MNI EUROPEAN OPEN: USD/JPY Testing 140.00, Trading Light

EXECUTIVE SUMMARY

- AN ATTEMPT ON FORMER PRESIDENT TRUMP’S LIFE WAS FOILED - BBC

- WEAK AUGUST CHINA ECONOMIC DATA - MNI

- FED EXPECTED TO CUT RATES THIS WEEK BUT UNCERTAIN BY HOW MUCH - MNI

- OPTIMISM IN UK HOUSING MARKET - BBG

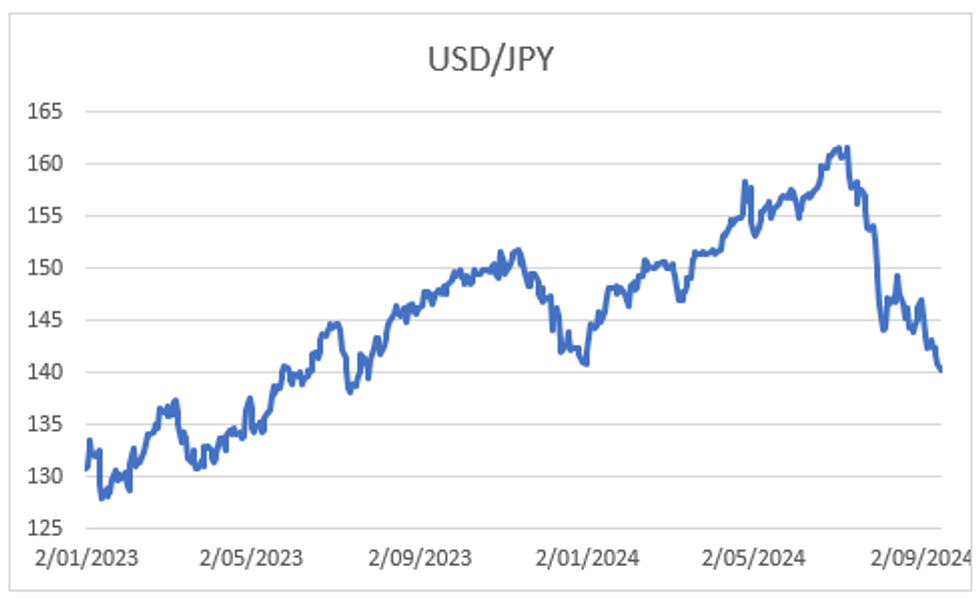

Fig. 1: USD/JPY Makes Fresh Lows

Source: MNI - Market News/Bloomberg

UK

BOE (MNI): “The Bank of England is likely to make low-key policy announcements next Thursday, announcing that it will slightly accelerate or hold roughly steady the pace of its reductions in bond holding over the next 12 months, and leaving its policy rate on hold.”

ECONOMY (BBG): “Asking prices for UK houses increased at double their long-term average pace in September, signaling new optimism by home-sellers in the wake of the Bank of England’s first interest-rate cut in more than four years.”

EU (BBC): “The British leader is set to meet Italian Prime Minister Giorgia Meloni on Monday. Top of the agenda will be migration and how the UK can learn from Italy - the European Union member receiving the highest number of migrant arrivals, but which has recently seen a dramatic fall.”

UKRAINE (BBC): “UK Prime Minister Sir Keir Starmer has held "productive" talks with US President Joe Biden about Ukraine – but he did not signal any decision on allowing Kyiv to fire long-range missiles into Russia.”

EU

TRADE (POLITICO): “Beijing will not make concessions as it negotiates on tariffs on electric vehicle imports with the EU, a social media account associated with the Chinese state broadcaster said.”

EU (MNI): “The European Union has not “embraced” the proposals of former Italian Premier and ECB Chief Mario Draghi for more joint financing and the repayment of the EUR800bn NGEU post-pandemic recovery instrument will remain the “top priority” and focus for the next European Commission, MNI understands.”

GERMANY (BBG): “A temporary extension of border controls to all of Germany’s nine land frontiers takes effect on Monday, part of an enhanced effort to tackle irregular migration and people smuggling that has irritated some of its neighbors.”

GERMANY (POLITICO): “China’s military on Saturday criticized the transit of two German navy ships through the Taiwan Strait, saying it increased security risks.”

ITALY (BBC): “Prosecutors in Italy are seeking a six-year jail term for deputy prime minister Matteo Salvini over a decision in August 2019 to stop a migrant boat from docking.”

UKRAINE (POLITICO): “Ukrainian President Volodymyr Zelenskyy said that he’s treating Republican presidential nominee Donald Trump’s vow to end the Russia-Ukraine war immediately as a campaign promise that is not necessarily based on anything specific that his country needs to be worried about.”

RUSSIA (BBG): “The US and UK are increasingly concerned that Russia is sharing with Iran secret information and technology that could bring it closer to being able to build nuclear weapons, in exchange for Tehran providing Moscow with ballistic missiles for its war in Ukraine.”

RUSSIA (POLITICO): “Iran's President Masoud Pezeshkian will attend the BRICS summit of emerging economies in Russia, Tehran's ambassador in Moscow confirmed Sunday. Pezeshkian will meet Russian President Vladimir Putin at the summit, which is scheduled for Oct. 22-24 in the Russian city of Kazan, Ambassador Kazem Jalali told Iranian state media.”

US

FED (MNI): “Fed leadership has made it abundantly clear that the FOMC will initiate a rate cutting cycle at the September meeting, with pre-blackout developments pointing toward a 25bp reduction as opposed to an outsized 50bp.”

FED (MNI): “The September update to Federal Reserve officials' individual forecasts is expected to show more interest rate cuts sooner, with policymakers clustered around 75 basis points this year and another 100 to 150bp in 2025, former Fed officials and staff told MNI.”

FED (MNI WATCH): “The Federal Reserve goes into its September policy meeting still weighing how aggressively to begin its interest rate cutting cycle as officials worry about how much weaker the labor market could get in the months ahead.”

POLITICS (BBC): “Former President Donald Trump is safe following an apparent assassination attempt at his Florida golf course, and a "potential suspect" is in custody, US authorities have confirmed.”

POLITICS (MNI): “Vice President Kamala Harris was widely judged to have won the first presidential debate with former President Donald Trump. She controlled the tone of the debate and effectively baited Trump into defensive responses that whiffed on Harris’ political vulnerabilities.”

GEOPOLITICS (BBC): “The United States has dismissed claims made by Venezuela that the CIA plotted to assassinate President Maduro and other top officials.”

BUSINESS (BBC): “TikTok will start making its case on Monday against a law that will see it banned in the US unless its Chinese owner ByteDance sells it within nine months.”

TRADE (BBC): “The US has proposed rules that would hit many low-value shipments from China with new taxes - a measure aimed at curbing the flood of packages from shopping sites such as Shein and Temu. The Biden administration said the plan was intended to stop "abuse" of an exemption that allowed packages worth less than $800 (£600) to enter the US without facing tariffs and other fees.”

OTHER

ISRAEL (BBG): “A missile fired by Yemen’s Houthis reached central Israel, setting off sirens from the outskirts of Tel Aviv to the Jerusalem foothills, and partially broke apart in mid-air after it was shot at, the Israeli military said.

ISRAEL (POLITICO): “Israeli Prime Minister Benjamin Netanyahu vowed that Yemen's Houthi rebels will pay a “heavy price” after a missile fired by the group landed in central Israel early Sunday.”

ARGENTINA (BBG): “President Javier Milei’s first budget proposal estimates annual inflation will slow to 18.3% by the end of 2025, according to a document sent to Argentina’s Congress Sunday.”

CHINA

ECONOMY (MNI): “China's economy slowed more than expected in August as weak demand continued to weigh on production, investment, and consumption which hit the second lowest level this year despite summer vacation, data released by the National Bureau of Statistics on Saturday showed.”

INFLATION (MNI): “China’s CPI is expected to rise moderately in the next stage, driven by rising services prices over the holiday season, said Liu Aihua, spokesperson at the National Bureau of Statistics, on Saturday.”

MARKET DATA

UK SEPT. RIGHTMOVE HOUSE PRICES +0.8% M/M; PRIOR -1.5%

UK SEPT. RIGHTMOVE HOUSE PRICES +1.2% Y/Y; PRIOR +0.8%

NEW ZEALAND BNZ AUG. SERVICES PSI 45.5; PRIOR 45.2

MARKETS / UP Today

US TSYS: Tsys Futures Edge Higher, Volumes Low With Asia Out

- Global rates are slightly higher, most of Asia out for a public holiday, with both JGBs & US tsys trading closed for the session. Tsys futures jumped slightly higher on the open, before paring some gains. TYZ4 is back to trading near session highs, however volumes have been on the low side.

- TUZ4 is outperforming +00⅞ at 104-11⅛ while TYZ4 is + 01 at 115-14+.

- The trend in TYZ4 is higher with the latest pullback is considered corrective. Wednesday’s initial rally resulted in a print above key resistance and the bull trigger at 115-19, the Aug 5 high. The move higher confirms a resumption of the uptrend and paves the way for a climb towards the 116.00 handle. MA studies remain in a bull-mode position with firm support is seen at 114-19, the 20-day EMA.

- Projected rate hikes through year end firmer vs. late Thursday levels (*) : Sep'24 cumulative -38.1bp (-31.5bp), Nov'24 cumulative -76.6bp (-68.6bp), Dec'24 -117.4bp (-107.5bp).

- Slow start to the week ahead with Empire Manufacturing early Monday, Tuesday Retail Sales while focus will turn to Wednesday's FOMC announcement

AUSSIE BONDS: ACGBS Richer, Curve Slightly Steeper, 10yr Tests 3.800%

ACGBs (YM +3.4 & XM +0.9) are richer today, although trade just off session's best level, while headlines have been almost non-existent will majority of Asia out today for public Holidays.

- Global rates look to have just continued with moves made in US tsys on Friday, while the weaker data out of China on Saturday, and talk from PBoC around further stimulus look to have helped local yields.

- Equities have been mixed today, Australia's ASX200 is slightly higher as banks outperformed, while Hong Kong equities were the only outlet traders could sell in response to the poor China data, the HSI was down about 1% at its worst however have recovered majortiy of that weakness to trade just 0.20% lower.

- Cash ACGBs are flat to 2.5bps richer with the 2yr is trading -2.6bps at 3.529%, the 10yr is now -0.2bps at 3.812% both made new cycle lows. The 2s10s is +2.40 at 27.810 while the AU-US 10-year yield differential dropped 2bps this morning to +15bps.

- Swap rates are 1-3bps lower, with the curve is slightly steeper

- The bills strip is cheaper, with pricing -0.5 to +1 across contracts.

- RBA dated OIS is little changed today with 21bps of cuts now priced into year-end. While we have firmed through meeting next year with the Feb meeting is now pricing in 46.5, up 4bps.

- Today, the calendar was empty, focus will now turn to Employment Data on Thursday

BONDS: NZGBs Richer, Curve Steepens, Economists See No GDP Growth

NZGBs are richer today, closing at session's best. Liquidity was very thin today, while headlines were light.

- Economists from the New Zealand Institute of Economic Research have revised their forecasts, now projecting 0.0% annual GDP growth for 2024-25, down from 0.6% in the June survey. For 2025-26, GDP growth is expected to be 2.2%, slightly lower than the previous forecast of 2.4%.

- New Zealand’s Performance of Services Index rose slightly to 45.5 in August from 45.2 in July although this marked the sixth consecutive month of contraction, the longest such period since the global financial crisis. Although still below the 50 threshold indicating growth, the gauge has recovered from a three-year low of 41 in June. All five sub-indexes remain in contraction, with the activity measure rising to 43.9. The composite index, which includes the PMI, increased to 45.6 from 45.0 in July

- The NZGB curve has bull-steepened today, yields closed 1.5-5.5bps lower. The 2yr is -5.2bps at 3.800%, while the 10yr is -3.0bps at 4.051% both at new cycle lows

- Swap rates are flat-5.5bps lower curve is steeper.

- RBNZ dated OIS has firmed slightly today, with 40bps priced in for October, and 88bps of cuts priced in by year-end, pricing has also firmed 2-5bps into May 2025.

- Focus for New Zealand this week will be on GDP due out Thursday.

GOLD: Bullion Reaches New High On Fed Rate Cut Expectations & Weaker US$

Gold prices have continued to rise during APAC trading today as not only is the Fed expected to cut rates for the first time this cycle on Wednesday but there are material expectations that it could be by as much as 50bp. Lower rates are supportive of gold given that it is a non-interest bearing asset. Bullion made a new record today rising to $2589.03/oz.

- It rose 0.8% on Friday to $2577.70 and is 0.3% higher today to $2585.80. The USD index is down 0.2%, pressured by the apparent attempt to assassinate former President Trump, which is also supporting gold prices.

- Bullion has been supported by geopolitical uncertainties over this year. On the weekend, Houthi rebels launched and landed a missile in Israel but without any damage. While Russia is bombarding the strategically important town of Pokrovsk, Ukraine.

- Gold prices have broken above resistance at $2584, 1.764 projection of the Jul 25 – Aug 2 – Aug 5 price swing, opening up $2600, round number resistance. Recent session moves have maintained the bullish price sequence of higher highs and higher lows. Moving average studies are in a bull-mode set up signalling a clear uptrend.

- The USD OIS market has just over 1.5 25bp rate cuts priced in.

- Later the NY Empire manufacturing index for September and euro area July trade data print. The ECB’s Lane and de Guindos make appearances today.

OIL: Crude Little Changed As Weak China Data Offset By Ongoing Libyan Issues

While oil prices rose moderately on Friday, they sold off into the US close. They have remained soft during today’s APAC trading, despite a weaker US dollar (BBDXY index -0.2%). Commodity prices have generally been fallen, while equities are mixed.

- Brent is little changed at $71.58/bbl, close the intraday low, while WTI is 0.1% higher at $68.72/bbl, as supply/demand developments offset each other.

- China’s August data dump, released on Saturday, was generally below expectations. Oil markets have been concerned about the strength of China’s economy for some time and the data added to fears that it won’t make its 2024 growth target. Apparent oil demand fell 5.9% y/y; China is the world’s largest crude importer.

- Some Libyan oil fields have been shut in recent weeks due to a dispute between the country’s two governments over the central bank managing oil revenues. Crude exports fell to 314kbd last week down from 468kbd in the first five days of September, according to Bloomberg tanker tracker data.

- Bloomberg is reporting that hedge funds are net bearish Brent for the first time since data began in 2011.

- Later the NY Empire manufacturing index for September and euro area July trade data print. The ECB’s Lane and de Guindos make appearances today.

LNG: Prices Higher As Global Competition For Supplies Remains Strong

European LNG prices rose 1.6% to EUR 35.75 after rising to EUR 36.19, but they are down over 10% in September to date. Since Russia’s invasion of the Ukraine, the region has become reliant on global supplies and Egypt’s purchase of 20 cargoes for Q4 at a premium to European prices rattled markets on Friday. The heating season begins on October 1 and while European storage is around 93% full, it will face significant competition if winter is particularly cold.

- Russian gas flows to Europe through Ukraine continue as normal. There is material uncertainty when the agreement that allows this expires at year end.

- European industrial demand is likely to remain weak though with manufacturing PMIs below 50 and July euro area IP down 0.3% m/m and 2.2% y/y.

- US natural gas prices fell 2.7% to $2.29 to be up almost 8% this month. Prices were pressured on Friday by the resumption of production following Hurricane Francine. The time of year is also not supportive of gas prices being between heating and cooling seasons. Maxar is forecasting temperatures higher-than-average over the coming 2 weeks. Storage levels remain elevated but are moderating towards the 5-year average.

- Hurricane Francine shut in 52% of natural gas production in the Gulf of Mexico, according to Bloomberg.

- Lower-48 US gas production was down 1% y/y while demand rose 0.1% y/y. Texas’ Freeport LNG facility saw a 1bcf/d increase in gas supplies on Friday from BNEF’s LNG Feedgas Model.

- North Asian prices rose 2.1% but are down 8.3% in September. Demand remains robust with China, South Korea and Bangladesh looking for shipments.

ASIA STOCKS: Asian Equities Mixed With Most Markets Out For Public Holidays

Asian markets are experiencing mixed trading as investors react to disappointing Chinese data, Typhoon Bebinca while liquidity is poor with majority of Asia out on public Holidays. Looking ahead it is busy week for central bank decisions with the Fed the most closely watched followed by BoJ & BoE, while locally we also have Indonesia & Taiwan central bank decisions.

- Hong Kong's HSI has recovered the morning's losses to now trade flat for the session, with the HSTech Index now trading 0.15% higher, while the HS Banks Index is just 0.25% lower, property however is again struggling with the Mainland Property Index down 2.20% the weakness is largely linked to the poor China data from Saturday with Industrial Production fell to 4.5% from 5.1% in July missing expectations of 4.7%, Retail Sales fell to 2.1% from 2.7% prior and missed expectations of 2.5%. Investment also slowed more than expected in August, while the jobless rate reached a six-month high.

- Taiwan's large-cap tech stocks are slightly higher today largely just tracking moves made on Friday in US equities. Germany sent its first warship through the Taiwan Strait in 22 years.

- Australian equities are slightly higher today with Financials contributing most to index gains WBC leads the way higher, up 1.50%. There is little on the calendar until Thursday when employment data is due out.

- US equity futures are little changed this morning with S&P Eminis flat, while Nasdaq 100 is 0.10% lower.

FOREX: Yen Outperforms, USDJPY Lowest Since Mid-2023

The USD index is down 0.2%, pressured by the apparent attempt to assassinate former President Trump, with all of the G10 stronger against the greenback. The yen has outperformed finding support from risk adverse trades but also expectations that the Fed will ease on Wednesday and that the BoJ’s next move will be a hike, even if it isn’t on Friday.

- USDJPY is down 0.5% to 140.18 after a low of 139.96, the first break below 140 since 2023 and strongest since July 2023. It continues to hold below support at 140.25, 28 December 2023 low. Liquidity is thin given the holiday not just in Japan but also South Korea and China.

- AUDUSD is 0.3% higher at 0.6726, close to the intraday high of 0.6730. AUDJPY is down 0.1% to 94.35 and has range traded today.

- NZDUSD is up 0.3% to 0.6174 after a high of 0.6181. Services data and NZIER forecast report showed that the economy remains weak. Further rate cuts are expected. AUDNZD is 0.1% higher at 1.0895 with moves above 1.09 being brief.

- European currencies have outperformed, apart from the yen, with EURUSD up 0.2% to 1.1097. USDSEK is down 0.4% to 10.195 and USDNOK -0.4% to 10.618. USDCHF is down 0.3% to 0.8462 resulting in EURCHF falling 0.1% to 0.9391. GBPUSD up 0.2% to 1.3154. BoE is not expected to cut rates at its Thursday meeting.

- Later the NY Empire manufacturing index for September and euro area July trade data print. The ECB’s Lane and de Guindos make appearances today.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 16/09/2024 | 0800/1000 | ** |  | Italy Final HICP |

| 16/09/2024 | 0810/1010 |  | ECB's De Guindos at VII Foro Banca event | |

| 16/09/2024 | 0900/1100 | * |  | Trade Balance |

| 16/09/2024 | 1200/1400 |  | ECB's Lane Speech at European Investment Bank Chief Economists' Meeting | |

| 16/09/2024 | 1230/0830 | ** |  | Monthly Survey of Manufacturing |

| 16/09/2024 | 1230/0830 | ** |  | Empire State Manufacturing Survey |

| 16/09/2024 | 1300/0900 | * |  | CREA Existing Home Sales |

| 16/09/2024 | 1530/1130 | * |  | US Treasury Auction Result for 13 Week Bill |

| 16/09/2024 | 1530/1130 | * |  | US Treasury Auction Result for 26 Week Bill |