-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI EUROPEAN OPEN: Stabilisation

EXECUTIVE SUMMARY

- BIDEN, ZELENSKY DISAGREE OVER “RISK LEVELS” OF RUSSIAN ATTACK (CNN)

- NEW RUSSIAN GAS PROJECTS FACE SANCTIONS IF UKRAINE ATTACKED (FT)

- NATIONAL INSURANCE RISE MAY BE DELAYED BY PM JOHNSON TO SECURE SURVIVAL (Times)

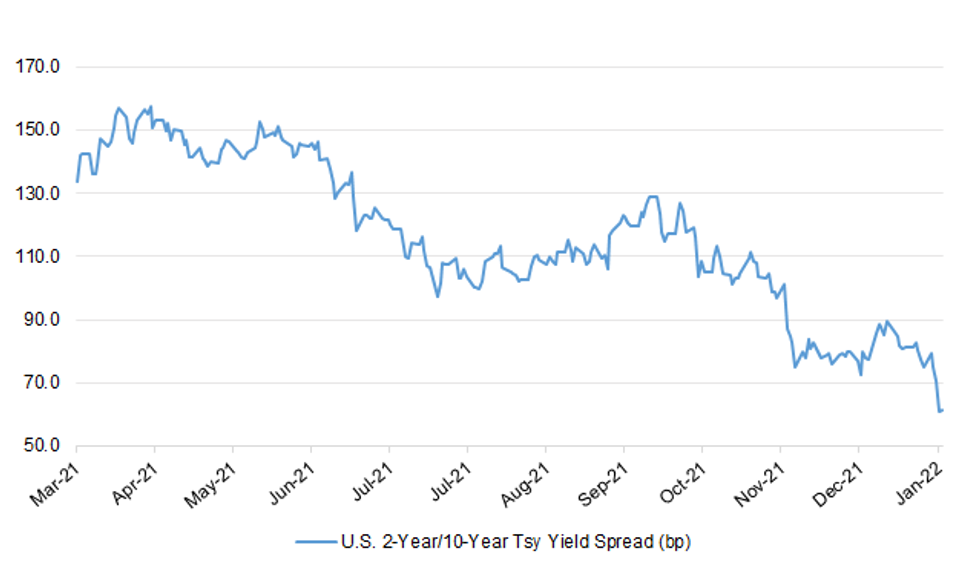

Fig. 1: U.S. 2-Year/10-Year Tsy Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS/ECONOMY: The Treasury is becoming increasingly alarmed that Boris Johnson may be preparing to scrap the national insurance rise in a desperate attempt to placate rightwing Tory MPs as he fights to save his job. The Guardian understands Rishi Sunak has privately stressed to MPs that the tax rise must go ahead as planned – with one frontbencher who has met him in recent days speculating the chancellor’s position could become untenable if Johnson seeks to overrule him. Treasury aides claim the embattled prime minister has not yet raised the prospect of cancelling or delaying the £12bn tax rise, with Johnson saying “there’s been no discussion at any level”. (Guardian)

POLITICS: Boris Johnson is “wobbling” over plans to increase national insurance after Tory MPs warned that the rise must be delayed as a condition of their support. (Times)

POLITICS: Boris Johnson has dismissed claims he approved the airlift of animals out of Afghanistan, saying they are "total rhubarb", as Sky News obtained more emails which call into question the government's account. Leaked messages appear to show that the prime minister's top parliamentary aide, Trudy Harrison, told Virgin Atlantic her efforts to secure a plane to evacuate animals from Kabul were backed by the government and that permissions would be "fast-tracked". (Sky)

POLITICS: British Prime Minister Boris Johnson has not been interviewed by the police about their investigation into alleged parties in his Downing Street residence during coronavirus lockdowns, his spokesman said on Thursday. Asked if Johnson had been interviewed, the spokesman said: "No." Johnson's office has not yet received civil servant Sue Gray's report into the possible lockdown breaches, he added. (RTRS)

ECONOMY: A work from home tax loophole is set to be closed after officials warned Rishi Sunak that it had cost the Treasury nearly £500 million during the pandemic. HM Revenue and Customs is urgently reviewing a rule that allows anyone who works even a single day from home to claim a yearly sum of up to £125 in tax relief, The Telegraph can disclose. (Telegraph)

BREXIT: The DUP has targeted 21 February as a fresh deadline for foreign secretary Liz Truss to deliver a solution to Northern Ireland Protocol problems, as the post-Brexit row rumbles on. First minister Paul Givan warned that unilateral action would be need if a deal on easing controls on goods moving between Northern Ireland and Great Britain cannot be reached with the EU within weeks. (Independent)

EUROPE

EU: Germany’s “immoral and hypocritical” relationship with Russia and China has driven a wedge between western and eastern Europe, Latvia’s defence minister has said in comments that highlight cracks in the west’s unity. Artis Pabriks told the Financial Times that western Europe’s “wishful thinking” about security was evident in its response to Russia amassing more than 100,000 troops on its border with Ukraine. In strongly worded remarks that lay bare the tensions within Nato over how to handle Russia, Pabriks said Berlin had an “immoral inability” to allow howitzer guns once stationed in Germany to be shipped from Estonia to Ukraine to help its defence against a possible invasion. (FT)

ITALY: Italy's parliament will make a fifth attempt to elect a new president on Friday, with party chiefs sounding more confident about finding a mutually acceptable candidate for the powerful role. Prime Minister Mario Draghi remains a contender, but his prospects have faded this week, with many lawmakers clearly reluctant to back him, partly because they fear any change to the government could trigger an early election. (RTRS)

POLAND: Poland’s thorny coalition politics are looming over its rule-of-law dispute with the EU, according to the bloc’s top justice official. European Justice Commissioner Didier Reynders laid out the dynamics in an interview with POLITICO this week. Brussels, he said, is applying “real pressure” on the country to get in line with EU standards on judicial independence and to comply with several recent EU court orders. But the commissioner suggested the fractious politics within Poland’s coalition government — currently made up of three conservative groupings — are contributing to the stalemate with Brussels. Reynders has both met Polish politicians during a visit to Warsaw in November and is also in touch with the country’s politicians who come to Brussels for EU meetings. (POLITICO)

FINLAND: Finland will begin gradually easing COVID-19 restrictions from Feb. 1 instead of mid-February as initially planned as the burden on its hospitals eases, the government said late on Thursday. (RTRS)

U.S.

POLITICS: President Joe Biden strongly affirmed Thursday that he will nominate the first Black woman to the U.S. Supreme Court, declaring such historic representation is “long overdue” and promising to announce his choice by the end of February. (AP)

POLITICS: Janelle Jones, the first Black woman to serve as chief economist at the U.S. Department of Labor, said she left her position Thursday after less than a year serving in the role. (BBG)

POLITICS: The U.S. Department of Health and Human Services (HHS) has "persistent deficiencies" in its ability to prepare for and respond to public health emergencies, the U.S. congressional watchdog warned in a report released on Thursday, citing concerns raised by the COVID-19 pandemic. HHS is at "high risk" of mismanaging a future crisis, the Government Accountability Office (GAO), the Congressional auditing agency, said, noting that the department failed to implement some previously made recommendations to improve its pandemic response. (RTRS)

POLITICS: U.S. border officials are preparing for as many as 9,000 border arrests per day by the spring, according to two Department of Homeland Security officials, which would be significantly larger than last year's peak and could cause a headache for the Democratic administration ahead of midterm elections. The number is a "worst-case scenario," said one of the officials, both of whom requested anonymity to discuss internal planning. (RTRS)

EQUITIES: Apple Inc. posted record quarterly sales that sailed past Wall Street estimates, a sign it was able to work through a supply-chain crunch fueled by the pandemic and chip shortages. Sales climbed 11% to $123.9 billion in the fiscal first quarter, which ended Dec. 25, the company said Thursday. Analysts had predicted $119.1 billion on average. Profit also beat projections. (BBG)

EQUITIES: Tesla is at risk of falling behind on one of the most critical products in the American auto industry: pickups. (Axios)

OIL: A federal judge invalidated the results of an oil and gas lease sale in the Gulf of Mexico on Thursday saying the Biden administration failed to properly account for the auction's climate change impact. The decision has cast uncertainty over the future of the U.S. federal offshore drilling program, which has been a big source of public revenue for decades but also drawn the ire of activists concerned about its impact on the environment and contribution to global warming. (RTRS)

OTHER

GEOPOLITICS: A call between US President Joe Biden and Ukrainian President Volodymyr Zelensky on Thursday "did not go well," a senior Ukrainian official told CNN, amid disagreements over the "risk levels" of a Russian attack. The White House, however, disputed the official's account, warning that anonymous sources were "leaking falsehoods." They did state that Biden warned Zelensky an imminent invasion is a "distinct possibility." On the call, which the Ukrainian official described as "long and frank," Biden warned his Ukrainian counterpart that a Russian attack may be imminent, saying that an invasion was now virtually certain, once the ground had frozen later in February, according to the official. Zelensky, however, restated his position that the threat from Russia remains "dangerous but ambiguous," and it is not certain that an attack will take place, the official said. (CNN)

GEOPOLITICS: Ukrainian President Volodymyr Zelensky tweeted the following on Thursday: “Had a long phone conversation with @POTUS . Discussed recent diplomatic efforts on de-escalation and agreed on joint actions for the future. Thanked President @JoeBiden for the ongoing military assistance. Possibilities for financial support to Ukraine were also discussed.” (MNI)

GEOPOLITICS: French President Emmanuel Macron holds a call with Russian President Vladimir Putin at 10:45 am Paris time to seek “clarifications” on Ukraine and try to de-escalate the crisis. (BBG)

GEOPOLITICS: Russia said on Thursday it was clear the United States was not willing to address its main security concerns in their standoff over Ukraine, but both sides kept the door open to further dialogue. The United States and NATO submitted written responses on Wednesday to Russia's demands for a redrawing of post-Cold War security arrangements in Europe since it massed troops near Ukraine, prompting Western fears of an invasion. Kremlin spokesman Dmitry Peskov said Moscow needed time for review and would not rush to conclusions, but that U.S. and NATO statements describing Russia's main demands as unacceptable did not leave much room for optimism. (RTRS)

GEOPOLITICS: The U.S. called for a meeting of the United Nations Security Council to discuss the standoff over Ukraine, seeking to apply international pressure on Russia to negotiate its concerns about European security among diplomats rather than on the battlefield. The meeting would be a rare opportunity for Washington and its allies to discuss the actions of another permanent Security Council member—Russia—on the world stage. Set for Monday, the meeting would occur just one day before Moscow takes over the rotating presidency of the council. (WSJ)

GEOPOLITICS: The UK and EU are preparing to hit new Russian gas projects with sanctions if the Kremlin orders an attack on Ukraine, the first time Europe has weighed targeting a sector it relies on for 40 per cent of its gas imports. The plans, being drawn up with US support, would severely curtail financing and technology transfer for new gas projects, according to people briefed on the discussions. (FT)

GEOPOLITICS: American officials fear that they will be unable to impose effective sanctions on President Putin if Russia invades Ukraine because of years of British tolerance of suspect money flooding into London. Diplomatic sources told The Times that US State Department officials had expressed “dismay and frustration” at the British government’s failure to take tough action against the flow of Russian funds, particularly in “Londongrad”. (Times)

GEOPOLITICS: The Minister for Foreign Affairs of Ukraine Dmytro Kuleba and the Head of EU Diplomacy Josep Borrel discussed by telephone the preparation of sanctions against Russia to deter its aggression. In addition, the head of European diplomacy informed the Minister about the results of the meeting of the EU Council on Foreign Affairs. Borrel also invited Kuleba to take part in the next meeting of the council. "Borrel confirmed that there are no intentions at this stage to evacuate family members and staff of the EU Delegation to Ukraine," the Foreign Ministry said in a statement. (Pravda)

GEOPOLITICS: A bipartisan group of U.S. senators have been meeting to hammer out legislation that would dramatically increase the amount of U.S. military aid for Ukraine, as it faces the threat of an invasion by Russia. The group of about five Democrats and five Republican Senators has made progress in talks on a bill, a source familiar with the negotiations told Reuters. Their goal is to write a bill that will pass the Senate next week. To become law, it would also have to pass the House of Representatives and be signed by President Joe Biden. (RTRS)

GLOBAL TRADE: The White House is considering extending Trump-era tariffs on solar power imports, but with a handful of tweaks to make it easier for domestic installers to access supplies, according to two sources familiar with the administration's thinking. The plan represents an attempt by U.S. President Joe Biden's administration to find common ground between two important political constituencies: union labor, which supports import restrictions to protect domestic jobs, and clean energy developers keen to access overseas supplies that are cheaper than U.S.-made goods. (RTRS)

GLOBAL TRADE: U.S. Trade Representative Katherine Tai told South Korea's trade minister on Thursday the United States was focused on "existing conversations" on steel and aluminum access and that domestic industry's concerns were influencing the Biden administration's approach, her office said. South Korea is seeking relief from U.S. tariffs of 25% on steel and 10% on aluminum after Washington reached a quota deal in October with the European Union. The Biden administration also has launched discussions with Britain and Japan over potential metals tariff relief. (RTRS)

U.S./CHINA: The Biden administration said it recommended changes to China’s requirements for Covid-19 quarantine and testing among American diplomats, adding to tensions between the world’s biggest economies ahead of the Olympics. “We have long-standing concerns regarding the PRC’s quarantine and testing policies that run counter to diplomatic privileges and immunities,” State Department spokesman Ned Price told reporters on Thursday, referring to China’s formal name. “We’ve recommended what we think are a series of reasonable options that would be consistent with Covid-19 mitigation measures and at the same time align with international diplomatic norms.” (BBG)

BOJ: Japan must cooperate with Europe and the United States in creating a global standard on the technical aspects of issuing a central bank digital currency (CBDC), the chief of Japan's central bank said on Friday. While the Bank of Japan (BOJ) had made no decision yet whether to issue its own digital currency, it was proceeding with experiments and a plan to deliberate on specific designs of one, Governor Haruhiko Kuroda told parliament. (RTRS)

BOJ: The Bank of Japan should keep its inflation-targeting stimulus rolling and consider shortening the maturity of its yield target to make its easing framework more sustainable, the International Monetary Fund said Friday, in comments that contrast with global moves to tighten policy. Given that Japan’s underlying inflation momentum remains weak at around 0.5% and is not currently projected to reach the BOJ’s 2% target, the central bank needs to keep its policy stance accommodative, said Ranil Salgado, Japan mission chief for IMF. (BBG)

JAPAN: Japan's health ministry is considering shortening the quarantine period for those who had close contact with people infected with the novel coronavirus to seven days from 10 days at present, it has been learned. (Jiji)

NORTH KOREA: North Korea on Friday confirmed this week's two rounds of weapons tests involving long-range cruise missiles and surface-to-surface tactical guided missiles, and vowed to "keep developing powerful warheads." On Thursday, South Korea's military said the North fired what appeared to be two short-range ballistic missiles toward the East Sea, marking its sixth such launch this month. The latest saber-rattling came just two days after Pyongyang launched two apparent cruise missiles from an inland area. "The Academy of Defense Science of the Democratic People's Republic of Korea conducted the test-fire for updating long-range cruise missile system and the test-fire for confirming the power of conventional warhead for surface-to-surface tactical guided missile on Tuesday and Thursday respectively," the Korean Central News Agency (KCNA) said, referring to the North by its official name. (Yonhap)

PHILIPPINES: The Philippines is temporarily suspending the COVID-19 risk classification for travelers beginning Feb. 1. There will instead be different requirements for arriving passengers based on their vaccination status, acting presidential spokesperson Karlo Nograles said on Friday. The removal of the red, yellow, green list classification means there will be no distinction regardless if a traveler arrived from a high-, moderate-, or low-risk country. (CNN Philippines)

BRAZIL: Brazilian President Jair Bolsonaro barred ministers from moving ahead with a bill currently under elaboration to lower fuel and electricity prices, Valor Economico reports, citing an unnamed person with knowledge of government affairs. The meeting held this Thursday would have been marked by a tense atmosphere, the newspaper adds, with Bolsonaro forbidding its ministers from speaking or defending the bill as it would not have the initially desired effect. The government now considers that the best alternative is to create a fund to stabilize prices and avoid passing on the rise of international oil prices to the domestic market. (BBG)

ARGENTINA: Argentina and the International Monetary Fund have reached an understanding on a fiscal path and the nation agreed to make a payment of more than $700 million due on Friday, according to people familiar with the talks. The agreement comes after almost a week of negotiations and it’s a first step before reaching a full deal to refinance more than $40 billion of an outstanding loan, the people said, asking not to be named without permission to speak publicly. The two parties have agreed for the country to reach a balanced primary budget in 2025, one of the people said. The nation’s economy ministry and IMF staff are expected to continue discussing details of the program, the people said. (BBG)

ARGENTINA: Argentina is facing a billion-dollar trip wire of debt repayments to the International Monetary Fund (IMF) coming due with uncertainty over whether the South American country will pay amid tense talks to revamp around $40 billion in loans. The grains-producing country, which has been battling currency and debt crises for years, is due to pay back $730 million to the IMF on Friday and another $365 million on Tuesday next week, though officials have not confirmed plans to pay. (RTRS)

IRAN: A British man pleaded guilty in Washington to charges related to illegal exports of sensitive military technologies to Iran in violation of U.S. sanctions, the Justice Department announced. Saber Fakih, 46, conspired with others in 2017 and 2018 to ship to Iran a high-powered, microwave-based directed-energy weapon system and technology that can be used to take control of an aerial drone, the department said in a statement Thursday. At the same time, a federal indictment was unsealed charging four others in the alleged conspiracy, the government said. (BBG)

GOLD: The boom in China’s gold demand may take a knock at the start of this year on the back of virus lockdowns and slower economic growth, according to the World Gold Council. While demand rebounded more than 50% last year on a stronger economy and easing Covid-19 measures, consumption early this year could be challenged by an increase in virus-related restrictions and weaker growth, the WGC said in a quarterly report. A trend of fewer weddings may also threaten jewelry purchases, a key source of demand in the world’s top gold buyer, it said. (BBG)

CHINA

PBOC: The People’s Bank of China aims to keep the yuan basically stable at a balanced level, and while the currency may deviate in the short term, market forces and policy factors will correct the deviation in the medium and long term, wrote Deputy Governor Sun Guofeng in the PBOC-run China Finance magazine. The central bank will use various monetary policy tools to smoothen short-term fluctuations in liquidity timely and appropriately, and guide financial institutions to vigorously boost credit supply, Sun said. It will increase targeted efforts, such as further increasing the relending quota to boost credit support for agriculture, rural areas and small and micro enterprises, wrote Sun. (MNI)

ECONOMY: China may expand budget deficit in 2022 to boost spending, while keeping deficit-to-GDP ratio similar to or lower than last year's target, set at 3.2% in March 2021, the China Securities Journal reported citing analysts. This year's deficit may reach CNY3.93 trillion, CNY360 billion more than in 2021, the newspaper said citing Zhong Zhengsheng, the chief economist at Ping An Securities. China may allow CNY3.65 trillion local government special bonds to be issued, matching last year's level, and will mainly spend them on new-energy and technology infrastructure, while giving more tax and fee cuts to manufacturing and small businesses, the newspaper said. (MNI)

ECONOMY: Hundreds of millions of Chinese people are expected to make the trip back to their hometowns over the Lunar New Year break, though holiday travel is nowhere near pre-pandemic levels as Covid-19 spreads. Many are making the journey home for the first time in years, after stringent testing and isolation rules for travelers last year prevented some people from taking the traditional extended year-end break. There had been about 290 million trips already in the first 11 days of the holiday travel period, according to Bloomberg calculations based on official statements and data, up 45% on the same period in 2021. For the full holiday period through Feb. 25, the Ministry of Transport expects people to make 1.18 billion trips. That’s well below the almost 3 billion trips made in 2019, the last year before the pandemic broke out in China, and shows the recovery in travel and spending has a long way to go. (BBG)

ECONOMY: China will jail forty-seven steel company officials for faking air pollution data, in a sign that Beijing’s crackdown on firms that are flouting environmental rules is intensifying. The officials who worked at four mills in Tangshan city near Beijing, China’s top steelmaking hub, were give prison sentences from six to eighteen months, the municipal government said in a statement on its WeChat channel that cited court documents. (BBG)

POLITICS: China has agreed to host a visit to Xinjiang by UN rights chief Michelle Bachelet “in the first half of the year after the Beijing Winter Olympics”, according to people familiar with the situation. The UN’s top human rights official has been negotiating with Beijing since September 2018 for a visit to Xinjiang, where some 1 million Uygurs are alleged to have been held in mass detention camps. Sources said Bachelet recently secured Beijing’s approval for a visit to the region sometime after the Games, which open on February 4, on the prerequisite that the trip should be “friendly” in nature and not framed as an investigation. Beijing also insisted that Bachelet’s office hold off on publishing a report into Xinjiang ahead of the Games, as requested by Washington, the sources said. (SCMP)

SPACE: China said it will strengthen its governance in space over the next five years to better protect its assets and interests, including the study of plans to build a near-earth object defence system and cooperation with other nations. China will also strengthen space traffic control, improve its space debris monitoring system, and build an integrated space-ground space climate monitoring system, according to a white paper published by the Chinese government on Friday. (RTRS)

EQUITIES: Chinese bourses have halted processing at least 60 initial public offering (IPO) applications as regulators investigate intermediaries in the deals, including Deutsche Bank AG's Chinese securities venture. Exchange disclosures on Wednesday showed 12 IPO plans in Shanghai's tech-heavy STAR Market and 48 in Shenzhen's start-up market ChiNext were suspended. (RTRS)

YUAN: The Chinese yuan is unlikely to depreciate sharply, as it is supported by China’s positive economic prospects, increased foreign holdings of yuan assets and controllable capital outflow risks, the China Securities Journal reported citing analysts. On Thursday, the onshore yuan fell the most in 10 months when it lost 426 basis points from the previous close to 6.3645 against the U.S. dollar, on a day when the dollar index rose to an 18-month high of over 97, the newspaper said. A moderate depreciation of the yuan enhances the currency’s flexibility and helps stabilize the economy by giving more space for monetary policy, the newspaper said citing Wen Bin, the chief researcher at Minsheng Bank. (MNI)

OVERNIGHT DATA

JAPAN JAN TOKYO CPI +0.5% Y/Y; MEDIAN +0.5%; DEC +0.8%

JAPAN JAN TOKYO CORE CPI +0.2% Y/Y; MEDIAN +0.3%; DEC +0.5%

JAPAN JAN TOKYO CORE-CORE CPI -0.7% Y/Y; MEDIAN -0.7%; DEC -0.3%

AUSTRALIA Q4 PPI +3.7% Y/Y; Q3 +2.9%

AUSTRALIA Q4 PPI +1.3% Q/Q; Q3 +1.1%

NEW ZEALAND JAN ANZ CONSUMER CONFIDENCE 97.7; DEC 98.3

NEW ZEALAND JAN ANZ CONSUMER CONFIDENCE -0.6% M/M; DEC +1.8%

The ANZ-Roy Morgan Consumer Confidence Index was unchanged at 98 in January, well under its long-term average of just shy of 120. The vast majority of the survey was conducted before confirmation of Omicron in the community. Households’ budgets are under cost of living pressure, with CPI inflation running around 6% particularly punitive for those who operate with very small buffers between incomes and outgoings, and who spend a large proportion of their income on necessities. Employment prospects are excellent, but most workers will be experiencing real wage falls, given the lag with which wage data responds. The housing market is cooling rapidly; credit is abruptly harder to get. Not the best time to splurge, appears to be the consensus. (ANZ)

SOUTH KOREA DEC INDUSTRIAL PRODUCTION +6.2% Y/Y; MEDIAN +1.8%; NOV +6.3%

SOUTH KOREA DEC INDUSTRIAL PRODUCTION +4.3% M/M; MEDIAN -0.3%; NOV +5.3%

SOUTH KOREA DEC CYCLICAL LEADING INDEX CHANGE -0.2; NOV -0.3

CHINA MARKETS

PBOC INJECTS NET CNY100BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY200 billion via 14-day reverse repos with the rate unchanged at 2.25% on Friday. The operation has led to a net injection of CNY100 billion after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity stable before the Spring Festival, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2376% at 09:58 am local time from the close of 2.0385% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 51 on Thursday vs 44 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3746 FRI VS 6.3382

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3746 on Friday, compared with 6.3382 set on Thursday, marking the biggest daily drop since Mar 9, 2021.

MARKETS

SNAPSHOT: Stabilisation

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 586.56 points at 26756.95

- ASX 200 up 149.82 points at 6988.1

- Shanghai Comp. up 14.489 points at 3408.736

- JGB 10-Yr future up 4 ticks at 150.79, yield up 0.6bp at 0.165%

- Aussie 10-Yr future up 8.5 ticks at 98.04, yield down 8.3bp at 1.940%

- U.S. 10-Yr future -0-02 at 127-19, yield up 1.79bp at 1.817%

- WTI crude up $0.63 at $87.24, Gold up $0.66 at $1798.1

- USD/JPY up 7 pips at Y115.44

- BIDEN, ZELENSKY DISAGREE OVER “RISK LEVELS” OF RUSSIAN ATTACK (CNN)

- NEW RUSSIAN GAS PROJECTS FACE SANCTIONS IF UKRAINE ATTACKED (FT)

- NATIONAL INSURANCE RISE MAY BE DELAYED BY PM JOHNSON TO SECURE SURVIVAL (Times)

BOND SUMMARY: U.S. Tsy Curve Slightly Bear Flattens As Dust Settles After Fed

The final Asia-Pac session of this lunar year allowed core FI markets to catch a breath after a volatile week dominated by the Fed's hawkish rhetoric and simmering Russia tension. A strong earnings report from Apple has helped soothe the nerves, lending support to U.S. equity index futures.

- T-Notes held a tight range, with a mild bearish bias. TYH2 last trades -0-03 at 127-18, near session lows. Eurodollar futures run 1.0-1.5 tick lower through the reds. Cash Tsys slipped across the curve, with yields last seen 0.8-1.8bp higher at typing. The curve flattened at the margin, with 10-Year Tsys leading losses. Core PCE Price Index & U. of Mich Sentiment headline the U.S. data docket on Friday.

- JGB futures faltered after the re-open to stabilise later on. JBH2 last operates at 150.78, 3 ticks above previous settlement. JGBs are broadly softer, with a degree of steepening evident in cash trade, as the super-long end underperforms. A deceleration in Tokyo CPI inflation underscored the need for the BoJ to stand by their ultra-loose policy stance.

- ACGB curve flattened in cash Sydney trade, with yields last seen 4.3-7.0bp lower. YM remains elevated and last sits +4.0, with XM +6.5 after trading sideways. Bills trade 3-4 ticks higher through the reds. The front end caught a light bid in the afternoon, even as domestic headline flow remained light. It is worth noting that around that time, the WSJ published an opinion piece noting that the RBA could "categorically rule out the idea" that raising interest rates in lockstep with the Fed "is an option." The auction for A$1.0bn worth of ACGB May '32 came and went.

JGBS AUCTION: Japanese MOF sells Y4.0668tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0668tn 3-Month Bills:

- Average Yield -0.0923% (prev. -0.0918%)

- Average Price 100.0248 (prev. 100.0229)

- High Yield: -0.0893% (prev. -0.0882%)

- Low Price 100.0240 (prev. 100.0220)

- % Allotted At High Yield: 16.1165% (prev. 63.4443%)

- Bid/Cover: 3.755x (prev. 3.364x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.25% 21 May 2032, issue #TB158:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.25% 21 May 2032, issue #TB158:

- Average Yield: 1.9536% (prev. 1.9068%)

- High Yield: 1.9575% (prev. 1.9100%)

- Bid/Cover: 2.1450x (prev. 2.5033x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 4.1% (prev. 7.5%)

- Bidders 37 (prev. 45), successful 23 (prev. 30), allocated in full 18 (prev. 21)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 2 February it plans to sell A$1.0bn of the 1.00% 21 November 2031 Bond.

- On Thursday 3 February it plans to sell A$1.0bn of the 13 May 2022 Note & A$1.0bn of the 10 June 2022 Note.

- On Friday 4 February it plans to sell A$1.0bn of the 0.25% 21 November 2025 Bond.

FOREX: Market Sentiment Stabilises

The dust settled after post-FOMC market swings, allowing risk sentiment to stabilise. A strong earnings report from Apple drove a tech-led uptick in U.S. e-mini futures, helping reduce demand for safe haven assets. Major currency pairs were happy to hold tight ranges in the final Asia-Pac session before Lunar New Year holidays.

- The yen traded on a softer footing, with USD/JPY consolidating above breached resistance from Jan 18 high of Y115.06.

- The NZD failed to jump on the risk-on bandwagon and underperformed all of its G10 peers, although domestic headline flow was fairly thin.

- U.S. Core PCE Price Index & final U. of Mich. Sentiment, EZ sentiment gauges as well as flash German & French GDPs take focus from here, in the absence of any notable central bank speak.

FOREX OPTIONS: Expiries for Jan28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1100(E734mln), $1.1130-50(E1.3bln), $1.1200-15(E1.4bln), $1.1300-20(E1.5bln)

- USD/JPY: Y114.00($672mln), Y114.50($645mln), Y115.00($1.3bln), Y115.50($1.5bln), Y115.90-00($1.7bln)

- EUR/JPY: Y126.25(E1.2bln), Y130.00(E1.2bln)

- USD/CAD: C$1.2695-00($709mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/01/2022 | 0630/0730 | ** |  | FR | Consumer Spending |

| 28/01/2022 | 0630/0730 | *** |  | FR | GDP (p) |

| 28/01/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 28/01/2022 | 0700/0800 | ** |  | SE | Retail Sales |

| 28/01/2022 | 0700/0800 | *** |  | SE | GDP |

| 28/01/2022 | 0700/0800 | * |  | NO | Norway Unemployment Rate |

| 28/01/2022 | 0700/0800 | ** |  | DE | Import/Export Prices |

| 28/01/2022 | 0745/0845 | ** |  | FR | PPI |

| 28/01/2022 | 0800/0900 | *** |  | ES | GDP (p) |

| 28/01/2022 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/01/2022 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/01/2022 | 0900/1000 | *** |  | DE | GDP (p) |

| 28/01/2022 | 1000/1100 | ** |  | EU | Economic Sentiment Indicator |

| 28/01/2022 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/01/2022 | 1000/1100 | * |  | EU | Business Climate Indicator |

| 28/01/2022 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 28/01/2022 | 1330/0830 | ** |  | US | Employment Cost Index |

| 28/01/2022 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 28/01/2022 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.