-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

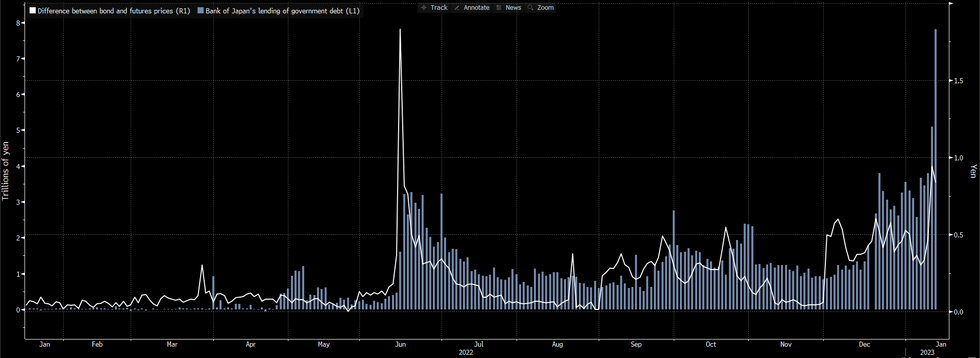

Free AccessFutures Basis Back From Levels Seen Pre-BoJ Run Higher, But Still Evident

BBG’s measure of basis between the pricing of JGB futures and their underlying bonds has moderated from the pre-BoJ spike higher (which didn’t get anywhere near challenging levels witnessed back in the mid-’22 attack on the BoJ’s YCC parameters).

- The BoJ’s choice to leave its monetary policy settings unchanged, coupled with the well-documented tweaks to the parameters underlying the Bank’s Funds-Supplying Operations against Pooled Collateral (a further backstop to its YCC settings), and the subsequent demand for JGBs related to and coming via that facility (whereby cheap borrowing finances received positions in swaps and longs in JGBs), resulted in a ~360 tick trough to peak rally for futures in recent sessions.

- Still, the basis measure identified remains elevated in a historical sense as the BoJ continues to face market functioning issues that are a product of its upsized JGB purchases against already large JGB holdings (short cover in certain illiquid cash bonds may be keeping a floor on the basis even after futures pulsed back from their YCC speculation induced lows, while other bonds may not even be trading), while continued positioning for a future tweak to BoJ policy settings via futures (albeit less extreme than pre-BoJ levels) also works in the same direction when it comes to basis.

- This is a huge issue when it comes to market efficiencies and makes the JGB futures contract a far less effective hedge for positions in underlying cash JGBs.

Fig. 1: BBG JGB Futures Net Basis Measure Vs. BoJ Lending Of JGBs

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.