-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI EUROPEAN OPEN: RBNZ Steps Up Pace Of Rate Hikes, Talked About Doing Even More

EXECUTIVE SUMMARY

- FED’S GEORGE SAYS HIGHER US SAVINGS MAY ALSO MEAN HIGHER RATES NEEDED (BBG)

- ECB'S SIMKUS OPEN TO DECEMBER 50BP HIKE (MNI)

- PBOC ADVISER: CHINA 2023 GROWTH CAN TOP 5% IF COVID IMPACT ENDS (BBG)

- CHINA TIGHTENS COVID RESTRICTIONS IN BIG CITIES AS CASES CLIMB (BBG)

- NEW ZEALAND CENTRAL BANK SHARPLY RAISES RATES, NOW EXPECTS TO PEAK AT 5.5% IN 2023 (DJ)

- WESTERN ALLIES AIM TO AGREE ON RUSSIAN OIL PRICE CAP WEDNESDAY (WSJ)

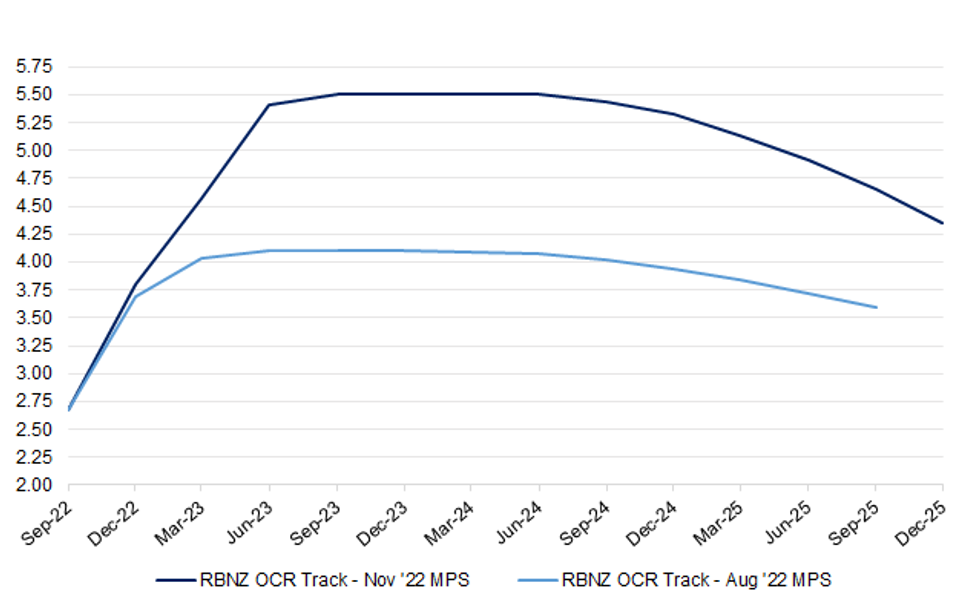

Fig. 1: Latest Evolution Of RBNZ Projected OCR Track

Source: MNI - Market News/Bloomberg

UK

FISCAL/RATINGS: Government sets out ambitious consolidation plan but low confidence in delivery hampers credibility. (Moody’s)

BOE: UK Chancellor of the Exchequer and the Governor of the Bank of England jointly agreed to reduce the maximum authorised size of the APF. (BBG)

POLITICS: Rishi Sunak pulled a vote on his UK government’s housebuilding plans as dozens of Conservative Members of Parliament threatened the first major rebellion of his premiership. (BBG)

EUROPE

ECB: The European Central Bank could get away with hiking by 50 basis points at its Dec 15 meeting, though more evidence of high inflation could call for 75 basis points, Bank of Lithuania president Gediminas Simkus told MNI. (MNI)

FISCAL: The Escape Clause from the European Union's fiscal rules will be deactivated at the end of next year even if a new fiscal rulebook is still to be agreed, sources have told MNI. (MNI)

GERMANY: Germany's economic picture has become slightly brighter, with improvements in gas supply, in particular, having an effect, the head of Germany's Ifo institute told Reuters on Tuesday. (RTRS)

GERMANY: Germany's finance ministry aims to introduce a 33% tax on oil and gas companies that have benefited from windfall profits, Die Welt newspaper reported on Tuesday. (RTRS)

GERMANY: German metalworking union IG Metall said on Wednesday it agreed a wage deal with Volkswagen for the carmaker's western German factories. The trade union said a press conference on the agreement would be held at 0800 GMT in the northern city of Hanover. (RTRS)

RIKSBANK: The Riksbank is widely expected to hike by 75-basis-points on Thursday after its November meeting, following its 100bps increase in September, but hefty declines in property prices and the Swedish central bank's own research showing high household sensitivity to interest rates suggest it will signal the end of the tightening cycle is near. (MNI)

U.S.

FED: Kansas City Federal Reserve Bank President Esther George said ample US savings will help to buffer households but could also mean higher interest rates are needed to cool spending. (BBG)

FISCAL: The White House said on Tuesday that it is open to seeing a debt ceiling increase approved before year-end in Congress's post-election "lame duck" session. "That is something we are open to," said White House spokesperson Karine Jean-Pierre. (RTRS)

FISCAL: The Biden administration on Tuesday announced that it will extend the payment pause on federal student loans until June 30 while its debt forgiveness plan remains blocked by federal courts. (CNBC)

ECONOMY/EQUITIES: HP Inc. will eliminate as many as 6,000 jobs over the next three years amid declining demand for personal computers that has cut into profits. (BBG)

OTHER

GLOBAL TRADE: The Netherlands will defend its economic interests when it comes to the sales of chip equipment to China, a senior Dutch official said, further evidence of the country’s resistance to meekly following Washington’s attempts to cut off China from semiconductor technology. (BBG)

GLOBAL TRADE: Hundreds of workers at Apple’s main iPhone-making plant in China clashed with security personnel, as tensions boiled over after almost a month under tough restrictions intended to quash a COVID-19 outbreak. (AFR)

U.S./CHINA: House Republicans James Comer and Cathy Rodgers say TikTok may have provided misleading or false information about its data sharing and privacy practices related to China and seek additional information from the company. (BBG)

U.S./CHINA: The US-China trade war will “inevitably return” given Beijing’s failure to address the nation’s high savings rate and low consumption that has constrained demand for US goods, with Washington expected to refocus on the trade deficit as the threat posed by Covid and inflation passes, Peking University economics professor Michael Pettis told MNI. (MNI)

U.S./CHINA/TAIWAN: The meeting at the G-20 summit in Bali between Chinese leader Xi Jinping and President Joe Biden was good for peace in the region, Taiwan Foreign Minister Joseph Wu said Wednesday at briefing in Taipei. (BBG)

RBNZ: The Reserve Bank of New Zealand raised interest rates aggressively on Wednesday in response to stubborn inflation pressures, ignoring recent signals from some its global peers that the pace of policy tightening could slow. (Dow Jones)

NEW ZEALAND: New Zealand Finance Minister Grant Robertson said the world economy faced a "year of reckoning" in 2023 but the small island nation is well-placed to fend off trouble among trading partners given its robust growth and a stable financial system. (RTRS)

SOUTH KOREA: South Korea's government and truckers remain at odds over a wages deal, the lead union said on Wednesday, hours before the planned start of a strike that is stoking fears over the nation's post-pandemic recovery and global supply chains. (RTRS)

SOUTH KOREA: South Korea should turn to tax cuts and regulatory reforms to avert stagnation as interest rates rise and inflation remains elevated, a former finance minister said. (BBG)

BOC: The Bank of Canada remains far from reaching its inflation goal and interest-rate hikes are just starting to show results cooling economic growth and price gains, Senior Deputy Governor Carolyn Rogers said Tuesday. (MNI)

BRAZIL: Brazil's President Jair Bolsonaro has challenged some of the results of last month's election, CNN Brasil reported on Tuesday, saying he had filed a claim with the electoral court to invalidate votes from some electronic voting machines. (RTRS)

BRAZIL: Brazil's Vice President-elect Geraldo Alckmin said on Tuesday that a constitutional amendment to exempt social spending from the budget cap will include a proposal to revise the country's fiscal framework in 2023. (RTRS)

BRAZIL: Advisers to President-elect Luiz Inacio Lula da Silva and members of Brazil’s congress are discussing a more moderate spending plan after last week’s budget proposal sent local markets plunging, according to two people with knowledge of the matter. (BBG)

BRAZIL: Brazil's government on Tuesday boosted its projection for this year's fiscal surplus, which will be the first since 2013, thanks to more upward revisions in federal revenues. (RTRS)

BRAZIL: The transition team for Brazil's President-elect Luiz Inacio Lula da Silva has asked the current administration to halt ongoing asset sales by state-run oil giant Petrobras until a new mines and energy minister is appointed, a member of the group said on Tuesday. (RTRS)

COLOMBIA: Colombia labor unions and business leaders may find an agreement around the 2023 minimum wage rise, Deputy Finance Minister Diego Guevara said in a Bogota event. (BBG)

COLOMBIA: Colombia’s inflation has been pushed in part by demand factors as the economy grows faster than its potential, central bank co-director Roberto Steiner said in an event in Bogota. (BBG)

ENERGY: The EU’s plans to cap gas prices to avoid a repeat of the surge in energy costs seen over the summer have come under fire from critics who say it is unlikely to ever be used. (FT)

OIL: The U.S. and its allies are seeking to agree on a level for a price cap on Russian oil as soon as Wednesday, with officials discussing setting it at around $60 a barrel as the group rushes to put the plan into place before Dec. 5, according to people familiar with the talks. (WSJ)

OIL: The European Union watered down its latest sanctions proposal for a price cap on Russia’s oil exports by delaying its full implementation and softening key shipping provisions. (BBG)

OIL: The Group of Seven nations should soon announce the price cap on Russian oil exports and the coalition will probably adjust the level a few times a year rather than monthly, a senior U.S. Treasury official said on Tuesday. (RTRS)

OIL: China’s crude buyers have paused purchases of some Russian oil as they wait for details of a US-led cap to see if it presents a better price. (BBG)

OIL: The specter of an oil-supply shock this winter has created a dilemma for OPEC and its wider circle of crude producers about whether to reverse course on the production cuts it set last month. (WSJ)

CHINA

CORONAVIRUS: China should both stick to the overall “Covid Zero” stance and adhere to the rules in implementation, according to a front-page commentary by the official Economic Daily newspaper. (BBG)

CORONAVIRUS: China is seeing near-record numbers of Covid cases, spurring major cities from Beijing to Shanghai to revert to broad restrictions on people’s movements and mass testing exercises to contain swelling outbreaks. (BBG)

PBOC: China can achieve gross domestic product growth above 5% in 2023 if the impact from Covid ends and support measures are implemented, says Wang Yiming, a member of the PBOC’s monetary policy committee, in a video speech Wednesday. (BBG)

PROPERTY: China's Bank of Communications Co Ltd (BoCom) said on Wednesday it has agreed to provide a 100 billion yuan ($13.98 billion) credit line to Chinese developer Vanke. (RTRS)

EQUITIES: Valuation of A-shares is at historical low and will rebound in the first half of next year, Shanghai Securities News reports, citing 2023 outlook research reports from some securities firms. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY69 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) on Wednesday injected CNY2 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY69 billion after offsetting the maturity of CNY71 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.6944% at 9:45 am local time from the close of 1.6201% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 47 on Tuesday vs 46 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1281 WEDS VS 7.1667 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1281 on Wednesday, compared with 7.1667 set on Tuesday.

OVERNIGHT DATA

AUSTRALIA NOV, P S&P GLOBAL MANUFACTURING PMI 51.5; OCT 52.7

AUSTRALIA NOV, P S&P GLOBAL SERVICES PMI 47.2; OCT 49.3

AUSTRALIA NOV, P S&P GLOBAL COMPOSITE PMI 47.7; OCT 49.8

“The mix of deteriorating demand and worsening price pressures does not bode well for the near-term outlook, and this has also been reinforced by the decline in private sector confidence in November.” (S&P Global)

SOUTH KOREA DEC BUSINESS SURVEY MANUFACTURING 69; NOV 73

SOUTH KOREA DEC BUSINESS SURVEY NON-MANUFACTURING 77; NOV 78

SOUTH KOREA Q3 EXTERNAL DEBT US$170.9BN; Q2 US$183.8BN

MARKETS

SNAPSHOT: RBNZ Steps Up Pace Of Rate Hikes, Talked About Doing Even More

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 up 50.506 points at 7231.8

- Shanghai Comp. down 1.683 points at 3087.26

- JGBs are closed

- Aussie 10-Yr future down 0.5 tick at 96.400, yield up 0.5bp at 3.599%

- U.S. 10-Yr future down 0-01+ at 112-18, cash Tsys are closed

- WTI crude down $0.11 at $80.84, Gold down $4.81 at $1735.44

- USD/JPY up 15 pips at Y141.38

- FED’S GEORGE SAYS HIGHER US SAVINGS MAY ALSO MEAN HIGHER RATES NEEDED (BBG)

- ECB'S SIMKUS OPEN TO DECEMBER 50BP HIKE (MNI)

- PBOC ADVISER: CHINA 2023 GROWTH CAN TOP 5% IF COVID IMPACT ENDS (BBG)

- CHINA TIGHTENS COVID RESTRICTIONS IN BIG CITIES AS CASES CLIMB (BBG)

- NEW ZEALAND CENTRAL BANK SHARPLY RAISES RATES, NOW EXPECTS TO PEAK AT 5.5% IN 2023 (DJ)

- WESTERN ALLIES AIM TO AGREE ON RUSSIAN OIL PRICE CAP WEDNESDAY (WSJ)

US TSYS: Chinese COVID Vs. Hawkish RBNZ In Limited Futures Trdae, Cash Closed Until London

Tsy futures have held tight ranges in Asia-Pac hours, with liquidity limited by the observance of a Japanese holiday, which also means that cash Tsys are closed until London hours.

- The early bid linked to regional reaction to Tuesday’s price action and continued COVID worry re: China (deeper restrictions in some of the country’s major cities) faded in the wake of the latest RBNZ decision, which came down on the hawkish side.

- News flow was limited elsewhere

- That leaves TYZ2 -0-01 at 112-18+, operating in a narrow 0-05+ range, on sub-standard volume of ~60K (which is even more restricted when you consider that ~22K lots of that came from quarterly roll activity).

- Looking ahead, the minutes from the latest FOMC decision headline the pre-Thanksgiving NY docket. We will also get flash PMI data, durable goods, new home sales, MBA mortgage applications, weekly jobless claims and the final UoM survey for Nov.

AUSSIE BONDS: ACGBs Twist Flatten, Hawkish RBNZ Knocks Space Off Best Levels

Aussie bond futures sat just above session lows at the close, with YM -4.0 & XM +0.5. The broader curve twist flattened, as the major ACGB benchmarks ran 5bp cheaper to 1.5bp richer, pivoting around 10s.

- The early bid derived from the overnight rally in futures, linked to a bid in U.S. Tsys on Tuesday & COVID-related worry re: China, faded in lieu of the hawkish RBNZ decision across the Tasman, with little in the way of fresh impetus observed thereafter (activity was in part limited by a Japanese holiday and lack of meaningful headline flow post-RBNZ).

- Bills finished 3-12bp cheaper through the whites, with the back of the whites and front of the reds leading the weakness. The hawkish noises from across the Tasman allowed RBA dated OIS to tick higher, with terminal cash rate pricing now sitting just above 3.90%, a little over 10bp firmer on the day.

- ACGB May-32 supply was smoothly absorbed.

- Tomorrow’s domestic economic docket is essentially empty, with liquidity in wider global markets set to be sapped by the observance of the Thanksgiving holiday in the U.S.

AUSSIE BONDS: ACGB May-32 Auction Results

The Australian Office of Financial Management (AOFM) sells A$900mn of the 1.25% 21 May 2032 Bond, issue #TB158:

- Average Yield: 3.5253% (prev. 3.6829%)

- High Yield: 3.5300% (prev. 3.6850%)

- Bid/Cover: 2.9500x (prev. 2.8188x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 2.7% (prev. 91.9%)

- Bidders 35 (prev. 42), successful 15 (prev. 19), allocated in full 10 (prev. 12)

NZGBS: RBNZ Triggers Hawkish Repricing As It Looks To Fend Off Inflation

The major cash NZGBs finished Wednesday’s session 2-20bp cheaper, with the front end leading the weakness in the wake of the latest RBNZ decision. Swap rates also shunted higher, with swap spreads wider across the term structure. The 2-/10-Year swap curve moved 15bp further into inverted territory vs. levels seen late Tuesday.

- Also note that the OCR now sits above the 10-Year NZGB yield, just.

- To recap, the final RBNZ decision of ’22 saw the Bank deliver the widely expected 75bp OCR hike. Its continued, almost singular, focus on combatting elevated inflation and inflation expectations, punctuated by confirmation that the Bank deliberated re: delivering a 100bp hike, along with a notable shift higher in the projected OCR track, weighed on NZGBs.

- The RBNZ now expects the OCR to peak at 5.50% in ’23 (up from the previous peak of 4.10%). Market pricing adjusted accordingly, with a peak cash rate of just under 5.50% priced into the RBNZ dated OIS strip.

- ANZ provided the most aggressive sell-side call that we have seen, looking for a peak OCR of 5.75%.

- Looking ahead, the weekly round of NZGB auctions headline domestic matters on Thursday.

EQUITIES: Protest Reports At China Iphone Factory Weighs On Sentiment

Asia Pac equities are mostly higher, China mainland stocks are underperforming though. US futures have drifted lower as the session has progressed, with Nasdaq futures near -0.25% at the time of writing.

- Bloomberg reported protests at the Foxconn plant in China, due to Covid related conditions. The plant is a large producer of Apple iphones. This has weighed on tech related sentiment in the region and US futures.

- China mainland stocks are lower, the CSI off 0.36%, while the Shanghai Composite is down by 0.20%. Covid developments today have centred on increased PCR testing requirements in major cities. This comes after the health authorities stated late yesterday the country should adhere to the CZS amid a severe outbreak.

- Reuters reported that property company Vanke will receive a 100bn yuan credit line from the Bank of Communications. The Shanghai Property Sub-index is up 0.25% so far today.

- The HSI is in positive territory but is away from best levels, last around +0.4%. The tech sub-index is +1.26%, amid better earnings results. The Kospi and Taiex are also higher, both indices up by a little over 0.5%. Japan markets are shut today.

- The ASX 200 is +0.60%, but NZ shares are down 0.85%, after the RBNZ delivered a hawkish 75bps rate hike and forecast a mild recession next year.

GOLD: Prices Dip On Reports Of Protests In China, Waiting For FOMC Minutes

Gold dipped after reports of violent protests at an iphone factory in China boosted the USD. Before that it had been range trading as it awaits the publication tonight of the minutes from the last FOMC meeting. It is off of the initial low of $1733.38/oz and is around $1734. It reached a high of $1742.97 earlier.

- Bullion continues to trade between its initial resistance of $1786.50 (November high and bull trigger) and support at $1718.60 (20-day EMA). Short-term conditions remain bullish for gold.

- Fed speakers suggesting that they’re open to slowing the pace of tightening supported gold overnight. The market will be look to the November minutes for other signs of a less hawkish Fed. If the Fed pivots and reduces the size of rate hikes, then gold prices are likely to benefit as they tend to move inversely with bonds yields.

- Tonight the Global S&P preliminary PMIs print for Europe and the US. Also, a swathe of US data including unemployment claims, durable goods orders and Michigan consumer sentiment are released ahead of the Thanksgiving holidays.

OIL: Prices Softer, But Waiting For Russian Price Cap Details

Oil prices are at their intraday low following reports of violent protests at an iphone factory in China boosted the USD. WTI is trading around the NY close at around $80.80/bbl after reaching a high of $81.48. Brent is around $88.15 also below its NY close of $88.36 and its high of $88.80. Despite the current dip, crude has been trading in a narrow range.

- WTI continues its retracement from the $92.53 November 7 high and the bearish theme remains. It has been trading close to the bear trigger and support of $80.49, the October 18 low.

- The range trading generally seen today reflects the market waiting for details on the plan to cap the price of Russian crude. There were reports that Europe may soften the plan after a related set of sanctions were diluted. Russia has said it won’t export crude to countries participating in the cap. Apparently, China has reduced oil imports from Russia due to the current uncertainty.

- The API reported another drawdown of US crude inventories of 4.8mn barrels.

- Markets are also awaiting the FOMC minutes published tonight for any signs of a pivot. Global S&P preliminary PMIs print for Europe and the US. Also, a swathe of US data including unemployment claims, durable goods orders and Michigan consumer sentiment are released ahead of the Thanksgiving holidays.

FOREX: NZD Shines On Hawkish RBNZ, USD Recovers From Early Losses

The BBDXY is back above 1285.00, up from earlier lows near 1282.50. U.S Tsy futures are away from earlier highs, although the tone in regional equities has also turned less supportive this afternoon. These moves have aided the USD from a cross-asset standpoint, although overall moves are modest.

- NZD/USD has bucked the firmer USD tone, although the pair is off earlier highs, post the RBNZ. We got above 0.6190, as the central raised rates by 75bps and pushed the terminal rate projection significantly higher. We are now back at 0.6160/65, but the Kiwi is outperforming on crosses.

- AUD/USD is down slightly for the session, last around 0.6640 (-0.15%), weighed by AUD/NZD selling and China headwinds this afternoon, with reports of protests at China's iphone factory weighing at the margin. The AUD/NZD cross touched 1.0750 post the RBNZ, but is now back close to 1.0780.

- USD/JPY is back near 141.50, with an early session dip sub 141.00 supported. EUR/USD is outperforming modestly, holding close to 1.0315, slightly up for the session.

- Coming up, flash Eurozone PMIs will be in the spotlight before US durable goods, new home sales and UMich sentiment data. The FOMC minutes caps off the Wednesday docket. Sell-side analysts mostly see risks to the minutes as leaning hawkish, at the very least cementing expectations for an upgrade to the median 2023 dot in December's next SEP vs September's editions.

FX OPTIONS: Expiries for Nov23 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700(E1.5bln), $0.9750(E1.5bln), $1.000-10(E766mln), $1.0050(E1.3bln), $1.0280(E756mln), $1.0300(E1.3bln), $1.0350(E805mln)

- USD/JPY: Y140.00($900mln), Y141.75-00($1.3bln), Y144.50-70($2.7bln)

- USD/CNY: Cny7.05-07($1.2bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/11/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/11/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/11/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 23/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/11/2022 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/11/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 23/11/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/11/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/11/2022 | 1500/1000 | *** |  | US | New Home Sales |

| 23/11/2022 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 23/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 23/11/2022 | 1700/1200 | ** |  | US | Natural Gas Stocks |

| 23/11/2022 | 1900/1400 |  | US | FOMC minutes | |

| 23/11/2022 | 1900/1900 |  | UK | BOE Pill Speech at Beesley Lecture Series | |

| 23/11/2022 | 2130/1630 |  | CA | Governor Macklem testifies at House finance committee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.