-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: US Yields Can't Break To Fresh Highs

EXECUTIVE SUMMARY

- FED CAN WAIT UNTIL SUMMER TO CUT RATES-ENGLISH- MNI

- FED SAYS BANK TERM FUNDING PROGRAM TO END IN MARCH - MNI BRIEF

- CHINA ADDS SUPPORT FOR DEVELOPER FUNDING BY EASING LOAN USES - BBG

- JAPAN'S TOP FOREX DIPLOMAT VIGILANT TO MARKET IMPACT FROM BOJ STIMULUS EXIT - RTRS

- TAX CUTS, FISCAL POLICY SEEN COMPLICATING RBA’S JOB -MNI

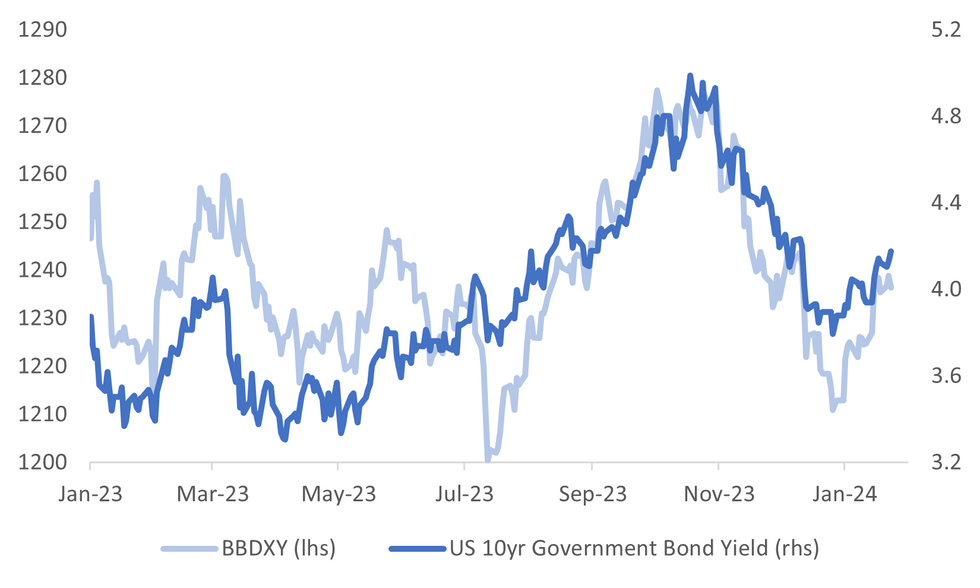

Fig. 1: US BBDXY Versus 10yr UST Yield

Source: MNI - Market News/Bloomberg

U.K.

FISCAL (BBG): The next UK government will inherit the most challenging set of tax and spending problems in 70 years, according to a leading think tank. The Institute for Fiscal Studies said a combination of high interest costs and feeble growth means the winner of the general election expected later this year will find it “more difficult to reduce debt as a fraction of national income than in any parliament since at least the 1950s.”

POLITICS (BBG): A senior Conservative politician who used a major newspaper to warn of electoral “catastrophe” if the ruling party keeps Prime Minister Rishi Sunak likely hoped for a better response. Instead, the anger leveled at Simon Clarke by his colleagues underscored the collective bind they are in.

EUROPE

NATO (BBG): German Chancellor Olaf Scholz said that he’s confident that Hungarian Prime Minister Viktor Orban will cease to block Sweden’s accession to NATO. He also sounded confident that Orban will wave through a €50 billion ($54.5 billion) support package for Ukraine at an extraordinary EU summit next week.

GERMANY (BBC): Train drivers across Germany have begun a strike that is set to last for six days, their longest stoppage on record.

FRANCE (BBC): French farmers enjoy high levels of public support and hope to spark a larger protest movement.

RUSSIA/FINLAND (POLITICO): Russia's foreign ministry announced on Wednesday it was terminating a cross-border agreement between Moscow and Helsinki. The abrupt move followed Finnish accusations that Russia has been fueling a migrant crisis on their mutual border.

FRANCE/INDIA (ECONOMIST): France and India will cement their friendship this week. On Thursday Emmanuel Macron arrives in Jaipur, where he will be taken on a tour of the western Indian city by Narendra Modi, India’s prime minister. On Friday the French president will be the guest of honour in Delhi at a parade marking India’s 75th Republic Day.

TURKEY (BBG): President Joe Biden has urged congressional lawmakers to approve the sale of F-16 warplanes to Turkey, after that country agreed to allow Sweden’s entry into NATO.

U.S.

FED (MNI INTERVIEW): The Federal Reserve will likely wait until summer before cutting interest rates, but policymakers could adjust their post-meeting statement next week to open the door to a reduction in March should the economic data call for it, former Fed board economist William English told MNI.

FED (MNI BRIEF): The Federal Reserve Board Wednesday announced that its Bank Term Funding Program will cease making new loans as scheduled on March 11, and adjusted the program's interest rate higher for loans made before the deadline. The Fed announced effective immediately the interest rate applicable to new BTFP loans has been adjusted such that the rate on new loans extended from now through program expiration will be no lower than the interest rate on reserve balances in effect on the day the loan is made.

CORPORATE (BBG): US aviation regulators ordered Boeing Co. to halt further production-rate increases for its 737 Max aircraft even as they cleared the way for a version of the jet involved in a near-calamity to return to the skies.

CORPORATE (BBG): International Business Machines Corp. delivered a positive outlook for revenue and cash flow in 2024, an optimistic signal for the pace of corporate technology spending, even as it expects to reduce jobs.

OTHER

ISRAEL (RTRS): The United Nations said on Wednesday that Israeli tanks struck a huge U.N. compound in Gaza sheltering displaced Palestinians, causing "mass casualties", but Israel denied its forces were responsible and suggested Hamas may have launched the shelling.

JAPAN (RTRS): Japan's top currency diplomat Masato Kanda said he was closely watching how central bank decisions, including an expected end to negative interest rates in Japan, affect markets as speculation over the events could trigger volatile asset moves. Kanda declined to comment on heightening market expectations that the Bank of Japan (BOJ) will end negative rates in April, saying it was "among important events" that currency authorities were closely watching.

AUSTRALIA (MNI): The Australian government’s fiscal stance will add upward pressure to inflation, reducing the likelihood of a Reserve Bank of Australia cash-rate cut until late 2024 at the earliest and potentially adding to further rate rises, prominent economists and former staffers told MNI.

CANADA (MNI BOC WATCH): Bank of Canada Governor Tiff Macklem told reporters Wednesday that officials didn't actively discuss the potential for cutting interest rates, because the focus of their decision to hold borrowing costs was on inflation that remains elevated.

OIL (MNI): The U.S. Energy Information Administration expects oil production to be relatively unfazed by Middle East tensions so far, but prices are still seen rising later this year before receding modestly in 2025, the agency told MNI.

SOUTH KOREA (BBG): SK Hynix Inc. reported a surprise operating profit boosted by strong sales of high-end memory chips used to power artificial intelligence applications. The world’s No. 2 maker of memory chips reported an operating profit of 346 billion won ($259 million) in the December quarter, compared with analyst estimates for a 169.9 billion won loss. Revenue climbed to 11.3 trillion won, beating the highest forecast.

CHINA

PROPERTY DEVELOPERS (BBG): Chinese regulators offered more financial support for struggling developers by broadening their access to some commercial loans, the latest effort to stem a property slowdown and revive market confidence amid a stock market rout.

RRR (21st Century Business): The People’s Bank of China’s greater-than-expected cut to the reserve requirement ratio by 50bp will help boost the economy, ease liquidity pressure before the Chinese New Year and stabilise the capital market, 21st Century Business Herald reported citing analysts.

HOUSING (SHANGHAI SECURITIES): Local authorities are lowering first-home loan interest rates or even removing their lower limit, with 60 out of 100 major cities seeing rates at the 3% level, Shanghai Securities News reported. A total of nine cities saw first-home loan interest rates fall in January by 5-30bp, mainly in second-, third- and fourth-tier cities, of which the average rate fell to 3.86% and 3.82%. The average first-tier city rate remains unchanged at 4.13% from the previous month.

POPULATION (YICAI): Authorities should implement policy reforms to boost birth rates such as providing financial subsidies to lower nursery fees and allowing foreign nannies to work in China, according to Liang Jianzhang, co-founder at Ctrip Group and a population economist. China lagged behind northern European countries who spend 2-3% of GDP per year on child subsidies, Liang noted. On the silver economy, the post-60s generation will be the first retirees who benefited from the reform and opening up era, and will therefore drive increased consumption growth.

CHINA MARKETS

MNI: PBOC injects net CNY366 bln via Omo Thur; rates unchanged

The People's Bank of China (PBOC) conducted CNY466 billion via 7-day reverse repo on Thursday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net injection of CNY366 billion reverse repos after offsetting CNY100 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8009% at 09:24 am local time from the close of 1.8813% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 56 on Wednesday, compared with the close of 47 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity lower At 7.1044 Thursday vs 7.1053 Wednesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1044 on Thursday, compared with 7.1053 set on Wednesday. The fixing was estimated at 7.1649 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA 4Q GDP EXPANDS 0.6% Q/Q; EST. +0.6%; PRIOR 0.6%

SOUTH KOREA 4Q GDP EXPANDS 2.2% Y/Y; EST. +2.1%; PRIOR 1.4%

SOUTH KOREA 2023 GDP EXPANDS 1.4% Y/Y; EST. +1.4%; PRIOR 2.6%

SOUTH KOREA FEB. NON-MANUFACTURING CONFIDENCE UNCHANGED AT 68

SOUTH KOREA FEB. MANUFACTURING CONFIDENCE RISES TO 71; PRIOR 69

NEW ZEALAND FIVE-MONTH BUDGET DEFICIT NZ$2.8B

NZ FIVE-MONTH BUDGET DEFICIT IS NZ$1.15B NARROWER THAN FORECAST

MARKETS

US TSYS: Tsys Yields Opened Higher Only to Reverse, Busy Night Ahead for US Data

TYH4 is trading at 111-03, + 03+ from NY closing levels.

- Cash Tsys yields opened higher this morning, however those moves were quickly reversed in early trading. There has been a small flattening of the curve, as the 10yr is currently 1.9bps lower, while the 2y trades 1.2bps lower.

- Outside of the Fed news flow of ceasing the BTFP (see below), news flows has been light. We did see US 10y futures get close to the Jan 19 lows, only to quickly reverse course, so that could be a factor in broader moves seen so far today.

- The Federal Reserve Board Wednesday announced that its Bank Term Funding Program will cease making new loans as scheduled on March 11, and adjusted the program's interest rate higher for loans made before the deadline. (MNI Policy Team, see this link for more details, https://marketnews.com/mni-brief-fed-says-bank-term-funding-program-to-end-in-march).

- Later tonight in the US: GDP, PCE, Weekly Claims and Treasury Sec Yellen Outlook

JGBS: Cheaper After 40Y Supply, Tokyo CPI Tomorrow

JGB futures are holding weaker but above session lows, -16 compared to settlement levels. JGB futures pushed to a new session low in early afternoon trade after the 40-year supply received only tepid demand.

- The actual high yield surpassed dealer expectations and the cover ratio witnessed a decline, dropping to 2.148x from 2.208x observed in the late-November auction. This outcome marked consecutive declines in cover. The cover ratio had steadily increased from May to September. Notably, today's ratio represented the lowest level at a 40-year auction since March 2011.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Weekly International Investment Flow data. Later today, the local calendar sees Tokyo Condominiums for Sale, Dept Store Sales and Machine Tool Orders data.

- Cash JGBs are dealing mostly cheaper, with yields 0.5bp lower (2-year) to 5.0bps higher (20-year). The benchmark 10-year yield is 2.5bps higher at 0.743% versus the Nov-Dec rally low of 0.555%.

- The 40-year is 0.7bps higher at 2.089% versus a pre-auction low of 2.069%.

- The swaps curve has bear-steepened, with rates 1-4bps higher. Swap spreads are tighter across maturities, apart from the 40-year.

- Tomorrow, the local calendar sees Tokyo CPI, PPI Services and Coincident & Leading Indices data, along with BOJ Minutes of Dec. Meeting.

AUSSIE BONDS: Slightly Cheaper, RBA Consulted On Tax Cut Changes, Aus. Day Holiday Tomorrow

ACGBs (YM -1.0 & XM -1.0) are cheaper but near Sydney session highs after today’s news flow surrounding the government’s proposed changes to the already-legislated tax cuts.

- In his speech at the National Press Club, PM Albanese said that the tax cut all taxpayers will receive was “broadly revenue neutral” and “won’t add to inflation pressures”. RBA Governor Bullock was consulted on the new tax package and apparently, she doesn’t expect any implications from the changes to RBA forecasts.

- ICYMI, In MNI Tax Cuts, Fiscal Policy Seen Complicating RBA's Job, our policy team speak to economic commentators. They say that the tax cuts will keep inflation high and are worth 50-75bp of monetary easing. Given the shift to people who are more likely to spend, the revised program may result in an upward revision to the RBA’s projections, which are scheduled on February 6. (See here)

- Cash ACGBs are flat to 1bp cheaper, with the AU-US 10-year yield differential 3bps tighter at +8bps.

- Swap rates are flat to 1bp higher.

- The bills strip is slightly cheaper, with pricing flat to -1.

- RBA-dated OIS pricing is little changed.

- Tomorrow, the local market is closed for Australia Day celebrations.

- QTC priced a new A$2.75b 4.75% Feb-34 fixed rate green bond, with a spread of 53.85bps over the ACGB 3.00% Nov-33.

NZGBS: Cheaper But Off Worst Levels, Heavy US Calendar Tonight

NZGBs closed 1-2bps cheaper but better than the session’s worst levels. There wasn’t much in the way of domestic drivers to flag, outside of the previously outlined NZ government’s financial statements for five months ended Nov. 30, which came in NZ$1.15bn better than projected in the half-year fiscal update.

- Today’s weekly NZGB supply saw weak demand metrics for the Apr-27 and May-34 bonds, with cover ratios below 2.0x. Nevertheless, post-auction dealings have seen the lines richen. The Apr-37 bond saw a healthier 3.37x cover ratio.

- The move away from session cheaps was aided by US tsys, which have richened 1-2bps in today’s Asia-Pac session, ahead of Thursday's busy US calendar: GDP, PCE, Weekly Jobless Claims and Tsy Sec Yellen’s Outlook.

- Swap rates closed 2-6bps higher, with the 2s10s curve steeper. Implied long end swap spreads were wider.

- RBNZ dated OIS pricing closed little changed across meetings. A cumulative 87bps of easing is priced by year-end compared to 92bps before yesterday’s Q4 CPI data release.

- Tomorrow, the local calendar is empty. The Australian market is closed for the Australia day holiday tomorrow.

FOREX: Dollar Can't Sustain Early Positive Momentum, As Yields Off Wednesday Highs

The USD index has tracked relatively tight ranges in the first part of Thursday trade. The early impetus was to the topside, but the BBDXY couldn't sustain a move above 1237.20. We last track around the 1236.20 level, little changed versus end NY levels from Wednesday.

- Early USD gains were aided by a rise in US yields, a follow on from the NY session, as better US data pushed benchmark yields higher across the board. However. US TSY 10yr futures couldn't break sub Jan 19 lows, which has seen yield reverse earlier gains.

- USD/JPY has tracked relative tight range, the pair last near 147.60/65, slightly weaker in yen terms versus NY closing levels. US-JP 10yr yield differentials are modestly lower, as a poor 40yr bond auction has seen JGB yields firm (10yr last near 0.74%).

- AUD/USD sits near 0.6580, also tracking a tight range. PM Albanese has announced rejigged tax cuts (from July 1 this year), but stated they won't add to inflation pressures. The currency hasn't received support from higher China/HK equities, while iron ore also continues to recover ground (last above $136.50/ton).

- NZD/USD is near 0.6110, an earlier dip to 0.6100 supported. CHF has lost around 0.2%, reversing some of Wednesday's 0.86% gain.

- Looking ahead, Norges Bank and ECB meetings take focus. The US sees the Q4 advance release for GDP before the monthly PCE report for December on Friday.

EQUITIES: China Equity Rally Extends, Mixed Trends Elsewhere

Regional equities are largely in the green today with Japanese Equities the exception. US Equity futures are close to unchanged today after a pull back on stronger than expect PMI data overnight, outside any notable new headlines, equities are expected to trade sideways going into a busy night for data.

- Nasdaq futures, are lower by -0.05%, while Eminis were last unchanged, headlines out early around Boeing, being halted from any further 737 Max Aircrafts product increases, may be weighing on sentiment.

- Japan Equity indices are fluctuating a bit today with the Nikkei trading down 0.85% early only to sharply rebound. The yen is largely unchanged, while yields on JGBs continue to move higher on the back of weak auction data, as traders speculate the BoJ will move away from negative rates this year. The Nikkei 225 is down -0.10%, while the Topix is down -0.10% at this stage.

- Hong Kong continued its strong week as the announcement of a rescue package to boost China equity markets drove sentiment, Hang Seng currently trading 1.25% higher today.

- China mainland stocks are tracking well today CSI 300 up 1.80%, while the Shanghai Composite is trading 2% higher, after the PBoC announced it would cut the RRR, while also announcing a set of rules to govern property developers, pushing the mainland China property index higher for the third straight day, currently up 2.65%,

- In Korea, Sk Hynix, the world's second largest chipmaker, reported a surprise profit, revenue climbed to 11.3 trillion won, beating even the highest forecast. This didn’t help the share price though, trading lower by 2.40%, this has weighed on the Kospi trading unchanged currently.

- The Taiwan Taiex index has continued its winning streak, chipmakers lead the way as ASML reports orders have more than tripled last quarter for its High-End Chip Machines. Taiex is currently up 0.70%

- In Australia, the ASX 200 continues its winning streak trading 0.40% higher today on the back of strong gains from the miners, as Iron Ore futures rallied after the PBoC announced cuts to RRR. In SEA, markets are mixed with the Nifty 50, Philippines PSEi off roughly 0.50%, while Indonesia and Malaysia trade 0.50% higher.

OIL: Crude Rises Further On US Stock Drawdown & China Stimulus

Oil prices are moderately higher during APAC trading after rising around a percent on Wednesday on news of a large US crude inventory drawdown. The US data and China’s RRR cut plus possible stimulus have supported crude markets today. WTI is up 0.4% to around $75.40/bbl after a low of $75.16 earlier. Brent has traded above $80 and is 0.3% higher at $80.27. After range trading through January, oil has been trending higher for the last week. The USD index is flat.

- The EIA reported a 9.23 mn barrel stock drawdown, a lot more than expected, as freezing temperatures resulted in production cuts and difficulties in unloading imports. The weather also impacted refining with refinery utilisation down 7.1pp, and reduced driving resulting in a gasoline inventory build of 4.91mn but distillate fell 1.42mn. The data will be monitored closely to see if the large crude draw is unwound as production normalises.

- Geopolitics remains important to oil market dynamics with Houthi rebels continuing to attack Red Sea shipping and the US defending vessels and its own troops in the region. There are also risks to Russian infrastructure from Ukraine.

- Later US Q4 GDP is released and is expected to rise 2% q/q saar. There are also US jobless claims, December durable orders and home sales. The ECB decision is today followed by President Lagarde’s press conference (see MNI ECB preview here). The German Ifo survey also prints.

GOLD: Weaker After Stronger US PMI Data

Gold is slightly stronger in the Asia-Pac session, after closing 0.8% lower at $2013.89 on Wednesday.

- Bullion traded poorly through the US cash equity open before extending declines on the solid US PMI data and a stabilisation of the greenback in FX markets.

- Stronger than expected US data cast doubt on prospects for an interest-rate cut by the Federal Reserve in March. The market is currently assigning around a 40% chance to a 25bp rate cut in March. This compares to the near 70% chance seen a week or so ago. Lower interest rates are typically positive for non-interest-bearing gold.

- Fed speakers are in blackout ahead of next week’s FOMC meeting.

- Investors now turn to Thursday’s heavy US calendar: GDP, PCE, Weekly Jobless Claims and Tsy Sec Yellen’s Outlook.

- Wednesday’s move takes a large step closer to support at $2001.9 (Jan 17 low), according to MNI's technicals team.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/01/2024 | 0700/0800 | ** |  | SE | PPI |

| 25/01/2024 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 25/01/2024 | 0800/0900 | ** |  | ES | PPI |

| 25/01/2024 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 25/01/2024 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 25/01/2024 | 1100/0600 | *** |  | TR | Turkey Benchmark Rate |

| 25/01/2024 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 25/01/2024 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 25/01/2024 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 25/01/2024 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 25/01/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 25/01/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/01/2024 | 1330/0830 | *** |  | US | GDP |

| 25/01/2024 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 25/01/2024 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 25/01/2024 | 1345/1445 |  | EU | ECB Monetary Policy Press Conference | |

| 25/01/2024 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/01/2024 | 1500/1000 | * |  | CA | Payroll employment |

| 25/01/2024 | 1500/1000 | *** |  | US | New Home Sales |

| 25/01/2024 | 1515/1615 |  | EU | ECB's Lagarde ECB Podcast - latest monetary policy decisions | |

| 25/01/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 25/01/2024 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 25/01/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/01/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/01/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 26/01/2024 | 2330/0830 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.