-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: US-China Tensions In Focus Ahead Of US Inflation Data

EXECUTIVE SUMMARY

- PENTAGON SAYS LATEST SHOOTDOWNS RESULT FROM INCREASED CAUTION (BBG)

- HARD LANDING OR SOFT LANDING? SOME ECONOMISTS SEE NEITHER IF GROWTH ACCELERATES (WSJ)

- SCHOLZ’S SPD CRASHES TO WORST RESULT EVER IN BERLIN ELECTION (BBG)

- RBA’s LOWE COMES UNDER PRESSURE FOR PRIVATE BRIEFING (BBG)

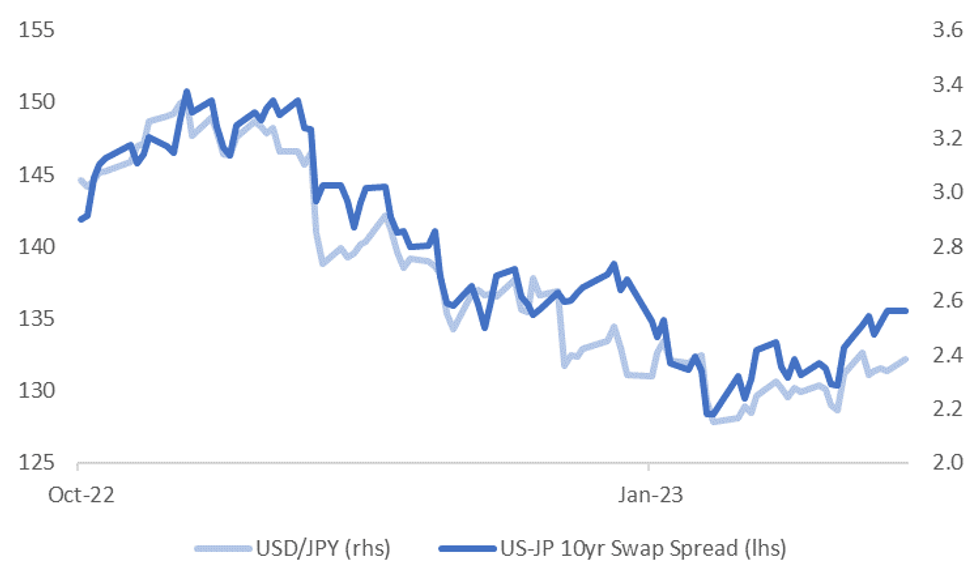

Fig. 1: USD/JPY & US-JP 10yr Swap Spread

Source: MNI - Market News/Bloomberg

UK

BOE: UK Wage and Inflation Data Set to Fuel Further BOE Rate Hikes. (BBG)

UK/EU: Sunak Is Privately Drafting Plans to Rebuild UK Ties With the EU (BBG)

EUROPE

GERMANY: Scholz’s SPD Crashes to Worst Result Ever in Berlin Election (BBG)

FRANCE: France protests look to test government's resolve on pension reforms(RTRS)

U.S.

ECONOMY: Hard or Soft Landing? Some Economists See Neither if Growth Accelerates - (WSJ)

GEOPOLITICS: U.S. Shoots Down a Fourth Flying Object - (NY TIMES)

GEOPOLITICS: Pentagon Says Latest Shootdowns Result From Increased Caution (BBG)

OTHER

U.S./CANADA: Object Shot Down Over Canada in Escalating Aerial Drama - (BBG)

U.S./CHINA: U.S. Blacklists 6 Chinese Entities Involved in Spy Balloon Programs (NY TIMES)

U.S./CHINA: U.S. List of China Balloon Suppliers Hints at New Age in Surveillance (WSJ)

U.S./CHINA: Members of U.S. special committee on China weighing visit to Taipei (NIKKEI)

CHINA/TAIWAN: Let's work to keep peace, China tells visiting Taiwan KMT official (RTRS)

JAPAN: Japan’s LDP Policy Head Says Monetary Policy Has Room for Reform (BBG)

PHILIPPINES/JAPAN: Philippines' Marcos open to a troop pact with Japan (RTRS)

US/PNG: U.S., Papua New Guinea negotiate defense agreement (RTRS)

SOUTH KOREA: Yoon Says People Suffering From Banks’ Higher Rates (BBG)

AUSTRALIA: RBA’s Lowe Comes Under Pressure for Private Briefing (BBG)

AUSTRALIA: RBA may be told to hold press conferences (AFR)

CHINA

MONEY MARKETS: China Set to Pump in Extra Cash to Calm Skittish Money Market (BBG)

MONEY MARKETS: Chinese Banks Plan to Extend More New Loans This Year: Report (BBG)

EQUITIES: China Vanke Plans Biggest Onshore Share Sale Since Ban Ended (BBG)

HOUSING: China Regulators Querying Banks on Mortgage Prepayment Strain (BBG)

GEOPOLITICS: China Ready to Down Object Flying Near Naval Base: Paper (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY104 BILLION VIA OMOs MONDAY

The People's Bank of China (PBOC) conducted CNY46 billion via 7-day reverse repos with the rates unchanged at 2.00% on Monday. The operation has led to a net injection of CNY104 billion after offsetting the maturity of CNY150 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9518% at 9:53 am local time from the close of 1.9405% on Friday.

- The CFETS-NEX money-market sentiment index closed at 41 on Friday, compared with the close of 45 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8151 MON VS 6.7884 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8151 on Monday, compared with 6.7884 set on Friday.

OVERNIGHT DATA

SOUTH KOREA FEB, 1-10 EXPORTS 11.9%, Y/Y

SOUTH KOREA FEB, 1-10 IMPORTS 16.9%

SOUTH KOREA FEB, 1-10 DAILY AVERAGE EXPORTS FALL 14.5% Y/Y

SOUTH KOREA FEB, 1-10 TRADE DEFICIT $4.97BN

NEW ZEALAND JAN BNZ SERVICES PMI 54.5; DEC 52.0

MARKETS

US TSYS: Little Changed In Asia

TYH3 deals at 112-22+, +0-00+, in the middle of its 0-05+ range on volume of ~85k.

- Cash tsys sit flat to 1bp cheaper across the major benchmarks.

- TYH3 briefly looked through Friday's session lows in early trade however there was little follow through.

- ACGBs recovering from session lows provided support.

- There was little macro headline flow.

- There is a thin data calendar today. ECB speak from Lagarde and Panetta as well as Fedpseak from Gov Bowman provide the highlights of the day. Further out the focus is on Tuesday's US CPI data for Jan.

FOREX: JPY Pressured In Asia, Greenback Firmer

JPY has been pressured in today's Asia-Pac session, Yen is currently the weakest performer in G-10 space at the margins.

- USD/JPY prints at ¥132.10/20, ~0.6% firmer in today's trading. The pair looks to be playing catch up with the more supportive yield environment for the USD as US-JP 10 year swap spread has widened in recent dealing.

- AUD/USD prints at $0.6906, ~0.1% softer today. The pair has dealt in a narrow $0.6890/30 range for the majority of the session with support seen below $0.69. Pressure from lower Copper and Iron Ore has weighed on the Aussie.

- Kiwi is little changed from today's opening levels at $0.6300/05. NZD/USD has observed narrow ranges with dips below $0.63 supported and resistance seen above $0.6320.

- CAD and NOK are both ~0.3% softer; facing pressure from weaker Oil prices, WTI is down ~1%.

- EUR and GBP are both ~0.1% lower.

- Cross asset wise, e-minis are down ~0.4% and BBDXY is ~0.3% firmer. US Treasury Yields are little changed, although the front end 2yr yield is +1bps to 4.53%.

- There is a thin data calendar today. ECB speak from Lagarde and Panetta as well as Fedpseak from Gov Bowman provides the highlight of the day.

EQUITIES: Cautious Tone (ex China) Ahead Of Key Event Risks

Regional markets have been under pressure to start the week, although China markets have bucked the broader trend, tracking higher in the first part of trade. US futures are mostly lower, with eminis off -0.37%, Nasdaq futures -0.43% at this stage.

- Familiar themes are dominating sentiment, with fears over a stronger for longer US theme ahead of tomorrow's CPI print weighing. US-China relations are the other concern, as on-going balloon and other related air incidents risk raising tensions. Fresh US curbs on tech related exports to China is a potential action from the US side.

- The China Dragon Index fell sharply in Friday trade (-3.66%), while the HSI is off by around 0.4% so far today. The tech sub index was down over 2% in early trade, but has largely pared these losses.

- China mainland stocks are firmer though, +0.70% for the CSI 300 so far today. Tensions with the US haven't weighed materially, while property developer Vanke plans to raise 15bn yuan in a private placement, the biggest since regulators lifted restrictions on the sector last year.

- The Kospi and Taiex are both weaker, in line with tech weakness from Friday's session and further Nasdaq futures losses today. The Nikkei 225 is also off by 1% at this stage, even as JPY has been the weakest performer in the 10 space. The new BoJ Governor is expected to be presented to parliament tomorrow.

- Outside of Indonesian stocks, SEA bourses and Indian shares are tracking weaker so far today.

OIL: Profit Taking And Growth Fears Weigh On Crude Today

Oil prices have been trending down during the APAC session and are now trading close to their intraday lows. On Friday WTI rose 2.2% and Brent 2.4% after Russia announced it would cut output in response to sanctions but today global growth concerns have come to the surface again. Profit taking is adding to this move with WTI down 1% to around $78.95/bbl and Brent is down 0.9% to $85.60, close to intraday lows.

- WTI reached a high of $80 today followed by a low $78.86. Initial resistance is at $80.33 but $83.14 is key. Brent hit a high of $86.64 today followed by a low of $85.46. $86.90 is initial resistance and $89 is the bull trigger. Brent is just above the 100-day simple moving average, whereas WTI is just below.

- After Russia announced it would cut its output by 500kbd in March, OPEC+ suggested that it wouldn’t increase its production to make up the shortfall.

- Later the focus is likely to be on Fed Governor Bowman ahead of US CPI on Tuesday, as data is scarce. US January CPI data is expected to show a further moderation in inflation. Concerns that tightening has a lot further to go in the US continue to make markets nervous.

- Also both OPEC and the International Energy Agency will publish their monthly reports on Tuesday and Wednesday respectively.

GOLD: Bullion Down As Markets Wait For Tuesday’s US CPI Data

Gold prices have been moving sideways for most of February, as signs grow that Fed rates may peak higher than previously expected. They rose 0.2% on Friday and are now down 0.4% to $1858.80/oz, just above the 50-day simple moving average. During the APAC session they reached a high of $1864.05 followed by a low of $1858.19. The US dollar is up slightly.

- On Friday bullion broke through support of $1855.50 briefly. Trend conditions remain bearish and gold is in a corrective cycle for now.

- Later the focus is likely to be on Fed Governor Bowman ahead of US CPI on Tuesday, as data is scarce. The market is waiting for US January CPI data, which is expected to show a further moderation in inflation.

UP TODAY (TIMES GMT/LOCAL

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/02/2023 | 0730/0830 | *** |  | CH | CPI |

| 13/02/2023 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 13/02/2023 | 1300/0800 |  | US | Fed Governor Michelle Bowman | |

| 13/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 13/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.