-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD/JPY At Fresh YTD Highs Despite Verbal Jawboning

EXECUTIVE SUMMARY

- US WEST COAST PORT EMPLOYERS, UNION ANNOUNCE TENTATIVE DEAL - BBG

- JAPAN’s MATSUNO SAYS EXCESSIVE MOVES IN FX MARKETS NOT DESIRABLE - BBG

- CHINA NEEDS TO TAKE STEPS TO FURTHER SUPPORT ECONOMY - ECO DAILY

- CHINA’s ECONOMY SLOWS IN MAY, FIRMING CASE FOR MORE SUPPORT - RTRS

- AUSTRALIAN JOBS SURGE BOOSTS RATE-HIKE BETS AS INFLATION LINGERS - BBG

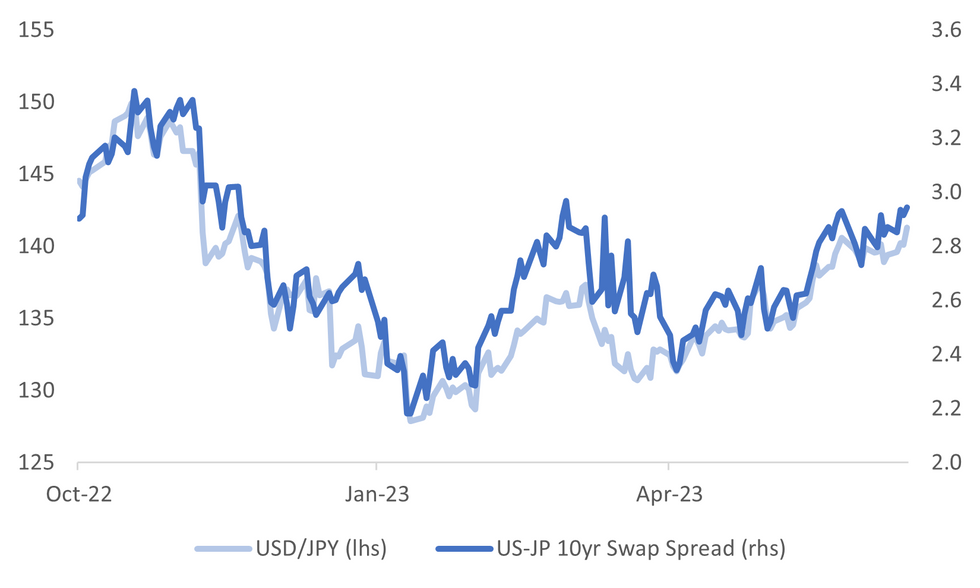

Fig. 1: USD/JPY Versus US-JP 10-Year Swap Rate Differential

Source: MNI - Market News/Bloomberg

U.K.

BoE: Britain’s trade strategy needs reinventing to ensure both services and manufacturing businesses can thrive following the nation’s exit from the European Union, according to a paper co-authored by a Bank of England policymaker. (BBG)

EUROPE

ECB: The ECB is expected to deliver a 25bp increase to the deposit rate today, lifting the rate to 3.50%. Markets are focused on guidance for how much further bank officicals expect the rate to raise as inflation remains sticky. (BBG)

U.S.

EMPLOYMENT: The Pacific Maritime Association and the International Longshore and Warehouse Union announced a tentative agreement on a new six-year contract covering workers at all 29 West Coast ports, according to a joint statement. The talks dragged on for more than a year to replace the previous contract that expired in July. (BBG)

US/China: Secretary of State Antony Blinken’s last attempt to visit China was derailed by an alleged Chinese spy balloon. Now he’s ready to try again, departing Friday for a two-day trip aimed at stabilizing ties with the world’s second-largest economy and reducing the risk that miscommunication ignites conflict between the two superpowers. (BBG)

US/China: Bill Gates, Microsoft Corp's co-founder, is set to meet Chinese President Xi Jinping on Friday during his visit to China, two people with knowledge of the matter said. (RTRS)

OTHER

JAPAN: Japanese Chief Cabinet Secretary Hirokazu Matsuno says that excessive movements in foreign exchange markets aren’t desirable and there’s no change to government stance that it would appropriately respond to any unwarranted moves as needed. (BBG)

JAPAN: Japan's exports grew unexpectedly in May on robust car sales, though the rate of expansion slowed to a crawl as inflation and rising interest rates bit into global demand, highlighting a patchy recovery in the world's third-largest economy. (RTRS)

AUSTRALIA: Australian employment smashed expectations in May and unemployment surprisingly declined, bolstering the case for the Reserve Bank to raise interest rates further to counter inflationary pressures. (BBG)

NZ: New Zealand led the world in raising interest rates to combat the post-pandemic inflation wave. Now it’s officially in recession in a possible harbinger of what lies ahead for others. (BBG)

SOUTH KOREA: South Korea is pressing to restore a summit with the leaders of China and Japan despite a diplomatic rift that’s led some parliament members of President Yoon Suk Yeol’s party to call for the expulsion of Beijing’s envoy. (BBG)

CHINA

POLICY: China needs to take steps to further support its economy as the external environment is becoming “more severe and complex”, domestic demand is still insufficient and private investment is still relatively weak, Economic Daily, backed by China’s cabinet, says in a front-page commentary. (BBG)

PROPERTY: The persistent slump in the property sector could push policymakers to take more supporting measures as soon as June to stimulate “reasonable” housing demand and boost market confidence, China Securities Journal reported, citing analysts. (CSJ)

ECONOMY: China's economy stumbled in May with industrial output and retail sales growth missing forecasts, adding to expectations that Beijing will need to do more to shore up a shaky post-pandemic recovery. (RTRS)

ELECTRICITY: Chinese electricity output rose in May as unseasonably hot weather strained the grid in some areas and generators rushed to ensure adequate power supplies. (BBG)

YUAN: China’s currency may appreciate in the second half of the year as the country's relatively strong economic fundamentals become important factors, according to Lian Ping, chief economist and research institute of Zhixin Investment. Writing in Yicai, Lian said the economy in H2 will display relative strength in consumption, investment and exports, and he expects a steady recovery of industrial production with favourable policies for private enterprises. Exporters are increasing trading with RCEP partners, a factor that could create an export rebound in Q4. (MNI)

EMPLOYMENT: The Ministry of Human Resources said officials will prioritise stabilising employment for women, youth and the elderly in upcoming policy support, according to 21st Century Herald. A spokesperson interviewed by the paper said efforts were needed to improve rights for women in the workplace, and the ministry will endeavour to expand jobs for college graduates. China must ensure it improves labour mobility by improving access to public services, affordable housing, medical services and basic education. (MNI)

CHINA MARKETS

PBOC Injects CNY2 Bln Via OMOs Thurs.

- As widely expected, the 1yr MLF rate was cut to 2.65% from 2.75%. The PBoC also conducted 237bn yuan of 1yr MLF, which meant a net injection of 37bn via the MLF.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.1489 THURS VS 7.1566 WED

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1489 on Thursday, compared with 7.1566 set on Wednesday.

OVERNIGHT DATA

NZ Q1 GDP Q/Q -0.1%; MEDIAN -0.1%; PRIOR -0.7%

NZ Q1 GDP Y/Y 2.2%; MEDIAN 2.6%; PRIOR 2.3%

JAPAN MAY TRADE BALANCE -¥1372.5bn; MEDIAN -¥1286.8bn; PRIOR -¥432.3bn

JAPAN MAY TRADE BALANCE ADJUSTED -¥-777.8bn; MEDIAN -¥860bn; PRIOR -¥1035.5bn

JAPAN MAY EXPORTS Y/Y 0.6% Y/Y; MEDIAN -1.2%; PRIOR 2.6%

JAPAN MAY IMPORTS -9.9%; MEDIAN -10.3%; PRIOR -2.3%

JAPAN APR CORE MACHINE ORDERS M/M 5.5%; MEDIAN 3.0%; PRIOR -3.9%

JAPAN APR CORE MACHINE ORDERS Y/Y -5.9%; MEDIAN -8.5%; PRIOR -3.5%

AU JUN CONSUMER INFLATION EXPECTATION 5.2%; PRIOR 5.2%

AU MAY EMPLOYMENT CHANGE 75.9k; MEDIAN 17.5k; PRIOR -4.0k

AU MAY FULL-TIME EMPLOYMENT CHANGE 61.7k; PRIOR -28.6k

AU MAY PART-TIME EMPLOYMENT CHANGE 14.3k; PRIOR 24.6k

AU MAY UNEMPLOYMENT RATE 3.6%; MEDIAN 3.7%; PRIOR 3.7%

AU MAY PARTICIPATION RATE 66.9%; MEDIAN 66.7%; PRIOR 66.7%

CHINA MAY NEW HOME PRICES M/M 0.10%; PRIOR 0.32%

CHINA MAY INDUSTRIAL PRODUCTION Y/Y 3.5%; MEDIAN 3.5%; PRIOR 5.6%

CHINA MAY RETAIL SALES Y/Y 12.7%; MEDIAN 13.7%; PRIOR 18.4%

CHINA MAY FIXED ASSETS EX RURAL YTD Y/Y 4.0%; MEDIAN 4.4%; PRIOR 4.7%

CHINA MAY PROPERTY INVESTMENT YTD Y/Y -7.2%; MEDIAN -6.7%; PRIOR -6.2%

CHINA MAY RESIDENTIAL PROPERTY SALES YTD Y/Y 11.9%; PRIOR 11.8%

CHINA MAY SURVEYED JOBLESS RATE 5.2%; MEDIAN 5.2%; PRIOR 5.2%

MARKETS

US TSYS: Pressured In Asia

TYU3 deals at 112-20+, -0-07+, a touch off the bottom of the observed 0-12+ range observed on volume of ~73k.

- Cash tsys sit 2-6bps cheaper across the major benchmarks. The curve has bear flattened.

- Tsys have been pressured through the Asian session. Spillover from ACGB's, in lieu of stronger than forecast Australian Employment data weighed.

- In recent dealing losses have marginally extended as USD firms led by a USD/JPY which is up ~0.9%. However, Wednesday's post-FOMC lows remain intact for now.

- In Europe today the latest ECB monetary policy decision is due. Further out a slew of data crosses including Retail Sales, Terms of Trade, Initial Jobless Claims and Empire Manufacturing.

JGBS: Futures Off Highs But Outperforming Weaker US Lead

JBG futures sit comfortably off session highs, last at 148.15, +3. We haven't been to sustain breaks sub 148.10, despite an offered tone to TYU3, which is back to 112-21d, -06, not too far from NY session lows on Wednesday.

- In the cash bond space, we are lower in yield terms, but only marginally, and remain well within recent ranges. The 10yr around 0.425%, the 20yr near 1.00% and 40yr close to 1.39%.

- The swap space is seeing slightly firmer yield moves, the 10yr back to 0.593% at the time of writing, although we remain sub recent highs just above 0.6000%.

- Rinban purchases totaled ¥1.3tn earlier, while we also had a 3 month t-bill auction (see this link).

- The domestic focus today has been on fresh FX weakness, which has seen USD/JPY climb to fresh YTD highs. Verbal rhetoric from the authorities has picked up, but hasn't altered the trend at this stage.

- Tomorrow, we have the BoJ outcome, with no major changes expected, see our preview here.

- The opposition is also expected to put forward a no-confidence motion, which could see PM Kishida call an early election.

AUSSIE BONDS: Pressured After Unemployment Rate Ticks Lower

ACGB's sit 6-12bps cheaper across the major benchmarks, the curve has bear flattened.

- Futures are also pressured, XM (-0.066) and YM (-0.118).

- The May Labour Report showed a net gain of 75.9k jobs with the unemployment rate ticking unexpectedly lower to 3.551% falling 0.13% on the month.

- Earlier in the session June Consumer Inflation Expectations held steady at 5.2%.

- RBA Dated OIS now price a terminal rate of 4.56% in December.

- The domestic data calendar is empty tomorrow.

NZGBS: Marginally Richer After Technical Recession Confirmed

NZGB's have finished dealing 1-2bps richer across the major benchmarks, the curve has bull flattened.

- This mornings Q1 GDP print confirmed a technical recession in New Zealand. The Q/Q print was in line with expectations at -0.1%, and the Y/Y print was a touch lower than expected at +2.2%.

- NZGBs head post GDP gains through the session.

- Terminal RBNZ rate pricing has ticked lower in OIS markets. A terminal rate of 5.61% is now seen against 5.64% pre data, there are also ~40bps of cuts priced for 2024.

- On the wires early tomorrow we have May BusinessNZ Mfg PMI, there is no estimate and the prior read was 49.1

FOREX: USD/JPY To Fresh YTD Highs Despite Verbal Jawboning, A$ Up On Jobs Beat

The USD has traded with a firmer bias in Asia Pac today, the BBDXY back close to 1232.00 at the time of writing, +0.25% versus NY closing levels. This is well above pre FOMC levels from Tuesday's sessions with US yield moves supporting gains, as the market digested the hawkish FOMC on hold outcome (better AU jobs data also helped these moves). Cash US Tsy yields gains have accelerated this afternoon, the 2yr back to 4.74% (+5bps). Only AUD is tracking higher against the USD at this stage.

- USD/JPY broke through 141.00 earlier, which prompted fresh verbal rhetoric from the Japan authorities. This saw the pair consolidate, but we have since move to fresh highs of 141.33.

- US yield moves we aided by higher AU yields which came post the AU May jobs beat. This helped bring AUD/USD up from lows sub 0.6770, to be last around 0.6800/05, fresh highs for the session. RBA terminal pricing has risen.

- NZD/USD has faltered, weighed by a slightly weaker than expected Q1 GDP report, which confirmed the economy was in a technical recession. The detail wasn't too bad though. NZD/USD saw support ahead of 0.6160, last tracking near 0.6180, still -0.50% for the session.

- EUR/USD sits around 1.0810/15 currently, not far from session lows.

- This comes ahead of the ECB meeting later, which is expected to delivery a 25bps hike. Later US May retail sales, trade prices, IP/capacity, business inventories, Empire & Philly indices and jobless claims print.

EQUITIES: Another Day, Another Fresh High For Japan Stocks

Regional equities haven't been a focus point today, with the dollar and yield backdrop taking center stage. Recent themes have persisted though, with Japan equities pushing higher again, while HK and China are also higher. Trends are mixed elsewhere, while US equity futures are close to flat, Eminis last near 4419.

- The Nikkei 225 has again made a fresh high, up a further ~0.6% at this stage (albeit down from session highs). The electrics sector is higher, while brokerages are higher amid reports of higher retail product sales (per reports from Nomura). USD/JPY is also at fresh highs for the year, through 141.00, likely aiding the export segment. Offshore inflows into Japan stocks continued for the 11th straight week.

- China onshore media continues to push the case for policy stimulus, with a front page article on today's Economic Daily (see this link for more details). May activity data was weaker than expected, while the 1yr MFL was cut 10bps as widely forecast. At the break, the CSI 300 is +0.54%, near 3885 in index terms. The HSI is +0.83% at the break.

- The Kospi continues to struggle, with the index down a further 0.50% today, despite better tech leads from Wednesday US trade.

- In SEA trends are mixed, most bourses are down but losses are under 0.50% At this stage, except for the Philippines.

OIL: Prices Remain Down As Fed Tightening Expectations Grow

After falling around a percent on Wednesday, oil prices are down another 0.3% during the APAC session as the USD continued to strengthen and US yields to rise on expected future Fed tightening. The USD index is 0.3% higher.

- Brent is down 0.2% to around $73.01/bbl, close to the intraday low of $72.96. Breaks below $73 haven’t been sustained. WTI is 0.3% lower to about $68.08, close to the intraday low of $68.04. $68 hasn’t been breached this session.

- Despite forecasts of the market being in deficit in H2 2023, it remains concerned about stock build and lacklustre demand. The rise in US gasoline inventories signalled weak demand during the driving season, but on the other hand China released a large number of crude import quotas suggesting rising demand.

- Later US May retail sales, trade prices, IP/capacity, business inventories, Empire & Philly indices and jobless claims print. The ECB meets and is expected to hike 25bp.

GOLD: Higher Yields Weigh On Bullion, Approaching Support

Gold is down 0.4% during APAC trading after falling only 0.1% on Wednesday. It is currently around $1934.02/oz, close to the intraday low. Earlier it reached a high of $1945.38 but began trending down as the USD strengthened and Treasury yields rose. The USD index is 0.3% higher.

- Bullion fell to $1940.19 following the Fed decision to keep rates unchanged but the hawkish projections and comments from Fed Chairman Powell that upcoming meetings remain live drove yields higher and gold down. It closed at $1942.52.

- Prices are down 1% since Friday but are holding just above support at $1932.20, the May 31 low.

- Later US May retail sales, trade prices, IP/capacity, business inventories, Empire & Philly indices and jobless claims print. The ECB meets and is expected to hike 25bp.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/06/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 15/06/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 15/06/2023 | - |  | EU | ECB Panetta at Eurogroup Meeting | |

| 15/06/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/06/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 15/06/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 15/06/2023 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 15/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 15/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 15/06/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/06/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 15/06/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/06/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/06/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 15/06/2023 | 1245/1445 |  | EU | Post-Meeting ECB Press Conference | |

| 15/06/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/06/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 15/06/2023 | 1400/1000 | * |  | US | Business Inventories |

| 15/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 15/06/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 15/06/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 15/06/2023 | 1535/1635 |  | UK | BOE Cunliffe at Politico Global Tech Summit | |

| 15/06/2023 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.