-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RESEND: RBA Signals More Hikes Ahead

EXECUTIVE SUMMARY

- FED’S BOSTIC SAYS HIGHER PEAK RATE ON TABLE AFTER JOBS BLOWOUT (BBG)

- TOP U.S. HOUSE REPUBLICAN MCCARTHY WANTS COMPROMISE ON DEBT CEILING, CUTS FROM BIDEN (RTRS)

- PILL: BANK OF ENGLAND READY TO DO MORE ON INFLATION IF NEEDED (RTRS)

- MOF HASN’T APPROACHED AMAMIYA FOR BOJ GOVERNOR, SUZUKI SAYS (BBG)

- RBA HIKES 25BP TO 3.35%, FURTHER INCREASES "NEEDED" (MNI)

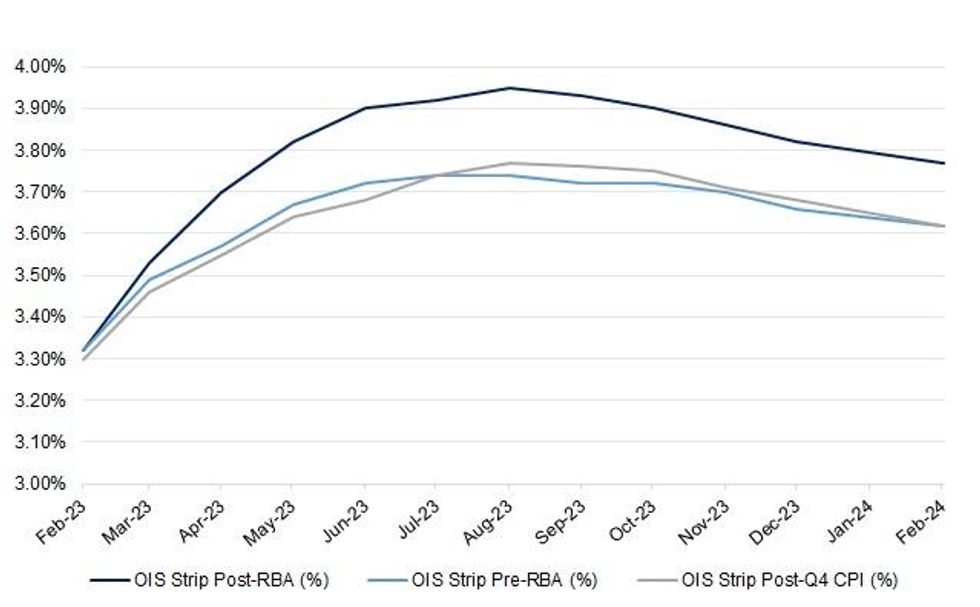

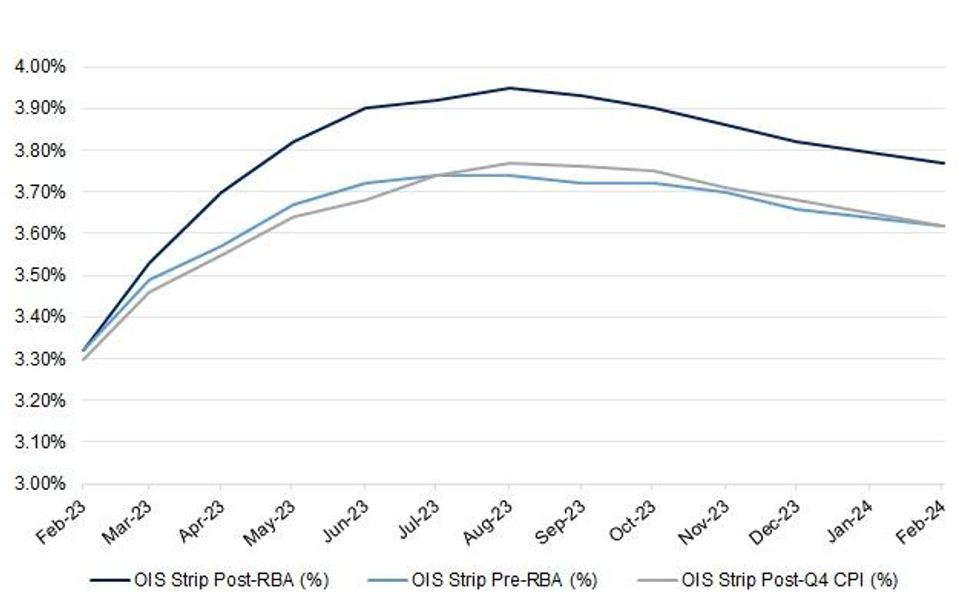

Fig. 1: The Recent Evolution Of Market Pricing Surrounding The RBA Cash Rate

Source: MNI - Market News/Bloomberg

UK

BOE: Bank of England Chief Economist Huw Pill said on Monday that the British central bank was prepared to do more to get inflation back to target after it suggested last week that interest rates were approaching their peak. (RTRS)

ECONOMY: Total spending on Barclays payment cards rose by 9.7% last month from January 2022, helped by a 66% jump in holiday bookings and a 21% rise in entertainment spending on the back of the release of new movies such as "Avatar: The Way of Water." The growth comparisons were flattered by last January's coronavirus restrictions, and colder weather in January this year pushed up spending on utilities by 45%. But consumers appeared to be taking a more optimistic view with Barclays' confidence measure rising to 63%, its highest since last July. (RTRS)

FISCAL: The bosses of Britain's biggest housebuilders will hold talks with the chancellor this week as they face a multibillion-pound bill in the form of several new levies. (Sky)

FISCAL/POLITICS: Health unions and the government remained deadlocked in their dispute over NHS workers’ demands for higher pay after ministers made clear they would not reopen the wage settlement in England for 2022-23. (FT)

POLITICS: Rishi Sunak is preparing to announce a small reshuffle of his Cabinet as soon as Tuesday as he attempts to get the right frontbench team to close the polling gap on Labour. The Prime Minister has been looking for a successor to Nadhim Zahawi as Conservative Party chairman but is also now expected by Whitehall insiders to go further in the shake-up. (Telegraph)

EUROPE

FRANCE: French labor unions are holding a third day of mass strikes and protests against raising the retirement age, keeping up pressure on the government as parliament debates the proposed reform. (BBG)

U.S.

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said January’s strong jobs report raises the possibility that the central bank will need to increase interest rates to a higher peak than policymakers had previously expected. (BBG)

FISCAL: U.S. President Joe Biden will insist in his State of the Union address that raising the debt limit of the United States is not negotiable and should not be used as "bargaining chip" by U.S. lawmakers, his top economic adviser Brian Deese said on Monday. (RTRS)

FISCAL: Republican U.S. House Speaker Kevin McCarthy called on Democratic President Joe Biden to agree to compromises and spending cuts, as the two remain deadlocked over raising the nation's $31.4 trillion debt ceiling. (RTRS)

EQUITIES: Investors burned by last month’s malfunction on the New York Stock Exchange can recoup all of their losses, but only if their trades fit certain parameters. The rest may wind up with nothing. (BBG)

OTHER

GLOBAL TRADE: German Economy Minister Robert Habeck on Monday said there was a chance that de facto free-trade status could be reached between Europe and the United States in the area of critical minerals under the U.S. Inflation Reduction Act (IRA). (RTRS)

GLOBAL TRADE: Brussels’ response to the US targeted support for green technologies has come under fire from one of its own top officials, who said the constant revision of EU state-aid rules created too much confusion for businesses. (FT)

GLOBAL TRADE: President Joe Biden will announce during his State of the Union speech that he is issuing proposed guidance to ensure construction materials in most federal infrastructure projects are made in the United States, the White House said in a statement on Monday. (RTRS)

U.S./CHINA: President Joe Biden said on Monday that the United States made it clear to China what it would do about a suspected Chinese spy balloon that was shot down by a U.S. fighter jet over the weekend. Speaking to reporters outside the White House, Biden said it was always his view that the balloon needed to be shot down. (RTRS)

U.S./CHINA: A senior U.S. general responsible for bringing down a Chinese spy balloon said on Monday the military had not detected previous spy balloons before the one that appeared on Jan. 28 over the United States and called it an "awareness gap." (RTRS)

U.S./CHINA: The White House on Monday said a suspected Chinese spy balloon's flight over the United States has done nothing to improve already tense relations with Beijing and that top diplomat Antony Blinken will seek to reschedule a postponed trip when the time is right. (RTRS)

U.S./CHINA: U.S. President Joe Biden said on Monday he was not sure if Washington would ban Chinese-owned short video app TikTok. (RTRS)

U.S./CHINA: Several developments loom that could further strain relations. US officials increasingly worry that Chinese state companies may be assisting Russia’s military effort against Ukraine by providing technology and semiconductors — which may raise pressure for action by the White House. The administration is already expected as early as next month to move to create a body to review outbound US investments into China. And the new Republican House Speaker Kevin McCarthy is expected to ape his Democratic predecessor Nancy Pelosi with a visit to Taiwan this year — though there are better and less inflammatory ways for the US to show solidarity with the self-governing island. (FT)

BOJ: Japan’s Finance Ministry hasn’t approached Bank of Japan Deputy Governor Masayoshi Amamiya about becoming the next governor, says Finance Minister Shunichi Suzuki. (BBG)

JAPAN: Japan stepped into the foreign exchange market three times in total last year, according to a fuller picture of the government’s latest intervention strategy to counter the yen’s historic fall. (BBG)

RBA: The Reserve Bank of Australia warned it expects more rate hikes will be "needed" after lifting rates by 25bp to 3.35% as it forecast a decline in inflation to "around" 3% by mid-2025. (MNI)

NEW ZEALAND/CHINA: New Zealand’s new Prime Minister Chris Hipkins said he won’t back away from criticizing China where necessary, as the new leader works to balance economic and diplomatic relations with his largest trading partner. (BBG)

BOK: A Bank of Korea policy board member said on Tuesday she believes the South Korean economy would be able to endure interest-rate differences with the United States to some extent. Suh Young-kyung made the remarks during her presentation at a scheduled event. (RTRS)

SOUTH KOREA: South Korea plans to more than double its foreign-exchange trading hours and allow offshore firms to participate in the market in line with efforts to attract more investment from overseas, the financial authorities said Tuesday.(Yonhap)

NORTH KOREA: The US Envoy for North Korea Sung Kim and his South Korean counterpart Kim Gunn discussed cooperation in countering North Korea’s unlawful ballistic missile development and malicious cyber activities, US State Department Spokesman Ned Price says. (BBG)

NORTH KOREA: North Korean leader Kim Jong Un has presided over a military meeting and pledged to expand the country's drills and beef up war readiness posture, South Korea's Yonhap news agency reported on Tuesday citing the North's state media. (RTRS)

TURKEY: Turkish Capital Markets Board cancels ‘depot rule’ it imposed a day ago in stock market trades, according to its bulletin. (BBG)

BRAZIL: The central bank statement which accompanied the interest rate decision last week could have been “a little more generous with the measures we have already taken,” Brazil Finance Minister Fernando Haddad tells journalists in Brasilia Monday evening. (BBG)

SOUTH AFRICA: Investors have lost faith in South Africa’s government and have halted investment despite a wealth of opportunities, the head of the country’s biggest employer in the crucial mining industry said. (BBG)

OIL: Europe will no longer set the reference price for Russia's flagship Urals crude, Igor Sechin, the CEO of Russia's oil major Rosneft said on Monday, now Asia has emerged at the largest buyer of Russian oil since the West placed it under sanctions. (RTRS)

CHINA

PBOC: The People’s Bank of China drained liquidity from the interbank market after Chinese New Year to mop up a big injection it made before the holiday, but analysts predict the central bank will remain flexible in its open market operations and keep liquidity ample amid the economic recovery in a bid to reduce funding costs, China Securities Journal reported Tuesday. (MNI)

CREDIT: China's banks are accelerating the approval of consumer loans to offset interest margin pressure as the volume of mortgage loans has shrunk and as authorities encourage lenders to support consumption, China Business News reported. (MNI)

FISCAL: The State-owned Assets Supervision and Administration Commission said in a meeting on Monday that it will strengthen investment in key security fields such as national defense and military industry, as well as food and energy resources, to serve the country's major strategies, according to Securities Times. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY78 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) conducted CNY393 billion via 7-day reverse repos with the rates unchanged at 2.00% on Tuesday. The operation has led to a net drain of CNY78 billion after offsetting the maturity of CNY471 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0432% at 9:44 am local time from the close of 2.0039% on Monday.

- The CFETS-NEX money-market sentiment index closed at 54 on Monday, compared with the close of 55 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7967 TUES VS 6.7737 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7967 on Tuesday, compared with 6.7737 set on Monday.

OVERNIGHT DATA

JAPAN DEC LABOUR CASH EARNINGS +4.8% Y/Y; MEDIAN +2.5%; NOV +1.9%

JAPAN DEC REAL CASH EARNINGS +0.1% Y/Y; MEDIAN -1.5%; NOV -2.5%

JAPAN DEC HOUSEHOLD SPENDING -1.3% Y/Y MEDIAN -0.4%; NOV -1.2%

JAPAN DEC, P LEADING INDEX 97.2; MEDIAN 97.1; NOV 97.7

JAPAN DEC, P COINCIDENT INDEX 98.9; MEDIAN 98.9; NOV 99.3

AUSTRALIA DEC TRADE BALANCE +A$12.237BN; MEDIAN +A$12.450BN; NOV +A$13.475BN

AUSTRALIA DEC EXPORTS -1% M/M; NOV -1%

AUSTRALIA DEC IMPORTS +1% M/M; NOV -3%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 83.6; PREV 86.8

Consumer confidence experienced its biggest weekly fall since early August 2022. Confidence about current and future finances fell sharply, perhaps sparked by concerns about the extent of cash rate rises after the Q4 inflation print. Household inflation expectations drifted up but are still lower than expectations during the final three months of 2022. Average confidence among homeowners paying off their mortgages fell less than other housing status cohorts, though still ended the week with lower confidence than renters and outright homeowners. (ANZ)

AUSTRALIA JAN FOREIGN RESERVES A$84.5BN; DEC A$85.4BN

NEW ZEALAND JAN ANZ COMMODITY PRICE INDEX -1.0% M/M; DEC -0.2%

The ANZ World Commodity Price Index eased 1.0% in the first month of 2023. Movements were mixed. Meat, forestry and aluminium prices lifted, while dairy and horticulture prices eased. In local currency terms the index dropped 1.2%. (ANZ)

UK JAN BRC LIKE-FOR-LIKE SALES +3.9% Y/Y; DEC +6.5%

MARKETS

US TSYS: Richer In Asia, Powell In Focus

TYH3 deals at 113-19+, +0-03+, a touch off the top of its 0-09+ range on volume of ~139K.

- Cash Tsys sit 1-5 bps richer across the major benchmarks, the curve has bull steepened.

- Participants faded Monday's leg of post-NFP cheapening in early Asia-Pac dealing after frenetic moves in recent sessions.

- The richening held through the Asian session.

- A couple of block buys in TU futures (+3.5K & +5.5K) aided the bid.

- Tsys looked through weakness in ACGBs as the RBA raised rates 25bps. The accompanying hawkish guidance noted that rates will need to rise further and more than once.

- The U.S. trade balance headlines an otherwise thin data slate today. More widely, Fed Chair Powell provides the macro highlight in his first remarks since last week's Fed meeting. 3-Year Tsy supply is also due.

JGBS: Futures Off Lows, 30-Year Auction Aids Twist Steepening

JGB futures recouped the losses incurred during the early break through their overnight session base, with the initial move lower presumably triggered by the firmer than expected wage data flagged earlier and Tokyo reaction to Monday’s weakening in core global FI markets. Futures are -10 into the close, while cash JGBs are 1bp richer to 1bp cheaper, pivoting around 30s.

- BoJ matters continue to dominate with Finance Minister Suzuki being the latest Cabinet level official to explicitly push back against the idea that BoJ Deputy Governor Amamiya has been tapped to succeed outgoing Governor Kuroda. Meanwhile, Chief Cabinet Secretary Matsuno noted that the timing and method of BoJ appointments are a matter for the Diet.

- Elsewhere, we saw comments surrounding last year’s intervention in FX markets on the part of the Japanese government, but there was little new information provided alongside the data, with Finance Minister Suzuki reiterating well-trodden rhetoric surrounding the FX market.

- The low price at the latest round of 30-Year JGB supply just missed expectations, while the price tail widened a touch even as the cover ratio pushed above the 6-auction average. It would seem that the relative richness vs. other super-long benchmarks and continued uncertainty re: BoJ policy post-Kuroda was enough to disincentivise some prospective bidders, albeit with prevailing yield levels proving enough to generate a baseline level of demand. 30+-Year paper struggled post auction, resulting in the aforementioned twist steepening.

- BoJ Rinban operations covering 1 to 25-Year JGBs headline domestically on Wednesday.

JGBS AUCTION: 30-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y728.7bn 30-Year JGBs:

- Average Yield: 1.543% (prev. 1.649%)

- Average Price: 101.15 (prev. 99.00)

- High Yield: 1.551% (prev. 1.654%)

- Low Price: 101.00 (prev. 98.90)

- % Allotted At High Yield: 96.996% (prev. 38.0180%)

- Bid/Cover: 3.323x (prev. 3.105x)

AUSSIE BONDS: Bear Flattening After RBA Points To Multiple Hikes

Aussie bonds were pressured after the RBA board delivered the expected 25bp hike, while pointing to further rate hikes in the months ahead (we place emphasis on the plural in future hikes). Terminal cash rate pricing has shifted above 3.90% to reflect this, after printing around 3.75% pre-decision.

- The Bank also tipped its hat to firm domestic demand resulting in more meaningful inflationary pressure, albeit while providing a sense of increased worry re: the health of some households (alongside some firmer language against the risks of a de-anchoring of inflation expectations, although it reaffirmed that expectations remain well anchored at present).

- The Bank didn’t allude to its updated underlying inflation forecasts (which will be published on Friday), while it only expects headline inflation to return to the upper end of the target range in ’25.

- Aussie bond futures breached their early session lows on the move, after firming off their early Sydney lows ahead of the RBA decision. YM finished -16.0, while XM was -13.5, a touch off their respective post-decision bases, while wider cash ACGBS sit 7.5-15.5bp cheaper as the curve bear flattens, reflecting the pricing of more aggressive RBA tightening near-term.

- The AU/U.S. 10-Year yield spread widened post-RBA, pushing out by half a dozen bp on the day to ~-2bp, briefly testing above parity.

- A$1.0bn of ACGB Nov-33 supply headlines domestically on Wednesday.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

NZGBS: Off Cheaps After Long Weekend Catch Up, RBA To Impact On Wednesday

NZGBs finished off cheapest levels on Tuesday, with the initial post-long weekend move reflecting the weakness observed in global core FI markets in lieu of Friday’s firmer than expected U.S. economic data, as well as reaction to the latest rounds of Fed, ECB & BoE speak. Still, core global FI found a bit of a base in the early rounds of wider Asia-Pac dealing, which allowed NZGBs to finish 14-17bp cheaper across the curve, with bear flattening in play. The local close came before the latest RBA decision across the Tasman, which pressured ACGBs, a move likely to be reflected in NZGBs come tomorrow’s local open (new flow & wide market-dependent).

- Swap rates were 16-17bp higher in a parallel shift, also finishing off session extremes, leaving swap spreads flat to wider on the day.

- RBNZ-dated OIS indicates ~55bp of tightening for this month’s decision, alongside a terminal OCR of ~5.25%, higher vs. Friday’s closing levels in lieu of the repricing of global central bank expectations witnessed in that window. Once again, these marks will likely be adjusted higher in reaction to the RBA decision during early Wednesday trade.

- There wasn’t much in the way of meaningful domestic headline flow to trade off, which left post-weekend adjustments at the fore.

- Looking ahead, there is nothing of note on the local docket on Wednesday.

EQUITIES: China/HK Equities Edge Higher, Mixed Trends Elsewhere

Regional equities have traded in a mixed fashion today. US futures are higher, albeit away from best levels. Eminis last around +0.10%, Nasdaq futures +0.14%. This follows falls during Monday trade for the major US bourses.

- China/HK equities are higher. The HSI is up 0.84% to the break, with the tech sub index around +2% at this stage. while the CSI is +0.34% at this stage. Sentiment has been lifted in the developer space, as Wuhan lifted home purchase curbs.

- Housing remains the missing link in terms of the China rebound story in 2023. Bloomberg notes the easing of curbs in Wuhan (on housing purchases) could pave the way for other cities to follow suit (see this link for more details).

- The tone elsewhere is more mixed. The Nikkei 225 is close to flat, while earlier wages data came in stronger than expected with real wages back in positive territory.

- The Kospi is up 0.60%, while the Taiex is also firmer (+0.20%), despite the negative tech lead from Monday's session.

- The ASX 200 is down -0.55%, with a hawkish RBA 25bps hike likely weighing at the margin. SEA equity indices are mostly lower, with Indonesian stocks the exception (+0.87%).

GOLD: Bullion Awaiting Fed Powell’s Comments

Gold prices range traded on Monday after falling sharply in the wake of the strong US payrolls data. They are up 0.3% during today’s APAC session to around $1872.30/oz, close to the intraday high of $1875.67. This has been helped by a slightly weaker USD (DXY -0.1%).

- Bullion has traded today above support at $1861.40, the post-payroll/ISM low. Resistance remains at $1903.40, the 20-day EMA.

- Later Fed Chairman Powell speaks, which could influence gold prices as the market looks for direction on the rate outlook. A more hawkish tone would be negative for zero-yielding gold. On the data front there is US December trade data and January NFIB business optimism.

OIL: Crude Stronger On Improved Demand Optimism And Supply Outages

Oil has been trading in a tight range during today’s APAC session. WTI is up 1% to $74.90, close to the intraday high of $74.98 and Brent is up 1% to $81.80, just below the high of $81.84. The market has been more positive today after Saudi Arabia signalled confidence in the demand outlook and reports of supply outages.

- Saudi Aramco, Saudi Arabia’s public energy company, increased prices for mainly the Asian market in March reflecting its optimism in the demand outlook.

- On the supply side, the pipeline from Kurdish oil fields in Iraq that goes through Turkey has been closed due to Monday’s earthquake. Usually 450kbd goes through that pipeline. Turkey also stopped flows to the Ceyhan export terminal. In addition, there was a power outage at a large Norwegian field.

- In January, Russia saw a 46% drop in oil and gas revenues, putting pressure on the government deficit. This was due to a drop in the price of Urals blend and in natural gas exports. The market is still watching for the impact of the latest sanctions on Russian supply.

- Later Fed Chairman Powell speaks, which could be important for direction on the rate outlook. On the data front there is US December trade data and January NFIB business optimism. There is also US API inventory data released.

FOREX: AUD Outperforming After RBA Hikes 25bps & Flags More Hikes To Come

AUD is the strongest performer in the G-10 space at the margins, with the greenback moderately weaker as its gives back some post NFP gains.

- AUD/USD prints at $0.6925/30 ~0.7% firmer, the pair was up as much as 1% in the aftermath of the RBA decision. The central bank raised the cash rate 25bps and noted in its statement that rates will need to rise further and more than once. Earlier the Dec trade balance had printed a touch below expectations.

- USD/JPY is ~0.3% softer, last printing ¥132.25/35. The 20-day EMA at 130.34 is the next downside target. Dec Labour Cash Earning rose 4.8% vs 2.5% exp, Dec Real Cash Earning were also on the wires printing at 0.1% vs -1.5% exp. Jan Household spending fell 1.3% more than the exp -0.4%. Dec, P Coincident Index printed in line with expectations

- NZD is also firmer, last printing $0.6320/25. The pair met resistance above its 50-day EMA, paring gains to sit at current levels. Jan ANZ Commodity Prices fell 1%, the prior read was -0.1%.

- EUR/USD and GBP/USD are both marginally firmer, with the moderate weakness in the USD boosting the pairs.

- Cross-asset flows see e-minis up ~0.1%, although off session highs, and BBDXY down ~0.1%.

- US Trade Balance, which headlines an otherwise thin data slate. Fed Chair Powell speaks today for the first time since last week's Fed meeting.

FX OPTIONS: Expiries for Feb07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E829mln), $1.0700-20(E816mln) $1.0800(E1.3bln), $1.0830-50(E1.6bln), $1.0890-00(E1.1bln), $1.0990-00(E1.2bln)

- USD/JPY: Y130.00($1.1bln), Y133.50($500mln)

- GBP/USD: $1.1900-25(Gbp588mln)

- EUR/GBP: Gbp0.8850-70(E1.2bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/02/2023 | 0645/0745 | ** |  | CH | Unemployment |

| 07/02/2023 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/02/2023 | 0745/0845 | * |  | FR | Foreign Trade |

| 07/02/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/02/2023 | 0900/0900 |  | UK | BOE Ramsden Intro at UK Women in Economics Event | |

| 07/02/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/02/2023 | 1015/1015 |  | UK | BOE Pill Chairs UK Women in Economics Panel | |

| 07/02/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 07/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/02/2023 | 1430/1430 |  | UK | BOE Cunliffe Speech at UK Finance | |

| 07/02/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 07/02/2023 | 1700/1800 |  | EU | ECB Schnabel in Finanzwende e.V. Webinar | |

| 07/02/2023 | 1730/1230 |  | CA | BOC Governor Macklem speech/press conference in Quebec City | |

| 07/02/2023 | 1740/1240 |  | US | Fed Chair Jerome Powell | |

| 07/02/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/02/2023 | 1900/1400 |  | US | Fed Vice Chair Michael Barr | |

| 07/02/2023 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.