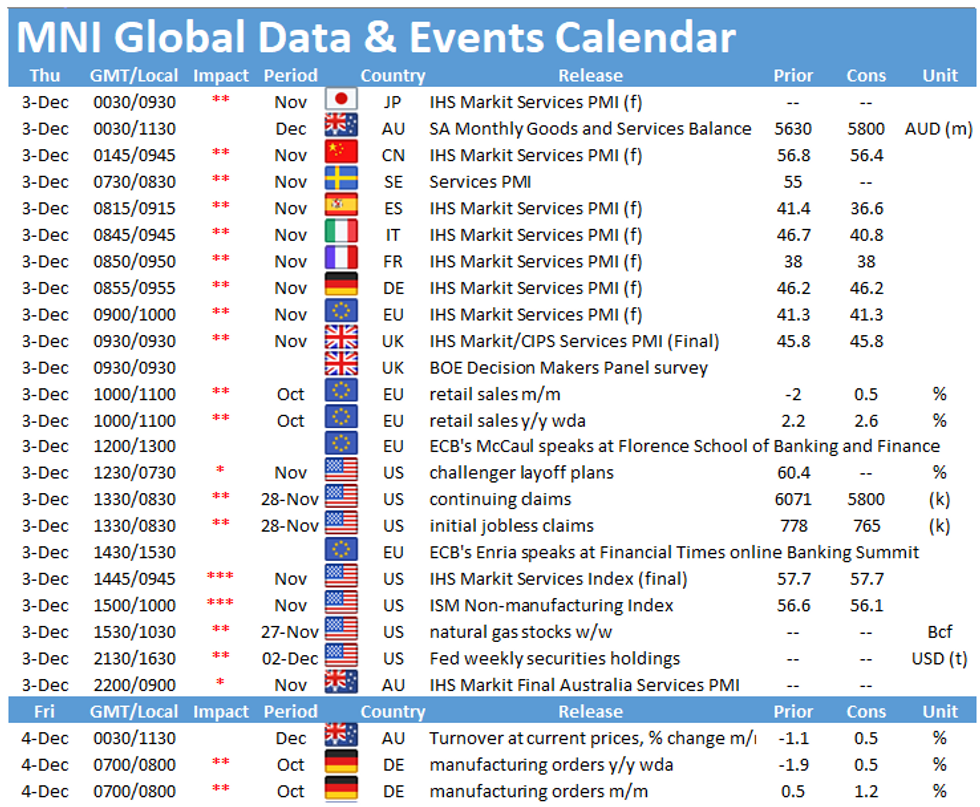

-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Searching For Direction

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

- HEADLINE FLOW STILL MIXED ON THE BREXIT FRONT

- ANOTHER STRONG CHINESE PMI READING SEEN OVERNIGHT

- CHINA SET TO ALLOW AUSTRALIAN THERMAL COAL CARGO ASHORE AMID BAN (BBG)

- RESIDENTS IN LOS ANGELES 'ORDERED TO REMAIN IN THEIR HOMES' (KTLA)

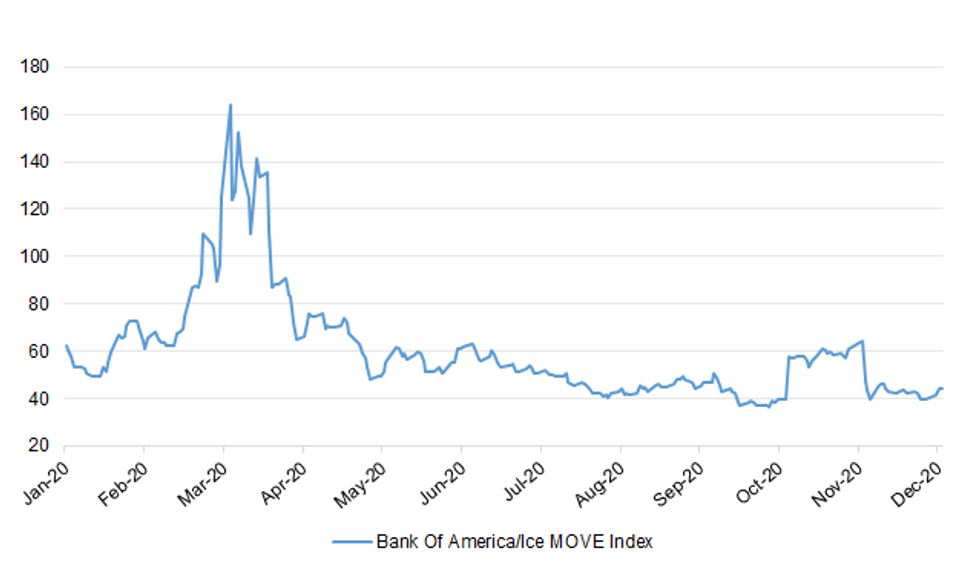

Fig. 1: Bank Of America/Ice MOVE Index

Source: MNI - Market News/Bank Of America/Ice/Bloomberg

Source: MNI - Market News/Bank Of America/Ice/Bloomberg

UK

BREXIT: After months and months, and yes, months of talks, several sources have told me on Wednesday that the process is likely to be concluded in the next few days. One ambassador told me there was a hope the agreement could be finalised on Friday, with another diplomatic source confirming a deal at the end of this week is a possibility - suggesting the agreement is basically done, even though "it could all still fall apart". As my colleague, BBC Europe editor Katya Adler, wrote earlier, the EU chief negotiator updated the bloc's members in a video call today, and it's certainly the case there are nerves on that side about how much he might give away. It's certainly not the case though the negotiators have managed to find ingenious solutions to every single issue raised in these vast talks that will placate both sides 100%. But there are two very good reasons - aside from whispers from those involved - that a conclusion is now very near. (BBC)

BREXIT: A Sky reporter tweeted the following on Thursday: "EU source says next 48 hours key. UK source agrees but adds 'we might not get there'. On other hand could get there by end of week - but it's 'v difficult to call'. What we can say is they're settling in for the night." (MNI)

BREXIT: France warned it could veto a trade deal between the U.K. and the European Union if it doesn't like the terms, piling pressure on the EU negotiating team not to make further concessions as talks build to a climax. At a meeting of the bloc's 27 ambassadors on Wednesday, the French envoy warned chief Brexit negotiator Michel Barnier of how bad it would look if he brokered a deal only to see it vetoed by EU leaders, according to a diplomatic note of the meeting seen by Bloomberg. Barnier swerved a request from ambassadors to see key parts of the text before it's finished, with some of those present voicing concerns he might be giving too much away and leaving them with too little time to scrutinize any agreement. (BBG)

BREXIT: Ireland's foreign minister Simon Coveney has warned the UK it will be making "a really big mistake" if it breaches the Northern Ireland Protocol on Brexit. The UK Government is poised to reintroduce elements of its controversial Internal Market Bill next week, which could override the protocol, in a move that would breach international law. The UK is also set to table its Finance Bill, elements of which could also breach parts of the Northern Ireland Protocol - designed to prevent a hard border on the island of Ireland -agreed last year. It comes amid an intense period of negotiations between the EU and the UK to reach a post-Brexit trade deal. Mr Coveney said on Wednesday that such a move by the UK would be taken as a "clear signal" by the EU that Britain does not want a deal. He said: "I think if they do that, it will be a clear signal to the EU that this process is not going to conclude well. (Press Association)

BREXIT: The shadow cabinet is split over whether to back a Brexit deal, as backbench Labour MPs warn that up to 60 could rebel if Keir Starmer insists they back the government rather than allowing a free vote. Two backbench MPs said the potential for a frontbench reshuffle – and new shadow ministerial posts – had been raised when the issue had come up in conversations with Starmer's office, as a way of containing potential rebels. (Guardian)

BREXIT: European Union officials are resisting calls from derivatives traders -- and even one regulator -- to allow access to London's dominant markets after the Brexit transition ends this month, saying upheaval in the market does not pose a risk to financial stability. Gilles Herve, policy officer at the European Commission, signaled at a conference Wednesday that the bloc was in no rush to extend the rights of EU-based firms through a process known as equivalence, and would instead push banks, hedge funds and money managers to trade derivatives within the bloc. "We hear you. We hear the challenges that you face. We are monitoring the situation, but at the moment we intend to stick to the line we defined two years ago," Herve said. "We always knew that Brexit would have consequences on financial markets and on market participants." (BBG)

FISCAL: Rishi Sunak has warned that the huge levels of debt built up as part of the fight against coronavirus could become unaffordable if there is a sudden rise in interest rates. The Treasury is likely to borrow £370 billion this year, more than double the £158 billion deficit in the peak year of the financial crisis. It has taken debt to close to 100 per cent of GDP for the first time since the 1960s. In an interview with John Pienaar on Times Radio, the chancellor said that while interest rates were "exceptionally low" the debt was affordable. "But that could change," he said. "I think no one has a perfect crystal ball about which way interest rates and inflation will move. (The Times)

EUROPE

EU/FISCAL: The rift between the European Union and its two budget holdouts is getting wider, with Poland and Hungary rejecting appeals to lift their veto and the rest of the bloc plotting to carve out a stimulus plan that excludes them. Budapest and Warsaw are growing more entrenched in their positions while the vast majority of other member states are determined not to give in to demands to revise a 1.8 trillion-euro ($2.2 trillion) spending package, two diplomats familiar with the ongoing discussions said. The bloc's leaders will now most likely have to tackle the matter when they meet on Dec. 10. (BBG)

GERMANY: The German authorities have decided to extend the partial lockdown, in force since the start of November, until January 10. The measures have closed all restaurants, bars, gyms, theatres and concert halls, and essentially shut down domestic tourism. There are in addition strict curbs on all social gatherings. Markus Söder, the prime minister of Bavaria, said after a video conference between the federal government and the leaders of the 16 federal states that the coronavirus situation had not relaxed "by any means", and extending the partial shutdown was the right thing to do. (FT)

FRANCE: The French economy is set to contract about 9% this year as a year-end lockdown-induced slump offsets a stronger than expected rebound from a first phase of COVID-19 restrictions, the INSEE official statistics agency forecast on Wednesday. The euro zone's second-biggest economy was course to contract 4.4% in the final three months of the year after rebounding 18.7% in the third quarter, when activity surged back more than expected following a first, harsher lockdown. (RTRS)

ITALY: The Italian government approved a new restriction plan to stem the spread of coronavirus over the Christmas and New Year holiday season that will ban movements between regions from Dec. 21 to Jan. 6. Movements between different towns will also be banned on Dec. 25, Dec. 26 and Jan. 1, according to a statement from the cabinet. Health Minister Roberto Speranza told the Rome Senate Wednesday that the administration of Prime Minister Giuseppe Conte, who is drafting a new decree due to come into force on Friday, will prolong a three-tier system that tailors restrictions to regional contagion levels. (BBG)

SPAIN: Spain will allow families to meet in groups of up to 10 on Christmas Eve, Christmas, New Year's Eve and New Year's Day as part of its restrictions on festive season gatherings, Health Minister Salvador Illa said in a news conference Wednesday. The government is seeking to strike a balance between permitting small-scale festive gatherings and combating the pandemic. The government will also restrict travel between mainland Spanish regions from Dec. 23 to Jan. 6, unless journeys are for family gatherings, he said. (BBG)

U.S.

FED: MNI BRIEF: Fed's Williams: Economy Still in Deep Recession

- New York Fed President John Williams said Wednesday the U.S. economy is "still in a deep recession" and the pace of recovery next year would depend on fiscal policy and the timing of a coronavirus vaccine rollout. "There's still a period of very heightened uncertainty in the near term," Williams said during a webinar - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI INTERVIEW: Fed's Barkin Favors Tying QE To Jobs Progress

- The Fed should pledge to continue asset purchases until the labor market has strengthened sufficiently, a scenario much easier to envision now that safe and effective Covid vaccines are ready to be deployed, Federal Reserve Bank of Richmond President Tom Barkin told MNI Wednesday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: Dallas Federal Reserve President Robert Kaplan said he wouldn't be in favor of changing the central bank's bond-purchasing program even though he sees some rocky times ahead for the U.S. economy. Speaking Wednesday to CNBC, Kaplan said financial conditions are such that the Fed probably doesn't need to do more than its current pace of at least $120 billion a month in Treasurys and mortgage-backed securities. (CNBC)

FED: MNI BRIEF: Fed Beige Book Flags Regional Weakness

- The Fed's new Beige Book Wednesday shows some sign of deterioration in the outlook compared to October's reading of anecdotal reports from central bank business contacts. "Most Federal Reserve Districts have characterized economic expansion as modest or moderate since the prior Beige Book period," the report said. "However, four Districts described little or no growth, and five narratives noted that activity remained below pre-pandemic levels for at least some sectors" - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: Senate Republicans' bid to confirm Judy Shelton as a Federal Reserve governor appears unlikely to succeed now that a new Democratic senator has been seated, denying President Trump's nominee the votes needed for approval. The Senate voted Wednesday to advance the confirmation of another of Mr. Trump's Fed nominees, Christopher Waller, the research director at the Federal Reserve Bank of St. Louis. The Senate voted 50-45 to clear a final procedural hurdle before Mr. Waller's confirmation vote, which is likely to occur Thursday. (WSJ)

FISCAL: House Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer on Wednesday urged Senate Majority Leader Mitch McConnell to use a $908 billion bipartisan stimulus plan as the basis for relief talks as Congress scrambles to send aid to Americans before the end of the year. In a joint statement, the Democratic leaders endorsed a more narrow aid approach than they have previously. The California and New York Democrats had insisted on legislation that costs at least $2.2 trillion. (CNBC)

FISCAL: "If we don't finish it by the ninth, and that's next week, we'll have to have a short CR," Shelby said. "I think it's where we're headed at the moment." He added that the length of that stopgap measure was undetermined, but said if history was any guide "we'll be here several more weeks." (Philadelphia Inquirer)

FISCAL: A PLITICO reporter tweeted the following on Wednesday: "several sources tell me Pelosi's covid relief offer was 1.3t. The problem solver/bipartisan group whatever that is was $908bn. McConnell is around $500b or so."

CORONAVIRUS: The number of coronavirus patients in US hospitals topped 100,000 for the first time on Wednesday, while new cases jumped by a record of more than 195,000. In addition to those milestones, the country tallied its second-biggest one-day jump in deaths of the entire pandemic. The number of people in US hospitals being treated for coronavirus hit a record 100,266, according to Covid Tracking Project data on Wednesday. (FT)

CORONAVIRUS: The U.S. should be able to distribute enough coronavirus vaccine doses to immunize 100 million people by the end of February, President Donald Trump's Covid-19 vaccine czar said Wednesday. That will be enough doses to protect a "significant portion" of the most at-risk Americans, which are the elderly, health-care workers and people with preexisting conditions, Dr. Moncef Slaoui, who is leading the Trump administration's vaccine program Operation Warp Speed, told reporters during a news briefing. (CNBC)

CORONAVIRUS: The next few months of the Covid-19 pandemic will be among "the most difficult in the public health history of this nation," Dr. Robert Redfield, the director of the Centers for Disease Control and Prevention, said Wednesday. Redfield, speaking at an event hosted by the U.S. Chamber of Commerce, said that about 90% of hospitals in the country are in "hot zones and the red zones." He added that 90% of long-term care facilities are in areas with high level of spread. (CNBC)

CORONAVIRUS: New York Governor Andrew Cuomo said he expects the state will receive its first batch of coronavirus vaccines from Pfizer on December 15, pending federal government approval. That shipment should provide enough vaccines for 170,000 New Yorkers, starting with care-home residents and healthcare workers, Mr Cuomo announced at a press conference on Wednesday morning. "We expect, if all safety & efficacy approvals granted, to receive these doses on December 15th," a slide from Mr Cuomo's presentation said, referring to Pfizer's vaccine. (FT)

CORONAVIRUS: All residents within the city of Los Angeles were ordered to remain in their homes effective immediately, according to a new emergency order issued Wednesday evening. The previous "safer-at-home" order was withdrawn and superseded by the new one issued Wednesday, which is "necessary for the protection of life and property in the City of Los Angeles," the order states. (KTLA)

CORONAVIRUS: AstraZeneca Plc will likely get results of its U.S. COVID-19 vaccine trial in late-January and could potentially file for an emergency authorization, the chief adviser for the U.S. government's Operation Warp Speed program said on Wednesday. The British drugmaker and Oxford University have already published interim efficacy results from their UK trial in November, but the results have raised questions among scientists. (RTRS)

EQUITIES: Boeing Co. is closing in on two key milestones in the comeback of its 737 Max, according to people familiar with the matter: the jet's return to regular service and the first delivery since U.S. regulators lifted a 20-month grounding. United Airlines Holdings Inc. is expected to receive the first Max delivery since the flying ban was imposed in March 2019 after two deadly crashes, said the people, who asked not to be named because the talks are confidential. The plans are in flux and American Airlines Group Inc. may get the initial handover instead, they said, as Boeing seeks to start unlocking delivery payments. (BBG)

EQUITIES: A group of U.S. states led by New York is investigating Facebook Inc for possible antitrust violations and plans to file a lawsuit against the social media giant next week, four sources familiar with the matter said on Wednesday. The complaint would be the second major lawsuit filed against a Big Tech company this year. The Justice Department sued Alphabet Inc's Google in October. More than 40 states plan to sign on to the lawsuit, one source said, without naming them. (RTRS)

OTHER

U.S./CHINA: The House unanimously approved legislation that threatens a trading ban of shares of Chinese companies, such as Alibaba, over concerns that their audits aren't sufficiently regulated. The bipartisan measure passed the Senate in May and could quickly become law with President Trump's signature. (WSJ)

U.S./CHINA: A federal appeals court said on Wednesday it will hear oral arguments on Dec. 14 on the government's appeal of an order that blocked a ban on Apple Inc and Alphabet's Google offering TikTok for download in U.S. app stores. (RTRS)

U.S./CHINA: The Trump administration expanded economic pressure on China's Xinjiang province on Wednesday, banning cotton imports from a powerful Chinese quasi-military organization that it says uses the forced labor of detained Uighur Muslims. (RTRS)

U.S./CHINA: China targeting influence operations toward incoming Biden team. (BBG)

U.S./CHINA/HONG KONG: The U.S. Congress "remains seriously concerned" about the alleged mistreatment of Hong Kong pro-democracy leader Joshua Wong in prison and is "disturbed" by possible further charges and jail time for such activists, U.S. House Speaker Nancy Pelosi said on Wednesday. "China's brutal sentencing of these young champions of democracy in Hong Kong is appalling," Pelosi said in a statement after Wong was jailed. "We call on all freedom-loving people around the world to join us in denouncing this unjust sentencing and China's widespread assault on Hong Kongers." (RTRS)

JAPAN/CHINA/HONG KONG: Japan has "grave concerns" about the jailing of three Hong Kong activists and has conveyed its worries to China over the situation, chief government spokesman Katsunobu Kato said on Thursday. Hong Kong authorities on Wednesday sentenced prominent democracy activists Joshua Wong to more than 13 months in prison over an unlawful anti-government rally in 2019, the toughest sentence for an opposition figure this year. (RTRS)

GLOBAL TRADE: The U.S. and European Union's top trade officials have stepped up work to settle a long-running dispute over aircraft subsidies before President Donald Trump leaves office in January, people familiar with the matter said. U.S. Trade Representative Robert Lighthizer and his EU counterpart, Valdis Dombrovskis, are in regular contact on the case involving Boeing Co. and Airbus SE, according to the people, who spoke on condition of anonymity because the talks are private. (BBG)

GLOBAL TRADE: China has proposed new guidelines that would limit the ways tech companies collect personal data through smartphone apps. (Nikkei)

CORONAVIRUS: Approving a coronavirus vaccine is only the first step toward suppressing the pandemic, as countries race to build distribution networks to deliver the doses to their populations, World Health Organization officials said on Wednesday. (CNBC)

CORONAVIRUS: The drugmaker Moderna said on Wednesday that it would soon begin testing its coronavirus vaccine in children aged 12 to 17. The study, listed Wednesday on the website clinicaltrials.gov, will include 3,000 children, with half receiving two shots of vaccine four weeks apart, and half getting placebo shots of salt water. (New York Times)

BOJ: MNI POLICY: BOJ Suzuki: Policy Sustainability; Warns Of Risks

- Bank of Japan board member Hitoshi Suzuki has said the BOJ should look for additional ways to better execute ETF and J-REIT purchases at a time when an appropriate lowering of the risk premia for asset prices become absolutely necessary. "It is expected to take more time to achieve the price stability target, due in part to the impact of Covid-19, I think it will become even more important for monetary easing measures to be sustainable and flexible," Suzuki told business leaders in Fukushima City via an online conference on Thursday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

BOJ: The Bank of Japan is likely to consider extending its special funding program to support virus-hit businesses at a policy meeting this month, according to people familiar with the matter. A recent resurgence of infection cases has intensified uncertainties for the economy and that will be a key topic at the two-day gathering through Dec. 18, the people said. By lengthening the duration of the support program beyond its current expiry in March, the bank would provide further relief to businesses seeking access to funding, they said.

JAPAN: Osaka Prefecture will issue a red alert for the first time as soon as today, signaling that the region is in a state of emergency, due to rising number of serious patients, broadcaster TBS reports without attribution. (BBG)

AUSTRALIA: Australia will receive its first COVID-19 vaccines by early 2021, the nation's health minister has revealed. Addressing the media on Thursday, Health Minister Greg Hunt said Australia was on track to roll out its first vaccinations in March. These will be distributed to health workers and aged care residents. (7 News)

AUSTRALIA/CHINA: China is set to allow a shipment of Australian coal into the country, according to a person familiar with the matter, despite a ban on such imports remaining in place as tensions between Beijing and Canberra escalate. A cargo of 135,000 tons of Australian thermal coal on the vessel Alpha Era, which has been waiting almost six months to unload at the southern Chinese port of Fangchenggang, is expected to clear customs and is bound for a local user, said the person, who asked not to be identified because the information is private. Two other ships, the Dong-A Eos and the Dong-A Astrea, recently completed unloading Australian coal at the port of Jingtang, while a third vessel, the Dong-A Oknos, is in the process, according to data intelligence firm Kpler. (BBG)

MEXICO: Banco de Mexico will work with the government to discuss an initiative that would allow the central bank to buy dollars from local banks, Governor Alejandro Diaz de Leon said in a conference. Facilitating the transfer of foreign currency from legitimate sources may be helpful, Diaz de Leon said. (BBG)

SOUTH AFRICA: About 800 South African gold miners who staged an underground protest at an operation owned by Hong Kong-based private-equity firm Heaven-Sent Gold Group Co. ended the action late Wednesday after two days underground. Workers at the Kopanang mine, south of Johannesburg, who spent Tuesday night and the rest of Wednesday underground, voluntarily came out later in the day, said Jeff Dong, chief executive officer of operator Village Main Reef. The protest had been deemed illegal by the company, which had initially given the workers an ultimatum to come to the surface or risk dismissal. "Everyone is out," Dong said via text. "Now people need to get some food and sleep." (BBG)

MIDDLE EAST: The Trump administration is pulling out as many as half of America's diplomats from the U.S. Embassy in Baghdad as tensions spike with Iran ahead of the first anniversary of the U.S. killing of a top Iranian general. The staff reduction, confirmed by a U.S. official and a State Department official, is in theory supposed to be temporary. But given the steep downward trajectory of U.S.-Iran relations in the final months of President Donald Trump's tenure, it's not clear when fuller staffing will resume. (Politico)

MIDDLE EAST: Saudi Arabia and Qatar are nearing a preliminary deal to end a rift that's dragged on for more than three years, prodded by a Trump administration seeking foreign policy wins during its waning days in the White House, three people with knowledge of the talks said. The tentative agreement does not involve the three other Arab countries that also severed diplomatic and trade ties with Qatar in June 2017 -- the United Arab Emirates, Bahrain and Egypt. A fourth person said a broader realignment remained a long way off as the underlying issues, such as Doha's relations with Tehran, remained unresolved. (BBG)

OIL: OPEC+ is making headway in its negotiations on oil-output cuts, raising the odds that Thursday's meeting can salvage a deal after failed talks earlier in the week. After days of direct negotiations between the group's heavyweights -- Russia, Saudi Arabia and the United Arab Emirates -- discussions are now focusing on proposals for gradual easing of output cuts over several months, said a delegate. It's unclear whether the tapering would start in January, or would be delayed to later in the first quarter. The proposals, if accepted by the whole OPEC+ group, would modify the current deal that allows 1.9 million barrels a day of fresh crude supplies to be added to the market from Jan. 1. (BBG)

CHINA

PBOC: The PBOC should not tighten monetary policy until at least H2 next year given investment and consumption are still below expectations and companies face tight credit conditions after a string of bond defaults, said Sheng Songcheng, a former official with the central bank and now an advisor to the Shanghai government. If the PBOC quits easing, speculative international capital may accelerate the appreciation of the yuan and inflate import prices, said Sheng in a blog post. (MNI)

LIQUIDITY: China's five major state-owned banks are planning to inject capital into affiliated Asset Investment Companies (AIC) to satisfy regulatory needs to raise capital adequacy ratios from 2-3% to 5% this year, the Securities Times reported citing industry sources. According to the report the ratio will then increase to 6% in 2021 and 8% by 2022. The new regulatory standards will tighten banks' capital as AIC's main debt-for-equity business consumes capital, the newspaper said citing industry insiders. The current risk weight of 400% for non-public company equity and 250% for public company equity will not change, the Times report said. (MNI)

OVERNIGHT DATA

CHINA NOV CAIXIN SERVICES PMI 57.8; MEDIAN 56.4; OCT 56.8

CHINA NOV CAIXIN SERVICES PMI 57.5; OCT 55.7

The Caixin China Composite Output Index came in at 57.5 in November, stronger than 55.7 the previous month. Both demand and supply in the manufacturing and services sectors were upbeat and employment continued to recover. The measures for output, new orders and employment all hit the highest since the first half of 2010. The gauge for future output expectations also stayed at a high level. To sum up, both the manufacturing and service sectors recovered at a faster pace as overseas demand kept expanding and employment saw substantial improvement. Manufacturers began increasing inventories to meet strong market demand. The measures for both input and output prices both rose. The gauge for business expectations remained high. We expect the economic recovery in the post-epidemic era to continue for several months. At the same time, deciding how to gradually withdraw the easing policies launched during the epidemic will require careful planning as uncertainties still exist inside and outside China. (Caixin)

JAPAN NOV, F JIBUN BANK SERVICES PMI 47.8; PRELIM 46.7

JAPAN NOV, F JIBUN BANK COMPOSITE PMI 48.1; PRELIM 47.0

There were indications that the tentative recovery in the Japanese service sector lost momentum as the country battled with a resurgence in COVID-19 cases. Although the rate of decline in activity was broadly unchanged in November, a sharper fall in new business signified that demand remains fragile amid short-term uncertainty surrounding the length of the pandemic. Uncertainty also led to a renewed fall in employment levels, albeit one that was fractional. Yet, firms maintained strong optimism that business conditions would improve over the coming 12 months. The loss of momentum extended across the Japanese private sector as activity remained firmly in contraction territory in November. The pace of decline was broadly unchanged from October, with the larger service sector recording a sharper fall than manufacturing. Despite a broad recovery in GDP in the third quarter of 2020, uncertainty prevented a stronger uptick as investment contracted for a second consecutive quarter. With our current projections anticipating a 5.4% decline in GDP during 2020, growth is projected for 2021. Japanese private sector firms remain confident of a wider recovery over the next year amid hopes that the pandemic will recede and private sector activity will be supported by a broad-based boost in demand stemming from stable business conditions and the Tokyo Olympics. As a result, we currently expect the economy to grow 2.2% in 2021, as the economy begins to emerge from the global downturn. (IHS Markit)

JAPAN OCT LOANS & DISCOUNTS TO CORPORATIONS +7.79% Y/Y; SEP +7.53%

AUSTRALIA OCT TRADE BALANCE A$7.456BN; MEDIAN A$5.800BN; SEP A$5.815BN

AUSTRALIA OCT EXPORTS +5% M/M; MEDIAN +4%; SEP +3%

AUSTRALIA OCT IMPORTS +1% M/M; MEDIAN +4%; SEP -6%

AUSTRALIA OCT HOME LOANS VALUE +0.7% M/M; MEDIAN +2.5%; SEP +5.9%

AUSTRALIA NOV, F IHS MARKIT SERVICES PMI 55.1; PRELIM 54.9

AUSTRALIA NOV, F IHS MARKIT COMPOSITE PMI 54.9; PRELIM 54.7

The recovery in the Australian service sector moved up a gear in November, with business activity expanding at the strongest pace for four months, according to the latest PMI data. Most encouraging was a further strengthening of demand, where survey data showed new business growth accelerating midway through the fourth quarter. A sustained upturn in activity and sales led firms to take on extra workers for the first time since the start of 2020. Growth in the service sector, however, was marred by an intensification in cost inflation, with input prices rising at the fastest rate for two years, linked to government subsidy reductions. Business sentiment also remained elevated, supported by expectations of a greater recovery from the COVID-19 downturn alongside strengthening market confidence in the months ahead. (IHS Markit)

AUSTRALIA NOV AIG CONSTRUCTION PMI 55.3; OCT 52.7

NEW ZEALAND OCT BUILDING PERMITS +8.8% M/M; SEP +3.6%

NEW ZEALAND NOV ANZ COMMODITY PRICE INDEX +0.9% M/M; OCT +2.0%

SOUTH KOREA NOV FOREIGN RESERVES US$436.3BN OCT US$426.5BN

CHINA MARKETS

PBOC NET DRAINS CNY70 BILLION VIA OMOS

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with rates unchanged at 2.2% on Thursday. This resulted in a net drain of CNY70 billion given the maturity of CNY80 billion repos today, according to Wind Information.

CHINA SETS YUAN CENTRAL PARITY AT 6.5592 THU VS 6.5611 WED

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5592 on Thursday, compared with the 6.5611 set on Wednesday.

MARKETS

BOND SUMMARY: Mixed, Narrow Trade For Core FI In Asia

Cash Tsys sit unchanged to 0.8bp cheaper across the curve, with modest bear steepening seen. T-Notes are still hugging a tight 0-03 range, last +0-02 at 137-15+. A 10K lift of the low delta TYH1 139.50 calls provided the highlight on the flow side during Asia-Pac hours. A deepening of COVID-19 restrictions in Los Angeles has seen a very modest downtick in e-minis in recent trade.

- The Tokyo morning saw JGB futures unwind their overnight losses, before a downtick in the cover ratio at the latest round of 30-Year JGB supply seemed to apply some light pressure during early afternoon trade. That contract last sits -3 vs. settlement, although cash JGBS sit unchanged to a touch richer on the day. BoJ board member Suzuki largely went over old ground and flagged the desire for a gradual steepening of the JGB yield curve. Local data provided little to go off for the space.

- Over in Australia we saw the RBA step in to enforce its 3-Year yield target, which added some support to the Aussie bond space, allowing YM and XM to print at unchanged levels at one point. The contracts last print -0.5 and -1.0 respectively. Local data saw a mix of firmer than expected exports and softer than expected imports provide a much wider than expected trade surplus for the month of October, while the latest round of housing finance data came in on the softer side of exp.

FOREX: USD Remains Heavy, Covid Concerns and Brexit in Focus

Another quiet Asia-Pac session, a familiar refrain this week. DXY initially bounced off recent lows hit near the end of the US session, before plumbing new depths as the session wore on. Last slightly lower at 90.992. The greenback shrugged off reports late in the session that Los Angeles implemented a city-wide lockdown stay at home order as Covid cases spiral.

- AUD and NZD US dollar crosses pulled back, AUD briefly caught a bid after reports that China would allow some coal deliveries. AUD/USD last at 0.7406 after touching 0.7419 earlier in the session – its highest level in 28-months. NZD last at 0.7061 after touching 0.7073 earlier in the session.

- Australian data was mixed, trade balance showed a higher than expected surplus as exports rose above expectations, and imports rose but fell short of expectations. Earlier in the session the final readings of the November Services PMI printed above the previous at 55.1 from 54.9, while the composite also eked out a slight rise at 54.9 from 54.7 previously. Building permits rose 8.8% in October against a previous increase of 3.6%, while the AiG Construction Index also rose to 55.3 from 52.7.

- The PBOC fixed USD/CNY at 6.5592, around 9 pips stronger than sell side estimates. This compares to a 39 pip difference yesterday that constituted was the third-largest miss since the PBOC announced that it was phasing out its counter-cyclical adjustment for the fixing in October. Data from China has been positive. Caixin services PMI rose to 57.5 from 55.7, the fourth consecutive monthly rise for the figure, and completes the set of positive surprises in PMI data.

- GBP was the worst performer within the G10 basket on Wednesday, GBP/USD declining -0.4% to 1.3370 at the end of US hours. The pair gained slightly in Asia after BBC reports that a Brexit trade deal may be reached by the end of the week, however optimism borne from the headline was tempered by reports soon after that France told Barnier of veto risks if he capitulates in Brexit talks. GBP/USD last up 0.16% at 1.3386.

- EUR/USD hit 1.2125 before pulling back. EUR seems resilient to reports that Italy will ban movement between regions from December 21 to January 6 due to coronavirus concerns.

- Yen pairs have been quiet, USD/JPY last at 104.47, EUR/JPY last at 126.60.

FOREX OPTIONS: Expiries for Dec3 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1795-1.1800(E1.1bln), $1.1870-85(E662mln),

$1.1920-35(E884mln), $1.1945-50(E1.4bln),

$1.1995-1.2000(E1.1bln) - USD/JPY: Y102.00($812mln-USD puts), Y103.00($1.9bln-USD puts), Y104.00($3.5bln-$3.46bln USD puts), Y104.45-50($1.6bln),

Y104.85-90($570mln), Y105.00-10($1.1bln), Y105.45-50($900mln) - GBP/USD: $1.3200(Gbp423mln)

- USD/CHF: $0.9035($500mln-USD puts)

- AUD/USD: $0.7350(A$722mln). $0.7385-0.7400(A$1.3bln, A$1.1bln AUD puts), $0.7435(A$673mln-AUD puts)

- AUD/NZD: N$1.0700(A$680mln)

- USD/CAD: C$1.3000($618mln-USD puts)

- USD/CNY: Cny6.60($1.2bln)

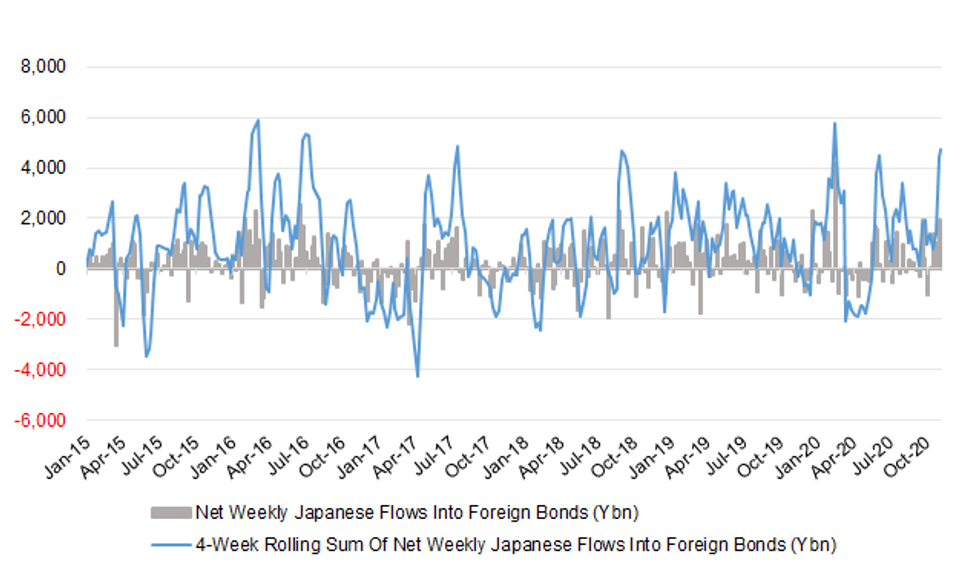

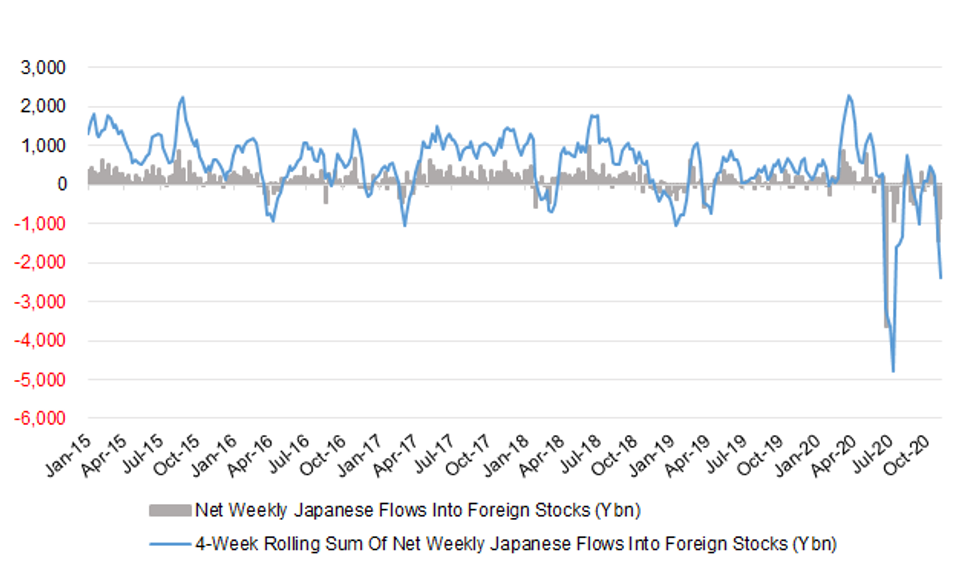

JAPAN: Weekly International Security Flow Data

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 372.4 | 1964.8 | 4719.4 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -835.8 | -1429.1 | -2384.4 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -116.1 | 461.6 | 1506.1 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 457.7 | -1193.3 | 171.7 |

Source: MNI - Market News/Japanese Ministry Of Finance

- The latest round of weekly international security flow data saw a change of direction for net weekly foreign flows surrounding Japanese bonds and equities. The trajectory of the 4-week rolling sums of Japanese investor flows surrounding foreign bonds and equities extended further, although the net weekly flows moderated (a reminder that the previous week saw the second largest ever round of net weekly sales of foreign equities on behalf of Japanese investors).

Source: MNI - Market News/Japanese Ministry Of Finance

Source: MNI - Market News/Japanese Ministry Of Finance

EQUITIES: Mixed In Asia

Wednesday represented another pretty non-committal session for Asia-Pac equity markets, with macro headline flow headlined by a stronger than expected Caixin Services PMI reading out of China, in addition to a BBG report which suggested that Australian thermal coal products were being let ashore in mainland China.

- Participants are perhaps keeping one eye on the recent uptick in longer dated U.S. Tsy yields and the evolving fiscal dynamic in DC, after the latter allowed the major U.S. indices to close in the green on Wednesday.

- The Australian materials sector was the outperformer on the ASX 200, aided by the latest leg higher in iron ore and the aforementioned story re: thermal coal cargo being let ashore in China.

- Nikkei 225 -0.1%, Hang Seng +0.6%, CSI 300 -0.1%, ASX 200 +0.4%.

- S&P 500 futures unch., DJIA futures -2, NASDAQ 100 futures +27.

GOLD: Bounce Continues

Bullion has continued its bounce from technical support, with spot supported by a downtick in U.S. real yields and the USD over the last 24 hours. These factors outweighed the continued drop in ETF holdings of gold. Spot last deals a handful of dollars higher at $1,835/oz, with bulls now targeting the Sep 28 low at $1,849.2/oz.

OIL: OPEC+ Crunch Time

The major crude benchmarks have recovered from worst levels of the session to trade at unchanged levels.

- The latest BBG source report (released Wednesday) has built upon the general idea that OPEC+ will come to some form of production deal by the time the latest round discussions wrap up later today. The piece noted that "OPEC+ is making headway in its negotiations on oil-output cuts, raising the odds that Thursday's meeting can salvage a deal after failed talks earlier in the week. After days of direct negotiations between the group's heavyweights -- Russia, Saudi Arabia and the United Arab Emirates -- discussions are now focusing on proposals for gradual easing of output cuts over several months, said a delegate. It's unclear whether the tapering would start in January, or would be delayed to later in the first quarter."

- This general sense of optimism, alongside a slight drawdown in headline crude stocks in the latest weekly DoE inventory report (which contrasted with the surprise, sizeable build in the API equivalent) allowed the benchmarks to add ~$0.80 apiece come settlement time on Wednesday.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.