-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Oil Up On Mid-East Supply Fears

EXECUTIVE SUMMARY

- THREE US TROOPS KILLED, UP TO 34 INJURED IN JORDAN DRONE STRIKE LINKED TO IRAN - RTRS

- ON HOLD BUT SHIFTING TO NEUTRAL GUIDANCE - MNI FED WATCH

- CHINA EVERGRANDE ORDERED TO LIQUIDATE, OWING $300BLN - RTRS

- PBOC SEEN EASING MLF, REPO RATES LATER IN 2024- MNI

- RBNZ TO CUT MID-YEAR, DESPITE TOUGH TALK - MNI INTERVIEW

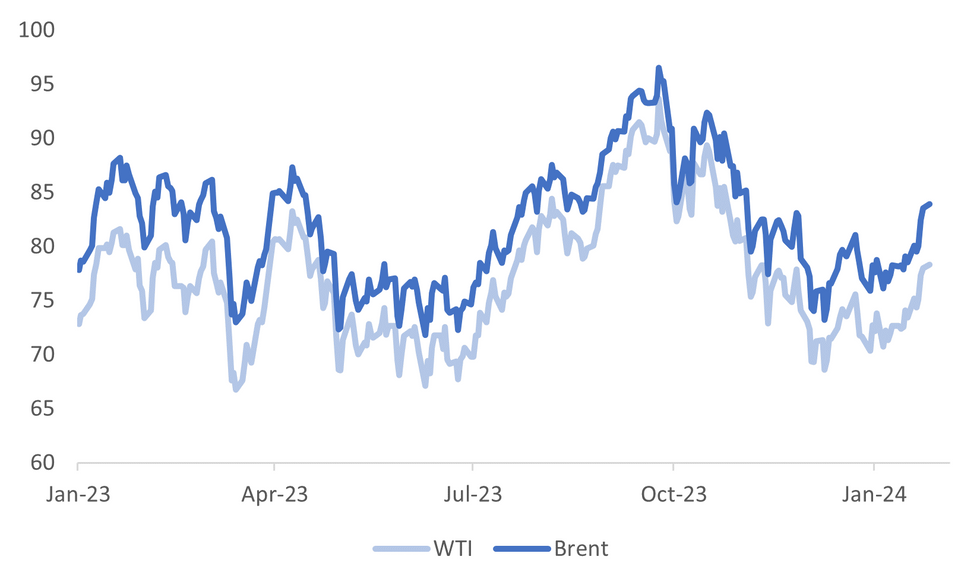

Fig. 1: Benchmark Oil Prices

Source: MNI - Market News/Bloomberg

U.K.

POLITICS (BBG): Business Secretary Kemi Badenoch said she “fully supports” UK Prime Minister Rishi Sunak and Tories speculating she could replace him as Conservative leader are only creating problems for a party facing a challenging election this year.

EUROPE

ECB (BBG): The European Central Bank could cut interest rates at any moment this year and all options are open at upcoming meetings, Governing Council member Francois Villeroy de Galhau said. The ECB is on the right path to defeating inflation as the increase in the deposit rate to a record 4% has already played a very significant role in moderating underlying inflation, the French central banker said.

ECB (BBG): The European Central Bank must have certainty on wages in order to be able to lower interest rates, according to Governing Council member Klaas Knot. There’s a “credible outlook” to bring inflation back to the ECB’s 2% goal in 2025, he said in an interview on Dutch state broadcaster NPO1 on Sunday.

HUNGARY (MNI POLICY): The National Bank of Hungary is weighing whether to press ahead with a 100-basis-points rate cut on Jan 30, amid concern it will have less room for future manoeuvre if a government proposal to use bond yields as benchmark for lending rather than the interbank loan rate goes ahead, MNI understands.

GERMANY (BBG): German Chancellor Olaf Scholz’s governing coalition remains under pressure as a voter poll shows the co-ruling Free Democratic Party below a new far-left group and at risk of dropping out of parliament.

FRANCE (BBG): French farmers’ unions threatened to block highways around Paris on Monday after government efforts to defuse recent protests with promises of additional aid fell short.

U.S.

MIDEAST (RTRS): Three U.S. service members were killed and dozens may be wounded after an unmanned aerial drone attack on U.S. forces stationed in northeastern Jordan near the Syrian border, President Joe Biden and U.S. officials said on Sunday. Biden blamed Iran-backed groups for the attack, the first deadly strike against U.S. forces since the Israel-Hamas war erupted in October and sent shock waves throughout the Middle East.

FED (MNI FED WATCH): The Federal Reserve is expected to hold rates at a 23-year high rate of 5.25%-5.5% range for a fourth straight meeting Wednesday and shift its forward guidance to more neutral language in anticipation of lowering rates later this year.

US/CHINA (BBG): The US wants cloud services providers such as Amazon.com Inc. and Microsoft Corp. to actively investigate and call out foreign clients developing artificial intelligence applications on their platforms, escalating a tech conflict between Washington and Beijing.

OTHER

OIL (BBG): A missile attack on Friday on a tanker taking Russian fuel through the Gulf of Aden may prove to be a defining moment for an oil market that had previously been somewhat immune to months of Houthi militants’ attacks on merchant trade.

COMMODITIES (MNI INTERVIEW): The U.S. pause on new export approvals for liquefied natural gas to study climate change impacts will be enough to chill future investment and risks antagonizing allies, former FERC commissioner Bernard McNamee told MNI.

OIL(BBG): Russia carried out its pledged cuts in overseas supplies of oil, according to Deputy Prime Minister Alexander Novak.

NEW ZEALAND (MNI): The Reserve Bank of New Zealand will maintain a vigilant stance on inflation and refrain from discussing cuts in the near term as non-tradable inflation remains above the upper end of its targets, however, considerable economic headwinds could force it to cut mid-year despite its tough talk, a former staffer told MNI.

SINGAPORE (RTRS): Singapore's central bank on Monday kept its monetary policy settings unchanged, as expected, in its first review of the year as inflation pressures continued to moderate and growth prospects improved.

THAILAND (YICAI): China signed a mutual visa exemption agreement with Thailand, causing a seven-fold increase in Thailand-related searches on C-trip the following day, according to Yicai. C-trip data shows Chinese passengers increased bookings to Singapore, Malaysia and Thailand 15 times y/y during this year's Spring Festival.

CHINA

PROPERTY (RTRS): A Hong Kong court on Monday ordered the liquidation of property company China Evergrande Group (3333.HK), opens new tab, a move likely to send ripples through China's crumbling financial markets as policymakers scramble to contain the deepening crisis.

POLICY RATES (MNI): The People’s Bank of China will likely cut rates for policy tools such as its medium-term lending facilities and 7-day repo by around mid-year, but weak credit demand will divert liquidity released by easing moves – such as last week's reserve requirement ratio cut – to unproductive financial arbitrage, policy advisors and economists told MNI.

HOUSING (21st Century Business Herald): Guangzhou city, one of the top four cities in China, has fully relaxed home purchase limits for buyers with local residency. Properties with a floor area of more than 120 sqm are excluded from housing purchase restrictions, according to a notice from the city government on Saturday. For those without local residency, they still need to meet the threshold of providing two-year payment of social security in the city to buy a floor area of less than 120 sqm.

EQUITIES (RTRS): China's securities regulator said on Sunday that it will fully suspend the lending of restricted shares effective from Monday, in policymakers' latest attempt to stabilise the country's stock markets following recent sharp falls.

US/CHINA (BBG): US National Security Advisor Jake Sullivan and Chinese Foreign Minister Wang Yi discussed scheduling a call between the two countries’ leaders for sometime this spring, a senior US official said.

CHINA MARKETS

MNI: PBOC Injects Net CNY378 Bln Via OMO Mon; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY500 billion via 7-day reverse repo on Monday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net injection of CNY378 billion reverse repos after offsetting CNY122 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8024% at 09:35 am local time from the close of 1.9517% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 44 on Friday, compared with the close of 45 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1097 on Monday, compared with 7.1074 set on Friday. The fixing was estimated at 7.1802 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND DEC TRADE BALANCE NZD -323m; PRIOR -1250m

NEW ZEALAND DEC EXPORTS NZD 5.94bn; PRIOR 5.95bn

NEW ZEALAND DEC IMPORTS NZD 6.26bn; PRIOR 7.20bn

NEW ZEALAND DEC TRADE BALANCE 12MTH YTD NZD -13567mn; PRIOR -13895mn

MARKETS

US TSYS: Cautious Tone Ahead of FOMC, China Evergrande Ordered Into Liquidation

TYH4 is trading at 111-06+, + 05+ from NY closing levels. Futures have been rangebound all day with very little to note. There was a very brief spike early this morning but this has been pared, with Tsys brushing off Friday night news around the Russian Oil tanker being hit in the Red Sea, and the weekend news about US soldiers being attacked in Jordan. The upcoming FOMC decision has most traders sitting on the sidelines ahead of the announcement on Wednesday. Heading into the meeting the market is predicting about a 50% chance of a rate cut in March.

A quick recap, US Treasuries opened 111-06, and briefly spiked to 111-09+ before settling and trading in a very small range for the remainder of the day, however around the 111-07+ level. Cash yields have been uneventful all day trading within the 0.5 to -0.5 range.

- •Cash bonds are trading -0.5 to -0.9bp richer across the curve, 2y at 4.343% (-0.6) and 10y at 4.13% (-0.8).

- China Evergrande headlines out earlier, as creditors were unable to reach an agreement on a restructure, this pushed the share price to records lows before being suspended and ordered into liquidation by a Hong Kong court

- Data is light on tonight, with FOMC policy announcement on Wednesday the major focus.

JGBS: Futures Downtick As Middle East-Induced Haven Buying Quickly Fades

JGB futures are dealing with a downtick in the Tokyo afternoon session, -6 compared to settlement levels, after quickly reversing early strength sparked by the weekend’s Middle East developments. Nevertheless, spillover from higher oil prices will likely remain in focus today, after the attack on a Russian Oil tanker in the Red Sea late Friday and the weekend attack on US soldiers in Jordan near the border with Syria.

- Cash US tsys are dealing ~1bp richer in today’s Asia-Pac session.

- Today, the local calendar has been empty, apart from BoJ Rinban Operations covering 3-10-year and 25-year+ JGBs. The results were mixed, with lower offer cover ratios across the buckets but positive spreads. The impact on the market has been minimal.

- Cash JGBs remain cheaper on the day, but slightly richer than lunchtime levels. The 20-year is underperforming, with its yield 2.3bps higher at 1.547%. The benchmark 10-year yield is 0.9bp higher at 0.726% versus the Nov-Dec rally low of 0.555%. The 2-year is outperforming (+0.4bp) ahead of tomorrow’s supply.

- Swaps curve is witnessing a bear-steepening, with rates flat to 3bps higher. Swap spreads are mostly wider, apart from the 20-year.

- Tomorrow, the local calendar sees Jobless Rate and Job-To-Applicant Ratio data.

AUSSIE BONDS: Light Calendar, Narrow Ranges, Limited Impact From Middle East

ACGBs (YM flat & XM +1.0) are flat after dealing in narrow ranges in today’s Sydney session. The local market was closed on Friday in observance of the Australia Day holiday. With the domestic calendar empty today, the focus has been abroad following the weekend’s events in the Middle East. Nevertheless, the bond market's reaction has so far been muted, with cash US tsys dealing little changed in today’s Asia-Pac session.

- (AFR) Treasurer Jim Chalmers says he will discuss the investment direction of the $212 billion Future Fund with incoming chairman Greg Combet, after both the Labor figures previously backed the $3.5 trillion superannuation sector playing a more active role in funding the energy transition. (See Bloomberg link)

- Cash ACGBs are 3-4bps richer relative to Thursday’s close, with the AU-US 10-year yield differential 1bp tighter at +8bps.

- Swap rates are 2-4bps lower, with the 3s10s curve steeper.

- The bills strip is little changed, with pricing flat to +2.

- RBA-dated OIS pricing is flat to 4bps softer across meetings, with December leading. A cumulative 43bps of easing is priced by year-end.

- December retail sales are out tomorrow. The main focus will however be Wednesday's CPI print for Q4, which comes before next week's RBA meeting.

NZGBS: Cheaper But Volumes Low Due To Auckland Holiday

NZGBs closed 3bps cheaper, with volumes low due to Auckland being out for a public holiday. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined trade balance data for December. The Australian and Japanese calendars were also light today.

- Early session strength following the weekend’s Middle East developments proved to be fleeting, with cash US tsys currently dealing flat to 1bp richer in today’s Asia-Pac session.

- Nevertheless, spillover from higher oil prices will remain the focus today, along with broader risk trends, after the attack on a Russian Oil tanker in the Red Sea late Friday and the weekend attack on US soldiers in Jordan near the border with Syria.

- Swap rates closed 1-3bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed slightly firmer across meetings. A cumulative 91bps of easing is priced by year-end.

- RBNZ Chief Economist Conway will deliver a keynote speech tomorrow. The speech will focus on the significant changes to the global economy since the COVID-19 pandemic. He will also make brief comments on domestic data developments since the November Monetary Policy Statement.

FOREX: USD Off Earlier Highs, A$ Marginally Outperforms

G10 FX markets have had a reasonably muted start to the week. The USD was mildly supported in early trade, as the market started off in risk averse fashion amid higher oil following further shipping attacks late last week and US troops in Jordan (near the Syrian border) coming under drone attack (with 3 reported casualties).

- However, the BBDXY couldn't breach the 1238 level, with US Tsys futures showing little follow through after spiking higher at the open. US equity futures opened weaker, but have clawed back losses, with Nasdaq futures back in positive territory. Oil prices moving off earlier highs has helped at the margins (Brent is still up around 0.50%). The BBDXY was last near 1237.

- AUD has outperformed marginally, up 0.20%, but hasn't been able to retake the 0.6600 handle. Outside of oil, other commodities are tracking higher, which is supportive at the margin.

- NZD/USD is also marginally higher, but hasn't drifted far away from 0.6100. Earlier trade data saw a narrower deficit in Dec, but the impact on sentiment was minimal.

- USD/JPY has stayed above 148.00 for the session, but couldn't sustained an earlier break above 148.30.

- Looking ahead, it is a quiet start to the week, with ECB speak and the Dallas Fed manufacturing survey on tap.

EQUITIES: Asia Equities Mostly Higher, China Evergrande Ordered Into Liquidation

Asia equities are mostly higher to start the trading week, with China equities mixed. US Equity futures opened lower this morning on the back of the attack on a Russian Oil tanker in the Red Sea (late on Friday) and the weekend attack on US soldiers in Jordan near the border with Syria, but along with other markets have recovered most of the initial move lower. Eminis are 015% lower, while the Nasdaq trades flat today. China Evergrande news has dominated the headlines here in Asia, after creditors were unable to come to an agreement on a restructurer pushing shares to lowest on record before a trading halt was put in place.

- Japan Equity indices are in the green today, energy producers are leading the way as the price of oil jumped, while Toyota is trading higher by 3.27% as the leading contributor to the Topix. The Nikkei 225 is up 1.09%, while the Topix is up 1.34%

- Hong Kong was up as much as 1.81% today, but has given a large chuck of that up now to be trading just 0.88% higher, Alibaba has contributed to most of the gain, Property names are also higher in Hong Kong today after the southern city of Guangzhou eased home-buying restrictions and pledged more financing support.

- China mainland stocks are underperforming today. News around China Evergrande, seemed to weigh on sentiment, with creditors unable come to a restructuring agreement and courts ordering Evergrande to be liquidated. China announced early last week that they were looking into a stock market rescue package and an MLF rate cut, and over the weekend the securities regulator said they will halt the lending of certain shares for short selling from this morning, however these measures haven't been enough to give the market the push higher it's been after. There has been concerns over the Biden administrations announcement around requiring US cloud firms to reveal foreign clients developing AI applications, and that some US lawmakers had proposed legislation targeting Chinese biotech companies. Currently the CSI 300 is close to flat while the ChiNext is 2.30% lower.

- Taiwan continues its winning streak from last week, trading 0.60% higher today, with energy names leading the way.

- In Korea, strong start to the week with the Kospi up 1.65%.

- Australia, is on track to make it six straight sessions of gains, and is currently 50 points away from all time highs, the market is being lead higher today Oil & Gas names. ASX 200 is currently 0.30% higher.

- In SEA, Nifty 50 is up 1.15%, Indonesia is up 0.90% while the Philippines are lower by 0.25%

OIL: Off Earlier Highs, But Positive Bias Intact On Mid-East Supply Concerns

Oil prices sit off earlier highs. Brent was last near $84/bbl, against an earlier high of $84.80/bbl. WTI was last tracking close to $78.40/bbl. Both benchmarks are around 0.50% higher, building on last week's +6% gains.

- The early spikes followed the late Friday Houti attack on a Russian linked carrier in The Red Sea. We have also had news of US soldiers under attack in Jordan on Sunday, near the border with Syria, reportedly by Iranian backed militia (with 3 fatalities).

- US President Biden has stated "We shall respond" at a campaign event in the US on Sunday. The Houthi attack from Friday raised concern that attacks on Red Sea shipping are expanding and not just confined to US, UK or Israeli linked ships.

- This is keeping Middle East supply concerns still front and center from a market concern standpoint.

- Elsewhere, Russia stated it has carried out its pledge to cut oversea oil supplies (see this BBG link for more details).

- For Brent, we tested late Nov highs close to $85/bbl earlier. This will remain the upside focus. On the downside the 200-day EMA sits back near $82.84/bbl.

GOLD: Pressured By A Resilient US Economy

Gold is 0.4% higher in the Asia-Pac session, after closing 0.1% lower at $2018.52 on Friday. Haven buying is likely behind today’s strength after the attack on a Russian Oil tanker in the Red Sea late Friday and the weekend attack on US soldiers in Jordan near the border with Syria.

- On Friday, a slight appreciation in the USD and higher US treasury yields pressured bullion after Friday’s data showed a resilient US economy, which could influence the Federal Reserve’s messaging about the pace of interest-rate cuts when it hands down its decision on Wednesday. Fed speakers have been in blackout ahead of this week’s FOMC meeting.

- It was a busy US data session on Friday. Inflation data was close to expected, while spending was firmer than forecast. US Pending Home Sales were also higher than expected, printing a whopping 8.3% m/m increase vs. 2.0% estimate.

- The market is currently assigning around a 50% chance to a 25bp rate cut in March. This compares to the near 70% chance seen a couple of weeks ago. Lower interest rates are typically positive for non-interest-bearing gold.

- Friday’s dip failed to test previously established technical levels, with support at $2001.9 (Jan 17 low) and resistance at $2039.4 (Jan 19 high), according to MNI’s technicals team.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/01/2024 | 0700/0800 | *** |  | SE | GDP |

| 29/01/2024 | 0700/0800 | ** |  | SE | Retail Sales |

| 29/01/2024 | 1200/1300 |  | EU | ECB's de Guindos on Investment Outlook | |

| 29/01/2024 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 29/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 29/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/01/2024 | 2330/0830 | * |  | JP | labor forcer survey |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.