-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: Positive Risk Tone Continues From Late Last Week

EXECUTIVE SUMMARY

- BRUSSELS PLANS SANCTIONS ON CHINESE COS. AIDING RUSSIA WAR: FT

- BIDEN TO MEET WITH MCCARTHY, JEFFRIES ON TUESDAY- BBG

- YELLEN WARNS OF DEBT CEILING "CONSTITUTIONAL CRISIS" - FT

- CHINA FOREIGN MINISTER SAYS IMPERATIVE TO STABILISE SINO_US RELATIONS RTRS

- BOJ MARCH MEETING MINUTES: A FEW MEMBERS SAID THERE WERE SOME POSITIVE SIGNS TOWARDS ACHIEVING BOJ'S PRICE TARGET - RTRS

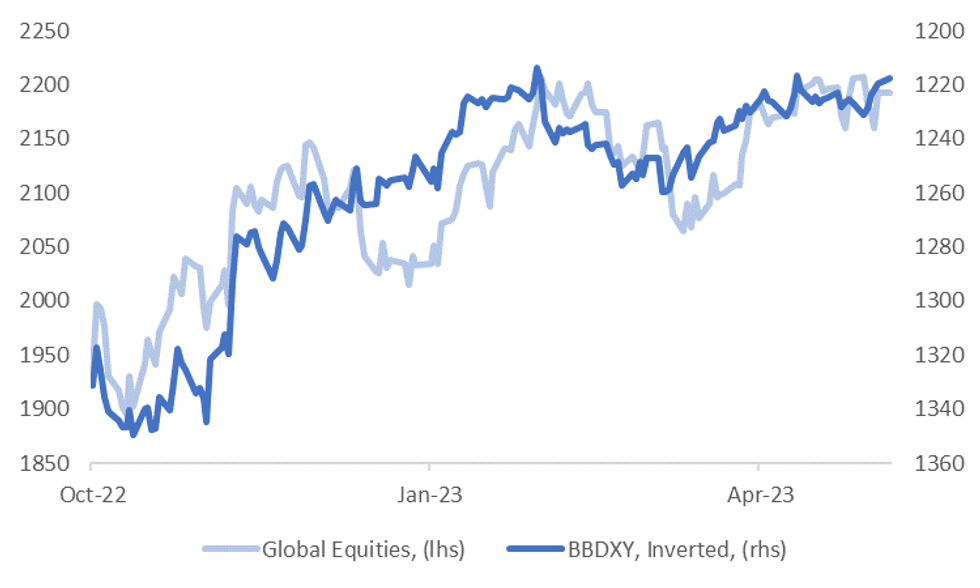

Fig. 1: Global Equities & BBDXY (Inverted)

Source: MNI - Market News/Bloomberg

EUROPE

EUROPE: Brussels has proposed sanctions on Chinese companies for supporting Russia’s war machine for the first time since the conflict in Ukraine began, in a development likely to increase tensions with Beijing. Seven Chinese businesses accused of selling equipment that could be used in weapons have been listed in a new package of sanctions to be discussed by EU member states this week, which has been seen by the Financial Times. (FT)

ECB: ECB’s Knot Vows More Rate Hikes Amid ‘Too High’ Core Inflation - (BBG)

UKRAINE: Russia launched a large-scale wave of strikes on Kyiv and across Ukraine sowing destruction and injuries, officials said early on Monday, as Moscow prepares for its cherished Victory Day holiday that marks the anniversary of its defeat of Nazi Germany. (RTRS)

U.S.

DEBT: Yellen Says No Good Alternative to Congress Lifting Debt Cap - (BBG)

DEBT: US Treasury secretary Janet Yellen has warned of a “constitutional crisis” if Congress does not raise the federal debt limit, as the government remains in danger of running out of cash in the absence of new borrowing capacity. (FT)

DEBT: Senate Republicans oppose vote just to raise US debt ceiling, push for other priorities. (RTRS)

DEBT: Biden, Lawmakers Look to Break Impasse on Debt Ceiling – (WSJ)

BANKING: FDIC Mulls Loss-Sharing With Nonbanks to Boost Bids on Failures – (BBG)

BANKING: Warren Buffett says Berkshire is cautious on banking sector - (RTRS)

POLITICS: President Joe Biden’s approval slid to a career low in the latest opinion poll for ABC News and the Washington Post that also showed the US leader lagging predecessor Donald Trump in early voter preferences for the 2024 election. (BBG)

OTHER

JAPAN: A few Bank of Japan board members said that the environment surrounding Japan’s inflation has started to change, according to the minutes of the March policy meeting. - (BBG)

South Korea/Japan: Yoon and Kishida seek to transcend historical issues to normalize ties (Korea Times)

OIL: Oil Crash Sends Speculators Fleeing at Fastest Pace in Six Weeks - (BBG)

TRADE: World Trade Data Begin to Show Early Signs of ‘Reglobalization’ - (BBG)

AUSTRALIA: Australia may record its first budget surplus in 15 years, bolstering the center-left government’s economic credentials as Treasurer Jim Chalmers moves to reinforce the central bank’s efforts to peg back inflation. (BBG)

HONG KONG: The Hong Kong Monetary Authority has increased inquiries with banks on their bond holdings since Silicon Valley Bank’s crisis in early March, Hong Kong Economic Journal reports, citing unidentified people. (BBG)

SOUTH KOREA: S. Korea eyes stronger ties with US in chip industry (Korea Herald)

SOUTH KOREA: S. Korea to attend new round of negotiations for IPEF this week (YNA)

CHINA

CHINA/US: China's foreign minister Qin Gang said it is imperative to stabilise Sino-U.S. relations, avoid a downward spiral and prevent accidents between China and the United States, according to a statement from the foreign ministry on Monday. (RTRS)

MONETARY POLICY: The People’s Bank of China (PBOC) should use more targeted policies to support the private sector, according to Liu Yuanchun, president at Shanghai University of Finance and Economics. At a recent forum, Liu noted current monetary policy was heavily distorted in favour of state owned and large companies in Q1, with policy interest rates at about 3%, state owned company rates near 1.8% and private firms charged 6-10%. (MNI)

ECONOMY: China will prioritise the development of a modern industrial system to become a modern country, the 20th Central Committee of Finance and Economics recently said. The government will focus on the real economy, nurturing entrepreneurs and supporting new technologies. (MNI)

FX RESERVES: China forex reserves rise to $3.205 trln in April- (RTRS)

FX RESERVES: China’s Gold Splurge Reaches Sixth Month as Reserves Rise Again - (BBG)

CHINA MARKETS

PBOC NET INJECTS CNY2bn VIA OMOs MONDAY

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Monday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY2 billion as no reverse repos matures today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7933% at 10:52 am local time from the close of 1.7206% on Friday.

- The CFETS-NEX money-market sentiment index closed at 55 on Saturday, compared with the close of 47 on Friday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 6.9158 FRI VS 6.9114 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.9158 on Monday, compared with 6.9114 set on Friday.

OVERNIGHT DATA

JAPAN APR JIBUN BANK PMI SERVICES 55.4; PRIOR 54.9

JAPAN APR JIBUN BANK PMI COMPOSITE 52.9; PRIOR 52.5

AU APR NAB BUSINESS CONFIDENCE 0; PRIOR -1.0

AU APR NAB BUSINESS CONDITIONS 14; PRIOR 16

AU MAR BUILDING APPROVALS M/M -0.1%; MEIDAN 3.0%; PRIOR 3.9%

AU MAR PRIVATE SECTOR HOUSE M/M -2.8%; PRIOR 11.3%

MARKETS

US TSYS: Curve Flattens In Asia

TYM3 deals at 115-26, +0-03, with a 0-07 range observed on volume of ~53k.

- Cash tsys sit 1bp cheaper to 2bps richer across the major benchmarks, the curve has twist flattened pivoting on 3s.

- Improving risk sentiment in Asia saw tsys firm through the session, the USD is pressured and regional equities are higher.

- Earlier in the session Tsys were marginally pressured in early trade as local participants perhaps focused on the headline number of Friday's NFP which saw the unemployment rate tick unexpectedly lower.

- From a flow perspective a block seller in UXY (1,361 lots) was the highlight.

- FOMC dated OIS price a terminal rate of ~5.1% in June, there are ~100bps of cuts priced for 2023.

- There is a thin data calendar in Europe with UK markets closed for the observance of a national holiday. Further out we have Wholesale Inventories and the Fed releases the May 2023 Financial Stability Report.

JGBS: Slightly Richer, Tight Range After Extended Holiday

JGB futures are higher in afternoon trade at 148.60, +15 compared to Tuesday settlement levels, after trading in a relatively tight range for the Tokyo session.

- There hasn’t been much in the way of domestic drivers to flag, outside of the BoJ March Minutes which showed board members believed it was important to continue with easing for prices goals and won’t hesitate to add easing if necessary.

- US tsys are 1bp cheaper to 1bp richer across major benchmarks with the 2/10 curve twist flattening in Asia-Pac trade.

- Technical analysis from MNI suggests that breaking the March 22 high (149.53) would signal the continuation of the uptrend. To the downside, the 50-dma provides support at 147.68, just above the April 18 low.

- Cash JGB curve twist flattens pivoting at the 7-year zone. Yields are 0.9bp higher to 0.7bp lower across the curve with the 1-year zone the weakest and the 40-year the strongest. The benchmark 10-year yield is 0.3bp lower at 0.418%, well below BoJ's YCC limit of 0.50%.

- The swaps curve has twist flattened also with rates 0.1bp higher to 0.6bp lower. The curve pivots at the 3-year zone with swap spreads tighter, except for the 1-year and 40-year zones.

- The local calendar is slated to release March Household Spending and Labour Cash Earnings tomorrow along with 10-year JGB supply.

AUSSIE BONDS: Holding Weaker, Awaits Federal Budget Tomorrow

ACGBs are weaker (YM -10.0 & XM -7.0) but off session cheaps. The release of the April NAB business survey and March building approvals data failed to provide a meaningful local catalyst. Business confidence rose 1pt to flat while business conditions dropped to +14 from +16 in March. Building approvals data undershot expectations with a decline of 0.1% m/m in March (+3.0% est.) following a revised +3.9% in February.

- Without meaningful macro news flow US tsys are little changed in Asia-Pac trade.

- Cash ACGBs are 7-10bp weaker but off the worst levels set in morning trade (10-13bp cheaper). The 3/10 cash curve is 3bp flatter with the AU-US 10-year yield differential +2bp at -4bp.

- The swaps curve is 2bp flatter with rates 5-7bp higher on the day. EFPs are 2bp tighter.

- The bills strip is steeper but with pricing off session cheaps at -3 to -11.

- RBA dated OIS pricing is 5-9bp firmer for meetings beyond October with early'24 leading.

- Treasurer Chalmers is slated to hand down the Federal Budget tomorrow. If it turns out to be significantly expansionary then RBA rate expectations may be affected. BBG consensus expects a A$5.35bn deficit, 0.25% of GDP for FY23.

NZGBS: Closed Weaker Near Morning Cheaps

NZGBs closed near session cheaps with benchmark yields 6-9bp higher and the 2/10 cash curve 3bp flatter. With no local data or meaningful local news flow, the NZGB market basically held near opening levels following the weaker lead-in from US tsys after solid non-farm payrolls data on Friday. NZ/US and NZ/AU 10-year yield differential both closed 1bp wider at respectively +72bp and +76bp.

- Swap rates closed 5-6bp higher with implied short-end swap spreads tighter.

- RBNZ dated OIS closed with pricing 1-6bp firmer across meetings with Apr’24 leading. 24bp of tightening is priced for the May 24 meeting.

- The local calendar is scheduled to release Retail Card Spending data for April tomorrow with a continued shift towards services expected.

- In Australia, Treasurer Chalmers is slated to hand down his first Federal Budget tomorrow. If it turns out to be significantly expansionary then RBA rate expectations may be affected.

- Further afield, the calendar is relatively light ahead of Wednesday’s release of US CPI for April.

FOREX: Antipodeans Firm As Risk Appetite Improves In Asia

The AUD and NZD are firmer on Monday as risk appetite improves, Hong Kong and Chinese equities are higher with the Hang Seng up ~0.8%.

- AUD/USD prints at $0.6770/75 ~0.3% firmer. The pair sits a touch above the high from Apr 20, with the next target for bulls $0.6806 high from Apr 14 and key resistance. April NAB Business Survey remained robust but showed that conditions are easing. Building Approvals fell in March -0.1% M/M an increase of 3.0% M/M was expected.

- Kiwi is also firmer, NZD/USD is up ~0.2%. We are consolidating in a narrow range above $0.63 handle. Bulls target a break of Apr high at $0.6379, from here they can target year to date highs at $0.6538.

- JPY was pressured in early trade before unwinding losses to deal flat. USD/JPY is now below the 135 handle and is little changed from Friday's closing levels.

- Elsewhere in G-10 EUR is 0.2% firmer and GBP is up ~0.1%.

- Cross asset wise; regional equities ex Japan are firmer, e-minis are little changed today. BBDXY is down ~0.1%.

- There is a thin data calendar today, German Industrial production provides the highlight. UK markets are closed for the observance of a national holiday.

EQUITIES: Regional Markets Rally, Although Returning Japanese Markets Lag

Most regional markets are tracking higher at the start of the week. The exception is Japan, with local markets returning from a 3-day break and struggling for positive traction amid US bank jitters. US equity futures opened higher but couldn't sustain positive momentum, with the Eminis off by around 0.08% at this stage, last near 4147. Still, this isn't too far off Friday session highs (just above 4160).

- China shares are firmer across the board, with the CSI 300 +1.00%, the Shanghai Composite around +1.55%. Banks have outperformed after a number of lenders lowered deposit rates to boost margins. Insurers also maintained a positive tone. Some offset came from weaker property developer performance amid signs the housing recovery lost traction in April.

- Hong Kong shares are also higher, with the HSI +0.75% at this stage. Some positive spillover from Golden Dragon Index gains through Friday's US session is helping. Alibaba is also planning an IPO in 2024 for its logistics division.

- The Kospi (+0.74%) and Taiex (+0.60%) are both higher, following positive leads from US tech on Friday, as the risk on mood prevailed.

- Japan stocks have returned, with local markets retracing modestly. The Topix down by 0.20% at this stage. This mainly owes to underperformance in the banking segment (playing some catch up with global weakness while Japan markets were closed Wed-Fri last week).

- SEA markets are mostly positive, albeit with the Singapore Strait Times and Indonesia JCI lagging somewhat.

OIL: Prices Rise Further In Better Risk Environment

Oil prices have moved higher during the APAC session on the improved risk environment. After rising 4% on Friday, crude is 0.5-0.6% higher today with WTI at $71.75/bbl and Brent $75.68. The USD index is 0.15% weaker.

- Brent fell through $75 briefly today but then bounced off its intraday low of $74.95. WTI held above $71 reaching a low of $71.04.

- The oil market remains nervous about the growth outlook despite the recent rally. It is likely to continue reacting strongly to any developments implying soft activity, especially given thin liquidity. Bloomberg is reporting though that physical demand indicators are suggesting that recent downward price action was excessive.

- The expectations in this week’s OPEC and US EIA monthly oil market reports could be market movers given the current degree of market sensitivity. They are published on Thursday and Tuesday respectively. Saudi Aramco, the largest global producer, releases results this week too.

- Goldman Sachs is expecting large oil market deficits in H2 2023 which it expects will support higher prices. It believes that the recent price moves were mostly driven by a “macro-financial selloff”.

- Later today the Fed releases the Q1 loan officer survey and the May 2023 financial stability report. Also, Fed’s Kashkari is moderating a panel discussion on minimum wages. The key piece of US data this week is Wednesday’s April CPI plus

GOLD: Prices Climbing Back Despite Stronger Equities

Gold gave up some of its gains on Friday after US Treasury yields rose following robust payroll data. It fell 1.6% to $2016.97/oz after reaching a low of just under $2000. It was still up 1.4% on the week though. Despite stronger risk appetite during the APEC session, bullion is up 0.4% today to $2024.45, close to the intraday high, as the USD index is weaker.

- Gold fell briefly below resistance of $2000.40, the 20-day EMA, to a low of $1999.61 on Friday.

- The World Gold Council said that central bank gold purchases slowed in Q1 but they remained strong from China which added to gold reserves for the 6th consecutive month in April.

- US CFTC reported that net gold longs increased 5.6% as the yellow metal has found favour in an increasingly uncertain global economic environment.

- Later today the Fed releases the Q1 loan officer survey and the May 2023 financial stability report. Also, the Fed’s Kashkari is moderating a panel discussion on minimum wages. The key piece of US data this week is Wednesday’s April CPI.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/05/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 08/05/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/05/2023 | 1400/1600 |  | EU | ECB Lane Speech/Q&A at Forum New Economy | |

| 08/05/2023 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 08/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 08/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 08/05/2023 | 2000/1600 |  | US | Fed's May Financial Stability Report | |

| 08/05/2023 | 2045/1645 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.