-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI EUROPEAN OPEN: No Deal On Debt Ceiling, Talks "Optimistic"

EXECUTIVE SUMMARY

- TALKS BETWEEN BIDEN, MCCARTHY END WITH OPTIMISM, NO DEAL - BBG

- YELLEN SAYS HIGHLY LIKELY US WILL RUN OUT OF CASH IN JUNE - BBG

- DE COS SAYS ECB SHOULD KEEP RATES HIGH - BBG

- JAPAN RECOVERY SHOWS GROWING MOMENTUM - BBG

- CHINA SOLAR SURGE CONTINUES - BBG

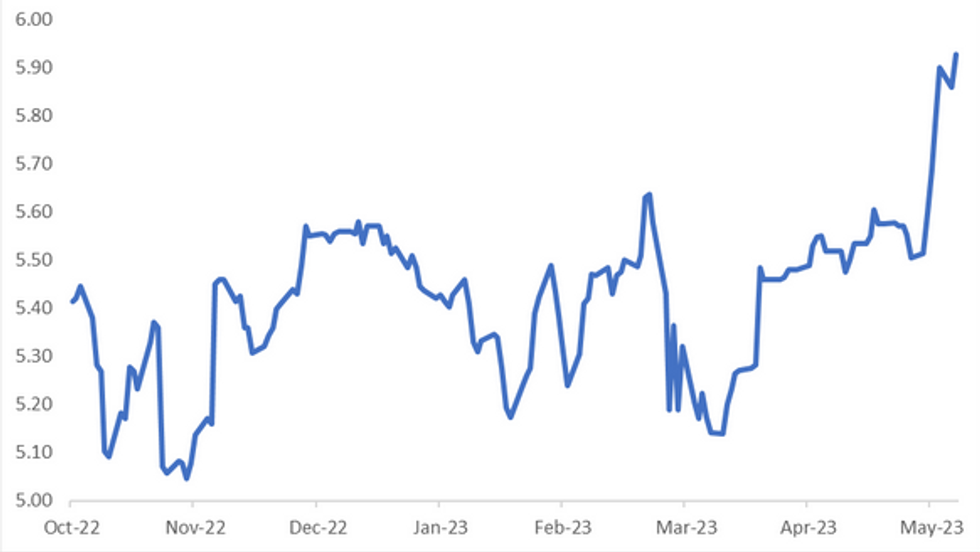

Fig. 1: RBNZ Dated OIS Terminal Rate Pricing

Source: MNI - Market News/Bloomberg

U.K.

ECONOMY: Oxford ranks highest in the UK for economic wellbeing as London lags behind (BBG)

POLITICS: UK’s speeding ticket row shows Sunaks hard road to election day (BBG)

STRIKES: Doctors in England are to hold a 72 hour strike after talks break down (BBG)

EUROPE

ECB: ECB not done raising rate, should keep them high De Cos says (BBG)

CREDIT SUISSE: CDS panel rules Credit Suisse a takeover not a bankruptcy event (BBG)

GREECE: Mitsotakis is breaking out of the box Greek leftists put him in (BBG)

U.S.

DEBT CEILING: Talks between President Biden and House Leader McCarthy end with optimism but without a deal (BBG)

DEBT CEILING: US default scenarios span from localised pain to Dimons “panic” (BBG)

DEBT CEILING: Yellen says its now “highly likely” US runs out of cash in early June (BBG)

FED: Two Fed hawks say more rate hikes may be needed to quell inflation. (BBG)

POLITICS: Tim Scott, the South Carolina Republican, has formally entered the 2024 Presidential race on Monday (BBG)

TIK TOK: TikTok has sued to block the US state of Montana from banning residents from accessing its social media platform. (BBC)

OTHER

JAPAN: Japans slow post pandemic recovery is showing signs of growing momentum, according to the latest gauages of strength in the service and factory sectors (BBG)

AUSTRALIA: Consumer Confidence recovered somewhat last week but remains in the doldrums overall (DJ)

AUSTRALIA: The Australian government on Tuesday welcomed a defence cooperation agreement between its closest neighbour Papua New Guinea (PNG) and the U.S. aimed at bolstering regional security amid China's plans to increase influence in the Pacific. (RTRS)

UKRAINE: The United Nations expressed concern on Monday that Ukraine's Black Sea port of Pivdennyi (Yuzhny) has not received any ships since May 2 under a deal allowing the safe wartime export of grain and fertilizer. (BBG)

BRAZIL: Brazil on Monday declared a state of animal health emergency for 180 days in response to the country's first ever detection of the highly pathogenic avian influenza virus in wild birds, in a document signed by Agriculture Minister Carlos Favaro. (RTRS)

BRAZIL: Private economists in Brazil lowered their expectation for the country's inflation index this year, but the move failed to impress central bank Governor Roberto Campos Neto as he continues to see them running well above official targets (RTRS)

BONDS: Mizuho set to be the third Japanese bank to sell AT1 bonds after the Credit Suisse crisis. (BBG)

BANKS: UBS China fund management project stalls after Credit Suisse deal. The Swiss bank suspends work on application for a wholly owned company in sector (Nikkei)

BANKS: Mizuho to buy investment bank Greenhill in $550 million deal. (BBG)

OIL: Advances as US debt talk progress buoys appetite for risk (BBG)

CHINA

PENSIONS: China will raise its basic pension by 3.8% above 2022 levels, according to the Ministry of Human Resources and Social Security and the Ministry of Finance. (MNI)

FINANCIAL REFORM: China’s newly opened National Financial Regulatory Administration (NFRA) will focus on deepening financial reforms, defusing risks and serving the real economy. (MNI)

LEVERAGE: China’s macro leverage will rise by 8pp in the next few years if economic growth trends near 4.5% and inflation at 2% (MNI)

PORK PRICES: Pork prices, a key component of CPI, should recover moderately in Q4 (MNI)

ENERGY: China’s solar sector is speeding past last year's record surge (BBG)

CHINA MARKETS

PBOC Injects CNY2 Billion Via OMOs Tuesday

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 2.00%. The operation has led to an unchanged liquidity after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9817% at 09:36 am local time from the close of 1.8222% on Monday.

- The CFETS-NEX money-market sentiment index closed at 51 on Monday, compared with the close of 48 on Friday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.0326 TUE VS 7.0157 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.0326 on Tuesday, compared with 7.0157 set on Monday.

OVERNIGHT DATA

SOUTH KOREA MAY CONSUMER CONFIDENCE 98.0; PRIOR 95.1

NEW ZEALAND APR ANZ TRUCKOMETER HEAVY M/M -2.2%; PRIOR 2.9%

AUSTRALIA MAY, P JUDO BANK COMPOSITE PMI 51.2; PRIOR 53.0

AUSTRALIA MAY, P JUDO BANK SERVICES PMI 51.8; PRIOR 53.7

AUSTRALIA MAY, P JUDO BANK MFG PMI 48.0; PRIOR 48.0

JAPAN MAY, P JIBUN BANK COMPOSITE PMI 54.9; PRIOR 52.9

JAPAN MAY, P JIBUN BANK SERVICES PMI 56.3; PRIOR 55.4

JAPAN MAY, P JIBUN BANK MFG PMI 50.8; PRIOR 49.5

MARKETS

US TSYS: Curve Marginally Flatter In Asia

TYM3 deals at 113-15, unchanged from Monday's settlement level, a 0-04 range has been observed on volume of ~97k.

- Cash tsys sit 1bp cheaper to 1 bp richer across the major benchmarks, the curve has twist flattened pivoting on 10s.

- Tsys firmed as reports surfaced of President Biden and House Leader McCarthy's talks on the US debt ceiling. Despite ending with no deal the talks were described as "optimistic" and will continue.

- There was little follow through on the early move and tsys pared gains to deal in a narrow range for the remainder of the session.

- FOMC dated OIS price a terminal rate of ~5.20% in July with ~50bps of cuts scheduled for 2023.

- In Europe today we have flash Eurozone, German and French PMIs. Further out we have a slew of US data including Philadelphia Fed Non-Mfg Activity, New Home Sales and flash Services & Mfg PMIs. Fedspeak from Dallas Fed President Logan will cross. We also have the latest 2-Year supply.

JGBS: Futures Hit Tokyo Session Cheaps In Afternoon Trade

JGB futures have weakened in afternoon Tokyo trade, reaching session lows and currently standing at -15 compared to the settlement levels.

- There haven't been significant domestic factors worth highlighting, apart from the previously mentioned positive results of the May Preliminary Jibun Bank Services and Manufacturing PMI. Consequently, local market participants are likely monitoring headlines and observing the movements in US tsys. In Asia-Pacific trade, US tsys have shown a twist flattening, with yields +1bp to -1bp.

- Cash JGBs are mixed across the curve with yields +1.3bp to -0.6bp. The 40-year zone is the strongest performer ahead of the scheduled supply on Thursday. The benchmark 10-year yield is 0.3bp lower at 0.396%. The futures-linked 7-year zone is the weakest with its yield +1.2bp.

- The auction of 10-year inflation-indexed JGBs draws a higher-than-expected cut-off price, indicating strong demand as the Asian nation’s inflation remains elevated. The bid-to-cover ratio rose to 3.5 from 3.06 on Feb. 9, which was the lowest since August 2021.

- Swap rates are higher with the curve steeper. Swap spreads are wider across the curve, beyond the 1-year zone.

- Tomorrow will see BoJ Rinban operations covering 1- to 25-Year JGBs along with Machine Tool Orders (April final).

AUSSIE BONDS: Weaker, Sitting Just Off Cheaps

ACGBs are weaker (YM -6.0 & XM -5.5) sitting just off Sydney session lows with a relatively light local calendar. Without domestic drivers, local participants were likely on headlines and US tsys watch. US tsys have twist flattened in Asia-Pac trade with yields +1bp to -1bp.

- Cash ACGBs are 5bp cheaper with the AU-US 10-year yield differential +1bp at -7bp.

- Swap rates are also 5-6bp higher with EFPs little changed.

- The bills strip is steeper with pricing -1 to -7.

- RBA dated OIS are 1-4bp firmer across meetings beyond June. The market attaches a 16% chance of a 25bp hike at the June meeting.

- A Bloomberg article reports an A$8.6 billion debt levy on businesses with payrolls above A$10 million a year and property investors form the centrepiece of Victoria’s budget to “pay off our COVID credit card”, Treasurer Tim Pallas revealed on Tuesday – AFR. (link)

- The local calendar is light tomorrow with the Westpac-MI Leading Index as the only release.

- RBA Jacobs, Head of Domestic Markets, speaking at a Fixed Income Forum in Tokyo (0810 BST / 1710 AEST).

- The AOFM plans to sell A$800mn of the 3.50% 21 December 2034 bond tomorrow.

NZGBS: Weaker, At Cheaps, RBNZ Policy Decision Tomorrow

NZGBs ended the session on a low note with the 2-year and 10-year benchmark yields respectively rising by 8bp and 6bp, ahead of tomorrow’s RBNZ policy meeting.

- The RBNZ will review revised projections that are expected to indicate stronger economic growth, sustained inflation, and a lower peak in the unemployment rate. It is likely that the projection for a recession in 2023 will be removed due to increased demand resulting from reconstruction spending and a surge in migration.

- A Bloomberg survey of economists revealed a median expectation of a 25bp hike to 5.50% from the RBNZ tomorrow. 18/21 economists expected a 25bp increase with ASB, TD Securities and UBS expecting a 50bp increase.

- RBNZ dated OIS pricing is 4-14bp firmer across meetings. 37bp of tightening is priced for tomorrow’s RBNZ meeting. Terminal rate expectations are at a new cycle high of 5.94%.

- Pricing has shunted firmer over recent days, following a more stimulatory than expected NZ budget. With a fiscal impulse moving into positive territory next year, pricing has firmed 9-38bp across meetings post-budget with early ’24 leading.

- Swap rates are 9-11bp higher with implied swap spreads 2-3bp wider.

- The local calendar sees the release of Retail Sales Ex-Inflation ahead of the RBNZ policy decision tomorrow.

FOREX: Greenback Little Changed In Asia, Fresh Multi-Month High For USD/JPY

The USD is little changed in Tuesday's Asian session, USD/JPY printed a fresh multi month high before meeting resistance ahead of ¥139 and paring losses to deal unchanged.

- USD/JPY prints at ¥138.45/55, unchanged from yesterday's closing levels. The pair printed its highest level since 29 Nov before meeting resistance ahead of ¥139 and paring losses in volatile trade. The latest round of flash PMIs showed the Japanese economy's recovery is gaining momentum.

- AUD/USD prints at $0.6650/55 little changed on Tuesday. Flash Judo Bank PMIs for May crossed Services PMI fell to 51.8 from 53.8, Mfg PMI remained in contractionary territory at 48.0. The Composite measure printed at 51.2.

- Kiwi has also traded in narrow ranges and is little changed in Asia. NZD/USD briefly firmed above $0.63 before paring gains after being unable to follow through on the move higher. The pair last prints at $0.6280/85.

- Elsewhere in G-10 NOK and SEK are marginally pressured however liquidity is generally poor in Asia.

- Cross asset wise; BBDXY is flat, e-minis are ~0.2% firmer.

- In Europe today we have Eurozone, German and French flash PMIs before a slew of US data including Philadelphia Fed Non-Mfg Activity, New Home Sales and Services & Mfg PMIs.

OIL: Prices Supported By Improved Risk Sentiment, But Demand Jitters Remain

Oil prices rose strongly on better risk sentiment following the announcement that although there hadn’t been a debt-ceiling deal following talks between President Biden and House Speaker McCarthy, they had been “productive” and both sides said a default was off the table. Prices have retreated since then but are still higher over the session. The USD index is flat.

- WTI is up 0.3% to $72.24/bbl after reaching an intraday high of $72.62 earlier. Brent is 0.2% higher to $76.14 following a high of $76.53. WTI remains comfortably below key short-term resistance at $73.81, the May 10 high. And for Brent resistance is at $77.60.

- Increased expected US gasoline demand, refilling the US SPR, the IEA’s expected crude deficit, and reduced OPEC output with possibly more announced at the June meeting are all supporting prices. On the other hand uncertainty over China’s economy, further Fed hikes, robust Russian supply and the debt-ceiling impasse have been weighing on the market.

- The immediate outlook for oil prices is highly dependent on debt-ceiling talks. See Debt: No Agreement Yet, But Talks Continue for today’s developments.

- The Saudi Arabian energy minister is due to speak at the Qatar Economic Forum today. Also API weekly US fuel inventory data prints. Later the Fed’s Logan gives welcoming remarks and preliminary May PMIs, May Richmond Fed business confidence and April US new home sales are released.

GOLD: Weighed Down By Debt Ceiling Stand Off & Fedspeak

In Asia-Pacific trade, gold has declined by 0.4% to reach 1963.15, following a modest drop of 0.3% to 1971.86 during Monday's trading session. Investors are carefully evaluating the ongoing US debt-ceiling standoff and the remarks from Federal Reserve officials, which have contributed to the cautious sentiment surrounding gold.

- A deal is one step closer following talks between President Biden and House Speaker McCarthy which has finished. Comments from McCarthy indicate that the meeting was “productive” and that the tone of discussions had improved.

- Given the uncertainties surrounding the debt-ceiling X-date, it is expected that gold trading will continue to be volatile unless a resolution is reached.

- Despite Federal Reserve Chair Powell's recent comments indicating a potential pause, market expectations for a 25bp interest rate hike at the upcoming FOMC meeting in June are slowly rising, currently reaching 22%. This sentiment was reinforced by overnight statements from Fed Bullard, a non-voting member for 2023, who voiced support for two more 25bp rate increases. Additionally, Fed Kashkari, a voting member for 2023, hinted at his preference for further tightening of monetary policy.

- According to a Bloomberg article, gold appears to be in the throes of a triple top, setting up a substantial correction in the coming months. (link)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/05/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 23/05/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/05/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/05/2023 | 0715/0915 |  | EU | ECB de Guindos Address at European Financial Integration Conf | |

| 23/05/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/05/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/05/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 23/05/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/05/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/05/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/05/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/05/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/05/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/05/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/05/2023 | 0915/1015 |  | UK | BOE Bailey, Pill, Tenreyro, Mann at MPR Hearing | |

| 23/05/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 23/05/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/05/2023 | 1300/0900 |  | US | Dallas Fed's Lorie Logan | |

| 23/05/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/05/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/05/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 23/05/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/05/2023 | 1445/1545 |  | UK | BOE Haskel Panellist at Richmond Fed Conference | |

| 23/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.