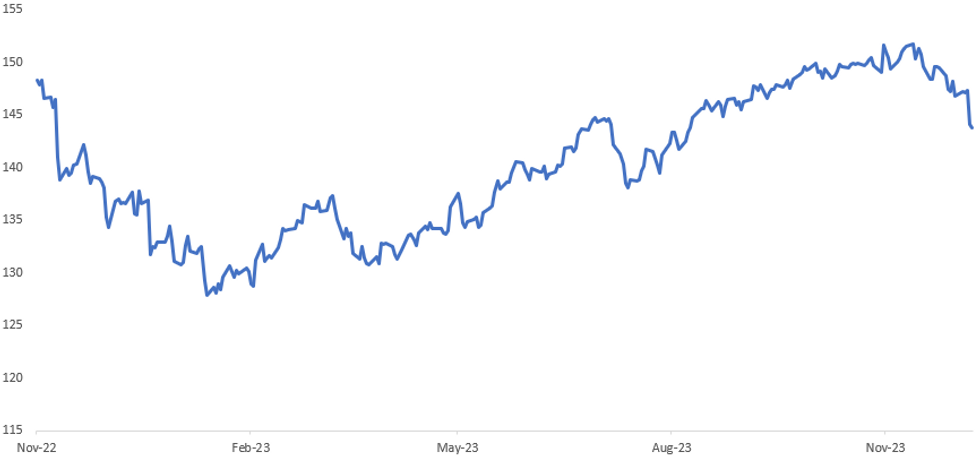

Fig. 1: USD/JPY Daily SPOT

Source: MNI - Market News/Bloomberg

U.K.

POLITICS (BBG): Rishi Sunak backed the winning side in the UK’s pivotal vote to leave the European Union, fueling a rise that ultimately made him premier. Now he’s fighting to avoid becoming the latest Conservative leader consumed by the resulting civil war in the governing party.

BANKS (BBG): Banks borrowed a record amount from the Bank of England on Thursday, as they clock into an arbitrage opportunity created by the UK’s quantitative-tightening program.

BREXIT (RTRS): Britain's "big promises" to boost the financial sector's post-Brexit global competitiveness have been a "damp squib", with many of the changes yet to be implemented and none so far having a substantial impact, lawmakers said in a report on Friday.

EUROPE

FISCAL DEAL (BBG): European Union finance ministers are still scrambling to find an agreement on new fiscal rules for the bloc.

BELT ROAD (BBC): Prime Minister Giorgia Meloni's administration notified Beijing that it would cease participating in the BRI ahead of a deadline at the year's end.

UKRAINE (BBC): Ukraine says it is hopeful that US lawmakers will approve new military aid for the country, despite Senate Republicans blocking a package on Wednesday.

GERMANY (POLITICO): Germany's ruling coalition will not manage to have a 2024 budget in place before the end of this year, a senior lawmaker from Chancellor Olaf Scholz'Social Democratic Party (SPD) said Thursday. Their inability to reach a deal underscores the deep rifts between Germany’s three ruling parties.

U.S.

FOMC (BBG): Money-market fund assets rose to a fresh all-time high as interest rates north of 5% and a Federal Reserve potentially done raising interest rates drove more inflows.

POLITICS (BBG): Legislation that would bar the import of enriched Russian uranium into the US has been teed up for a vote in the US House of Representatives.

OTHER

JAPAN (BBG): Japan’s economy shrank at the sharpest pace since the height of the pandemic, an outcome that complicates the policy path for the Bank of Japan amid soaring speculation it is edging closer to scrapping the world’s last negative rate regime.

JAPAN (MNI): The y/y drop of inflation-adjusted real wages, a barometer of households' purchasing power, narrowed to 2.3% in October from a 2.9% fall in September, the 19th straight monthly fall, data released by the Ministry of Health, Labour and Welfare showed on Friday.

YEN (BBG): The rally in the yen spilled over into a second day as traders wagered that the Bank of Japan will scrap the world’s last negative interest-rate regime much sooner than previously thought.

BANK OF CANADA (MNI): Bank of Canada Deputy Governor Toni Gravelle said Thursday the idea of divergence between investors predicting interest-rate cuts and officials signaling potential further tightening may be overstated.

AUSTRALIA (BBG): It’s a persistent global conundrum: Can policymakers close coal mines and power plants without ruining local economies in the process?

MIDDLE EAST (BBG): Prime Minister Benjamin Netanyahu threatened devastation in Beirut and southern Lebanon if Hezbollah opens a second front in Israel’s war with Hamas.

MIDDLE EAST (BBG): President Vladimir Putin and his Iranian counterpart Ebrahim Raisi vowed to deepen ties on Thursday, a day after the Russian leader made a rare visit to Saudi Arabia and the United Arab Emirates.

OIL (BBG): Oil ticked higher on Friday but remained on course for the longest weekly losing streak since 2018 on concerns about a global glut, with traders doubtful that deeper supply cuts by OPEC+ will be effective.

CHINA

FTZ (GOV.CN): The Shanghai Pilot Free Trade Zone will take the lead implementing high-standard digital trade rules and allow companies and individuals to provide data overseas due to business needs should they meet the security requirements, according to a general plan for advancing institutional opening-up of Shanghai FTZ published by the State Council on Thursday. Authorities will support the FTZ to lead the formulation of an important data catalog and establish a legal, safe, and convenient cross-border data flow mechanism, the document said.

EXPORTS (YICAI): China's exports will likely fall in U.S. dollar terms in 2023, as December exports are unlikely to accelerate significantly from November's 0.5% y/y growth, while exports for the first 11 months fell 5.2% y/y, according to Zheng Houcheng, director at the Yingda Securities Research Institute. Zheng said exporters will feel pressure due to the high U.S. federal funds rate and the U.S. ISM manufacturing PMI remaining low. Additionally, international oil prices are likely to come under pressure which will suppress China’s PPI and negatively impact exports.

PLATFORM ECONOMY (Securities Daily): China will support platform companies, such as Tencent and Alibaba, to play a more active role to promote the development of the digital economy, according to the National Data Administration. Platform companies have played a leading role creating new job opportunities, enhancing international competitiveness and promoting research on key technologies to help high-quality development, the administration said, adding it will work with relevant departments to launch typical investment cases for platform companies.

GERMAN FDI (MNI): De-risking and the diversion of capital to the U.S. could see German foreign direct investment into China fall next year to below the pre-Covid level of EUR5.5 billion after reaching a near record high of EUR10.3 billion in H1 this year, a senior trade representative told MNI.

CHINA MARKETS

MNI: PBOC Injects Net CNY78 Bln Fri; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY197 billion via 7-day reverse repo on Friday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY78 billion after offsetting the maturity of CNY119 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7550% at 09:47 am local time from the close of 1.8239% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 54 on Thursday, compared with the close of 51 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1123 Friday vs 7.1176 Thursday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1123 on Friday, compared with 7.1176 set on Thursday. The fixing was estimated at 7.1420 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND Q3 Mfg Activity -2.8% Q/Q; Prior -0.8%

SOUTH KOREA Oct BoP Current Account Balance $6,796.1mn; Prior$5420.7mn

JAPAN Oct Labor Cash Earnings 1.5% Y/Y; Prior 0.6%

JAPAN Oct Real Cash Earnings -2.3% Y/Y; Prior -2.9%

JAPAN Oct Household Spending -2.5% Y/Y; Prior -2.8%

JAPAN Q3, F GDP -0.7% Q/Q; Prior -0.5%

JAPAN Q3, F GDP Deflator 5.3% Y/Y; Prior 5.1%

JAPAN Q3, F GDP Private Consumption -0.2% Q/Q; Prior 0.0%

JAPAN Q3, F GDP Business Spending -0.4% Q/Q; Prior -0.6%

JAPAN Q3, F GDP Inventory Contribution -0.5%; Prior -0.3%

JAPAN Q3, F GDP Net Exports Contribution -0.1%; Prior -0.1%

JAPAN Oct Trade Balance BoP Basis -Y472.8bn; Prior Y341.2bn

JAPAN Nov Bank Lending 2.8% Y/Y; Prior 2.7%

JAPAN Nov Eco Watchers Survey Current 49.5; Prior 49.5

JAPAN Nov Eco Watchers Survey Outlook 49.4; Prior 48.4

MARKETS

US TSYS: Activity Limited In Asia As NFP In View

TYH4 deals at 110-29, -0-08, a 0-06+ range has been observed on volume of ~70k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Activity has been limited in Asia with narrow ranges observed, the proximity to this evening's NFP print may be limiting activity.

- Tsys were marginally pressured in early trade as a downtick in JGBs spilled over to the wider space. However the move didn't follow through and Tsys remained well within recent ranges.

- Looking ahead, the aforementioned NFP print headlines today's docket, the MNI preview is here. Also due to cross is UofMich Consumer Sentiment.

JGBs: Bear-Steepening Scaled Back In The Tokyo Afternoon, US NFP Due

JGB futures are weaker, -9 compared to settlement levels, but well off the Tokyo session's low. The key driver for the morning’s extension of yesterday’s post-30Y auction sell-off had been labour and real cash earnings data, which printed on the higher side of expectations.

- Bloomberg also reported that JGB futures were heavy today with traders using the rollover into the March contract as a window to refresh bearish positions for an extended drive lower. (See link ICYMI)

- The move away from session cheaps in the afternoon session was consistent with results from today’s BOJ Rinban Operations, which showed lower offer cover ratios across all buckets.

- US tsys are dealing 1-2bps cheaper in today’s Asia-Pac session ahead of US NFP data later today.

- This morning's bear-steepening of the cash JGB curve remains in play, but yields are well below session highs. The benchmark 10-year yield is 1.0bps higher at 0.769% versus the morning high of 0.808%.

- The swaps curve has also maintained its bear-steepening, with rates 2-5bps higher. Swap spreads are wider.

- On Monday, the local calendar sees M2 & M3 Money Stock, BSI Large All Industry and Machine Tool Orders data.

AUSSIE BONDS: A Typical Subdued Pre-NFP Friday Session, JGBs Pressured

ACGBs (YM +2.0 & XM +3.0) are slightly richer after dealing in relatively narrow ranges in a typical pre-NFP Friday session. With the local calendar light, the local market has oscillated with offshore developments in today’s Sydney session.

- After a moderately negative lead in from NY trading for US tsys, weakness extended after JGBs bear-steepened, with yields 1-9bps higher at one stage. This shift was triggered by higher-than-expected labour and real cash earnings data. The current movement extends the sell-off initiated by yesterday's disappointing 30-year auction result. Nevertheless, this weakness has been somewhat tempered during the Tokyo afternoon session.

- US tsys are dealing 1-2bps cheaper in today’s Asia-Pac session.

- Higher interest rates and inflation in Australia mean an increasing number of mortgage holders are facing severe financial stress, though most households remain resilient, according to Andrea Brischetto, the RBA’s head of financial stability, in a speech today. (See Bloomberg link)

- Cash ACGBs are 2-4bps richer, with the AU-US 10-year yield differential 1bp tighter at +14bps.

- Swap rates are 3-4bps lower, with EFPs little changed.

- The bills strip has bull-flattened, with pricing +1 to +2.

- RBA-dated OIS pricing is dealing little changed across meetings.

- Tomorrow, the local calendar sees Westpac Consumer Confidence, along with a speech by Michele Bullock, RBA Governor, at the AusPayNet Summit in Sydney.

NZGBS: Closed On A Weak Note, Pressured By JGBs, US NFP Due

NZGBs closed on a weak note, with benchmark yields 2-5bps higher led by the 10-year. This move came despite weak Q3 Manufacturing Activity data, which printed -2.8% q/q versus +0.2% prior.

- The key driver of today’s session has been spillover softness from global markets, particularly JGBs. The JGB curve has bear-steepened, with yields 1-7bps higher, following higher-than-expected labour and real cash earnings data. Today’s move extends the sell-off sparked by yesterday’s poor 30-year auction result.

- Cash US tsys are 1bp cheaper across benchmarks so far in the Asia-Pac session, ahead of this evening’s Non-Farm Payrolls release.

- Swap rates closed 2-8bps higher, with the 2s10s steeper.

- RBNZ dated OIS pricing closed 1-2bps firmer for meetings beyond July’24. Terminal OCR expectations remain at 5.54% but the market now has two 25bp rate cuts fully priced by Nov’24.

- On Monday, the local calendar sees Card Spending Retail and Net Migration data.

OIL: Crude Stronger Ahead Of Payrolls, Fundamentals Remain Negative

Oil prices are up around 1.5% during APAC trading ahead of the US payroll report later as signals suggest the market is oversold. They look like they will again post a weekly decline though driven by oversupply concerns. Brent has broken above $75/bbl and is currently at $75.31, and WTI is above $70 at $70.40. The USD index is 0.1% lower.

- While supply has been the focus since OPEC’s decision last week, demand is also posing risks to the market. US recession concerns persist and a Bloomberg survey is showing expectations that China’s crude consumption will grow by 500kbd in 2024, less than a third of this year’s rise.

- Russian Urals prices have fallen below the $60 price cap. Last month Russia’s output exceeded what it had promised.

- Brent is now down over 17% since mid-September and this is feeding through to fuel prices, which we are already seeing in lower headline CPI data.

- There is now a significant risk to the easing of oil & gas sanctions on Venezuela, as it acts to illegally take territory in Guyana.

- Later the key data are the November US payrolls which are expected to rise 183k with the unemployment rate remaining at 3.9%. There will also be Michigan consumer sentiment and inflation expectations. The ECB’s de Guindos will attend the ECOFIN meeting.

GOLD: Steady Ahead Of US Non-Farm Payrolls Data

Gold is slightly higher in the Asia-Pac session, after closing 0.1% higher at $2028.47 on Thursday.

- Bullion is on track for its first weekly loss in four after retreating from a record high on Monday on signs investors may have gotten ahead of themselves concerning the timing of US rate cuts.

- Nonetheless, the US STIR market has 110bps of easing priced by November 2024, with a slightly more than 50:50 chance of the first rate cut by March.

- Later today sees the release of US Non-Farm Payrolls data. This data may prove to be crucial in shaping bets for monetary policy.

- According to MNI’s technicals team, resistance for the precious metal is seen at $2072.7 (50% retrace of Dec 4-5 down leg).

EQUITIES: APAC Markets Follow US Higher Especially Tech, US Payrolls Later

APAC equity markets have generally followed the US’s Wednesday rally, especially the Nasdaq’s (+1.4%), in trading today, except in Japan where yen appreciation appears to be weighing on markets. US futures are little changed ahead of today’s US payroll data while Asian moves have tended to be moderate (see MNI preview here).

- USDJPY is down 2.4% since Wednesday as traders expect the BoJ to tighten and as a result equities are down sharply today with the Nikkei 1.7% lower.

- China’s CSI 300 is up 0.4% with the property index down 0.4%. The Hang Seng is +0.2%.

- Korea and Taiwan have benefited from the better tech sentiment with the KOSPI up 1% and the KOSDAQ +1.5%. Current account data for October showed stronger exports. Taiwan’s TAIEX is +0.7%.

- The ASX is 0.2% stronger supported by the mining and energy sectors. Whereas the NZX 50 is flat.

- In ASEAN markets are mixed with the Jakarta comp 0.4% higher, SE Thai +0.3%, Singapore’s Straits Times +1% and Malay KLCI +0.1%. The Philippines PSEi is closed for a holiday.

- India’s Nifty 50 is 0.4% higher after monetary policy was left unchanged but still restrictive.

- Later the key data are the November US payrolls which are expected to rise 183k with the unemployment rate remaining at 3.9%. There will also be Michigan consumer sentiment and inflation expectations. The ECB’s de Guindos will attend the ECOFIN meeting.

FOREX: Yen Volatile In Asia

The Yen has ticked lower in Asia today, USD/JPY breaching the ¥143 handle and printing a low of ¥142.50 in volatile early trade before paring losses through the session to sit ~0.2% lower.

- There was no overt headline driver for the move lower which came in thin liquidity and was perhaps position squaring ahead of today's NFP print as recent BOJ speak continues to support the Yen.

- AUD/USD is marginally firmer rising ~0.2% to sit above the $0.66 handle. The uptrend in AUD/USD remains intact, resistance comes in at $0.6623 high from Dec5 then $0.6691, high from Dec 4 and bull trigger. Support is at the 20-Day EMA ($0.6547).

- Kiwi is little changed from opening levels, narrow ranges have been observed today with a narrow $0.5155/75 range persisting.

- Elsewhere in G-10 there are no moves of note to report.

- The cross-asset space is muted; BBDXY is a touch lower as are US Tsys.

- November NFP print provides the highlight of today's session, the MNI preview is here.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/12/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 08/12/2023 | 0700/0800 | ** |  | SE | Private Sector Production m/m |

| 08/12/2023 | 0730/0830 |  | EU | ECB's De Guindos participates in ECOFIN meeting | |

| 08/12/2023 | 0930/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 08/12/2023 | 1330/0830 | *** |  | US | Employment Report |

| 08/12/2023 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 08/12/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/12/2023 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.