-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD Index Hits Fresh MTD Lows, Yen Rebound Continues

EXECUTIVE SUMMARY

- FED LIKELY DONE HIKING, FOCUSED ON LENGTH OF HOLD - MNI

- UK INFLATION HAS BECOME MORE ‘HOMEGROWN’ DEPUTY BOE GOV. SAYS - BBG

- RBA’s BULLOCK SEES STRONGER DEMAND KEEPING PRICES ELEVATED - BBG

- AUSSIE RETAIL SALES FALL IN OCTOBER - MNI BRIEF

- PBOC'S PAN SEES MORE HEALTHY, SUSTAINABLE CHINA GROWTH IN 2024 - BBG

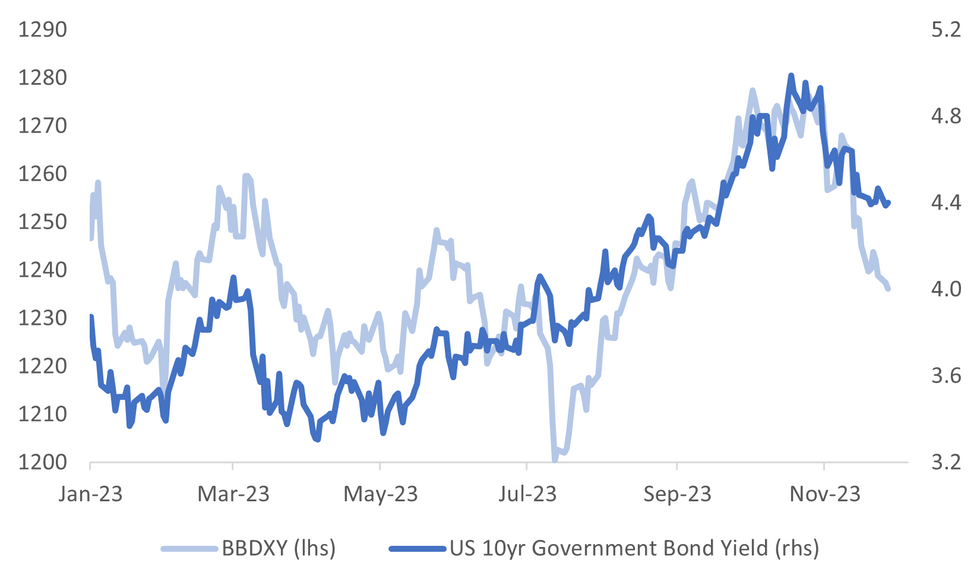

Fig. 1: BBDXY USD Index US Tsy Nominal 10yr Yield

Source: MNI - Market News/Bloomberg

U.K.

BOE (BBG): UK inflation has become much more “homegrown” and just over half of the tightening the Bank of England has done to date has still to come through, according to Bank of England Deputy Governor Dave Ramsden.

INFLATION (BBG): Inflation in UK shops has fallen to a 17-month low as retailers fight to attract shoppers ahead of the crucial holiday period. The British Retail Consortium said Tuesday that inflation fell 0.9 percentage points in November to 4.3%, the lowest level since June 2022. It’s the sixth-straight month that the trade association has recorded declines.

HOUSING (BBG): Homebuyers are getting the edge in the UK property market, forcing the growing ranks of sellers to slash prices in order to secure deals.

GEOPOLITICS (BBC): A diplomatic row has broken out between the British and Greek governments over the Parthenon Sculptures, also known as the Elgin Marbles.

EUROPE

ECB (BBG): European Central Bank officials may soon revisit their €1.7 trillion ($1.9 trillion) pandemic bond portfolio and reconsider how long they will replace maturing securities, President Christine Lagarde said.

GERMANY (DPA): Chancellor Olaf Scholz plans to speak in the German lower house, or Bundestag, on Tuesday morning about his coalition government's budget crisis.A two-hour debate is planned following his government statement. It is to be expected that the opposition will sharply attack the government for a debt manoeuvre that was ruled to be unconstitutional.

ITALY (BBG): Prime Minister Giorgia Meloni’s government approved a plan worth €27.4 billion ($30 billion) to promote green investments and ease the cost of energy for the industrial sector.

UKRAINE (RTRS): U.S. Secretary of State Antony Blinken will highlight the NATO alliance's ongoing support for Ukraine in its war with Russia in Europe this week, the top State Department official for Europe said on Monday, even as the war in Gaza continues to take up much of the Biden administration's bandwidth.

FISCAL (POLITICO): EU countries want the Commission to cut at least 20 percent, or around €13 billion, from its proposed midterm budget increase, according to two EU diplomats.

SWEDEN (BBC): Tesla has sued the Swedish Transport Agency after postal workers stopped delivering licence plates connected to the electric car company.

U.S.

FED (MNI): The Federal Reserve is most likely done raising interest rates and policymakers are already pivoting to communication about the need for a prolonged period of higher rates, while expressing caution about whether inflation is sustainably headed to the central bank’s 2% target.

HOUSING (RTRS): Sales of new U.S. single-family homes fell more than expected in October as higher mortgage rates squeezed out buyers even as builders cut prices, but the setback is likely temporary amid a persistent shortage of previously owned houses on the market.

OTHER

MIDEAST (BBG): Israel and Hamas agreed Monday to extend a cease-fire in their devastating war until Thursday morning, as 11 more freed hostages arrived in Israel.

AUSTRALIA (BBG): Australia’s central bank is grappling with demand in the economy that’s proving “a little bit stronger” than expected and helping to keep inflation pressures elevated, Governor Michele Bullock said.

AUSTRALIA (MNI BRIEF): Australian retail turnover fell 0.2% in October from September’s 0.9% increase and August’s 0.2% gain, according to figures released today by the Australian Bureau of Statistics today. All retail categories suffered except food, which increased 0.5%.

CHINA

FISCAL (SECURITIES DAILY/BBG): China is likely to allocate about 2.28t yuan ($319b) of 2024’s new special local government bonds quota by the end of this year to help boost demand for 2024, the Securities Daily reported, citing Golden Credit Rating analyst Feng Lin.

PROPERTY (CSJ/BBG): The land markets in some Chinese are heating up after price curbs on plots were removed, the China Securities Journal reported, citing local auction data.

ECONOMY (BBG): China’s central bank governor gave an upbeat assessment of the world’s second-biggest economy, saying it’ll meet its about 5% expansion target this year and achieve more healthy, sustainable growth in 2024.

ECONOMY (PBoC): China’s economy has a solid foundation to achieve its end of year economic goals following Q3 GDP growth of 4.9%, according to the People’s Bank of China’s third quarter annual report. Going forward, policymakers will pay more attention to cross-cyclical and counter-cyclical adjustments and promote the steady decline in real-economy financing costs using the guiding role of policy interest rates.

CORPORATE (RTRS): China-founded fashion company Shein has confidentially filed to go public in the United States, two sources familiar with the matter told Reuters on Monday.

CHINA MARKETS

PBOC Injects Net CNY96 Bln Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY415 billion via 7-day reverse repo on Tuesday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY96 billion after offsetting the maturity of CNY319 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8140% at 09:27 am local time from the close of 2.1288% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 44 on Monday, compared with the close of 45 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1132 Tuesday vs 7.1159 Monday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1132 on Tuesday, compared with 7.1159 set on Monday. The fixing was estimated at 7.1435 by Bloomberg survey today.

MARKET DATA

MARKETS

SOUTH KOREA NOV CONSUMER CONFIDENCE 97.2; PRIOR 98.1

SOUTH KOREA OCT RETAIL SALES Y/Y 6.4%; PRIOR 9.5%

SOUTH KOREA OCT DISCOUNT STORE SALES Y/Y -4.1%; PRIOR 10.0%

SOUTH KOREA OCT DEPARTMENT STORE SALES Y/Y-2.6%; PRIOR 3.1%

UK NOV BRC SHOP PRICE INDEX Y/Y 4.3%; PRIOR 5.2%

AUSTRALIA RETAIL SALES OCT M/M -0.2%; MEDIAN 0.1%; PRIOR 0.9%

US TSYS: Tick Away From NY Highs In Narrow Ranges

TYZ3 deals at 108-28, -0-04, a 0-05 range has been observed on volume of 63k.

- Cash tsys sit 1-2bps cheaper across the major benchmarks, light bear flattening is apparent.

- Tsys ticked away from NY session highs through the Asian session, participants perhaps used Monday's richening as an opportunity to exit long positions/add fresh shorts.

- Narrow ranges were observed for the most part as the move lower was limited.

- The data docket is thin in Europe today. Further out we have US Conference Board consumer confidence, Richmond Fed Mfg and Business Conditions and Dallas Fed Services. The latest 7-Year supply is due, as is Fedspeak from Fed Governor Waller and Chicago Fed President Goolsbee.

JGBS: Morning Strength Pared After A Poor 40Y Auction

JGB futures are only slightly richer, +9 compared to the settlement levels, after paring the morning’s gains following a poor 40-year auction.

- The issuance of 40-year bonds today encountered a tepid reception, with the actual high yield surpassing dealer expectations. The cover ratio witnessed a decline, dropping to the lowest level at a 40-year auction since March 2022. As the first 40-year supply following the BOJ’s shift to a 1% YCC reference rate, today’s result holds significance particularly given it was in stark contrast to the robust demand metrics witnessed at the 20- and 30-year JGB auctions in November.

- There hasn’t been much else in the way of domestic drivers to flag.

- Cash US tsys are 1-2bps cheaper in today's Asia-Pac session.

- The cash JGB curve is mixed with the belly outperforming. Yields are 1.8bps lower (5-year) to 2.0bps higher (40-year). The benchmark 10-year yield is 1.3bp lower at 0.765% versus the cycle high of 0.97% set in late October and the BOJ's 1% YCC reference rate. The 40-year JGB is around 3bp cheaper in post-auction dealings.

- The swaps curve has twist-steepened, pivoting at the 4s, with rates 0.8bp lower to 1.4bps higher. Swap spreads are mixed.

- Tomorrow, the local calendar is empty, apart from BOJ Rinban operations covering 3- to 25-year JGBs.

AUSSIE BONDS: Richer But Well Off Session’s Best Levels, CPI Monthly Due Tomorrow

ACGBs (YM +6.0 & XM +6.0) sit richer but well off the Sydney session’s best levels. The move away from the session’s best levels likely reflected both domestic and offshore influences.

- On the domestic front, RBA Governor Bullock participated in a panel at the HKMA-BIS conference today. She reiterated her view that stronger-than-expected demand and inflation may mean further tightening. She also said that the main challenge for the RBA going forward will be to reduce domestic inflationary pressures.

- There was also likely spillover from a poor 40-year JGB auction. The actual high yield surpassed dealer expectations and the cover ratio declined to the lowest level at a 40-year auction since March 2022. The 40-year JGB is around 3bp cheaper in post-auction dealings.

- Cash ACGBs are 6bps richer, with the AU-US 10-year yield differential 4bps wider at +10bps.

- Swap rates are 6-7bps lower, with EFPs little changed.

- The bills strip has twist-flattened, with pricing -1 to +6.

- RBA-dated OIS pricing is flat to 5bps softer on the day across meetings, with Feb’25 leading.

- Tomorrow, the local calendar sees the CPI Monthly for October along with Q3 Construction Work Done and the Private Capital Expenditure Survey for 2023-24.

- Tomorrow, the AOFM plans to sell A$800mn of the 2.75% 21 June 2035 bond.

NZGBS: Closed On A Strong Note Ahead Of Tomorrow’s RBNZ Policy Decision

NZGBs closed richer, at or near the session’s best levels, with yields 6-8bps lower. With the domestic calendar empty today ahead of the RBNZ policy decision tomorrow, local participants appear to have been guided by US tsys’s strong resumption to trading yesterday after the Thanksgiving long weekend. That said, those gains have been slightly pared in today’s Asia-Pac session, with cash US tsys flat to 2bps cheaper.

- Swap rates are 11-12bps lower, with the 2s10s curve slightly flatter.

- RBNZ dated OIS pricing is flat to 8bps softer across meetings, with Oct’24 leading. Notably, the market assigns a 15% probability to a 25bp hike at tomorrow's policy meeting.

- We expect the RBNZ to leave rates at 5.5%, where they have been since May. Bloomberg consensus is unanimous at 5.5%. As a result, the focus will be on the accompanying updated forecasts, statement and press conference. (See MNI’s preview here)

- Terminal OCR expectations remain steady at 5.54%. It is noteworthy that the recent peak in the expected terminal rate, recorded at 5.72%, occurred in the lead-up to the Q3 CPI release in mid-October. Subsequently, expectations have undergone a gradual softening, amounting to nearly 20bps. Looking ahead, the market fully prices in a 25bp rate cut by August 2024.

FOREX: Fresh MTD Low For BBDXY

The greenback has ticked marginally lower today, BBDXY printed a fresh November low. An offer in USD/JPY has spillover into moderate USD pressure. Bloomberg noted that month end rebalancing is providing support for the Yen. The cross asset space is relatively muted; US Tsy Yields are a touch higher and US Equity Futures are marginally lower.

- USD/JPY is down ~0.3%, the pair briefly tested ¥148 before marginally paring losses. We sit at ¥148.20/25. Support is at ¥147.15 low from Nov 21. Resistance comes in at ¥149.94, the 20-Day EMA.

- AUD/USD has breached Monday's highs and now sits at touch off its highest level since early August. We sit a touch above $0.6616 the high from Aug 10, the next target for bulls is $0.6656, 61.8% retracement of Jul-Oct bear leg.

- Kiwi has observed narrow ranges for the most part, NZD/USD is see-sawing around $0.61 handle and is little changed from opening levels.

- Elsewhere in G-10 there hasn't been any moves of note.

- The docket is thin in Europe today.

EQUITIES: Hong Kong & Japan Weaken, Firm Gains For South Korean & Taiwan

Equity sentiment is mixed in Asia Pac markets in Tuesday trade to date. Japan and Hong Kong markets are weaker. Most other major markets are higher. US equity futures have been range bound and currently sit a touch weaker. Eminis were last near 4561 (flat), Nasdaq futures are at 15995 (off 0.10%).

- Hong Kong markets sit lower at the break, off 0.60%. Familiar headwinds in terms of earnings concerns and property headwinds are weighing. SCMP noted that the Beijing small cap (BSE 50) index slumped as the authorities looked to curb sharp recent gains. The Beijing Stock Exchange also stated it was untrue that the exchange asked major shareholders not to reduce holdings (BBG).

- PBoC Governor Pan spoke HK, he played down the risks from real estate, stating spill over to the financial system was limited. The economy should achieve its growth target in 2023 as well, while risks from local government debt levels were also contained at an aggregate level.

- The CSI 300 is around flat at the lunch time break.

- The Kospi (+0.7%) is doing better led by Samsung gains. Taiwan's Taiex is also up firmly, over 1% led by the semi conductor sector.

- Japan's markets are lagging, with the Topix off 0.50%, the Nikkei -0.35%. A further rally in the yen (+0.35%) is likely weighing.

- In SEA trends are mixed, Singapore and Malaysia stocks off modestly, but mostly positive gains elsewhere.

OIL: Steady Trends As Market Awaits OPEC Meeting

Oil has tracked a fairly tight range through the first part of Tuesday trade. Brent was last in the $80.15/20 region, a touch above Monday closing levels. We have clawed back 0.25% of Monday's 0.74% loss at this stage. For WTI we are close to the $75/bbl level, following a similar trajectory to Brent.

- Brent drifted higher in early trade, but highs near $80.50/bbl remained well within Monday's ranges. Recent dips sub $80/bbl have been supported and some distance from testing support at $76.60 (Nov 16 low).

- Focus remains on Thursday's OPEC+ meeting. There have been reports that the group remains divided over whether to cut output further with many reluctant to do so and the Nigeria/Angola quota increase has not yet been agreed. CME Group estimates a 67.8% probability that there will be no change in the output level and 24.8% that it will be increased, according to Dow Jones.

- The market is speculating that if OPEC+ can’t agree on quotas that Saudi Arabia will end its voluntary cuts and “flood the market” pushing prices down for all members.

GOLD: Steady Near Highest Level Since May

Gold is slightly higher in the Asia-Pac session, after closing 0.7% higher at $2014.13 on Monday.

- The yellow metal currently sits near the highest level since May, supported by lower US Treasury yields and a weaker USD index.

- US yields and the USD have declined in November as investors made wagers on a dovish pivot from the US Federal Reserve next year, with weak economic data bolstering expectations that the central bank is done with rate hikes.

- Bullion reached a high of $2018.21 on Monday, piercing resistance at $2009.4 (Nov 7 high). According to MNI’s technicals team, a clear break of this hurdle would confirm a resumption of the uptrend and open $2022.2, the May 15 high.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/11/2023 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 28/11/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 28/11/2023 | 0900/1000 | ** |  | EU | M3 |

| 28/11/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 28/11/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/11/2023 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/11/2023 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 28/11/2023 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 28/11/2023 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 28/11/2023 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 28/11/2023 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/11/2023 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 28/11/2023 | 1500/1000 |  | US | Chicago Fed's Austan Goolsbee | |

| 28/11/2023 | 1505/1005 |  | US | Fed Governor Christopher Waller | |

| 28/11/2023 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 28/11/2023 | 1545/1045 |  | US | Fed Governor Michelle Bowman | |

| 28/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/11/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 28/11/2023 | 1700/1700 |  | UK | BOE's Haskel UK Inflation Speech | |

| 28/11/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/11/2023 | 1805/1305 |  | US | Fed Governor Michael Barr | |

| 28/11/2023 | 1830/1930 |  | EU | ECB's Lane lecture on Macroeconomic policy | |

| 28/11/2023 | 2030/1530 |  | US | Fed Governor Michael Barr | |

| 28/11/2023 | 2325/1825 |  | CA | BOC Executive Director of Supervision Ron Morrow speech. |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.