-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI China Daily Summary: Tuesday, December 10

MNI EUROPEAN OPEN: USD Lower As UST Yields Hold Close To Monday Lows

EXECUTIVE SUMMARY

- WHITE HOUSE SAYS IRAN ‘ACTIVELY FACILITATING’ SOME ATTACKS ON US MILITARY BASES - RTRS

- BANK OF ENGLAND RATE HAS PEAKED, TO STAY AT 5.25% THROUGH Q2 - RTRS

- CHINA, US OFFICIALS DISCUSS MACROECONOMIC DEVELOPMENTS IN MEETINGS - RTRS

- CHINA’S RECORD COPPER PRODUCTION SIGNALS RESILIENT DEMAND - BBG

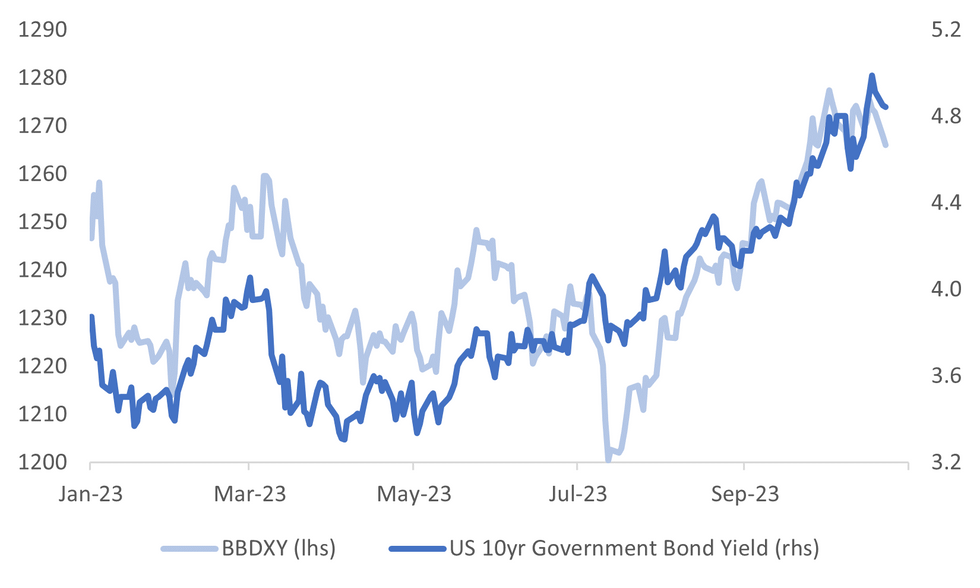

Fig. 1: US Tsy 10yr Nominal Yield & BBDXY Index

Source: MNI - Market News/Bloomberg

U.K

BOE (RTRS): The Bank of England is likely done with policy tightening and will leave Bank Rate at 5.25% on Nov. 2, according to the vast majority of economists polled by Reuters who did however caution the chance of another increase this year was high.

EUROPE

NATO (BBG): Turkish President Recep Tayyip Erdogan asked the country’s parliament to ratify Sweden’s application to join NATO, a crucial step in the Nordic nation’s bid to become a member of the military alliance after almost a year and a half of delays.

FRANCE/ISRAEL (RTRS): French President Emmanuel Macron flies to Israel on Tuesday at a delicate juncture of its conflict with Hamas, coming with proposals and pushing for a humanitarian truce despite a looming ground offensive into Gaza.

ECB (BBG): European Central Bank officials weighing whether they’ve raised borrowing costs far enough are confronting a related challenge: how to ensure their policy continues to work.

ECB (BBG): There’s a growing need for the European Central Bank to rethink how soon it starts shrinking the €1.7 trillion ($1.8 trillion) stash of bonds it bought during the pandemic — or risk disorienting markets down the line.

ECB (POLITICO): The European Central Bank is set to end a year-long sequence of interest rates hikes this Thursday and usher in a policy pause that is expected to stretch well into next year.

U.S.

US/IRAN (RTRS): The White House on Monday said Iran was in some cases "actively facilitating" rocket and drone attacks by Iranian-backed proxy groups on U.S. military bases in Iraq and Syria, and President Biden has directed the Department of Defense to brace for more and respond appropriately.

US/CHINA (RTRS): China's top diplomat Wang Yi will travel to the United States later this week, senior Biden administration officials said on Monday, in a long-anticipated visit that comes amid soaring tensions in the Middle East, which U.S. officials hope Beijing can help contain.

US/CHINA (RTRS): Officials from the United States and China on Monday held a two-hour long virtual meeting to discuss domestic and global macroeconomic developments, the U.S. Treasury Department said, calling the meeting "productive and substantive".

OTHER

JAPAN (BBG): Japanese salaries in August rose a revised 0.8 percent from a year earlier, according to data from the Ministry of Health, Labor and Welfare. Regular wages rose a revised 1.3 percent.

JAPAN (BBG): The Bank of Japan announced yet another unscheduled bond-purchase operation to curb rising sovereign yields as traders challenge its resolve ahead of a policy decision next week.

JAPAN (RTRS): Japan's factory activity shrank for a fifth straight month in October while the service sector saw its weakest growth this year, a survey showed on Tuesday, amid growing uncertainty over the outlook for the world's third-largest economy.

BITCOIN (BBG): Bitcoin extended a rally fueled by expectations of fresh demand from exchange-traded funds, reaching the highest price since May last year.

CHINA

EQUITIES (SECURITIES DAILY/BBG): Some Chinese state-owned enterprises are trying to boost their listed units’ share prices via buybacks or other measures, a move that can lift investor confidence, the Securities Daily said in a report that cited exchange filings and analysts.

EQUITIES (SECURITIES DAILY/BBG): Further careful research is needed on whether China should introduce a stabilization fund to shore up its stock market, Securities Daily reports, citing Gui Haoming, an analyst at Shenwan Hongyuan Securities

GOVERNMENT (SCMP/BBG): Liu He, retired vice-premier and a trusted aide to Chinese President Xi Jinping, has retained his position as office director for a key economic policy making body, South China Morning Post reports, citing unidentified people.

SOCIAL SECURITY (YICAI): China will optimise its social security system through better classifying and monitoring of low income groups according to their needs, so the achievement of reform and opening can benefit those in poverty, a State Council policy document said.

COMMODITIES (BBG): China continues to churn out record quantities of copper, indicating that demand in the biggest consumer of the metal remains resilient despite falling prices.

CHINA MARKETS

MNI: PBOC Injects Net CNY522 Bln Via OMO Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY593 billion via 7-day reverse repo on Tuesday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY522 billion after offsetting the maturity of CNY71 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8452% at 09:24 am local time from the close of 2.0040% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 60 on Monday, compared with the close of 54 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1786 Tuesday vs 7.1792 Monday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1786 on Tuesday, compared with 7.1792 set on Monday. The fixing was estimated at 7.3007 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA SEP PPI Y/Y 1.3%; PRIOR 1.0%

JAPAN OCT P JIBUN BANK PMI MFG 48.5; PRIOR 48.5

JAPAN OCT P JIBUN BANK PMI SERVICES 51.1; PRIOR 53.8

JAPAN OCT P JIBUN BANK PMI COMPOSITE 49.9; PRIOR 52.1

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 106-13+, -0-02, a 0-06 range has been observed on volume of ~91k.

- Cash tsys sit 1bp cheaper to 1bp richer across the major benchmarks, the curve has twist flattened pivoting on 5s.

- Tsys firmed off session lows alongside regional equities firming and pressure on the USD as risk sentiment improved through the Asian session. However ranges remain narrow with little follow through on moves thus far.

- The recovery came after an early move lower as participants faded yesterday's richening, perhaps using the opportunity to close long positions/add fresh shorts. Several block sellers of TY, 2 clips of 3k, also weighed.

- Flash PMIs from Europe and the UK headline the European session. Further out we have flash S&P Global PMIs, Philly Fed Non-Mfg Index and Richmond Fed Mfg Index. The latest 2-Year Supply is also due.

JGBS: Futures At Session Highs, Curve Twist Flattens

In the Tokyo afternoon session, JGB futures have rebounded to a new intraday high, +27 compared to the settlement levels. The strengthening through to session appeared to reflect both domestic and offshore factors.

- Locally, the BOJ announced an unscheduled bond purchase of ¥300bn worth of 5-to-10-year bonds and ¥100bn of 10-to-25-year JGBs at market prices. After some initial volatility, benchmark yields have moved lower by around 1-2bps across benchmarks.

- There hasn’t been much in the way of domestic data to flag outside of the previously outlined Jibun Bank PMI data. September Department store sales are due later today.

- Assisting the afternoon strengthening in JGBs has been firming in US tsys from session lows. Cash US tsys are 1.5bp cheaper to 1bp richer, with the curve twist-flattening, pivoting on 5s.

- The cash JGB curve has also twist-flattened, pivoting at the 3s, with yields 0.7bp higher to 3.5bps lower. The benchmark 10-year yield is 2.2bps lower at 0.855% versus the cycle high of 0.882% set yesterday.

- The swaps curve has bull-flattened, with rates flat to 2.2bps lower. Swap spreads are wider beyond the 3-year.

- Tomorrow, the local calendar sees Leading and Coincident Indices for August (Final) alongside a Liquidity Enhancement Auction for 15.5-39-year JGBs at 1700 JT.

AUSSIE BONDS: Richer Ahead Of RBA Gov Bullock’s Speech & Q3 CPI Tomorrow

ACGBs (YM +6.0 & XM +9.5) are richer and at Sydney session highs after US tsys pare early Asia-Pac weakness. With the data docket light today, the direction of the local market has been linked to US tsys dealings in today’s Asia-Pac session ahead of RBA Governor Bullock’s speech tonight at CBA’s annual conference (1900 AEDT) and Q3 CPI tomorrow.

- In the wake of yesterday's abrupt turnaround, which pushed down US tsy yields following the 10-year's surge to a fresh cycle high above the 5% threshold, US tsys have exhibited a twist-flattening in today's Asia-Pacific session. Cash US tsys are dealing 1.5bps cheaper to 1bp richer.

- Cash ACGBs are 6-9bps richer, with the AU-US 10-year yield differential 3bps higher at -16bps.

- Swap rates are 5-9bps lower, with the 3s10s curve flatter.

- The bills strip has bull-flattened, with pricing +1 to +7.

- RBA-dated OIS pricing is 2-5bps softer across ’24 meetings, with terminal rate expectations at 4.32% versus 4.36% yesterday. The market has attached a 38% chance of a 25bp hike at the RBA’s November meeting.

- Tomorrow, the local calendar sees Q3 CPI data, with Bloomberg consensus expecting a cooling in the headline and core CPI measures. The Trimmed Mean measure is forecast to fall to 5.0% y/y from 5.9% in Q2.

NZGBS: Closed Richer & At Session Bests After Trade Resumed Following Yesterday’s Holiday

NZGBs closed at the session’s best levels, 2-9bps richer, after yesterday’s holiday. With the domestic calendar empty until Friday’s release of ANZ Consumer Confidence data, local participants have been guided by US tsys.

- In the wake of yesterday's abrupt turnaround, which pushed down US tsy yields following the 10-year's surge to a fresh cycle high above the 5% threshold, US tsys have exhibited a twist-flattening in today's Asia-Pacific session. Cash US tsys are dealing 1.5bps cheaper to 1bp richer.

- The NZGB 10-year closed with a mixed performance versus its $-bloc counterparts. The NZ-US and NZ-AU 10-year yields differentials closed 1bp wider and 4bps narrower respectively.

- Swap rates closed 6-9bps lower, with the 2s10s curve flatter and implied swap spreads slightly narrower.

- RBNZ dated OIS pricing closed flat to 2bps softer across meetings, with terminal OCR expectations at 5.61% versus 5.63% yesterday.

- While the local calendar is empty tomorrow, Australia sees Q3 CPI data.

FOREX: USD Pressured In Asia

The greenback has extended Monday's fall in Asia, BBDXY is down ~0.2% and has fallen below its 20-Day EMA. The move lower in the USD was seen alongside US Tsys and regional equities firming from session lows. Bitcoin dealt at the $35k handle for the first time since Sep 2022 which weighed on the USD at the margins.

- The Aussie is the strongest performer in the G-10 space at the margins. AUD/USD is up ~0.4% last printing at $0.6355/60 and is at its highest level since 18 Oct. Resistance is at $0.6393, high from Oct 18. Tomorrow Australia's Q3 CPI is due.

- Kiwi is ~0.2% higher, last printing at $0.5860/65, bulls look to move through the $0.59 handle to target the 20-Day EMA ($0.5907).

- Yen is a touch firmer, USD/JPY is down ~0.1% and has observed narrow ranges thus far today. Technically bulls remain in the drivers seat, resistance is at ¥150.16, high from Oct 3 and bull trigger. Support comes in at ¥149.16, 20-Day EMA.

- Elsewhere in G-10, EUR and GBP are following the broader USD move and are ~0.1% firmer.

- Flash PMIs from the Eurozone and the UK provide the highlight in todays European session.

EQUITIES: Japan Markets Weighed By Earnings, Mixed Trends Elsewhere

Regional equity markets have been mixed in Asia Pac trade so far for Tuesday. Japan markets have been the weakest performers, but there have been pockets of strength elsewhere. US equity futures have been in positive territory, but gains haven't pushed beyond 0.30%. Eminis were last near 4250.50, +0.20% higher for the session. We remain sub the simple 200-day MA (4258) at this stage.

- Japan's Topix is weaker, but sits above session lows. The index last down around 0.65%, with the Nikkei 225 off by a similar amount. Shares in EV supplier Nidec have fallen sharply, after earnings were weaker than expected.

- Hong Kong markets have returned, and hold in negative territory at the break. The HSI is off around 0.65%. We are away from session lows though (near -1.7% loss at one stage). The properties sub index is down nearly 1%. Evergrande fell sharply in early trade, while there remains concern around a Country Garden default.

- The CSI 300 is around flat at the break. The index is up from earlier lows, with property headwinds being offset to some extent by reports of the country's sovereign wealth fund buying ETFs yesterday. SOEs are also reportedly looking at further share buy backs (see this BBG link).

- Elsewhere, the Kospi and Taiex are only down modestly. The ASX 200 is around flat.

- Indonesian stocks have curbed some recent losses, the JCI up 0.80% so far today. Singapore shares are also higher, but other parts of SEA are weaker.

OIL: Crude Moves Higher Watching Middle East & US Economy

Oil prices are off their intraday highs but are still about 0.7% higher during the APAC session after falling around 2% on Monday. Brent has traded above $90 and made a high of $90.60/bbl earlier after prices fell to $90.18. It is currently $90.44. WTI has spent much of the session above $86 rising to a high of $86.30 before falling to $85.82. It is now around $86.04. The USD index is 0.2% lower.

- Developments in the Middle East remain the main driver of oil markets but US economic news also remains important. This week the data focus is on US preliminary October PMIs and core consumption for September.

- Prices are currently in a holding pattern while the prospects of an Israeli ground offensive seem to be in doubt, especially while negotiations to release hostages continue. War risk has been priced into crude but some of that was taken out yesterday as the conflict hasn’t spread outside Israel/Gaza. Iran is the main risk to global oil shipments.

- API data on US crude/product inventories are published later. Last week saw a drawdown of over 4mn barrels.

- In the US, preliminary October PMIs, Philly Fed non-manufacturing and Richmond Fed indices are released. Also ECB President Lagarde speaks, UK labour market data and European preliminary PMIs are out.

GOLD: Slightly Higher In Asia-Pac After Sliding On Monday Despite Lower Yields & USD

Gold is 0.2% higher in the Asia-Pac session, after closing -0.4% at $1972.85 on Monday.

- There was no discernible boost for bullion from a slide in the USD index in the second half of the session and the large intraday rally in US Treasuries. The US 10-year yield traded in a 19bp range, breaching the 5% mark (5.019%) for the first time since 2007, before finishing 6bps lower at 4.85%. The 2-year finished 3bps richer at 5.05%.

- Bloomberg reported Bill Gross had covered short positions, while Pershing Square fund manager/CEO Bill Ackman tweeted he had covered shorts in US tsys in light of "too much risk in the world to remain short." Additionally, Reuters reported asset manager Vanguard is bullish on longer-dated US tsys after this year’s brutal selloff, betting that the Federal Reserve is at the end of its rate hiking cycle and that the economy will slow next year.

- The decline in yields provided support for equities, while oil declined with gold and the USD.

- Geopolitics remained a focus, but the delay to a much-feared Israel ground assault on Gaza provided some stability to the markets as diplomats tried to prevent a wider regional conflict.

- According to MNI’s technicals team, Friday’s high of $1997.2 marks resistance whilst it remains off support at $1945.3 (Oct 19 low).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/10/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 24/10/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 24/10/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/10/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/10/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0800/1000 |  | EU | ECB Bank Lending Survey (Q3 2023) | |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/10/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 24/10/2023 | 0900/0500 | * |  | US | Business Inventories |

| 24/10/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 24/10/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/10/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/10/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/10/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/10/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 24/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 24/10/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.