-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - ECB Set to Deliver Third Consecutive Cut

MNI China Daily Summary: Thursday, December 12

MNI EUROPEAN OPEN: Talk Of China Trimming Travel Quarantine Support Sentiment Into London

EXECUTIVE SUMMARY

- FED’S BULLARD SEES 2023 SHIFT WITH END OF FRONT-LOADING HIKES (BBG)

- FED ‘HONING IN' ON APPROPRIATE LEVEL OF RATES – EVANS (MNI)

- TRUSS’S GOVERNMENT ON THE BRINK AS TORIES AGITATE FOR HER TO GO (BBG)

- ‘DAYS LEFT FOR LIZ TRUSS’ AS MPS MOVE AGAINST HER (THE TIMES)

- BOE WON'T HOLD BONDS BOUGHT AFTER MINI-BUDGET FOR 'LONG TIME', SAYS CUNLIFFE (RTRS)

- CHINA DEBATING CUT TO COVID QUARANTINE FOR INBOUND TRAVELERS (BBG)

- CHINA GATHERS CHIP FIRMS FOR EMERGENCY TALKS AFTER BIDEN CURBS (BBG)

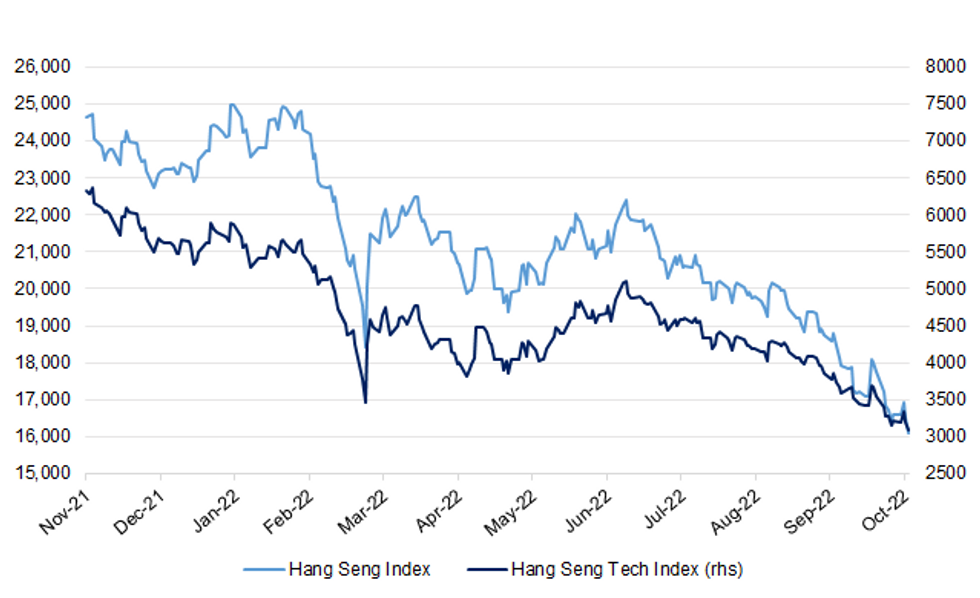

Fig. 1: Hang Seng Index Vs. Hang Seng Tech Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Bank of England Deputy Governor Jon Cunliffe said on Wednesday the central bank did not want to hold for a long time bonds it bought during an emergency programme to support the gilt market in the wake of the government's mini-budget. "We've said that we'll unwind in a timely and orderly manner," Cunliffe told lawmakers on the Treasury Committee. "So this is not (quantitative easing). We don't want to hold on to these for a long time." (RTRS)

BOE: Rather than fearing Bank of England gilt sales, UK market participants have been cheerleaders for sales at the shorter end of the market, according to Andrew Hauser, Executive Director Markets. (MNI)

BOE: The UK Treasury is set to transfer more than £11 billion ($12.4 billion) to the Bank of England this fiscal year to cover projected losses in its bond-buying program, according to a person familiar with the situation. (BBG)

POLITICS: Liz Truss’s premiership looked close to imploding after she fired one minister over a security breach and two others were heard resigning amid the fallout from a chaotic parliamentary vote before agreeing to stay in their posts. Many Conservative lawmakers now want Truss to resign immediately, a sudden reversal from a widely-held view that a leadership change should wait at least until a new economic plan is announced on Oct. 31 to calm financial markets. (BBG)

POLITICS: The most senior Tory backbench MP is facing mounting calls to press for Liz Truss to resign after a chaotic day in parliament. Friends of Sir Graham Brady, chairman of the 1922 Committee of Tory backbenchers, said he was “naturally cautious” and was reluctant to act unless a significant number of colleagues came forward. He is also concerned that attempts to remove Truss would lead to further turmoil in the markets. (The Times)

POLITICS: A Labour motion that would have forced a vote on a bill to ban fracking has been defeated amid farcical scenes in the House of Commons. (Sky)

RATINGS: DBRS Morningstar placeed the United Kingdom’s AA (high) ratings under review with negative implications. (DBRS)

EUROPE

FISCAL: Some EU leaders are likely to broach the question of adopting a new SURE-style loan programme to help consumers and businesses deal with the consequences of high energy prices at their summit meeting in Brussels on Thursday and Friday, but the proposal will continue to face stiff German resistance, officials told MNI. (MNI)

FRANCE: France's left-wing Nupes opposition bloc on Wednesday announced it would call for a no-confidence vote in the lower house of parliament against Prime Minister Elisabeth Borne's government linked to the passing of the 2023 budget bill. (RTRS)

ITALY: Italy should have a new government in place by early next week, League leader Matteo Salvini said on Wednesday. Salvini, part of a rightist coalition led by the Brothers of Italy party that won a national election last month, said he expected the government to be sworn in some time between Saturday and Monday. He had initially said he expected the government to be installed by Oct. 26. (RTRS)

U.S.

FED: Federal Reserve Bank of St. Louis President James Bullard said it’s good news that markets are pricing in anticipated interest-rate hikes by policymakers, making it important that officials “follow through” and implement those increases to curb high inflation. (BBG)

FED: Federal Reserve Bank of Minneapolis President Neel Kashkari said that the US central bank could potentially pause its interest-rate increases at some point next year if policymakers see clear evidence that core inflation is slowing. (BBG)

FED: The Federal Reserve’s aggressive interest rate hikes put it closer to the appropriate level of monetary tightness needed to bring inflation down, Chicago Fed President Charles Evans said Wednesday, adding he still sees the September SEP as a good guide to the peak of rates. (MNI)

FED: U.S. businesses are becoming more pessimistic about economic conditions in the face of high inflation and rising interest rates, the Federal Reserve said in a Wednesday report. (WSJ)

FED: Federal Reserve policymakers will likely be forced to raise interest rates more than their own forecasts suggest because of persistent inflation pressures, but the time still may be nearing for the central bank to slow the pace of those rate increases, former Fed officials and economists told MNI. (MNI)

FISCAL: The Supreme Court on Wednesday was asked to block the Biden administration’s student loan debt relief program, which is set to take effect this weekend. (CNBC)

POLITICS/MARKETS: Federal officials working on the government response to Covid-19 made well-timed financial trades when the pandemic began—both as the markets plunged and as they rallied—a Wall Street Journal investigation found. (WSJ)

MARKETS: Federal Reserve researchers and officials quizzed experts from Wall Street and around the world last week about a pressing question: Could a market meltdown like the one that happened in Britain late last month occur here? (New York Times)

OTHER

U.S/CHINA: China’s top technology overseer convened a series of emergency meetings over the past week with leading semiconductor companies, seeking to assess the damage from the Biden administration’s sweeping chip restrictions and pledging support for the critical sector. (BBG)

SOUTH KOREA: South Korea’s finance ministry, Bank of Korea, Financial Supervisory Service and Financial Services Commission held a meeting Thursday to discuss financial companies’ FX liquidity conditions, along with risk factors and the level of financial soundness at those firms in relation to the recent drop in the won, the finance ministry says in a statement. (BBG)

BOC: The leader of the opposition party propping up Canadian Prime Minister's Justin Trudeau's minority government attacked the central bank Wednesday, objecting to Governor Tiff Macklem's comments about holding down wages and raising interest rates as the economy faces recession. (MNI)

CANADA: Finance Minister Chrystia Freeland issued a warning to Canadians Wednesday — the coming months won't be pretty as rising interest rates slow a once red-hot economy and force some people out of their jobs. (CBC)

BRAZIL: Brazil's presidential race has narrowed to a 4-percentage-point gap between leftist front-runner Luiz Inacio Lula da Silva and far-right incumbent President Jair Bolsonaro, and they are now statistically tied, according to a poll published on Wednesday. (RTRS)

RUSSIA: Russia said on Wednesday that it will reassess cooperation with U.N. Secretary-General Antonio Guterres if he sends experts to Ukraine to inspect drones that Western powers say were made in Iran and used by Moscow in violation of a U.N. resolution. (RTRS)

RUSSIA: A senior U.S. Treasury Department official traveled to Turkey this week to discuss sanctions and export controls imposed on Russia following its invasion of Ukraine, the Treasury Department said, as Washington closely monitors growing economic ties between Ankara and Moscow. (RTRS)

RUSSIA: Two Russian nationals were arrested and several other individuals charged with evading sanctions to smuggle US military technology, some of which was used in Ukraine, and Venezuelan oil. (BBG)

RUSSIA: Weekly consumer prices in Russia rose marginally for the fourth week running, data published on Wednesday showed, adding weight to analysts' expectations that the Bank of Russia may decide to end its rate-cutting cycle next week. (RTRS)

SOUTH AFRICA: Eskom has announced that stage 3 power cuts have been extended indefinitely. (ENCA)

SOUTH AFRICA: The South African Transport and Allied Workers Union (SATAWU) has called off its strike at Transnet, ending a boycott that paralysed the state-owned logsitics firm and impacted commodities exports from Africa's most advanced economy. (RTRS)

IRAN: Iranian security forces have arrested 14 foreigners, including American, British and French citizens, for their involvement in anti-government protests, the semi-official Fars news agency said on Wednesday. (RTRS)

MIDDLE EAST: Iran and Saudi Arabia must reopen their embassies to facilitate a rapprochement between the two regional rivals, a top adviser to Iran's supreme leader said on Wednesday, amid moves by Tehran and Riyadh to revive ties. (RTRS)

COLOMBIA: Colombian President Gustavo Petro said higher US interest rate are sucking money out of South America, and called on investors to keep their funds in the country even as the peso weakened to a record low. (BBG)

METALS: Peru’s Chumbivilcas communities agreed to halt a road blockade in the mining corridor used by MMG’s Las Bambas copper mine until Oct. 25 in a truce with the government, said Juan Ahuate Samata, leader of Pulpera Condes indigenous community, in a phone interview. (BBG)

OIL: Saudi Arabia privately pressed several Arab countries to issue statements supporting the recent OPEC+ decision to cut oil production, according to a former U.S. official and an Arab official. (Axios)

OIL: President Joe Biden said Wednesday the United States will sell 15 million barrels from the nation’s Strategic Petroleum Reserve (SPR) by the year’s end and detailed a strategy to refill the stockpile when prices drop. (RTRS)

OIL: U.S. President Joe Biden said oil companies need to use their record-profits to ramp up production rather than to enrich shareholders. (CNBC)

OIL: A U.S. Senate committee this week quietly advanced a bill that seeks to rein in OPEC+ after the oil producer group led by Saudi Arabia and Russia this month agreed to cut output. (RTRS)

CHINA

CORONAVIRUS: Chinese officials are debating whether to reduce the amount of time people coming into the country must spend in mandatory quarantine, according to people familiar with the discussions, as the country’s Covid Zero policy leaves it increasingly isolated from the rest of the world. (BBG)

ECONOMY: China should be able to stabilise the economy and return to a growth rate of around 5% if Covid outbreaks are controlled, China Newsweek reported citing Liu Yuanchun, president of Shanghai University of Finance and Economics. (MNI)

ECONOMY/CREDIT/BANKS: China's commercial banks are ramping up credit supply in Q4 in response to top policymakers' calls to increase support for the real economy, Yicai.com reported citing industry sources. (MNI)

PBOC: Chinese banks maintained their benchmark lending rates for a second month, with economists dialing down expectations for further central bank easing as the yuan continues to weaken. (BBG)

PBOC: The People’s Bank of China still has room to lower financing costs in the real economy and quicken the use of structural tools to help promote the steady growth of total credit, China Securities Journal reported citing analysts. (MNI)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7293% at 9:36 am local time from the close of 1.5057% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 48 on Wednesday vs 52 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 7.1188 THURS VS 7.1105 WEDS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1188 on Thursday, compared with 7.1105 set on Wednesday.

OVERNIGHT DATA

CHINA SEP SWIFT GLOBAL PAYMENTS CNY 2.44%; AUG 2.31%

JAPAN SEP TRADE BALANCE -Y2.0940TN; MEDIAN -Y2.1547TN; AUG -Y2.8200TN

JAPAN SEP EXPORTS +28.9% Y/Y; MEDIAN +26.6%; AUG 22.1%

JAPAN SEP IMPORTS +45.9% Y/Y; MEDIAN +44.9%; AUG 49.9%

JAPAN SEP TRADE BALANCE ADJ -Y2.0098TN; MEDIAN -Y2.0718TN; AUG -Y2.3378TN

AUSTRALIA SEP EMPLOYMENT CHANGE +923; MEDIAN +25.0K; AUG +36.3K

AUSTRALIA SEP FULL-TIME EMPLOYMENT +13.3K; AUG +55.0K

AUSTRALIA SEP PART-TIME EMPLOYMENT -12.4K; AUG -18.7K

AUSTRALIA SEP UNEMPLOYMENT RATE 3.5%; MEDIAN 3.5%; AUG 3.5%

AUSTRALIA SEP PARTICIPATION RATE 66.6%; MEDIAN 66.6%; AUG 66.6%

AUSTRALIA Q3 NAB BUSINESS CONFIDENCE +9; Q2 +5

Consistent with recent monthly survey outcomes, business conditions remained strong across states and industries in Q3. Business confidence also strengthened to be back above average. (NAB)

RBA SEP FX TRANSACTIONS GOVERNMENT -A$1.490BN; AUG -A$690MN

RBA SEP FX TRANSACTIONS MARKETS +A$1.460BN; AUG +A$658MN

RBA SEP FX TRANSACTIONS OTHER -A$262MN; AUG -A$303MN

MARKETS

SNAPSHOT: Talk Of China Trimming Travel Quarantine Support Sentiment Into London

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 214.73 points at 27042.65

- ASX 200 down 69.356 points at 6730.7

- Shanghai Comp. up 20.869 points at 3065.247

- JGB 10-Yr future down 29 ticks at 147.88, yield down 0.1bp at 0.256%

- Aussie 10-Yr future down 11.5 ticks at 95.92, yield up 11.5bp at 4.06%

- U.S. 10-Yr future down -0-04+ ticks at 109-27+, yield up 1.08bp at 4.1443%

- WTI crude up $1.24 at $86.79, Gold up $3.13 at $1632.5

- USD/JPY up 3 pips at Y149.93

- FED’S BULLARD SEES 2023 SHIFT WITH END OF FRONT-LOADING HIKES (BBG)

- FED ‘HONING IN' ON APPROPRIATE LEVEL OF RATES – EVANS (MNI)

- TRUSS’S GOVERNMENT ON THE BRINK AS TORIES AGITATE FOR HER TO GO (BBG)

- ‘DAYS LEFT FOR LIZ TRUSS’ AS MPS MOVE AGAINST HER (THE TIMES)

- BOE WON'T HOLD BONDS BOUGHT AFTER MINI-BUDGET FOR 'LONG TIME', SAYS CUNLIFFE (RTRS)

- CHINA DEBATING CUT TO COVID QUARANTINE FOR INBOUND TRAVELERS (BBG)

- CHINA GATHERS CHIP FIRMS FOR EMERGENCY TALKS AFTER BIDEN CURBS (BBG)

US TSYS: Light Cheapening Overnight

TYZ2 deals -0-04 at 109-28, operating 0-02 off the base of its narrow 0-06 overnight range, on volume of ~86K. The contract has registered a fresh cycle low, with the nearby 30 Nov ’07 low (109-23+) providing the next level of technical support for bears to target. Cash Tsys sit ~1bp cheaper across the curve.

- Tsys held a modest cheapening bias in Asia-Pac hours, as regional participants reacted to Wednesday’s sell off, registering fresh cycle highs for yields across the curve in the process.

- It wasn’t all one-way in flow terms, with softer than expected Australian headline job growth and a small block buy in WN futures (+750) helping to support the space at one point.

- Note that we also saw block sellers of TY futures (-1.5K & 01.4K) during Asia-Pac hours.

- Tsys have looked through a BBG source report which suggested that “Chinese officials are debating whether to reduce the amount of time people coming into the country must spend in mandatory quarantine.” Those headlines generated a light bid for oil, e-minis & the Chinese yuan, within broader risk-on flows, pulling e-minis away from worst levels of the day alongside a bid in Chinese & HK equities.

- Chicago Fed President Evans provided the now standard hawkish Fed rhetoric.

- Thursday’s NY docket will see the release of the latest Philly Fed survey, weekly jobless claims and existing home sales data. We will also get 5-Year TIPS supply and Fedpseak from Bowman, Jefferson, Cook & Harker.

JGBS: Unscheduled BoJ Fails To Provide Meaningful Support

The major benchmark JGBs have seen a mixed afternoon, with super-long paper recovering from lows, leaving wider cash JGBs little changed to ~2bp cheaper on the day. 7s and 20s provide the weakest points on the curve (tied to a move lower in futures & potential structural demand issues, respectively), while 2s and 10s are little changed, with the latter of course limited by the presence of the BoJ’s YCC scheme. 30+-Year paper is nearly back to flat, perhaps on fresh interest from lifers and pension funds, which seemed to become apparent on Wednesday afternoon as well.

- Futures print -30, at worst levels of the session, and 25 ticks off September’s low, where initial technical support lies. A break there would expose levels not seen since June, when the BoJ’s will re: its YCC scheme was being tested.

- The show higher in yields triggered an unscheduled round of 5- to 25+-Year BoJ Rinban operations (as we suggested may be the case). However, this did little to placate the market, with 10-Year JGB yields immediately showing above the upper limit of the range permitted under the BoJ's YCC (per BBG), while JGB futures nudged lower in the wake of the announcement.

- Tomorrow’s local docket will see the release of national CPI data & 1- to 10-Year BoJ Rinban operations.

AUSSIE BONDS: Bear Flattening Holds

A shift higher in RBA terminal rate pricing & payisde flow in swaps, which was linked to Wednesday’s move in the likes of Fed & BoC pricing, applied further pressure to ACGBs in Sydney trade, which allowed the space to extend on the weakness seen in futures during the overnight session.

- That leaves YM & XM -13.0 apiece on the day into the bell, a little off of worst levels, with bear flattening observed on the wider cash ACGB curve, where 11-13bp of cheapening was seen across the major benchmarks.

- The latest round of labour market data saw a brief bid come in, with less than 1K of jobs added in September (vs. BBG median of +25K), while the unemployment rate and participation rates held steady, matching expectations. A reminder that leading labour market indicators have flagged a slight colling in the labour market, although vacancies have stuck at elevated levels.

- The space looked through the latest BBG source piece re: a potential trimming of the Chinese COVID quarantine for international travellers.

- Bills run 3-17bp cheaper through the reds, with RBA dated OIS pricing a terminal rate of ~4.25%.

- A$700mn of ACGB Apr-25 supply and the release of next week’s AOFM issuance slate headline the domestic docket on Friday.

NZGBS: Off Lows As Swaps Reverse & Longer Dated NZGB Supply Is Well Received

NZGBs peeled away from session cheaps on Thursday, after initially cheapening on spill over from Wednesday’s U.S. Tsy trade and concession into weekly NZGB supply.

- The weekly NZGB auctions (covering NZGB May-28, Apr-33 & May-51) saw firm demand for the two longer bonds, with cover ratios of 4.41x & 3.44x, respectively, while the shortest bond on offer saw more muted demand, registering a cover ratio of 1.20x, with worries re: more aggressive RBNZ tightening probably limiting demand there.

- Benchmark NZGBs, finished 2.5-9.0bp cheaper on the day, with bear flattening in play.

- Swaps fully reversed their early push higher into the bell, resulting in swap spread tightening across the curve.

- This came alongside a pullback in terminal RBNZ OCR pricing in the dated OIS strip, which moved from as high as ~5.50% at one point, back to just below 5.40% into the close.

- Looking ahead, Friday will see the release of the monthly NZ trade balance data.

EQUITIES: HSI At Fresh 13 year Lows, As Tech Headwinds Continue

Asia Pac equities are weaker, outside of a few South East Asian Markets. Wall St declines from overnight, coupled with lower futures since the open, led by the tech sector (Nasdaq futures off by over 1% on disappointing Tesla revenue), have been the major headwinds.

- The HSI is off by close to 2.5%, making fresh lows back to 2009. The tech sub-index -4.60%. This comes after the China Golden Dragon Index lost just over 7% overnight. The China authorities have reportedly held meetings with top China chip makers in light of US curbs on export/technology sharing in the sector. No clear policy response is evident at this stage.

- Mainland stocks are also lower, but to a more modest degree. The CSI 300, is down around 0.70%. Higher covid case numbers in Beijing are weighing on sentiment, while higher frequency growth indicators, like subway rides have moderated in recent weeks. Earlier 1yr and 5yr LPR rates were left unchanged, as expected.

- The Nikkei 225 is off by 1.3%, while the Taiex is down 1.65%, again led by declines in TSMC. The chip sector is facing headwinds from the slowing global growth backdrop/along with US-China tensions. The Kospi is down 1.6%.

- Indonesian stocks have outperformed, up close to 1.4%, led by local bank shares.

OIL: Prices Surge On China Quarantine News

After rallying strongly overnight on supply worries, oil prices have been fairly stable during trading today but have just surged on reports that China is considering reducing inbound quarantine periods to 7 days. WTI is up 0.8% to $86.20/bbl and Brent is +0.6% and is around $93.

- Oil prices continue to be thrown around by concerns that a global slowdown will depress demand for oil on one side and supply issues on the other (OPEC+ cuts, EU sanctions on Russian seaborne oil exports, Kazakhstan).

- The market has not reacted to President Biden’s announcement to add 15mn barrels from the Strategic Petroleum Reserve. The information had already been expected and on the other hand the EIA announced an unexpected drawdown in crude inventories of 1.725mn barrels.

- The US also only has 25 days of diesel available, the lowest since 2008, which is important for heating in winter. Europe’s fuel inventories are also declining. (Bloomberg)

- WTI moving averages have been converging and prices are now just above 5- and 20-day moving averages but still below the 50-day MA.

GOLD: Yield Spike Weighs

Downside levels are once again in focus for gold. The precious metal lost 1.38% through yesterday's session and is down a further 0.20% so far today. Spot levels currently hold close to $1626.

- Today's trends have been a continuation of the overnight price action, although we have made fresh lows close to $1622.50, before support emerged. Moves back towards the $1630 have generally drawn selling interest since late NY trading.

- September 28 lows around $1615 are in focus, only 0.65% away in percentage terms.

- The resurgent US yield backdrop, particularly in terms of real yields (10yr closed a fresh cyclical high at 1.72%), is a clear headwind for gold. This is feeding into USD strength, which is mostly outweighing safe haven/risk aversion benefits gold otherwise might be receiving.

- The gold/copper ratio has broadly been stable in recent months, likewise for gold to oil.

FOREX: Risk-Off Pattern Holds Despite Incremental Relief From Report On China Border Rules Debate

The underlying risk tone was negative, with U.S. e-minis losing altitude as the session progressed, after Wednesday's poor showing from benchmark indices on Wall Street. However, risk assets got some reprieve from a BBG report flagging debates among Chinese officials on whether to reduce the mandatory quarantine period for inbound travellers, stressing that any such decision would have to be cleared by senior leaders.

- The greenback benefitted from safe haven demand, with the BBDXY testing 1,350 as a result. The index wiped out gains in a knee-jerk reaction to the China story, but then gradually unwound the reaction move.

- Expected Gotobi Day flows and 10-Year JGB yield sitting above the 0.25% cap raised the risk of further gains for USD/JPY but the pair respected a very tight range, as risk aversion favoured the yen. Participants monitored the pair for signs of an intervention by Japanese officials on approach to the psychologically significant Y150 figure, which has held for now.

- Japanese officials stood their ground. The BoJ announced an unscheduled round of bon-buying in defence of its YCC framework, reaffirming its dovish bias. Elsewhere, FinMin Suzuki pledged readiness to act appropriately on excessive FX moves.

- The Antipodeans fell prey to the wider cautious mood, with losses facilitated by a weaker than expected Australian jobs report. Employment growth was meagre, but doesn't move the needle much for the RBA, as forward-looking indicators already pointed to a slower but still very tight labour market.

- The kiwi paced losses, confirming its sensitivity to swings in market sentiment. Selling pressure was amplified by the partial withdrawal of hawkish RBNZ bets. Meeting-dated OIS price ~78bp worth of tightening next month versus yesterday's peak of 91bp. NZD/USD has now fully erased gains registered after the strong Q3 CPI print earlier this week.

- USD/CNH showed above the upper end of the PBOC's permitted USD/CNY trading band (+/-2% from fixing mid-point) but failed to hold above there and retreated, extending losses to new session lows as the aforesaid BBG report crossed the wires.

- Data highlights going forward include U.S. jobless claims, existing home sales & Philly Fed Biz. Survey. The PBOC will set its benchmark Loan Prime Rates, while Fed's Harker, Jefferson, Cook & Bowman, ECB's de Cos & Norges Bank's Bache will speak.

FX OPTIONS: Expiries for Oct20 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9685-00(E1.9bln), $0.9750(E787mln), $0.9800(E1.9bln), $0.9850(E1.3bln), $0.9870-80(E $0.9990-00(E1.4bln)

- USD/JPY: Y145.00($3.5bln), Y147.90-00($3.7bln)

- GBP/USD: $1.1145-60(Gbp606mln)

- EUR/JPY: Y146.00(E753mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/10/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/10/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/10/2022 | 0720/0320 |  | ID | Bank of Indonesia Rate Decision | |

| 20/10/2022 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/10/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 20/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 20/10/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/10/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 20/10/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/10/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/10/2022 | 1600/1200 |  | US | Philadelphia Fed's Patrick Harker | |

| 20/10/2022 | 1630/1230 |  | US | Fed Governor Lisa Cook | |

| 20/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 20/10/2022 | 1730/1330 |  | US | Fed Governor Philip Jefferson | |

| 20/10/2022 | 1745/1345 |  | US | Fed Governor Lisa Cook | |

| 20/10/2022 | 1805/1405 |  | US | Fed Governor Michelle Bowman | |

| 21/10/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 21/10/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 21/10/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/10/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 21/10/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/10/2022 | 1310/0910 |  | US | New York Fed's John Williams | |

| 21/10/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/10/2022 | 1600/1200 | ** |  | US | Treasury Budget |

| 22/10/2022 | 0900/1100 |  | EU | ECB Panetta at Festa dell'ottimismo | |

| 23/10/2022 | - |  | SL | Slovenia Presidential Election | |

| 24/10/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 24/10/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 24/10/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/10/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/10/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/10/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/10/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 25/10/2022 | 0600/0800 | ** |  | SE | PPI |

| 25/10/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/10/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/10/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 25/10/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/10/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/10/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/10/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/10/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/10/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/10/2022 | 0030/1130 | *** |  | AU | CPI inflation |

| 26/10/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 26/10/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/10/2022 | 0800/1000 | ** |  | EU | M3 |

| 26/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/10/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/10/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 26/10/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 26/10/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/10/2022 | 1500/1100 |  | CA | BOC Governor Press Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.