-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Post-Fed Central Bank Deluge On Deck

EXECUTIVE SUMMARY

- FED HIKES RATES BY 50BPS, SEES END-2023 RATE AT 5.1% (MNI)

- SCHOLZ ON SOVEREIGNTY FUND: USE MONEY FROM EXISTING PACKAGES FIRST (RTRS)

- HUNT LOOKS AT PROLONGING ENERGY AID FOR ALL COMPANIES (FT)

- CHINA’S COVID DEATH TOLL COULD TOP 2 MILLION, HK STUDY SHOWS (BBG)

- U.S. TO REMOVE SOME CHINESE ENTITIES FROM RED FLAG LIST SOON, U.S. OFFICIAL SAYS (RTRS)

- TC ENERGY RESTARTS PART OF KEYSTONE OIL PIPELINE AFTER SPILL (BBG)

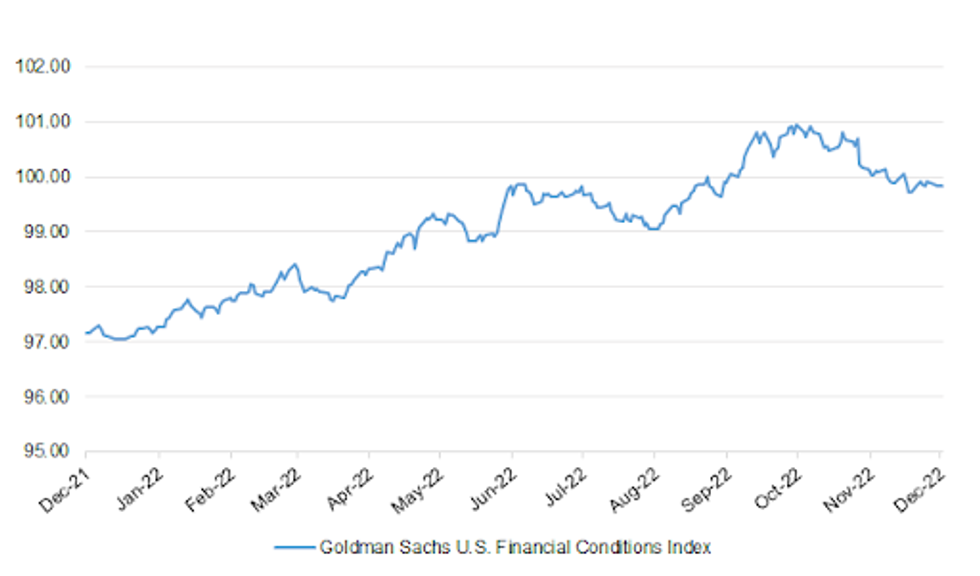

Fig. 1: Goldman Sachs U.S. Financial Conditions Index

Source: MNI - Market News/Bloomberg

UK

FISCAL: Chancellor Jeremy Hunt is exploring plans to keep providing all British businesses with help for their energy bills once winter has passed, in what would be a break with current government policy to limit such aid to “vulnerable industries” after March. (FT)

ECONOMY/POLITICS: Anti-strike laws will be brought in to ‘protect lives and livelihoods’, Rishi Sunak has vowed – as nurses prepare to stage an unprecedented walkout. (Daily Mail)

EUROPE

FISCAL: German Chancellor Olaf Scholz on Wednesday countered proposals for a European Sovereignty Fund by arguing there was still money available from prior European support packages that should be used up first. (RTRS)

IRELAND: Ireland’s economic growth will slow significantly in 2023 due to high inflation and weaker consumer confidence, according to the OECD. (BBG)

AUSTRIA: Austria plans to increase the volume of green debt instruments it sells next year and keep its government bond issuance little changed at around 45 billion euros ($48 billion) versus roughly 44 billion euros this year, its treasury said on Wednesday. (RTRS)

U.S.

FED: Federal Reserve Chair Jerome Powell on Wednesday sought to convince investors interest rates are headed above 5% in 2023 and will stay there until high inflation is tamed, although market expectations remained stubbornly more dovish, counting on a lower terminal rate and cuts next year. (MNI)

POLITICS: About a month after launching his 2024 presidential campaign, former President Donald Trump’s standing with voters has hit its lowest point in over seven years, according to a Quinnipiac University poll released Wednesday. (CNBC)

EQUITIES: Tesla Inc Chief Executive Officer Elon Musk has sold 22 million shares worth $3.58 billion in the electric-vehicle maker this week, a U.S. securities filing showed on Wednesday. (RTRS)

OTHER

U.S./CHINA:The Biden administration plans to remove some Chinese entities from a red flag trade list, a U.S. official told Reuters on Wednesday amid closer cooperation with Beijing. (RTRS)

U.S./CHINA: The US Senate voted to ban the hugely popular TikTok video-sharing app from all government-issued phones and other devices as the Biden administration considers restrictions on the Chinese-owned platform. (BBG)

U.S./CHINA: The United States is prepared to help China deal with a surge of COVID-19 infections if Beijing requests assistance, the White House said on Wednesday. John Kirby, the White House national security spokesperson, told reporters that China has not requested help at this stage. (RTRS)

JAPAN: Japan’s ruling Liberal Democratic Party tax panel is making final preparations to impose a 4-4.5 ppt surtax on corporations to help fund a planned increase in defense spending, Jiji reports, without attribution. (BBG)

BOK: The Bank of Korea (BOK) says it will keep a close eye on changes in the nation's financial and foreign exchange markets and take timely measures to stabilize the markets should volatility expand. (KBS World)

SOUTH KOREA: South Korea's finance minister said on Thursday that local financial markets have comparably stabilised recently, while reaffirming that authorities will continue to take measures for the markets to further stabilise. (RTRS)

HONG KONG: Hong Kong’s de facto central banker repeated his warning for borrowers to prepare for higher funding costs, even as the city’s base rate rose at a slower pace for the first time this year in lockstep with a policy downshift by the US Federal Reserve. (SCMP)

MEXICO: Mexico’s senate approved in general terms a bill backed by Andres Manuel Lopez Obrador that would reform parts of the electoral process, a partial win for the president in the lead-up to the 2024 federal election that will determine his successor. (BBG)

BRAZIL: Brazil's incoming finance minister Fernando Haddad downplayed on Wednesday possible changes to the country's State-Owned Enterprise Law to make it easier for politicians to take roles at state-run firms, saying effective auditing from the federal government is more important. (RTRS)

BRAZIL:Brazil’s electoral court is investigating outgoing President Jair Bolsonaro, his running mate and some allies in congress for allegedly casting doubt on the result of the October election and abusing their power during the campaign. (BBG)

RUSSIA: The Biden administration is planning to send Ukraine advanced electronic equipment that converts unguided aerial munitions into “smart bombs” that can target Russian military positions with a high degree of accuracy, according to senior U.S. officials familiar with the matter. (Washington Post)

RUSSIA: Canada on Wednesday said it would revoke a sanctions waiver that allowed turbines for Nord Stream 1, Russia's biggest gas pipeline to Europe, to be repaired in Montreal and returned to Germany. (RTRS)

SOUTH AFRICA: Eskom on Wednesday night announced the reduction of Stage 5 load shedding to Stage 4. (EWN)

METALS: The state-owned Chilean Copper Commission (Cochilco) on Wednesday cut its projection for the price of copper for 2023 to $3.70 per pound due to greater supply. (RTRS)

METALS: China’s steel production fell again last month as mills cut output to stem losses and cope with a slide in demand. (BBG)

OIL: TC Energy Corp. restarted a segment of its Keystone oil pipeline after one of the worst onshore crude oil spills in the US since 2010. (BBG)

CHINA

CORONAVIRUS: More than 2 million people in China may die from Covid-19 as the government rapidly abandons pandemic curbs, according to a new study by researchers in Hong Kong. (BBG)

CORONAVIRUS: From locking in workers to hoarding medicines, beds and disinfectant, China’s factories are going to great lengths to keep the machines running — and the global supply chain intact — as an onslaught of Covid cases looms. (BBG)

YUAN: The yuan could rally to 6.5 against the U.S. dollar next year as China’s economic rebound gathers pace and the Federal Reserve approaches the peak of its tightening cycle, advisers and economists told MNI. (MNI)

ECONOMY: China’s export outlook for next year can be improved if measures are taken to promote foreign trade, according to Yicai.com. Policy recommendations include making full use of the Regional Comprehensive Economic Partnership trade agreement, diversifying exports by increasing trade with Belt and Road nations, and coordinating efforts with the Asian Infrastructure Investment Bank. (MNI)

POLICY: The State Council has issued a report detailing plans to enhance domestic demand from 2022- 2035, according to China Securities News. (MNI)

PBOC: The People’s Bank of China issued draft rules on supervising and managing financial infrastructure to promote finance to better serve the real economy, according to a statement on the PBOC website. (MNI)

PROPERTY: Beijing’s plans to revive the property sector by easing financing rules is being undermined by weak sales that have diminished the value of developers’ collateral needed to access finance, raising pressure on local governments to deliver more policy support to boost transactions, advisers and analysts told MNI. (MNI)

CHINA MARKETS

PBOC NET INJECTS CNY150 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) on Thursday injected CNY2 billion via 7-day reverse repos, and CNY650 billion via 1-year Medium-term Lending Facility, with the rates unchanged at 2.00% and 2.75%. The operations have led to a net injection of CNY150 billion after offsetting the maturity of CNY2 billion reverse repos and CNY500 billion MLFs today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.5630% at 9:38 am local time from the close of 1.6756% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Wednesday vs 46 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.9343 THURS VS 6.9535 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9343 on Thursday, compared with 6.9535 set on Wednesday.

OVERNIGHT DATA

CHINA NOV INDUSTRIAL PRODUCTION +2.2% Y/Y; MEDIAN +3.5%; OCT +5.0%

CHINA NOV INDUSTRIAL PRODUCTION +3.8% Y/Y YTD; MEDIAN +4.0%; OCT +4.0%

CHINA NOV RETAIL SALES -5.9% Y/Y; MEDIAN -4.0%; OCT -0.5%

CHINA NOV RETAIL SALES -0.1% Y/Y YTD; MEDIAN +0.4%; OCT +0.6%

CHINA NOV FIXED ASSET INVESTMENT EX-RURAL +5.3% Y/Y YTD; MEDIAN +5.6%; OCT +5.8%

CHINA NOV SURVEYED UNEMPLOYMENT RATE 5.7%; MEDIAN 5.6%; OCT 5.5%

CHINA NOV NEW HOME PRICES -0.25% M/M; OCT -0.37%

JAPAN NOV TRADE BALANCE -¥2.0274TN; MEDIAN -Y1.6787TN; OCT -Y2.1662TN

JAPAN NOV EXPORTS +20.0% Y/Y; MEDIAN +19.7%; OCT +25.3%

JAPAN NOV IMPORTS +30.3% Y/Y; MEDIAN +26.9%; OCT +53.5%

JAPAN NOV TRADE BALANCE ADJUSTED -¥1.7323TN; MEDIAN -Y1.2382TN; OCT -Y2.2076TN

JAPAN OCT TERTIARY INDEX +0.2% M/M; MEDIAN +0.8%; SEP -0.2%

AUSTRALIA NOV EMPLOYMENT CHANGE +64.0K; MEDIAN +19.0K; OCT +43.1K

AUSTRALIA NOV FULL-TIME EMPLOYMENT CHANGE +34.2K; OCT +55.0K

AUSTRALIA NOV PART-TIME EMPLOYMENT CHANGE +29.8K; OCT -11.9K

AUSTRALIA NOV UNEMPLOYMENT RATE 3.4%; MEDIAN 3.4%; OCT 3.4%

AUSTRALIA NOV PARTICIPATION RATE 66.8%; MEDIAN 66.6%; OCT 66.6%

AUSTRALIA DEC 1-YEAR CONSUMER INFLATION EXPECTATIONS +5.2%; NOV +6.0%

AUSTRALIA NOV RBA FX TRANSACTIONS GOVERNMENT -A$719MN; OCT -A$785MN

AUSTRALIA NOV RBA FX TRANSACTIONS MARKET +A$672MN; OCT +A$597MN

AUSTRALIA NOV RBA FX TRANSACTIONS OTHER +A$644MN; OCT +A$605MN

NEW ZEALAND Q3 GDP +2.0 Q/Q; MEDIAN +0.9%; Q2 +1.9%

NEW ZEALAND Q3 GDP +6.4% Y/Y; MEDIAN +5.5%; Q2 +0.3%

MARKETS

SNAPSHOT: Post-Fed Central Bank Deluge On Deck

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 110.84 points at 28045.9

- ASX 200 down 46.502 points at 7204.8

- Shanghai Comp. down 11.487 points at 3164.747

- JGB 10-Yr future down 18 ticks at 148.02, yield up 0.1bp at 0.253%

- Aussie 10-Yr future down 9.2 ticks at 96.5320, yield up 9.4bp at 3.457%

- U.S. 10-Yr future up 0-01+ at 114-24+, yield up 1.64bp at 3.4938%

- WTI crude down $0.71 at $76.57, Gold down $15.44 at $1791.95

- USD/JPY up 25 pips at Y135.73

- FED HIKES RATES BY 50BPS, SEES END-2023 RATE AT 5.1% (MNI)

- SCHOLZ ON SOVEREIGNTY FUND: USE MONEY FROM EXISTING PACKAGES FIRST (RTRS)

- HUNT LOOKS AT PROLONGING ENERGY AID FOR ALL COMPANIES (FT)

- CHINA’S COVID DEATH TOLL COULD TOP 2 MILLION, HK STUDY SHOWS (BBG)

- U.S. TO REMOVE SOME CHINESE ENTITIES FROM RED FLAG LIST SOON, U.S. OFFICIAL SAYS (RTRS)

- TC ENERGY RESTARTS PART OF KEYSTONE OIL PIPELINE AFTER SPILL (BBG)

US TSYS: Off Session Lows As Curve Twist Flattens

TYH3 deals at 114-25+, +0-02+, after ticking away from the base of its 0-11 overnight range, operating on volume of ~73K.

- Cash Tsys are 3.0bp cheaper to 1.5bp richer across the major benchmarks, with the curve twist flattening, pivoting around 20s.

- Early Asia dealing saw regional participants exhibit a willingness to fade the richening observed during Fed Chair Powell’s post-FOMC meeting press conference.

- Cheapening then extended as cross-market impact from the Antipodean rates space was felt, as both ACGBs and NZGBs softened on stronger than expected local data, before Tsys then moved away from session lows through the Asian afternoon.

- The space looked through weaker than expected monthly economic data from China, with more focus on the recent alterations in China’s COVID-related reactions.

- A block seller of FV futures headlined on the flow side (-1.7K).

- Fed dated OIS price ~32bp of tightening for the Feb ’23 meeting and a terminal rate of just under 4.90%, shy of the ~5.10% seen in the Fed’s latest dot plot.

- In Europe today we have the ECB, BOE and SNB rate decisions. Further out there is a slew of U.S. data including retail sales, TIC flows, business inventories, Empire M’fing survey, initial jobless claims and industrial production.

JGBS: 20s Struggle In Wake Of Poorly Received Supply

JGB futures consolidated their overnight losses in Tokyo dealing, with the cash space playing catch up to the post-Tokyo weakness, which was linked to the latest news wire source reports surrounding the potential for a BoJ policy framework review in the post-Kuroda era (that we have documented elsewhere).

- There was a soft reception for the latest round of 20-Year JGB supply, which saw the low price, and indeed the average price, miss wider dealer expectations, with the cover ratio nudging further below the 6-auction average.

- A combination of spill over from the core global FI price action during the Tokyo lunch break and the weak auction details applied pressure to JGB futures in early afternoon trade, although the overnight lows in futures were not tested on the move. 20s cheapened on the curve.

- The space then regained some poise into the close, leaving futures -20 at the bell, while cash JGBs were little changed to 4bp cheaper, with 20s providing the weakest point, both pre- and post-supply.

- In domestic news flow we saw continued rumours surrounding tax tweaks to fund Japan’s increased defence spending, but this was inconsequential for markets, with the broader tax category alterations already highlighted by policymakers.

- Looking ahead, Friday’s local docket will be headlined by flash PMI readings.

JGBS AUCTION: 20-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y983.1bn 20-Year JGBs:

- Average Yield: 1.088% (prev. 1.029%)

- Average Price: 100.18 (prev. 101.16)

- High Yield: 1.103% (prev. 1.039%)

- Low Price: 99.95 (prev. 101.00)

- % Allotted At High Yield: 81.4814% (prev. 22.0618%)

- Bid/Cover: 2.903x (prev. 3.035x)

AUSSIE BONDS: Labour Market & Offshore Matters Apply Pressure

The combination of a firmer than expected domestic labour market data, trans-Tasman impetus from a blockbuster NZ GDP release and payside swap flow-derived pressure weighed on ACGBs during the post-FOMC Sydney session, leaving YM -7.0 & XM -9.2 at the close, below their respective overnight session bases. Cash ACGBs were 7-10bp cheaper across the curve, with bear steepening in play.

- There was some widening of the AU/U.S. 10-Year yield spread, which moved back towards parity, closing around the -5bp mark.

- Bills finished 8-14bp cheaper on the day, with the back end of the whites and front end of the reds underperforming.

- This came as market pricing re: RBA tightening shifted higher, with RBA dated OIS now pricing ~19bp of tightening for the Feb ’23 meeting, alongside a terminal cash rate of just under 3.80%.

- EFPs were wider against this backdrop.

- Note that we saw a moderation in the monthly consumer inflation expectations print, which pared back to 5.2% from 6.0% (over a 1-Year horizon).

- Flash S&P Global PMI data headlines the local docket on Friday.

NZGBS: Pressured As GDP Hawkishly Reshapes RBNZ Pricing

NZGB yields shifted higher on Thursday, with NZ GDP data, regional reaction to the FOMC meeting and some trans-Tasman impetus in lieu of a firm round of Australian labour market data all applying pressure at different points in the day.

- That left the major cash NZGB benchmarks 14.5-16.5bp cheaper across the curve at the close, with the wings leading the weakness.

- Swap rates were 13-16bp higher across that curve, with some flattening apparent, leaving swap spreads little changed to a touch narrower.

- This came as RBNZ dated OIS shunted higher, to virtually fully price a 75bp hike at the Feb ’23 meeting, alongside a peak OCR of just below ~5.60%, as the market eyes the potential for a more pronounced round of monetary tightening in a bid to “cool the jets” after the much firmer than expected GDP print (which blew all expectations, including that of the RBNZ, out of the water).

- Today’s NZGB supply (covering NZGB Apr-27, Apr-33 & May-51) saw cover ratios between 1.50-2.00x, representing smooth, albeit relatively vanilla, reception of the auctions.

- Friday’s local docket will headlined by m’fing PMI and non-resident bond holding data.

EQUITIES: Weaker Across The Board

Regional equities are tracking lower, although for some of the major index's losses haven't extended since the open. These moves are in line with overnight weakness in major bourses, while US futures have edged lower this afternoon. Higher US cash Tys yields, 3-4bps firmer across the curve, have also weighed on broader risk appetite.

- China/HK stocks opened lower, but have recouped some losses as the session progressed. The HSI is down a little over 1.1% at this stage, while the CSI 300 is off by -0.25%.

- China activity data was uniformly weaker than expected, but there was a 150bn net injection via the 1yr MLF, which likely helped sentiment at the margin.

- The Kospi is down over 1.2%, while the Taiex is close to flat. Japan stocks are weaker, with the Nikkei 225 down 0.40% at this stage. The weaker tech trend from overnight has likely weighed on these markets today.

- South East Asia markets are lower across the board.

GOLD: Gold Prices Down On Hawkish Fed Comments

Gold prices are down during the session by 0.8% to around $1793.50/oz unwinding just over half of the post-US CPI gain. Even though DXY is only up slightly, gold markets have been rattled by Fed Chairman Powell’s comment that rates are not yet close to their terminal rate.

- The Fed’s rate expectations were revised up to end 2023 at 5.1% before being eased to 4.1% in 2024. A longer and higher rate trajectory is likely to weigh on bullion as it is non-yielding and thus other assets become more attractive to investors. But there tends to be safe haven buying of gold during recessions. As a result, ANZ has revised up its end-2023 forecast to US$1900/oz.

- Despite the correction seen today trend conditions for gold remain bullish. Resistance is at Tuesday’s high of $1824.50.

- In the US, retail sales data print for November and are expected to moderate from the October gains. There are also jobless claims and the Philly and NY Fed surveys. A number of European central banks meet with the focus on the ECB and BoE.

OIL: Oil Prices Ease As Pipeline Partially Reopens

MNI (Australia) - Oil prices are down around 0.8% during the session but they have been trading in a range of around a dollar. The partial reopening of the Keystone pipeline in North America weighed on crude after it rallied over the week. WTI is currently trading around $76.60/bbl and Brent $82.10.

- Prices are now below the resistance levels they broke through during the NY session.

- The reopening of Keystone helped to ease supply concerns in the market. The demand outlook continues to be influenced by the offsetting factors of a tightening Fed and China reopening its economy.

- The International Energy Agency said in its report yesterday that prices may rise in 2023 as sanctions impact Russian supply and demand improves. But it expects demand in early 2023 to be muted.

- In the US, retail sales data print for November and are expected to moderate from the October gains. There are also jobless claims and the Philly and NY Fed surveys. A number of European central banks meet with the focus on the ECB and BoE.

FOREX: Dollar Firms, Aided By Higher Yields

The USD has firmed as the session has progressed. The BBDXY is up around 0.25% for the session so far, putting the index above 1254.00. Highs post the FOMC in NY trading were around 1256.75. The USD has been aided by a 3-4bps move higher in yields (2-7yr part of the curve), while softer equity sentiment in the region has also weighed.

- AUD/USD is among the weakest performers, down over 0.50% at this stage, and back sub 0.6830. This comes despite employment data comfortably beating expectations. Commodities are weaker in terms of oil and copper, with weaker China activity data a potential catalyst, although iron ore is trading resiliently (last above $109/tonne).

- NZD/USD is down 0.30%, last under 0.6440. NZ also saw better data, this time in terms of Q3 GDP, which has buoyed NZ bond yields. This has likely help NZD outperform on a cross basis. AUD/NZD is back to the low 1.0600 region, against NY session highs above 1.0600.

- NOK is also weaker by 0.50%, with USD/NOK back above 9.7700, as oil prices weigh.

- USD/JPY has been supported on dips, the pair last 135.75/80. The yen has slightly outperformed on a cross basis.

- Looking ahead, in the US, retail sales data print, there are also jobless claims and the Philly and NY Fed surveys. A number of European central banks meet with the focus on the ECB and BoE.

FX OPTIONS: Expiries for Dec15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E3.5bln), $1.0500(E542mln), $1.0550(E526mln), $1.0600(E551mln), $1.0700(E1.7bln)

- USD/JPY: Y138.80-00($1.1bln)

- GBP/USD: $1.2350(Gbp1.5bln), $1.2450(Gbp693mln), $1.2495-00(Gbp574mln)

- USD/CAD: C$1.3500($659mln)

- USD/CNY: Cny6.9900-00($1.8bln), Cny7.1500($1.1bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/12/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 15/12/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 15/12/2022 | 0830/0930 |  | CH | SNB interest rate decision | |

| 15/12/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 15/12/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 15/12/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 15/12/2022 | - |  | IE | Ireland Prime Minister Transition | |

| 15/12/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/12/2022 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 15/12/2022 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 15/12/2022 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 15/12/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 15/12/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 15/12/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/12/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 15/12/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 15/12/2022 | 1345/1445 |  | EU | ECB Press Conference Following Rate Decision | |

| 15/12/2022 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/12/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 15/12/2022 | 1500/1000 | * |  | US | Business Inventories |

| 15/12/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 15/12/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 15/12/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 15/12/2022 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

| 15/12/2022 | 2100/1600 | ** |  | US | TICS |

| 16/12/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.