-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD & Yields Slip Ahead Of CPI Print

EXECUTIVE SUMMARY

- CRUISE MISSLE FROM YEMEN STRIKES TANKER SHIP - US OFFICIALS - RTRS

- ZELENSKY MAKES PLEA FOR US AID AHEAD OF BIDEN MEETING - BBC

- TUSK WINS VOTE TO BECOME POLAND'S PRIME IN PRO-EU SHIFT - BBG

- JAPAN NOV CGPI RISE SLOWS TO 0.3% VS. OCT 0.9%

- AUSTRALIAN BUSINESS CONFIDENCE DROPS AS CONSUMERS REMAIN GLOOMY - BBG

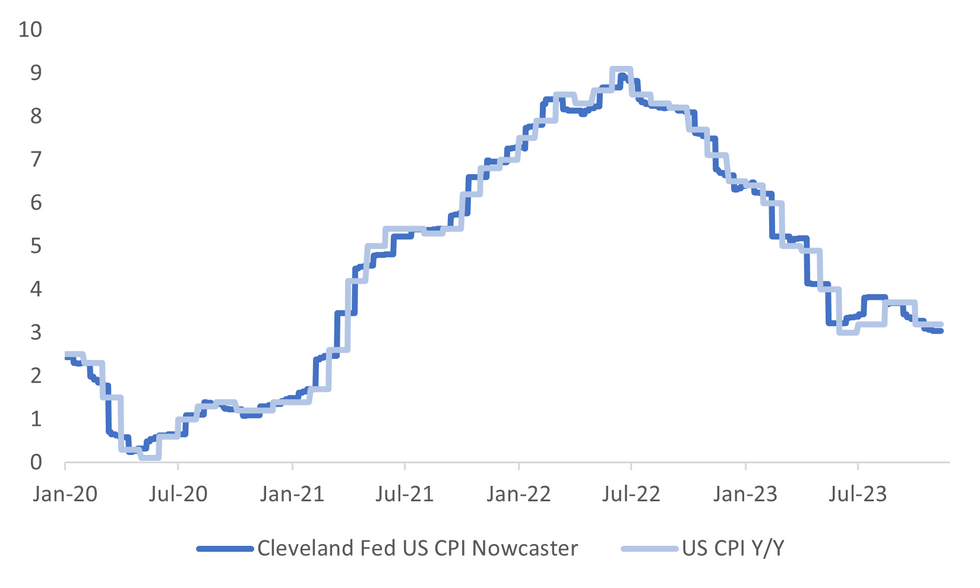

Fig. 1: US CPI Y/Y Versus Cleveland Fed Nowcaster

Source: MNI - Market News/Bloomberg

U.K.

HOUSING (BBC): Rapid rises in the cost of renting have already peaked, according to property portal Zoopla, although tenants will still have to pay more next year. Its latest report into the rental sector suggests rent on new lets was 9.7% higher in October compared with a year earlier, averaging £1,201 a month.

UK/CHINA (BBG): British companies in China are holding off investment decisions because of a gloomy economic outlook and geopolitical uncertainty, according to a recent survey. This pessimism was captured in the first annual survey by the British Chamber of Commerce in China after the country emerged from strict pandemic controls, underscoring the persistent headwinds facing the Chinese economy beyond temporary disruptions caused by Covid-19 curbs.

EUROPE

UKRAINE (BBC): Ukrainian President Volodymyr Zelensky issued an impassioned appeal for continued US military aid as he arrived in Washington on Monday. Addressing military officials, he said Ukraine is not fighting just for its own freedom but for global democracy.

POLAND (BBG): Donald Tusk was appointed to be Poland’s prime minister, kicking off a delayed transfer of power to pro-European Union parties almost two months after they secured a surprise electoral victory.

FRANCE (BBG): France’s economy will avoid a recession thanks to the services sector, according to a central bank survey. Gross domestic product will expand 0.1% in the fourth quarter, after a 0.1% contraction in the previous three months, the Bank of France said on Monday. This is slightly less optimistic than a 0.1% to 0.2% range it gave on Nov. 8.

FRANCE (BBC): A key immigration reform bill supported by French President Emmanuel Macron's government has been defeated. MPs from the far right, far left and moderate right and left voted on Monday to reject the bill.

SWITZERLAND (MNI): The Swiss National Bank will hold key interest rates at 1.75% and leave foreign exchange guidance unchanged this Thursday, with attention focused on the timing of its first rate cut of the cycle next year as the country’s eurozone export markets weaken, two leading Switzerland-based economists told MNI.

U.S.

FED (MNI FED WATCH): The Federal Reserve is expected to keep interest rates on hold for a third straight meeting Wednesday and keep the door open to hiking again next year if progress stalls on getting inflation back to 2%, but anticipation is building for cuts starting as early as spring.

FED (MNI INTERVIEW): The Federal Reserve could begin lowering its policy interest rate once trailing 12-month core inflation falls to about 2.8%, which could come around the middle of next year, a former senior Fed Board researcher told MNI.

INFLATION (MNI): U.S. consumers' expectations for year-ahead price growth fell to their lowest level since April 2021, the Federal Reserve Bank of New York found in its latest survey, and longer-term expectations stayed steady.

MIDEAST (RTRS): A land-based cruise missile launched from Houthi-controlled Yemen has struck a commercial tanker vessel, causing a fire and damage but no casualties, two U.S. defence officials told Reuters on Monday.

POLITICS (RTRS): Donald Trump maintains his dominant position in the 2024 Republican presidential nominating contest, drawing the support of more than half of the party's voters, according to a Reuters/Ipsos opinion poll completed on Monday.

POLITICS (RTRS): The U.S. special counsel prosecuting Donald Trump on federal charges of trying to overturn his 2020 election defeat asked the Supreme Court on Monday to launch a fast-track review of the former president's claim he cannot be tried on those charges.

OTHER

JAPAN (MNI BRIEF): The y/y rise in Japan's corporate goods prices index slowed to 0.3% in November from October's revised 0.9% for the 11th straight deceleration, showing that prices in the upstream continued to fall, Bank of Japan data showed Tuesday.

AUSTRALIA (BBG): Australia says China lifted a ban on three of the nation’s meat exporters as relations between the trading partners continues to improve.

AUSTRALIA (BBG): Australia’s business confidence plunged to an 11-year low while consumer sentiment held in pessimistic territory, suggesting the Reserve Bank’s interest-rate increases are now beginning to drag on corporates.

NEW ZEALAND (BBG): New Zealand’s inflow of migrants climbed to a fresh record high, extending further into “unsustainable” territory and giving the central bank more cause to ponder whether another interest-rate increase is needed.

CHINA

ECONOMY (RTRS): President Xi Jinping and other top leaders have started the annual Central Economic Work Conference to discuss China’s 2024 growth target and plans, Reuters reported, citing unidentified people familiar with the matter.

ECONOMY (YICAI): Consumption will drive economic growth in Q4 with economists predicting a 12.1% y/y increase in total retail sales for November, according to Yicai. The news outlet expects November industrial production to slow from the previous month, but grow 5% y/y due to low base effects.

POLICY (CSJ/BBG): Politburo’s emphasis on “flexible, appropriate, targeted and effective” monetary policy means cuts in interest rates and required reserve ratio are likely to be introduced in a timely manner, while structural monetary policy tools are expected to continue, China Securities Journal reports, citing experts.

MARKETS (CSJ/BBG): Securities and fund businesses wholly owned by foreign companies in China could facilitate competition and inject vitality into the domestic market, China Securities Journal reports Tuesday, citing industry insiders.

PORK PRICES (YICAI): Pork prices will rise slightly in the short term after failing to increase during peak season as demand has not met supply, according to a report from CITIC Securities. Researchers at China Post Securities expect a limited pork-price rebound before the spring festival, but the industry will experience improved capacity balance in 2024 on a month-on-month basis.

CHINA MARKETS

MNI: PBOC Injects Net CNY204 Bln Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY414 billion via 7-day reverse repo on Tuesday, with the rate unchanged at 1.80%. The operation has led to a net injection of CNY204 billion after offsetting the maturity of CNY210 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:23 am local time from the close of 1.8983% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 48 on Monday, compared with the close of 53 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Higher At 7.1174 Tuesday vs 7.1163 Monday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1174 on Tuesday, compared with 7.1163 set on Monday. The fixing was estimated at 7.1762 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND NOV CARD SPENDING RETAIL M/M 1.6%; PRIOR -0.6%

NEW ZEALAND NOV CARD SPENDING TOTAL M/M 0.8%; PRIOR -0.2%

NEW ZEALAND OCT NET MIGRATION SA 7810; PRIOR 10010

AUSTRALIA DEC WESTPAC CONF M/M 2.7%; PRIOR -2.6%

AUSTRALIA DEC WESTPAC CONF INDEX 82.1; PRIOR 79.9

AUSTRALIA NOV NAB BUSINESS CONFIDENCE -9; PRIOR -2

AUSTRALIA NOV NAB BUSINESS CONDITIONS 9; PRIOR 13

JAPAN NOV M/M 0.2%; MEDIAN 0.2%; PRIOR -0.3%

JAPAN NOV Y/Y 0.3%; MEDIAN 0.1%; PRIOR 0.9%

MARKETS

US TSYS: Slightly Richer Ahead Of Tonight's US CPI Data, Post-JGB Auction Spillover

TYH4 is currently trading at 110-15, +0-04+ from NY closing levels.

- Cash tsys are 1-3bps richer across benchmarks after reversing early Asia-Pac session weakness.

- There has been no meaningful newsflow so far in the session.

- Asia-Pac session strength appears tied to spillover from the post-5Y auction rally in JGBs. In contrast to the recent 2-, 10-, and 30-year supply, which experienced challenges in market digestion, today’s outcome stands out.

- Nevertheless, investors are likely to remain close to the sidelines in anticipation of the US inflation data scheduled for later today and the Federal Reserve's decision on Wednesday.

JGBS: Richer After 5Y Supply, US CPI Data Tonight

JGB futures are sharply richer, +22 compared to settlement levels, after today’s 5-year supply sees mixed results. The auction's low price beat dealer expectations but the cover ratio declined relative to the previous month's auction. The tail also lengthened slightly.

- Nonetheless, today’s result stood out relative to recent 2-, 10-, and 30-year supply, which experienced greater challenges in market digestion. However, it's important to note that the result still fell short of presenting a convincingly robust outcome.

- There hasn’t been much in the way of domestic data drivers to flag, outside of the previously outlined Nov PPI data, which came close to expectations. The print is unlikely to shift BOJ thinking ahead of next week's policy meeting.

- US tsys are 1-3bps richer in the Asia-Pac session ahead of tonight's US CPI data.

- The cash JGB curve has twist-flattened, pivoting at the 2s, with yields 1.3bps higher to 2.4bps lower. The benchmark 10-year yield is 1.6bps lower at 0.749% versus the morning high of 0.778%.

- The swap curve is richer, with swap spreads mixed.

- Tomorrow, the local calendar sees the Tankan Mfg and Non-Mfg Indices, along with BOJ Rinban operations covering 1-3-year, 5-10-year, and 25-year+ JGBs.

AUSSIE BONDS: Slightly Richer Ahead Of US CPI Data, JGB Spillover

In futures roll-impacted trading, ACGBs (YM +1.4 & XM +1.8) are slightly stronger after dealing in relatively tight ranges in today’s Sydney session. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Westpac Consumer Sentiment and NAB Business Confidence data.

- RBA Governor Bullock largely discussed payments at the AusPayNet Summit today. That said, when asked about monetary policy she said that the RBA still believes that it can slow the economy enough to return inflation to target while preserving most of the employment gains.

- Afternoon strength appears tied to spillover from the post-5Y auction rally in JGBs. In contrast to the recent 2-, 10-, and 30-year supply, which experienced challenges in market digestion, today’s outcome stands out.

- US tsys are 1-3bps richer in the Asia-Pac session.

- Cash ACGBs are 2bps richer, with the AU-US 10-year yield differential 2bps wider at +11bps.

- Swap rates are 3bp lower.

- The bills strip is slightly richer, with pricing flat to +1.

- RBA-dated OIS pricing is little changed.

- Tomorrow, the local calendar sees CBA Household Spending.

- The Mid-Year Economic and Fiscal Outlook (MYEFO) is also scheduled to be published tomorrow with Treasurer Chalmers giving a press conference in the late morning according to Treasury.

NZGBS: Subdued Session Ahead Of US CPI Data

NZGBs have closed flat to 2bps richer across benchmarks following a relatively uneventful local session.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Total Spending and Net Migration data.

- Given the potential for significant developments in the upcoming days, local investors have opted to stay on the sidelines during today’s session in anticipation of the US inflation data scheduled for later today and the Federal Reserve's decision on Wednesday. This week also sees ECB and BOE policy meetings before the BOJ policy decision next Tuesday.

- The RBNZ’s annual re-weighting of TWI will come into effect on December 13, with the AUD weight rising to 17.7% from 16.5%. The Yuan weight falls to 22.6% from 25.6%, while the USD weight rises to 14.5% from 13.8%.

- Despite the subdued session, swap rates closed at their best levels, with rates 3-4bps lower.

- RBNZ dated OIS pricing is little changed across meetings, with terminal OCR expectations at 5.56%.

- Tomorrow, the local calendar sees REINZ House Sales (Nov), BoP Current Account Balance (Q3) and Food Prices (Nov).

FOREX: USD Slips Ahead Of CPI Print

The dollar sits lower as the US CPI comes into view. The BBDXY off 0.10-0.15% for the session, last near 1242. A slightly softer US Tsy yield backdrop hasn't aided sentiment for the dollar, with NZD, AUD and JPY the top performers against the USD.

- Yen was the early gainer, USD/JPY getting down to 145.54, before stabilizing. The pair last near 145.60/65, +0.35% firmer in yen terms for the session. Lower US yields have helped, but yen strength appeared before such trends emerged, unwinding some gains from Monday's session. On the data front, the PPI continued to slow in y/y terms.

- NZD/USD is outperforming marginally, last near 0.6150 (+0.40%). Earlier data showed a better card spending backdrop, supported by migration flows.

- AUD/USD shrugged off a weaker business sentiment reading from NAB, while consumer sentiment firmed marginally. The pair was last near 0.6590 (+0.35%). Comments from RBA Governor Bullock didn't shed any fresh light on the rate outlook (still very much data dependent).

- Outside of the US CPI print later, note we have the German ZEW out prior, along with UK jobs data.

EQUITIES: Most Major Indices Higher, Mixed Trends in SEA

Major indices in North East Asia are higher, while China headline bourses are flat, although property sub-indices are doing better. Trends are more mixed in South East Asia. US futures sit marginally firmer at this stage, ahead of key US CPI data later. Eminis late near 4680, while Nasdaq futures are outperforming at the margin, last 16469.

- US Tsy yields couldn't sustain early upside, with the back end of the curve around 2bps lower at this stage. This has likely helped equity sentiment at the margin.

- The HSI is up 0.85% at the break, with the tech sub index up +1.65%. China's CSI 300 and Shanghai Composite indices are close to flat at the break, but the break, but property sub indices are notably higher.

- Share buy back announcements are helping the CSI 300, while potentially more fiscal stimulus may be a priority next year as the Central Economic Work Conference meeting is expected to conclude today. This meeting will also focus on 2024 economic targets.

- The Kospi and Taiex are marginally higher, despite a strong lead from the SOX in Monday US Trade. In Japan, the Topix is close to flat, while the Nikkei 225 is +0.30%.

- In SEA, Thailand stocks continue to underperform, down nearly 0.40. We may see fiscal news outlined by the government later. Other markets are either flat or modestly higher at this stage.

OIL: Oil Prices Climb Higher Ahead Of Key Events, US CPI & EIA Report Coming Up

Oil prices have risen for the last 3 trading days and have trended higher again during today’s APAC session. There are a number of key events for the oil market this week including today’s US CPI, Wednesday’s Fed decision and monthly reports from OPEC (Wed), IEA (Thurs) and EIA (today). The USD index is down 0.1%.

- Brent has traded above $76 for most of today’s session and is up 0.3% to $76.24/bbl, close to the intraday high. WTI is also 0.3% higher at $71.54.

- Prices remain well down in December to date as the market has worried that there will be a widening surplus despite OPEC+ planning cuts worth 2.2mbd in Q1 2024. With the focus on supply, the API US inventory data out later today and the EIA report will be monitored closely. The US has seen strong crude output.

- The market is sceptical that OPEC members will adhere to their new quotas but if they do, analysts believe that prices will find some support.

- Later US CPI data for November print and are expected to show a slight easing in headline to 3.1% and core steady at 4% (see MNI US CPI Preview). There are also real earnings and the November budget statement. UK labour and wages data are on the schedule.

GOLD: Unexpectedly Weak On Monday Ahead Of US CPI Data

Gold is slightly stronger in the Asia-Pac session, after closing 1.1% lower at $1981.95 on Monday. Bullion’s weakness came despite limited USD strength and only a small lift in US Treasury yields. Yields initially moved higher on the back of poor US Treasury auctions yesterday but the sell-off was quickly reversed.

- Monday’s downturn precedes the release of today’s US CPI data and the forthcoming FOMC decision on Wednesday. Investors eagerly await the CPI figures, hoping for insights into whether the recent disinflation trend persists, seeking clues about the Federal Reserve's prospective interest rate trajectory for 2024.

- An earlier low of $1976.05 briefly cleared support at $1978.2 (50-day EMA) to open a key support at $1931.7 (Nov 13 low), according to MNI’s technicals team.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/12/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 12/12/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 12/12/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 12/12/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 12/12/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/12/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/12/2023 | - | *** |  | CN | Money Supply |

| 12/12/2023 | - | *** |  | CN | New Loans |

| 12/12/2023 | - | *** |  | CN | Social Financing |

| 12/12/2023 | 1330/0830 | *** |  | US | CPI |

| 12/12/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/12/2023 | 1500/1000 | * |  | US | Services Revenues |

| 12/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/12/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/12/2023 | 1900/1400 | ** |  | US | Treasury Budget |

| 13/12/2023 | 2145/1045 | ** |  | NZ | Current account balance |

| 13/12/2023 | 2350/0850 | *** |  | JP | Tankan |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.