-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Meaningful Round Of Chinese Property Support Catches Many Off Guard

EXECUTIVE SUMMARY

- BETTER CPI ‘JUST ONE DATA POINT’ – FED’S WALLER (MNI)

- FED FACES TOUGH TASK DECIDING WHEN TO STOP RAISING RATES, DALY WARNS (FT)

- DEMS KEEP CONTROL OF SENATE (ABC)

- UK C’LLR HUNT: EVERYONE WILL HAVE TO PAY MORE TAX (BBC)

- HUNT GIVEN WARNING OF £70BN INCREASE IN UK GOVERNMENT BORROWING (FT)

- BIDEN LOOKS TO SET GUARDRAILS ON US-CHINA TIES IN XI MEETING (BBG)

- CHINA PLANS SWEEPING RESCUE POLICIES TO AVERT PROPERTY CRISIS (BBC)

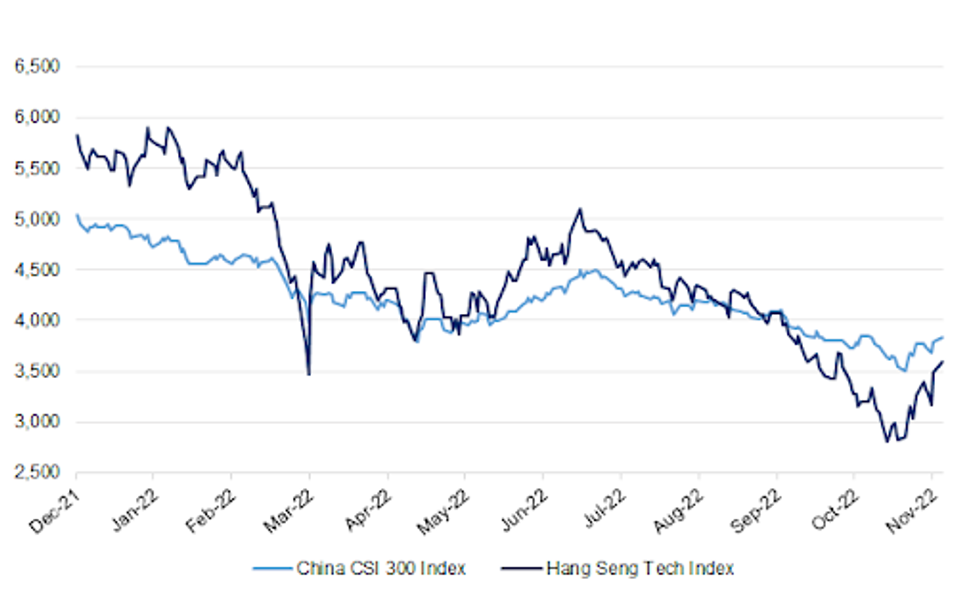

Fig. 1: CSI 300 Vs. Hang Seng Tech Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Chancellor Jeremy Hunt is planning a big package of spending cuts and tax increases in Thursday’s Autumn Statement after being warned that UK public borrowing will be about £70bn larger than expected. (FT)

FISCAL: Everyone will have to pay more tax under plans due to be announced on Thursday, Chancellor Jeremy Hunt says. Offering a message few ministers would risk saying out loud, Mr Hunt told the BBC: "I've been explicit that taxes are going to go up." (BBC)

FISCAL: Rishi Sunak warned last night that Britain would be punished by the financial markets if he did not raise taxes and cut spending, as ministers announced they were curtailing support for energy bills from April. (The Times)

FISCAL: British finance minister Jeremy Hunt is considering a big increase in a windfall tax on oil and gas firms and extending it to power generation firms as he tries to find ways to repair the country's public finances, sources said on Saturday. (RTRS)

FISCAL: British finance minister Jeremy Hunt said on Sunday a strong economy needed good public services and he would approach cuts to government departments in a "balanced way". (RTRS)

FISCAL: Proposals to allow local authorities to impose further rises in council tax next year are now “more likely than not”, as Jeremy Hunt looks for ways to ease inflationary pressures on social care. (The Times)

FISCAL/ENERGY: The Treasury is considering raising the energy cap from its current level of £2,500 from next April, with discussions in progress over whether to announce a new policy at next week’s autumn statement. (Guardian)

FISCAL/ENERGY: Energy handouts are set to be targeted at pensioners and those on benefits after April, as Jeremy Hunt seeks to cut the cost of the bailout. (Telegraph)

FISCAL/POLITICS: UK Chancellor Jeremy Hunt is expected to delay much of the £55 billion ($65 billion) of savings to fill the hole in the public finances until after the next election in an attempt to protect the economy and shore up Tory support as the country heads into recession. (BBG)

ECONOMY: Britain's labour force shortages are more of an issue for the economy than Brexit, finance minister Jeremy Hunt said on Sunday, adding that he would seek to address constraints that businesses are facing on hiring in his upcoming budget plan. (RTRS)

EUROPE

ECB: The European Central Bank could announce a start date for its quantitative tightening program following the December Governing Council meeting when policymakers will discuss balance sheet reduction, Bank of Spain Governor Pablo Hernandez de Cos said in an event in S’Agaro, Spain. (MNI)

ECB: The European Central Bank will probably receive several hundreds of billions of euros in early repayments of long-term loans this year after officials toughened the terms of the program to aid their fight against inflation. (BBG)

ITALY: The new Italian government will likely miss its fiscal targets as headwinds to growth remain in the euro area’s third biggest economy, credit agency Moody’s Corp. said in a statement. (BBG)

SPAIN: Spain has requested that the European Union make a third disbursement of pandemic recovery funds worth €6 billion ($6,2 billion), despite delays in the government implementing a system to audit the use of the money. (BBG)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- Fitch affirmed Malta at A+; Outlook Stable

- Fitch affirmed Slovenia at A; Outlook Stable

- Fitch affirmed Switzerland at AAA; Outlook Stable

- DBRS Morningstar confirmed Luxembourg at AAA, Stable Trend

U.S.

FED: Federal Reserve officials need to see more than just one better-than-expected CPI report before they can become comfortable inflation is coming down consistently, Fed Governor Christopher Waller said Sunday. (MNI)

FED: Boston Fed President Susan Collins said the central bank has more work to do to tame inflation, but the risks that the US central bank goes too far have increased after a string of large interest-rate increases. (BBG)

FED: The US central bank is entering a new phase of policy tightening that will be harder to navigate, a top official has warned, as pressure builds on the Federal Reserve to temper what has become one of its most aggressive campaigns to raise interest rates in decades. “This next phase of policymaking is much more difficult, because you have to be mindful of so many things,” Mary Daly, president of the San Francisco branch told the Financial Times. (FT)

ECONOMY: Higher interest rates and mounting fears of a downturn next year are biting into the morale of consumers, who are now expecting a worsening labor market, the head of the University of Michigan's Survey of Consumers, Joanne Hsu, told MNI. (MNI)

FISCAL: With odds of a split U.S. Congress rising, Treasury Secretary Janet Yellen warned that lawmakers' failure to raise the statutory limit on U.S. debt posed a "huge threat" to America's credit rating and functioning of U.S. financial markets. (RTRS)

FISCAL: The U.S. Senate will need to address the nation's debt ceiling in coming weeks, Majority Leader Chuck Schumer said on Sunday, vowing to tackle it and other major issues in a "productive" session before the current Congress ends. (RTRS)

FISCAL: Congress should move to pass either a permanent or very large extension of the debt limit during remainder of its current session, U.S. House Speaker Nancy Pelosi said on Sunday, noting that Republicans have said they plan to use the measure as leverage to target popular social benefit programs. (RTRS)

POLITICS: The 2022 midterm elections shaped up to be some of the most consequential in the nation's recent history, with control of Congress at stake. All 435 seats in the House and 35 of 100 seats in the Senate were on the ballot, as well as several influential gubernatorial elections in battleground states like Arizona, Georgia, Pennsylvania and Wisconsin. Democrats were defending their narrow majorities in both chambers and retained control of the Senate, though control of the House isn't yet clear. But a Republican flip of the lower chamber would be enough to curtail most of President Joe Biden's legislative agenda and would likely result in investigations against his administration and even his family. (ABC)

EQUITIES: Stocks are extending a rally sparked by hopes of a slowdown in inflation, but equity analysts have only gotten more pessimistic about what’s to come for a key driver of returns. After cutting S&P 500 earnings estimates for nine straight weeks, analysts have finally priced in negative earnings growth for the final quarter of this year. According to Bloomberg Intelligence, analysts now project S&P 500 earnings to decline 0.39% year-over-year in the fourth quarter, down from August’s expectations of 6% growth. (BBG)

OTHER

GLOBAL TRADE: Senior United Nations officials met with a Russian delegation in Geneva on Friday to discuss Moscow's grievances about the Black Sea grains export initiative and address the need for unimpeded food and fertilizer exports, a U.N. spokesperson said. (RTRS)

U.S./CHINA: President Joe Biden seeks to prevent US-China ties from deteriorating further in a meeting with Chinese leader Xi Jinping on Monday, American officials said ahead of the long-awaited sit-down. (BBG)

U.S./CHINA: US Treasury Secretary Janet Yellen will seek information on China’s Covid lockdown policies and its troubled property sector during a meeting with the head of the nation’s central bank this week, according to senior Treasury Department officials. (BBG)

G20: Russia and the US failed to agree on language for a joint statement following a multilateral summit in Cambodia, making it unlikely the Group of 20 nations will reach a consensus in Indonesia either this week. (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Monday that the BOJ should continue with monetary easing and help firms support economic activity. (MNI)

TURKEY: A suspect is in custody related to an explosion that killed at least six people and injured at least 81 others in Istanbul on Sunday, Turkey’s interior ministry said early Monday. The incident has been deemed a terrorist attack, Turkish Vice President Fuat Oktay said Sunday, according to state news agency Anadolu. (CNN)

MEXICO: Thousands of people marched in Mexico City on Sunday to protest the government’s plan to overhaul the nation’s electoral system. (BBG)

RUSSIA: U.S. Treasury Secretary Janet Yellen said some sanctions on Russia could remain in place even after any eventual peace agreement with Ukraine, raising the prospect of a long-term U.S. effort to squeeze Russia’s economy. (WSJ)

RUSSIA: Turkey is committed to seeking a peace dialogue between Russia and Ukraine, Turkish media cited President Tayyip Erdogan as saying on Saturday, as he accused the United States and other Western countries of provoking Moscow. (RTRS)

IMF: The IMF said G20 leaders should keep tightening fiscal and monetary policy to get inflation back under control even as the global economy shows more signs of tilting into recession. (MNI)

METALS: The London Metal Exchange decided against a ban on new deliveries of Russian metal, in a blow to big western aluminum producers and some traders who had lobbied the exchange to take action. (BBG)

OIL: Treasury Secretary Janet Yellen said it’s “very likely” that European sanctions will force Russia to offer some of its crude oil exports at a price set by the US and its allies, if Moscow wishes to prevent a shut-in of some supplies. (BBG)

OIL: The United States is happy for India to continue buying as much Russian oil as it wants, including at prices above a G7-imposed price cap mechanism, if it steers clear of Western insurance, finance and maritime services bound by the cap, U.S. Treasury Secretary Janet Yellen said on Friday. (RTRS)

CHINA

PROPERTY: China has unveiled its most sweeping rescue package to bail out a real estate market mired in a record slowdown and deepening liquidity crunch, according to people familiar with the matter. (BBG)

PBOC: The People’s Bank of China is expected to roll over the maturing CNY1 trillion medium-term lending facility with the same amount on Tuesday, which will plug a liquidity gap amid upcoming tax payments, China Securities Journal reported citing analysts. (MNI)

CORONAVIRUS: China’s top health officials said a sweeping overhaul to its Covid Zero playbook was a refinement of rules and not a relaxation of controls, dismissing interpretations that the changes were a step toward living with the virus. (BBG)

ECONOMY: Alibaba Group Holding Ltd. decided not to disclose full sales results for its signature Singles’ Day shopping festival for the first time, after forecasts that the figure may suffer a decline unprecedented in the event’s 14-year history. (BBG)

ECONOMY: China’s industrial production and consumption growth may slow in October amid Covid outbreaks and controls, though investment in infrastructure and manufacturing may remain high to offset declining real estate investment, Yicai.com reported citing analysts. (MNI)

BONDS: BlackRock, the world’s largest asset manager, has put off the launch of an exchange traded fund that invests in Chinese bonds, amid growing tensions between Washington and Beijing and a reversal in the gap between Chinese and US yields. (FT)

CHINA MARKETS

PBOC NET INJECTS CNY3 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) on Monday injected CNY5 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net injection of CNY3 billion after offsetting the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8667% at 9:41 am local time from the close of 1.8220% on Friday.

- The CFETS-NEX money-market sentiment index closed at 45 on Friday vs 43 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 7.0899 MON VS 7.1907 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0899 on Monday, compared with 7.1907 set on Friday, marking the biggest daily rise (1.40%) since FX reform in 2005.

OVERNIGHT DATA

NEW ZEALAND OCT BNZ-BUSINESS NZ SERVICES PMI 57.4; SEP 55.9

Expansion levels for New Zealand's services sector lifted in October, according to the BNZ - BusinessNZ Performance of Services Index (PSI). (BNZ)

UK NOV RIGHTMOVE HOUSE PRICE INDEX -1.1% M/M; OCT +0.9%

UK NOV RIGHTMOVE HOUSE PRICE INDEX +7.2% Y/Y; OCT +7.8%

MARKETS

SNAPSHOT: Meaningful Round Of Chinese Property Support Catches Many Off Guard

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 215.33 points at 28048.24

- ASX 200 down 11.651 points at 7146.3

- Shanghai Comp. up 13.964 points at 3101.677

- JGB 10-Yr future down 21 ticks at 149.27, yield up 0.1bp at 0.243%

- Aussie 10-Yr future down 11 ticks at 96.23, yield up 11bp at 3.764%

- U.S. 10-Yr future down 0-11+ at 111-30+, yield up 8.24bp at 3.8949%

- WTI crude up $0.04 at $88.99, Gold down $11.91 at $1759.35

- USD/JPY up 85 pips at Y139.66

- BETTER CPI ‘JUST ONE DATA POINT’ – FED’S WALLER (MNI)

- FED FACES TOUGH TASK DECIDING WHEN TO STOP RAISING RATES, DALY WARNS (FT)

- DEMS KEEP CONTROL OF SENATE (ABC)

- UK C’LLR HUNT: EVERYONE WILL HAVE TO PAY MORE TAX (BBC)

- HUNT GIVEN WARNING OF £70BN INCREASE IN UK GOVERNMENT BORROWING (FT)

- BIDEN LOOKS TO SET GUARDRAILS ON US-CHINA TIES IN XI MEETING (BBG)

- CHINA PLANS SWEEPING RESCUE POLICIES TO AVERT PROPERTY CRISIS (BBC)

US TSYS: Under Pressure On Chinese Stimulus & As Waller Echoes Powell

Cash Tsys run 5-8bp cheaper across the curve after their elongated weekend, bear flattening. Meanwhile, TYZ2 deals around the midpoint of its 0-09+ range, printing -0-09+ at 112-00+ on healthy volume of just under 125K into London hours. Note that all of the major benchmarks operate comfortably within their recent respective ranges.

- News of a notable round of support for the Chinese property space, coupled with some hawkish Fedspeak from Waller (who echoed tones from Chair Powell’s post-meeting press conference, while conceding that the Fed could step the pace of hikes down to 50bp in December) applied some pressure in early Asia-Pac trade.

- Note that an FT interview with San Francisco Fed President Daly got far less attention, with the piece seeing Daly stress focus on the level of terminal interest rates, as opposed to the pace it will take to reach the peak of the current cycle, while she also highlighted the increased level of difficulty that will become evident during the upcoming stage of tightening.

- A reversal of the early bid in Chinese equities may have helped limit Tsy losses in Asia.

- Communique surrounding the impending Biden-Xi meeting will now be eyed ahead of NY hours. Further out, Monday will see Fedspeak from Brainard and Williams, with the latter’s comments set to cross in the NY-Asia crossover.

JGBS: Steeper To Start The Week

JGBs were pressured by the global matters that we have touched on elsewhere, while familiar tones re: policy direction and inputs from BoJ Governor Kishida, alongside continued headwinds for Japanese PM Kishida’s cabinet approval ratings, provided little in the way of meaningful market reaction.

- JGB futures came under some secondary pressure during the Tokyo afternoon, with the contract printing -22 into the close, while the bearish steepening of the curve extended as the day wore on, leaving the major cash JGB benchmarks running little changed to 8bp cheaper ahead of the bell. 10-Year yields were capped by their proximity to the upper end of the BoJ’s permitted trading band.

- The latest round of BoJ Rinban operations (covering 1- to 3-, 5- to 10- & 25+-Year JGBs) failed to provide any meaningful support, with the breakdown of the results somewhat unremarkable in offer/cover terms.

- Looking ahead, preliminary GDP data and 5-Year JGB supply headline domestic matters on Tuesday.

AUSSIE BONDS: Cheapening Evident On Monday, Global & Domestic Factors At Work

The impetus from hawkish Fedspeak and a meaningful round of support for the Chinese property sector biased ACGBs lower from the off on Monday.

- The launch and subsequent pricing of A$1.7bn of the new NSWTC Fed-35 bond then provided a local source of weight for the space.

- There wasn’t much else to go off in terms of domestic headline flow, which left the major cash ACGBS running 9-11bp cheaper at the bell, with the intermediate area of the curve leading the way lower. YM & XM hovered at/just above their respective session bases at the close, finishing 10.0 & 11.0 lower on the day, respectively.

- EFPs were marginally narrower on the day.

- Bills were 1-12bp cheaper through the reds, bear steepening.

- RBA dated OIS ticked higher on the day, with a terminal cash rate pricing of ~3.90% observed come the bell (10bp or so higher vs. Friday).

- Looking ahead, Tuesday’s domestic docket includes the release of the minutes from the latest RBA monetary policy meeting, with the Bank’s review of its forward guidance scheme set to cross at the same time.

NZGBS: NZGBs Hold Cheaper On The Day, With Local Issuance & Global Matters At Work

NZGBs meandered through the second half of Monday trade, after an early round of cheapening centring on some hawkish Fedspeak, meaningful support for the Chinese property sector and confirmation of the launch of the green NZGB May-34, which will price tomorrow.

- The lack of a lasting bid in the global equity space, despite the presence of the aforementioned Chinese support package for the property sphere, likely limited the weakness witnessed.

- That left the major NZGBs 4-6bp cheaper at the bell, with some light bear flattening in play.

- Meanwhile, swap rates were little changed to ~9bp higher, resulting in mixed swap spread performance as shorter dated spreads narrowed and longer dated spreads widened.

- RBNZ dated OIS pricing was incrementally higher on the day, leaving terminal OCR pricing just below 5.10%.

- Looking ahead, the pricing of the aforementioned green NZGB syndication and REINZ house price data headline the local docket on Tuesday.

EQUITIES: China Property Stocks Surge On Fresh Policy Support

HK/China stocks have continued to rally, following further support measures announced for the property sector. Trends elsewhere in the region are more mixed though, with lower US futures likely weighing at the margin. The main US indices are off by around -0.20-0.40% at this stage. Hawkish Fed speak at the start of the Asia session has been a likely headwind.

- The HSI shot higher at the open, but run into resistance around the 18000 level. The index is still 2.9% higher for the session and is moving back towards this resistance level. The tech sub index is +3.3% higher.

- The CSI 300 is up 1.15%, while the Shanghai Composite Index is +0.7%, led by the property sub-index, +4.5%. This follows China's release of a 16 point plan around addressing issues in the housing sector. This came straight after the 20-point plan around adjusting CZS. Coming up later is a meeting between China President and US President Biden ahead of the G20 meetings in Bali (the meeting takes place at 5:30pm Bali time, which is 9:30am BST).

- The NIkkei 225 is down around 0.80% at this stage, led by the tech sector, while the Kospi has struggled to stay in positive territory. The Taiex has done better, up by 1.35% at this stage.

- The ASX 200 is down slightly, despite generally positive commodity price gains. Weakness in consumer/finance names has outweighed gains from resource stocks.

OIL: Optimism On China Supports Prices

Oil prices are up slightly on the day with WTI trading around $89.15/bbl +0.2% and Brent around $96.30 +0.3%, boosted by expectations of increased Chinese demand in a persistently tight market. However, prices are still below the early November highs.

- China eased some Covid restrictions while providing a package to support its troubled property sector. Since China is the world’s largest importer of crude, these developments are seen as potentially increasing global oil demand. Given the tightness of supply heading into the Northern Hemisphere winter, these expectations could support prices going forward as global growth slows.

- WTI prices are around their 10-day simple moving average, but remain above the 20- and 50- day MA.

- Tonight there are a number of Fed speakers, who may take the opportunity to remind markets that rates are still rising. Hawkish comments could boost the USD and weigh on oil prices.

GOLD: Edges Down From Last Week's Multi-Month Highs

Gold is down slightly from closing levels at the end of last week. We were last around $1763.50, -0.45% for the session. This is line with a slightly firmer USD picture against the majors. $1771.24 was last week's closing level.

- US yields have re-opened to a firmer tone, aided by hawkish Fed speak at the start of today's session. This has weighed on gold via the firmer USD backdrop.

- The precious metal has been supported on dips back towards $1760 today, but like elsewhere may be seeing some modest consolidation post last week's +5.31% rally.

- On the topside the simple 200-day MA sits at $1804.13, while pre-US CPI print levels from last Thursday come in just under $1710, which presumably should act as a support point.

- Gold ETF holdings have also started to stabilize, after being in a sharp downtrend since mid-June.

FOREX: Hawkish Fedspeak Bolsters USD, China Real Estate Support Package Aids Risk

Hawkish Fedspeak set the tone of the Asia-Pac session, with U.S. Tsy yields rising 5.6-8.8bp across the curve after Fed Governor Waller played down the significance of the recent below-forecast U.S. CPI reading when interpreted in isolation, casting doubt on expectations of an imminent peak in the rate-hike cycle. The BBDXY index crept higher, adding 0.38% through the session.

- Thin morning liquidity accentuated the upswing in USD/JPY in reaction to Waller's comments, with the yen taking a hit due to its sensitivity to relative U.S./Japan yield dynamics. Spot USD/JPY ran as high as to Y139.94 before trimming gains into the Tokyo fix. Positive risk tone helped keep the yen in check, along its safe-haven peer CHF.

- Sentiment was buoyed by China's announcement of new support measures for the domestic property sector. Spot USD/CNH went offered, lodging fresh multi-week lows in the process, with the rate bottoming out at CNH7.0211. The in-line PBOC fix briefly limited selling pressure, but the pair's weakness resumed promptly thereafter.

- Commodity-tied FX were bolstered by China's real estate rescue package, despite hawkish Fed comments. Antipodean cross AUD/NZD faltered, even as Australia/New Zealand 2-year swap spread reversed initial losses.

- Sterling lagged its G10 peers. Over the weekend, UK C'llr Hunt said his new financial plan will seek to make any recession "as short and shallow as possible."

- EZ industrial output headlines the thin data docket for the remainder of the day. Comments are due from Fed's Brainard & Williams, as well as ECB's de Guindos, Panetta, Centeno & Nagel.

FX OPTIONS: Expiries for Nov14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0000(E1.2bln), $1.0025-30(E568mln)

- GBP/USD: $1.1715(Gbp557mln)

- AUD/USD: $0.6920-30(A$903mln)

- EUR/JPY: Y146.00(E1.4bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/11/2022 | 1000/1100 |  | EU | ECB Panetta Speech at CEPR-EABCN Conference | |

| 14/11/2022 | 1000/1100 | ** |  | EU | Industrial Production |

| 14/11/2022 | - |  | UK | House of Commons Returns | |

| 14/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 14/11/2022 | 1345/0845 |  | CA | BOC's Macklem opening remarks at diversity conference | |

| 14/11/2022 | 1600/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 14/11/2022 | 1615/1715 |  | EU | ECB de Guindos Speech at Euro Finance Week | |

| 14/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 14/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 14/11/2022 | 1630/1130 |  | US | Fed Vice Chair Lael Brainard | |

| 14/11/2022 | 2330/1830 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.