-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD Off Recent Highs Ahead Of The FOMC

EXECUTIVE SUMMARY

- FAILED BANK EXECUTIVES. REGULATORS TO TESTIFY BEFORE SENATE PANEL (RTRS)

- NATO IS PLANNING TO OPEN LIAISON OFFICE IN TOKYO: NIKKEI ASIA

- RUSSIA’S OIL EXPORTS SHOW NO SIGN OF OUTPUT CUT (BBG)

- US, ALLIES WEIGH NEW RUSSIA SANCTIONS AHEAD OF G-7 SUMMIT (BBG)

- THE NEXT RBA BOSS COULD BE JENNY WILKINSON (IF SHE WANTS IT) (AFR)

- BoK GOVERNOR SAYS IT’S ‘PREMATURE’ TO TALK ABOUT RATE CUTS (CNBC)

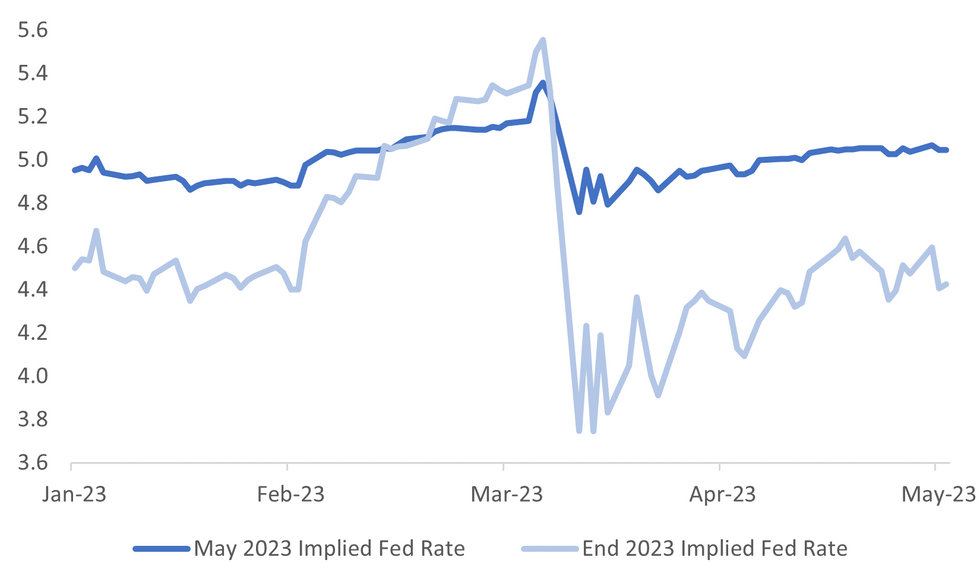

Fig. 1: Market Fed Expectations For May & Year End 2023 (Futures Based)

Source: MNI - Market News/Bloomberg

UK

HOUSING: Britons brave enough to buy a home in the midst of the housing downturn have 66% more properties to choose from compared with a year ago. (BBG)

EUROPE

RUSSIA: Russian President Vladimir Putin was warned he could be arrested if he attends a BRICS summit in South Africa in August. Authorities in the country warned that would be compelled to detain the president following a warrant for his arrest issued in March by the International Criminal Court in The Hague.(CNBC)

RUSSIA: Russia’s oil exports jumped above 4 million barrels a day last week, offering no sign that Moscow has delivered on its threat to cut output, according to tanker-tracking data compiled by Bloomberg. (BBG)

U.S.

GEOPOLITICS: The US, Europe and other key allies of Ukraine are preparing fresh penalties against Russia to try and tighten the net on President Vladimir Putin’s economy more than 14 months into his war, according to people familiar with the matter. (BBG)

FED: Demand for Daikin Applied Americas Inc's climate control equipment is soaring, and worker recruitment is in hyperdrive, with hiring trips to women's shelters and immigrant support groups and an open door for applicants with no high school degree or manufacturing experience. (RTRS)

US/CHINA: U.S. policymakers will study the need for regulations to keep vital artificial intelligence technology out of the hands of America's competitors, in a possible clampdown akin to restrictions on semiconductor exports to China. The Commerce Department will talk with the business community on Wednesday and Thursday about export controls on information technology, asking about such topics as the hardware used by the Chinese military in AI development. (NIKKEI)

BANKS: Famed investor Michael Milken said Tuesday that the current banking crisis stemmed from a classic asset-liability mismatch that has played out miserably time and again in history. (CNBC)

BANKS: The U.S. Senate Banking Committee said on Tuesday it would hear from former top officials at the failed Silicon Valley Bank and Signature Bank, as well as top U.S. banking regulators at separate hearings later this month. (RTRS)

OTHER

JAPAN: NATO to open Japan office, deepening Indo-Pacific engagement. Two sides to upgrade cooperation on cyber, disruptive tech and disinformation. (Nikkei)

SOUTH KOREA: It will be too premature to discuss a Bank of Korea policy pivot now, the central bank’s Governor Rhee Chang-yong says during a live-streamed television interview with CNBC.(BBG)

SOUTH KOREA: South Korea wishes to expand ties with Japan in various areas, including chips and batteries, as well as global issues, such as climate change, the finance minister said Tuesday, as the two countries gear up to normalize economic ties after several years of trade tensions. (yonhap)

SOUTH KOREA: Concerns are growing over China's possible economic retaliation against Korea after President Yoon Suk Yeol's recent remarks on Taiwan elicited angry responses from Beijing, according to sources, Tuesday. (Korea Time)

AUSTRALIA: Jenny Wilkinson is now considered the frontrunner to be the next governor of the Reserve Bank of Australia – if the Canberra-based econocrat is up for taking on the high-profile, Sydney job. (AFR)

NZ: A minister in New Zealand’s Labour government has abruptly quit the party, saying she will contest the upcoming election for the minor Māori party – roiling colleagues who were blindsided by her defection. (GUARDIAN)

INDIA: The Biden administration has decided to remain publicly quiet on India’s democratic backsliding, according to senior US officials, as the US intensifies efforts to keep New Delhi on its side in the rivalry with China. (BBG)

BRAZIL: Brazil President Luiz Inácio Lula da Silva on Tuesday said he’s actively working to help Argentina overcome its financial crisis after meetings with its president, Alberto Fernandez, in Brasilia. (BBG)

CHINA

TRAVEL: China’s big-spending shoppers are back, to the relief of the global luxury industry. But in a pandemic-era shift, they’re doing more of their spending at home, even with mainland borders open again — and the consequences for foreign destinations and brands once reliant on deep Chinese pockets could be dire. (BBG)

OVERNIGHT DATA

NZ Q1 EMPLOYMENT CHANGE Q/Q 0.8%; MEDIAN 0.8%; PRIOR 0.5%

NZ Q1 EMPLOYMENT CHANGE Y/Y 2.5%; MEDIAN 1.8%; PRIOR 1.6%

NZ Q1 UNEMPLOYMENT RATE 3.4%; MEDIAN 3.5%; PRIOR 3.4%

NZ Q1 PARTICIPATION RATE 72.0%; MEDIAN 71.8%; PRIOR 71.7%

NZ Q1 PVT WAGES INC OVERTIME Q/Q 0.9%; MEDIAN 1.1%; PRIOR 1.1%

NZ Q1 PVT WAGES EX OVERTIME Q/Q 0.9%; MEDIAN 1.1%; PRIOR 1.1%

NZ AVERAGE HOURLY EARNINGS Q/Q 2.1%; PRIOR 0.9%

AU APR JUDO BANK FINAL PMI SERVICES 53.7; PRIOR 52.6

AU APR JUDO BANK FINAL PMI COMPOSITE 53.0; PRIOR 52.2

MARKETS

US TSYS: Narrow Ranges In Futures, Cash Closed Until London, FOMC On Tap

TYM3 deals at 115-18+, +0-00+, with a narrow 0-03+ range observed on volume of ~29k.

- Cash tsys were closed due to the observance of a national holiday in Japan and will re-open in the London session.

- The space looked through the New Zealand Q1 employment report, which showed that the labour market remains very tight and isn’t easing, and firmer than forecast Retail Sales from Australia.

- Ranges in TY remained narrow with little follow through on moves.

- FOMC dated OIS price a 22bp hike for today's meeting with a terminal rate of 5.05% in May. There are ~60bps of cuts priced for 2023. The MNI preview of the event is here.

- The FOMC rate decision and Fed Chair Powells press conference provide the highlight today. Before the decision crosses we have ADP Employment, final read of Services PMI and latest ISM Services survey.

AUSSIE BONDS: Richer, Well Off Session Bests Ahead of FOMC Decision

ACGBs sit richer (YM +5.0 & XM +3.5) but off session bests as the local market mulls the RBA’s surprise 25bp hike yesterday, RBA Governor Lowe’s hawkish speech after market and stronger than expected retail sales. However, it's worth noting that liquidity was likely affected today due to cash tsys being closed until the London session, as Japan is observing a national holiday.

- RBA Kohler in her address to CEDA, text released on the RBA website, noted that Australia’s faster-than-expected population growth could have “unanticipated or more pervasive effects” on the economy. The market nudged a little lower on the release.

- Cash ACGBs are 4-6bp richer with the 3/10 curve 2bp steeper. The AU-US 10-year yield differential is +6bp at -1bp, after being -18bp ahead of the RBA decision.

- Swap rates are 3-5bp lower with EFPs 1bp wider.

- The bills strip is flatter with pricing +3 to +8.

- RBA dated OIS has softened by 2-8 basis points across meetings out to Feb'24, partially offsetting the firming yesterday. The market attaches a 14% chance of a 25bp rate hike at the RBA's June meeting, with a cumulative tightening of 10bp expected by August.

- The local calendar is slated to release March trade data tomorrow.

- Ahead of that, all eyes will turn to the FOMC decision later today.

NZGBS: Twist Flattened After Strong Employment Data

NZGBs closed with the cash 2/10 curve twist flattening with the 2-year benchmark ending 5bp weaker, at the session’s cheap, and the 10-year 2bp richer. The local market opened grappling with the dual influences of post-RBA weakness in ACGBs and overnight strength in US tsys following softer data and US regional banks concerns. The local market was initially richer but weakened following the release of strong employment data.

- Q1 labour market data showed that the labour market remained very tight. Employment rose a stronger than expected 0.8% Q/Q to be +2.4% Y/Y after +0.5% and 1.6% in Q4. Unemployment held steady at a 3.4% rate versus expectations of 3.5%. Private sector wages undershot expectations of +1.1% Q/Q with a print of +0.9%.

- Swap rates closed 3bp higher to 4bp lower with the 2s10s curve twist flattening and implied swap spreads narrower.

- RBNZ dated OIS closed 4-7bp firmer across meetings.

- Building consents are slated for release tomorrow.

- All eyes will now turn to the FOMC decision later today with BBG consensus expecting a 25bp increase to 5.25%.

- The NZ Treasury announced that they plan to sell NZ$200mn of the May-26 bond, NZ$150mn of the May-32 bond and NZ$50mn of the May-41 bond tomorrow.

FOREX: USD Pressured In Asia, NZD Outperforms After Employment Data

The kiwi is the strongest performer in the G-10 space at the margins on Wednesday, Q1 labour data showed that the labour market remains very tight and isn’t easing. The greenback is pressured as moves seen in the NY session on Tuesday extended through todays Asian session.

- NZD/USD prints at $0.6235/40, the pair is up ~0.5% today. The 200-Day EMA provided resistance as bulls were unable to break through $0.6249.

- AUD/NZD is pressured, down ~0.4% and is dealing below the $1.07 handle. Bears target year to date lows at $1.0588.

- Yen is firmer, USD/JPY has extended losses through Tuesdays lows and deals a touch above the ¥136 handle after breaching support at ¥136.14 low from 1 May. Bears now target ¥135.13 high from Apr 19 and recent breakout level.

- Elsewhere in G-10 EUR and GBP are both ~0.2% firmer, BBDXY is ~0.2% lower.

- Cross asset wise; e-minis are marginally firmer and 10 Year Us Treasury futures are little changed in Asia.

- The latest FOMC rate decision and Fed Chair Powells press conference provide today's highlights. There is also a slew of US data including ADP Employment, Services PMI and ISM Services.

EQUITIES: Negative Spillover From US Losses Hits Asia Pac Markets

Asia equity markets are down across the board today, following the negative lead from Wall St on Tuesday. Fresh banking concerns have weighed on financial related plays today, although China markets are still closed, while Japan is off for the rest of the week, which has likely dampened liquidity to some extent. US equity futures have crept higher this afternoon, albeit just back into positive territory. This hasn't impacted sentiment much, as the market awaits the Fed decision later.

- The HSI is down 1.75% at this stage. The tech sub index was off by nearly 3% at one stage. Losses have been fairly broad based though. Note the China Golden Dragon Index lost 3.63% in Tuesday US trade. The HS China Enterprises Index is down by 1.91% at this stage.

- In Australia, the S&P200 is off by 1.40%, as local bank stocks are hit from negative US spillover. NZ markets are also off by more than 1%, not buoyed by resilient Q1 employment figures.

- The Kospi is down by over 1.00%, the Kosdaq 1.40%, while the Taeix has fared slightly better, down by 0.50% at this stage.

- In SEA markets are tracking lower, with the commodity sensitive JCI off by over 1%. Other markets are down but losses haven't been larger than 1% at this stage.

OIL: Prices Fail To Rebound, Waiting For The Fed Decision

Oil has failed to take back any of its losses in the APAC session today as it treads water ahead of the Fed decision later. It fell over 5% on Tuesday and today it has been trading sideways. WTI is currently trading around $71.60/bbl between the intraday low of $71.51 and $71.69 and Brent is holding above $75 at about $75.32 between a low of $75.18 and a high of $75.41. The USD index is down 0.2%.

- Russia announced earlier in the year that it was going to reduce output and then extended it when OPEC+ announced its recent production cut. But according to Bloomberg, tanker-tracker data is indicating that Russia’s oil shipments jumped to 4mbd last week from 3mbd the week before. Russian oil earnings have been rising again and the government is planning to restart FX purchases.

- It is generally expected that the Fed will hike rates 25bp today but that it could signal that it is about to pause (see MNI Fed Preview: May 2023).

- Oil has been weighed down by not only the upcoming FOMC decision but also weaker risk appetite, the US debt ceiling impasse and disappointing US job opening data suggesting slower growth plus this week’s bank rescue.

- April US ADP employment is released, which should give some direction for Friday’s employment data. It is expected to rise 148k after 145k last month. There is also the services PMI and non-manufacturing ISM for April. EIA US crude and fuel inventory data also print. The Fed announcement will follow after the data.

GOLD: Holding Above $2000 As US Economic Outlook Softens, Focus On Fed

Gold has held onto Tuesday’s gains during APAC trading on Wednesday and is holding above $2000/oz. It rose 1.7% yesterday on safe haven flows reaching a peak of $2019.44 and is currently trading around $2017.05/oz down off the intraday high of $2019.53, highest since mid-April, ahead of today’s Fed meeting. The USD index is 0.15% lower.

- It is generally expected that the Fed will hike rates 25bp today but that it could signal that it is about to pause (see MNI Fed Preview: May 2023). A dovish statement is likely to support gold prices, as the yellow metal is non-yield bearing and should rally on lower rate expectations and Treasury yields. This week’s gold rally has opened up the bull trigger of $2048.70, the April 13 high.

- Bullion has been boosted by not only the upcoming FOMC decision but also weaker risk appetite, geopolitical tensions, the US debt ceiling impasse and disappointing US job opening data suggesting slower growth plus this week’s bank rescue.

- April US ADP employment is released, which should give some direction for Friday’s employment data. It is expected to rise 148k after 145k last month. There is also the services PMI and non-manufacturing ISM for April. The Fed announcement will follow after the data.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/05/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 03/05/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 03/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 03/05/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 03/05/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/05/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/05/2023 | 1400/1000 | ** |  | US | housing vacancies |

| 03/05/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 03/05/2023 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.