-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI EUROPEAN OPEN: Muted Start To The Week In Asia

EXECUTIVE SUMMARY

- FEDS GOOLSBEE SAYS TOO EARLY TO DECLARE VICTORY ON INFLATION - BBG

- US SHALE RESURGENCE - BBG

- SUEZ CANAL AUTHORITY CLOSELY FOLLOWING TENSIONS IN REGION - BBG

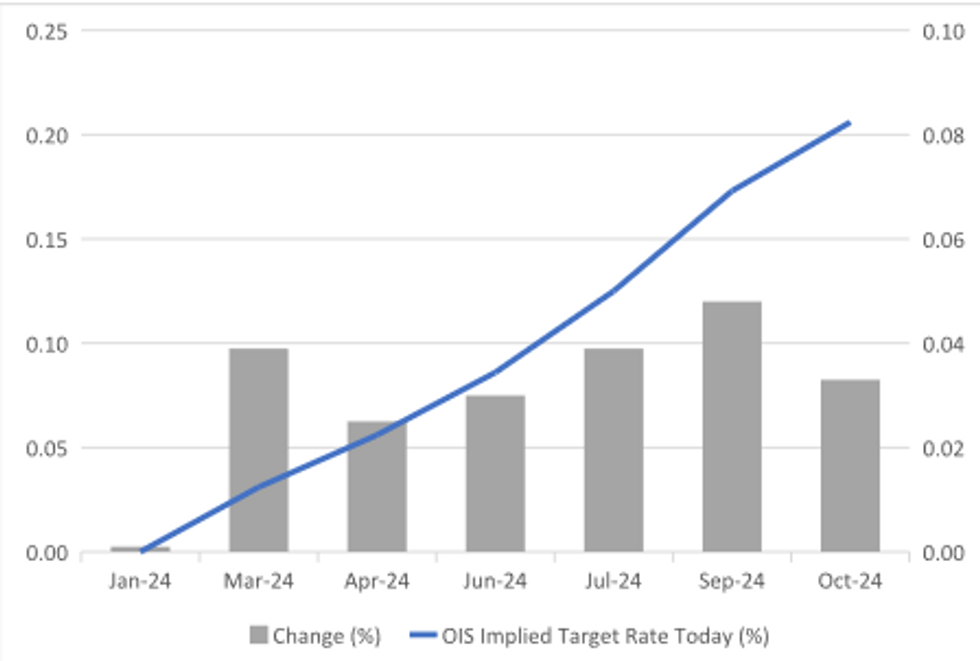

Fig. 1: BOJ-dated OIS

Source: MNI - Market News/Bloomberg

U.K.

POLITICS (BBC): Michelle Mone has admitted that she stands to benefit from tens of millions of pounds of profit from personal protective equipment (PPE) sold to the UK government during the pandemic by a company led by her husband, Doug Barrowman.

EUROPE

FRANCE (BBG): Carrefour SA made an offer to take over a network of 7,000 local supermarkets owned by the struggling French retail group Casino Guichard-Perrachon SA, Les Echos reported, without disclosing its sources.

RUSSIA (BBG): Vladimir Putin said Russia has no intention of attacking NATO countries, describing as “complete nonsense” claims by President Joe Biden that Moscow poses a threat to members of the defense alliance.

U.S.

FOMC (BBG): Federal Reserve Bank of Chicago President Austan Goolsbee said it’s too early to declare victory in the central bank’s inflation fight, and decisions on interest-rate cuts will be based on incoming economic data. “We’ve made a lot of progress in 2023, but I still caution everyone, it’s not done,” Goolsbee said Sunday in an interview on CBS’s Face the Nation. “And so the data is going to drive what’s going to happen to rates.”

WALL ST (BBG): The financial world is moving fast, as the Federal Reserve prepares to start cutting interest rates and stock indexes are at or near all-time highs.

CORPORATE M&A (BBG): Illumina Inc. said it will sell Grail Inc. after a US appeals court found that its $7 billion acquisition of the cancer detection startup violated antitrust laws.

OTHER

POLITICS (BBG): Australia’s Labor government has regained its polling lead over the right-wing opposition after the Reserve Bank kept interest rates unchanged earlier this month amid signs of cooling price pressures in the economy.

MIDDLE EAST (BBG): Israel’s foreign minister said any call for a cease-fire with Hamas is a “prize for terrorism,” after France, UK and Germany urged efforts toward halting the war as the civilian death toll mounts.

MIDDLE EAST (BBG): Egypt’s Suez Canal Authority said it’s “closely following” tensions in the Red Sea and any impact on canal crossings, after Yemeni militant attacks on vessels hundreds of miles to the south prompted major shipping lines to temporarily avoid the region.

OIL (BBG): OPEC’s one-time nemesis — US shale — is rearing its head just months after the sector was all but written off as a threat to the cartel’s sway over worldwide oil markets.

METALS (BBG): Hedge fund Elliott Associates was granted permission to appeal its loss in court against the London Metal Exchange over a nickel squeeze, extending the legal battle over the latter’s decision last year to cancel billions of dollars worth of trades.

CHINA

SPECIAL BOND (XINHUA): China will optimise the investment direction and quota allocation of local government special bonds and reasonably expand the scope of using such bonds as capital funds for infrastructure projects, Xinhua New Agency reported, citing the Office of the Central Financial Commission. Price level is an important monetary-policy target necessary to make good use of aggregate and structural tools and to promote a steady decrease of social financing costs. Authorities will also vigorously develop new types of digital, green and healthy consumption, and actively promote spending on smart homes, entertainment and tourism, and sports events to drive related investments.

YUAN BOND (SSN): Foreign investors have continued to increase their holdings of yuan bonds since Q3, with the inflows of USD33 billion in November recording the second-highest monthly increase in history. China-U.S. interest spread narrowing by about 60 bps by end-November from the October high amid increasing expectations for Fed rate cuts, alongside an 2.6% appreciation in the yuan against dollar, which supported the purchase of yuan bonds, said Yu Lifeng, senior analyst of Golden Credit Rating. The foreign allocation of yuan bonds is likely to keep rising as the end of Fed rate hikes will drive more funds to emerging markets, said Yu. The recovery of the Chinese economy will also play an increasingly supportive role in stabilizing cross-border capital flows, said Wang Chunying, spokesperson of the State Administration of Foreign Exchange.

PAYMENTS (21st Century Business Herald): China will implement stronger regulation that targets the management of the non-banking payment industry to promote standardised and healthy development, according to the State Council. The document, signed by Premier Li Qiang, clarified the definition and permissions of non-bank payment firms and strengthened customer protection against misuse of personal information or unspecified fees. Amongst other regulations, authorities will establish effective due diligence, strengthen risk management and stipulate legal liability. The State Council also said it would stop disguised forms of non-bank payments.

CHINA MARKETS

PBOC Drains Net CNY41 Bln Via OMO Mon; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY184 billion via 7-day reverse repo and CNY60 billion via 14-day on Monday, with the rates unchanged at 1.80% and 1.95%, respectively. The reverse repo operation has led to a net drain of CNY41 billion reverse repos after offsetting CNY285 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8167% at 10:55 am local time from the close of 1.7870% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Friday, compared with the close of 47 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.0933 Monday vs 7.0957 Friday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0933 on Monday, compared with 7.0957 set on Friday. The fixing was estimated at 7.1128 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND Q4 WESTPACE CONSUMER CONFIDENCE 88.9; PRIOR 80.2

NEW ZEALAND NOVEMBER PSI 51.2; PRIOR 49.2

NEW ZEALAND NOVEMBER NON RESIDENT BOND HOLDINGS 60.5%; PRIOR 61.3%

MARKETS

US TSYS: Narrow Ranges In Asia, Docket Thin Today

TYH4 deals at 112-17, +0-04, a 0-05+ range has been observed on volume of ~55k.

- Cash tsys sit 2bps richer to 1bp cheaper, the curve has twist steepened pivoting on 10s.

- Tsys were marginally pressured in early trade as Asia-Pac participants digested Friday's Fedspeak from NY Fed President Williams as well as remarks on Sunday by Chicago Fed President Goolsbee.

- A reminder Goolsbee said it’s too early to declare victory in the central bank’s inflation fight, and decisions on interest-rate cuts will be based on incoming economic data.

- The move lower didn't follow through and Tsys ticked away from session lows as little macro newsflow crossed through the session.

- Monday's docket is thin, NY Feds Services Business Survey and NAHB Housing Market Index cross as does more Fedpseak from Chicago Fed President Goolsbee.

JGBs: Mixed, Light Calendar Ahead Of BoJ Policy Decision Tomorrow

JGB futures are richer in afternoon dealings, +24 compared to settlement levels, ahead of the BoJ Policy Decision tomorrow.

- There hasn’t been much in the way of domestic drivers to flag today.

- After Friday’s pushback by Fed officials against market expectations for easing in 2024, local participants were watchful of early weakness in US tsys during today’s Asia-Pac session. However, with no follow-through seen, local market selling abated. Currently, US tsys are dealings flat to 2bps richer.

- Cash JGBs are dealing mixed, with 0.6bps lower (10-year) to 2.7bps higher (2-year).

- Swaps are also mixed, with swap spreads tighter.

- Tomorrow, the local calendar sees the BOJ Policy Decision. Our analysis aligns with the prevailing consensus, which once again foresees the BoJ keeping all key targets and YCC parameters unchanged.

- Despite previous surprises in July and October, coupled with December last year, indications suggest a different outcome this time. The likelihood of the BoJ terminating its negative interest rate policy (NIRP) without prior adjustments to forward guidance appears low.

- We anticipate that any revisions to forward guidance would likely coincide with the publication of an Outlook Report in January or April. Ultimately, a shift from the current strong easing bias to a tightening bias should be necessary before the BoJ considers rate hikes. See the MNI BoJ Preview here:

ACGBs: Richer, Light Calendar Today, RBA Minutes Tomorrow

ACGBs (YM +5.0 & XM +6.6) are richer and at highs following today’s data-light Sydney session. After Friday’s pushback by Fed officials against market expectations for early and aggressive easing in 2024, local participants were watchful of early weakness in US tsys during today’s Asia-Pac session. However, with no follow-through seen, the local market bid returned.

- Currently, US tsys are dealings flat to 2bps richer, with a light steepening bias apparent.

- Cash ACGBs are 6-7bps richer, with the AU-US 10-year yield differential 3bps tighter at +16bps.

- Swap rates are 8-10bps lower, with the 3s10s curve flatter and EFPs tighter.

- The bills strip shows a bull-flattening, with pricing +2 to +8.

- RBA-dated OIS pricing is 1-9bps softer across meetings, with early 2025 leading. 57bps of easing is priced by Dec’24.

- RBA Minutes for the December Meeting are due tomorrow.

NZGBS: Richer, Narrow Ranges, Light Calendar

NZGBs closed flat to 4bps richer across benchmarks after a relatively subdued open to the trading week. Westpac McDermott Miller consumer confidence and BNZ’s performance of services index failed to provide a domestic driver for the market. Accordingly, it was US tsys in today’s Asia-Pac session, which likely guided the local market after Fed officials pushed back against market expectations for early and aggressive easing in 2024.

- Narrow ranges have persisting in Asia-Pac trade on Monday for cash US tsys. The early move lower didn’t follow through, with little meaningful macro newsflow crossing. This leaves cash tsys 2bps richer to 1bp cheaper, with a light steepening apparent.

- Swap rates are 2-5bps lower, with implied swap spreads tighter and the 2s10s curve flatter.

- RBNZ dated OIS pricing is flat to 3bps firmer across meetings. A 100bps of easing is still priced by Nov’24.

- Tomorrow, the local calendar sees Trade Balance and ANZ Business Confidence data.

FOREX: Antipodeans Firm In Asia

The Antipodeans have ticked higher in Asia, firmer US Equity Futures and a recovery from session lows in US Tsys boosted risk sentiment today. Ranges remained narrow and cross asset flows have been muted for the majority of the session.

- Kiwi is the strongest performer in the G-10 space at the margins. NZD/USD prints at $0.6240/45, bulls target a break of the high from 14 Dec ($0.6249) which opens the $0.63 handle.

- AUD/USD is ~0.2% higher, the pair has risen above the $0.67 handle however we remain well within post-FOMC ranges. Resistance comes in at $0.6729 High Dec 14 and $0.6747 76.4% retracement of the Jul 13 - Oct 26 bear leg.

- Yen is little changed from opening levels and USD/JPY has sat in a narrow range for the most part today. A reminder that USD/JPY is in a technical downtrend. Support comes in at ¥140.71 76.4% of the Jul 14 - Nov 13 bull run. Resistance is at ¥142.90 High Dec 14.

- Elsewhere in G-10 the EUR has trimmed some of Fridays losses and is up ~0.1%.

- The docket is thin on Monday, due tomorrow is the latest monetary policy decision from the BOJ.

GOLD: Less Dovish Fedspeak Sparks A Pullback On Friday

Gold is slightly firmer in the Asia-Pac session, after closing 0.8% lower at $2019.62 in dealings ahead of the weekend.

- Friday’s drop can be attributed to a pushback by Fed officials against market expectations for early and aggressive easing in 2024. NY Fed Williams said “We aren’t really talking about rate cuts right now” and suggested the Fed is still focused on whether rates are sufficiently restrictive to get inflation back to its 2% target. Meanwhile, Atlanta Fed Bostic said he sees two 25bps rate cuts in the latter half of 2024.

- The US Treasury 2-year yield surged by 10bps before settling 5bps higher at 4.44% by the end of Friday's trading. The 10-year yield also showed an initial increase but quickly retraced, ultimately finishing the week with minimal change at 3.91%, slightly above the weekly yield low.

- Currently, US tsys are dealings flat to 2bps richer in today's Asai-Pac session.

- Equally significant, the closing figures on Friday revealed that implied Fed funds futures continued to signal a 19 basis point easing by March, 63 basis points in cuts by June, and a cumulative 140 basis points for the year 2024.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/12/2023 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 18/12/2023 | 1030/1030 |  | UK | BOE's Broadbent speech at London Business School | |

| 18/12/2023 | 1330/1430 |  | EU | ECB Schnabel Lectures On EU Fiscal Policy And Governance | |

| 18/12/2023 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 18/12/2023 | 1500/1600 |  | EU | ECB Lane Chairs Panel on EMU Reforms | |

| 18/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 18/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.