-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Lagarde Reaffirms Recent Hawkish Narrative

EXECUTIVE SUMMARY

- ECB WILL STAY COURSE TO RETURN INFLATION TO 2%, LAGARDE SAYS (BBG)

- U.S. CONFRONTS CHINA OVER COMPANIES’ TIES TO RUSSIAN WAR EFFORT (BBG)

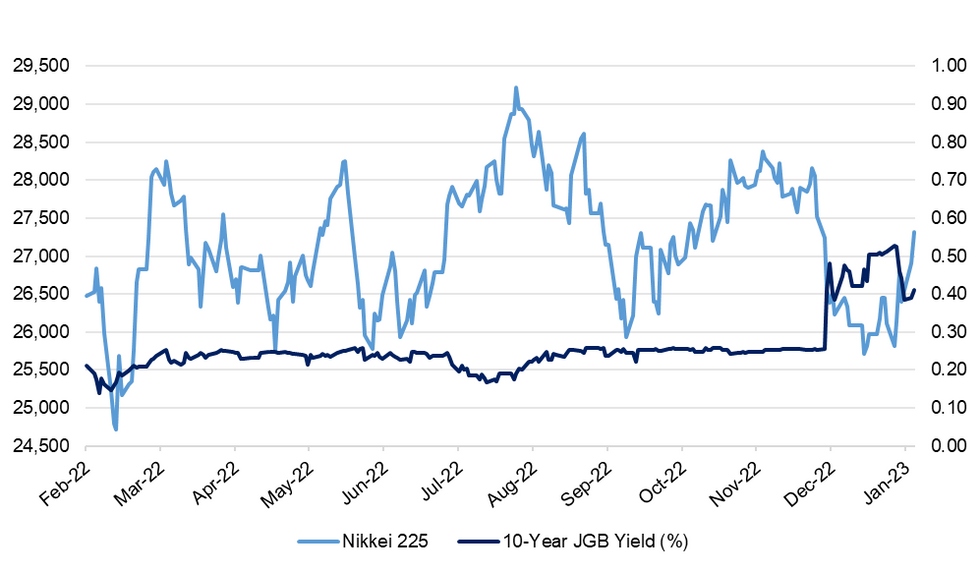

Fig. 1: Nikkei 225 Vs. 10-Year JGB Yield

Source: MNI - Market News/Bloomberg

UK

ENERGY: Discounts for households to use less electricity at peak times will be offered again on Tuesday as part of a scheme to avoid blackouts. (BBC)

BREXIT: Britain and the European Union are unlikely to fundamentally change their underlying Brexit settlement, making sector-specific deals for financial services, fisheries and energy necessary to prevent more disruption, a report said. (RTRS)

EUROPE

ECB: Christine Lagarde said the European Central Bank will do everything necessary to return inflation to its goal, pointing to more “significant” interest-rate increases at coming meetings. (BBG)

U.S.

FISCAL: Senate Majority Leader Charles E. Schumer on Monday dared House Republicans to make public the spending cuts they want to see implemented in exchange for helping raise the federal debt ceiling. (Washington Times)

EQUITIES: The US Justice Department is poised to sue Alphabet Inc.’s Google as soon as Tuesday regarding the search giant’s dominance over the digital advertising market, according to people familiar with the matter. (BBG)

EQUITIES: Ford Motor Co. plans to cut about 3,200 jobs across Europe, following workforce reductions in the US as the automaker slashes costs in a shift toward electric vehicles. (BBG)

OTHER

U.S./CHINA: China invoked the US’s brinkmanship over its own debt limit as it hit back at Treasury Secretary Janet Yellen’s criticism of Beijing’s handling of debt issues in developing countries. (BBG)

GEOPOLITICS: The Biden administration has confronted China’s government with evidence that suggests some Chinese state-owned companies may be providing assistance for Russia’s war effort in Ukraine, as it tries to ascertain if Beijing is aware of those activities, according to people familiar with the matter. (BBG)

NATO: The U.S. State Department on Monday said Finland and Sweden are ready to join the NATO alliance, after Turkish President Tayyip Erdogan said Sweden should not expect Turkey's support for its membership after a protest near the Turkish embassy in Stockholm at the weekend including the burning of a copy of the Koran. (RTRS)

EU/JAPAN: Japan and the EU are considering establishing a diplomatic hotline and also having regular high-level meetings to bolster information sharing, Yomiuri reports, citing a senior official from the bloc. (BBG)

BOJ: A decade after the Bank of Japan began its massive easing program, Gov. Haruhiko Kuroda continues to insist that the central bank is not ready to take any steps toward ending its ultraloose monetary policy. Yet the bank's surprise decision in December to expand its 10-year yield range suggests otherwise. Speculation about a possible end to its unprecedented easing continues to mount as market players no longer take Kuroda's statements at face value after the blindside. (Nikkei)

BOJ: The top priority confronting the new Bank of Japan governor is to correct misguided expectations among mainly foreign market participants that the central bank will move towards policy normalisation, a former BOJ chief economist said. (MNI)

BOJ: Japan’s trimmed mean measure of underlying inflation rose 3.1% y/y in December, a fresh record high pace as pass-through of cost increases continued, data released by the Bank of Japan on Tuesday showed. (MNI)

JAPAN/BOJ: The head of Suntory Holdings Ltd, Takeshi Niinami, said on Tuesday he expects next the Bank of Japan governor to show a clear roadmap including criteria for ending its yield-curve control (YCC) policy. Niinami, an influential leader who is expected to become the next chairman of business lobby Keizai Doyukai in April, also told Reuters that he wants to keep increasing wages for Suntory employees as long as cost of living continues to rise, in a bid to help their lives and to activate private-sector-led economic growth. (RTRS)

JAPAN: The Japanese government is considering downgrading its Covid-19 classification in early May, designating it on a scale along with the seasonal flu, Mainichi reports, without attribution. (BBG)

SOUTH KOREA: South Korea plans to scrap a number of regulations in the local stock market within this year to make investment easier for foreign investors, its financial regulator said on Tuesday, in an effort to bring in more money into the market. (RTRS)

USMCA: U.S. officials raised "grave concerns" over Mexico's agricultural biotechnology policies in meetings with their Mexican counterparts on Monday, the office of U.S. Trade Representative Katherine Tai said. (RTRS)

TURKEY: Turkish President Recep Tayyip Erdogan said his ruling AK Party will propose a bill to relieve the debt burden of millions of people, a move aimed at strengthening his voter base ahead of this year’s elections. (BBG)

BRAZIL/ARGENTINA: Brazil and Argentina are in early talks to establish a shared unit of value for bilateral trade to reduce reliance on the U.S. dollar, Brazilian President Luiz Inacio Lula da Silva said on Monday, though the move is not aimed at replacing existing currencies. (RTRS)

RUSSIA: Russia's Chief of the General Staff Valery Gerasimov said late on Monday that the new plan on changes to the country's armed forces considers possible NATO expansion and the use of Ukraine against Russia. (RTRS)

RUSSIA: The EU’s foreign policy chief, Josep Borrell, has said Germany is not blocking the export of Leopard 2 tanks. (Guardian)

RUSSIA: German defense contractor Rheinmetall AG could deliver as many as 139 type 1 and 2 Leopard battle tanks, with some ready for shipment by April or May, RedaktionsNetzwerk Deutschland reported, citing a spokesman. (BBG)

RUSSIA: The price cap on Russian crude oil exports is starving President Vladimir Putin’s budget of income, though it likely won’t force him to ratchet down spending for years thanks to a $45 billion buffer of yuan reserves. (BBG)

IRAN/OIL: The Biden administration’s top Iran envoy said it will increase pressure on China to cease imports of Iranian oil as the US tries to enforce nuclear sanctions. “China is the main destination of illicit exports by Iran,” and talks to dissuade Beijing from the purchases are “going to be intensified,” US Special Envoy for Iran Robert Malley said in a Bloomberg Television interview Monday. (BBG)

METALS: Mines owned by Southern Copper and BHP are operating normally in the latest wave of protests in Peru. (BBG)

ENERGY: Freeport LNG, the second-largest U.S. liquefied natural gas exporter, on Monday said it had completed repairs to its Texas plant and asked U.S. regulators for permission to take early steps to restart the fire-idled facility. (RTRS)

ENERGY: China is quickly becoming the dominant force in liquefied natural gas, with Chinese buyers accounting for 40% of recent long-term LNG contracts among global players. (Nikkei)

OIL: Urals and KEBCO crude oil loadings from Russia's Baltic ports of Primorsk and Ust-Luga are set to rise by 50% this month from December as sellers try to meet strong demand in Asia and benefit from rising global energy prices, traders said and Reuters calculations showed. (RTRS)

OIL: Energy Secretary Jennifer Granholm said Monday that her agency will be able to refill the emergency oil stockpile without trouble despite a lack of interest in an earlier purchase attempt. (Washington Examiner)

OIL: The US is reviewing and considering canceling a planned sale of crude oil from its Strategic Petroleum Reserve (SPR) this year as the Biden administration switches its focus to refilling the reserve after a year of record releases aimed at taming oil prices. (Energy Intelligence)

OIL: President Joe Biden will veto a bill by U.S. House of Representatives Republicans on the Strategic Petroleum Reserve (SPR) if it passes Congress, Energy Secretary Jennifer Granholm said on Monday. (RTRS)

OIL: MEG Energy, an oil shipper on Canada's Trans Mountain Expansion (TMX) project, said on Monday the pipeline is expected to start filling with oil in late 2023 and be fully operational early next year. (RTRS)

OVERNIGHT DATA

JAPAN JAN, P JIBUN BANK MANUFACTURING PMI 48.9; DEC 48.9

JAPAN JAN, P JIBUN BANK SERVICES PMI 52.4; DEC 51.1

JAPAN JAN, P JIBUN BANK COMPOSITE PMI 50.8; DEC 49.7

Japan’s private sector kicked off 2023 on a more positive note, as signalled by activity returning to growth territory in January. However, similar to trends recorded over much of the past six months, a divergence between the manufacturing and services sectors has remained. While manufacturing firms continued to face muted customer demand, service providers made sustained gains from the travel subsidy programme and recent relaxation of COVID measures. (S&P Global)

JAPAN DEC NATIONWIDE DEPARTMENT STORE SALES +4.0% Y/Y; NOV +4.5%

JAPAN DEC TOKYO DEPARTMENT STORE SALES +8.0% Y/Y; NOV +7.8%

AUSTRALIA DEC NAB BUSINESS CONFIDENCE -1; NOV -4

AUSTRALIA DEC NAB BUSINESS CONDITIONS +12; NOV +20

Business conditions fell by 8pts in December, notching up a third successive decline. They remain well above average at +12 index points reflecting the extraordinary strength seen in early-to-mid 2022. Notwithstanding a small improvement in confidence in the month, the larger than usual gap to conditions persisted. With confidence still in negative territory (and well below average) and forward orders moderating further in the month, there are signs that conditions may ease further. (NAB)

AUSTRALIA JAN, P JUDO BANK MANUFACTURING PMI 49.8; DEC 50.2

AUSTRALIA JAN, P JUDO BANK SERVICES PMI 48.3; DEC 47.3

AUSTRALIA JAN, P JUDO BANK COMPOSITE PMI 48.2; DEC 47.5

Australia’s economy has started 2023 on a softer footing than what we experienced through much of 2022. This welcome slowdown of economic activity is evident across both the manufacturing sector and service industries although the January Flash Services PMI has improved slightly from December. The manufacturing PMI fell below the neutral 50 level for the first time in nearly three years suggesting a further cyclical slowdown in manufacturing activity should be expected in early 2023. (Judo Bank)

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 85.9; PREV 87.7

Consumer confidence softened by 1.8pts to 85.9 last week, representing the first drop in confidence in 2023 so far. Consumer confidence regarding current and future finances fell a little, though future financial conditions are still in positive territory. Sentiment about current economic conditions improved but consumers’ five-year view outlook on the economy softened. Household inflation expectations rose 0.3ppt to 5.7% but remained below the inflation expectations of late 2022. Media coverage of the inflation data and the first RBA meeting of 2023, which we expect to result in a cash rate hike, could both be headwinds for confidence incoming weeks. (ANZ)

NEW ZEALAND DEC BUSINESSNZ PERFORMANCE SERVICES INDEX 52.1; NOV 53.8

Expansion levels for New Zealand’s services sector continued to lower in December, according to the BNZ – BusinessNZ Performance of Services Index (PSI). (BusinessNZ)

MARKETS

US TSYS: Little Changed In Muted Asian Session

TYH3 deals at 114-24+, +0-02+, and is operating in a narrow 0-04 range on light volume of ~20k.

- Cash Tsys sit 0.5bp richer to 0.5bp cheaper across the major benchmarks.

- China, Hong Kong and Singapore were closed again today, as the impact of the LNY period once again thinned out liquidity in Asia.

- Macro headline flow was also scarce.

- In Europe today flash PMI data from the Eurozone and UK headline the docket. Further out we have PMIs from the U.S. as well as Philadelphia Fed Non-Manufacturing Activity and Richmond Fed Manufacturing Index. On the supply side we have the latest 2-Year Tsy auction.

JGBS: Futures Consolidate Overnight Losses, Long End Bid

JGB futures have dealt either side of late overnight session levels during Tokyo trade, -20 into the bell, as they pull away from session lows after correcting from post-BoJ highs lodged late Monday. Cash JGBs are 1.5bp cheaper (10s are the only benchmark that have cheapened) to 3bp richer, with demand observed in the long end (perhaps as lifers begin to redeploy capital after the post-BoJ steepening).

- The swap curve has twist flattened, with benchmark rates running 2bp higher to 3bp lower, with a pivot observed around 20s.

- BBG’s measure of basis between the pricing of JGB futures and their underlying bonds has moderated from the pre-BoJ spike higher. Still, the basis measure identified remains elevated in a historical sense as the BoJ continues to face market functioning issues (see more on that matter here)

- Note that the BoJ’s trimmed mean measure of underlying inflation rose 3.1% Y/Y in December, representing a fresh record high, as pass-through of cost increases continued.

- There was incremental slippage when it comes to the average and high spreads that prevailed at the latest liquidity enhancement auction covering off-the-run 1- to 5-Year JGBs, with the cover ratio also ticking lower. However, these metrics still depict smooth takedown of today’s supply.

- BoJ Rinban operations headline tomorrow.

JGBS AUCTION: Liquidity Enhancement Auction For OTR 1- To 5-Year JGBs

Results The Japanese Ministry of Finance (MOF) sells Y499.3bn of 1- to 5-Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.004% (prev. -0.005%)

- High Spread: -0.001% (prev. -0.003%)

- % Allotted At High Spread: 36.7681% (prev. 99.1150%)

- Bid/Cover: 4.150x (prev. 5.391x)

AUSSIE BONDS: Most Of Early Weakness Pared

Aussie bond futures ticked away from their respective overnight bases as participants digested the latest NAB business survey, leaving YM -1.0 & XM -1.5, essentially unwinding their modest overnight losses, while cash ACGBs were 0.5 to 1.0bp cheaper across the curve.

- EFPs were essentially flat on the day.

- When it comes to the details, the NAB business confidence reading saw a modest uptick, alongside a downtick in the conditions print. The survey points to slower activity at solid levels and continued tight capacity, but with softening labour demand and price pressures, welcome developments for the RBA on net. However, NAB also noted that the fading of the post-COVID demand bounce and higher rates are impacting business. The risks to growth and potential feed through into the RBA terminal cash rate discussion allowed futures to tick higher in Sydney hours.

- RBA dated OIS was little changed on the day, showing 18bp of tightening for next month’s meeting and a terminal cash rate of 3.55-3.60%.

- Looking ahead, Q4 CPI data headlines the local docket on Wednesday. The BBG survey median looks for the headline CPI print to hit +7.6% Y/Y vs. the 7.3% seen in Q3, while the trimmed mean measure is seen at +6.5% Y/Y vs. the 6.1% observed in Q3.

- This will be further supplemented by the latest Westpac leading index print.

NZGBS: Early, Modest Cheapening Holds, CPI In View

A near-enough flatline session for the NZ rates space after the initial adjustments, as the continued observance of the LNY holidays limits broader liquidity in Asia-Pac markets and regional headline flow.

- The move higher in U.S. Tsy & German Bund yields observed at the backend of last week spilled over into Monday trade, subsequently applying some pressure to NZGBs in early Tuesday dealing, with the benchmarks running 3.0-4.5bp cheaper at the close as the curve bear steepened.

- Swap rates finished 3-4bp higher, moving in sympathy with bonds.

- Local data flow saw a slowing in the rate of expansion in the latest BusinessNZ PSI print, with the collators noting that “December marked a significant slowdown in a short space of time for the PSI, although the loftiness in New Orders/Business suggested there was still a lot of demand- side pressure at play.”

- Political matters continue to dominate domestic headlines, but these are second order (at best) considerations for markets given the domestic and macro backdrops.

- Tomorrow’s Q4 CPI data presents the domestic highlight of the week, with near-term RBNZ dated OIS pricing steady today, showing just under 65bp of tightening for next month’s meeting, alongside a terminal OCR of just over 5.45%.

EQUITIES: Japan Stocks Back To Pre-December BoJ Levels

Regional equity markets are tracking higher, although a lot of markets are still closed for the LNY break. Japan markets have led the way, with the Nikkei 225 up 1.70% at this stage. Tech and semiconductor names have led the rally. This follows the 5% surge in the SOX during Monday's US session.

- Tech optimism is being buoyed by hopes of reduced Fed hawkishness. Underperformance in this sector followed the move higher in US real yields last year.

- The Nikkei is now back around levels that prevailed prior to the mid Dec BoJ meeting, last near 27355.

- Elsewhere, the ASX 200 is tracking modestly higher, up 0.43% at this stage. Thai stocks are also up, while Indian equities are +0.20% in the first part of trade.

- Only Indonesian equities are weaker, down 0.36% at this stage, with markets returning after yesterday's holiday.

- US equity futures are down a touch (-0.05/-0.10% at this stage), but have tracked a tight range through the session.

GOLD: Bullion Holding Onto Recent Gains, Watch US PMIs

Gold is holding onto its gains from recent days and has moved higher today by 0.2% to $1934.05/oz, close to its intraday high of $1937.14, as the USD is weaker. It reached a low of $1911.45 on Monday. Trend conditions for gold remain bullish and initial resistance is at Friday’s high of $1937.60.

- The fear of a recession in the US and expected slowing in Fed tightening has supported the rally in gold prices. But analysts are warning that profit taking could derail the rally. (Dow Jones)

- Later the US preliminary PMIs and the Richmond Fed manufacturing index for January are released. After the soft retail sales data, weak PMIs are likely to increase US slowdown concerns and drive a further rally in gold.

OIL: Range Trading As Various Forces Offset Each Other, Thin Asian Trading

Oil has been trading in a very narrow range today of less than 50c, as liquidity in the market remains thin due to the Lunar New Year holidays. It is off of yesterday’s highs but is holding onto most of its recent gains. WTI is currently trading around $81.67/bbl after an intraday high of $81.88 and Brent is $88.15 after $88.36.

- While WTI is holding above $81/bbl, it needs to clear $82.66, the January 18 high, for the bullish trend to resume and open up $83.14, the December 1 high. Brent has been supported by concerns regarding the supply of Russian crude, which has increased its spread to WTI. The next level to watch for Brent is $89.18.

- Concerns over US recession risk continue to tussle with optimism regarding demand from China.

FOREX: USD Maintains Recent Ranges, JPY Finds Some Support

The BBDXY is still sub NY closing levels, but up from earlier session lows near 1223. We last tracked near 1224.00 (-0.10% for the session). A firmer yen tone has persisted, with JPY up 0.35% at this stage. Other pairs have seen more modest gains against the USD.

- With many regional centers and China still out for the LNY break, cross asset signals have been fairly muted. US cash Tsy yields mostly steady. The regional equity tone is positive led by Japan stocks, but this is largely following firm gains in offshore markets through Monday's session, particularly in the tech space.

- USD/JPY has traded with a weaker bias, last around 130.20/25. PMI services data was slightly better than expected, while manufacturing was steady and still in contraction territory.

- AU and NZ survey data hasn't shifted the needle ahead of tomorrow's key CPI outcomes for both economies.

- AUD/USD was last at 0.7035, highs for the session were at 0.7045. NZD/USD is attempting a move above 0.6500. Dips in both currencies have been supported. EUR/USD is a touch higher last around 1.0875/80.

- Coming up, flash PMIs for Jan are due across the major economies and the EU area. In the US the Richmond Fed index is also due.

FX OPTIONS: Expiries for Jan24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0795-05(E928mln), $1.0900(E561mln)

- USD/JPY: Y128.00-10($924mln), Y130.00($916mln), Y131.00($821mln)

- AUD/USD: $0.7000(A$524mln)

- USD/CAD: C$1.3400($726mln), C$1.3460($610mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/01/2023 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 24/01/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 24/01/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/01/2023 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/01/2023 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/01/2023 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/01/2023 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/01/2023 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/01/2023 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/01/2023 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/01/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/01/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/01/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/01/2023 | 0945/1045 |  | EU | ECB Lagarde Video Message at Croatia Conference | |

| 24/01/2023 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 24/01/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/01/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/01/2023 | 1445/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/01/2023 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 24/01/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 24/01/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 25/01/2023 | 2145/1045 | *** |  | NZ | CPI inflation quarterly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.