-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD Softness Continues, As UK & US Markets Return

EXECUTIVE SUMMARY

- ATTACKS ON BANK’S INFLATION RECORD ARE TRIPE, SAYS BEN BROADBENT - THE TIMES

- ECB SHOULDN'T EXCLUDE SECOND RATE CUT IN JULY, VILLEROY SAYS - BBG

- JAPAN APRIL SERVICES PPI RISES 2.8% VS. MARCH’S 2.3% - MNI BRIEF

- AUSTRALIAN RETAIL SALES REMAIN TEPID AS HOUSEHOLDS HUNKER DOWN - BBG

- FED'S BOWMAN CONSIDERED WAITING LONGER TO TAPER QT - MNI

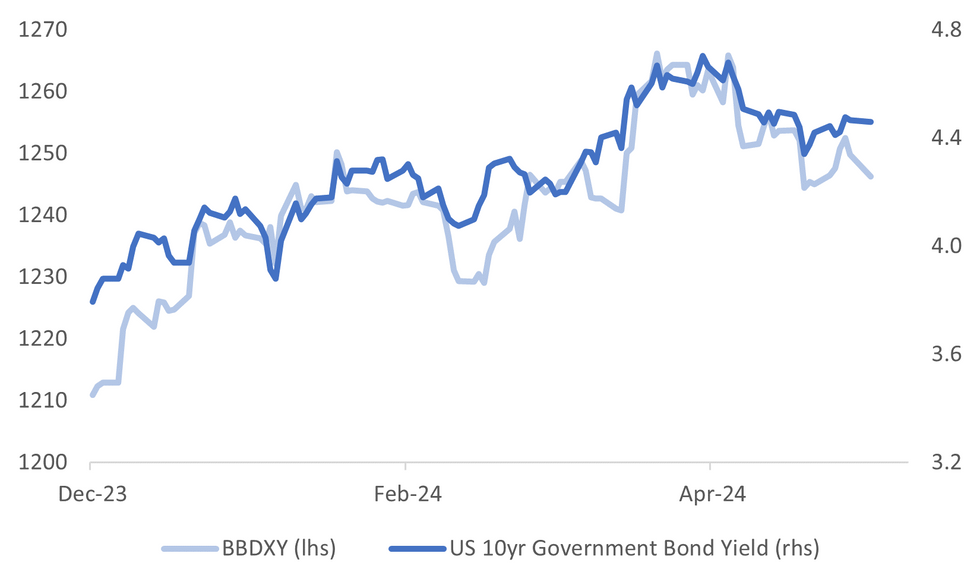

Fig. 1: USD BBDXY Index & Nominal US Tsy 10yr Yield

Source: MNI - Market News/Bloomberg

UK

BOE (THE TIMES): A deputy governor of the Bank of England has hit back at critics, including a former governor, who have accused it of failing to control inflation. Ben Broadbent, who is leaving the Bank next month after 13 years with the institution, said claims that its rate setting monetary policy committee had failed to foresee surging inflation over the past three years because its members shared similar backgrounds were “absolute tripe”.

INFLATION (BBG): Price increases at UK retailers fell in early May to their lowest level in more than two years, adding to signs of an improving economic outlook. The rise in shop prices slowed to 0.6% in the first week of May, its lowest since the end of 2021, the British Retail Consortium said on Tuesday. That was below the category’s three-month average of 0.9% and its advance of 0.8% in the same period last month.

ELECTION (BBC): Sir Keir Starmer has promised voters he will "fight for you" and put "country first, party second". In his first major speech since the general election was called, the Labour leader said he could be trusted because he had "changed this party permanently".

EUROPE

ECB (BBG): The European Central Bank shouldn’t rule out lowering borrowing costs at both its June and July meetings, Governing Council member Francois Villeroy de Galhau said — pushing back against fellow monetary officials who are uncomfortable at the idea of consecutive cuts.

ECB (BBG): The European Central Bank should use quantitative-easing programs primarily in times of crisis as their costs might be more pronounced than other tools in its repertoire, according to Executive Board member Isabel Schnabel.

EU (POLITICO): French President Emmanuel Macron Monday tried to win over German hearts and bring them round to backing his grand plans for Europe. Macron said Europe faced an existential threat, and urged the EU to double its public spending to meet challenges such as the green transition, artificial intelligence and defense.

EU ELECTIONS (POLITICO): Europe’s Socialists have warned Ursula von der Leyen they won’t back her for a second term as European Commission president if she continues to suggest she could work with hard-right MEPs aligned with Italian Prime Minister Giorgia Meloni.

TRADE (DW): The EU could soon follow the US and impose duties on imports of Chinese electric vehicles. That's set off alarm bells among German auto CEOs, who fear reprisals from Beijing.

UKRAINE (BBC): Ukrainian President Volodymyr Zelensky has urged Western leaders to pressure Russia into peace using "all means" necessary. Speaking in Spain, Mr Zelensky said there needed to be "tangible coercion of Russia" , which was seeking to "destroy Ukraine and move on".

UKRAINE (POLITICO): “Spain has been supporting Ukraine for two years. Unfortunately, Russian aggression continues and we have to increase our support,” Spanish Prime Minister Pedro Sánchez said at a joint news conference with Zelenskyy. Spain pledged a package of more than €1 billion in military aid for this year and promised to give €5 billion until 2027, Zelenskyy said.

UKRAINE (RTRS): Russian forces captured two villages in Ukraine, the defence ministry said on Monday. The settlements were Ivanivka in the Kharkiv region and Netailove in Donetsk.

ITALY (BBG): Stellantis NV proposed building two more hybrid vehicles in Italy, part of its efforts to appease local politicians as the Fiat maker eyes moving some production to lower-cost countries.

POLAND (DW): Defense officials in Poland have shared details on a plan to strengthen the country's eastern border. The movement of Russian diplomats in Poland will also be restricted due to accusations of spying and nefarious acts.

ISRAEL (POLITICO): EU foreign ministers have for the first time engaged in a “significant” discussion on sanctioning Israel if it doesn’t comply with international humanitarian law, Irish Foreign Minister Micheál Martin said Monday.

US

FED (MNI): Federal Reserve Governor Michelle Bowman said Tuesday she was one of the few officials who thought it might be appropriate to wait longer before tapering QT or taper more gradually.

FED (MNI BRIEF): The Federal Reserve should say more in its policy statements and explain how risks to its outlook could change the interest rate path, as well as link each policymaker's economic outlook to his or her policy path in the dot plot, Cleveland Fed President Loretta Mester said Tuesday.

OTHER

MIDEAST (BBG): An Egyptian soldier was killed during a clash with Israeli troops at a Gaza border crossing on Monday while an Israeli airstrike on Sunday killed at least 40 Palestinians at a camp for displaced people, further inflaming regional tensions over the Israel-Hamas war.

ASIA PAC (YICAI): China wants to accelerate China-Japan-ROK Free Trade Agreement negotiations and strengthen cooperation in high-end manufacturing, new energy industries, artificial intelligence, and biomedicine, Premier Li Qiang said at the 9th China-Japan-ROK Leaders Meeting in Seoul. Huang Fei, director at the Seoul Graduate School of Science noted the three nations have huge opportunity for industrial and supply-chain synergy beneath end product competition.

JAPAN (MNI POLICY): The BOJ wants to understand how the weak yen is influencing inflation and its impact on small firm wages.

JAPAN (MNI BRIEF): Japan's services producer price index rose 2.8% y/y in April, marking the 38th straight rise and accelerating from March's 2.4%, showing that businesses continue to revise retail prices, preliminary data released by the Bank of Japan on Tuesday showed.

AUSTRALIA (BBG): Australian retail sales almost stagnated in April as higher borrowing costs and still-elevated inflation encouraged households to save more and spend less. Sales advanced 0.1% from the prior month, slower than economists’ estimated 0.2% gain, government data showed Tuesday. The outcome follows a 0.4% decline in March.

AUSTRALIA (DJ): Australian consumer confidence last week recorded its lowest level so far for this year with confidence around the outlook for household finances falling sharply. Consumer confidence decreased to 80.2pts last week, down 1.8 points from the prior week, according to a survey by ANZ Bank and pollster Roy Morgan released Tuesday.

CHINA

HOUSING (SECURITIES DAILY): Shanghai became the first among China’s biggest cities to lower down-payment ratios and the mortgage rate floor for homebuyers on Monday. The down-payment ratios for first- and second-time buyers were lowered to a minimum of 20% and 35%, from the previous 30% and 50%.

HOUSING (CSJ): China’s banks have approved over 900 billion yuan of loans for property developers under a “white list” program promoted by regulators, but the actual amount that has been extended is smaller than that, China Securities Journal said in a report Tuesday, citing bank employees and experts.

REGULATION (XINHUA): China Politburo stressed the need to further strengthen regulation and party leadership in the financial sector in a meeting chaired by President Xi Jinping on Monday, according to Xinhua News Agency.

MARKETS (21ST CENTURY BUSINESS HERALD): Some local securities regulatory bureaus ask listed companies to report the detailed use of raised funds, 21st Century Business Herald reports, citing unidentified people.

TECH (CSJ): China set up a national integrated circuit industry investment fund (phase III) on Friday with registered capital totaling CNY344 billion. The six major state-owned banks including Industrial and Commercial Bank of China and Agricultural Bank of China on Monday also pledged to contribute CNY114 billion, with a shareholding ratio of 33.14%.

CHINA MARKETS

MNI: PBOC Conducts CNY2 Bln Via OMO Tues; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Tuesday, with the rates unchanged at 1.80%. The operation has led to no change to the liquidity after offsetting the CNY2 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8284% at 09:28 am local time from the close of 1.8965% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 53 on Monday, compared with the close of 50 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1101 on Tuesday, compared with 7.1091 set on Monday. The fixing was estimated at 7.2421 by Bloomberg survey today.

MARKET DATA

AUSTRALIA APRIL RETAIL SALES RISE 0.1% M/M; EST. +0.2%; PRIOR -0.4%

NEW ZEALAND APRIL FILLED JOBS RISE 0.1% M/M; PRIOR +0.3%

JAPAN APRIL SERVICES PRODUCER PRICES RISE 2.8% Y/Y; EST. +2.3%; PRIOR 2.4%

SOUTH KOREA APRIL RETAIL SALES +10.8% Y/Y; PRIOR +10.9%

SOUTH KOREA APRIL DISCOUNT STORE SALES FALL 6.7% Y/Y; PRIOR +6.2%

SOUTH KOREA APRIL DEPARTMENT STORE SALES FALL 2% Y/Y; PRIOR +8.9%

MARKETS

US TSYS: Treasury Futures Steady, Fed's Mester & Bowman Speaking In Tokyo

- Treasury futures have traded in tight ranges today, TU is + 00.875 at 101-15+, while TY is + 02+ at 108-25.

- Tsys Flow: Block seller of FV at 105-28

- Cash treasury curve is slightly steeper today with the 2y -1.1bps at 4.935%, while the 10Y is -0.6bp at 4.459%, the 2y10y remains below the trend line and the 200-day EMA, but 1bps higher than recent lows at -47.75bps, vs Dec lows of -56bps

- Across local rate markets: ACGB curve is flatter, yields are 0.5-1.5bps lower, NZGB curve is little changed, yields are about 3bps higher, while JGB curve is slightly steeper, yields are flat to 2bps higher with the 10Y now 1.031%.

- Currently, The Fed's Bowman & Mester, and the ECB's Schnabel are speaking at the BOJ-IMES event in Tokyo

- Today, FHFA House Price Index, Conf. Board Consumer Confidence & Dallas Fed Manf. Activity

JGBS: Another Cycle High For The 10yr JGB Yield, BoJ Speak On Tap Tomorrow.

JGBs fell post the lunchtime break, getting to fresh cycle lows of 143.38. We sit slightly higher now, last at 143.43, -.09 versus settlement levels.

- The 10yr climate bond auction saw a yield slightly higher than the BBG surveyed outcome (1.04%, versus 1.035%), which may have applied some downside pressure post the lunch time break.

- 143.44 is the bear trigger for JGB futures per the MNI technical team. A convincing break sub this level could see 141.65, a Fibonacci projection, targeted.

- In the cash JGB space, we ticked up in terms of the back end of the yield curve. The 10yr holds close to 1.04%, the 30% yr is above 2.19%. The 10yr swap rate is nearing 1.07%.

- News flows has been fairly light, with FinMin Suzuki crossing the wires earlier, with comments on FX and wage growth outpacing inflation the major focus points. Earlier we had stronger than forecast PPI services data for April.

- Tomorrow, we just have the May consumer confidence index on tap. Also note BoJ Board member Kumamoto speaks in the morning.

- The latest from our MNI policy team on the BOJ can be found at this link.

AUSSIE BONDS: ACGBs Little Changed, Retail Sales Miss Estimates

ACGBs (YM +0.0 & XM +0.5) are little changed today as we trade near session lows. the yield curve is slightly flatter this morning. Earlier today, retail sales missed estimates while tomorrow we have Westpac Leading Index.

NZGBS: Slightly Cheaper, Business Confidence Wednesday

NZGBs closed slightly cheaper, with the curve flatter ranges were narrow and yields finish near session highs. There was little in the way of local headlines today, we the market focused on the NZ Budget and US GDP on Thursday.

- The NZGB curve is flatter, the 2Y +3.2bps at 4.909%, 10Y is +2.8bps at 4.800%. While the US-NZ 2Y swap 3bps lower at -24bps, off yearly highs -5.5bps made earlier this month.

- Swap rates are 1-4bps higher

- The RBNZ will implement Debt-to-Income (DTI) restrictions starting July 1, limiting high-DTI lending by banks. The restrictions apply to new residential property loans for both owner-occupiers and investors.

- Filled jobs rose 0.1% m/m in April, vs a revised 0.3% rise in March down from 0.4%. Filled jobs rose to 2.404m from a revised 2.402m

- RBNZ dated OIS pricing is little changed today. A cumulative 20bps of easing is priced by year-end.

- Looking Ahead: ANZ Business Confidence & Activity Outlook On Wednesday

FOREX: USD Remains Softer, Higher Beta FX Outperforming Marginally

The USD BBDXY index sits down around 0.10% in the first part of Tuesday trade, back close to the 1246.4 level. USD weakness has been fairly uniform against the majors, albeit with high beta FX outperforming modestly.

- NZD/USD was the early outperformer but AUD gains have caught up as the session progressed. The AUD/NZD appeared to find some support ahead of the 1.0800 level (now back at 1.0825/30).

- We had Aust, NZ and Japan data, but nothing that shifted the sentiment needle materially. Aust April retail sales were a touch below expectations (up 0.1% m/m), while April PPI services for Japan rose 2.8y/y% (against a 2.3% forecast).

- AUD/USD was last near 0.6670, while NZD/USD is around the 0.6160 level, still a fresh multi month high for the Kiwi back to mid March.

- USD/JPY sits slightly lower, last near 156.70, but well within recent ranges. FinMin Sukuzi was on the wires earlier, with familiar rhetoric around FX markets.

- In the cross asset space, we have had firmer US equity futures (a USD negative), although the regional equity tone is more mixed. US yields sit slightly lower, led by the front end.

- Looking ahead, we currently have Fed’s Bowman and ECB Schnabel headlines (who are speaking in Japan) crossing. Then later Kashkari, Cook and Daly appear. In terms of data, US March house price and May Conference Board consumer confidence data are released.

ASIA STOCKS: China & Hong Kong Equities Mixed, Property Pares Gains

Hong Kong & Chinese equities are mixed today, while ranges have been tight. Property stocks initially opened higher on the back of Shanghai announcing relaxation of lending and down payments although we have since given up those gains on the back of Logan delaying a vote to suspend repayment on some onshore bonds, Citi say's gaming stocks look cheap as they are trading at 9x 1yr forward EV/EBITDA while China has setup a semiconductor funds after the US imposed tariffs on the sector.

- Hong Kong equities are mixed today, property names are now the worst performing sector with the Mainland Property Index down 0.80%, while the HS Property Index is down , while the HS Property Index is down 0.5%, HStech Index is up 0.40%, while the wider HSI is up 0.30%. In China, the CSI300 is down 0.25%, while the small-cap CSI1000 and CSI2000 Indices are both down 0.40%, and the growth focus ChiNext Index is down 0.75%

- MNI China Press Digest May 28: Housing, FTA, Integrated Circuit - (See link)

- in the property space, Logan has postponed the deadline for voting on its proposal to halt repayment on certain yuan bonds. The new deadline is June 3, extended from May 27, to gather more support. The company has already secured backing from creditors for suspending repayments on other bonds. Initially, on May 10, Logan requested bondholders to vote on a plan to suspend payments on all of its onshore public debt for 10 months

- Shanghai has lowered down payment ratios and minimum mortgage thresholds to support its property sector, reducing down payments to 20% for first-time buyers and 30% for second-home buyers. This follows a central government initiative, including a 300 billion yuan funding package, to aid the property market after April saw the steepest home price decline in a decade. The central government has empowered local authorities to adjust down-payment ratios and mortgage rates. In September, Shanghai had already eased the minimum down-payment requirements and mortgage thresholds for certain housing types, as per BBG

- China has established its largest semiconductor investment fund, Big Fund III, with 344 billion yuan to boost its domestic chip industry amidst escalating US restrictions. This fund underscores Beijing's push for technological self-sufficiency, with significant contributions from the central government and state-owned enterprises, as tensions with the US over advanced chip access continue to rise.

- Looking ahead: China PMI on Friday, for Hong Kong we have Trade Balance later today, and Retail Sales of Friday

ASIA PAC STOCKS: Asian Equities Mixed As Markets Seek Direction

Asia markets are mixed today, it has been a very quiet session ranges have been very tight with the US and UK out on Monday as markets look for some direction. Shortly the Fed's Mester and Bowman will speak at a BoJ events, while earlier today Australian Retail sales came in below estimates, Japan April PPI Services was higher than estimates. Taiwan markets are the top performing in the region, as they continue to see the greatest inflows in the region.

- Japanese equities are mostly lower today, the yen is a touch stronger at 156.78 largely on the back of a weaker USD. Earlier we had PPI Services was 2.8% vs 2.3% est, there is little else in the way of economic data today or market headlines. Focus will turn to the BoJ-IMES Conference where Fed speakers are about to speak. The Topix is unchanged while the Nikkei 225 is down 0.15%

- Taiwan equities are slightly higher today, while Taiwan was the only market in the region to see inflows on Monday. This week focus will be on GDP data due out on Thursday. The Taiex continues to make new all time highs, and is up 0.36% today.

- South Korean equities are higher today. We just had store sales data out with department store sales were -2% y/y in Apr, vs a 8.9% rise in March, discount store sales were -6.7% y/y in April, vs a 6.2% rise in March, while retail sales were 10.8% y/y vs 10.9% in March. Equity flows continue to slow, with just $143m of inflows over the past 5 sessions. The Kospi is 0.05% higher today and now trades back above all major moving averages.

- Australian equities are lower today, earlier Retail sales missed estimates coming in at 0.1% vs 0.2% est. Financials and Health care stocks are the worst performing, offsetting gains made in Materials, with the ASX200 down 0.25%

- Elsewhere in SEA, New Zealand equities are down 0.55%, Singapore equities are 0.36% higher, Indonesian equities are 1.15% higher, Malaysian equities are down 0.15%, while the Philippines PSEi is down 0.70%

OIL: Crude Stronger As Commodities Higher & Geopolitical Jitters Resurface

Oil prices are stronger again today rising with most other commodities on a weaker US dollar (USD index -0.1%). Tensions between Israel and Egypt on the Rafah border have supported crude in particular. WTI has approached $79/bbl and is 1.6% higher at $78.92 after an intraday high of $78.95. Brent has held above $83 and is up 0.3% to $83.32, close to the intraday high.

- Geopolitics came into play again with an Egyptian soldier killed in an unusual altercation with Israel on the Gaza border. Israel took control of the Rafah border crossing three weeks ago. An investigation is now taking place. Although geopolitical tensions are never far away, the conflict in Gaza has not disrupted oil flows although Houthi attacks on shipping in the Red Sea have resulted in increased shipping times as vessels go around southern Africa.

- Today the Fed’s Mester & Bowman and ECB’s Schnabel speak from Japan and then later Kashkari, Cook and Daly appear. In terms of data, US March house price and May Conference Board consumer confidence data are released.

GOLD: Holding Monday Gains As USD Weakness Continues

Bullion hasn't spent too much time outside of the $2350/$2355 range so far today, largely tracking sideways. This keeps us reasonably close to Monday session highs ($2358.55) and holding gains seen from that session (+0.73%).

- We last tracked near $2351.4, which is close to the 20-day EMA ($2354). Lows from last week rest near $2325.5. Upside focus will remain on recapturing the $2400 handle.

- Cross asset moves have been supportive in terms of weaker USD backdrop since the start of the week, with the BBDXY down a further 0.15% in the first part of Tuesday trade. US yields also sit off recent highs.

- These moves haven't translated into further gold gains today, but have likely kept dips supported

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/05/2024 | 0800/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 28/05/2024 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 28/05/2024 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 28/05/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/05/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 28/05/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 28/05/2024 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 28/05/2024 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 28/05/2024 | 1355/0955 |  | US | Minneapolis Fed's Neel Kashkari | |

| 28/05/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/05/2024 | 1400/1000 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/05/2024 | 1400/1000 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 28/05/2024 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 28/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/05/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 28/05/2024 | 1700/1300 |  | US | San Francisco Fed's Mary Daly | |

| 28/05/2024 | 1705/1305 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.