-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Tokyo CPI Surprises On The Upside, As BoJ Meeting Comes Into View

EXECUTIVE SUMMARY

- US CARRIES OUT STRIKES AGAINST IRANIAN TARGETS IN SYRIA - PENTAGON - RTRS

- JAPAN OCT TOKYO CORE CPI RISE 2.7% VS. SEPT 2.5% - MNI BRIEF

- CHINA TO PUSH FOR FORMAL BELT & ROAD STRUCTURE - MNI

- CHINA, U.S. DISCUSS CURRENCY, FINANCIAL STABILITY - MIN BRIEF

- CPI BAKES IN RBA NOVEMBER RATE RISE - EX STAFF - MNI

- CHILE CUTS RATES LESS THAN EXPECTED, FLAGS GEOPOLITICAL RISKS - RTRS

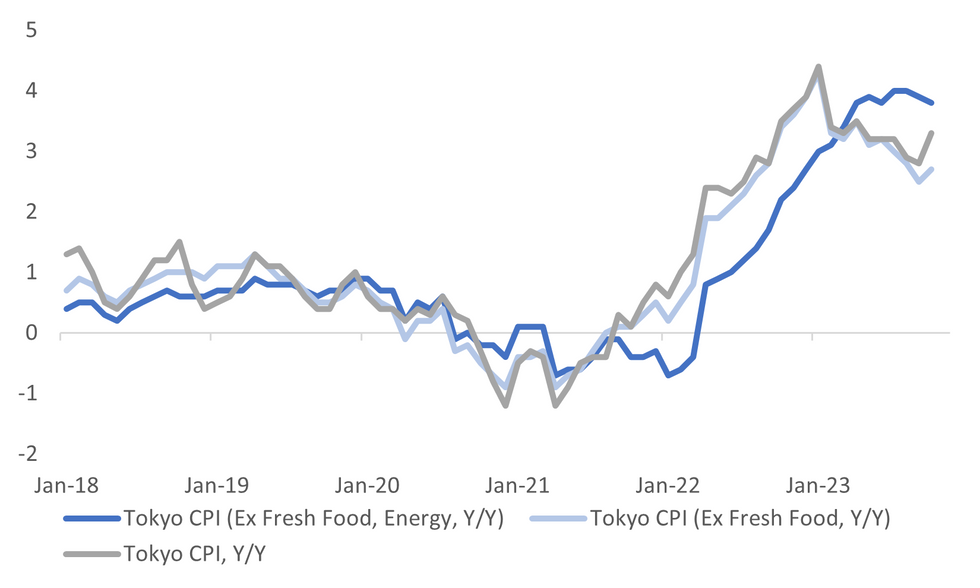

Fig. 1: Tokyo Headline & Core CPI Trends Pick Up In October

Source: MNI - Market News/Bloomberg

U.K.

BOE (BBG): Bank of England Deputy Governor Jon Cunliffe said the UK will probably need to produce a digital version of the pound in the coming years to maintain its involvement in the money people use every day.

EUROPE

EU/ISRAEL (BBG): European Union leaders agreed to call for humanitarian corridors and breaks in the Israel-Hamas war to ensure aid reaches Gaza, after five hours of wrangling.

GEOPOLITICS (BBG): Serbia and Kosovo were told to dial back mounting tensions during a meeting with the leaders of Germany, France and Italy on the sidelines of a European Union summit in Brussels.

UKRAINE (RTRS): Newly elected U.S. Speaker of the House Mike Johnson said on Thursday that funding to support Ukraine and Israel should be handled separately, suggesting he will not back President Joe Biden's $106 billion aid package for both countries.

U.S.

MIDEAST (RTRS): The U.S. military on Thursday carried out strikes against two facilities in eastern Syria used by Iran's Islamic Revolutionary Guard Corps and groups it backs, the Pentagon said, in response to a spate of attacks against U.S. forces in both Iraq and Syria.

MIDEAST (WAPO): President Biden faces mounting pressure to strike Iranian proxies that have repeatedly attacked — and injured — U.S. troops in Iraq and Syria this month, but he is weighing any decision to retaliate against his broader concern that the war in Gaza could be on the precipice of erupting into a region wide tempest, according to U.S. officials and others familiar with the administration’s deliberations.

POLITICS (RTRS): Republicans in the U.S. House of Representatives on Thursday were debating their next move on how to avert a partial government shutdown next month, with one prominent lawmaker saying they needed to agree quickly on a "path forward."

ECONOMY (BBG): Treasury Secretary Janet Yellen said the surge in longer-term bond yields in recent months is a reflection of a strong US economy, not the jump in government borrowing driven by a widening fiscal deficit.

US/CHINA (BBG): Treasury Secretary Janet Yellen said that the US relationship with China is in a more positive place now after a “dangerous” period when there were about two years of little contact between senior officials of the world’s top two economies.

CORPORATE (BBG): Intel Corp. surged in late trading after predicting a return to sales growth in the fourth quarter, fueled by an improving personal computer market and a more competitive product line.

CORPORATE (BBG): Amazon.com Inc. Chief Executive Officer Andy Jassy gave investors much of what they wanted this earnings season: robust sales and profit growth along with a hint that the cloud division earnings machine is regaining momentum.

OTHER

IRAN (BBG): Iran’s foreign minister warned that the US won’t escape unaffected if the Hamas-Israel war turns into a broader conflict, firing back after the Biden administration said Iran was ultimately to blame for a recent spate of drone attacks on American forces.

JAPAN (MNI BRIEF): The y/y rise in the Tokyo core inflation rate accelerated to 2.7% in October from September’s 2.5% due to slower negative contributions from energy and solid food prices excluding perishable food, for the first rise in four months, data from the Ministry of Internal Affairs and Communications showed on Friday.

AUSTRALIA (MNI): This week’s higher inflation figures will force the Reserve Bank of Australia to steepen its forecasts for the projected path of prices and to hike the cash rate a further 25bp to 4.35% at its Nov 7 meeting, former RBA staff and advisors told MNI.

NEW ZEALAND (RTRS): Consumer confidence in New Zealand rose in October but more remained wary about purchasing major household items, the best retail indicator, ANZ-Roy Morgan data showed on Friday.

THAILAND (BBG): Thailand’s economic expansion is set to gather pace next year with a rebound in exports, tourism and domestic consumption, the nation’s finance ministry said Friday after it slashed its estimate for GDP growth this year citing sluggish trade.

CHILE (RTRS): Chile's central bank cut its benchmark interest rate on Thursday by 50 basis points to settle at 9.00% in a unanimous decision, as the South American nation's monetary authority sees inflation pressures easing.

CHINA

POLITICS (MNI BRIEF): Former Chinese Premier Li Keqiang has died at the age of 68, China Xinhua News Agency has reported.

BELT & ROAD (MNI): China wants eventually to develop its Belt and Road Initiative into a common market, with shared external tariffs, starting with framework treaties to open up trade further in a similar pattern to that followed by ASEAN, a leading Chinese international affairs expert told MNI.

POLICY (CSJ): The People’s Bank of China will likely cut the reserve requirement ratio in Q4 to create a suitable liquidity environment for government bond issuance. Net government bond financing in Q4 will increase by about CNY1.5 trillion compared to the same period last year, after Beijing announced plans to issue an additional CNY1 trillion in treasury bonds this week.

BONDS (21st Century Business): The issuance of local government bonds reached CNY8.2 trillion as of October 25, breaking through the CNY8 trillion mark for the first time. Annual issuance will likely exceed CNY8.5 trillion as local authorities issue more special refinancing bonds. The borrowers began to issue special refinancing bonds in October, which have reached CNY840 billion as of Wednesday, to swap out high-interest off-balance-sheet debts and repay arrears. The balance of local government statutory debt is close to CNY40 trillion, with the debt ratio exceeding the warning level.

ECONOMY (21st Century Business): China’s economic high frequency data has shown recent improvement with the market expecting a stronger recovery in Q4 following the government's recent announcement of new treasury bonds, according to the 21st Century Herald.

EQUITIES (BBG): Another 10% decline in a major Chinese equity gauge may trigger a wave of selling in index futures tied to structured products, adding fresh risks to the slumping stock market.

US/CHINA (MNI BRIEF): China and the U.S. had a “professional, pragmatic, candid and constructive” communication at the first meeting of a new financial working group on Wednesday, where currency and financial stability, supervision, and regulation were discussed, the People’s Bank of China said in a statement on Friday.

PROFITS (BBG): China’s industrial companies saw profits rise in September for a second straight month, in a further sign that policy support is helping the manufacturing sector recover.

CHINA MARKETS

MNI: PBOC Drains Net CNY329 Bln Via OMO Fri; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY499 billion via 7-day reverse repo on Friday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY329 billion after offsetting the maturity of CNY828 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0455% at 10:14 am local time from the close of 2.1278% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 44 on Thursday, compared with the close of 39 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1782 Friday vs 7.1784 Thursday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1782 on Friday, compared with 7.1784 set on Thursday. The fixing was estimated at 7.3111 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND OCT ANZ CONSUMER CONFIDENCE INDEX 88.1; PRIOR 86.4

NEW ZEALAND OCT ANZ CONSUMER CONFIDENCE M/M 2.0; PRIOR 1.6%

JAPAN OCT TOKYO CPI Y/Y 3.3%; MEDIAN 2.8%; PRIOR 2.8%

JAPAN OCT TOKYO CPI EX-FRESH FOOD Y/Y 2.7%; MEDIAN 2.5%; PRIOR 2.5%

JAPAN OCT TOKYO CPI EX-FRESH FOOD, ENERGY Y/Y 3.8%; MEDIAN 3.7%; PRIOR 3.9%

AUSTRALIA Q3 PPI Q/Q 1.8%; PRIOR 0.5%

AUSTRALIA Q3 PPI Y/Y 3.8%; PRIOR 3.9%

CHINA SEP INDUSTRIAL PROFITS Y/Y 11.9%; PRIOR 17.2%

CHINA SEP INDUSTRIAL PROFITS YTD Y/Y -9.0%; PRIOR -11.7%

MARKETS

US TSYS: Marginally Cheaper In Asia

TYZ3 deals at 106-08+, -0-02+, a 0-05 range has been observed on volume of ~84k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Tsys have observed narrow ranges in Asia today, there was a brief move lower in early dealing. There was no headline driver as participants perhaps focused on Thursday GDP print.

- The move lower didn't follow through and Tsys dealt in narrow ranges for the remainder of the session.

- In Europe today the docket is thin, further out we have US PCE deflator, personal spending and income and University of Michigan consumer sentiment.

JGBS: Futures At Session Highs Despite Tokyo CPI Beat, BOJ Policy Decision On Tuesday

JGB futures are richer and at session highs, +21 compared to settlement levels, after initially cheapening on the back of higher-than-expected Tokyo CPI data.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Tokyo October CPI data.

- Bloomberg reports that Japan’s life insurers plan to boost holdings of unhedged foreign debt while approaching purchases of yen-denominated bonds with caution as they seek clarity on when the central bank may adjust policy. (See link)

- The cash JGB curve has slightly twist-flattened, pivoting at the 5s, with yields 0.7bp higher to 1.5bps lower. The benchmark 10-year yield is 0.4bp lower at 0.871%, above BOJ's YCC soft limit of 0.50% but below its hard limit of 1.0%. It is also lower than the cycle high of 0.892% set yesterday.

- Swap rates are also slightly mixed, with swap spreads mixed.

- On Monday, the local calendar sees Jobless Rate, Retail Sales, Dept. Store and Supermarket Sales and Industrial Production data, along with 2-year supply.

- The BOJ’s Policy Decision is due on Tuesday, with the prevailing consensus anticipating that the BOJ will uphold its existing policies. In a Reuters survey of economists conducted between October 17-25, 25 out of 28 economists expected no change in policy.

AUSSIE BONDS: Richer, Narrow Ranges, Retail Sales On Monday

ACGBs (YM +4.0 & XM +7.5) are richer, mid-range, after subdued dealings in the Sydney session. With the domestic data docket light today (Q3 PPI the only release), local participants have been on headlines and US tsys watch. US tsys ~1bp cheaper in today’s Asia-Pac session, after yesterday’s strong rally.

- Cash ACGBs are 4-7bps richer, with the AU-US 10-year yield differential 4bps higher at -6bps.

- Swap rates are 2-6bps lower, with the 3s10s curve flatter.

- The bills strip is slightly richer, with pricing flat to +3.

- RBA-dated OIS pricing is 1-4bps softer across meetings. The market currently attaches a 67% chance of a 25bp hike at November’s policy meeting. Terminal rate expectations sit at 4.45%, the highest level since late July.

- Next week, the local calendar sees Retail Sales on Monday, followed by Private Sector Credit, CoreLogic House Prices and Judo Bank PMIs on Tuesday.

- On Wednesday, the AOFM plans to sell A$800mn of the 4.50% Apr-33 bond.

- AFR reports that “Investments managed by the Future Fund slid a half percentage point in the September quarter to $205.2 billion as Australia’s sovereign wealth fund readied itself for further inflation and the potential for the Middle East conflict to escalate into a regional war.” (See link)

NZGBS: Slightly Richer, Close At Cheaps, Heavy Local Calendar Next Week

NZGBs closed flat to 2bps richer after dealing in relatively narrow ranges for today’s local session. Nevertheless, NZGBs did close at or near session cheaps.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined ANZ consumer confidence data. To recap, ANZ believed the survey was “another mixed bag for the RBNZ - willingness to spend is low, as the RBNZ requires, but consumers’ inflation expectations are still inconsistent with the inflation target, and there hasn’t been much progress on that front in recent months.''

- Swap rates closed flat to 2bps lower, with the 2s10s curve steeper. The implied swap spread box steepened by 4bps.

- RBNZ dated OIS pricing closed flat to 2bps softer across meetings, with terminal OCR expectations at 5.61%.

- Looking ahead to next week, the local calendar presents a rather light schedule on Monday, with Building Permits and ANZ Business Confidence set for Tuesday. Wednesday is expected to bring significant releases, featuring CoreLogic House Prices, Employment, and Wages data, along with the publication of the RBNZ's Financial Stability Report.

- Next Thursday, the NZ Treasury plans to sell NZ$225mn of the 4.5% May-30 bond, NZ$175mn of the 4.25% May-34 bond and NZ$100mn of the 2.75% May-51 bond.

USD Marginally Lower In Asia

The greenback ticked lower in Asia on Friday, BBDXY is down ~0.1%. US Equity Futures have pared some of Thursday's losses, e-minis are up ~0.5%, and US Tsy Yields are a touch firmer.

- The AUD is leading the bid in the G-10 space, AUD/USD is up ~0.2% at $0.6335/40. Technically The bearish outlook for AUD/USD is intact, support comes in at $0.6270 the Oct 26 low and key support. Resistance is at $0.6414, 50-Day EMA.

- Kiwi is little changed today, a narrow $0.5820/30 range has persisted for the most part. AUD/NZD has ticked higher, the pair continues to consolidate between the 200-Day EMA and the $1.09 handle.

- Yen is a touch firmer today. The uptrend remains intact, resistance now comes in at ¥151.09, 2.674 proj of the Jul 14-21-28 price swing. Support is at ¥149.37, the 20-Day EMA.

- Elsewhere there have been little moves of note in G-10 space.

- The docket is light in Europe today.

EQUITIES: Sentiment More Positive, Aided By Nasdaq Future Gains

Regional equities are mostly higher in Asia Pac Friday trade to date. All the major indices are firmer, albeit away from best levels. Some parts of SEA are tracking weaker though (Philippines and Thailand). Weakness in Thursday US and EU cash trading has been offset by a better tone to US futures today, led by Nasdaq gains (0.80%). Eminis are also higher, last near 4180, +0.55% for the session.

- Better momentum for Amazon and Intel who posted positive earnings updates in late in US trade on Thursday has aided the futures backdrop.

- Japan's Nikkei 225 is +1.2% higher, the Topix near +1.1% firmer. The electrical appliances sector is leading gains, while BBG notes Japan equity short bets may be close to a peak (see this link).

- Other markets in NEA are more muted. The Kospi opened higher, but is now back to flat. Foreign selling continues to outpace institutional and retail buying. The Taiex is around 0.50% higher.

- In Hong Kong the HSI is up 1% at the break, while the CSI 300 also continues to firm, up 0.60%.

- In SEA, the Philippines PCOMP is off a further 0.80% to sub 6000. Fallout from yesterday's off-cycle rate hike weighing. In Thailand, the MoF has revised down its 2023 growth forecast to 2.7% (from 3.5%, RTRS), with the SET down by around 0.30% at this stage.

OIL: Benchmarks Recoup Some Of Thursday's Losses

Brent crude has spent most of the session tracking higher, last just above $89/bbl. This puts us +1.25% above Thursday closing levels in NY. We are still tracking comfortably lower for the week, at this stage -3.40%. The WTI benchmark has tracked a similar trajectory, last near $84.30/bbl, but this benchmark is down a little over 5% for the week.

- Oil's rise today is line with a firmer risk-on tone in other asset markets. Most notably US equity futures are higher, led by better earning results in the tech space. The USD is also down a touch.

- In the Middle East, the US military struck two targets in Syria in response to earlier attacks on US military personnel in both Iraq and Syria. The targets were linked to Iran, but the US stated they weren't linked to the Israel/Hama conflict.

- Iran stated the US won't be spared if the Israel-Hamas conflict spreads (see this BBG link for more details).

- Still, concerns around a wider Middle East conflict, coupled with tight supply, have been overshadowed this week by a firmer USD/weaker equity backdrop, which has driven oil benchmarks to weekly losses.

GOLD: Thursday’s Gains Supported By The Middle East Conflict, A Weaker USD & Lower US Yields.

Gold is +0.2% in the Asia-Pac session, after closing 0.25% higher at $1984.71 on Thursday.

- This precious metal rebounded from a low of $1,971.87, driven by a weakening USD.

- Furthermore, gold continues to reap the benefits of the ongoing Middle East conflict, although the somewhat erratic trading in US Treasuries has added a level of uncertainty to the outlook.

- However, on Thursday, we observed a significant decline in yields across the US Treasury curve following the release of the latest round of US data. Participants appeared to focus on the weaker-than-forecast Core PCE Price Index (+2.4% q/q versus +2.5% est. and +3.7% prior) and Jobless Claims (210k versus 207k est. and 198k prior), which were at their highest in 5 months.

- Additional support was seen in the US Treasury space after solid demand metrics for the latest 7-year auction.

- Resistance for bullion is seen at $1997.2 (Oct 20 high), according to MNI’s technicals team.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/10/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 27/10/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 27/10/2023 | 0700/0900 | *** |  | ES | GDP (p) |

| 27/10/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/10/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/10/2023 | - |  | EU | ECB's Lagarde Participates in Euro Summit | |

| 27/10/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 27/10/2023 | 1300/0900 |  | US | Fed's Michael Barr | |

| 27/10/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 27/10/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.