-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: Trouble On The U.S. Fiscal Front?

EXECUTIVE SUMMARY

- U.S. SENATE PARLIAMENTARIAN: RECONCILIATION CAN BE USED TO PASS LEGISLATION (RTRS)

- FED'S MESTER LAUDS JOBS REPORT, BUT SAYS LOOSE POLICY IS STAYING PUT (CNBC)

- JOHNSON EASES LOCKDOWN BUT FOREIGN TRAVEL ON HOLD FOR UK (BBG)

- CHINA IS SAID TO ASK BANKS TO CURTAIL CREDIT FOR REST OF YEAR (BBG)

- YIELDS TO SUPPORT YUAN, VOLATILITY AHEAD (MNI)

- RBA LEAVES POLICY SETTINGS UNCHANGED

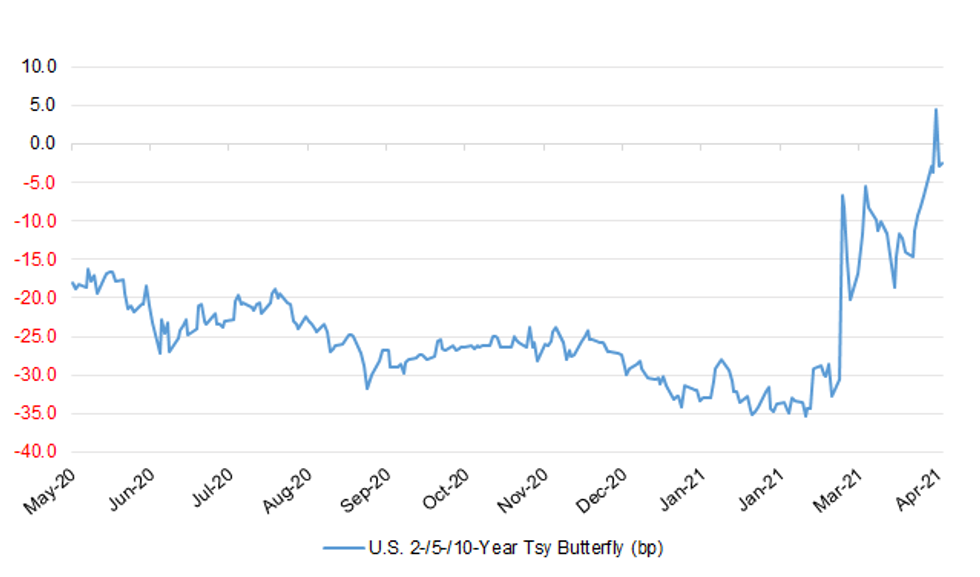

Fig. 1: U.S. 2-/5-/10-Year Tsy Butterfly (bp)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: U.K. Prime Minister Boris Johnson confirmed restaurants, pubs and shops will open again as England's lockdown is eased next week, but the ban on foreign travel may remain for longer. The earliest date for resuming non-essential international travel will be May 17 and officials warned Monday that a further delay could be required if coronavirus infections continue to surge elsewhere in the world. A decision will be taken nearer the time, they said. "We can't be complacent -- we can see the waves of sickness afflicting other countries, and we've seen how this story goes," Johnson said at a press conference in London on Monday. "We still don't know how strong the vaccine shield will be when cases begin to rise, as I'm afraid that they will." (BBG)

CORONAVIRUS: Leading travel industry figures have reacted with dismay to Boris Johnson's latest comments on the lockdown roadmap, saying they need more clarity. The prime minister said he was "hopeful" that foreign travel could begin again on 17 May. But he said more data was needed before a firm decision could be taken. The British Travel Association said the announcement was "beyond disappointing" and called for "a clear pathway to international travel and trade". Its chief executive, Clive Wratten, said moves to open borders had "once again been kicked down the road". "The business travel industry continues to be crippled by today's lack of movement," he added. (BBC)

CORONAVIRUS: The final step in the U.K.'s plan to reduce Covid-19 restrictions could lead to a surge in infections and deaths that would rival the country's first wave, government advisers said in a report. Step 4 of the U.K.'s road map for easing pandemic restrictions, in which most limits on social contact would be removed, might lead to a situation at least as severe as the country's post-holiday surge in January, researchers from the London School of Hygiene & Tropical Medicine said in advice to the government that they cautioned was preliminary. Step 4 is seen coming no earlier than June 21. (BBG)

FISCAL: Britain will on Tuesday launch a government-backed loan scheme to help companies access finance as the economy reopens from a strict lockdown, offering maximum loans of 10 million pounds ($14 million). Finance minister Rishi Sunak said the loans, ranging from 25,001 pounds to 10 million, would replace existing COVID-19 programmes and be on top of a grant scheme that has been launched to help companies restart trading. The scheme will be administered by the British Business Bank, with loans available through commercial lenders and the government providing an 80% guarantee. It will run until the end of this year and interest rates will be capped at 14.99%. (RTRS)

FISCAL: The government of Prime Minister Boris Johnson is resisting requests for a UK bailout of struggling train operator Eurostar, with ministers insisting that the company should look to its shareholders to ease its plight. Eurostar is at risk of bankruptcy following a collapse in revenue after passenger numbers plunged during the pandemic. UK ministers are said to be taking a tough line. One UK official briefed on the situation said: "The tunnel and the rolling stock are there. Someone would take them on, even if the company went to the wall. There's no appetite for bailing them out at all." (FT)

ECONOMY: A plan by Britain's finance minister Rishi Sunak to use a two-year "super-deduction" tax break to encourage companies to invest appears to be working, according to a manufacturing survey. Make UK said almost a quarter of the companies they survey plan to increase investment as a direct response to the policy while more than a quarter plan to bring forward their investment plans. The incentive was also seen by almost a third of the 149 companies that were surveyed as the measure that had made the most impact in Sunak's March annual budget speech. "The budget has made a clear impact on manufacturers in terms of confidence and they are stepping up their plans to invest in response," Verity Davidge, Director of Policy at Make UK, said. (RTRS)

POLITICS: Boris Johnson is on course for a decisive victory over Labour in the Hartlepool by-election, according to a new poll that raises more questions about Sir Keir Starmer's electoral strategy. The first poll in what had been an impregnable Labour stronghold, which elects a new MP a month from today, suggests that the Conservatives have already opened up a seven-point lead over the opposition and are set to win with nearly half of the vote. It has renewed tension between Starmer and the big unions, one of whose leaders calls the Labour leader "an irrelevance" to working-class voters in seats such as Hartlepool. (The Times)

EUROPE

FRANCE: Contaminations in France's latest Covid-19 wave could peak as early as this week, Health Minister Olivier Veran said. This means that the number of patients admitted to intensive care units may be at a high in two weeks' time and close to the peak of the pandemic's first wave a year ago, Veran said Monday in an interview with TF1 TV channel. The pace of vaccinations suggests that all those who want a shot will have received one by early summer, after which the government will have to convince vaccine-skeptics of receiving their jabs, Veran said. French President Emmanuel Macron has pledged that all willing adults will be vaccinated by the end of the summer. (BBG)

FRANCE: The board of Air France-KLM approved an aid package aimed at strengthening the indebted carrier's balance sheet, according to people familiar with the matter. The plan will be unveiled early Tuesday, said the people, who asked not to be named because the information isn't public. The funding includes the conversion of government loans into hybrid bonds and raising fresh equity, one of the people said. A spokeswoman for the company declined to comment. (BBG)

EQUITIES: Credit Suisse Group AG will on Tuesday detail losses from its relationship with Archegos Capital Management LP after dumping over $2 billion worth of stock to end exposure to the troubled investor, two sources familiar with the matter said. The episode, which analysts have said could cost the Swiss bank several billion dollars, is also expected to result in the departures of Chief Risk Officer Lara Warner and Brian Chin, the bank's investment banking head, the sources said. Credit Suisse and Archegos declined to comment. Warner and Chin did not respond to requests for comment. The two executives are paying the price for a year in which Credit Suisse's risk management protocols have come under harsh scrutiny, with two major relationships turning sour in quick succession, saddling the bank with what JPMorgan Chase & Co analysts estimate could add up to $7.5 billion. (RTRS)

U.S.

FED: March's strong job gains weren't enough to convince Cleveland Federal Reserve President Loretta Mester that it's time to change monetary policy. The central bank official told CNBC on Monday that she welcomed news that nonfarm payrolls rose 916,000 for the month, thanks to a surge in leisure and hospitality jobs as well as a jump in government and construction hiring. But the Fed remains committed to keeping rates low until the employment picture brightens considerably, she added. "I'm thinking that we'll see a very strong second half of the year, but we're still far from our policy goals," Mester said during a "Closing Bell" interview. "It was great to see that report. We need more of them coming our way." (CNBC)

ECONOMY: MNI INTERVIEW: ISM Sees Service Inflation Creep Amid Rebound

- U.S. service price increases should continue with labor and material in short supply, ISM survey chair Anthony Nieves told MNI Monday, but some pressure will be released once a rollback of Covid restrictions fuels the birth of new enterprises. The service sector is "starting to see price pressure across the board" and some respondents in the ISM survey "are already categorizing this as strong inflation," Nieves said. "I think it's more of a creeping inflation" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: U.S. Senate parliamentarian has issued an opinion that a revised budget resolution may contain budget reconciliation instructions, U.S. Senate Democratic leader Chuck Schumer's spokesman said in a statement on Monday. Spokesman Justin Goodman, who called the parliamentarian's opinion "an important step forward," said no decisions had been made on whether Democrats will use the procedural tool, which allows legislation to pass by a simple majority, avoiding the Senate's usual 60-vote threshold. (RTRS)

FISCAL: President Joe Biden said Monday that he is not worried that a plan to increase corporate America's tax bill would dampen the U.S. economy as it emerges from the Covid-19 pandemic. Asked whether he is concerned that the White House plan to raise the corporate rate to 28% could harm an already-fragile recovery, Biden replied "not at all." (CNBC)

FISCAL: Centrist Sen. Joe Manchin (D-W.Va.), who has emerged as a powerbroker in the 50-50 Senate, said President Biden's $2.25 trillion infrastructure proposal needs changes and that raising the corporate tax rate to 28 percent goes too far. Manchin said Monday he would instead support raising the corporate tax rate to 25 percent, a level he identified last month as something he could back. "As the bill exists today, it needs to be changed," Manchin told Hoppy Kercheval, the host of West Virginia Metro News's "Talkline" show. "If I don't vote to get on it, it's not going anywhere," he added. (The Hill)

FISCAL: White House press secretary Jen Psaki said Monday the president is ready to negotiate with Manchin and other senators on how to pay for his ambitious infrastructure proposal."He knows some will come forward with different ways to pay for this package, and some may have views that it shouldn't be paid for at all," Psaki said, noting that Biden is aware of the different views within the Democratic caucus on how or whether to pay for the infrastructure plan. (The Hill)

CORONAVIRUS: White House chief medical advisor Dr. Anthony Fauci warned Monday that Americans should continue to be vigilant and adhere to public health measures as warmer summer months approach. "You might remember a little bit more than a year ago when we were looking for the summer to rescue us from surges. It was, in fact, the opposite," Fauci said during a White House coronavirus briefing. "We saw some substantial surges in the summer. I don't think we should even think about relying on the weather to bail us out of anything we're in right now," he added. (CNBC)

CORONAVIRUS: President Joe Biden's administration is working with AstraZeneca Plc to find new manufacturing capacity in the U.S. after the company agreed to abandon a Baltimore Covid-19 vaccine plant that will focus exclusively on making doses for Johnson & Johnson. The talks are the latest development after an error at the Emergent BioSolutions Inc. facility -- in which ingredients for the two companies' vaccines were mixed up -- led to a batch of 15 million doses worth of drug substance being spoiled. (BBG)

CORONAVIRUS: New Jersey will open Covid-19 vaccinations to people 16 and older starting April 19, Governor Phil Murphy will announce Monday. The state had said all adults would be eligible for the shot by May 1, in line with a goal set by President Joe Biden for universal adult eligibility. But other states, including neighboring New York and Connecticut, announced earlier eligibility dates as vaccine supply began ramping up. (BBG)

CORONAVIRUS: Everyone age 16 and up became eligible for the COVID-19 vaccine in Wisconsin on Monday, the same day that an outbreak of a more contagious variant of the coronavirus was reported at a Dane County child care center and positive cases statewide continued to increase. (AP)

CORONAVIRUS: Maryland Governor Larry Hogan said all residents 16 and older will be able to get a shot beginning Tuesday at any of the state's mass vaccination sites. By April 12, everyone 16 and over will be eligible for a vaccine from all providers, the governor's spokeswoman Kata Hall said on Twitter. (BBG)

CORONAVIRUS: Gayle Smith, a former U.S. Agency for International Development administrator and chief executive officer of the ONE Campaign to eradicate preventable disease, was named the coordinator for global Covid response and health security at the U.S. State Department. Smith, who helped lead the Obama administration's response to the Ebola outbreak in 2014, was introduced Monday by Secretary of State Antony Blinken. (BBG)

EQUITIES: EQUITIES: Credit Suisse Group AG unloaded about $2.3 billion worth of stocks tied to the Archegos Capital blowup more than a week after some rivals dumped their shares and skirted losses. The Swiss bank hit the market with block trades tied to ViacomCBS Inc., Vipshop Holdings Ltd. and Farfetch Ltd., a person with knowledge of the matter said. The stocks traded substantially below where they were last month before Bill Hwang's family office imploded. Shares in the three companies declined in postmarket trading, as did U.S.-listed shares of Credit Suisse. (BBG)

EQUITIES: Credit Suisse will announce the departure of two senior executives and detail how much it expects to lose through its exposure to family office Archegos in an investor update Tuesday, sources familiar with the matter said. The Swiss bank will say that Chief Risk Officer Lara Warner and Brian Chin, CEO of its investment bank, will leave the bank, the sources said on Monday. (RTRS)

OTHER

U.S./CHINA: China needs to manage any political friction with U.S.-led allies and not let it develop into stronger economic opposition, the state-run newspaper Global Times said in an editorial. Beijing should calibrate its actions more effectively to avoid stoking U.S. allies joining its anti-China policy, the newspaper said. A new cold war will be unlikely as long as China opposes the decoupling of the world economy, said Global Times. MNI notes that Chinese state media last month advocated boycotts against Western apparel makers including H&M and Nike for barring the use of Xinjiang cotton. The Times editorial, published under the official People's Daily, appears to be attempting to dampen the fervor. (MNI)

TAIWAN/CHINA: A Chinese carrier group is exercising near Taiwan and such drills will become regular, China's navy said late on Monday in a further escalation of tensions near the island that Beijing claims as its sovereign territory. Taiwan has complained of an increase in Chinese military activity near it in recent months, as China steps up efforts to assert its sovereignty over the democratically run island. China's navy said the carrier group, lead by the Liaoning, the country's first aircraft carrier put into active service, was carrying out "routine" drills in the waters near Taiwan. The aim is to "enhance its capability to safeguard national sovereignty, safety and development interests", it added. (RTRS)

RBA: Australia's central bank kept its key policy instruments unchanged Tuesday following the cooling of a global bond selloff and as the impact of record-low interest rates on asset markets comes into focus. Reserve Bank of Australia Governor Philip Lowe and his board held the cash rate and three-year yield target at 0.10% and made no changes to the longer-dated bond-buying program. The central bank on Friday releases its semi-annual financial stability review that's likely to hone in on lending and housing. "Given the environment of rising housing prices and low interest rates, the bank will be monitoring trends in housing borrowing carefully," Lowe said in a statement. "It is important that lending standards are maintained." (BBG)

AUSTRALIA/NEW ZEALAND: New Zealand Prime Minister Jacinda Ardern has announced quarantine-free travel between New Zealand and Australia is set to commence from 11:59pm Sunday April 18. Ms Ardern said New Zealand would manage the travel bubble by effectively considering Australia another region, albeit a more complicated one. Outbreaks would see restrictions be reinstated on a state-by-state basis. Ms Ardern gave hypothetical scenarios to demonstrate what this would mean: "For instance, if a case is found that is quite clearly linked to a border worker in a quarantine facility and is well contained, you'll likely see travel continue in the same way as you could see life continue if that happened here in Australia. "If, however, a case was found that was not clearly linked to the border, and a state responded by a short lockdown to identify more information, we'd likely pause flights from that state in the same way we would stop travel into and out of a region in New Zealand as if it was were going into a full lockdown. "And if we saw multiple cases of unknown origin, we would likely suspend flights for a set period of time." (ABC)

NORTH KOREA: Japan is closely monitoring reports that North Korea will stay away from this year's Tokyo Olympics because of the virus pandemic, Chief Cabinet Secretary Katsunobu Kato said Tuesday. Japan will work to create the environment for a lot of countries to take part in the Games. Cabinet decided to extend Japan's sanctions on North Korea for another two years. Every country has responsibility to protect human rights; goal of policies is to achieve improvement in human rights situation. (BBG)

TURKEY: Turkey's President Recep Tayyip Erdogan on Monday said that a joint statement by roughly 100 retired admirals appeared to incite a coup against his government. "It is out of the question to accept 104 retired admirals to come together and issue a midnight statement in a country with a past full of coups and ultimatums," Erdogan said Monday. "This can't be called free speech. It is regarded as an attack on democracy, the rule of law and will of the nation." (BBG)

MEXICO: Mexico's government said on Monday it reached a deal with business and labor representatives on a new legal framework for subcontracting staff that would boost profit sharing for workers and allow only specialized services to be outsourced. In a statement, the government said the deal set out a new formula that would increase workers' profit sharing by 156% and eliminate discretionality in how it was applied. Under the accord, subcontracting staff would be prohibited in general, but regulations would be created to allow work to be subcontracted provided it was for "specialized services" outside a company's main line of business, the government said. (RTRS)

BRAZIL: Brazil's Economy Minister Paulo Guedes said on Monday he expects the impasse surrounding this year's federal budget to be resolved "well before" the official April 22 deadline, and dismissed the recent controversy surrounding it as "noise". Guedes said in an online event hosted by XP Investimentos and Infomoney that excesses in the budget, which was approved by Congress but is now being revised, have to be removed, but insisted he has no issue with Congress and that the political climate is constructive. (RTRS)

BRAZIL: Expectation is 1m people vaccinated daily in April and the number will be 2m in May, Senate President Rodrigo Pacheco said in an interview with CNN. Pandemic scenario for April in Brazil is bad, he said. Functions of governors and mayors are equally important to fight against health crisis. Executive and Legislative should identified a solution to budget issues. Congress wanted a bigger amount for emergency aid, but there was a fiscal difficulty. (BBG)

RUSSIA: The United States finds reports of Russian military movements on Ukraine's border "credible," has asked Moscow to explain the "provocations" and is ready to engage on the situation, the U.S. State Department said on Monday. (RTRS)

SOUTH AFRICA: South Africa has finalized a deal that will see it supplied with 20 million shots of the Covid-19 vaccine produced by Pfizer Inc. and BioNTech SE with deliveries starting mid-April, allowing it to begin a broad roll-out of inoculations, Business Day reported, citing the country's Department of Health. The deal had been delayed by Pfizer's insistence that South Africa's health and finance ministers personally sign the pact, which includes indemnity clauses to protect the company, according to correspondence between the ministers seen by Bloomberg and confirmed by the National Treasury. To date South Africa has inoculated just over a quarter of a million people, all of them health workers, as part of a study being carried out by Johnson & Johnson. That's meant that its fallen behind a number of its emerging market peers as well as other African countries. (BBG)

OIL: Indian state refiners will buy 36% less oil from Saudi Arabia in May than normal, three sources said, in a sign of escalating tensions with Riyadh even after the Kingdom supported the idea of boosting output from OPEC and allied producers last week. Energy relations between India, the world's third biggest oil importer and consumer, and Saudi Arabia have soured as global oil prices spiked. New Delhi blames cuts by the Saudis and other oil producers for driving up crude prices as its economy tries to recover from the pandemic. (RTRS)

CHINA

PBOC: China's central bank asked the nation's major lenders to curtail loan growth for the rest of this year after a surge in the first two months stoked bubble risks, according to people familiar with the matter. At a meeting with the People's Bank of China on March 22, banks were told to keep total advances in 2021 at roughly the same level as last year, said the people, asking not to be identified as the matter is private. Some foreign banks were also urged to rein in new lending through so-called window guidance recently after ramping up their balance sheets in 2020, one of the people said. The comments give further detail to what the central bank stated publicly after the meeting, when it said it asked representatives of 24 major banks to keep loan growth stable and reasonable. In 2020, banks doled out a total of 19.6 trillion yuan ($3 trillion) of credit, with about a fifth directed to inclusive financing such as small business loans. (BBG)

YUAN: MNI EXCLUSIVE: Yields To Support Yuan, Volatility Ahead

- Relatively high Chinese yields and calmer trade relations between Beijing and Washington could still drive the yuan to as high as 6.2 to the dollar this year despite its recent weakness, but a declining yield differential with U.S. Treasuries and a recovering dollar index herald a period of greater volatility, Beijing policy advisors and traders told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: China's first quarter GDP growth may have exceeded an annualized 20% given the rapid growth in investment, consumption and exports, the Shanghai Securities News reported. Retail sales may have jumped 28% y/y, the report said citing Zhu Jianfang, chief economist of CITIC Securities. Fixed-asset investment may ease to 28% from 35% in Jan-Feb, while infrastructure investment is expected to rise, according to Liu Xuezhi of Bank of Communications. The 32.4% jump in exports indicated stronger external demand, the News report said. (MNI)

INFLATION: China's March CPI is predicted to rise 0.4% both month-on-month and year-on-year in March, compared from 0.6%% and -0.2% in February, the Economic Information Daily said citing Li Chao, chief economist of Zheshang Securities. A recovery in travel boosted related industries including aviation, hotel, and tourism, Li Chao told the newspaper. (MNI)

OVERNIGHT DATA

CHINA MAR CAIXIN SERVICES PMI 54.3; MEDIAN 52.1; FEB 51.5

CHINA MAR CAIXIN COMPOSITE PMI 53.1; FEB 51.7

The Caixin China Composite Output Index climbed to 53.1 in March, up 1.4 points from the previous month. The manufacturing and services sectors continued to recover, with the services sector improving more than manufacturing. The employment gauge improved, with services employment performing better than manufacturing. Respondents remained optimistic about the economic outlook for the coming year. However, input costs and output prices remained high, adding to inflationary pressure. To sum up, the economy continued to recover from the epidemic. Supply and demand in the manufacturing and services sectors remained in expansionary territory, though at different paces due to the end of the Covid-19 flare-ups in the fall and the winter. The recovery in manufacturing slowed for the fourth straight month, whereas for services, it expanded at a much faster pace. Consequently, employment in the services sector significantly improved, while the job market in the manufacturing sector remained under clear pressure. More attention still needs to be paid to inflation going forward. Input costs and output prices in the services and manufacturing sectors have been rising for several months, reflecting growing inflationary pressure. This has restricted the room for future policy changes and is not conducive to a sustained economic recovery in the post-epidemic period. (Caixin)

JAPAN FEB LABOUR CASH EARNINGS -0.2% Y/Y; MEDIAN -0.6%; JAN -1.3%

JAPAN FEB LABOUR REAL CASH EARNINGS +0.2% Y/Y; MEDIAN -0.1%; JAN -0.6%

JAPAN FEB LABOUR HOUSEHOLD SPENDING -6.6% Y/Y; MEDIAN -5.0%; JAN -6.1%

MNI DATA IMPACT: Japan Feb Wages Down But Real Pay Positive

Average wages in Japan fell 0.2% y/y in February, recording a 11th straight drop following a 1.3% fall in January. Real wages emerged into positive territory, however, for the first time in 12 months, according to preliminary data released Tuesday by the Ministry of Health, Labour and Welfare. Total monthly average cash earnings per regular employee fell 0.2% y/y to JPY265,972 in February. In real terms, average wages rose 0.2% y/y in February, the first rise in 12 months following a 0.6% decline in January. Total CPI minus impute rents fell 0.5% y/y in February after falling 0.7% in January. Base wages, the key to a steady recovery in cash earnings, rose 0.4% y/y after rising 0.2% in January, for the second straight rise. Overtime pay fell 9.3% y/y in February, widening from -6.6% previously - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA MAR ANZ JOB ADVERTISEMENTS RISE +7.4% M/M; FEB +8.8%

ANZ Australian Job Ads rose 7.4% m/m in March, following an upwardly-revised 8.8% m/m in February. ANZ Job Ads is now at the highest level since November 2008and is pointing to further sharp declines in the unemployment rate. Six months ago, our view was that ANZ Job Ads would need to sustain levels materially higher than pre-pandemic in order to entrench the labour market recovery. ANZ Job Ads has done better than that, now 23% above its pre-COVID level and at a 12-year high. This strength has been reflected in the labour market, with employment close toa record high in February. (ANZ)

CHINA MARKETS

PBOC NET DRAINED CNY10 BLN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. This resulted in a net drain of CNY10 billion on liquidity given the maturity of CNY20 billion repos today, according to Wind Information. The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

PBOC SETS YUAN CENTRAL PARITY AT 6.5527 TUES VS 6.5649 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5527 on Tuesday, compared with the 6.5649 set on Friday.

MARKETS

SNAPSHOT: Trouble On The U.S. Fiscal Front?

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 345.85 points at 29742.03

- ASX 200 up 66.607 points at 6895.3

- Shanghai Comp. down 11.077 points at 3473.315

- JGB 10-Yr future up 12 ticks at 151.17, yield down 1bp at 0.11%

- Aussie 10-Yr future up 4.5 ticks at 98.26, yield down 6.7bp at 1.774%

- U.S. 10-Yr future up 0-07+ at 131-11, yield down 1.41bp at 1.6862%

- WTI crude up $0.35 at $59.00, Gold up $7.03 at $1735.33

- USD/JPY up 1 pip at Y110.18

- U.S. SENATE PARLIAMENTARIAN: RECONCILIATION CAN BE USED TO PASS LEGISLATION (RTRS)

- FED'S MESTER LAUDS JOBS REPORT, BUT SAYS LOOSE POLICY IS STAYING PUT (CNBC)

- JOHNSON EASES LOCKDOWN BUT FOREIGN TRAVEL ON HOLD FOR UK (BBG)

- CHINA IS SAID TO ASK BANKS TO CURTAIL CREDIT FOR REST OF YEAR (BBG)

- YIELDS TO SUPPORT YUAN, VOLATILITY AHEAD (MNI)

- RBA LEAVES POLICY SETTINGS UNCHANGED

BOND SUMMARY: Core FI Firms On U.S. Fiscal Questions

The space has firmed in Asia-Pac hours, T-Notes last +0-08+ at 131-12, with the cash curve bull flattening as 30s richen by ~2.0bp. The space looked through headlines from Senate Democratic Leader Schumer's staff, which noted that the U.S. Senate parliamentarian has issued an opinion that a revised budget resolution may contain budget reconciliation instructions. Democratic Senator Manchin's previously flagged opposition to President Biden's corporate tax proposals negate the viability of the Democrats being able to force the infrastructure legislation through via a 50/50 vote split in the Senate (with Vice President Harris casting the deciding vote in any such instance), with Manchin seemingly pushing for a 25% corporate tax rate vs. Biden's 28% proposal. On the flow side Asia-Pac hours saw a 5.0K block seller of the 1x2 FVM1 123.75/124.00 call strip and FV/US futures steepener block flow (+9.0K vs. -2.5K). Eurodollar futures print unchanged to 2.5 ticks higher through the reds, with a 10K screen lift of EDM2 seen in early Asia dealing. JOLTS job openings, as well as Fedspeak from Richmond Fed President Barkin & Chicago Fed President Evans headline locally on Tuesday.

- JGBs saw a modest bid creep in during early Tokyo trade. Much of the move came before the latest bid in U.S. Tsys, with little local news apparent to drive the uptick, outside of a downtick in local equity indices. Local data was mixed, with household spending missing and labour cash earnings data beating. The latest round of 30-Year supply wasn't the firmest, with local participants likely eying the allure of offshore paper in the early part of the new Japanese FY, although the low price managed to top dealer expectations, while the tail narrowed and cover ratio firmed. Still, the latter continued to operate in the lower confines of the recently observed range, with the March auction providing a particularly low comparative bar. Still, the space has firmed into the close, with futures +13 on the day. The cash curve has bull flattened, with the super-long end looking through the sub-par auction results.

- Aussie bonds have firmed a little in the wake of the latest RBA monetary policy decision, which saw the Bank leave its monetary policy settings unchanged as expected. At first skim it was very matter of fact from the RBA, as it tipped its hat to the knowns going into the decision & pointed to a more upbeat central economic scenario, with no real surprises seen through the text. The Bank highlighted the recent positive developments in both the labour market and in terms of Q4 economic growth, although noted that a reduction in spare capacity that will result in the required level of wage growth to meet the Bank's inflation target will take some time. The Bank also noted that lending standards in the housing market will be "monitored carefully." The Bank's forward guidance was left as was. Early Sydney trade saw some chop with participants adjusting to the largely U.S.-centric news flow in play since the end of Sydney dealing last week, before the space ground higher alongside global core FI counterparts. The latest ANZ jobs ads reading was firm and was accompanied by upward revisions to the already firm prior reading. YM +1.5, XM +4.5 as we move into the latter rounds of Sydney trade, with the cash curve twist flattening. A$1.2bn of ACGB 1.00% 21 December 2030 supply headlines the local docket on Wednesday.

JGBS AUCTION: 30-Year Auction Results

The Japanese Ministry of Finance (MOF) sells Y735.4bn 30-Year JGBs:

- Average Yield 0.688% (prev. 0.691%)

- Average Price 100.28 (prev. 100.22)

- High Yield: 0.691% (prev. 0.700%)

- Low Price 100.20 (prev. 100.00)

- % Allotted At High Yield: 66.6415% (prev. 29.9498%)

- Bid/Cover: 3.107x (prev. 2.766x)

EQUITIES: Markets Mixed On Return

A few markets still remain closed for holidays, with mixed performance from those markets that are open despite a positive lead from the US. Chinese markets return after being closed yesterday, indices have struggled to make headway into positive territory and currently nurse some small losses. South Korea saw similar price action with markets in minor negative territory as the won strengthens. Markets in Japan are lower, weighed on by the energy sector. Markets in Australia were higher, boosted by the prospect of a travel corridor with New Zealand expected to announced today. US futures are in negative territory, receding after the S&P and Dow Jones hit record highs yesterday.

GOLD: Still Nowhere Near Key Resistance

The richening in the U.S. Tsy space and downtick in the USD has supported bullion in early trade this week, with spot last dealing $8/oz higher at $1,736/oz. Bulls need to a find a way to challenge and break key resistance in the form of the March 18 high ($1,755.5/oz) to alter the technical perspective.

OIL: Bounces

Crude futures are higher in Asia on Tuesday, bouncing after a sharp decline on Monday; WTI & Brent sit around $0.30 higher on the day into European hours.

- Markets look ahead to talks between the US and Iran regarding the status of the nuclear pact, which could potentially lay the ground for a resumption of oil exports from Iran. However, comments from both sides have not been encouraging and chances of a deal at the meeting are seen as slim.

- Headwinds could oil could manifest as demand concerns; India has reported over 100,000 cases a day and imposed lockdown measures on Mumbai and other areas, while Chile has also closed its borders amid ongoing lockdowns in several European countries.

FOREX: Early Moves Reversed

After an initial decline the greenback picked up from lows, putting pressure on high beta currencies as risk assets lost favour.

- AUD and NZD are both lower, impacted by a stronger USD. Markets await the RBA rate announcement. There is seemingly little scope for anything in the way of notable developments at the upcoming RBA meeting, given the recent deluge of rhetoric from the RBA Governor.

- JPY has lost some ground, USD/JPY up 20 pips at 110.38. Data earlier in the session was broadly positive with labour cash earnings and real cash earnings both rising above estimates. Household spending fell more than expected though, despite encouraging retail sales data in the period.

- Offshore yuan has declined, USD/CNH up 53 pips at 6.5618, data earlier in the session showed Caixin Services PMI rose to 54.3 in March from 52.1 previously, this denotes the highest reading since December 2020 and the eleventh consecutive month of expansion. Service providers were very confident about the prospects for the economic recovery and getting the pandemic under control. The gauge for business expectations rose to the highest point since February 2011. Elsewhere reports the PBOC asked lenders to reign in loan growth over bubble risks have been rerun.

FOREX OPTIONS: Expiries for Apr06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E1.9bln, E1.5bln of EUR puts), $1.1825(E889mln-EUR puts), $1.1845-50(E400mln), $1.1870-80(E483mln-EUR puts), $1.1975-95(E1.4bln), $1.2000-05(E1.1bln)

- USD/JPY: Y107.65-80($1.8bln), Y108.00-05($761mln), Y108.70($810mln), Y110.00-10($638mln)

- GBP/USD: $1.3750(Gbp461mln)

- EUR/GBP: Gbp0.8700(E620mln)

- AUD/USD: $0.7640-50(A$975mln-AUD puts), $0.7725-35(A$812mln)

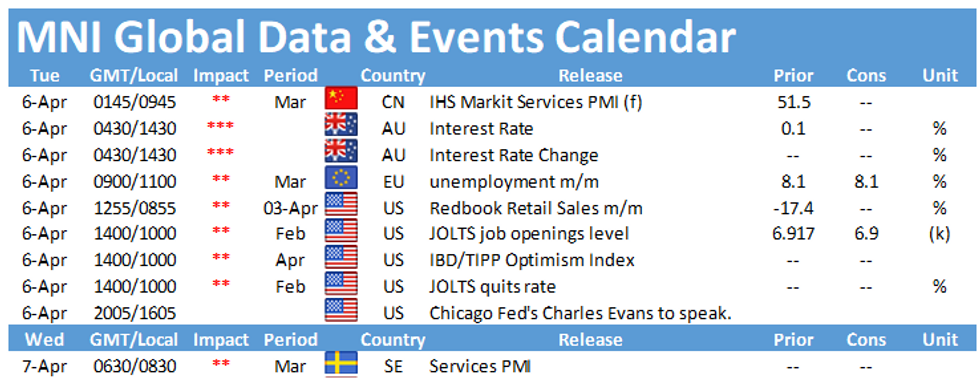

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.