-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN OPEN: US Tech Weakness Weighs On Equity Rally

EXECUTIVE SUMMARY

- YELLEN SAYS AMERCIANS SEEING INFLATION 'WELL UNDER CONTROL' - BBG

- EX-FED'S LOCKHART SEES NO RUSH TO CUT IN 1H - MNI INTERVIEW

- CHINA PRESSES IRAN TO REIN IN HOUTHI ATTACKS IN RED SEA, SOURCES SAY - RTRS

- TOP US, CHINA OFFICIALS TO MEET IN THAILAND, FOSTERING CONTACTS - BBG

- UK CONSUMER CONFIDENCE HITS TWO-YEAR HIGH AS INFLATION COOLS - BBG

- TOKYO CPI DELIVERS DOWNSIDE SURPRISE - MNI

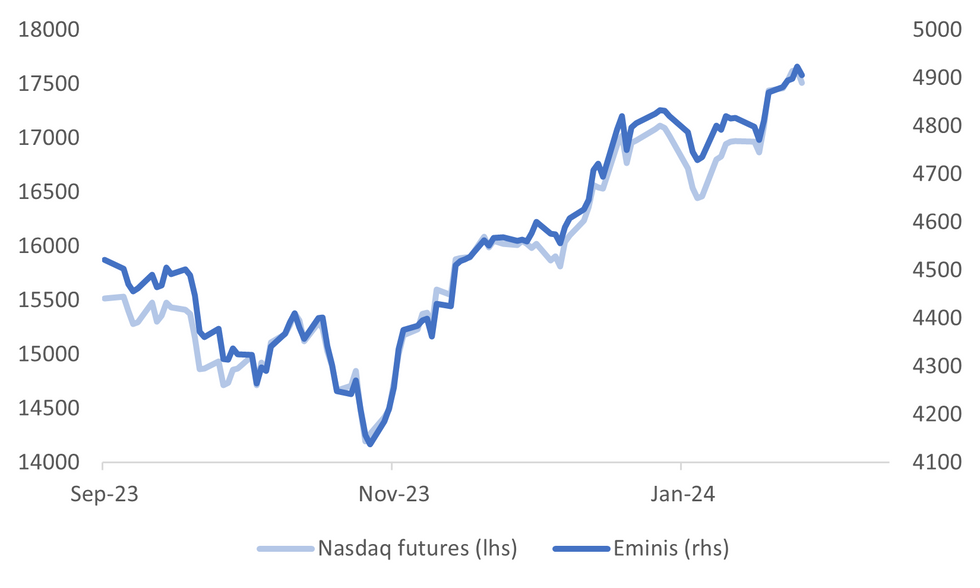

Fig. 1: US Equity Futures (Eminis & Nasdaq)

Source: MNI - Market News/Bloomberg

U.K.

CONSUMER CONFIDENCE (BBG): UK consumer confidence climbed to the highest level in two years in January as slowing inflation made households more optimistic about their finances. GfK Ltd. said its measure of sentiment increased 3 points to minus 19, the highest level since January 2022. Confidence is still weak by historical standards as the reading remains below the 10-year average of minus 15.

TRADE (RTRS): Britain has suspended talks on a free trade deal with Canada amid unhappiness on both sides about the lack of access to agricultural markets, Canadian officials said on Thursday. The talks - which started in March 2022 - are among a number of negotiations Britain has launched around the world in the wake of its decision to leave the European Union, which excluded it from existing EU free trade deals.

EUROPE

ECB (MNI ECB WATCH): The European Central Bank kept its key interest rate on hold at 4% on Thursday for a third consecutive meeting, with President Christine Lagarde saying it was too early to discuss the timing of cuts but repeating that she saw no reason to disagree with a growing consensus for easing to begin by the summer.

ECB (MNI BRIEF): There was consensus on the European Central Bank's Governing Council that it was too early to discuss rate cuts at the January meeting, President Christine Lagarde said on Thursday.

RUSSIA (BBG): Vladimir Putin is testing the waters on whether the US is ready to engage in talks for ending Russia’s war in Ukraine. He’s put out feelers to the US via indirect channels to signal he’s open to discussion, including potentially on future security arrangements for Ukraine, according to two people close to the Kremlin.

FRANCE (BBG):Emmanuel Macron’s government will try to defuse French farmers’ fury over falling incomes and stringent European regulations, in an attempt to stop demonstrations from escalating into a blockade of Paris.

U.S.

FED (MNI INTERVIEW): The Federal Reserve will put off interest rate cuts for as long as U.S. growth and employment stay solid to gather as much evidence on falling inflation as it can -- likely through the first half of the year, former Atlanta Fed President Dennis Lockhart told MNI.

ECONOMY (MNI BRIEF): U.S. GDP grew at a faster-than-expected 3.3% annual rate in the fourth quarter of 2023, driven by consumption growth at 2.8%, underscoring the resilience of the economy even as interest rates rose sharply. Wall Street had expected growth of 2.0%, down from a very hot 4.9% in the third quarter.

INFLATION (BBG): Treasury Secretary Janet Yellen said that inflation is now “well under control” after a historic surge triggered by the pandemic, and that she believed many Americans would agree. “Inflation is now near-term at close to the lowest levels we’ve seen in that survey,” she said Thursday in an apparent reference to inflation expectations reported by the University of Michigan consumer sentiment survey. “So I think Americans do believe that inflation is under control.”

ECONOMY (ABC): With the economy looming large in the 2024 election, Treasury Secretary Janet Yellen said Thursday she sees "no reason" for a recession this year and insisted consumers are turning more optimistic about their finances.

FISCAL (BBG): Treasury Secretary Janet Yellen said that a second Biden administration would seek to retain tax reductions enacted by former President Donald Trump that apply to those earning less than $400,000.

CORPORATE (BBG): Intel Corp. tumbled in late trading after delivering a disappointing forecast on Thursday, renewing doubts about a long-promised turnaround at the once-dominant chipmaker.

POLITICS (BBG): Stand For America Fund Inc., the super political action committee backing Nikki Haley, raised $50.1 million in the last six months of 2023, according to a person familiar with the fundraising, a haul that’s fueled by Wall Street and corporate executives who are seeking to stop Donald Trump’s White House comeback bid.

OTHER

MIDEAST (RTRS): Chinese officials have asked their Iranian counterparts to help rein in attacks on ships in the Red Sea by the Iran-backed Houthis, or risk harming business relations with Beijing, four Iranian sources and a diplomat familiar with the matter said.

JAPAN (MNI): The Tokyo Jan CPI print was weaker across the board relative to expectations. The headline was 1.6% y/y (versus 2.0% forecast and 2.4% prior). Ex fresh food was 1.6%y/y (versus 1.9% forecast and 2.1% prior). Ex fresh food and energy printed at 3.1% y/y, (versus 3.4% forecast and 3.5% prior).

JAPAN (MNI BRIEF): Japan's government has lowered its real GDP forecast for fiscal 2024 starting on April 1 to 1.3% from FY2023's forecast of 1.6% due to the slowing global economy, the Cabinet Office said on Friday.

JAPAN (RTRS): Bank of Japan policymakers actively debated in December the conditions for phasing out stimulus, and agreed to deepen discussions on the appropriate pace of future interest rate hikes, minutes of the meeting showed, a sign they were gearing up for a near-term exit from negative interest rates.

CHINA

US/CHINA (BBG): US National Security Advisor Jake Sullivan and Chinese Foreign Minister Wang Yi will meet soon, maintaining the high-level contacts that were revived after the countries’ presidents met in California.

JAPAN/CHINA (BBG): A high-powered delegation of Japanese executives is returning to Tokyo with little tangible to announce from their visit to Beijing except a promise from China’s leadership to improve the business environment.

MARKETS (BBG): Morgan Stanley cut its targets for major Chinese stock indexes while raising estimates for Japanese benchmarks, as the performance gap between the two continues to widen.

CHINA MARKETS

MNI: PBOC Injects Net CNY390 Bln Via OMO Fri; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY461 billion via 7-day reverse repo on Friday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net injection of CNY390 billion reverse repos after offsetting CNY71 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8607% at 10:07 am local time from the close of 1.9405% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Thursday, compared with the close of 56 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity higher At 7.1074 Friday vs 7.1044 Thursday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1074 on Friday, compared with 7.1044 set on Thursday. The fixing was estimated at 7.1702 by Bloomberg survey today.

MARKET DATA

JAPAN JAN TOKYO CPI Y/Y 1.6%; MEDIAN 2.0%; PRIOR 2.4%

JAPAN JAN TOKYO CPI EX-FRESH FOOD Y/Y 1.6%; MEDIAN 1.9%; PRIOR 2.1%

JAPAN JAN TOKYO CPI EX-FRESH FOOD, ENERGY Y/Y 3.1%; MEDIAN 3.4%; PRIOR 3.5%

JAPAN DEC PPI SERVICES Y/Y 2.4%; MEDIAN 2.4%; PRIOR 2.4%

JAPAN NOV F COINCIDENT INDEX 107.6; PRIOR 114.5

JAPAN NOV F LEADING INDEX CI 114.6; PRIOR 107.7

UK JAN GfK CONSUMER CONFIDENCE -19; MEDIAN -21; PRIOR -22

MARKETS

US TSYS: Rally Extends After Q4 GDP’s Goldilocks-Style Print

TYH4 is trading at 111-17+, +0-07+ from NY closing levels.

- Cash bonds are dealing 1-3bps richer in today’s Asia-Pac session. News flow has been light, with local participants extending yesterday's rally sparked by a Goldilocks-style print for Q4 GDP.

- Early next week, we have the next quarterly refunding announcement (QRA) from the Treasury, which will set out its plans for debt issuance over the next three months. The question of how much debt the US government needs to issue, and the strength of demand for that debt, has become increasingly important in the last year, and these QRAs have taken on extra significance.

- Later today the US calendar shows Personal Income & Spending, PCE Deflator for December, Pending Home Sales and Dallas Fed Manf. Activity data.

- The FOMC’s policy decision is due to be handed down next Wednesday.

JGBS: Futures Sharply Richer, US Monthly PCE Deflator Due Later Today

JGB futures remain sharply higher in Tokyo afternoon session, +37 compared to settlement levels, but are off the session high set during early dealings following the release of lower-than-expected Tokyo CPI. As previously outlined, Tokyo CPI printed weaker across the board relative to expectations in January.

- The other noteworthy news flow was the release of the BoJ Minutes from the December meeting. In short, BoJ board members had a big debate on the timing of liftoff and the pace of subsequent rate hikes. That said, not everyone was convinced of the need to move at all quickly, with some members saying that it was likely that the BoJ was likely to keep substantial easing for the time being.

- Coincident & Leading Indices data is due later today.

- (Bloomberg Economics) The surprisingly sharp slowdown in Tokyo’s inflation in January will give the Bank of Japan pause. (See link)

- Elsewhere, cash US tsys are dealing 1-2bps richer in today’s Asia-Pac session, as local participants digest yesterday’s Goldilocks Q4 GDP print. Later today sees the PCE Deflator for December.

- Cash JGBs are richer, with the futures-linked 7-year leading (3.6bps lower).

- Swaps curve has bull flattened, with rates 1-3bps lower.

- The local calendar is empty on Monday apart from BoJ Rinban Operations covering 3-10-year and 25-year+ JGBS.

NZGBS: Drifted Richer With US Tsys, Aussie Market Closed

NZGBs closed 4-5bps richer, with the 2/10 curve flatter. With the domestic calendar empty and the Australian market closed for Australia Day, the local market has drifted richer with US tsys during today’s Asia-Pac session.

- US tsy yields are dealing 1-2bps richer, with a slight flattening bias present ahead of Friday’s US data drop of Personal Income & Spending, PCE Deflator, Pending Home Sales and Dallas Fed Manf. Activity data. The monthly PCE Deflator for December is the standout ahead of Next week’s FOMC policy meeting.

- ICYMI, RBNZ Chief Economist Conway will deliver a keynote speech on 30 January. The speech will focus on the significant changes to the global economy since the COVID-19 pandemic. He will also make brief comments on domestic data developments since the November Monetary Policy Statement.

- Bloomberg reported that ANZ sees slack emerging across the NZ economy, which will take the wind out of domestic inflation. They see CPI inflation slowing to 2.5% in Q3 from 4.7% in Q4 2023. (See link)

- Swap rates are 5-6bps lower.

- RBNZ dated OIS pricing is flat to 4bps softer across meetings, with August-November leading.

- Next week, the local calendar sees Trade Balance data on Monday, ANZ Business Confidence on Wednesday, CoreLogic House Prices on Thursday and ANZ Consumer Confidence and Building Permits on Friday.

EQUITIES: Weaker Tech Weighs On Sentiment, But Chian/HK Markets Still Up For The Week

Weaker US equity futures, particularly in the tech space, has weighed on Asia Pac sentiment today. Nasdaq futures sit close to session lows, last off around 0.70%, while Eminis are down around -0.30%. Disappointing revenue forecasts from tech names Intel and KLA weighed on sentiment late in US trade.

- The Topix is off around 1.1%, the Nikkei 225 slightly more in Japan. The electric appliances sector the weakest performer. Toyota was also down, while month end rebalancing was a factor also cited in contributing to weakness (BBG).

- Weakness hasn't been uniform though. In Taiwan the Taiex is around flat, while in South Korea the Kospi has climbed nearly 1%. An IPO launch for a shipbuilder has helped the aggregate index.

- Hong Kong and China mainland shares sit lower at the break. The HSI is off by around 1%, with the tech sub index off by ~2.7%. Both indices are higher for the week though, following early China stimulus efforts/rescue headlines.

- China's CSI 300 is down 0.68% at the break, but like the Hong Kong indices is still up for the week. The real estate sub index is also rallying further, up 2.4%. The authorities pledged stable credit to the sector yesterday. While gaming stocks are also higher on fresh approvals made in January (see this BBG link for more details).

- Australia and India markets are closed today for public holidays.

- In SEA, Indonesian markets are down around 0.75% at this stage. The index is back mid Dec levels, with some carry over from political uncertainty yesterday a potential headwind.

FOREX: G10/Dollar Trends Steady, US PCE In Focus Later

G10 FX trends have been relatively muted in Friday trade to date. The BBDXY sits marginally lower versus end Thursday levels in NY, last near 1237.2.

- Cross asset sentiment has been softer in the equity space, led by tech plays (Nasdaq futures off around 0.7% on late earnings disappointment, led by Intel). This hasn't impacted sentiment a great deal in the FX space though.

- Likewise, a modestly softer US yield backdrop (nearly -2bps lower for some benchmarks). US Treasury Secretary Yellen said on Thursday (US time) that surprisingly strong economic growth in the fourth quarter was a "good thing" that signals continued healthy consumer spending without increases in inflationary pressures.

- USD/JPY has seen a low of 147.48, against a high of 147.85 (we currently track at 147.70/75). the Tokyo Jan CPI print was much weaker than expected. Lower entertainment prices (weighed by the Jan earthquake) a factor.

- Still, the data suggests no rush for the BoJ to move away from easy policy settings. The BoJ Dec minutes also came out. In short, BoJ board members had a big debate on the timing of liftoff and the pace of subsequent rate hikes. That said, not everyone was convinced of the need to move at all quickly, with some members saying that it wasn’t too late to make a decision post-spring wages and others stating that it was likely that the BoJ was likely to keep substantial easing for the time being.

- AUD/USD has drifted a little higher but remains sub 0.6600, with local markets closed today for a public holiday. NZD/USD has traded tight ranges, the pair last in the 0.6105/10 region.

- Looking ahead, the main focus will be in the US session, with the PCE Core Deflator and personal spending data on tap.

OIL: China's Reported Efforts To Stem Houthi Attacks Help Trim Oil's Weekly Advance

In the first part of Friday trade front end benchmarks for oil are tracking moderately softer. Brent is just under $82.10/bbl, off around 0.40%/ WTI is under $77/bbl, off by around 0.6% at this stage. This is reversing part of Thursday's ~3% gains for the benchmarks. We are comfortably higher for the week though, with WTI up ~4.75%, Brent +4.5%.

- A Reuters piece crossed in earlier trade, with reports that the China authorities have asked Iran to curb Houthi attacks on Red Sea, with the news wire reporting that if China's interests are harmed it could impact commercial relations with Iran.

- This has likely weighed on sentiment at the margins. Equity risk off, albeit in the tech space, has likely been another headwind.

- Still, broader concerns around supply through the Red Sea, coupled with Ukrainian drone strikes on Russia energy infrastructure, have added geopolitical risk premiums to prices in recent sessions. Lower US stocks has been another support point.

- In terms of upside targets, $84.22 (Nov 30 high) is in focus for Brent, while for WTI, $77.48 (Fibo retrace of Sep 19 – Dec 13 bear leg) after which lies $79.56 (Nov 30 high) are areas to watch.

GOLD: Supported By A Goldilocks-Style GDP Print

Gold is slightly higher in the Asia-Pac session, after closing +0.3% higher at $2020.84 on Thursday.

- The precious metal was supported by lower US Treasury yields on Thursday after a Goldilocks-style print for Q4 GDP. Q4 GDP printed 3.3% annualised growth, well above the consensus of 2.0%, but the Core PCE Price Index showed 2.0%, in line with consensus and prior.

- Despite Thursday’s gain, bullion looks set for its second weekly decline ahead of Friday’s US data drop: Personal Income & Spending, PCE Deflator, Pending Home Sales and Dallas Fed Manf. Activity data. The monthly PCE Deflator for December is the standout ahead of next week’s FOMC policy meeting.

- According to MNI’s technicals team, the bear threat remains present, with support at $2001.9 (Jan 17 low).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/01/2024 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 26/01/2024 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 26/01/2024 | 0700/0800 | ** |  | SE | Unemployment |

| 26/01/2024 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 26/01/2024 | 0900/1000 | ** |  | EU | M3 |

| 26/01/2024 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 26/01/2024 | 1500/1000 | ** |  | US | NAR Pending Home Sales |

| 26/01/2024 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 26/01/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.