-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Lack Of Fresh Stimulus Details Weighs On China Assets

EXECUTIVE SUMMARY

- BLINKEN TO WRAP UP RARE VISIT TO CHINA, MAY MEET XI JINPING - RTRS

- BETS FOR SOARING UK INTEREST RATES MAY UNRAVEL OVER 30 HOURS - BBG

- CHINA STOCKS RETREAT AFTER STATE COUNCIL DISAPPOINTS ON STIMULUS - BBG

- JAPAN REMOVAL FROM US FX WATCH LIST TO KEEP YEN TRADERS ON EDGE - BBG

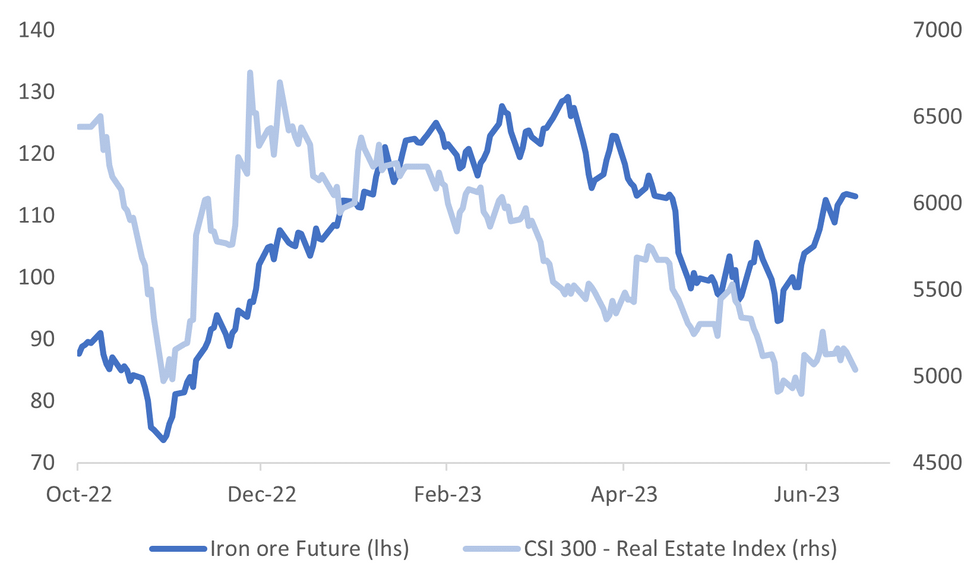

Fig. 1: Iron Ore & CSI 300 - Real Estate Index

Source: MNI - Market News/Bloomberg

U.K.

PROPERTY: Asking prices for British homes fell in June for the first time in six years, indicating an earlier-than-usual summer slowdown amid mortgage market turmoil and expectations of further Bank of England interest rates increases, a survey showed on Monday. Property website Rightmove said the drop was very small - 82 pounds ($105), or close to zero in percentage terms - but it was nonetheless the first monthly decline in asking prices this year and the first drop seen in the month of June since 2017. (RTRS)

BoE: Britain’s bond market is approaching an inflection point, with inflation data and a Bank of England decision set to shape the outlook for traders after yields rose to the highest level since 2008. Those two events, due over 30 hours starting Wednesday morning, could bring a halt to upward momentum in interest-rate bets. Official data is expected to show inflation slowed to its lowest in 14 months, while investors are pricing in a 13th consecutive rate hike from the BOE to bring wage-price pressures under control. (BBG)

EUROPE

UKRAINE: Russia reported fierce fighting on Sunday on three sections of the front line in Ukraine, a day after hosting an African peace mission that failed to spark enthusiasm from either Moscow or Kyiv. A Russian-installed official said Ukraine had recaptured Piatykhatky, a village in the southern Zaporizhzhia region, and were entrenching themselves there while coming under fire from Russian artillery. (RTRS)

SWEDEN: A Swedish parliament defence committee report said a Russian military attack against Sweden cannot be ruled out, Swedish public service broadcaster SVT said on Sunday, citing sources. (RTRS)

U.S.

US/CHINA: U.S. Secretary of State Antony Blinken met with China's top diplomat Wang Yi on Monday at the start of the second and final day of a rare visit to Beijing, aimed at ensuring that the many disagreements between the strategic rivals do not spiral into conflict. (RTRS)

US/CHINA: The U.S. secretary of state and Chinese foreign minister on Sunday held what both called candid and constructive talks on their differences from Taiwan to trade but seemed to agree on little beyond keeping the conversation going with an eventual meeting in Washington. Speaking after a 5-1/2 hour meeting followed by a dinner, U.S. and Chinese officials both emphasized their desire for stable and predictable relations, but China was clear it regards Taiwan as the most important issue and greatest risk. (RTRS)

US/CHINA: Secretary of State Antony Blinken had “candid” talks with his Chinese counterpart in Beijing, the two countries said, as both looked to project a positive but cautious tone about a visit that’s meant to bring some semblance of normalcy back to a strained relationship. (BBG)

FX: The US Treasury said seven major economies, including China, were on its “monitoring list” for currency practices, while refraining in a semiannual report from designating any trading partner as a foreign-exchange manipulator. (BBG)

OTHER

JAPAN: Japan welcomed its removal from a US watch list of countries scrutinized for their foreign exchange policies, a development that may heighten intervention concerns among traders with the yen poised for further weakness. (BBG)

JAPAN: Japanese-made semiconductors are skirting sanctions and entering Russia, mainly via third countries such as China, the Nikkei reports, citing Russian customs data from the Indian research company Export Genius. (BBG)

JAPAN: Support for Japanese Prime Minister Fumio Kishida fell in three polls carried out over the weekend, threatening his prospects in a general election that may come as soon as the autumn. (BBG)

NZ: New Zealand Prime Minister Chris Hipkins will lead a 29-strong business delegation to China June 25-30, visiting Beijing, Tianjin and Shanghai, his office says in emailed statement. While in China Hipkins will meet with President Xi Jinping, Premier Li Qiang, and the Chairman of the Standing Committee of the National People’s Congress Zhao Leji. (BBG)

NZ: RBNZ says a public appointment process has begun to find two new external members for the Monetary Policy Committee, according to statement on website. Peter Harris’ term ends on March 31, 2024 and Caroline Saunders’ term ends on June 30, 2024.(BBG)

AUSTRALIA: Australia will invest A$2 billion ($1.4 billion) to build thousands of government-subsidized homes across the country, Prime Minister Anthony Albanese said, a move that will help resolve a housing supply crunch that is being blamed for resurgent property prices. (BBG)

CHINA

MARKETS: Chinese stocks slide on Monday as the State Council fell short of announcing further policy measures to support the economy. The retreat comes after major indexes capped their best week in months on stimulus bets. (BBG)

GROWTH: Goldman Sachs Group Inc. became the latest bank to cut their forecasts for China’s economy, citing limited options to boost stimulus. Analysts at Goldman lowered their estimates for China’s gross domestic product growth this year to 5.4% from 6% previously, according to a report dated Sunday. (BBG)

JOBS: China should put effort into ensuring stability of its job market, with labor market recovery weaker than expected, Economic Daily commentary says. Policy support should be launched to ease challenges faced by cos. including difficulties in financing, unfair competition; to help them create more jobs. (BBG)

POLICY: Further fiscal, monetary and industry policy stimulus are expected to launch at a faster pace to support the Chinese economy — boosting consumption and investment demand — according to a China Securities Journal report Monday, citing analysts and unidentified market sources. (BBG)

CHINA/EU: Chinese Premier Li Qiang arrived in Berlin Sunday for an official visit to Germany, the Xinhua news agency says in a report. Upon his arrival, Li said Beijing is ready to work with Berlin to further explore cooperation potential and push for new developments in bilateral ties (BBG)

CHINA MARKETS

PBOC Injects Net CNY87 Bln Via OMOs Monday

The People's Bank of China (PBOC) conducted CNY89 billion via 7-day reverse repos on Monday, with the rates at 1.90%. The operation has led to a net injection of CNY87 billion after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9200% at 09:26 am local time from the close of 1.9416% on Friday.

- The CFETS-NEX money-market sentiment index closed at 46 on Friday, compared with the close of 48 on Thursday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.1201 MON VS 7.1289 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1201 on Monday, compared with 7.1289 set on Friday.

OVERNIGHT DATA

NZ MAY PERFORMANCE SERVICES INDEX 53.3; PRIOR 50.1

NZ MAY NON RESIDENT BOND HOLDINGS 63.2%; PRIOR 62.1%

UK JUNE RIGHTMOVE HOUSE PRICES M/M 0.0%; 1.8%

UK JUNE RIGHTMOVE HOUSE PRICES Y/Y 1.1%; 1.5%

JAPAN MAY TOKYO CONDOMINIUMS FOR SALE Y/Y -21.5%; PRIOR -30.3%

MARKETS

US TSYS: Futures Marginally Firmer, Cash Closed Today

TYU3 deals at 113-04, +0-02+, a narrow 0-04 range has been observed on volume of ~22k.

- Cash tsys are closed today due to the observance of a national holiday in the US.

- Tsy futures were firmer in early dealing as US Equity futures firmed to early session highs.

- The USD firmed, with the antipodeans pressured, and equity futures ticked away from best levels with tsys as the lack of detail on potential Chinese stimulus weighed on risk appetite.

- TY dealt in narrow ranges with little follow through for the remainder of the session.

- There is a thin data calendar today, further out the calendar for the week is highlighted by Housing Starts, Philadelphia Fed Non-Mfg Index and Jobless Claims.

JGBS: Subdued Session, Light Calendar, Futures Richer At Session Bests

JBU3 is sitting at Tokyo session highs in afternoon trade at 148.42, +10 compared to the settlement levels.

- With domestic drivers light on the ground, local participants have likely been on headlines and US tsys watch. US tsy futures are trading slightly firmer in Asia-Pac trade. A reminder that cash tsys are closed today due to the observance of a US national holiday.

- Tokyo Condominiums For Sale, the only release today, showed a 21.5% y/y decline in May. There was no immediate market reaction, as expected, to the data.

- Cash JGBs strengthen over the Tokyo session to be flat to 1.2bp richer across the curve with the 10-year benchmark leading. The 10-year yield is at 0.400%, below the BoJ's YCC limit of 0.50%. The 5-year benchmark is 0.4bp lower at 0.077%, ahead of supply later in the week.

- Swap spreads are generally tighter across the curve except for the 7-20-year zone.

- The local calendar tomorrow sees Industrial Production (Apr F), Capacity Utilisation (Apr) and Machine Tool Orders (May F).

AUSSIE BONDS: Richer, Narrow Range, US Holiday

ACGBs are slightly richer (YM +2.0 & XM +3.5) after trading in a narrow range in the Sydney session. With the local calendar light today, local participants have likely been on headlines and US tsys watch.

- US tsy futures are slightly firmer in Asia-Pac trade. A reminder that cash US tsys are closed today due to the observance of a US national holiday.

- Cash ACGBs are 2-4bp richer with the AU-US 10-year yield differential at +23bp (using 10-year US tsys Friday closing level).

- Swap rates are 3-6bp lower with the 3s10s curve flatter and EFPs tighter.

- The bills strip is steeper with pricing +1 to +5.

- RBA dated OIS is 3-8bp softer for meetings beyond September with Feb’24 leading. Terminal rate expectations sit at 4.61%.

- The local calendar is slated to release the RBA Minutes for the June Meeting tomorrow. After the RBA surprised with a 25bp rate hike, the market will be keen for a more detailed account of the decision. RBA Deputy Governor Bullock (1330 AEST) and RBA Assistant Governor Kent (1135 AEST) are also slated to speak tomorrow.

- On Wednesday the Westpac Leading Index prints for May, ahead of Preliminary Judo Bank PMIs for June on Friday.

NZGBS: Richer On The Day, Outperforms ACGBs, US Holiday

NZGBs closed 5-6bp richer after opening slightly cheaper following the weaker lead-in from US tsys trading ahead of the weekend. With the market reaction to the increase in the BusinessNZ PSI limited, the strengthening over the local session appears to have been aided by a slight richening in both US tsy futures (cash tsys are closed for the Juneteenth holiday) and ACGBs in Asia-Pac trading. Nonetheless, NZGBs outperformed with the NZ/AU 10-year yield differential 5bp narrower at 43bp.

- Swap rates closed 1-4bp lower with the 2s10s curve flatter and implied swap spreads 3-4bp wider.

- RBNZ dated OIS closed little changed with terminal OCR expectations at 5.61%.

- NZ services expanded last month, according to the Performance of Services Index compiled by the Bank of New Zealand Ltd. and Business NZ. The May PSI jumped 3.2pts to 53.3 after declining to its lowest level this year in April.

- NZGBs held by international investors, as reported by the RBNZ, rose from 62.1% to 63.2% in May, the highest level since 2016.

- The local calendar is slated to release Q2 Westpac Consumer Confidence tomorrow ahead of May Trade Balance data on Thursday.

EQUITIES: China Stocks Lower, As Market Waits For Greater Stimulus Details

Regional equity markets are mostly tracking lower. A negative lead from Wall St on Friday hasn't helped, while lack of details around fresh stimulus measures/timing from the China authorities post Friday's State Council meeting is also weighing. US equity futures tried to track higher in early trade, but couldn't sustain gains. Eminis were last under 4449 (-0.10% weaker).

- At the break, China's CSI is down 0.84%, with the index back under its simple 200-day MA (3951.08. last 3930.18). The real estate sub index is off by 2.00%. Lack of fresh stimulus detail from Friday's State Council meeting has weighed on sentiment. We are also seeing further growth forecast downgrades from the sell-side, which is an additional headwind.

- HK shares are also weaker, the HSI off by 1.57% at the break, tech shares down 2.63%, after rallying for the past 6 sessions. The Golden Dragon index fell in US trade on Friday, which is likely hurting sentiment.

- Japan's Nikkei 225 has lost ground, now down over 1.1%. The index struggling to breach the 33800 handle, now back close to recent lows near 33300.

- The Kospi is -0.85% weaker, although still above 2600 in index terms. SocGen downgraded South Korean stocks to neutral.

- In SEA markets are weaker, although outside of the Philippines, losses are less than 1%.

- Australia's ASX 200 is the only benchmark tracking higher at this stage, although Indian shares have also opened with a positive bias.

FOREX: Antipodeans Pressured In Asia

The antipodeans have been pressured in Asia as waning risk appetite on the lack of detail on further Chinese stimulus has weighs in Asia.

- AUD/USD is down ~0.5%, last printing at $0.6835/40. Support is at $0.6818 high from May 10, resistance comes in at $0.69, high from June 16. AUD/JPY is down ~0.8% after posting its highest level since Sep 2022 on Friday.

- Kiwi is down ~0.5%, NZD/USD prints at $0.6205/10. Bears focus on a move below $0.62 to target the 20-Day EMA ($0.6158). NZD/JPY is down ~0.6%, the pair has trimmed Friday's gains which saw it print the highest level since early 2015. On the wires early in the session May PSI rose to 53.3 and the prior read was revised higher to 50.1.

- Yen is a touch firmer, USD/JPY briefly printed through Friday's high, however resistance was seen ahead of the ¥142 handle. The pair last sits at ¥141.60/70 ~0.1% softer.

- Elsewhere in G-10 NOK is ~0.3% softer however liquidity is generally poor in Asia. EUR and GBP are little changed from Friday's closing levels observing narrow ranges thus far.

- Cross asset wise; US 10-Year Tsy Futures are a touch firmer as is BBDXY. E-minis have pared early gains to sit ~0.1% lower. WTI futures are ~1.5% lower.

- There is a thin data calendar today, US markets are closed for the observance of a national holiday.

OIL: Nerves Drive Crude Lower As Waiting For China Stimulus

Oil prices have given up most of last week’s gains and today are down around 1.5% on the generally weaker risk tone in Asia as markets wait for details on any further policy stimulus in China. The USD index is 0.1% higher.

- WTI is down below $71/bbl again and is currently trading around $70.96, close to the intraday low of $70.82. Brent fell below $76 and is now about $75.48, after a low of $75.34.

- WTI futures contracts are continuing to signal that there is plenty of supply currently. Demand remains an issue for the market as the full impact of monetary tightening is yet to be felt and China’s growth forecasts are being revised down. But the IEA and OPEC expect the market to be in deficit in H2 2023.

- There is little on the calendar later with the US closed today.

GOLD: Slightly Weaker In Asia After First Weekly Decline In Three Weeks

Gold is slightly weaker during the Asia-Pacific session, following its first weekly decline in three weeks. The subdued prices can be attributed to the anticipation of further monetary tightening and a decrease in safe-haven demand.

- Last week, bullion experienced a 0.2% decrease, reflecting indications that both the US Fed and the ECB are likely to continue raising interest rates. This trend negatively affects gold, which does not offer interest-bearing returns.

- Haven assets like gold are facing challenges in gaining momentum, as market sentiment leans towards risk-taking. This sentiment has been strengthened recently by positive indications of improving Sino-US relations and optimism surrounding China's potential implementation of additional stimulus measures to support its sluggish recovery.

- According to MNI technicals team, the bear cycle in gold remains intact. The yellow metal is trading below trendline support drawn from the Nov 3 2022 low - the trendline intersects at $1966.8. The break of this line reinforces bearish conditions and marks a resumption of the downtrend. The focus is on $1903.5, 61.8% of the Feb 28 - May 4 bull cycle. Initial firm resistance is $1985.3, the May 24 high. Clearance of this resistance would signal a short-term reversal instead.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/06/2023 | 1100/1300 |  | EU | ECB Lane Fireside Chat | |

| 19/06/2023 | 1140/1340 |  | EU | ECB Schnabel at Euro50 Group Conference | |

| 19/06/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/06/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 20/06/2023 | 0115/0915 | *** |  | CN | Loan Prime Rate |

| 20/06/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/06/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/06/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 20/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 20/06/2023 | 1030/0630 |  | US | St. Louis Fed's James Bullard | |

| 20/06/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 20/06/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 20/06/2023 | 1710/1910 |  | EU | ECB de Guindos Remarks at German Bernacer Prize |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.