-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI EUROPEAN OPEN: Silent Night

EXECUTIVE SUMMARY

- OMICRON HOSPITAL RISK AS MUCH AS 70% LOWER (BBG)

- UK NEW YEAR'S EVE LIKELY TO ESCAPE NEW COVID CURBS (TELEGRAPH)

- CHINA RAISES ‘FIRM’ OBJECTIONS AFTER BIDEN SIGNS LAW ON UYGHUR (BBG)

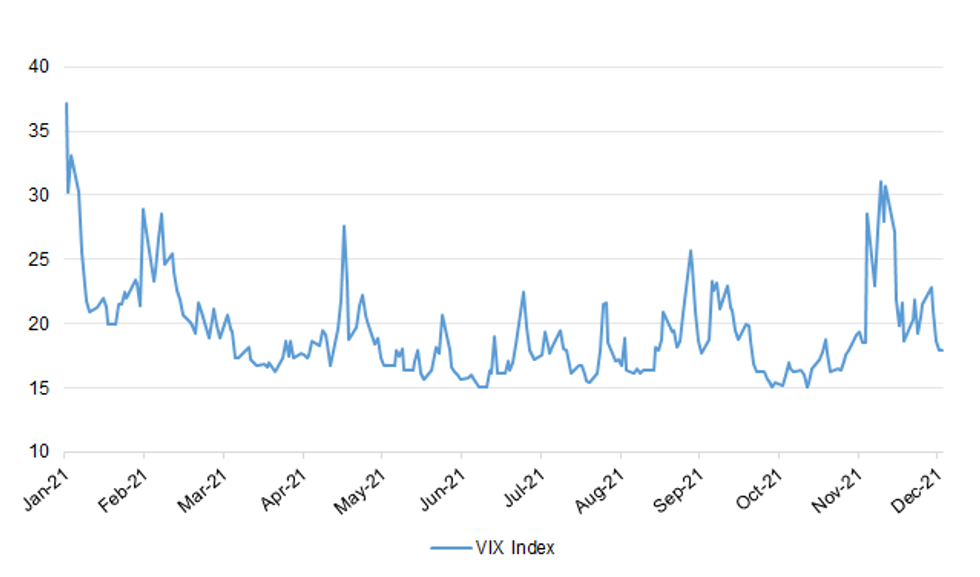

Fig. 1: VIX Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: New Year's Eve restrictions are increasingly unlikely, Government sources have said - after an official report confirmed omicron is likely to be a far milder variant of Covid. A new analysis by the UK Health Security Agency (UKHSA) found that the risk of admission to accident and emergency was 31 to 45 per cent lower when a person develops omicron rather than delta, while the risk of hospitalisation was 50 to 70 per cent lower. The Prime Minister will use his Christmas message on Friday to urge Britons to get the Covid jab, declaring it a “wonderful” festive gift that people can give to their family and the nation. (Telegraph)

BREXIT: British companies found it increasingly difficult over the course of this year to trade with the European Union under the terms of the Brexit trade deal struck with the bloc, a survey showed on Thursday. (RTRS)

FISCAL: Kwasi Kwarteng is racing to draw up a rescue package to protect millions of households from surging energy prices as demands grow for a VAT cut to household bills. (Telegraph)

ECONOMY: The UK public’s appetite for eating out has plunged to its weakest since the spring amid growing evidence of the impact of the Omicron variant on the hospitality sector during its crucial pre-Christmas period. The number of seated diners fell by 14 percentage points in the week ending 20 December to 88% of the level in the same period of 2019, before the start of the pandemic, according to the weekly digest of flash economic indicators from the Office for National Statistics (ONS). Using data from the online restaurant booking site OpenTable and other sources, the ONS said Britons were eating out less and working from home more in response to rising infection rates and the government’s plan B measures. (Guardian)

EUROPE

GERMANY: Germany’s head of state had little good cheer in his annual Christmas address to the nation, warning that the coronavirus will remain a challenge for Europe’s largest economy. “The pandemic won’t suddenly be gone one day,” President Frank-Walter Steinmeier said in the text of a speech to be delivered on Saturday. “It will occupy us for a long time to come.” The country’s largely ceremonial head of state -- who’s likely to secure a new five- year mandate in February -- reinforced a public call to get inoculated against Covid-19. (BBG)

FRANCE: France identified around 88,000 coronavirus cases in the last 24 hours, “the worst figures registered since the start of the pandemic,” BFM TV cited Health Minister Olivier Veran as saying. Daily cases are likely to hit 100,000 closer to Dec. 25, Veran said during a visit to a vaccination center in Paris, according to BFM. France had expected cases to reach that level by the end of the month. (BBG)

ITALY: Italy recorded the highest number of coronavirus cases since the beginning of the pandemic. The first country in Europe to move into lockdown last year reported 44,595 cases on Thursday, up from 36,293 a day earlier. Patients in intensive care units rose by 13 to 1,023, still well below the peak of more than 4,000 last year. (BBG)

U.S.

CORONAVIRUS: Just like Covid-19 testing sites and vaccines, Covid-19 treatment pills in the U.S. will be in short supply for months until production can increase. The federal distribution to states will be based on population, and it will likely be up to doctors to prescribe Pfizer Inc.’s Paxlovid. The National Institutes of Health said it will release recommendations on how to allocate treatments. (BBG)

OTHER

GLOBAL TRADE: Canada plans to formally join Mexico in calling for an arbitration panel to resolve a dispute with the U.S. over how to interpret rules governing the origin of vehicle parts. The two countries expect to request in the first days of January the creation of a tribunal of experts to rule on the matter as allowed under the U.S.-Mexico-Canada Agreement, known as USMCA, according to three people familiar with the plans. The individuals spoke on condition they not be identified because they aren’t authorized to speak publicly on the issue. Canada Trade Minister Mary Ng’s office didn’t immediately respond to requests for comment. The conflict focuses on differences over how to calculate the percentage of a vehicle that comes collectively from the three countries. (BBG)

U.S./CHINA: The U.S. law on Xinjiang is a serious violation of international law and basic norms of international relations, as well as “gross interference” in China’s internal affairs, Chinese foreign ministry says in a statement. The so-called forced labor in Xinjiang is totally “vicious lies” made up by anti-China forces, Mofa says, adding that the U.S. is attempting to undermine Xinjiang’s prosperity and stability and contain China’s development. China will respond further depending on development of the situation. (BBG)

JAPAN: Japanese Prime Minister Fumio Kishida's cabinet approved on Friday a record $940 billion budget for the next fiscal year as COVID-19 responses added to the costs of supporting an ageing population and rising military outlays to cope with China. The 107.6 trillion yen ($941.55 billion) budget for fiscal year 2022/23, which starts in April, is Japan's biggest-ever initial spending plan, underlining its priority on reviving the pandemic-hit economy over restoring long-term fiscal health. The first annual budget under Kishida comes after parliament approved 36 trillion yen of extra stimulus spending for this fiscal year to aid the recovery from COVID-19. But there is still limited room for spending in growth areas like green and digital transformation. The budget includes 5 trillion yen set aside to cover emergency costs of COVID-19, a record defence outlay of 5.37 trillion yen, the largest-ever welfare cost of 36.3 trillion yen and 24.3 trillion yen for debt servicing. Japan's public debt is twice the size of its $5 trillion economy, the heaviest among industrialised countries. Kishida has pledged to improve Japan's public finances in the long run and the budget foresees new borrowing next fiscal year of 36.9 trillion yen, less than the 43.6 trillion yen initially planned for this year. Lower borrowing will be replaced with higher tax revenues, seen rising for the first time in two years to a record 65.2 trillion yen as COVID-19 curbs on economic activity are eased. The government estimates real economic growth of 3.2% in fiscal year 2022/23, up from a prior estimate of 2.2% which provides the basis for the budget plan. But with debt still accounting for 34.3% of the budget, it will remain difficult to achieve a primary budget surplus by fiscal year 2025/26 as the government aims to do. The primary budget deficit - excluding new bond sales and debt servicing - is seen at 13 trillion yen in FY2022/23, improving from 20 trillion yen seen this year but still far from the government's target. (RTRS)

CORONAVIRUS: Omicron appears to be less severe but more contagious than any other Covid-19 strain to date, the U.K. government said, as daily infections soared to another new record close to 120,000. An individual with omicron is 50% to 70% less likely to be admitted to hospital, compared with the delta strain, the U.K. Health Security Agency said Thursday. They are also between 31% and 45% less likely to attend emergency departments with omicron than with delta. However, data from the HSA also showed that while a booster improves protection, it starts to wane more rapidly than with delta, and is 15% to 25% lower from 10 weeks after the third dose. (BBG)

GEOPOLITICS: Japan will consider partnering with the U.S. and Europe to restrict exports of advanced surveillance technology that enables authoritarian states to violate human rights on a wide scale, Nikkei has learned. (Nikkei)

JAPAN: Japan is sticking for now with its goal to balance its budget by the end of March 2026 even after approving record spending for next year. “As we’ve written in this year’s government plans, we are still looking to reach a primary balance in the fiscal year 2025,” said Finance Minister Shunichi Suzuki, shortly after the cabinet approved a record initial budget of 107.6 trillion yen ($940 billion) for the year starting in April. “We’ll reconfirm this by the end of March, after we’ve taken a closer look at Covid-19’s impact on Japan’s fiscal health,” Suzuki said. (BBG)

AUSTRALIA: Australia would further shorten the wait time for people to receive their COVID-19 booster shots, Health Minister Greg Hunt said on Friday, as the country grapples with record infections fuelled by the Omicron variant. (RTRS)

JAPAN/CHINA: Japan is likely to shelve plans to send officials to the Winter Games in Beijing next year, and will make an announcement as early as Friday, public broadcaster NHK said. (RTRS)

BOK: The Bank of Korea will determine the appropriate timing of adjusting the degree of monetary policy accommodation after considering trends in growth and inflation, financial imbalance conditions and changes in monetary policies of major countries and their impact; will closely monitoring how internal and external risks develop, the central bank says in a 2022 policy outline. (BBG)

TURKEY: Turks transferred 10 billion lira ($889 million) worth of forex deposits into a new instrument the government introduced this week that covers any FX depreciation losses, Finance Minister Nureddin Nebati said on Thursday. Since the instrument was announced on Monday the lira has rallied sharply from an all-time low, raising questions over whether the central bank is backing state-bank interventions to sell dollars and accelerate the gains. "Now people are asking why we intervened through the central bank or Treasury," Nebati said on broadcaster NTV. "Is Turkey an unskillful country that watches the developments by itself and doesn't use all the instruments at its disposal in a positive way? It uses all the instruments," he added. (RTRS)

BRAZIL: Brazil President Jair Bolsonaro said he would like to increase all civil servant wages but that the spending cap means he cannot. Bolsonaro defended the wage increase for police officers during remarks made via his weekly webcast. (BBG)

BRAZIL: Customs agents in a union meeting approved a work stoppage in inspection areas, according to a note from the agents’ union. Customs agents also approved a slowdown strike for operations in customs areas, except for medicines and hospital supplies, live loads, perishables, those defined as priorities by current legislation, and traffic of travelers in international transit. It was the largest assembly since 2016, according to the union. (BBG)

RUSSIA: U.S. President Joe Biden has yet to agree to a time and place of fresh talks with Russian President Vladimir Putin, White House spokesperson Jen Psaki said on Thursday. Psaki also refuted criticism leveled by Putin on Thursday that the U.S. and its allies have been the aggressor in the Russia-Ukraine border escalation. “Well facts are a funny thing and facts make clear that the only aggression we’re seeing at the border of Russia and Ukraine is the military buildup by the Russians and the bellicose rhetoric by the leader of Russia," Psaki said. (RTRS)

RUSSIA: The United States is prepared to hold talks with Russia as early as January, a senior Biden administration official told reporters on Thursday, though no specific date or location as been set yet. Washington would respond fully to Moscow's security proposals at the talks next month, the official added. (RTRS)

RUSSIA: U.S. Secretary of State Antony Blinken spoke with NATO Secretary General Jens Stoltenberg on Thursday to discuss concerns about Russia’s military build-up on the borders of Ukraine, the U.S. State Department said. "They discussed NATO’s dual-track approach to Russia, noting the alliance remains ready for meaningful dialogue with Russia, while standing united to defend and protect allies," the State Department said on Thursday. (RTRS)

SOUTH AFRICA: South Africa will stop contract tracing and won’t quarantine people as it shifts focus on Covid-19 mitigation strategies. Authorities in Africa’s most-industrialized nation will conduct contract tracing only in case of a cluster outbreak, the nation’s Director General of Health said in a circular dated Thursday, which was confirmed by department spokesman, Foster Mohale. As many as 80% of the nation’s population as past infections providing some immunity, the department said. “Quarantine has been costly to essential services and society as many people stay away from their work and thus lose their income and children miss on their schooling,” according to the circular. “We never identify most high risk patients.” (BBG)

METALS: MMG Ltd's Las Bambas copper mine said on Thursday that a temporary truce to lift a month-long blockade affecting a key copper transport road in Peru does not guarantee conditions to restart operations in a sustainable way. Residents of the Chumbivilcas province had been blocking the road since Nov. 20, forcing Las Bambas, which produces some 2% of global copper output, to suspend production. (RTRS)

OIL: The U.S. Department of Energy said on Thursday it approved a second exchange of 250,000 barrels of crude oil for release to Marathon Petroleum Company from the Strategic Petroleum Reserve (SPR). The department has provided over 5 million barrels of SPR crude oil to boost the nation’s fuel supply, including the first exchange awarded to ExxonMobil earlier in the month, the Energy Department said in a statement. (RTRS)

CHINA

PBOC: The People’s Bank of China is adopting a more flexible policy approach to address the current economic downturn, judging by the recent cut to reserve requirement ratios and the refinancing rates for agricultural loans, the Economic Daily reported citing Tang Jianwei, chief researcher of the Bank of Communications. The central bank is also keeping its structural supports for SMEs, technological innovation and green development, the newspaper said citing Tang. The recent 5-bps cut to LPR will steadily reduce financing costs by lowering rates on current loans and repricing of existing loans, the newspaper said citing analysts. (MNI)

INFRASTRUCTURE: China needs increased infrastructure investment to boost demand and stabilize growth, but it should advance high-tech infrastructure without excess and wasteful projects, the 21st Century Business Herald said in an editorial. Developing a green economy is the key to achieving carbon peak and neutrality, which demands more investment in new energy and materials, energy conservation and environmental protection while investing in 5G, industrial use of the Internet and AI will also be accelerated to promote the digital economy, the newspaper said. China has ensured sufficient funding given issuances of local government special bonds may exceed CNY3.5 trillion in 2022, the newspaper said. (MNI)

FINANCE: China should vigorously develop the capital market and increase the proportion of direct financing, as well as promote the innovation of bank and digital finance, so to better support the steady growth of the economy next year, wrote Huang Yiping, former member of PBOC’s Monetary Policy Committee in an article published on Yicai.com. China should better support innovative SMEs to promote sustainable growth, while the credit risk assessment based on financial data and mortgage assets are unfavorable to SMEs, said Huang, urging for more support to SMEs while using digital technology and big data to assess credit risks. (MNI)

CREDIT: Sunac China Holdings plans to transfer funds to its offshore account for four private bond payments totaling $620 million due Dec. 29 and 30, according to REDD, citing three sources briefed by the company. (BBG)

CORONAVIRUS: Authorities in northwestern Chinese city of Xi’an punished 26 officials responsible for ineffective work in Covid-19 curbs, China’s top anti-graft agency said in a statement, after the city was locked down amid coronavirus flare-up. (BBG)

OVERNIGHT DATA

JAPAN NOV CPI +0.6% Y/Y; MEDIAN +0.5%; OCT +0.1%

JAPAN NOV CPI EX-FRESH FOOD +0.5% Y/Y; MEDIAN +0.4%; OCT +0.1%

JAPAN NOV CPI EX-FRESH FOOD & ENERGY -0.6% Y/Y; MEDIAN -0.6%; OCT -0.7%

MNI BRIEF: Japan Nov Core CPI Up At Fastest Pace Since Feb 2020

- Japan's November annual core consumer inflation rate rose 0.5% y/y, the fastest pace since February 2020 on energy and accommodation costs and the third straight y/y rise, data the Ministry of International Affairs and Communication released on Friday showed - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN NOV SERVICES PPI +1.1% Y/Y; MEDIAN +1.0%; OCT +1.0%

JAPAN NOV HOUSING STARTS +3.7% Y/Y; MEDIAN +7.5%; OCT +10.4%

CHINA MARKETS

PBOC INJECTS NET CNY10 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos and CNY10 billion via 14-day reverse repo with the rate unchanged at 2.2% and 2.35% respectively on Fri'da'y. This operation has injected net CNY10 billion after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to maintain the liquidity stable towards year-end, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9732% at 10:07 am local time from the close of 1.8924% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 49 on Thursday vs 46 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3692 FRI VS 6.3651 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3692 on Friday, compared with 6.3651 set on Thursday.

MARKETS

SNAPSHOT Silent Night

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 15.78 points at 28782.59

- ASX 200 up 32.728 points at 7420.295

- Shanghai Comp. down 24.638 points at 3619.159

- JGB 10-Yr future down 4 ticks at 151.83, yield down 0bp at 0.066%

- Aussie 10-Yr future up 1.5 tick at 98.37, down 1.3bp at 1.577%

- U.S. Tsy markets are closed

- WTI crude is closed, Gold up $0.82 at $1809.63

- USD/JPY up 2 pips at Y114.41

- OMICRON HOSPITAL RISK AS MUCH AS 70% LOWER (BBG)

- UK NEW YEAR'S EVE LIKELY TO ESCAPE NEW COVID CURBS (TELEGRAPH)

- CHINA RAISES ‘FIRM’ OBJECTIONS AFTER BIDEN SIGNS LAW ON UYGHUR (BBG)

BONDS: Tight Asia Trade, Tsys Closed

U.S. Tsy futures and cash Tsy markets are closed.

- The modest overnight U.S. Tsy-driven weakness was unwound during today’s holiday-shortened Sydney session. This left YM +0.5 and & XM +1.5 at settlement, with nothing in the way of notable headline flow observed when it comes to sniffing out a driver for the move, which took place on low pre-Christmas volume.

- JGB futures lacked a clear sense of direction and closed -4, while cash trade saw most of the major benchmarks trade within -/+0.5bp of Thursday’s closing levels. The MoF confirmed its issuance plans for the next FY, which fell in line with suggestions that were made in source reports earlier this week. Meanwhile, the latest round of BoJ Rinban operations provided no real impetus for the space. Also note that the BoJ conducted its latest round of JGB repo operations, perhaps looking to remove worry re: any potential gyrations in the space between Christmas & the turn of the calendar year.

EQUITIES: Mainland China Sees Modest Losses

The major regional equity indices were little changed in pre-Christmas Asia-Pac dealing, with e-minis closed for the holiday. There wasn’t much to go off in terms of headline flow, as you would expect. Chinese equities nudged lower (CSI 300 -0.4% at typing), with some pointing to liquidity worry, observed via an uptick in the 14-day repo rate, as a potential driver for the limited pressure.

FOREX: Commodity Dollar Bloc Modestly Lower In Asia

Headline flow has been muted, with liquidity thin ahead of the Christmas break. FX trade has taken a very modest defensive tilt, allowing the JPY & CHF to move to the top of the G10 FX table. Note that USD/JPY threatened a break above Y114.50 early in Tokyo trade, before fading. Conversely, the commodity dollar bloc struggled (the moves are limited in the grander scheme of things), with low liquidity exacerbating the move in CAD at points. A raft of early market closures and a U.S. holiday will further crimp liquidity ahead of Christmas, with nothing in the way of tier 1 risk events on the docket.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.