-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI EUROPEAN OPEN: USD Edges Lower Ahead Of Jackson Hole

EXECUTIVE SUMMARY

- CHINA'S LOAN PRIME RATE WILL LIKELY REMAIN UNCHANGED ON TUESDAY - MNI

- FORMER BOJ CHIEF ECONOMIST SEKINE DISCUSSES THE OUTLOOK FOR FURTHER MONETARY TIGHTENING - MNI

- FED'S GOOLSBEE SAID HE WOULD LIKE FOR THE CB TO BEGIN CONSIDERING DIALING BACK ITS LEVEL OF RESTRICTIVENESS - MNI

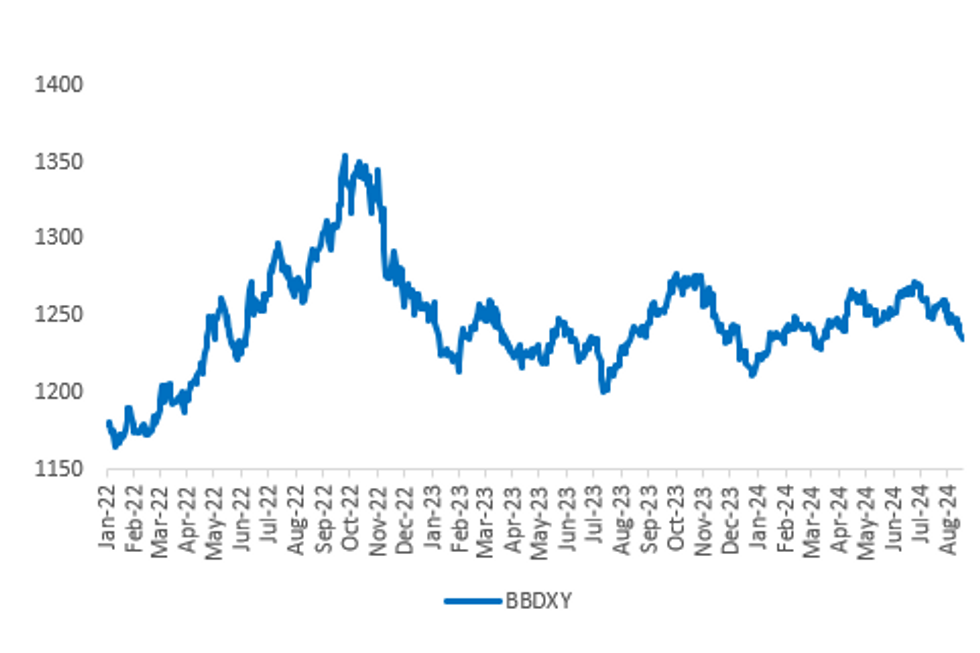

Fig. 1: US Dollar Index Back At March Levels

Source: MNI - Market News/Bloomberg

UK

ECONOMY (BBG): “Britain’s prospective home buyers stepped up their search for property after the Bank of England’s first reduction in interest rates since the start of the pandemic, Rightmove Plc said.”

EMPLOYMENT (BBG): “British companies stepped up advertising for jobs for the first time this year, a sign of strength in the labor market, data from Adzuna showed.”

EUROPE

UKRAINE (BBC): “Ukraine says it has destroyed a second strategic bridge in a week as it continues its incursion into Russia's Kursk region. Hours later, Ukrainian President Volodymyr Zelensky said the aims of the military incursion into Kursk included the creation of a "buffer zone" to stop Russian attacks.”

UKRAINE (POLITICO): “Safety at Ukraine's Zaporizhzhia nuclear power plant is deteriorating, the International Atomic Energy Agency (IAEA) warned following a drone strike near the facility, Europe's largest nuclear plant.”

GERMANY (POLITICO): “The German government will stop new military aid to Ukraine as part of the ruling coalition's plan to reduce spending, the Frankfurter Allgemeine Zeitung (FAZ) reported on Saturday. The moratorium on new assistance is already in effect and will affect new requests for funding, not previously approved aid, according to the FAZ report, which cited non-public documents and emails as well as discussions with people familiar with the matter.”

SWEDEN (MNI WATCH): The Riksbank is expected to deliver its second rate cut this cycle when it announces its policy decision on Aug 20, after inflation fell from a double-digit high to below the 2% target and as the economy slows, with analysts divided as to whether it will signal faster easing ahead.

US

FED (BBG): “Recent US economic data have given Federal Reserve Bank of San Francisco President Mary Daly “more confidence” that inflation is under control and it’s time to consider adjusting benchmark borrowing costs, but the economy is “not in an urgent place,” according to the Financial Times.”

FED (MNI BRIEF): Federal Reserve Bank of Chicago President Austan Goolsbee on Friday said he would like for the central bank to begin considering dialing back its level of restrictiveness, also suggesting that because it could talk time for rate cuts to filter through to the real economy it could be better to move gradually.

FED (MNI): The speed and extent of Federal Reserve rate cuts expected to start in September will depend on how much the labor market and the economy weaken in the months ahead, former senior Federal Reserve staffers told MNI.

POLITICS (BBG): “Vice President Kamala Harris has stormed into contention in the fast-growing and diverse states of Arizona, Georgia, Nevada and North Carolina, not long after Donald J. The new polls from The New York Times and Siena College show how quickly Ms. Harris has reshaped the terrain of 2024 and thrust the Sun Belt back to the center of the battleground-state map.”

ECONOMY (BBG): “Goldman Sachs Group Inc. economists lowered the probability of a US recession in the next year to 20% from 25%, citing this week’s retail sales and jobless claims data.”

ISRAEL (BBC): “US Secretary of State Antony Blinken has arrived in Israel in his latest effort to push for a ceasefire and hostage-release deal in Gaza. The US and Israel have expressed optimism about a deal since talks resumed in Doha last week, but Hamas says suggestions of progress are an "illusion".”

KOREA (CNA): “South Korea and the United States kicked off annual summertime military exercises on Monday (Aug 19), seeking to boost their joint readiness to fend off North Korea's weapons and cyber threats.”

UKRAINE (POLITICO): “Sen. Mark Kelly said Sunday that Ukraine’s decision to counter the ongoing Russian invasion by attacking Russia itself could change how that war plays out.”

OTHER

JAPAN (MNI INTERVIEW): Former BOJ chief economist Toshitaka Sekine discusses the outlook for further monetary tightening in Japan. On MNI Policy MainWire now, for more details please contact sales@marketnews.com

ISRAEL (BBG): “Israel and Hamas blamed each other for impeding a cease-fire and hostage deal as the top US diplomat arrived in Tel Aviv to press for an agreement. Mediators say the current round of negotiations have brought the two sides closest to an official pause in fighting in months. But objections from both sides on Sunday raised the chances of renewed stalemate.”

ISRAEL (BBG): “Hezbollah said it launched a salvo of rockets at northern Israel following one of the deadliest strikes on Lebanon since both sides began trading fire more than 10 months ago.“

ISRAEL (BBG): “Israel’s economic growth slowed more than expected over the second quarter of the year, failing to sustain its initial rebound from the war against Hamas. Gross domestic product rose by an annualized 1.2% in seasonally adjusted terms, after surging a revised 17.3% during the prior three months, according to preliminary figures published by Israel’s Central Bureau of Statistics on Sunday.”

SINGAPORE (BBG): “Lawrence Wong used his first major policy speech since becoming Singapore’s prime minister to dish out new social benefits for citizens, while pledging to simplify compliance and regulatory processes to trim business costs.”

THAILAND (BBG): “Thailand’s economy expanded faster than expected last quarter, aided by tourism, although the outlook remains fraught with risks after a leadership change last week has made the fate of a key stimulus program uncertain.”

BRAZIL (MNI): Central Bank of Brazil Governor Roberto Campos Neto declined on Friday to reveal his position on whether he sees the balance of risks for inflation as tilted to the upside or not, though he conceded that there were differences on the subject at the last Copom meeting.

CHILE (BBG): “BHP Group and workers in Chile resolved a last-minute spat over benefits that had threatened to upend a wage deal and reignite a strike at the world’s biggest copper mine.”

CHINA

FINANCE (MNI): China’s deposits fell in July as banks lowered their deposit interest rates, which pushed funds into wealth management and treasury bonds, according to Zhou Maohua, macro researcher at Everbright Bank. Data showed RMB deposits increased by CNY10.7 trillion in the first seven months, down from CNY11.5 trillion during H1, while CITIC Securities noted July saw wealth management funds increase by about CNY1.78 trillion.

PBOC (MNI WATCH): China's Loan Prime Rate will likely remain unchanged on Tuesday following July's cut, but continued weak demand will weigh on credit and challenge Beijing's economic targets, which may push the central bank to ease later this year.

ECONOMY (MNI): China saw utilised foreign investment reach CNY539.5 billion in July, down 29.6% y/y, according Ministry of Commerce data. The Foreign Investment Department stressed that quality of investment should also be considered alongside quantity, as well as the overall development of foreign-funded enterprises.

TRADE (MNI): Government policy to open market access and remove entry barriers aims to provide foreign-funded enterprises with a sense of gain, Li Xuzhen, deputy representative of international trade negotiations at the Ministry of Commerce for international trade has said.

CHINA MARKETS

The People's Bank of China (PBOC) conducted CNY52.1 billion via 7-day reverse repo on Monday, with rate unchanged at 1.70%. The operation has led to a net drain of CNY22.4 billion after offsetting the maturity of CNY74.5 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7009% at 09:45 am local time from the close of 1.8357% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 51 on Friday, compared with the close of 44 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

MARKET DATA

UK AUG. RIGHTMOVE HOUSE PRICES -1.5% M/M; PRIOR -0.4% M/M

UK AUG. RIGHTMOVE HOUSE PRICES +0.8% Y/Y; PRIOR +0.4%

JAPAN JUNE CORE MACHINE ORDERS +2.1% M/M; EST. +0.9%; PRIOR -3.2%

JAPAN JUNE CORE MACHINE ORDERS -1.7% Y/Y; EST. +1.1%; PRIOR +10.8%

NEW ZEALAND JULY BNZ SERVICES PSI44.6; PRIOR 40.7

MARKETS

US TSYS: Tsys Futures At Session's Best, Curve Flattens

- Treasury futures are off earlier lows and now trade at session's best, although well within Friday's ranges, while volumes are elevated early however have dropped off in the afternoon. TUU4 -00⅝ to 103-04¾, while TYU4 + 00+ to 113-04.

- Cash treasury curve has twist-flattened over the day, with the 2yr yield +0.6bps to 4.056%, while the 10yr yield was -0.2bp at 3.881%, the 2s10s is back near pre-FOMC levels -0.773 at -17.907.

- Projected rate cuts into year end vs. this mornings pre-data levels (*): Sep'24 cumulative -33.8bp (-33.8bp), Nov'24 cumulative -64.2bp (-62.0bp), Dec'24 -96.8bp (-93.5bp).

- Looking ahead, the Fed's Waller to speak, Democratic Convention & Leading Index

ACGBS: Narrow Ranges During A Data-Light Session, RBA Minutes Tomorrow

ACGBs (YM -1.0 & XM -0.5) are slightly weaker, with tight ranges, in a data-light Sydney session.

- It is a relatively light week for local data/news flow, with tomorrow’s release of the RBA’s August 6 meeting minutes the highlight. With the statement and Governor Bullock sounding slightly more hawkish, the minutes will be scrutinised, especially around the rate hike discussion to determine how serious it was. Upside risks to inflation will be another area of focus.

- Cash US tsys are slightly mixed, with a flattening bias, in today’s Asia-Pac session after modest gains on Friday.

- Attention now turns to the KC Fed-hosted Jackson Hole economic symposium "Reassessing the Effectiveness and Transmission of Monetary Policy," which will be held Aug. 22-24. Fed Chairman Powell speaks at 1000ET Friday Morning.

- Cash ACGBs are flat to 1bp cheaper, with the AU-US 10-year yield differential at +5bps.

- Swap rates are flat.

- The bills strip has bear-flattened, with pricing flat to -2.

- RBA-dated OIS pricing is little changed. A cumulative 18bps of easing is priced by year-end.

- The AOFM plans to sell A$800mn of the 3.00% 21 November 2033 bond on Wednesday and A$700mn of the 2.75% 21 November 2028 bond on Friday.

NZGBS: Some Profit-Taking After Strong Post-RBNZ Rally, New May-36 Bond Priced Tomorrow

NZGBs closed on a weak note, with benchmark yields 4bps higher. NZ Treasury’s announcement of the launch of a new May 2036 nominal bond possibly weighed on the market. The issue will be priced tomorrow with NZ treasury expecting to issue at least NZ$3bn.

- Today's price movement also likely reflects profit-taking after the strong post-RBNZ decision rally. Nevertheless, NZGBs remain 5-21bps richer, with the 2/10 curve 16bps steeper.

- NZGBs have also underperformed their $-bloc counterparts, with the NZ-US 6bps wider at +29bps.

- The AU-NZ 10-year yield differential is -4bps today, now standing at -24bps compared to the recent high of -5bps in late July.

- The recent move lower in the 10-year yield differential coincided with a move lower in the AU-NZ 1Y3M spread leading up to the RBA’s August policy meeting. However, this move has reversed, with the AU-NZ 1Y3M spread now approaching cyclical highs. Interestingly, the increase in the 1Y3M spread has not been reflected in the AU-NZ 10-year yield differential.

- Swap rates closed 3-5bps higher.

- RBNZ dated OIS pricing closed 4-7bps firmer across meetings. A cumulative 73bps of easing is priced by year-end.

- The local calendar will see REINZ House Sales and Trade Balance data tomorrow and Q2 Retail Sales Ex Inflation on Friday. Also, RBNZ Deputy Hawkesby will speak tomorrow.

JGBS: Futures Hovering Near Session Cheaps, 20Y Supply Tomorrow

JGB futures are weaker and hovering near session lows, -19 compared to the settlement levels.

- Outside of the previously outlined Machina Orders, there hasn't been much in the way of domestic drivers to flag.

- (MNI, ICYMI) The BoJ will be watching to see whether the US manages to avoid a steep economic slowdown, former BoJ chief economist Toshitaka Sekine told MNI. “The BoJ is unlikely to raise its policy interest rate amid low visibility and volatile markets. I don’t think the low visibility will disperse by the September and October policy-setting meetings,” he said.

- Sekine, who correctly anticipated the BoJ’s July hike in its short-term rate target to 0.25%, said there was a danger it could fall behind the curve if it leaves real interest rates below equilibrium levels for too long, feeding inflation and other economic distortions.

- Cash US tsys are slightly mixed, with a flattening bias, in today’s Asia-Pac session.

- Attention now turns to the Jackson Hole economic symposium, which will be held Aug. 22-24. Fed Chairman Powell speaks at 1000ET Friday morning.

- Cash JGBs are 2-5bps cheaper across benchmarks, with the 20-year underperforming ahead of tomorrow’s supply.

- The swaps curve has bear-steepened, with rates 1-5bps higher. Swap spreads are mixed.

- Tomorrow, the local calendar will see Tokyo Condominiums for Sale data.

ASIA STOCKS: Asian Equities Mixed, Tech Outperforms, Asia FX Surges

Asian markets are trading mixed today, with Japan's stocks falling due to a stronger yen, which pressured technology firms, leading to a decline in the Nikkei 225 and Topix Index. In contrast, Hong Kong's market saw gains, driven by strong earnings from tech giants like Alibaba and JD.com. The broader sentiment in the region is cautious, with investors closely monitoring upcoming comments from Federal Reserve Chair Jerome Powell at the Jackson Hole symposium, which could influence global monetary policy expectations.

- Japanese stocks are slightly lower today, after strong returns since the August 5 sell-off. In June, Japanese machinery orders fell by 6%, but rose 7.4% in the April-June quarter, with private-sector orders slightly up by 2.1% in June but marginally down by 0.1% for the quarter, while a 3.8% decline is forecast for total orders in the July-September quarter. The yen has rallied about 1% which has heavily weigh on tech stocks with the Nikkei falling 0.90% while the TOPIX is 0.65% lower.

- Hong Kong and Chinese markets are trading higher today, led by strong gains in technology stocks following better-than-expected earnings reports. The Hang Seng China Enterprises Index rose as much as 1.8%, with major contributors like Alibaba, JD.com, and Meituan posting significant advances. Investor sentiment is buoyed by speculation around potential fiscal stimulus from Beijing and easing measures, which could support economic growth. The rally is also driven by expectations of a softer U.S. economic landing and possible Fed rate cuts in 2024.

- South Korean equities are a touch lower today, the market has seen gradual recovery since the sharp 8.77% drop on August 5, driven by easing recession fears in the U.S. Technology stocks like Samsung Electronics and SK hynix weighed on the market, while automotive and financial stocks, such as Hyundai Motors and KB Financial have seen gains. The KOSPI is 0.60% lower, while the KOSDAQ is down 0.65%.

- Taiwan equities are higher this morning, following strong inflows into the region to end last week. TSMC is unchanged this morning, while the Taiex is up 0.20%.

- Australian equities are unchanged today with losses in Consumer Staples & Discretionary offset gains in Utilities and Healthcare stocks. New Zealand equities are the worst performing in the region today with the NZX50 down 0.80% after A2 Milk dropped 18% on the back soft guidance.

- Asia EM is mostly higher today with Asian FX rallying, Indonesian's JCI is up 0.10%, India's Nifty 50 is 0.15% higher, Philippines PSEi is 0.90% higher, Malaysia's KLCI is 1.10% higher while Singapore's Strait Times is is unchanged,

ASIA STOCKS: Foreign Investors Return, Tech Stocks See Bulk Of Inflows

- South Korea: South Korea recorded an inflow of $967m Friday, contributing to a net inflow of $1.267b over the past five trading days. The 5-day average inflow is $253m, contrasting with the 20-day average outflow of $59m, and a 100-day average inflow of $78m. Year-to-date, South Korea has seen substantial inflows totaling $18.028b.

- Taiwan: Taiwan saw a significant inflow of $1.642b Friday, with a net inflow of $3.371b over the past five trading days. The 5-day average inflow is $674m, while the 20-day average shows an outflow of $447m, and the 100-day average reflects an outflow of $145m. Year-to-date, Taiwan has experienced outflows totaling $8.099b.

- India: India had an outflow of $283m Thursday, resulting in a net outflow of $863m over the past five trading days. The 5-day average outflow is $173m, compared to a 20-day average outflow of $87m and a 100-day average inflow of $15m. Year-to-date, India has seen inflows totaling $1.510b.

- Indonesia: Indonesian equities registered an inflow of $49m Friday, leading to a net inflow of $187m over the past five trading days. The 5-day average inflow is $37m, with a 20-day average inflow of $22m and a 100-day average outflow of $8m. Year-to-date, Indonesia has accumulated inflows totaling $326m.

- Thailand: Thailand saw an inflow of $10m Friday, with a slight net inflow of $14m over the past five trading days. The 5-day average inflow is $3m, matching the 20-day average inflow of $2m, but there is a 100-day average outflow of $25m. Year-to-date, Thailand has experienced outflows amounting to $3.312b.

- Malaysia: Malaysia recorded an inflow of $65m Friday, contributing to a net inflow of $68m over the past five trading days. The 5-day average inflow is $14m, while the 20-day average shows an outflow of $7m, and the 100-day average reflects an inflow of $2m. Year-to-date, Malaysia has seen inflows totaling $29m.

- Philippines: The Philippines saw an inflow of $11m Friday, leading to a net inflow of $25m over the past five trading days. The 5-day average inflow is $5m, in line with the 20-day average inflow of $1m, but there is a 100-day average outflow of $7m. Year-to-date, the Philippines has experienced outflows totaling $475m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | 967 | 1267 | 18028 |

| Taiwan (USDmn) | 1642 | 3371 | -8099 |

| India (USDmn)* | -283 | -863 | 1510 |

| Indonesia (USDmn) | 49 | 187 | 326 |

| Thailand (USDmn) | 10 | 14 | -3312 |

| Malaysia (USDmn) | 65 | 68 | 29 |

| Philippines (USDmn) | 11 | 25 | -475 |

| Total | 2461 | 4069 | 8008 |

| * Up to Date 15-Aug-24 |

OIL: Crude Little Changed, Key Events Later In The Week

Oil prices are little changed today and have been trading in a narrow range as the market waits for the outcomes of further meetings in the Middle East. Continued lacklustre data from China have added to existing worries regarding crude demand from the world’s largest importer. The USD index is down 0.3% today but has only managed to lift crude off its intraday low.

- WTI is down 0.2% to $75.40/bbl off today’s low of $75.10, while Brent is 0.1% lower at $79.58/bbl after falling to $79.26 earlier. The tightness implied by the spread between Brent’s two nearest contracts has eased.

- Gaza ceasefire talks continue with conflicting reports on progress towards an agreement. Uncertainty over Iran’s response to the attack on Hamas’ political leader in Tehran also persists. There had been a lot of diplomatic pressure for it to hold until peace talks had concluded.

- Later the Fed’s Waller speaks and US July leading index prints. The focus of the week for oil markets will be Wednesday’s EIA inventory data & FOMC minutes, Thursday’s preliminary August US PMIs & the start of the Jackson Hole symposium followed by Fed Chair Powell’s speech on Friday.

GOLD: Consolidating After Hitting An All-Time High On Friday

Gold is 0.2% lower in today’s Asia-Pac session, after soaring to a fresh all-time high on Friday, notably above the psychological $2,500/oz mark.

- The rise followed US data indicating inflation slowed last month while retail sales surged, easing recession worries while strengthening expectations the Federal Reserve can begin easing in September.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- "Gold's data dependency remains paramount, as jobs, inflation, and economic data all have the potential to clarify the Fed's path and future monetary policy," a strategist at RBC Capital Markets, said in a note. (per BBG)

- Attention now turns to the KC Fed-hosted Jackson Hole economic symposium "Reassessing the Effectiveness and Transmission of Monetary Policy," which will be held Aug. 22-24. Fed Chairman Powell speaks at 1000ET Friday Morning.

- According to MNI’s technicals team, the technical break above $2483.7, the Jul 17 high and the bull trigger resumes the uptrend. The initial target of note is $2528.4, the 3.00 projection of the Oct 6 - 27 - Nov 13 price swing.

LNG: With Robust Asian Demand, Europe Nervous Re Ukraine

European LNG prices were slightly lower on Friday but are still around 10% higher in August to date. They fell 0.4% to EUR 39.43 off the intraday low of EUR 39.12. Prices have been supported by Ukraine’s move into Russia’s Kursk province and the acquisition of gas infrastructure at Sudzha, the last pipeline taking gas from Russia to Europe through Ukraine.

- Ukraine’s incursion into Russia is yet to disrupt gas flows though, but Europe remains alert to possible outages.

- US natural gas fell 3.1% to $2.13 on forecasts for cooler weather in the east and west. Prices are currently around $2.11 and still up 3.3% this month. The market has looked through the first summer inventory drawdown in eight years as output has been cut back and cooling demand has been robust. Production on Friday was up 1.8% y/y while demand rose 4.1% y/y.

- North Asian prices increased 4.8% on Friday to be up over 15% in August as hot weather continues to drive strong cooling demand. India’s LNG imports rose 15% y/y in July. High Asian demand continues to compete with Europe for shipments.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/08/2024 | - |  | SE | Riksbank Meeting | |

| 19/08/2024 | 2350/0850 | * |  | JP | Machinery orders |

| 19/08/2024 | - |  | UK | DMO to hold quarterly consultation investors / GEMM consultation | |

| 19/08/2024 | 1315/0915 |  | US | Fed Governor Christopher Waller | |

| 19/08/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 19/08/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.