-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Tech Outlook Surges, Fitch May Cut US Rating

EXECUTIVE SUMMARY

- UNITED STATES AAA RATING MAY BE CUT BY FITCH - BBG

- BOSTIC: BEST CASE IS FED WON'T MULL RATE CUT TILL WELL INTO '24 - BBG

- NVIDIA’S RESULTS SPARK NEARLY $300BN RALLY IN AI STOCKS - RTRS

- SINGAPORE SAYS ASPECTS OF US-CHINA RIFT ‘APPEAR INSURMOUNTABLE’ - BBG

- RBNZ’s ORR CONFIDENT CURRENT RATE SETTINGS WILL TAME INFLATION - BBG

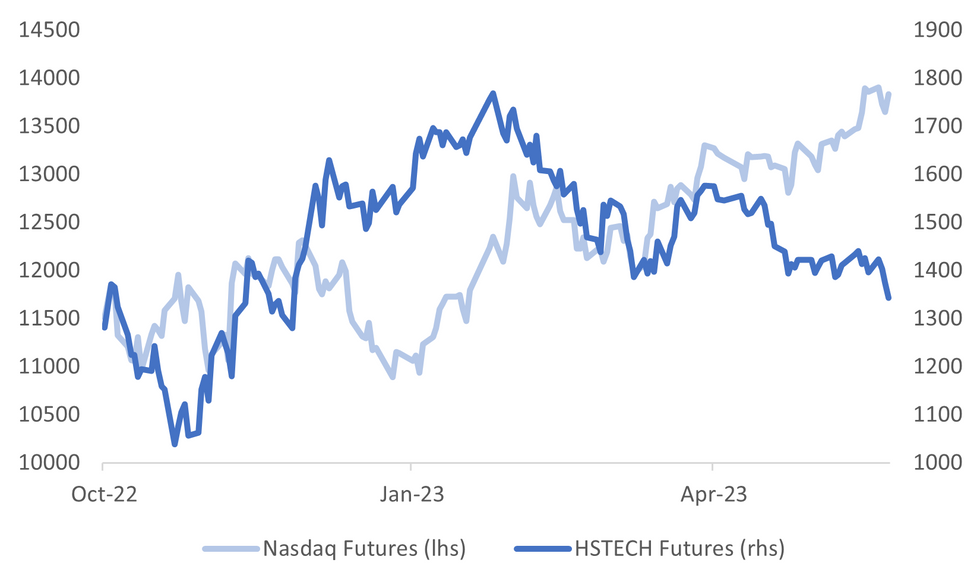

Fig. 1: NASDAQ Futures Versus HS TECH Futures

Source: MNI - Market News/Bloomberg

U.K.

INFLATION: PM Sunak finds UK inflation may follow him into the election year. ONS figures have defied forecasts proving stickier each time and extending further into items like grocery and mobile phone bills. (BBG)

POLITICS: PM Sunak’s government will commission an independent review into the development of the northern England Teesworks site following allegations of corruption around a project at the heard of the Conservative Party’s pledge to boost disadvantaged areas of the country (BBG)

EUROPE

ENERGY: EU Nations must strengthen measures to reduce gas and electricity demand to speed the green energy transition according to two non-profit groups. (BBG)

GREECE: Greece will hold new elections in a month after this weekend’s ballot failed to produce a government. While outgoing PM Mitsotakis secured a landslide victory he fell slightly short of an absolute majority. Junes vote will award 50 bonus seats to the winner making it easier to have a single party administration. (BBG)

U.S.

RATINGS: United States ratings placed on watch negative from outlook stable by Fitch. The Rating Watch Negative reflects increased political partisanship that is hindering reaching a resolution to raise or suspend the debt limit despite the fast-approaching x date: Fitch. Fitch still expects a resolution to the debt limit before the x-date. Fitch believes risks have risen that the debt limit will not be raised or suspended before the x-date and consequently that the government could begin to miss payments on some of its obligations. (BBG)

DEBT: House Speaker Kevin McCarthy’s optimism that White House and GOP negotiators would reach a deal in time to avert a potentially catastrophic default didn’t mollify analysts as the US was put on a ratings watch late Wednesday. The California Republican said after a four-hour meeting between his and President Joe Biden’s hand-picked negotiators that a deal was possible before June 1, the date by which Treasury Secretary Janet Yellen has warned the US could run out of money to pay its bills. (BBG)

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said the central bank will need to be flexible as it considers whether to raise interest rates further. “We’re going to let the data guide us, and we don’t want to be locked into any particular movement,” Bostic said in an interview with Marketplace published online Wednesday. “The policies that we’ve done, the tightening that we’ve done, is just starting to show up into the economy.” (BBG)

POLITICS: Florida Governor Ron DeSantis said on Wednesday he would seek the 2024 Republican nomination for president, but an audio interview on Twitter meant to showcase his entry into the race instead drew attention for technical snafus. (RTRS)

TECH: Stocks related to artificial intelligence surged in extended trade on Wednesday, adding almost $300 billion in market capitalization after chipmaker Nvidia Corp (NVDA.O) forecast strong revenue growth and said it was boosting production of its AI chips to meet surging demand. (RTRS)

OTHER

NZ: Reserve Bank of New Zealand Governor Adrian Orr speaks to parliamentary committee Thursday in Wellington about yesterday’s Monetary Policy Statement. On why the Monetary Policy Committee is confident that current rate settings will tame inflation: “The level of restrictiveness for interest rates at the present point, they are well above what we would consider neutral and they are constraining spending and investment intentions” (BBG)

SINGAPORE: The widening rift between the world’s two biggest economies, the US and China, now looks in some regards to be irreconcilable, according to Singapore Deputy Prime Minister Lawrence Wong. The geopolitical situation has become more dangerous amid tensions between the two sides with the Taiwan Strait becoming the region’s “most dangerous flashpoint,” Wong said in his speech at the Nikkei Forum 28th Future of Asia in Tokyo. “We are moving closer to the edge,” he said, reflecting a sentiment that has become more prevalent among Asian leaders.(BBG)

SOUTH KOREA: The Bank of Korea left its policy rate unchanged for a third straight meeting and lowered its growth forecast for this year, as officials wait for a sustained cooling of inflation amid increasing signs of slower-than-expected recovery. The central bank kept its seven-day repurchase rate at 3.5% on Thursday as predicted by all 17 economists surveyed by Bloomberg News. South Korea was among the first central banks globally to pause interest rate hikes three months ago. (BBG)

SOUTH KOREA: South Korea and US are discussing holding its first Nuclear Consultative Group meeting as early as next month, DongA Ilbo newspaper says, citing unidentified government sources.The two sides are discussing holding the first meeting within July, at the latest. (BBG)

CHINA

YUAN: There’s no room for significant depreciation of the yuan as the currency’s recent weakness was mainly driven by a strong dollar, while China’s continued economic recovery is expected to provide support, Securities Daily says in a report Thursday, citing analysts. (BBG)

TECH: China should focus on addressing the potential security issues that artificial intelligence may bring as the technology is showing its huge influence and application potential in various industries, Economic Information Daily says Thursday. (BBG)

PBOC: The People’s Bank Of China has released 27 measures to increase support for the science and technology sector. The central bank aims to create a financial system capable of developing a world class innovation sector with global influence. Policymakers will promote high-quality innovative SMEs to list on the stock exchange and support the sector to make use of international and domestic markets. Under the plan, banks are encouraged to increase credit and R&D loans to the sector. (Source: Yicai) (MNI)

ECONOMY: The Shanghai government will boost private sector confidence, according to Chen Jining, secretary of the Municipal Party Committee in Shanghai. The Government will encourage private firms to invest in innovative technology and participate in major national projects, and strategies. Authorities will create a market environment for fair competition with equal access and treatment, and work to remove hidden barriers. Chen said he will support private enterprises to go global, and build a cross-border industrial chain rooted in Shanghai. (Source: Yicai) (MNI)

CHINA MARKETS

PBOC Net Injects CNY5 Bln Via OMOs Thurs

The People's Bank of China (PBOC) conducted CNY7 billion via 7-day reverse repos on Thursday, with the rates unchanged at 2.00%. The operation has led to a net injection of CNY5 billion after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9410% at 09:26 am local time from the close of 1.7497% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 50 on Wednesday, same as the close on Tuesday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.0529 THURS VS 7.0560 WED

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0529 on Thursday, compared with 7.0560 set on Wednesday.

OVERNIGHT DATA

SOUTH KOREA APR PPI Y/Y 1.6%, PRIOR 3.3%

MARKETS

US TSYS: Curve Bear Flattens In Asia

TYM3 deals at 113-04, -0-09+, a touch off the base of the 0-09+ range on volume of ~146k.

- Cash tsys sit flat to 3 bps cheaper across the major benchmarks, the curve has bear flattened.

- Early in the session Tsys briefly extended higher before paring gains as Fitch placed the US on negative ratings watch as the deadline for an increase in the debt ceiling approaches.

- Tsys were pressured after a statement from the US Treasury noting that the Fitch report shows the swift need for bipartisan action. They also said that brinkmanship over the debt limit does serious harm to business, raises short term borrowing costs and threatens the credit rating of the US.

- TYM3 briefly dealt below support at 113-04, the low from 23 May. The next downside support level is 112-30 61.8% retracement of Mar-24 rally.

- Fedspeak from Atlanta Fed President Bostic crossed, he noted that data will be guiding the Fed on future rate decisions and that it doesn't want to get locked into a particular move.

- In Europe today we have the final read of German GDP, further out a slew of US data crosses including Q1 GDP, Initial Jobless Claims and Pending Home Sales. Fedspeak from Richmond Fed President Barkin and Boston Fed President Collins will cross. We also have the latest 7 Year Supply.

JGBS: Futures At Cheaps, Weighed By 40-Year Supply

JGB futures are 148.44, -17 versus settlement levels, after pushing to 148.41, a Tokyo session lows and the lowest level since May 9.

- 40-year supply appeared to weigh on the market despite being successfully absorbed by the market. While the high yield came in below dealer expectations, the cover ratio, which indicates demand, declined to 2.377x compared to 2.694x at the late-March auction. It appears the overall flattening and richening of the yield curve reduced demand relative to the late March auction, as flagged in our auction preview.

- Cash JGBs weaken in afternoon Tokyo trade with yields higher across the curve. Yield movements range from 0.2bp higher (40-year) to 1.4bp higher (7-year). The benchmark 10-year yield is 1.1bp higher at 0.425%, below the BoJ's YCC limit of 0.50%. The 40-year yield moved 1.5bp higher in post-auction trade.

- The swaps curve bear steepens with swap spreads wider beyond the 1-year zone.

- The local calendar sees Tokyo CPI scheduled along with the weekly 3-month bill auction.

- Later today sees the release of Q1 US GDP (2nd estimate). Nonetheless, the market attention is likely to remain on US debt ceiling negotiations.

AUSSIE BONDS: Cheaper, Fitch US Ratings Warning Weighs

ACGBs are cheaper (YM -8.0 & XM -4.0) sitting just off Sydney session cheaps. With local economic data and headlines light, local participants have been on US tsy watch.

- To recap, early in the session Fitch placed the US on negative ratings watch as the deadline for an increase in the debt ceiling approaches. US tsys are 1-3bp cheaper in Asia-Pac trade with the curve flatter.

- Cash ACGBs are 4-7bp cheaper with 3/10bp curve flatter and the AU-US 10-year yield differential -2bp at -7bp.

- Swap rates are 2-4bp higher with EFPs 2bp tighter.

- The bills strip bear flattened with pricing -3 to -7.

- RBA dated OIS are 1-6bp firmer with late ‘23/early ’24 leading.

- The local calendar heats up tomorrow after a light few days with the release of April Sales. While the official ABS retail estimates account for regular seasonal fluctuations, they can encounter challenges during the Easter period. This is primarily due to the variable timing of the holiday and its proximity to other holidays, which can disrupt the accuracy of the adjustments.

- Later today sees the release of Q1 US GDP (2nd estimate). Nonetheless, the market attention is likely to remain on US debt ceiling negotiations.

NZGBS: Weaker But Outperforms The $-Bloc

NZGBs closed 3-4bp cheaper within a relatively narrow range. The local market grappled with conflicting factors, including the dovish hike by the RBNZ and the upward pressure on global yields due to the ongoing uncertainty surrounding the debt ceiling. Accordingly, NZGBs have maintained yesterday’s outperformance in the $-Bloc with NZ/US and NZ/AU 10-year yield differentials 3bp and 2bp respectively lower.

- The strong relative performance of NZGBs was supported by solid auction results for the May-28 and Apr-33 bonds, which exhibited higher cover ratios compared to their previous auctions. However, it is worth noting that the cover ratio for the May-51 bond was relatively low at 2.46x, in contrast to the prior auction result of 4.42x.

- Swap rates closed 3-4bp higher with the 2s10s curve unchanged and implied short-end swap spreads wider.

- RBNZ dated OIS closed with pricing 5-7bp firmer for meetings beyond August. Terminal rate expectations sit at 5.63%. A 30% chance is attached to a 25bp hike in July.

- The local calendar remains light tomorrow with ANZ Consumer Confidence as the highlight.

- Later today sees the release of Q1 US GDP (2nd estimate).

EQUITIES: Tech/AI Stocks One Of The Few Bright Spots, Negative Trends Elsewhere

Regional equity markets are mostly tracking lower, led by HK shares and China related bourses. Some positive offset has come from a sharp rise in US Nasdaq futures, ignited by a surge in chipmaker Nvidia after hours on a positive sales outlook. Nasdaq futures are +1.40%, slightly down from session highs, Eminis are +0.40%.

- We saw some wobbles in early trade, as Fitch stated it was placing the US on negative ratings watch, as debt ceiling negotiations continue. However, this hasn't had a lasting impact on sentiment.

- Clear negatives have been evident in terms of the HSI, which is off by over 2% at this stage. The HS Chine Enterprise Index is slightly worse, -2.30%. Xpeng weakness has weighed, with the company's earnings guidance reportedly disappointing the market.

- Mainland China shares also continue to track lower, unable to sustain any upside momentum, the CSI 300 sitting -0.50% weaker at this stage. Northbound stock connect outflows are -5.73bn yuan so far.

- Positive tech/chip sentiment is evident for the Taiex, up around 0.80% at this stage. The Nikkei 225 is around 0.50% firmer, but the Topix is down slightly. Chip stocks in South Korea are also higher, but not enough to drive the aggregate market higher, the Kospi last -0.50%.

- Markets are mostly weaker in SEA, although Thai shares are close to flat, while Indian stocks have opened up in modestly positive territory.

FOREX: Greenback Firmer In Asia, Fitch Places US On Negative Rating Watch

The greenback is firmer in Asia today, BBDXY is up ~0.2%. Fitch has put the US on negative ratings watch as the deadline for an increase in the debt ceiling approaches. US Tsy released a statement noting that the Fitch report shows the swift need for bipartisan action. They also said that brinkmanship over the debt limit does serious harm to business, raises short term borrowing costs and threatens the credit rating of the US.

- Kiwi is pressured and is the weakest performer in the G-10 space at the margins, NZD/USD has extended yesterday's post-RBNZ losses and is down a further 0.4% today. We currently sit a touch above year to date lows.

- AUD/USD is down ~0.2%, the low from May 24 ($0.6532) has been broken. The next downside support is at $0.6403 76.4% retracement of the Oct-Feb bull cycle.

- Yen is marginally pressured, USD/JPY is ~0.1% firmer. Wednesday's highs have been breached and we sit at the highest level since late November.

- Elsewhere in G-10, EUR and GBP are both ~0.2% lower.

- Cross asset wise; US Equity Futures are higher, e-minis up ~0.4% NASDAQ up 1.4% after Nvidia, the world's most valuable chipmaker, rose 26% after demand for AI buoyed its sales forecast. 2 Year US Treasury Yields are ~3bps higher.

- In Europe today we have the final read of German GDP, further out a slew of US data crosses including Q1 GDP, Initial Jobless Claims and Pending Home Sales.

OIL: Crude Currently Supported By Saudi Comments & US Stock Drawdown

Oil prices have been zig-zagging sideways in a narrow range during APAC trading today after rising around 2% on Wednesday. WTI is down 0.2% to $74.20/bbl, while Brent is fairly steady around $78.32. Crude has been supported by a sharp drawdown in US stocks despite the lack of a debt-ceiling deal and Fitch announcing today that the US was on negative credit watch as a result. The USD index is up 0.2%.

- The Fed is currently expected to be on hold at its June 14 meeting but a number of Fed officials are still sounding hawkish and warning that inflation has not yet been contained.

- OPEC+ meets over the June 3-4 weekend and while the Saudi energy minister warned that speculators should “watch out’, many analysts still think that the group will leave their output quota unchanged. But there is a risk of another cut.

- Fed’s Barkin and Collins speak later. There are also revised US and German Q1 GDP data, and US jobless claims and Chicago/Kansas Fed indices.

GOLD: Holding At Six-Week Lows

Gold remains relatively unchanged in the Asia-Pacific session, holding steady after experiencing a 0.9% decline on Wednesday, with prices closing at 1957.16, slightly above the six-week low.

- After tumbling last week to the lowest since early April, bullion has been trading in a tight range as investors wait for more clarity on the debt-ceiling standoff and the Federal Reserve’s rate path.

- There was no progress in resolving the US debt impasse on Wednesday.

- Bullion is facing headwinds from growing bets on another Federal Reserve rate hike this year. The release of the minutes from the May FOMC meeting revealed a division among officials regarding their support for further interest rate hikes, emphasising the importance of maintaining flexibility. A tighter monetary policy tends to undermine the non-yielding asset.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/05/2023 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/05/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 25/05/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 25/05/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 25/05/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/05/2023 | 0900/1100 |  | EU | ECB de Guindos Presents ECB Annual Report 2022 | |

| 25/05/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/05/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 25/05/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 25/05/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/05/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 25/05/2023 | 1230/0830 | *** |  | US | GDP |

| 25/05/2023 | 1350/0950 |  | US | Richmond Fed's Tom Barkin | |

| 25/05/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 25/05/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 25/05/2023 | 1430/1030 |  | US | Boston Fed's Susan Collins | |

| 25/05/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 25/05/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/05/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/05/2023 | 1630/1730 |  | UK | BOE Haskel Speech at Peterson Institute | |

| 25/05/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.