-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 2025 Rate Cut Projections Abate

MNI BRIEF: Canada Says Has Leverage Against Trump Tariffs

MNI EUROPEAN OPEN: US Yields Firm On Supply Fears/Higher Oil

EXECUTIVE SUMMARY

- BIDEN DEBT-BILL SIGNING SET TO UNLEASH TSUNAMI OF US DEBT SALES - BBG

- BIG BANKS MAY FACE 20% BOOST TO CAPITAL REQUIREMENTS IN US - WSJ

- SAUDI ARABIA GOES IT ALONE AT OPEC+ WITH MILLION-BARREL CUT - BBG

- BOJ OFFICIALS MULL RECOMMENDING JULY YCC TWEAK - MNI

- CHINA’s SERVICES ACTIVITY PICKS UP IN MAY AS NEW ORDERS SHORE UP CONSUMPTION - SCMP

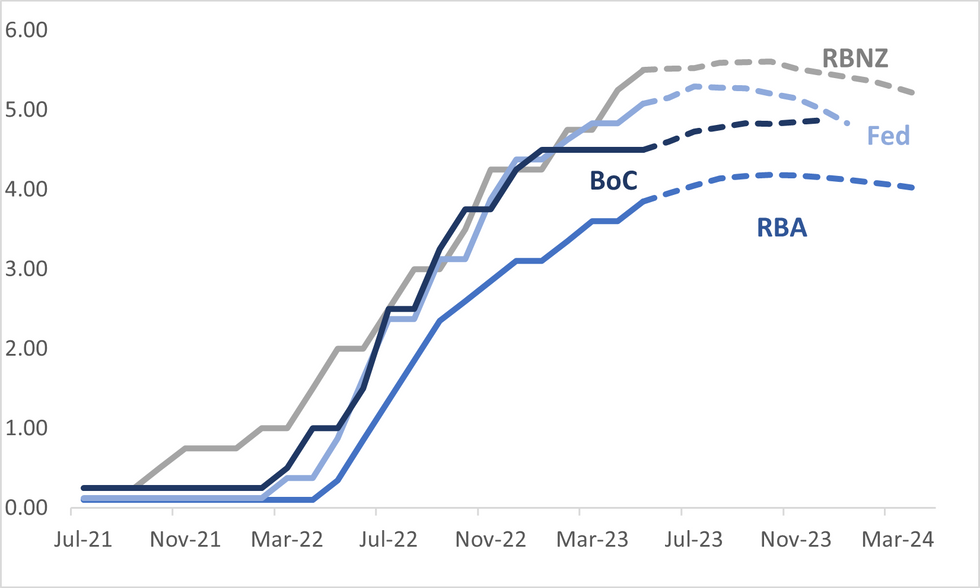

Fig. 1: Market Pricing - Fed, RBA, BoC & RBNZ

Source: MNI - Market News/Bloomberg

U.K.

ECONOMY: British Prime Minister Rishi Sunak wants to cut taxes by as much as 2 pence in the pound before the next national election which is expected in 2024, the Telegraph newspaper reported. Government officials believed that a slower-than-expected fall in Britain's high inflation rate would not prevent a tax cut from April, the paper said without citing its sources. (RTRS)

POPULATION: Rishi Sunak this week will defend his efforts to curb migration, saying the UK government is struggling to cope with the number of arrivals. The prime minister will appear at an event in Kent in southern England on Monday to draw attention to progress over the last six months, notably 50% increase on raids for those working illegally and 700 new staff to track people crossing the English Channel in small boats. (BBG)

EUROPE

UKRAINE: Russia said on Monday that its forces had thwarted a major Ukrainian offensive at five points along the front in the southern Ukrainian region of Donetsk and killed hundreds of pro-Kyiv troops. (RTRS)

RUSSIA: Russia's Pacific Fleet forces have started operational exercises in the waters of the Sea of Japan and the Sea of Okhotsk that will last until June 20, Russia's Defence Ministry said on Monday. (RTRS)

U.S.

DEBT: President Joe Biden’s signature of legislation suspending the federal debt ceiling has given the Treasury Department the green light to resume net new debt issuance after months of disruption. Ever since mid-January, when it hit the $31.4 trillion debt ceiling, the Treasury has been using special accounting measures to maintain payments on all federal obligations. There were just $33 billion of those left available as of May 31. (BBG)

ECONOMY: The International Monetary Fund has yet to see enough banks pulling back on lending that would cause the U.S. Federal Reserve to change course with its rate-hiking cycle. “We don’t yet see a significant slowdown in lending. There is some, but not on the scale that would lead to the Fed stepping back,” the IMF’s Managing Director Kristalina Georgieva told CNBC’s Karen Tso Saturday in Dubrovnik, Croatia. (CNBC)

BANKING: U.S. regulators are preparing to force large banks to shore up their financial footing, moves they say will help boost the resilience of the system after a spate of midsize bank failures this year. The changes, which regulators are on track to propose as early as this month, could raise overall capital requirements by roughly 20% at larger banks, people familiar with the plans said. The precise amount will depend on a firm's business activities, with the biggest increases expected to be reserved for U.S. megabanks with big trading businesses. (WSJ)

OTHER

OIL: Oil prices jumped more than $1 a barrel on Monday after the world's top exporter Saudi Arabia pledged to cut production by another 1 million barrels per day from July, counteracting macroeconomic headwinds that have depressed markets. (RTRS)

OIL: Saudi Arabia will make an extra 1 million barrel-a-day oil supply cut in July, taking its production to the lowest level for several years after a slide in crude prices. The bold move by the most important member of the OPEC+ coalition came at the cost of ceding ground to two key allies: Russia, which made no commitment to cut output deeper, and the United Arab Emirates, which secured a higher production quota for 2024. Oil prices advanced on Monday. (BBG)

JAPAN: (MNI) Tokyo - Bank of Japan staff are set to increase their inflation forecast for the BOJ’s July meeting and could recommend increasing the 0% rate currently targeted under yield curve control, though it is uncertain Governor Kazuo Ueda would follow such advice, MNI understands. In their July forecast, officials could revise higher the BOJ’s baseline view, frequently mentioned by Ueda, that the year-on-year rise of core CPI will fall below 2% toward the middle of this fiscal year. (MNI)

CHINA

ECONOMY: China’s services activity picked up in May, a private-sector survey showed on Monday, as a rise in new orders shored up a consumption-led economic recovery in the second quarter. The Caixin/S&P Global services purchasing managers’ index (PMI) rose to 57.1 in May from 56.4 in April. The 50-point mark separates expansion from contraction in activity. (SCMP)

US/CHINA: A Chinese warship came within 150 yards (137 meters) of a U.S. destroyer in the Taiwan Strait in "an unsafe manner," U.S. military officials said, as China blamed the United States for "deliberately provoking risk" in the region. (RTRS)

US/CHINA: A highly anticipated defense forum in Singapore kicked off with a friendly handshake between Pentagon chief Lloyd Austin and Chinese Defense Minister Li Shangfu. It ended Sunday with few other signs of optimism that the world’s biggest economies could avoid an eventual collision. (BBG)

EQUITIES: Investors should increase “confidence, determination and patience” amid recent increase in volatility in China’s A shares due to the country’s sound economic fundamentals and market liquidity, according to a commentary in the Economic Daily on Monday. (Economic Daily)

EQUITIES: A more transparent and clear policy environment will help firms make the most of domestic and international stock markets, said a report in the China Securities Journal citing unnamed analysts. (CSJ)

EQUITIES: Shares of Chinese property developers decline despite new support measures being mulled by the government, with analysts saying the policies fall short of the market’s expectations. Measures under consideration include reducing the down payment in some non-core neighborhoods of major cities and lowering agent commissions on transactions. (BBG)

BANKING: Some rural banks have continued to lower fixed-deposit rates by at least 10 basis points across different durations, the China Securities Journal reports, citing notices published by local lenders. (CSJ)

PROPERTY: Guangxi recently put in place rules stating that property developers cannot begin sales activities for their homes until after they have received pre-sales permit, the Nan Ning Wan Bao newspaper reports Sunday, citing the policy. (Nan Ning Wan Bao)

CHINA MARKETS

PBOC Net Drains CNY23 Bln Via OMOs Monday

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Monday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY23 billion after offsetting the maturity of CNY25 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9281% at 10:11 am local time from the close of 1.7783% on Friday.

- The CFETS-NEX money-market sentiment index closed at 44 on Friday, same as the close on Thursday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.0904 MON VS 7.0939 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0904 on Monday, compared with 7.0939 set on Friday.

OVERNIGHT DATA

SOUTH KOREA MAY FX RESERVES $420.98bn; PRIOR $426.68bn

AU JUDO BANK MAY F SERVICES PMI 52.1; PRIOR 51.8

AU JUDO BANK MAY F COMPOSITE PMI 51.6; PRIOR 51.2

AU MELBOURNE INSTITUTE INFLATION M/M 0.9%; PRIOR 0.2%

AU MELBOURNE INSTITUTE INFLATION Y/Y 5.9%; PRIOR 6.1%

AU Q1 INVENTORIES Q/Q 1.2%; MEDIAN 0.3%; PRIOR 0.3%

AU Q1 COMPANY PROFTIS Q/Q 0.5%; MEDIAN 2.0%; PRIOR 12.7%

AU MAY ANZ JOBS ADS 0.1%; PRIOR -0.7%

JAPAN MAY F JIBUN BANK SERVICES PMI 55.9; PRIOR 56.3

JAPAN MAY F JIBUN BANK COMPOSITE PMI 54.3; PRIOR 54.9

CHINA MAY CAIXIN SERVICES PMI 57.1; MEDIAN 55.2; PRIOR 56.4

CHINA MAY CAIXIN COMPOSITE PMI 55.6; PRIOR 53.6

MARKETS

US TSYS: Weaker, Sitting Just Above Session Cheaps, Looming Supply Surge Weighs

TYU3 is sitting near Asia-Pac cheaps at 113-19+, -7+ from NY closing levels, after reaching a low of 113-17+.

- Cash tsys are 0.9-3.6bp cheaper across benchmarks in Asia-Pac trade, but 1.0 to 1.5bp richer than session cheaps.

- With the Asian calendar light, local participants have likely been on headlines watch as they digest the sharp post-payrolls sell-off on Friday.

- US Treasury yields seem to be under pressure due to the imminent risk of increased debt issuance following months of disruption, as President Biden signed legislation to suspend the federal debt ceiling. (link)

JGBS: Futures Heavy, Pressured By US Tsys, 30-Year Supply Tomorrow

JGB futures are trading on a low note, currently standing at 148.54, -28 compared to the settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Jibun Bank Services and Composite PMIs.

- Accordingly, local participants are likely to have been on headlines and US tsys watch as they digest the sharp post-payroll sell-off on Friday. Cash tsys are 1.5-4.1bp cheaper with tsy futures at 113-19, -8 versus NY closing levels.

- US Treasury yields seem to be under pressure due to the imminent risk of increased debt issuance following months of disruption, as President Biden signed legislation to suspend the federal debt ceiling. (link)

- The strength of May price rises will lead the BOJ and Governor Kazuo Ueda to make a tough call on yield curve control. (link)

- Cash JGBs are cheaper with yields higher beyond the 2-year zone. Yields are 0.3-2.6bp higher across benchmarks with the futures linked 7-year zone leading. The benchmark 10-year yield is 1.7bp higher at 0.431%. The 30-year JGB yield is 0.7bp higher at 1.281% ahead of tomorrow’s supply.

- The swaps curve bear steepens with rates 0.3bp to 2.6bp higher and swap spreads wider.

- The local calendar tomorrow sees April’s Labour Cash Earnings and Household Spending along with 30-year supply.

AUSSIE BONDS: Cheaper, RBA Policy Decision Tomorrow, Uncertain Outcome

ACGBs are weaker (YM -12.0 & XM -12.0), sitting at Sydney session cheaps as US tsys extend Friday’s post-Payroll sell-off in Asia-Pac trading.

- The RBA Policy Decision is scheduled for tomorrow. While the BBG consensus anticipates no change, it is important to note that this view is not unanimous. The meeting holds significance as the case for a further rate increase is likely to be seriously discussed, following the upside surprise in the April Monthly CPI Indicator.

- RBA dated OIS pricing is 2-10bp firmer for meetings beyond August with Apr’24 leading. The market currently is currently attaching a 52% chance of a 25bp hike at tomorrow’s meeting. The expected terminal rate sits at 4.17%, just shy of today’s intraday high of 4.20%. Nonetheless, the current level is the highest level since March 3. Year-end easing expectations continue to be unwound with only 4bp priced.

- Cash ACGBs are 11-12bp cheaper with the AU-US 10-year yield differential at +4bp.

- Swap rates are 11bp higher with EFPs 1bp tighter.

- The bills strip twist steepens with pricing +3 to -13.

- Ahead of the RBA decision tomorrow, the local calendar is scheduled to release Q1 Current Account and Net Exports data.

FOREX: USD Supported By Firmer Yield Backdrop

The USD has mostly been supported today, albeit within recent ranges. US yields have tracked higher, with higher oil and debt issuance fears (post the debt ceiling agreement) appearing as supports. However, we are off session highs at this stage, with the 2yr back at 4.53%, after getting close to 4.55% in early trade.

- This has likely helped curb USD gains to a degree, with the BBDXY last around 1242.70/75, versus 1243.30 highs for the session. USD/JPY got to fresh highs of 140.25/30 but we now sit back at 140.05/10. Positive PMI revisions for May did little to boost yen sentiment.

- AUD/USD dips sub 0.6600 have been supported but we still sit lower versus NY closing levels from the end of last week. AU data has been mixed today, but not shifting the RBA expectations needle much ahead of tomorrow's outcome, with market pricing close to 50% priced for a 25bps move at this stage.

- The China Caixin services PMI printed better than expected, dragging the A$ from its lows, but follow through has been limited.

- NZD/USD is softer but within recent ranges, last 0.6060. NZ onshore markets have been closed today.

- EUR/USD was last just under 1.0700, GBP/USD is -0.20% weaker, sitting at 1.2425/30 currently.

- Looking ahead, we have Swiss CPI, EU and UK PMIs for the services sector. ECB's Lagarde also speaks. In The US, the ISM services PMI and factory orders are on tap.

EQUITIES: Fresh Highs For Japan Stocks, China Property Shares Give Back Some Of Friday's Gains

Regional equities are mostly higher, with Japan stocks leading the way. China stocks have given back some of Friday's gains in terms of the CSI 300, as property stocks ease. US futures are in the red. Eminis off around 0.10% at this stage to 4283 while Nasdaq futures have fallen 0.40%.

- Higher US yields are weighing, with firmer oil prices (post the Saudi cut) and a potential US debt issuance dump (post the debt ceiling agreement), boosting yields. A headline also crossed from the WSJ, which stated US banks may face a 20% boost in capital requirements in the US, but this hasn't impacted broader equity sentiment at this stage.

- The CSI 300 is -0.45% lower at the break while the Shanghai Composite is not too far away from flat. Property related stocks have slipped, reversing some of the impressive gains from Friday, which were fueled by fresh stimulus reports. Reports indicate measures under consideration include lower down payments in parts of some cities, although fresh details didn't appear forthcoming over the weekend.

- The HSI is doing better, up 0.54% at the break, with the underlying tech index close to flat.

- Japan's Nikkei is +1.75%, hitting a fresh 33 high. Tech related plays have performed well, but momentum also appears to be a factor. Higher USD/JPY levels are also likely helping at the margin.

- The ASX 200 is up over 1%, while Indonesia markets have returned from a two-day break. We were higher in earlier trade but now sit back closer to flat for the JCI.

OIL: Crude Gives Up Most Of Early Gains Following Saudi Output Cut

Oil started Monday trading strongly higher following the surprise announcement that Saudi Arabia would reduce its output by an additional 1mbd from July in addition to the 1.6mbd announced by OPEC+ in April. The move should provide a floor to prices, unless economic data deteriorates more than expected. Brent reached an intraday high of $78.73/bbl earlier but has given up a lot of those gains and is now trading around $77.11, up 1.3% from Friday’s NY close. WTI is +1.4% to $72.75 after a high of $75.06. The USD index is 0.1% higher.

- China’s Caixin services PMI for May rose to 57.1, stronger than expected, from 56.4. Manufacturing also rose and the composite now stands at 55.6 up from 53.6, thus providing some optimism for China’s oil demand.

- The July voluntary cut by Saudi Arabia may be extended or deepened as the oil producer can remain flexible depending on market stabilisation. There was a long debate on quotas and the rest of the group, including Russia, didn’t follow but did confirm that they would extend the existing cuts through 2024. In contrast, UAE will increase production next year covered by unused quotas from African members.

- The Fed’s Mester (non-voting) gives welcome remarks later and ECB President Lagarde also speaks. Services PMIs/ISM for May are released.

GOLD: Down Again, Pressured By Higher Yields & A Firmer Dollar

Gold has experienced a slight weakening in the Asia-Pacific session, with prices at 1945.45 (-0.1%). This decline follows a 1.5% drop on Friday, which can be attributed to a shift in investor sentiment towards risk-on assets after the resolution of the US debt-default issue, dampening demand for bullion.

- Furthermore, the increase in US tsy yields on Friday likely contributed to the decline in gold, given it lacks yield-bearing characteristics.

- The move higher in yields came despite mixed employment data: strong May jobs gains and up-revisions for the prior two data sets, versus a higher unemployment level.

- Potentially pressuring US tsy yields has been the looming threat of net new debt issuance after months of disruption. (link)

- Additionally, the dollar spot index experienced an increase on Friday, further influencing the price dynamics of gold.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/06/2023 | 0600/0800 | ** |  | DE | Trade Balance |

| 05/06/2023 | 0630/0830 | *** |  | CH | CPI |

| 05/06/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/06/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/06/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/06/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/06/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/06/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/06/2023 | 0900/1100 | ** |  | EU | PPI |

| 05/06/2023 | 1300/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 05/06/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/06/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/06/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 05/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 05/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 05/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.