-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - ECB Set to Deliver Third Consecutive Cut

MNI China Daily Summary: Thursday, December 12

MNI EUROPEAN OPEN: Moderna CEO Triggers Risk-Off Flows

EXECUTIVE SUMMARY

- MODERNA CHIEF PREDICTS EXISTING VACCINES WILL STRUGGLE WITH OMICRON (FT)

- FED'S POWELL TO TESTIFY OMICRON POSES DOWNSIDE RISKS (MNI)

- YELLEN: FAILURE TO DEAL WITH DEBT LIMIT WOULD 'EVISCERATE' U.S. ECONOMIC RECOVERY (RTRS)

- OFFICIAL CHINA PMIS BEAT EXP.

- ECB’S DE GUINDOS: ECB TO CONTINUE BOND BUYING THROUGHOUT 2022 (RTRS)

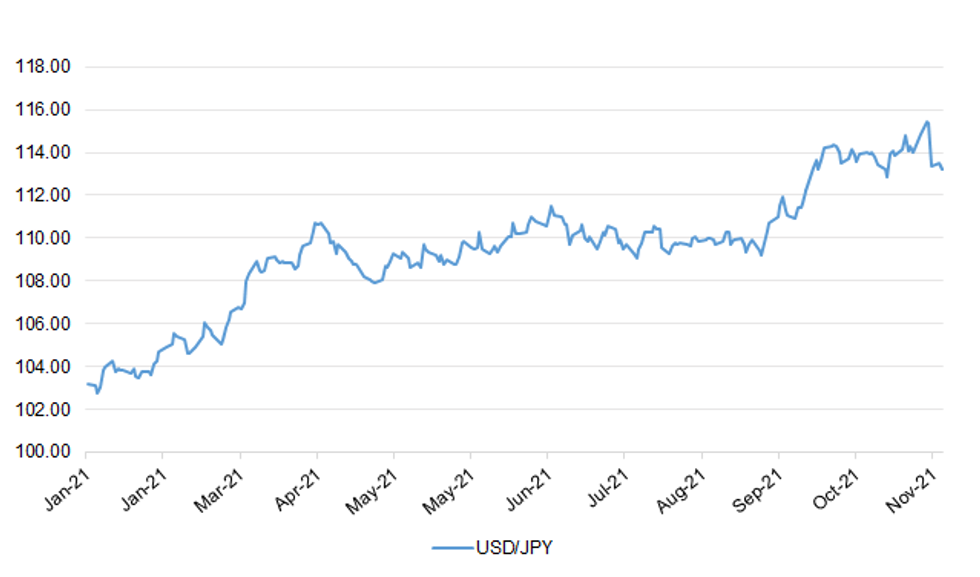

Fig. 1: USD/JPY

Source: MNI - Market News/Deutsche Bank/Bloomberg

Source: MNI - Market News/Deutsche Bank/Bloomberg

UK

CORONAVIRUS: UK business leaders have warned ministers that the new Covid-19 variant could dampen consumer confidence in the run-up to Christmas, and called for clarity over further restrictions if cases continue to rise. Business secretary Kwasi Kwarteng and other officials held a series of meetings with businesses on Monday to discuss the government’s next steps to restrain the Omicron variant, after the number of cases in the UK increased to 11. Under new measures announced on Saturday night, the contacts of those who catch the new variant in England must self-isolate for 10 days. In an online meeting, business groups raised concerns with Kwarteng about a potential “second pingdemic” if there is a sharp rise in infections, leading to a wave of people being ordered to stay at home, according to people on the call. (FT)

CORONAVIRUS: Retailers are worried about staff being abused as rules on mask-wearing are reintroduced and argue that it should not be the job of staff to enforce them, industry bodies have said. The British Retail Consortium (BRC) said enforcement "must remain the duty of the authorities". The Association of Convenience Stores (ACS) said it would urge members to communicate rules but not challenge those who refuse to follow them. (Sky)

POLITICS: Yvette Cooper is elevated to shadow home secretary while Lisa Nandy will move from shadow foreign secretary to the levelling up brief as Labour leader Sir Keir Starmer reshuffles his cabinet. Ms Cooper, who held the home affairs brief previously from 2011 to 2015 under former Labour leader Ed Miliband, will depart her current role as chair of the influential Commons home affairs select committee in returning to the shadow cabinet. She will go head to head with Home Secretary Priti Patel on the issue of migrant crossings. Ms Nandy will now shadow Levelling Up Secretary Michael Gove, while David Lammy has been promoted into her former shadow foreign secretary role from the justice brief. (Sky)

SCOTLAND: Scotland’s government will next year start formal preparations for a second referendum on independence from the UK that it wants to hold before the end of 2023, the country’s first minister Nicola Sturgeon said on Monday. Her comments, in the closing speech to her Scottish National party’s conference, set the stage for a heightened constitutional stand-off with the UK government. (FT)

EUROPE

ECB: The European Central Bank is likely to keep buying bonds through next year to boost the bloc's economy but 2023 is less clear, ECB Vice President Luis de Guindos told French newspaper Les Echos on Tuesday. The comments indicate that no rate rise will come next year as the ECB's policy guidance stipulates that any interest rate increase would only come "shortly after" quantitative easing ends. "I’m confident that those net purchases will continue throughout next year. Beyond that, I don’t know," de Guindos said. (RTRS)

SWEDEN: Sweden has identified its first case of the omicron variant of Covid-19, the nation’s Public Health Authority said on its website. The person had recently visited southern Africa and lives in southern Sweden. (BBG)

U.S.

FED: MNI: Fed's Powell To Testify Omicron Poses Downside Risks

- The Omicron variant poses downside risks to employment and economic activity and increased inflation uncertainty, Federal Reserve Chair Jerome Powell will tell Congress Tuesday. "Greater concerns about the virus could reduce people’s willingness to work in person, which would slow progress in the labor market and intensify supply-chain disruptions," Powell said in prepared testimony for the U.S. Senate Banking Committee. While Powell did not directly address the outlook for monetary policy, the Chair said there is still ground to cover to reach maximum employment for both employment and labor force participation, and "we expect progress to continue - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: The Senate Banking Committee is considering hearings as early as December on the nominations of Federal Reserve Chair Jerome Powell for a second term as leader of the nation’s central bank and the elevation of Fed Governor Lael Brainard to become vice chair. Sherrod Brown, the panel’s chairman and an Ohio Democrat, said he wants to move quickly on confirming both Fed policymakers, although the exact timing of their hearings isn’t set. Brown said he’d comply with a rule that confirmation hearings come at least two weeks after the White House sends the Senate paperwork formalizing them as President Joe Biden’s selections. Brown added that he expects the paperwork this week and expressed confidence that both Powell and Brainard would be confirmed by the full Senate, which is now split 50-50 between both parties. (BBG)

FED: Although the U.S. labor market's recovery from the depths of the pandemic seems volatile and uneven, a research paper released Monday by the Federal Reserve Bank of San Francisco said the rebound looks more like past cycles than may appear. The key factor is that most of the surge in joblessness as the pandemic struck last year came in the form of temporary layoffs. "After we account for the unusual surge in temporary layoffs, the unemployment pattern in the current recovery is actually similar to the past," Robert Hall and Marianna Kudlyak wrote. "Workers on temporary layoff depart from unemployment quickly, mainly because they are recalled to their existing jobs, but also because some take new jobs or leave the labor force." Now, the economy is working to get those who had completely lost jobs back into the labor force, the authors added. (WSJ)

ECONOMY: President Joe Biden hosted the CEOs of several major retailers at the White House on Monday to discuss administration efforts to tackle global supply chain bottlenecks, and to reassure Americans that goods will be on shelves for the holidays. (CNBC)

FISCAL: U.S. Treasury Secretary Janet Yellen urged Congress to raise the U.S. debt limit or risk undermining what she described as the U.S. economy's "quite remarkable" recovery from the COVID-19 pandemic. Yellen, in remarks prepared for a Senate Banking Committee hearing on Tuesday, said she was confident "at this point" that U.S. economic growth remained strong, but said failure to deal with the debt limit would "eviscerate" the recovery. She also called on Congress to pass President Joe Biden's $1.75 trillion social and climate spending bill, saying it would end the "childcare crisis" and let parents return to work. (RTRS)

FISCAL: Democratic Senator Joe Manchin said Monday he won’t commit yet to Senate Majority Leader Chuck Schumer’s timetable for moving ahead on President Joe Biden’s nearly $2 trillion tax and spending bill before the end of the year. The West Virginia lawmaker said he’s still reviewing a version of the legislation passed two weeks ago by the House, and has made no decisions about timing for debate and whether he can support a bill after the Senate completes its own draft. He said he remains opposed to the paid family leave provision in the House measure. Schumer said on the Senate floor Monday that his “goal” is to finish and pass the legislation before Congress breaks for the Christmas holiday. (BBG)

FISCAL: Two Democratic U.S. senators said on Monday they are in talks with a key fellow Democrat over his objections to a proposal to provide a $4,500 tax incentive for union-made U.S. electric vehicles as part of the "Build Back Better" legislation before the Senate. (RTRS)

FISCAL: Negotiations in the Senate over expanding the state and local tax deduction hit a new snag with two key lawmakers at odds over whether the plan should raise revenue for other spending priorities in President Joe Biden’s economic agenda. Senator Bob Menendez, a New Jersey Democrat, told reporters Monday that Senator Bernie Sanders has “walked away” from a previously-agreed-to plan that changes to the deduction be revenue neutral over the 10-year budget window, which would allow for a more generous tax break. Sanders said on Monday he wants the reworked SALT deduction to raise revenue -- which he says could amount to a couple hundred billion dollars -- to pay for expanding dental and vision health coverage under Medicare. (BBG)

FISCAL: State and local governments distributed more than $2.8 billion in emergency rental assistance funds to more than 521,000 renters in October, the U.S. Treasury Department said on Monday, forecasting that $25 billion to $30 billion in such funds would be spent or obligated by the end of the year. (RTRS)

CORONAVIRUS: U.S. President Biden tweeted the following on Monday: “It will be a few weeks before we know everything we need to know about how strongly the existing vaccines protect against the new variant. But Dr. Fauci and our medical team believe that our vaccines will continue to provide a degree of protection against severe disease.” (MNI)

CORONAVIRUS: President Biden on Monday said that the new coronavirus variant, Omicron, is "a cause for concern, not a cause for panic." Biden said later this week the administration will be releasing a strategy on how "we're going to fight COVID this winter. Not with shutdowns or lockdowns, but with more widespread vaccinations, boosters, testing and more." (Axios)

CORONAVIRUS: Dr. Anthony Fauci, the nation's top infectious diseases expert, said Monday that he doesn't anticipate the United States will implement additional travel restrictions even if the Omicron variant proves worse than previous strains of Covid-19. (CNN)

CORONAVIRUS: President Joe Biden said Monday he is directing federal agencies to be prepared to move as quickly as possible to approve additional vaccines or boosters tailored to shield against the new omicron coronavirus variant. The current Covid vaccines are believed to provide at least some protection from the heavily mutated omicron strain, and booster shots “strengthen that protection significantly,” Biden assured Americans in a speech at the White House. (CNBC)

CORONAVIRUS: The Food and Drug Administration could authorize Covid-19 boosters from Pfizer Inc. and BioNTech SE for use in 16- and 17-year olds as soon as next week as concerns rise over the possible spread of a new, possibly more transmissible variant, according to a person familiar with the planning. (WSJ)

CORONAVIRUS: Federal workers will not be punished for failing to comply with President Joe Biden's vaccination mandate until next year, the White House announced Monday. The deadline for federal workers to receive the vaccine or face suspension or firing was Nov. 22. The White House said 96.5% of the 3.5 million employee workforce, the country's largest, has already complied. A spokesperson for the Office of Management and Budget said Monday that the deadline was “not a cliff and that our goal is to protect workers, not penalize anyone.” (NBC)

CORONAVIRUS: A federal judge in Missouri issued an order Monday partially blocking the Biden administration from implementing a vaccine mandate for certain health care workers. The judge's order, which covers the 10 states that brought the case, played down the effectiveness of the vaccines and said that the "public would suffer little, if any, harm from maintaining the 'status quo' through the litigation of this case." The mandate came out of the US Department of Health and Human Services' Centers for Medicare and Medicaid Services. It covers certain health care staff at providers that participate in Medicare and Medicaid, and set a December 6 deadline for those workers to have received the first dose of the Covid-19 vaccine. (CNN)

CORONAVIRUS: The Centers for Disease Control and Prevention strengthened its COVID-19 booster-shot recommendations, reflecting the threat the new omicron variant poses to the pandemic response in the U.S. and worldwide. The CDC on Monday recommended that everyone 18 and older get an additional shot after completing a first course of COVID-19 vaccination. The agency said earlier this month that people under 50 could get an additional dose and encouraged vaccination for those 50 and above. (MarketWatch)

CORONAVIRUS: New York Governor Kathy Hochul said there were no reported cases of the omicron variant in the state but she was monitoring infections found nearby in Ontario, Canada. At a briefing Monday, she said she was focused on getting more of the state vaccinated and planned to tap its National Guard to help administer booster shots at nursing homes. (BBG)

OTHER

GLOBAL TRADE: Commerce Secretary Gina Raimondo on Monday urged the U.S. House to immediately pass legislation that supports American production of semiconductor chips to avoid future supply interruptions and lower the country’s dependence of the parts from China. Speaking in the Motor City, Raimondo used an ongoing global shortage of chips that has depleted vehicle inventory levels and caused rolling shutdowns of U.S. auto plants as proof that the country needs to onshore its supply chains for critical components such as semiconductor chips. (CNBC)

GLOBAL TRADE: China aims to have more than 15 local software companies with annual revenue surpassing 100b yuan each by 2025, according to a five-year plan on software development issued by the industry ministry. Plan urges speeding up development of software technology and products in cloud computing, big data, AI, 5G and blockchain sectors. The ministry also released a five-year plan on integration of IT and industrial sector, which calls for faster development of industrial chips and software and boosting capability of intelligent manufacturing. (BBG)

GLOBAL TRADE: In a sign that the global supply of chips for the auto industry is improving after months of shortages, inventories have risen for the first time in nine months at leading suppliers, Nikkei has learned. (Nikkei)

GLOBAL TRADE: The U.S. Federal Trade Commission said on Monday it has started an investigation into supply chain disruptions and has ordered nine large companies to provide detailed information about the situation. (RTRS)

CORONAVIRUS: The chief executive of Moderna has predicted that existing vaccines will be much less effective at tackling Omicron than earlier strains of Covid-19 and warned it would take months before pharmaceutical companies can manufacture new variant-specific jabs at scale. Stéphane Bancel said the high number of Omicron mutations on the spike protein, which the virus uses to infect human cells, and the rapid spread of the variant in South Africa, suggested the current crop of vaccines may need to be modified next year. “There is no world, I think, where [the effectiveness] is the same level . . . we had with Delta,” Bancel told the Financial Times in an interview at the company’s headquarters in Cambridge, Massachusetts. (FT)

CORONAVIRUS: Pfizer Inc.’s top executive said the company will know within two to three weeks how well its Covid-19 vaccine holds up against the new omicron variant, and even in a worst-case scenario he expects the existing formula will retain some efficacy against the heavily mutated strain. The company is currently conducting lab tests to see how antibodies generated by the existing vaccine work against the new variant, Chief Executive Albert Bourla said on Bloomberg Television’s “Balance of Power with David Westin.” (BBG)

JAPAN: Finance Minister Shunichi Suzuki says the Japanese government has serious concerns about how the omicron variant of the coronavirus could impact the economy. Difficult to say at this stage what impact omicron will have on the economy and what support measures might be needed. Omicron’s characteristics are still unclear. Separately, he says currency stability is important and he will continue to closely monitor the impact of FX on the economy. Also says he’s seeking swift passage of Japan’s extra budget through parliament. Important that government keep medium- and long-term goals for its budgets. (BBG)

NEW ZEALAND: New Zealand’s opposition has announced a new leader, former airline boss Christopher Luxon, after its leader Judith Collins flamed out of the role last week. The National party emerged from its caucus meeting on Tuesday to announce Luxon, a political novice and former Air New Zealand chief executive, would be taking the party’s helm. He will be National’s fifth leader in as many years, and will work alongside deputy Nicola Willis. The party was forced into a new leadership vote last week, after leader Judith Collins self-destructed in an ill-fated attempt to take down political rival Simon Bridges. Luxon promised a new era for the National party, which has spent much of its recent years embroiled in leadership battles and minor scandals and plagued by bleak polling. (Guardian)

RBNZ: New Zealand’s central bank would consider risks to be pointed more in favor of faster monetary tightening had market interest rates not risen so much already, its chief economist said. “If we were sitting here and still seeing very low interest rates, then you might say the risks are actually more on the upside,” Yuong Ha said in an interview Tuesday in Wellington. “But market pricing has moved a long way in a very short space of time.” The Reserve Bank last week raised its official cash rate for the second time in two months, to 0.75%, and projected a tightening cycle that will take it to about 2.5% over the coming two years. The key downside risk to that outlook is how households respond to the spread of Covid-19 in New Zealand, while the main upside risk was faster inflation becoming embedded, the RBNZ said. But Ha said the downside risks, including the emergence of the Omicron coronavirus variant, were unlikely to change the picture of rising price pressures. (BBG)

IRAN: EU, Iranian and Russian diplomats sounded upbeat as Iran and world powers held their first talks in five months on Monday to try to save their 2015 nuclear deal, despite Tehran taking a tough stance in public that Western powers said would not work. Diplomats say time is running out to resurrect the pact, which then-U.S. President Donald Trump abandoned in 2018 in a move which infuriated Iran and dismayed the other powers involved - Britain, China, France, Germany and Russia. European Union, Iranian and Russian delegates to the talks offered optimistic assessments after the new round began with a session of the remaining parties to the deal, without the United States - whom Iran refuses to meet face-to-face. (RTRS)

IRAN: In a statement following the talks, the Iranian foreign ministry said that Iran’s top negotiator Ali Bagheri Kani emphasised to the participants that Iran is serious about reaching a “fair agreement” that would secure Iran’s legitimate interests. “So long as the US’ maximum pressure campaign breathes, reviving the JCPOA is nothing more than exorbitant talk,” the negotiator was quoted as saying. (Al Jazeera)

IRAN: Israel has shared intelligence over the past two weeks with the U.S. and several European allies suggesting that Iran is taking technical steps to prepare to enrich uranium to 90% purity — the level needed to produce a nuclear weapon, two U.S. sources briefed on the issue tell me. Enriching to 90% would bring Iran closer than ever to the nuclear threshold. The Israeli warnings come as nuclear talks resume in Vienna, with Iran returning to the negotiating table on Monday after a five-month hiatus. (Axios)

IRAN: The United States should remove all sanctions inconsistent with Iran's 2015 nuclear agreement with major powers, including those that apply to China, the Chinese envoy to Iran nuclear talks said on Monday. (RTRS)

METALS: Vale SA just gave some much needed supply-side support to a nascent recovery in iron ore prices, trimming its production guidance for this year and issuing a lower-than-expected projection for next year. The world’s second-largest producer of the steelmaking ingredient now expects to produce 315-320 million metric tons this year, compared with previous guidance of 315-335 million tons. Next year, Vale anticipates 320-335 million tons compared with a 346 million-ton consensus among analysts. Vale is defending margins by withholding some lower-quality supply and seeking $1 billion in cost savings after iron ore futures tumbled in recent months as China limited steel output to contain pollution and power use.

OIL: The United States is not reconsidering a plan to release strategic oil reserves, after a drop in oil prices related to the new Omicron COVID-19 variant, White House press secretary Jen Psaki said Monday. (RTRS)

OIL: President Joe Biden’s administration stands ready to release even more barrels of oil from its strategic reserves should the need arise again, according to the U.S. State Department’s senior advisor for global energy security. “Absolutely. This is a tool that was available to us and will be available again,” Amos Hochstein told CNBC’s Hadley Gamble in Dubai, the United Arab Emirates on Monday. (CNBC)

OIL: Canada's Trans Mountain said on Monday it was "still days away" from restarting the key oil pipeline at a reduced capacity as heavy rains continue to impede restoration efforts. The pipeline, owned by the Canadian government, ships 300,000 barrels a day of crude and refined products from Alberta to the Pacific Coast. It was temporarily shut down as heavy rains and flooding caused widespread disruption in parts of British Columbia. The operator said assessments of the impacts from the latest storm are being undertaken with a focus on the Coldwater and Coquihalla regions. (RTRS)

CHINA

PBOC: The PBOC may increase liquidity injection via reverse repos, renew maturing MLFs with excess, or even cut banks' reserve ratios, to keep year-end liquidity stable and prevent any upsurge in market rates, the Securities Daily reported citing analyst Wang Qing with Golden Credit Rating. Increasing reverse repos and MLF can meet the liquidity gap in December, but an RRR cut is still possible by yearend if the PBOC is to send a pro-growth signal and boost credit and aggregate finance, Wang was cited as saying. There will be CNY950 billion MLF maturing in December, which will be the second-highest this year, along with local government bond issuance, and assessment on banks to drain liquidity, the daily said. (MNI)

YUAN/PBOC: China should consider increasing the allocation of U.S. dollar assets in its foreign exchange reserves, adhere to a prudent monetary policy, improve global policy communication and establish a risk warning system to effectively respond to the impact of the shift in U.S. monetary policy, said the Economic Daily in a commentary. The rebound of the dollar index will help ease the continued appreciation pressure of the Chinese yuan, though the currency will still be supported by China’s exports and move in two ways, the newspaper said. The narrowing China-U.S. interest spread may lead to faster foreign capital outflows, and commodity prices may become more volatile, the newspaper said. (MNI)

FISCAL: Debt raised through China’s so-called local government financing vehicles rose to CNY5.1 trillion this year, CNY400 billion more than the previous record, as loose liquidity helped these entities owned by local authorities borrow more funds, the 21st Century Business Herald said using data by Wind. As usual, most of the money raised was for repaying debt and the net capital raised, at CNY1.65 trillion, was lower than that of 2020, it said. Under China’s tiered management of these debt instruments, the proportion of lower-credit debt has declined, the more developed regions are raising more debt while debt by those of low credit standings has sharply fallen, said the newspaper. As of Nov. 28, China’s outstanding LGFV debt stood at CNY12.75 trillion, the newspaper said. (MNI)

ECONOMY: The economies of most Chinese provinces slowed in the third quarter of 2021, driven by production disruptions caused by power shortages and distress in the property sector. The pace of recovery will come under pressure while headline growth will be marginally lower in the fourth quarter, according to a new report by Moody's Investors Service. "Economic recovery remains unstable and uneven – GDP stood at 9.8% in the first three quarters of 2021, down from 12.7% in the first half of the year. The two-year average growth rate for the first three quarters of the year was 5.3%, still lower than pre-pandemic growth of 6.0% for the same period of 2019," says Yubin Fu, a Moody's Vice President and Senior Analyst. "Of China's (A1 stable) 31 provinces, only three – Jilin, Hainan and Shandong – recorded a two-year average growth rate that was higher than pre-pandemic levels," adds Fu. (Moody's)

CORONAVIRUS: China's existing Covid-19 containment strategy, characterised by resolute and prompt responses to cut transmission and tackle new outbreaks, should be sufficient for tackling the new Omicron variant of the novel coronavirus, Chinese health experts and officials said. They added that the country's zero-Covid policy should continue to be enforced this winter and spring, as new modelling shows that dropping it prematurely would risk causing "a colossal outbreak". (Straits Times)

HUARONG: China Huarong Asset Management Co.’s 18 strategic investors have set up a private equity fund to inject cash into the bad-debt manager, Caixin reports, citing business registration data. Zhongbaorongxin Private Equity Fund Co. has registered capital of 14.8 billion yuan ($2.3 billion), with Jia Biao, president of China Insurance Investment Co., as the representative of the company. (BBG)

POLICY: China issued guidance on Tuesday to strengthen protection of employee rights and interests in new transport sectors. In a statement, the transport ministry said ride-hailing companies should improve income distribution mechanisms and provide social insurance for drivers. (RTRS)

ENERGY: China’s economic planning agency recently held a seminar with the nation’s coal industry association on setting up a mechanism to strengthen monitoring of coal production and trade cost, according to an NDRC statement. Coal firms say their costs are affected by multiple factors, including mining condition, technological capability, investment in mining safety and environmental protection as well as transportation. China will set up a coal cost survey system as soon as possible after receiving industry feedbacks, NDRC says, without giving timetable. (BBG)

OVERNIGHT DATA

CHINA NOV MANUFACTURING PMI 50.1; MEDIAN 49.7; OCT 49.2

CHINA NOV NON-MANUFACTURING PMI 52.3; MEDIAN 51.5; OCT 52.4

CHINA NOV COMPOSITE PMI 52.2; OCT 50.8

MNI BRIEF: China Manufacturing PMI Rebounds To 3-Month High

- The China Purchasing Managers' Index (PMI) rebounded to 50.1 in November from October's 49.2, back to expansion above the breakeven 50 level, hitting the highest in three months, as an electricity crunch eased and the prices of some raw materials dropped significantly, data from the National Bureau of Statistics on Tuesday showed. Both production and demand recovered, with the production and the new order sub-index rising to 52.0 and 49.4, respectively, up 3.6 and 0.6 percentage points from October. New export orders also rebounded 1.9 pps to 48.5 with the Christmas spending season approaching. The non-manufacturing service index decreased slightly by 0.1 pp to 52.3, remaining a steady recovery - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN OCT, P INDUSTRIAL PRODUCTION +1.1% M/M; MEDIAN +1.9%; SEP -5.4%

JAPAN OCT, P INDUSTRIAL PRODUCTION -4.7% Y/Y; MEDIAN -4.4%; SEP -2.3%

MNI BRIEF: Japan October Industrial Output Posts Gain

- Japan's industrial output posted the first m/m rise in four months, up 1.1% in October, showing that automobile production is gradually recovering from a decline caused by the shortage of auto-parts, the Ministry of Economy, Trade and Industry showed. The October increase was due mainly to higher production, +15.4%, for the first increase in four months. Based on its survey of manufacturers, METI projected that industrial production would rise 9.0% on month in November. Adjusting the upward bias in output plans, METI forecast production would rise just 4.2% on month in November. Based on this assumption, production would fall 0.4% on quarter in October-December, the second straight drop following -3.7% in Q3 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN OCT JOBLESS RATE 2.7%; MEDIAN 2.8%; SEP 2.8%

JAPAN OCT JOB-TO-APPLICANT RATIO 1.15; MEDIAN 1.17; SEP 1.16

MNI BRIEF: Japan October Jobless Rate Falls To 2.7%

- Japan's average unemployment rate stood at a seasonally adjusted 2.7% in October, data released by the Ministry of Internal Affairs and Communications on Tuesday showed. The data showed that the labor market continues to be protected by the government's Employment Adjustment Subsidy, which is set to expire in March 2022 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA Q3 BOP CURRENT ACCOUNT BALANCE +A$23.9BN; MEDIAN +A$29.3BN: Q2 +A$22.9BN

AUSTRALIA Q3 NET EXPORTS OF GDP +1.0%; MEDIAN +1.0%; Q2 -1.0%

AUSTRALIA OCT BUILDING APPROVALS -12.9%; MEDIAN -1.5%; SEP -3.9%

AUSTRALIA OCT PRIVATE SECTOR CREDIT +0.5% M/M; MEDIAN +0.6%; SEP +0.6%

AUSTRALIA OCT PRIVATE SECTOR CREDIT +5.7% Y/Y; MEDIAN +5.8%; SEP +5.3%

AUSTRALIA WEEKLY ANZ-ROY MORGAN CONSUMER CONFIDENCE INDEX 106.0; PREV. 107.4

Consumer confidence fell 1.3% for the last weekend of November compared to the prior weekend. News of Omicron likely impacted sentiment, with some new restrictions for international travellers being quickly imposed. Only 16.3% of respondents expect ‘good times’ for the economy over the next five years, the lowest since August 2020. Despite the overall dampened outlook, ‘time to buy major household items’ rose toits highest since early July 2021. As well, confidence in ‘financial conditions’ is holding up quite well. Weekly inflation expectations rose 0.2ppt to 4.8% but stayed below its recent high despite petrol prices surging 3.6% in the past two weeks. (ANZ)

NEW ZEALAND NOV, F ANZ BUSINESS CONFIDENCE INDEX -16.4; PRELIM -18.1; OCT -13.4

NEW ZEALAND NOV, F ANZ ACTIVITY OUTLOOK INDEX 15.0; PRELIM 15.6; OCT 21.7

Overall, the full-month November ANZBO results show relatively small changes compared to the preliminary result. Business confidence, export intentions, and investment intentions were all a little higher, but own activity, and capacity utilisation dipped. Overall, the theme continues to be gradually easing activity indicators but cost and inflation pressures remain extreme. (ANZ)

SOUTH KOREA OCT INDUSTRIAL PRODUCTION -3.0% M/M; MEDIAN -0.1%; SEP -1.1%

SOUTH KOREA OCT INDUSTRIAL PRODUCTION +4.5% Y/Y; MEDIAN +2.0%; SEP -1.8%

SOUTH KOREA OCT CYCLICAL LEADING INDEX -0.5% M/M; SEP -0.3

UK NOV LLOYDS BUSINESS BAROMETER 40; OCT 43

CHINA MARKETS

PBOC NET INJECTED CNY50 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rates unchanged at 2.2% on Tuesday. The operation has led to a net injection of CNY50 billion after offsetting the maturity of CNY50 billion repos today, according to Wind Information. The operation aims to keep liquidity reasonable and ample, the PBOC said on its website. The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2032% at 09:32 am local time from the close of 2.2474% on Monday. The CFETS-NEX money-market sentiment index closed at 68 on Monday vs 45 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3794 TUE VS 6.3872 MON

On July 21, 2005, China switched to a managed-float formula against a basket of currencies, weakening the yuan's peg to the dollar

MARKETS

BONDS: Moderna CEO Cautious Re: Omicron Vaccines, Weighing On Risk

The previously flagged sense of caution from the Moderna CEO re: the efficacy of the current crop of vaccines and imminent development of a suitable vaccine when it comes to fighting the Omicron COVID strain provided a bid for the core FI space ahead of European hours, after a generally lethargic round of early Asia trade.

- U.S. Tsys were already in the process of unwinding their early cheapening (which came as e-minis nudged higher and Chinese official PMI data beat expectations). The aforementioned headline allowed TYH2 to push trough Monday’s high, last dealing +0-18+ at 130-27+, 0-03 off best levels. Cash trade sees the major Tsy benchmarks richen by 2.0-4.5 bp, with 7s leading the rally. House price data, consumer confidence and the latest MNI Chicago PMI reading headline the NY economic docket on Tuesday. Elsewhere, focus will fall on the Powell-Yellen testimony on the Hill (a reminder that Powell’s pre-released comments sounded a little more cautious vs. recent Fed rhetoric, owing to Omicron, meaning that focus will shift to the answers in the Q&A session).

- JGB futures followed the broader ebb & flow and deal +19 ahead of the Tokyo close, with 7s leading the bid in the cash JGB space, pointing to a futures-driven move. 2-Year supply was easily absorbed. We saw comments from Japanese Finance Minister Suzuki, who flagged the government’s strong concerns re: the Omicron strain of COVID, pointing to the need for swift passage of the supplementary budget measures and stability in the FX market.

- Aussie bond futures looked through local data, surging to best levels of the day on the broader risk-off move, before finishing off of highs (perhaps a case of fast money accounts/longs booking some quick profit ahead of the close). YM was +4.0, while XM was +5.5 at the bell.

EQUITIES: Lower Overnight

The major equity indices traded lower overnight, with pessimism from Moderna's CEO re: the efficacy of current vaccines when it comes to fighting the Omicron COVID variant, in addition to a bit of a reality check when it comes to new vaccination timelines, weighing on risk. Chinese & Hong Kong equities had already lost ground on Tuesday, which dragged the likes of the Nikkei 225 and the ASX 200 back from best levels of the day, before broader E-minis also moved away from best levels (the DJIA now leads declines in the latter, shedding ~1.3%).

- Note that Chinese media flagged the details of guidance when it came to greater oversight re: the ride hailing space, which may have weighed on the Chinese tech space and related names. There was also an argument for good news being bad news re: the Chinese markets, with firmer than expected official PMI data perhaps lessening the need for imminent policy easing. Note that the PBoC continued its recent run of net liquidity injections via OMOs on Tuesday.

- This came after Fed Chair Powell sounded a little more cautious in his pre-released, initial comments ahead of his Tuesday testimony. A reminder that Monday saw the NASDAQ 100 reverse all of Friday’s Omicron-inspired losses, while the S&P 500 & DJIA ate away at their own respective Friday losses, aided by the retracement from cheaps in the U.S. Tsy space, alongside less worry re: the mortality rate of the new COVID strain.

- All in all, participants continue to weigh up the balance of the economic impact of the Omicron COVID strain vs. the potential elongation of ultra-loose policy settings owing to the same economic impact.

GOLD: In The Recent Range

Gold hasn’t got anywhere near testing Friday’s highs since Sunday’s re-open, with spot last a handful of dollars higher on the session, printing just shy of $1,790/oz. The underlying level of fear surrounding the Omicron COVID variant has eased, although a wider, longer length sample will need to be observed before making any firm judgement on its mortality rate. The new variant resulted in a little more caution when it came to pre-released testimony comments from Fed Chair Powell. Note that the testimony will take place on the hill later Tuesday, with the Q&A session set to provide the focal point of that event. A reminder that initial technical support is now located at the Nov 24 low ($1,778.7/oz), with key support coming in below there, at the Nov 3 low ($1,759.0/oz). To the topside, initial resistance is seen at the Nov 16 high ($1,877.2/oz).

OIL: Lower In Asia

WTI and Brent trade ~$2.00 below their respective settlement levels at typing, with the previously flagged caution from the Moderna CEO re: the prospects of current vaccines being successful in the fight against the Omicron COVID variant triggering broader risk-off flows.

- This comes after a relatively sharp pullback from best levels on Monday, with initial gains coming on the back of less worry re: the mortality threat posed by the Omicron COVID variant, before optimistic tones from some of the parties at the latest round of Iran-related talks (which do not include the U.S.) mixed with questions re: short-term demand implications surrounding Omicron weighed on the space.

- We also saw the White House stress that it is not reconsidering the plan to release inventory from its SPR, even though oil prices have shifted lower since the announcement. An administration official went as far as telling CNBC that the Biden admin stands ready to release even more barrels of oil from its strategic reserves should the need arise again, when questioned on the matter.

- Continued focus falls on this week’s OPEC+ gathering (particularly in light of the recent co-ordinated release of crude stockpiles on the part of some of the major oil consuming nations), while the latest API inventory estimates will also provide interest later on Tuesday.

FOREX: Moderna CEO Weighs On Risk

An FT interview with the CEO of Moderna generated a defensive round of flows as we moved towards European trade, as he “predicted that existing vaccines will be much less effective at tackling Omicron than earlier strains of Covid-19 and warned it would take months before pharmaceutical companies can manufacture new variant-specific jabs at scale.”

- This allowed the JPY to move to the top of the G10 FX table after some early underperformance (which was being pared ahead of the release of the interview), while the commodity-linked currencies gave way, falling to the bottom of the G10 board.

- USD/JPY hovers just above Y113.00 and Monday’s low (Y112.99) as a result.

- EUR/USD traded above $1.1300 on the news, after an earlier failed test of the figure.

- JPY, AUD & NZD ignored local data releases.

- Stronger than expected official Chinese PMI data and a cautious round of rhetoric from Fed Chair Powell during the NY/Asia crossover (owing to Omicron) provided a couple of boosts to the broader risk asset sphere throughout the session, but the moves were timid and have been dominated by the aforementioned caution from the Moderna CEO.

- Flash Eurozone CPI data, the latest MNI Chicago PMI reading from the U.S. & Canadian GDP headline the remainder of Tuesday’s economic docket. Elsewhere, comments from Fed Chair Powell & U.S. Tsy Sec. Yellen on the Hill, as well as ECB speak from Villeroy & de Cos, will garner attention.

FOREX OPTIONS: Expiries for Nov30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1250-55(E905mln),$1.1350(E550mln), $1.1445-50(E1.5bln)

- USD/JPY: Y113.80($1.2bln), Y115.00($2.8bln)

- USD/CNY: Cny6.3800($525mln), Cny6.3900($552mln), Cny6.4300($891mln)

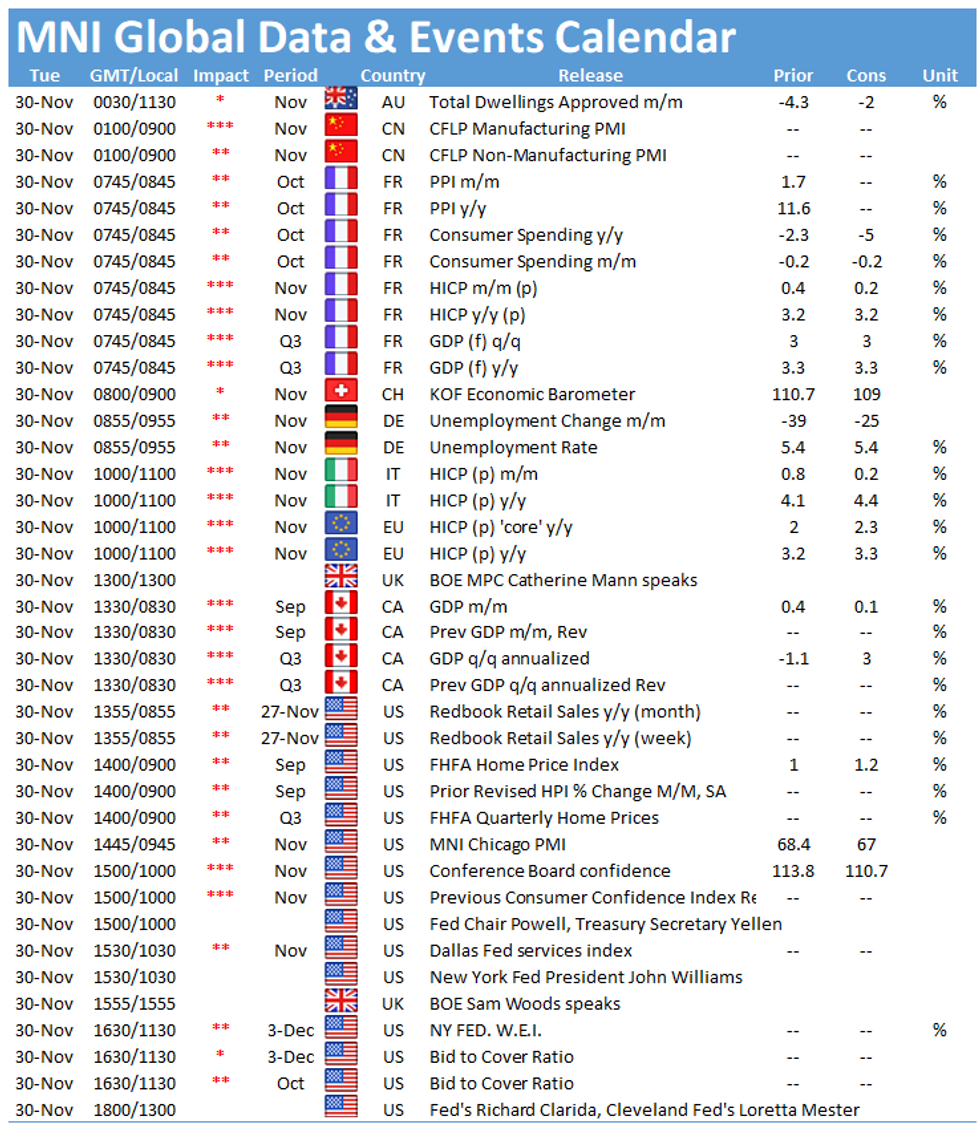

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.