-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Looking Through FOMC Mins & Vaccine Headlines

EXECUTIVE SUMMARY

- FED MINUTES SHOW BULLISH TILT BUT NO TAPER MENTION (MNI)

- PFIZER: SOUTH AFRICAN VARIANT COULD SIG. REDUCE VACCINE PROTECTION (RTRS)

- CHINA NOT TARGETING U.S. IN RARE-EARTH EXPORTS, OPTION REMAINS (GLOBAL TIMES)

- PBOC CONDUCTS NET DRAIN OF LIQUIDITY VIA OMOS AFTER LNY, ROLLS MATURING MLF

- GAMESTOP FRENZY PROMPTS SEC TO WEIGH MORE SHORT SALE TRANSPARENCY (WSJ)

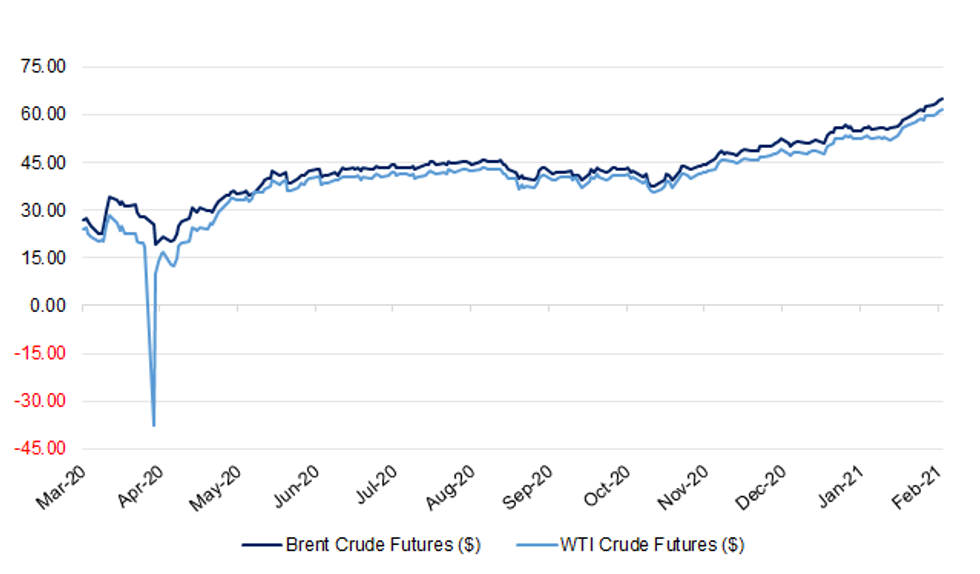

Fig. 1: WTI & Brent Crude Futures (Continuation Chart)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Coronavirus infections are falling fast across England, the latest large survey has found, with positive tests now less than one-third the level reported three weeks ago. According to the React-1 study led by Imperial College London and published on Thursday, just 0.51 per cent of the randomly selected sample of 85,400 volunteers was infected between February 4 and 13, compared with 1.57 per cent between January 6 and 22. "It's very reassuring to see this speed of decline," said Prof Steven Riley of Imperial. "It is better than we had expected." (FT)

CORONAVIRUS: Parents will be asked to test their children twice a week under plans for a phased return to the classroom, The Telegraph can disclose. (Telegraph)

CORONAVIRUS: Anti-lockdown Tories have piled further pressure on Boris Johnson to lift restrictions, telling him experts say the numbers don't justify keeping Britain closed until July. The Prime Minister has vowed to use 'data not dates' when deciding how and when to end the measures in place to control the spread of coronavirus, but is facing a growing backlash from business chiefs and MPs. The vaccine rollout has helped slash the number of deaths and infections, but the PM is being regularly reminded of the social cost of lockdown, amid fears firms unable to open under current restrictions will soon collapse. (Daily Mail)

FISCAL: Two million people have not worked for at least six months, according to a new report calling for Rishi Sunak to extend the furlough scheme. (Telegraph)

FISCAL: The chancellor must take action to tackle the rent debt crisis in the forthcoming budget, housing charities and groups representing landlords and renters have said. In a joint statement released by organisations including the Big Issue, Crisis, Shelter, Citizens Advice, Joseph Rowntree Foundation and Nationwide Building Society, Rishi Sunak was called upon to act now to avoid renters "being scarred by debts they have no hope of clearing and a wave of people having to leave their homes in the weeks and months to come". (Guardian)

BOE: MNI Brief: BOE's Ramsden-Flat Rates Back QE/Bank Rate Rethink

- Market expectations for near flat Bank Rate over the next quarter of a century justify the Bank of England's move to rethink its strategy of not unwinding the stock of quantitative easing until the benchmark rate is raised from 0.1% to around 1.5%, said BOE Deputy Governor Dave Ramsden. The BOE has publicly asked Bank staff to revisit its unwind strategy and Ramsden's comments make the case for a change in approach. The National Institute of Economic and Social Research's deputy director Hande Kucuk took a similar line in a recent interview with MNI, saying the BOE was likely to indicate it would start unwinding quantitative easing before hiking Bank Rate - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BREXIT: Boris Johnson has drafted former Brexit negotiator Lord David Frost into his cabinet to take charge of forging a new relationship with the EU. He will seek to maximise post-Brexit trading opportunities when he becomes a full cabinet member next month, Downing Street said. He will also replace Michael Gove as co-chair of a committee on implementing the Brexit withdrawal deal. Mr Gove will keep his seat at the cabinet table. (BBC)

BREXIT: Boris Johnson's adviser on regulatory reform, Iain Duncan Smith, has said he will not lead a "slash-and-burn exercise" when it comes to changing Britain's post-Brexit rules. Duncan Smith's comments chime with warnings from business leaders that they do not want the UK prime minister to oversee a "bonfire" of EU red tape and instead want to see him focus on ensuring the government becomes "nimbler" at making new rules. The idea of a post-Brexit conflagration, laying waste to what they see as stifling Brussels regulation, has been a staple of Eurosceptic discourse for years, but it is being quietly doused by the government. (FT)

BREXIT: Ministers are moving to scrap strict EU limits on state aid to allow the government to provide more support to businesses crippled by the costs of the extended coronavirus lockdown. Under proposals being drawn up by the Department for Business, caps would be eased on money that can be paid in grants to companies that have been forced to shut. These were put in place last year by the European Commission and the UK was forced to abide by them as part of the transition period. However, despite severing ties with the bloc at the end of the year, guidance issued last month stated the old rules "should still be applied" until further notice. (The Times)

ECONOMY: MNI BRIEF: Jan UK Pay Awards Lowest Since Aug

- UK headline pay awards fell in January to the lowest level since August, the latest XpertHR survey showed, reflecting the "continuing uncertainty in which businesses are operating." according to survey author Sheila Attwood - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: About 2.6 million people in the U.K., or 8% of workers, expect to lose their jobs in the next three months, according to a survey that suggests long-lasting damage to the economy from the coronavirus. The figures include people who have already been told that they will be made redundant, with young people and the lowest earners at greatest risk, the Resolution Foundation said Wednesday. The analysis found about 2 million people had been unemployed or on furlough for the past six months, a length of time that leaves them at higher risk. A separate British Chambers of Commerce survey found a quarter of the 1,100 businesses polled planning job cuts if government support programs end as planned. (BBG)

POLITICS: Keir Starmer will on Thursday vow that as prime minister he would "create a new partnership between an active government and enterprising business", in his first big speech on the economy since becoming Labour leader last April. Starmer will also promise that a Labour government would prioritise "financial responsibility", saying he took the issue "incredibly seriously" and that people expected the government to look after their money. His embrace of enterprise and fiscal discipline marks a clear break from the leadership of Jeremy Corbyn, as Starmer attempts to reposition Labour as a responsible government-in-waiting. Starmer's problem is identifying a distinctive economic space for Labour at a time when the Conservative government is borrowing £400bn a year and engaged in massive state intervention in the economy. (FT)

EUROPE

FRANCE: France is extending the duration of quarantine to 10 days for those who test positive to Covid in the northeastern section of the nation where virus circulation and the prevalence of new variants is particularly high. The French government also said testing and tracing campaigns will intensify there, and that vaccines will be earmarked for the area. (BBG)

ITALY: Premier Mario Draghi easily won a confidence vote in Parliament's upper chamber Wednesday night after vowing to do whatever it takes to lead Italy out of the coronavirus pandemic and rebuild its economy into a more sustainable and equitable one for future generations. The Senate voted 262-40 with two abstentions to back Draghi's technical-political government, which he formed at the request of Italy's president to steer Italy through the health and economic crises. A confidence vote Thursday in the lower Chamber of Deputies is also expected to give Draghi broad backing, since he has secured support from across Italy's political spectrum. Draghi told senators that Italy has a once-in-a-lifetime chance to rethink and rebuild the country, urging them to unite behind his government, which he vowed will be environmentally conscious, staunchly pro-European and oriented toward technological and digital reforms. (AP)

U.S.

FED: MNI BRIEF: Fed Minutes Show Bullish Tilt But No Taper Mention

- Federal Reserve officials were becoming more optimistic about the economic outlook because of vaccine rollouts but not ready to start debating the timing of a reduction in its monthly USD120 billion bond buys, minutes from the January meeting released Wednesday showed - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: San Francisco Fed President Daly tweeted the following on Wednesday: "What is the real unemployment rate? Not 6.3%. How can we know? Look around. Millions of people on unemployment benefits. Lines at food banks. Countless workers out of the labor force taking care of families. This is a long way from full employment." (MNI)

FED: Dallas Federal Reserve President Robert Kaplan said on Wednesday the race to vaccinate the United States against the coronavirus is his top economic concern, even as he expressed hope efforts to contain the pandemic will be successful, clearing the way for faster growth. "The most important thing is how we manage the virus, and these variants, and getting people vaccinated and speeding the vaccinations so we head off the potential impact of these variants: that's still the number one thing I'm watching," Kaplan told Reuters in an interview. (RTRS)

FISCAL: President Joe Biden will ask the Department of Justice to review his legal authority to cancel student loan debt, the White House said on Wednesday, adding the president does not favor $50,000 in student loan relief without limitation. White House spokeswoman Jen Psaki told reporters that Biden believes relief above $10,000 should be targeted based on the borrower's income and the kind of debt in question. (RTRS)

ECONOMY: The franchising industry is set to make a comeback after the coronavirus pandemic left the future of the industry in question. A new report shows that the rebound could be successful if Covid is handled efficiently, according to CNBC's Kate Rogers. The International Franchise Association estimates that more than 26,000 franchised locations will be added this year, which amounts to a rise of 3.5%. The gain should offset last year's setbacks. (CNBC)

CORONAVIRUS: Trends portraying the continued moderation of the pandemic in the US remained in place on Wednesday, with coronavirus hospitalisations hitting their lowest since November and new cases and deaths hovering around the lowest levels in months. The number of people currently in US hospitals with coronavirus dropped to 63,398, down from 64,533 on Tuesday, according to data from Covid Tracking Project. That was the lowest number of hospitalisations since November 10. The downward trend has been helped along by big states like California, which on Wednesday reported that hospitalisations fell below 9,000 for the first time since late November. States reported an additional 66,098 coronavirus infections, up from 56,312 on Tuesday. Monday's single-day increase of 55,077 cases was the smallest since mid-October. Covid Tracking Project said in a Twitter message that "Weather-related outages in Texas have resulted in significant case and fatality reporting delays" and it was likely that winter storms that have affected vast parts of the country have "partially resulted in artificially low numbers" in other states. (FT)

CORONAVIRUS: The U.S. Centers for Disease Control and Prevention is asking Americans to postpone their travel plans after a newly released investigation found Minnesota residents who were infected with a highly contagious Covid variant had histories of domestic and international travel before displaying symptoms. (CNBC)

CORONAVIRUS: The Biden administration announced Wednesday that it will invest more than $1.6 billion to increase Covid-19 testing programs in schools and elsewhere and increase genomic sequencing in the United States. (CNBC)

CORONAVIRUS: New Jersey Gov. Phil Murphy announced on Twitter that the state will be extending its public health emergency for another 30 days. (CNBC)

CORONAVIRUS: New York Gov. Andrew Cuomo announced a series of planned reopenings amid a decline in Covid-19 cases following the holidays, but said state officials are keeping a close eye on the spread of highly transmissible virus variants that could reverse progress. Indoor family entertainment centers, like arcades, trampoline parks or laser tag facilities, will be allowed to reopen starting March 26 at 25% capacity with additional precautions, like social distancing, mask wearing and frequent cleaning. (CNBC)

CORONAVIRUS: The Democratic leaders of the New York State Senate are moving to strip Gov. Andrew M. Cuomo of unilateral emergency powers granted during the pandemic, setting up a remarkable rebuke for the governor from members of his own party. (New York Times)

EQUITIES: Wall Street's main regulator is weighing whether to require more transparency of short selling and the opaque network of stock lending and borrowing that facilitates it, according to people familiar with the matter. The Securities and Exchange Commission was ordered 11 years ago to impose such rules but never did it. Now, dealing with the fallout from frenetic trading in GameStop Corp. shares, the agency under new leadership is considering using its authority to shine more light on the mechanics of the bearish trades. The 2010 Dodd-Frank financial overhaul law required the SEC to collect information about how much of each public company's stock has been sold short. The SEC doesn't gather or disseminate data on such bets by specific investors. (WSJ)

EQUITIES: Robinhood Markets and Citadel, central players in the GameStop Corp. saga that gripped markets last month, are using congressional testimony to push back against conspiracy theories circulating in Washington that they coordinated to restrict retail investors from adding to their bets. Robinhood Chief Executive Officer Vlad Tenev said in written testimony for a Thursday House Financial Services Committee hearing that the brokerage halted trades to meet demands from its clearinghouse. Claims it sought to help hedge funds are "absolutely false and market-distorting rhetoric," he said. Ken Griffin, Citadel's billionaire founder, said in his prepared remarks that he didn't learn Robinhood had barred GameStop buy orders until after the restrictions were publicly announced. (BBG)

EQUITIES: The social media persona "Roaring Kitty" at the center of last month's frenzied rally in shares of GameStop Corp violated securities laws and caused "huge losses" for investors, according to a class action lawsuit filed in federal court in Massachusetts. Keith Gill, or Roaring Kitty on YouTube and DeepF***ingValue on Reddit forums, allegedly hid his sophisticated financial training and duped retail traders into buying inflated stocks, according to the complaint filed on Tuesday. (RTRS)

OTHER

U.S./CHINA: China's rare-earth exports to the US are not being restricted and are continuing unaffected, but reviews of such an option may have been done and measures could be taken against foreign companies that hurt China's interests, when necessary, experts and industry sources said. Western media reports claimed that China is imposing export controls on rare-earth minerals that are crucial for the production of the US F-35 fighter jets and other advanced weaponry, The Financial Times reported on Tuesday, citing unidentified sources. (Global Times)

U.S./CHINA: American companies would lose hundreds of billions of dollars if they slashed investment in China or the nations increased tariffs, the U.S. Chamber of Commerce said in a report highlighting the cost of a full decoupling of the world's largest economies. American gross domestic product would see a one-time loss of as much as $500 billion should U.S. companies reduce foreign direct investment in China by half, the Washington-based business lobbying group said in a report on Wednesday. Applying a 25% tariff on all two-way trade would trim U.S. GDP by $190 billion annually by 2025, the group said in a joint study with Rhodium Group, a New York data and analytics firm. (BBG)

GLOBAL TRADE: President Joe Biden's top economic adviser, Brian Deese, has sought the Taiwanese government's help resolving a global semiconductor shortage that's idling U.S. car manufacturing plants, according to a letter reviewed by Bloomberg News. In the letter, Deese thanked Taiwan's minister of economic affairs, Wang Mei-Hua, for her personal engagement on the microchips shortage and relayed concerns from U.S. automotive companies. Top White House officials are engaged in trying to resolve the shortage, which has presented an early challenge to Biden's administration. Deese, the director of the National Economic Council, as well as National Security Adviser Jake Sullivan are personally involved in the effort to address bottlenecks in auto companies' supply chains, a White House spokesperson said. The spokesperson asked not to be identified by name because the talks have been private. (BBG)

CORONAVIRUS: A laboratory study suggests that the South African variant of the coronavirus may reduce antibody protection from the Pfizer Inc/BioNTech SE vaccine by two-thirds, and it is not clear if the shot will be effective against the mutation, the companies said on Wednesday. The study found the vaccine was still able to neutralize the virus and there is not yet evidence from trials in people that the variant reduces vaccine protection, the companies said. Still, they are making investments and talking to regulators about developing an updated version of their mRNA vaccine or a booster shot, if needed. For the study, scientists from the companies and the University of Texas Medical Branch (UTMB) developed an engineered virus that contained the same mutations carried on the spike portion of the highly contagious coronavirus variant first discovered in South Africa, known as B.1.351. The spike, used by the virus to enter human cells, is the primary target of many COVID-19 vaccines. Researchers tested the engineered virus against blood taken from people who had been given the vaccine, and found a two- thirds reduction in the level of neutralizing antibodies compared with its effect on the most common version of the virus prevalent in U.S. trials. Their findings were published in the New England Journal of Medicine (NEJM). Because there is no established benchmark yet to determine what level of antibodies are needed to protect against the virus, it is unclear whether that two-thirds reduction will render the vaccine ineffective against the variant spreading around the world. However, UTMB professor and study co-author Pei-Yong Shi said he believes the Pfizer vaccine will likely be protective against the variant. "We don't know what the minimum neutralizing number is. We don't have that cutoff line," he said, adding that he suspects the immune response observed is likely to be significantly above where it needs to be to provide protection. (RTRS)

CORONAVIRUS: Johnson & Johnson has only manufactured "a few million" doses of its single-shot Covid-19 vaccine ahead of its regulatory clearance expected later this month, President Joe Biden's coronavirus czar said. The administration has learned in the last couple of weeks that J&J will only have a few million doses ready when the vaccine is likely authorized by the FDA, Jeff Zients told reporters during a White House news briefing on the pandemic. (CNBC)

BOJ: Bank of Japan Governor Haruhiko Kuroda met with Prime Minister Yoshihide Suga on Thursday as he looks to spread the message that next month's policy review isn't aimed at scaling back monetary easing. In their first meeting since September, the governor said he told Suga that the review is aimed at making monetary easing more effective and sustainable over a longer period, according to public broadcaster NHK. (BBG)

BOJ: MNI BRIEF: BOJ Credit Costs Worry If Stock Markets Readjust

- Bank of Japan officials are watching closely to gauge whether the strong stock market rally can help cap the cost of credit for companies, MNI understands, although they acknowledge there are still risks - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: The Australian state of Victoria reported no locally transmitted coronavirus cases on Thursday as it relaxed a five-day lockdown designed to stem the spread of a highly contagious variant. A lockdown was imposed on the state last week following an outbreak among staff at a quarantine hotel involving the variant first discovered in the UK. (FT)

RBA: The Reserve Bank of Australia will likely have to extend its government bond buying program beyond September to take some steam out of the Australian dollar, John Edwards, an economist and former member of the central bank's policy-setting board said. Mr. Edwards told the Wall Street Journal that despite the RBA's best efforts to lower interest rates and put downward pressure on the Australian dollar in recent months, the currency remains on track to rise to 80 U.S. cents soon, a level it hasn't traded at in two years. (Dow Jones)

NEW ZEALAND: People in New Zealand will have to wear a face covering on most public transport, the government announced after the end of a lockdown of Auckland ended Wednesday. There were no new positive Covid-19 cases in the community reported Thursday. (BBG)

SOUTH KOREA: Finance Minister Hong Nam-ki and Bank of Korea (BOK) Governor Lee Ju-yeol reaffirmed their stance to maintain an expansionary fiscal and accommodative monetary policy as the nation's economy remains vulnerable to the impact of a third wave of the coronavirus. Thursday's meeting marked the first time in a year that the leaders of the central bank, finance ministry and two financial regulators gathered to discuss joint strategies for dealing with the impact of the pandemic. At the last meeting in February 2020, the officials pledged to join hands to tackle the emerging coronavirus crisis. A year later, addressing the continuing impact of the pandemic remains at the top of their priority lists. (Korea Times)

MEXICO: Mexico will announce a significant reduction to state oil firm Petroleos Mexicanos' tax burden for 2021 in the coming days, Finance Minister Arturo Herrera said in an interview. Lowering the state's demands on Pemex, its biggest taxpayer, could help the oil giant reorder its finances as it struggles with a $110.3 billion debt load, sinking production, and some of the highest tax obligations of any oil company in the world. During the past two years Mexico adjusted its tax policy to compensate for a reduction in oil revenue from royalties and other contributions, Herrera said. "We are heading in that direction, and in the coming days we will update how we continue down that path," he said. "Anything to do with Pemex given its size has to be significant." (BBG)

MEXICO: The Mexican government called the top U.S. representative in Mexico on Wednesday to press for natural gas supplies after the Texas governor ordered fuel to remain in the state during a freeze that has overwhelmed its energy grid. (RTRS)

BRAZIL: Authorities in Rio de Janeiro and several other Brazilian cities have said they would pause some coronavirus jabs because of a shortage of vaccines, as supply bottlenecks threaten to slow the inoculation programme in Latin America's largest nation. A number of municipalities including Rio, home to 6.7m people, have in recent days paused first injections — or said they intend to — because of a lack of supply, with priority given to those waiting for a second shot. Salvador, home to almost 3m residents, has suspended first vaccine doses for health workers and the elderly. (FT)

DEBT: Global debt surged by more than $24tn in 2020, the biggest annual increase on record, as governments around the world borrowed heavily to fund their response to the pandemic and as companies piled on new debt to build cash buffers and protect themselves from the economic downturn. The Institute of International Finance said the ratio of total debt to output soared 35 percentage points to reach 335 per cent of global GDP during 2020, dwarfing the increase at the height of the global financial crisis of 10 percentage points in 2008 and 15 in 2009. The IIF warned of a difficult period of adjustment ahead. (FT)

OIL: Saudi Arabia plans to increase its oil output in the coming months, reversing a recent big production cut, say advisers to the Kingdom, a sign of growing confidence over an oil-price recovery. The world's largest oil exporter surprised oil markets last month when it said it would unilaterally slash 1 million barrels a day of crude production in February and March in an effort to raise prices. (WSJ)

OIL: Total U.S. oil production has plunged by close to 40% -- the most ever -- as an unprecedented cold blast freezes well operations across the central U.S., according to traders and industry executives with direct knowledge of the operations. Crude output has now fallen by more than 4 million barrels a day nationwide, they said, asking not to be identified because the information isn't public. (BBG)

ENERGY: Texas is restricting the flow of natural gas across state lines in an extraordinary move that some are calling a violation of the U.S. Constitution's commerce clause. Texas Governor Greg Abbott on Wednesday told a media briefing that he was banning gas from leaving the state through Feb. 21 to ensure in-state power generators had ample supplies. But a copy of Abbott's order seen by Bloomberg showed he's requiring Texas gas be offered for sale in-state before being shipped elsewhere. (BBG)

CHINA

ECONOMY: Retail and dining sales in the week-long Chinese New Year rose 4.9% over the comparable period in 2019 to CNY821 billion, 28.7% more than last year, the Ministry of Commerce said on its website late Wednesday. Sales of jewellery and clothing more than doubled while communication and home electronics also registered double-digit growth, according to the Ministry. Restaurant sales in large cities surged as many residents avoided returning to rural ancestral homes and celebrated the holidays locally. (MNI)

INFLATION: China's CPI may turn positive after March, the PBOC-run newspaper Financial News reported citing Wang Qing, an analyst with Golden Credit Rating. China is likely to face more moderate inflation in 2021 than other nations given its more stable monetary policy, slow wage growth and steady price expectations, the newspaper said citing Shen Jianguang, chief economist of JD Digits. In the long run, inflation and increasing asset prices due to higher importing costs may be a concern, Shen added. China's CPI fell 0.3% y/y in January after gaining 0.2% in the previous month. (MNI)

DEFAULTS: Tsinghua Unigroup sees uncertainty in coupon payment and early redemption due March 25 for a 4.94% 2b yuan local bond because of tight liquidity, according to a statement to the Shanghai stock exchange. (BBG)

OVERNIGHT DATA

AUSTRALIA JAN EMPLOYMENT CHANGE +29.1K; MEDIAN +30.0K; DEC +50.0K

AUSTRALIA JAN FULL-TIME EMPLOYMENT CHANGE +59.0K; DEC +35.7K

AUSTRALIA JAN PART-TIME EMPLOYMENT CHANGE -29.8K; DEC +14.3K

AUSTRALIA JAN UNEMPLOYMENT RATE 6.4%; MEDIAN 6.5%; DEC 6.6%

AUSTRALIA JAN PARTICIPATION RATE 66.1%; MEDIAN 66.2%; DEC 66.2%

AUSTRALIA JAN RBA FX TRANSACTIONS GOVERNMENT -A$431MN; DEC -A$1,283MN

AUSTRALIA JAN RBA FX TRANSACTIONS MARKETS +A$406MN; DEC +A$1,254MN

AUSTRALIA JAN RBA FX TRANSACTIONS OTHER -A$3,723MN; DEC +A$1,534MN

CHINA JAN SWIFT GLOBAL PAYMENTS CNY 2.42%; DEC 1.88%

CHINA MARKETS

PBOC NET DRAINS CNY260 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY200 billion via one-year medium-term lending facilities (MLFs) with the rate unchanged at 2.95% on Thursday. This aims to roll over the same amount of MLFs maturing today. The PBOC also injects CNY20 billion via 7-day reverse repos. This resulted in a net drain of CNY260 billion given the maturity of CNY280 billion of reverse repos today, according to Wind Information.

- The operation aims to maintain reasonable and ample liquidity, as cash returns to the banking system after the Chinese New Year holiday, the PBOC said on its website.

PBOC SETS YUAN PARITY HIGHER AT 6.4536 THU; +8.64% Y/Y

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4536 on Thursday. This compares with the 6.4391 set on last Wednesday, the last working day before the week-long Chinese New Year holiday.

CHINA CFETS YUAN INDEX DOWN 0.30% IN WEEK TO FEB 10

The CFETS Weekly RMB Index decreased to 96.66 last Wednesday, Feb. 10, down from 96.95 in the week ended Feb. 5. This followed a 0.47% increase over the previous week. The gauge, which compares the yuan to a basket of currencies from China's 24 major trading partners, is up 5.47% from 91.65 on Dec. 27, 2019.

MARKETS

SNAPSHOT: Looking Through FOMC Minutes & Vaccines Headlines

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 36.49 points at 30255.7

- ASX 200 up 0.677 points at 6885.9

- Shanghai Comp. up 27.094 points at 3682.538

- JGB 10-Yr future up 7 ticks at 151.30, JGB 10-Yr yield down 0.9bp at 0.09%

- Aussie 10-Yr future up 3.5 ticks at 98.6300, Aussie 10-Yr yield down 3.3bp at 1.369%

- U.S. 10-Yr future up 0-04+ ticks at 135-28+, U.S. 10-Yr yield up 0.5bp at 1.2753%

- WTI crude up $0.59 at $61.74, Gold up $6.28 at $1782.41

- USD/JPY up 2 pips at Y105.89

- FED MINUTES SHOW BULLISH TILT BUT NO TAPER MENTION (MNI)

- PFIZER: SOUTH AFRICAN VARIANT COULD SIG. REDUCE VACCINE PROTECTION (RTRS)

- CHINA NOT TARGETING U.S. IN RARE-EARTH EXPORTS, OPTION REMAINS (GLOBAL TIMES)

- PBOC CONDUCTS NET DRAIN OF LIQUIDITY VIA OMOS AFTER LNY, ROLLS MATURING MLF

- GAMESTOP FRENZY PROMPTS SEC TO WEIGH MORE SHORT SALE TRANSPARENCY (WSJ)

BOND SUMMARY: Core FI Lacks Sense Of Direction In Asia

T-Notes traded either side of their late NY levels during Asia-Pac hours, with little in the way of market moving headlines witnessed, which went alongside relatively sedate core market trade as China returned from the LNY break. T-Notes last +0-05+ at 135-29+, with cash Tsys sitting unchanged to marginally cheaper on the day. The latest round of vaccine related headline flow (which was negative at first glance, although some of the details were a little more upbeat) saw no tangible market reaction. The uptick from yesterday's lows resulted in some downside interest in Asia-Pac hours, with the TYJ1 134.50/133.50 put spread lifted via a 3.0K block trade. We also saw a FV/TY flattener block (3,630 FVH1 vs. 2,260 TYH1) Eurodollar futures print 0.25 to 1.5 ticks higher through the reds, with a sizable 50K screen buyer of EDZ2 seen in Asia-Pac hours.

- JGBs firmed in the Tokyo morning, but drifted away from best levels on the back of soft 20-Year JGB supply, with futures last 9 ticks above yesterday's settlement levels. Elsewhere, a meeting between BoJ Governor Kuroda and Japanese PM Suga provided no deviation from familiar BoJ rhetoric re: the BoJ's ongoing monetary policy review.

- Aussie Bonds mostly tracked the broader impetus, as opposed to local issues. The latest Australian labour market report was virtually as expected, with a nudge lower in the unemployment, underemployment and underutilisation measures. YM -0.5, XM +3.5.

JGBS AUCTION: 20-Year Auction Results

The Japanese Ministry of Finance (MOF) sells Y977.3bn 20-Year JGBs:

- Average Yield 0.482% (prev. 0.443%)

- Average Price 100.31 (prev. 101.04)

- High Yield: 0.488% (prev. 0.448%)

- Low Price 100.20 (prev. 100.95)

- % Allotted At High Yield: 47.0278% (prev. 78.8026%)

- Bid/Cover: 3.127x (prev. 3.346x)

JGBS AUCTION: 1-Year Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.85364tn 1-Year Bills:

- Average Yield -0.1221% (prev. -0.1128%)

- Average Price 100.122 (prev. 100.113)

- High Yield: -0.1221% (prev. -0.1108%)

- Low Price 100.122 (prev. 100.111)

- % Allotted At High Yield: 96.2593% (prev. 81.7787%)

- Bid/Cover: 4.173x (prev. 3.495x)

JAPAN: Limited Flows In Weekly International Securities Flow Data

Little to really flag in terms of notable net headline flows in the latest round of weekly Japanese international security flow data.

- Japanese net purchases of offshore bonds moderated, while foreign investors were net sellers of Japanese bonds after 4 consecutive weeks of net purchases. The latter resulted in the 4-week rolling sum of the measure retracing to near enough flat levels, while there was no major movement in the 4-week rolling sums of the 3 remaining metrics.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 477.1 | 1028.6 | 2989.6 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -23.8 | -509.4 | -1366.9 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -747.7 | 589.1 | 46.8 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 330.1 | 463.2 | 815.5 |

Source: MNI - Market News/Japanese Ministry Of Finance

EQUITIES: China's Return Can't Stop Selloff

Another negative day for Asia-Pac equity markets, markets in the US finished mixed with the Dow eking out a small gain but other major indices finishing with minor losses.

- Chinese markets returned to the fray after LNY, initial gains were quickly wiped out and major indices now trade in negative territory. The negative sentiment quickly spread to other bourses in the region, most of which were already under pressure. The KOSPI and the Hang Seng lead the way lower, with Hong Kong officials scheduled to give a briefing on vaccination programme later today. Taiwan is the exception, up around 0.4% after rallying strongly in its first session back yesterday, there were also some reports that the US has enlisted Taiwan's help to ease auto chip shortage.

- Futures in the US are slightly lower, but off their lows as a bid in e-minis coincided with a sell off in treasuries.

GOLD: Still Below Bear Trigger

Gold has softened over the last 24 hours or so, but recovered from Wednesday's worst levels (around $1,770/oz), to last print $7/oz higher vs. settlement levels at $1,783/oz. Longer dated real U.S. yields are little changed over a 24 hour horizon, with the DXY a touch firmer. Wednesday's move represented a breach and close below the bear trigger in the form of the Feb 4 low, allowing those of a bearish disposition to switch focus to key support at $1,764.8/oz, which represents the Nov 30 '20 low.

OIL: Crude Rises As Supply Shock Roils Global Traders

Crude futures are extending their impressive rally, in positive territory and on track for the twelfth gain in thirteen sessions. Brent is firmly above $65/bbl. The adverse weather conditions in the US have now resulted in a shock to global supplies and helped push WTI to levels not seen since late 2018. WTI is up $0.80 at $61.90/bbl, having briefly popped over $62, while brent is up $0.97 at $65.32/bbl.

- According to analyst estimates the big freeze in the US has taken 4mnl bpd of oil supply offline, there are growing fears the extreme weather will last longer than the few days originally thought, with another storm forecast to hit eastern and central US later in the week.

- The rally drew strength in Asia after API inventory data showed a 5.m bbl draw, above estimates. Downstream figures did show gain in stocks, gasoline inventories rose 3.9m bbls. Markets now look ahead to US DOE figures later today.

FOREX: Greenback Rally Pauses, Commodity Currencies Supported

China's return to markets after a five-day break was underwhelming, equities were lower while fixed income was supported by broad risk aversion, the greenback paused a two-day rally while oil prices continued to rise.

- The NOK was the best performer among its G10 peers, supported by the rally in crude which has seen brent over $65/bbl.

- AUD initially rose as high as 0.7770 after labour market data was broadly in-line with estimates but the breakdown showed a lower participation rate and less hours worked, the rate later pared the gains to trade around neutral levels. NZD moved in sympathy with its Antipodean counterpart.

- JPY pairs are slightly weaker after BoJ Gov Kuroda reportedly told PM Suga that a BoJ review is aimed at sustaining monetary easing over a longer period, as opposed to tightening policy.

- An inside day for offshore yuan, USD/CNH has moved slightly higher from opening levels as equity markets sold off. A fairly uneventful yuan fixing, the PBOC fixed USD/CNY at 6.4536, just marginally higher than sell side estimates of 6.4529.

FOREX OPTIONS: Expiries for Feb18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E527mln), $1.1895-05(E859mln), $1.1940-41(E663mln), $1.2000-10(E1.8bln), $1.2050(E642mln), $1.2100(E1.3bln), $1.2125-35(E831mln), $1.2200(E1.5bln)

- USD/JPY: Y104.50-70($826mln), Y104.95-00(E596mln), Y105.95-00($900mln), Y107.75($1bln)

- AUD/USD: $0.7400(A$1.2bln), $0.7555-75(A$1.3mln), $0.7700-10(A$649mln)

- AUD/NZD: N$1.0820-30(A$769mln)

- USD/CNY: Cny6.35($1.8bln), Cny6.45($1.1bln), Cny6.50($1.25bln)

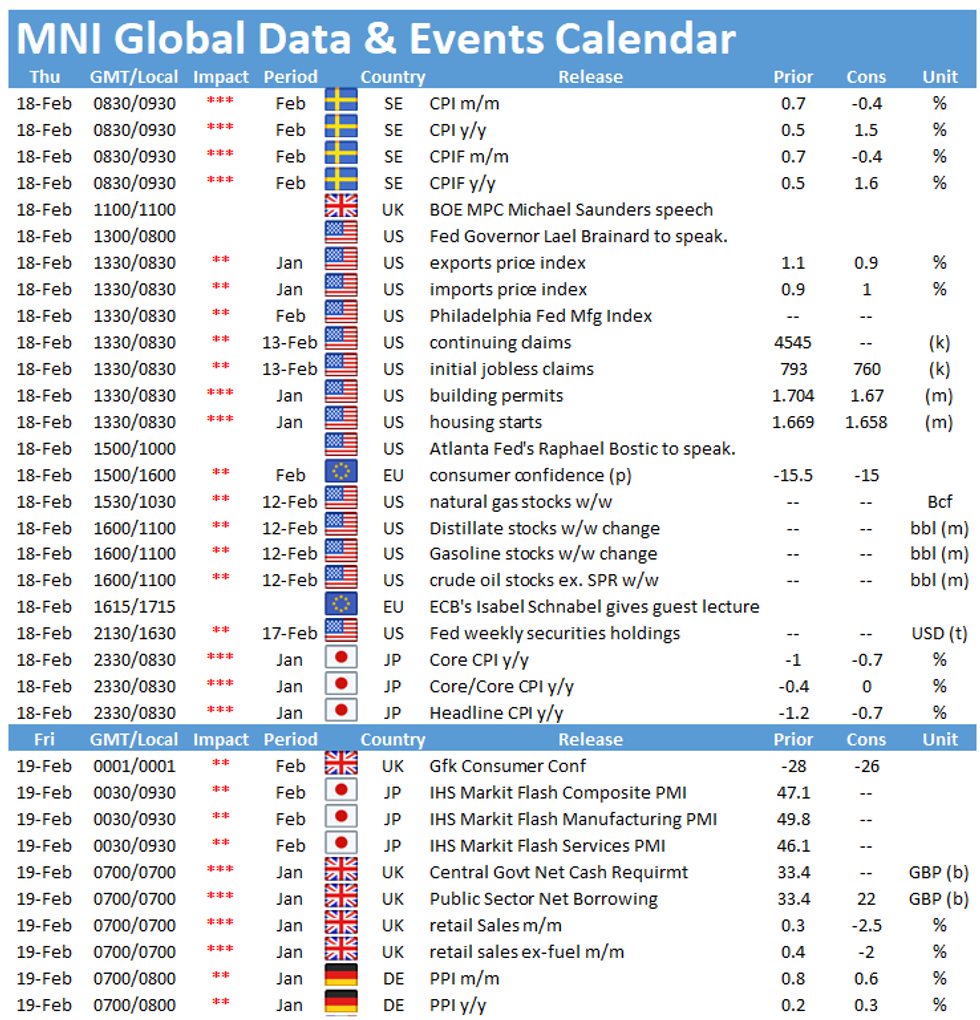

UP TODAY (TIMES GMT/LOCAL)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.