-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

US Treasury Auction Calendar Through April 2025

MNI EUROPEAN OPEN: Stronger CNY Fixing Weighs On USD Sentiment

EXECUTIVE SUMMARY

- FED’S BOSTIC NOW ANTICIPATES JUST ONE RATE CUT THIS YEAR - BBG

- NAGEL REITERATES RATE-CUT DECISION HINGES ON DATA - FUNKE

- JAPAN’S CURRENCY CHIEF DELIVERS MOST ROBUST FX WARNING IN MONTHS - BBG

- YUAN REBOUNDS AS PBOC SENDS STRONG MESSAGE OF SUPPORT VIA FIXING - BBG

- AUSTRALIA TO RECOMMEND MINIMUM WAGE RISE IN LINE WITH INFLATION - RTRS

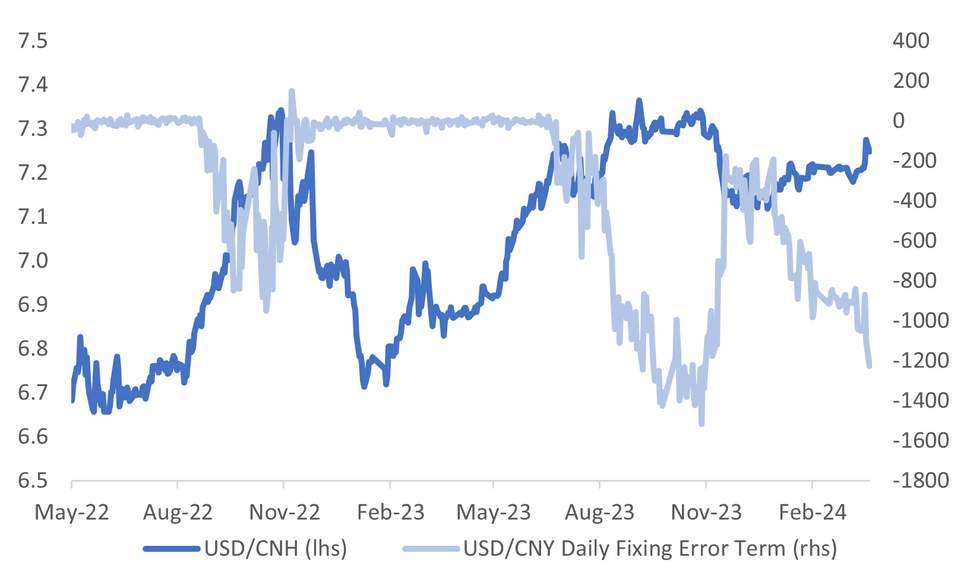

Fig. 1: USD/CNH Versus USD/CNY Fixing Error (Difference Between USD/CNY Fix and Bloomberg Consensus Estimate)

Source: MNI - Market News/Bloomberg

U.K.

GEOPOLITICS (POLITICO): A group of British politicians has been targeted by Chinese cyberattacks, U.K. Deputy Prime Minister Oliver Dowden will tell parliament on Monday, according to the Sunday Times.

LABOR (BBC): The number of people leaving the workforce in the UK due to long term sickness is at its highest since the 1990s, a report suggests. Adults economically inactive due to ill-health rose from 2.1m in July 2019 to a peak of 2.8m in October 2023, said the Resolution Foundation. It is the "longest sustained rise" since 1994-1998, when records began.

EUROPE

ECB (FUNKE): “The probability that we will lower interest rates before the summer break has recently increased,” European Central Bank Governing Council member Joachim Nagel reiterates in interview with Funke Mediengruppe, according to a pre-release.

ECB (BBG): The European Central Bank must — and will — act as inflation retreats toward its 2% target, according to Governing Council member Mario Centeno.Officials have managed to bring price growth down from historic highs without crashing the euro-zone economy, the Portuguese central bank chief said Friday, attributing the resilience to the strength of the labor market.

RUSSIA (RTRS): Russia struck critical infrastructure in Ukraine's western region of Lviv with missiles early on Sunday, Kyiv said, in a major airstrike that saw one Russian cruise missile briefly fly into Polish airspace according to Warsaw.

ITALY (MNI): The impact on Italy’s budget deficit from the Superbonus tax credits for home renovations should be “much more limited” in 2024 than in 2023, when the programme was largely responsible for the country missing its fiscal targets by almost 2% of GDP, sources close to the matter told MNI.

IRELAND (BBC): Simon Harris has been confirmed as the new leader of Irish political party Fine Gael, paving the way for the 37-year-old to become Ireland's youngest taoiseach (prime minister). He is replacing Leo Varadkar, who announced on Wednesday he was stepping down as party leader and taoiseach

SLOVAKIA (POLITICO): Career diplomat and pro-West candidate Ivan Korčok won the first round of Slovakia’s presidential election Saturday on 42 percent support with over 99 percent of districts reporting. His opponent, ruling coalition member Peter Pellegrini, was in second on 37 percent. With no candidate having won a majority, a runoff ballot is set for April 6.

U.S.

FED (BBG): Federal Reserve Bank of Atlanta President Raphael Bostic says he now projects just one interest-rate cut this year, adding that reduction will likely happen later in the year than he previously expected.

CAPITAL (MNI BRIEF): Federal Reserve Vice Chair for Supervision Michael Barr said Friday he expects broad and material changes to the Basel III endgame proposal and will be aiming for a broad consensus among officials on any capital plan going forward. He said he doesn't see liquidity pressures in the banking sector currently.

US/CHINA (POLITICO): Treasury Secretary Janet Yellen will visit China in April to meet with the country’s senior leaders, Politico reported, citing US government officials with knowledge of the trip.

FISCAL (BBG): President Joe Biden signed a $1.2 trillion funding package that keeps the US government running through Sept. 30, averting a partial shutdown.

OTHER

JAPAN (BBG): Japan’s top currency official delivered his most robust salvo of warnings in months against speculative moves in the foreign exchange market as the yen continues to hover near a 2022 intervention level.

JAPAN (MNI BRIEF): A few Bank of Japan board members believed the sustainable and stable achievement of the bank's 2% price target was in sight at the January 22-23 meeting, the minutes released on Monday showed.

AUSTRALIA (RTRS): Australia's government will support a minimum wage increase in line with inflation this year as low-income families continue to grapple with costs of living, although the rise would be smaller as inflation eased. In a submission to the Fair Work Commission's 2023-24 Annual Wage Review to be unveiled on Thursday, the Labor government will recommend the increase to ensure "the real wages of the low-paid workers do not go backwards", a position the government has held in the last two years.

CHINA

YUAN (BBG): China’s yuan pared losses seen Friday after the central bank signaled its support for the managed currency via a stronger-than-expected daily reference rate.

ECONOMY (BBG): Chinese Premier Li Qiang downplayed investor concerns of challenges facing the economy, saying Beijing is stepping up policy support to spur growth and systemic risks are being addressed.

ECONOMY (RTRS): China needs to "reinvent itself" with economic policies to speed resolution of its property market crisis and boost domestic consumption and productivity, the International Monetary Fund's Managing Director Kristalina Georgieva said on Sunday.

ECONOMY (YICAI): China’s economic indicators for January and February showed improvement and the government remains confident in meeting its annual development goals, according to Lan Fo’an, finance minister. Speaking at the China Development Forum, Lan said authorities will strengthen fiscal intensity this year with a general public budget expenditure of CNY28.5 trillion, up 4% y/y.

INDUSTRY (YICAI): China will accelerate building its innovation capabilities, implement a number of major scientific and technological projects, promote high-end, intelligent and green development of manufacturing, and cultivate emerging industries, said Zheng Shanjie, head of the National Development and Reform Commission Sunday at the China Development Forum

FISCAL (ECONOMIC DAILY): China’s overall fiscal operations are still at a tight balance given that some local governments continue to face notable funding shortages, the Economic Daily wrote in front-page commentary published on Monday.

MARKETS (SECURITIES JOURNAL): Chinese authorities are set to strengthen measures in support of mergers and acquisitions, and allow higher valuations for restructuring, according to a report by the China Securities Journal on Monday.

TECH (FT): China has adopted new guidance to limit the use of US-made microprocessors and servers in government computers, the Financial Times reported.

CHINA MARKETS

MNI: PBOC Injects Net CNY40 Bln Via OMO Mon; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY50 billion via 7-day reverse repo on Monday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY40 billion after offsetting CNY10 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8913% at 09:30 am local time from the close of 1.8639% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 46 on Friday, compared with the close of 50 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0996 on Monday, compared with 7.1004 set on Friday. The fixing was estimated at 7.2222 by Bloomberg survey today.

MARKET DATA

JAPAN JAN F LEADING INDEX CI 109.5; PRIOR 109.9

JAPAN JAN F COINDICDENT INDEX 112.1; PRIOR 110.2

MARKETS

US TSYS: Treasury Futures Off Earlier Highs Ahead Of Fed Speaker Later

- Jun'24 10Y started the week on a positive note reaching an earlier high of 110-30, before erasing most of the mornings gains to trade down at 110-25+ and now back below initial resistance of 110-26+.

- Looking at technical levels: Initial support lays at 109-24+ (Mar 18 low/ the bear trigger), further down 109-14+ (Nov 28 low). Futures now trade back below initial resistance of 110-26+ (Mar 21 high), if we can manage to get back above initial resistance the target becomes 111-00+ (50-day EMA), while a break above here would open a retest of 111-24 (Mar 12 high).

- Cash yields are flat to 1.5bps higher today with the curve slightly flatter today, the 2yr +0.8bps at 4.598%, 10yr -1bp at 4.208% while the 2y10yr is +0.129 at -39.190

- Atlanta Fed President Raphael Bostic now anticipates only one interest-rate cut this year, likely occurring later than previously expected, citing less confidence in inflation trajectory. Despite Fed officials' outlook for three rate cuts, Bostic notes the economy's resilience, advocating for patience and a slower pace in shrinking the central bank's balance sheet.

- Monday Data Calendar: Fed Speak, New Home Sales, Dallas Fed Mfg

JGBS: Firmer Bias, But Limited US Tsy Upside Curbs Gains

JGB futures have mostly traded with a positive bias in the first part of Monday trade. We were last at 145.60, +.19. Session highs came in at 145.70, while lows were at 145.42.

- The general tone in global yields through the latter stages of last week was to soften after some dovish shifts from EU central banks. This has spilled over to JGBs to some degree.

- US Tsy futures are off earlier highs (TYM 4 last at 110.25), which has likely kept JGB futures from extending higher. We do have more US Fed speak later on Monday.

- The BoJ mins for the Jan meeting came and went without much market reaction. They have obviously been superseded by last week's shift away from NIPR. The mins stated if there was a delay in exiting NIPR it could mean more aggressive rate hikes later, while financial conditions were expected to remain accommodative even when such a move was made.

- We also had a step up in FX rhetoric from FX chief Kanda earlier, but yen couldn't break higher.

- In the cash JGB yield space, most yield weakness is evident in the belly of the curve, with 7 and 10yr yields off around 1bps respectively. The 2 yr yield is holding above 0.20% at this stage. In the swaps space, the 10yr is down slightly, last near 0.86%.

- Looking ahead, tomorrow has the PPI and machine tool orders. On Wed we have BoJ board speak (Tamura), along with a 40yr debt sale.

AUSSIE BONDS: Yields Lower, CPI Wednesday, Min Wage To Rise

ACGBs (YM +4 & XM +3.5) are richer today tracking moves higher made by US treasuries. There is little in the way of eco data today, with the major focus on Wednesday's CPI data. President Of the Federal Reverse Bank of Atlanta now see's just one cut for the year down from two and the cut happening much later in the year than previously expected.

- (Bloomberg) -- Australian economy has 'rare trifecta': treasurer (see link)

- (Reuters) -- Australia to recommend minimum wage rise in line with inflation (See Link)

- Cash ACGBs are 2-4bps cheaper, the curve is flatter with the 2yr -3.5bp at 3.776%, the 10y now back below 4.0% down 3.7bps at 3.994%, while the 2y10y is -0.110 to 20.220

- The AU-US 10-year yield differential is back unchanged from Friday opening levels after pushing higher during the US session on Friday to -16bps and now trades back to at -21bps, while AU swap rates are 1-2bps lower.

- RBA-dated OIS pricing is 1-5bps softer for meetings beyond June. A cumulative 48bps of easing is priced by year-end.

- Looking ahead: The calendar is empty on Monday, while Tuesday we have Westpac Consumer Confidence

NZGBS: Yields Edge Lower, Conway To Speak Tuesday

NZGBs yield opened lower across benchmarks and continued to grind lower over the day finishing 2-4bps lower. A risk off tone has pushed yields on longer date bonds back to levels from early January, the 10y now trades at 4.479%. There has been very little in the way of local headlines, NZ will look to sell 84, 164 & 350-day Bills on Tuesday, while Conway to also speak.

- (Bloomberg) -- RBNZ Paper Suggests Use of Smaller Suite of Labor Indicators (See link).

- NZGBs yields closed lower today, with the curves bull flattening. The 2y is -2.7bps to 4.581%, while the 10y is -3.5bps to 4.521%

- Swap rates are 1-4bps lower today, while the 2s10s curve is flatter

- The NZ trade weight Index is just off earlier lows, down 0.14% to 70.56, while the AU-NZ 2yr swap is just off monthly highs at -0.8425, the NZD has managed to get back above 0.6000, trading at 0.6008, while Equities are up 0.82%.

- The NZ commodity price Index dipped for the first time since Earlier January now at 116.48, from 116.79 a yearly high after Milk prices fell slightly.

- RBNZ dated OIS is unchanged this morning with a cumulative 71bps of easing is priced by year-end.

- Today, the calendar is light. Upcoming RBNZ's Conway speaks about Feb MPS on Tuesday

FOREX: USD/JPY Shrugs Off Step Up In FX Rhetoric, Higher CNY Fixing Weighs On Broader USD Sentiment

The BBDXY index sits lower for the Monday session as we approach the London/EU cross over, last near 1245.15, off a little over 0.10%. We are up from earlier lows of 1243.55, which came post the stronger than expected CNY fixing.

- The CNY fixing was the main focus point today, as markets assessed whether we would see a run of further yuan weakness. In the event the fixing was set stronger than expected (back sub 7.1000), which has seen USD/CNY largely reverse Friday's gains.

- Prior to this we had a step up in official rhetoric from Japan's Chief currency diplomat Kanda. He described recent FX moves as being speculative and that the authorities wouldn't hesitate to act. Still, the pair could test Friday lows around 151.00 during this period or post the stronger CNY fixing. We track near 151.25/30 in recent trade, only marginally stronger in yen terms.

- The BoJ minutes for the Jan meeting were released, but have largely been superseded by last week's BoJ meeting, which ended NIRP.

- AUD/USD is higher, last near 0.625/30, nearly 0.20% firmer. Earlier highs were at 0.6544 as the currency benefited from a stronger yuan and a more positive HK/China equity tone.

- NZD/USD has lagged at the margins, last near 0.6000, up from fresh YTD lows of 0.5986.

- US yields have recovered from earlier lows, likely aiding the USD regaining some ground from earlier lows.

- Looking ahead, we have Fed speak (including Bostic again, along with Goolsbee and Cook) and some US data (new home sales and Dallas Fed Manufacturing). The BoE's Mann also speaks.

ASIA EQUITIES: Hong Kong & China Equities Erase Earlier Losses

Hong Kong and China equities are mostly higher post the break on Monday, after initially opening lower. Equities were helped higher after Premier Li Qiang downplayed investors concerns facing the economy. Focus this week will turn to corporate earnings as economic data is light. Earnings from Country Garden and China Vanke will be closely watched as investors wait to see the extent of China's property woes, while earnings from Chinese banks will also shed some light on where the market is heading. It has been announced that Treasury Secretary Janet Yellen will visit China in April to meet with the country's senior leaders.

- Hong Kong equities are slightly higher today, the Mainland Property Index opened slightly lower, however quickly erased those loses and now trade up about 3% to be the top performing sector. The HSTech is unchanged after plummeting as much as 4.35% on Friday while the wider HSI is up 0.40%. In China, equities indices have been grinding higher after initialy opening the session lower with the CSI300 up 0.42%, the smaller cap CSI1000 lags wider market moves and is up just 0.14% while the ChiNext is down 0.37%

- China Northbound flows were -3.1billion yuan on Friday, with the 5-day average at 1.55 billion, while the 20-day average sits at 2.27 billion yuan.

- In the property space today it has been quiet for company specific news however China’s Premier Li Qiang reviewed proposals to fortify the nation’s property market policies during a State Council meeting. Li emphasized the need for systematic planning of real estate support policies to stimulate demand effectively. He also advocated for augmenting the supply of high-quality housing and ensuring the stable advancement of the real estate market. addressing economic challenges by stepping up policy support to stimulate growth, citing low consumer price growth and manageable government debt levels. Despite positive economic indicators, including strong exports and industrial production, longer-term challenges such as deflation, a property downturn, and low foreign investment confidence persist, prompting a focus on boosting domestic demand and advancing strategic industries.

- Apple Inc. is reportedly considering using Baidu Inc.'s generative artificial intelligence technology in its devices within China, marking a potential collaboration between the two tech giants in the tightly regulated Chinese market. Baidu's expertise in AI could provide Apple with a significant advantage, with discussions ongoing as Apple explores partnerships with various AI providers for its products, similar to its arrangement with Google and OpenAI for search functionalities.

- Fears of a slowdown in Chinese luxury spending have impacted fashion giant Gucci, leading to a nearly 20% decline in sales this quarter, particularly in the Asia-Pacific region. This contributed to a $9 billion market value loss for Gucci's parent company, Kering SA. The broader luxury industry is also feeling the effects, with Swiss watch exports to China tumbling and analysts predicting further cooling of luxury demand in the country.

- Looking ahead, it's a quiet week for China econ data, while Hong Kong has Trade Balance data out on Tuesday.

ASIA PAC EQUITIES: Equities Mixed, Japan Equities Fall On Yen Support, Aus/NZ Higher

Regional Asian equities are mostly lower, today with Australia and New Zealand equities the exceptions. It has been a quiet day for market headlines and economic data, as markets await a busy end to the week for economic indicators, including the Fed's preferred inflation gauge. Earlier, Japan's currency chief warned of significant moves in the FX markets driven by market speculation rather than fundamentals, in relation to the weakening yen from the past week.

- Japan's equities are lower today as investors seek to lock in profits after the Nikkei hit new all-time highs on Friday, while the Topix marked a 6-day advance on Friday. Exporters are lower today as the yen edged higher following a warning from Japan's Currency Chief to the FX market. Japan has just released the Leading Index coming in at 109.5 vs 109.9 previously, while the Coincident Index rose to 112.1 from 110.2 previously, shortly Store Sales data will be released. The Topix is down 0.88%, while the Nikkei 225 is down 0.69%.

- South Korean equities are slightly lower to unchanged with tech names have leading the decline. Representatives from various international financial firms are visiting Korea to explore investment opportunities and discuss corporate governance practices amid the government's Corporate Value-up Program launch, aiming to enhance transparency and attract more overseas investments. The trip organized by the Asian Corporate Governance Association aligns with efforts to improve Korea's corporate governance standards and elevate the valuation of listed companies, potentially increasing foreign investor interest in the Korean market. The Kospi is down 0.19%.

- Taiwanese equities have edged higher today after initially starting the day lower, there has been very little in the way of market news and headlines out of the region. The Philadelphia SE Semiconductor Index was only slightly higher on Friday, while local semiconductor names including TSMC are lower. The Taiex is up 0.14%

- Australian equities are higher today, with banks leading the gains. Earlier, Fitch Ratings stated that "The ratings of the four major Australian banks have significant buffers to withstand a slowing economy and higher unemployment,". Miners are higher after ANZ called for the bottom for Iron Ore prices. The ASX200 finished up 0.53%.

- Elsewhere in SEA, New Zealand equities are higher, up 0.74%, Singapore equities down 0.20%, Indonesian equities down 0.33% after marking 5 straight days of foreign investors inflows, while Malaysian equities are down 0.35% and Indian equity markets are closed for a public holiday.

OIL: Crude Higher Again Buoyed By Conflicts & Weaker USD

After falling moderately on Friday, oil prices have trended higher again today driven by events related to Russia. Brent broke through $86 earlier but couldn’t sustain the move and is now up 0.6% to $85.92/bbl. WTI has rallied above $81 to be up 0.6% at $81.14/bbl, after an intraday high of $81.28. Crude has been supported by a weaker US dollar. The USD index fell 0.2% but is now down 0.1%.

- The focus is on Russia with Friday’s terrorist attack in Moscow, the energy sector targeted by Ukrainian drones and sanctions impacting energy exports. Drone strikes are estimated to have taken around 12% of refining capacity offline.

- India has said that it won’t take Russian oil on state-run Sovcomflot tankers because of sanctions. India has become the second largest buyer of Russian crude after China since Russia invaded Ukraine. Commentators are noting that sanctions are now impacting Russian exports and raising shipping costs.

- Iran-backed Houthis fired a missile at a Chinese-owned oil tanker sailing in the Red Sea on Saturday.

- Conditions around crude remain bullish and money managers’ net long positions are at their highest in over a year, according to Bloomberg.

- Later the Fed’s Bostic, Goolsbee and Cook speak and the Chicago & Dallas Fed indices are released as well as February new home sales. BoE’s Mann also appears.

GOLD: Firms As USD Index Weakens Post Stronger CNY Fixing

Gold has moved higher in the first part of Monday trade. The precious metal was last near $2170.50 up close 0.25% for the session so far. Gold has largely followed broader USD gyrations in the first part of Monday trade.

- We rose earlier amid broad USD gains after the stronger than expected CNY fixing printed. Highs came in at $2178.36, while earlier lows (pre CNY fixing) were at $2164.08. These moves keep us within recent ranges for the metal. As USD sentiment stabilized somewhat, gold move off its session highs.

- Friday lows in the metal were $2157, while upside focus will remain on break back above the $2200 level.

- Goldman Sachs presented a generally positive commodity price outlook for 2024, with central bank cuts to aid sentiment, although the bank noted that gains won't be uniform. It expects gold to reach $2300 by year end (see this BBG link for more details).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/03/2024 | 0800/0900 | ** |  | ES | PPI |

| 25/03/2024 | 1000/1100 |  | EU | ECB's Lagarde at EIB Climate Council | |

| 25/03/2024 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 25/03/2024 | 1225/0825 |  | US | Atlanta Fed's Raphael Bostic | |

| 25/03/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 25/03/2024 | 1415/1415 |  | UK | BOE Mann At Royal Economic Society Annual Conference | |

| 25/03/2024 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/03/2024 | 1430/1030 |  | US | Fed Governor Lisa Cook | |

| 25/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/03/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.