-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

MNI EUROPEAN OPEN: RBA +25bps Surprise Sees A$ & Local Yields Surge

EXECUTIVE SUMMARY

- YELLEN WARNS CONGRESS TREASURY MAY RUN OUT OF CASH SOON AS JUNE (BBG)

- BIDEN INVITED TOP CONGRESS LEADERS TO MEET MAY 9 ON DEBT LIMIT (BBG)

- UK SHOP PRICE INFLATION COOLS FOR FIRST TIME IN 2023, BRC SAYS (BBG)

- RBA DELIVERS SHOCK INTEREST RATE INCREASE WITH MORE TO COME (AFR)

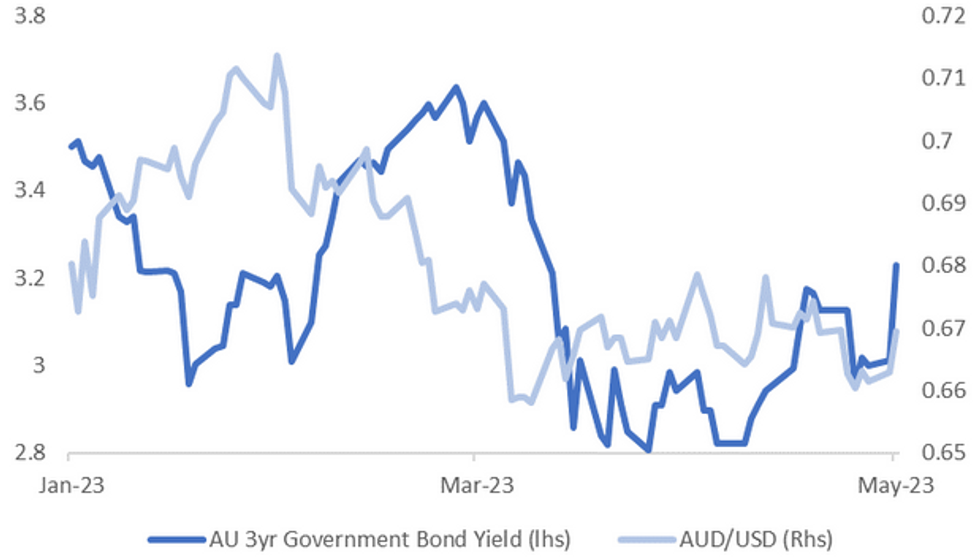

Fig. 1: AUD and AU Bond Yields Spike Post RBA +25bps Hike

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Heavy discounting on clothing and furniture pulled down UK shop price growth for the first time in 2023, a sign that households may be past the worst of an inflation shock. (BBG)

EUROPE

UKRAINE: Russian forces were reportedly moving into defensive positions, as Ukraine’s defense chief said the military was “reaching the finish line” for a major push to reclaim occupied land. (NYT)

U.S.

DEBT: U.S. President Joe Biden on Monday summoned the four top congressional leaders to the White House next week after the Treasury warned the government could run short of cash to pay its bills as soon as June. (RTRS)

DEBT: President Joe Biden invited top congressional leaders for a May 9 meeting on the debt limit as the US barrels closer to a potential default that the Treasury Department warned Monday could come sooner than anticipated. (BBG)

DEBT: Treasury Secretary Janet Yellen told US lawmakers that her department’s ability to use special accounting maneuvers to stay within the federal debt limit could be exhausted as soon as the start of June. (BBG)

DEBT: U.S. Senate Majority Leader Chuck Schumer on Monday set in motion an expedited process for the chamber to consider a clean two-year suspension of the federal debt ceiling, a Schumer spokesman said. (RTRS)

ECONOMY: Morgan Stanley is preparing a fresh round of job cuts amid a renewed focus on expenses as recession fears delay a rebound in dealmaking. (BBG)

BANKS: US financial regulators have recommended partly revamping American deposit insurance to increase coverage for day-to-day business accounts as a way to reduce the risk of bank runs, such as the ones that brought down Silicon Valley Bank and First Republic. (FT)

FED: The White House is considering promoting Federal Reserve Governor Philip Jefferson to vice chair and naming a Latino candidate to an open board slot in a shift from prior plans, according to people familiar with the matter. (BBG)

OTHER

AUSTRALIA: The Reserve Bank of Australia has raised interest rates to 3.85 per cent, stunning economists and markets, which were predicting almost no chance of an increase just one month after the central bank hit pause. (AFR)

SOUTH KOREA/JAPAN: Japanese Prime Minister Fumio Kishida says he plans to visit S. Korea on May 7 and 8 to hold a summit meeting with President Yoon Suk Yeol, Nikkei reports. (BBG)

SOUTH KOREA/JAPAN: Japan and South Korea held their first bilateral finance leaders' meeting in seven years on Tuesday, a sign relations between the two are thawing amid shared challenges from geopolitical tensions and slowing economic growth. (RTRS)

SOUTH KOREA/JAPAN/CHINA: South Korea will seek ways to expand cooperation with China and Japan in areas including finance, trade & investment and the economy as countries reopen from the pandemic, Finance Minister Choo Kyung-ho says at the start of a trilateral meeting with his Chinese and Japanese counterparts held on the sideline of the Asia Development Bank’s annual conference. (BBG)

HONG KONG: Hong Kong’s economy expanded 2.7% in the first quarter from a year earlier after the city removed pandemic controls and the border with mainland China reopened. (BBG)

ASEAN: Asian finance leaders will on Tuesday look for ways to tighten safeguards to address emergency funding needs during pandemics and natural disasters, as global recession fears and volatile financial markets cloud the economic outlook. (RTRS)

CHINA

TRAVEL: China is increasingly barring people from leaving the country, including foreign executives, a jarring message as the authorities say the country is open for business after three years of tight COVID-19 restrictions. (RTRS)

PROPERTY: KWG Group Holdings Ltd. faces possible repayment demands on $4.5 billion of debt after defaulting last week, adding to the list of delinquent Chinese developers even as new-home sales nationally gain steam. (BBG)

YUAN: Russia is likely to resume buying foreign currency for its reserves as soon as this month as rising oil earnings stabilize public finances despite US and European efforts to squeeze Kremlin income.(BBG)

OVERNIGHT DATA

SOUTH KOREA APR CPI M/M 0.2%; MEDIAN 0.2%; PRIOR 0.2%

SOUTH KOREA APR CPI Y/Y 3.7%; MEDIAN 3.7%; PRIOR 4.2%

SOUTH KOREA APR CORE CPI Y/Y 4.6%; PRIOR 4.8%

SOUTH KOREA APR PMI 48.1; PRIOR 47.6

HONG KONG Q1 GDP Y/Y 2.7%; MEDIAN 0.5%; PRIOR -4.2%

JAPAN APR MONETARY BASE Y/Y -1.7%; MEDIAN -1.3%; PRIOR -1.0%

UK APR BRC SHOP PRICE INDEX Y/Y 8.8%; PRIOR 8.9%

MARKETS

US TSYS: Pares Gains In Asia As RBA Hikes 25bps

TYM3 deals at 114-17, +0-01, a touch off the base of the 0-06+ range on volume of ~99k.

- Cash tsys sit little changed from Mondays closing levels across the major benchmarks.

- Cross market spillover from ACGBs as the RBA unexpectedly raised the cash rate 25bps saw tsys pressured to session lows before marginally paring losses.

- Earlier in the session Asia-Pac participants faded Monday’s cheapening perhaps using the opportunity to exit short positions/enter fresh long positions.

- After the early richening, in the lead up to the RBAs monetary policy decision narrow ranges were observed with little follow through on moves.

- Final European Manufacturing PMIs and preliminary Eurozone CPI headline the European session today. Further out we have JOLTS Job opening, Factory and Durable Goods Orders

JGBS: Futures Back To Overnight Lows, Pressured By US Tsys & ACGBs

JGB futures sit near Tokyo session lows, -14 versus settlement levels as cross-market spill over from ACGBs as the RBA unexpectedly raised the cash rate 25bp. Us tsys were pressured to session lows after the RBA decision, 2-3bp off bests.

- Without significant domestic drivers, local participants seem to have been focusing on US tsys ahead of the Euro Area CPI release for April later today, as well as the FOMC policy decision tomorrow.

- Despite the overnight weakness, JBM3 currently sits at 148.38, sandwiched between the April trading range's top at 147.92 and the March 22 high at 149.53.

- Cash JGBs are 0.2bp richer to 2.9bp cheaper across the benchmarks with the 1-year zone the strongest and the 20-year zone the weakest. The benchmark 10-year yield is 1.9bp higher at 0.426%, well below the BoJ's YCC limit of 0.50%.

- Any impetus from solid demand at the latest liquidity enhancement auction covering off-the-run 1- to 5-Year JGBs appears to have been countered by the RBA-Induced cheapening in US tsys.

- Swaps curve twist steepens with swap spreads slightly tighter to slightly wider across the curve, except for the 20-year zone where the swap spread was materially tighter.

- With the local calendar light this week, local participants will continue to eye US tsys ahead of the FOMC decision tomorrow.

AUSSIE BONDS: Sharply Cheaper, RBA Hawkish Again On Inflation

ACGBs sit sharply lower (YM -23.0 & XM -13.5) after the RBA surprises the market by lifting the cash rate by 25bp to 3.85% from 3.60%, labelling inflation as still “too high”. RBA dated OIS pricing had only a 14% chance of a 25bp rate hike priced ahead of the decision. At the time of writing, 3-year and 10-year futures were as much as 22bp and 14bp lower respectively after the RBA decision.

- The RBA began the year with a hawkish stance on inflation but softened its stance after monthly CPI data indicated that inflation had peaked. However, the RBA has once again adopted a hawkish stance with the decision statement, stating that “Some further tightening of monetary policy may be required to ensure that inflation returns to target...”.

- RBA dated OIS has shunted 22-32bp higher across meetings with terminal rate expectations lifting to just shy of 4.0% at 3.98%.

- Cash ACGBs are 12-20bp higher after the decision with the AU-US 10-year yield differential +11bp at -7bp.

- Swap rates are 13-22bp higher after the decision with the 3s10s curve 9bp flatter.

- The bills strip bear flattens with pricing -34 to -19 after the decision.

- Elsewhere, more information is trickling out regarding the May 9 budget. The government is focused on providing cost-of-living relief while not providing fiscal stimulus that adds to inflation – The Australian.

NZGBS: Closed At Cheaps Ahead Of Employment Data Tomorrow

NZGBs closed at session cheaps with benchmark yields 9-11bp higher. Us tsys edging away from Asia-Pac bests aided the move late in the local session.

- Swap rates are 3-5bp with implied swap spread significantly wider.

- RBNZ dated OIS closed 4-6bp firmer for meetings beyond July with Feb’24 leading. The May meeting has 23bp of tightening priced with terminal OCR expectations at 5.55% (July).

- In a report titled, ‘Financial Strain on Households and Businesses’, the RBNZ noted that debt servicing costs are expected to more than double the share of disposable income required to service the interest component of mortgage debt for households with a mortgage, from 9% to 22% by the end of 2023.

- The local calendar is scheduled to release tomorrow the Q1 Labour Market Report with BBG consensus expecting some cooling in tight labour market conditions with the unemployment rate increasing to 3.5% from 3.4%. Q1 wage growth is expected to remain at Q4’s strong pace of +1.1% Q/Q.

- The RBNZ Financial Stability Report is also slated for release tomorrow.

- Given that the local market has closed ahead of the RBA rates decision, tomorrow's opening is expected to reflect not only the Australian market's response to the announcement but also any fluctuations in the US Tsys overnight.

FOREX: AUD Firms in Asia As RBA Hikes 25bps

The AUD is the strongest performer in the G-10 space at the margins on Tuesday. The RBA lifted the cash rate 25bps to 3.85%, the market had been expecting rates to be held steady at 3.60%.

- AUD/USD prints at $0.6695/0.6700, the pair has rallied ~1% since the RBA decision. We have breached the 20-Day EMA ($0.6673), bulls now target a move above $0.67.

- AUD/NZD is ~0.7% firmer, the cross is back above the $1.08 handle and has breached the 20-Day EMA. Bulls now target the 200-Day EMA at $1.0868.

- Kiwi is ~0.2% firmer, NZD/USD prints at $0.6180/85. However the pair has not yet been able to sustain a break of the 20-Day EMA ($0.6187) having met resistance here through today's Asian session.

- Elsewhere in G-10 ranges have narrow with little follow through on moves.

- Cross asset wise; e-minis are a touch softer and BBDXY is ~0.1% lower. US Treasury Yields are little changed from Mondays closing levels across the curve.

- Final European Manufacturing PMIs and preliminary Eurozone CPI headline the European session today. Further out we have JOLTS Job opening, Factory and Durable Goods Orders.

GOLD: Bullion Range Trading Ahead Of Fed Decision

Gold prices have been steady during the APAC session with trading in a range of less than $5. They fell 0.4% on Monday after briefly breaking above the $2000 level to reach an intraday high of $2006.05/oz. Gold is currently trading around $1981.80. The USD index is down slightly.

- Bullion is in a holding pattern ahead of the Fed’s rate decision on Wednesday. It is expected to hike rates another 25bp and then possibly signal that it will pause (see MNI Fed Preview: May 2023). A more dovish statement would be good for gold prices.

- A lack of agreement on increasing the US debt ceiling may also be providing some support to gold through safe haven flows. President Biden has invited congressional leaders to a meeting on May 9.

- Later today US JOLTS job openings and factory orders for March print. Also April manufacturing PMIs in Europe and preliminary April euro area CPI data are released.

OIL: Demand Outlook Troubling Crude Ahead Of Expected Fed Hike

After falling 1.3% on Monday, oil prices are stable today and trading in a narrow range. Brent is up 0.1% to $79.40/bbl and WTI stable around $75.77, both are just off intraday highs. The USD index is down slightly.

- Ahead of the Fed’s rate decision on Wednesday, crude markets continue to focus on demand uncertainties. The FOMC is expected to hike rates another 25bp and then possibly signal that it will pause (see MNI Fed Preview: May 2023). A more dovish tone to the statement would help to calm some fears re a US recession. While, China’s recovery doesn’t seem uniform with industrial data lacklustre but retail and travel trends robust.

- Later today US JOLTS job openings and factory orders for March print. Also April manufacturing PMIs in Europe and preliminary April euro area CPI data are released.

EQUITIES: HSI Volatility Dominates As Asian Markets Re-Open

Regional equity markets are mixed today. Hong Kong markets re-opened much higher (returning from yesterday's holiday), but quickly found selling interest. The HSI back close to flat. US futures are down a touch, but are away from worst levels. The market digesting late comments from the US session around the debt ceiling and developments in the banking space post J.P. Morgan's take over of First Republic.

- The HSI opened up strongly led by tech, but quickly ran into selling interest. Initial optimism rested with China spending/activity over the May day holiday period (which continues this week), with anecdotes of strong activity. We also had a decent beat on Q1 GDP for Hong Kong, but that failed to lift sentiment further.

- Fresh concerns in the property sector following a default from last Friday along with weaker earnings appeared to curb the rally. The HSI is back to around flat, the tech index is up off lows, but still more than 2% down from opening highs.

- Other markets which returned from yesterday's break have fared better. The Kospi is +0.65%, while the Taiex is +0.20%. Singapore and Malaysia markets are also higher, but away from opening highs.

- Indonesian stocks are bucking this trend, down over 1%. Construction company Waskita has fallen sharply after its CEO was detained by the Attorney General's office.

- The ASX 200 is around flat, while Japan stocks are trading slightly in the red, the Topix off by 0.20%.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/05/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 02/05/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 02/05/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0800/1000 | ** |  | EU | M3 |

| 02/05/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 02/05/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 02/05/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 02/05/2023 | 1000/1200 | ** |  | IT | PPI |

| 02/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 02/05/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 02/05/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 02/05/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 02/05/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 02/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 03/05/2023 | 2245/1045 | *** |  | NZ | Quarterly Labor market data |

| 03/05/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.