-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: December CPI Housing & Core Goods in Focus

MNI ASIA MARKETS ANALYSIS: Post-PPI Highs Rejected

MNI US MARKETS ANALYSIS - Pricing Sees Sept Fed Cut Nailed On

MNI (LONDON) - Highlights:

- September Fed rate cut looks nailed on, according to market pricing

- Eurozone flash inflation comes in inline with tracking estimates

- Renewed tensions in Middle-East support oil markets

US TSYS: Geopolitics Weighs, Quarterly Refunding and ECI Offer Pre-FOMC Focus

- Treasuries have seen some two-way trade overnight but are ultimately little changed on the day as yesterday's Israel strikes continue to have an impact on fixed income markets but with a partly offsetting factor from higher oil prices.

- Late on 30 July, Israel carried out an air strike on a Beirut suburb, hitting a building containing senior Hezbollah commander Fuad Shukr. Several hours later the political leader of Hamas, Ismail Haniyeh, was killed in a raid in Tehran although Israel has not claimed responsibility for the killing.

- TYU4 at 111-18 (unch) is within session ranges but earlier touched yesterday’s risk-off induced high of 111-21. Cumulative volumes are solid as they approach 350k.

- The trend needle continues to point north, with resistance seen at 111-31 (Fibo projection of Apr-May price swings).

- Cash yields sit 0.2-0.6bp lower on the day. 2s10s at -22.1bps is within yesterday's range.

- Ahead, the Employment Cost Index is likely to be watched even more closely than normal with the pause in the Atlanta Fed's wage tracker limiting alternate wage measures, and it lands along with Treasury's Quarterly Refunding Announcement for a flurry of activity at 0830ET.

- Data: Weekly MBA data (0700ET), ADP employment Jul (0815ET), ECI Q2 (0830ET), MNI Chicago PMI Jul (0945ET), Pending home sales Jun (1000ET)

- Fed: FOMC decision (1400ET), Powell press conference (1430ET).Preview here.

- Treasury QRA (0830ET). Preview here.

- Bills issuance: US Tsy $60B 17W Bill auction (1130ET)

STIR: September Cut Seen Locked In Ahead Of Today's FOMC Decision

- Fed Funds implied rates have lifted by ~1bp overnight for most meetings over the next six months but continue to be weighed by yesterday’s geopolitics-driven risk off moves.

- The BoJ's ultimately very well telegraphed 15bp hike to 0.25% had little impact at the time.

- Markets continue to see extremely low odds of a cut from the FOMC today but will be looking for a teeing up to a September cut with a 25bp move more than fully priced.

- See the full MNI Fed Preview here: https://roar-assets-auto.rbl.ms/files/65494/FedPrevJul2024%20-%20with%20analysts.pdf

- Cumulative cuts from 5.33% effective: 1bp Jul, 28bp Sep, 44bp Nov, 68bp Dec and 85bp Jan.

STIR: OI Points To Mix Of Modest Long Setting & Shoer Cover During Tuesday's SOFR Uptick

OI data points to a mix of net long setting and short cover in SOFR futures during Tuesday’s uptick, although OI changes in packs and individual contracts were fairly limited ahead of today’s FOMC decision.

- A reminder that heightened tension in the Middle East drove a rally in the contracts ahead of the close, leaving ~69bp of ’24 Fed cuts priced into Fed Funds futures late in the day.

| 30-Jul-24 | 29-Jul-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRM4 | 1,134,067 | 1,132,313 | +1,754 | Whites | -4,888 |

| SFRU4 | 1,068,343 | 1,077,127 | -8,784 | Reds | +6,560 |

| SFRZ4 | 1,176,552 | 1,170,051 | +6,501 | Greens | +9,477 |

| SFRH5 | 896,883 | 901,242 | -4,359 | Blues | +7,176 |

| SFRM5 | 828,256 | 827,844 | +412 | ||

| SFRU5 | 661,056 | 654,843 | +6,213 | ||

| SFRZ5 | 894,806 | 900,074 | -5,268 | ||

| SFRH6 | 567,294 | 562,091 | +5,203 | ||

| SFRM6 | 527,537 | 526,398 | +1,139 | ||

| SFRU6 | 475,505 | 472,430 | +3,075 | ||

| SFRZ6 | 393,139 | 389,201 | +3,938 | ||

| SFRH7 | 235,380 | 234,055 | +1,325 | ||

| SFRM7 | 250,628 | 249,613 | +1,015 | ||

| SFRU7 | 200,919 | 198,684 | +2,235 | ||

| SFRZ7 | 220,025 | 215,600 | +4,425 | ||

| SFRH8 | 139,744 | 140,243 | -499 |

MIDEAST: Strikes On Hezbollah & Hamas Figures Changes Security Landscape

Two notable strikes against senior figures within militant groups opposed to Israel within the past 24 hours could have a significant impact on the security outlook for the Middle East.

- Late on 30 July, Israel carried out an air strike on a suburb of the Lebanese capital, Beirut, hitting a building containing senior Hezbollah commander Fuad Shukr. Israel claims that Shukr was killed in the attack, while Hezbollah has only confirmed that he was in the building.

- Several hours later the political leader of Hamas, Ismail Haniyeh, was killed in a raid in the Iranian capital Tehran. He had been in attendance for the swearing-in of new Iranian President Masoud Pezeshkian. Israel has not claimed responsibility for the killing.

In the PDF below we outline some of the potential regional impacts and responses to the strikes:

MNIPOLITICALRISK-HamasHezbollahStrikes31Jul.pdf

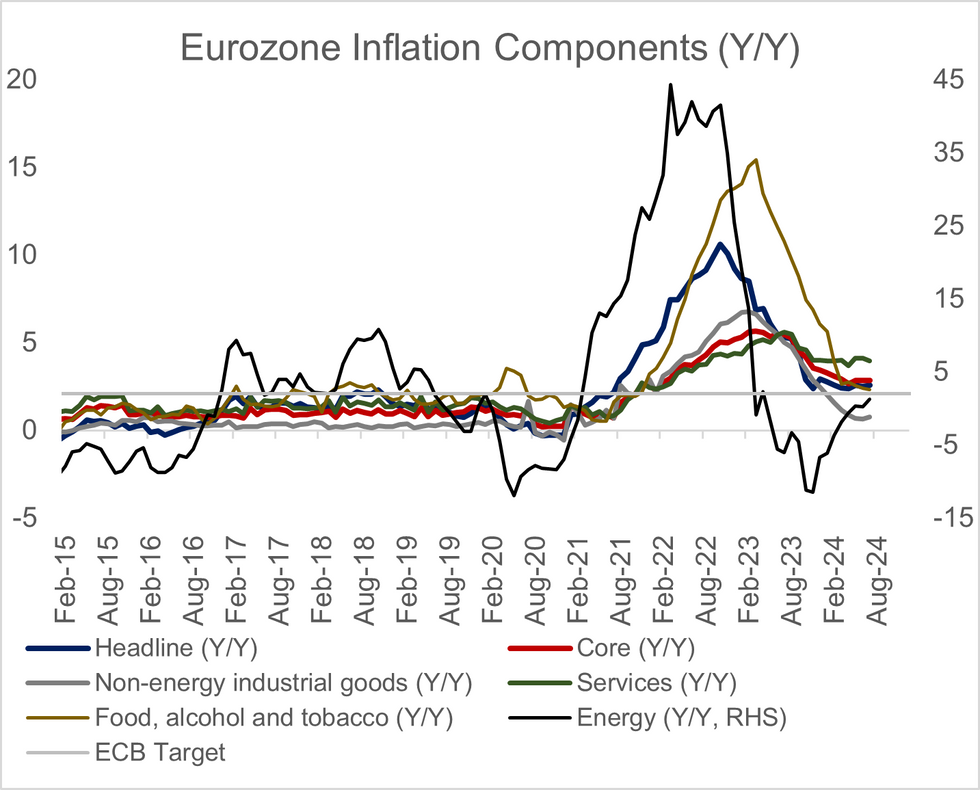

EUROZONE DATA: Flash Inflation In-Line With Tracking; Services Softens But Only Slightly

Eurozone July flash headline printed in-line with MNI's tracking estimate at 2.6% Y/Y (vs 2.5% cons; 2.5% prior) and 0.0% M/M (vs -0.1% cons; 0.2% prior). On an unrounded basis, headline was 2.59% Y/Y and -0.02% M/M.

- Core HICP also printed a tenth above consensus on a rounded basis, remaining at 2.9% Y/Y for the third consecutive month (vs 2.8% cons; 2.9% prior), but with the surprise boosted by rounding. On an unrounded basis, core was 2.86% Y/Y and -0.15% M/M.

- Looking at the individual categories, services inflation fell slightly to 4.0% Y/Y after two months at 4.1% but is yet to show signs of meaningful further disinflationary progress having plateaued at an average 4.0% Y/Y since November.

- Non-energy industrial goods inflation rose slightly to 0.8% Y/Y (vs 0.7% prior).

- Energy price inflation meanwhile increased as expected, up to 1.3% Y/Y (vs 0.2% prior) as downward base effects have faded.

- At a country level, annual HICP fell in 8 countries, rose in 11 countries, and was unchanged for Ireland.

Source: Eurostat, MNI

Source: Eurostat, MNI

EUROPE ISSUANCE UPDATE

German auction results

* E3bln (E2.472bln allotted) of the 2.40% Nov-30 Bund. Avg yield 2.25% (bid-to-offer 1.82x; bid-to-cover 2.20x).

FOREX: AUD/JPY Through Late April Lows on CPI, BoJ Surprise

- Central banks continue to roil markets, with the surprise rate hike from the BoJ of 15bps to 0.25% leaning against expectations split between no change and a 10bps hike. The resultant JPY strength was compounded by Ueda's tone in the post-decision press conference, at which Ueda strongly suggested the BoJ are only at the beginning of their tightening cycle, and 0.50% would be no ceiling for rates in the near-term.

- USD/JPY has traded through to new pullback lows and - importantly - through 151.94, the low from last week and key pivot level on several occasions since 2022. Both 151.10 support and the 200-dma have also given way, while a close below 97.78 in AUD/JPY would entirely reverse the rally off the late April low.

- While JPY trades firmer, AUD is the weakest in G10, slipping as CPI came in soft relative to expectations. Both the weighted- and trimmed-mean CPI release for Q2 came in soft, helping usher in AUD/NZD sales and a move below 1.10 for the cross.

- The Fed decision takes focus later today, at which markets are on watch for any signal from the FOMC that the bank are closing in on a potential rate cut at the September meeting. Outside of the Fed meeting, MNI Chicago PMI is also due, as well as the US ADP Employment Change states for July, and Canada's May GDP update.

FX OPTIONS: Expiries for Jul31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0750-65(E1.8bln)

- USD/JPY: Y154.00($1.4bln), Y155.00($2.3bln), Y156.50-65($1.7bln)

- AUD/USD: $0.6525-35(A$869mln), $0.6630-50(A$1.1bln)

- USD/CAD: C$1.3620-28($870mln)

COMMODITIES: WTI Futures Bounce Off Tuesday's Lows, Bearish Threat Remains

- A bear threat in WTI futures remains present and the contract has traded lower this week. The recent breach of both the 20- and 50-day EMAs, reinforces the bear theme. A continuation lower would open $72.23, the Jun 4 low and the next key support. For bulls, a reversal higher would instead refocus attention on the key resistance points at $83.58, the Jul 5 high, and $84.36, the Apr 12 high.

- The recent move down in Gold is considered corrective, however, the yellow metal has managed to pierce support at the 50-day EMA - at $2363.9. A clear break of this average would signal scope for a deeper retracement towards $2277.4, the May 3 low and a key support. For bulls, this week’s gains are constructive. A stronger reversal would refocus attention on $2483.7, the Jul 17 high, and a bull trigger. Clearance of this hurdle resumes the uptrend.

EQUITIES: Latest Bounce in Eurostoxx 50 Futures Appears Corrective

- Eurostoxx 50 futures traded lower last week, and a bearish threat remains present. The contract has breached 4846.00, the Apr 19 low. A clear break of this level would pave the way for an extension towards 4734.54, the 200 day MA (cont). Moving average studies are in a bear-mode set-up, highlighting a downtrend. The latest bounce appears to be a correction. Initial firm resistance to watch is 4980.00, Jul 23 high.

- S&P E-Minis traded lower last week and the move down resulted in a break of both the 20- and 50-day EMAs. This reinforces the short-term bearish cycle and signals scope for an extension near-term. Note that the move down is considered corrective. Potential is seen for a move towards 5396.09, the lower band of a MA envelope, ahead of 5370.62 a Fibonacci retracement. Gains are considered corrective, key S/T resistance is 5629.75, Jul 23 high.

| Date | GMT/Local | Impact | Country | Event |

| 31/07/2024 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 31/07/2024 | 1215/0815 | *** | ADP Employment Report | |

| 31/07/2024 | 1230/0830 | *** | Employment Cost Index | |

| 31/07/2024 | 1230/0830 | *** | Gross Domestic Product by Industry | |

| 31/07/2024 | 1230/0830 | *** | Treasury Quarterly Refunding | |

| 31/07/2024 | 1345/0945 | *** | MNI Chicago PMI | |

| 31/07/2024 | 1400/1000 | ** | NAR Pending Home Sales | |

| 31/07/2024 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 31/07/2024 | 1800/1400 | *** | FOMC Statement | |

| 01/08/2024 | 2300/0900 | ** | S&P Global Manufacturing PMI (f) | |

| 01/08/2024 | 0030/0930 | ** | S&P Global Final Japan Manufacturing PMI | |

| 01/08/2024 | 0130/1130 | ** | Trade Balance | |

| 01/08/2024 | 0130/1130 | ** | Trade price indexes | |

| 01/08/2024 | 0145/0945 | ** | S&P Global Final China Manufacturing PMI | |

| 01/08/2024 | 0715/0915 | ** | S&P Global Manufacturing PMI (f) | |

| 01/08/2024 | 0745/0945 | ** | S&P Global Manufacturing PMI (f) | |

| 01/08/2024 | 0750/0950 | ** | S&P Global Manufacturing PMI (f) | |

| 01/08/2024 | 0755/0955 | ** | S&P Global Manufacturing PMI (f) | |

| 01/08/2024 | 0800/1000 | ** | S&P Global Manufacturing PMI (f) | |

| 01/08/2024 | 0830/0930 | ** | S&P Global Manufacturing PMI (Final) | |

| 01/08/2024 | 0900/1100 | ** | Unemployment | |

| 01/08/2024 | 1100/1200 | *** | Bank Of England Interest Rate | |

| 01/08/2024 | 1100/1200 | *** | Bank Of England Interest Rate | |

| 01/08/2024 | 1130/1230 | BoE Press Conference | ||

| 01/08/2024 | - | *** | Domestic-Made Vehicle Sales | |

| 01/08/2024 | 1230/0830 | *** | Jobless Claims | |

| 01/08/2024 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 01/08/2024 | 1230/0830 | ** | Preliminary Non-Farm Productivity | |

| 01/08/2024 | 1300/1400 | BOE Monthly Decision Maker Panel Data | ||

| 01/08/2024 | 1345/0945 | *** | S&P Global Manufacturing Index (final) | |

| 01/08/2024 | 1400/1000 | *** | ISM Manufacturing Index | |

| 01/08/2024 | 1400/1000 | * | Construction Spending | |

| 01/08/2024 | 1430/1030 | ** | Natural Gas Stocks | |

| 01/08/2024 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 01/08/2024 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 01/08/2024 | 1615/1715 | BOE's Pill MPR virtual Q&A |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.