-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Gilt Week Ahead

MNI POLITICAL RISK - Trump Rounds Out Cabinet Nominations

MNI EUROPEAN OPEN: USD/Yields Soften Post CPI, As ECB Comes Into View

EXECUTIVE SUMMARY

- UAW PREPARES TO STRIKE AT DETROIT THREE AUTOMAKERS, REJECTS NEW OFFERS - RTRS

- CHEVRON AUSTRALIA LNG WORKERS SET TO BEGIN TWO-WEEK TOTAL STRIKES - RTRS

- AUSSIE EMPLOYMENT HOLDS AT 3.7%, EMPLOYMENT SOLID - MNI BRIEF

- JAPAN MACHINE ORDERS FALL MOST IN THREE YEARS, CLOUD OUTLOOK - BBG

- UK HOUSING MARKET SLUMP DEEPENS WITH FEWEST SALES SINCE LOCKDOWN - BBG

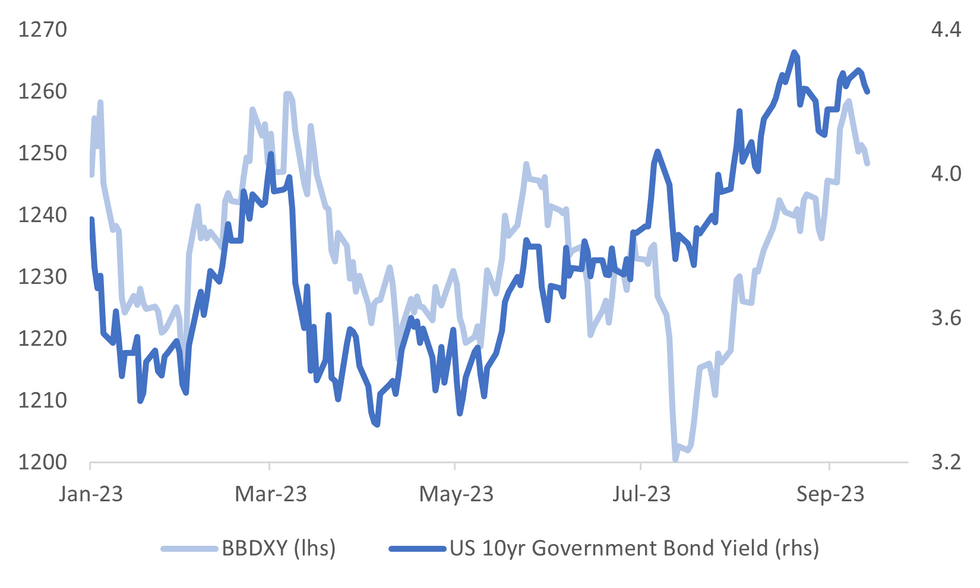

Fig. 1: USD BBDXY & 10-yr Nominal Treasury Yield

Source: MNI - Market News/Bloomberg

U.K.

HOUSE PRICES: Britain’s housing market slowed further in August in the face of high mortgage rates, with sales falling to levels not seen since people were confined to their homes in the early stage of the pandemic, a survey found. The Royal Institution of Chartered Surveyors also said almost every region is now experiencing “relatively steep” falls in house prices, with a key index deeper in negative territory than at any time since 2009 and agents predicting the downturn will worsen in the coming months. (BBG)

EUROPE

EV: If a surge in government support for strategic industries risks fueling a global subsidy war, then the European Union may have just sparked one of its biggest battles. With European officials fearing millions of auto jobs are at risk from China’s surging electric vehicle exports, the bloc’s executive arm on Wednesday launched an investigation into Beijing’s financial support for the EV industry. (BBG)

U.S.

LABOUR: United Auto Workers (UAW) President Shawn Fain said on Wednesday the union is preparing to strike against the Detroit Three automakers, a day before four-year labor deals are set to expire Thursday night. Fain said the Detroit Three automakers had offered pay raises of as much as 20% over four and a half years but called the hikes inadequate. (RTRS)

MARKETS: Chip designer Arm Holdings Plc secured a $54.5 billion valuation in its U.S. initial public offering (IPO) on Wednesday, seven years after its owner SoftBank Group Corp took the company private for $32 billion. The IPO represents a climb-down from the $64 billion valuation at which SoftBank last month acquired the 25% stake it did not already own in the company from the $100 billion Vision Fund it manages. (RTRS)

OTHER

COMMODITIES: Workers at Chevron's two major liquefied natural gas (LNG) projects in Australia are set to begin total strikes for two weeks from Thursday, potentially disrupting output that accounts for more than 5% of global supply. Australia is the world's biggest LNG exporter and its main buyers are in Asia. Traders anticipate any cuts to supplies would intensify competition, with Asian buyers competing with Europe for cargo, spurring spot price volatility in the European gas market. (RTRS)

JAPAN: Japan’s machinery orders fell the most in almost three years in July, clouding the outlook for corporate capital investment. Core machine orders, a leading indicator of capital investment, dropped 13% from a year ago, the Cabinet Office reported Thursday. That was the biggest decline since August 2020, and worse than analysts’ forecast of a 10.3% slump. The orders lost 1.1% in July from the previous month. (BBG)

AUSTRALIA: The Australian unemployment rate remained at 3.7% in Aug., in line with market expectations, while employment jumped by about 65,000, according to data released today by the Australian Bureau of Statistics. Employment growth is typically 32,000 per month, according to Bjorn Jarvis, head of labour statistics at the ABS. “The employment-to-population ratio rose 0.1 pp to 64.5%, around the record high in June," Jarvis said. (MNI BRIEF)

NEW ZEALAND: The RBNZ’s total assets increased for a second month in August led by foreign currency investments and cash balances, according to an update on the central bank website Thursday in Wellington. (BBG)

INDIA: India’s central bank is said to have asked some foreign banks about operational aspects of handling increased custodian flows into the country ahead of JPMorgan’s bond index review, The Economic Times reported. Bond index providers are increasingly tilted in favor of building a large, liquid market as Russia’s exclusion last year has created a gap, the report said, citing people it didn’t identify. (BBG)

SOUTH KOREA: The level of financial imbalance in South Korea has recently shown signs of increasing again as household debt has risen, Bank of Korea says in its monetary credit policy report. Unlike major countries, household debt in South Korea has continued to increase without deleveraging, reaching a level that undermines macroeconomic and financial stability. (BBG)

MEXICO: Mexico’s 2024 draft budget will help Pemex repay debt during 2024, avoiding a default, but won’t address the state oil company’s structural liquidity pressures, Moody’s Investors Service analysts led by Roxana Munoz said in a note. (MOODY’S)

TURKEY: Turkey’s central bank raises the reserve requirement ratio, or the amount of cash lenders have to set aside, for FX-linked deposits maturing in up to 6 months to 25% from 15%, according to a decree published in the Official Gazette. (BBG)

CHINA

HOUSING: Shenzhen, one of China’s biggest cities, has further relaxed homebuying eligibility criteria in the latest series of measures to prop up the local housing market, according to a Caixin report, citing people familiar with the matter. (CAIXIN)

PROPERTY: Moody’s Investors Service has revised the outlook for China’s property sector to negative from stable as weaker economic growth prospects and continued homebuyers’ concerns over project delivery will dampen property sales, according to the agency’s new report. (MOODY'S)

EV: The European economy may suffer as the European Commission wields trade protectionist measures to suppress China’s EV industry, Global Times says in a commentary on its website. (BBG)

TECH: The Chinese government’s position on Apple Inc. only grew more muddled Wednesday, with Beijing both pushing back on reports about iPhone restrictions but also raising concerns about security problems with the device. “China has not issued laws and regulations to ban the purchase of Apple or foreign brands’ phones,” Foreign Ministry spokeswoman Mao Ning told a regular press briefing in Beijing on Wednesday. It marked the government’s first comments on reports that authorities are reining in employees’ use of Apple products. (BBG)

YUAN: The People's Bank of China still has plenty of policy tools to deal with abnormal fluctuations of the yuan, following its recent movement to increase the issuance of central bank bills in Hong Kong to tighten the liquidity of offshore yuan, said Ming Ming, chief economist of CITIC Securities. (Shanghai Securities News)

ETFS: China-focused equity ETFs saw record net inflows of USD20.6 billion in Aug., despite the net selling volume of northbound funds hitting a new high last month. Some long-term investors bought low via ETFs when the A-share market experienced bearish sentiment and the influx of funds all came from listed funds in the Asia-Pacific region. (Yicai)

EQUITIES: Some A-share investors regard the northbound fund flow via the stock connect program as a bellwether of the stock market trend, but it shouldn’t become the sole factor for their investment decision, Economic Daily said in a commentary Thursday. (BBG)

CHINA MARKETS

MNI: PBOC Net Drains CNY220 Bln Thursday via OMO

The People's Bank of China (PBOC) conducted CNY110 billion via 7-day reverse repos on Thursday, with the rates unchanged at 1.80%. The operation has led to a net drain of CNY220 billion after offsetting the maturity of CNY330 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:24 am local time from the close of 1.8884% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 56 on Wednesday, compared with the close of 39 on Tuesday.

PBOC Yuan Parity At 7.1874 Thursday Vs 7.1894 Wednesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1874 on Thursday, compared with 7.1894 set on Wednesday. The fixing was estimated at 7.2754 by Bloomberg survey today.

MARKET DATA

UK AUGUST RICS HOUSE PRICE BALANCE -68%; MEDIAN -55%; PRIOR -55%

JAPAN JULY CORE MACHINE ORDERS M/M -1.1%; MEDIAN -0.8%; PRIOR 2.7%

JAPAN JULY CORE MACHINE ORDERS Y/Y -13.0%; MEDIAN -10.3%; PRIOR -5.8%

JAPAN JULY F IP M/M 1.8%; PRIOR -2.0%

JAPAN JULY F IP Y/Y -2.3%; PRIOR -2.5%

JAPAN JULY CAPACITY UTILIZATION M/M -2.2%; PRIOR 3.8%

AUSTRALIA SEPTEMBER CONSUMER INFLATION EXPECTATION 4.6%; PRIOR 4.9%

AUSTRALIA AUGUST EMPLOYMENT CHANGE 64.9K; MEDIAN 25.0K; PRIOR -1.4K

AUSTRALIA AUGUST FULL TIME EMPLOYMENT CHANGE 2.8K; PRIOR -18.7K

AUSTRALIA AUGUST PART-TIME EMPLOYMENT CHANGE 62.1K; PRIOR 17.3K

AUSTRALIA AUGUST UNEMPLOYMENT RATE 3.7%; MEDIAN 3.7%; PRIOR 3.7%

AUSTRALIA AUGUST PARTICIPATION RATE 67.0%; MEDIAN 66.7%; PRIOR 66.9%

MARKETS

US TSYS: Marginally Richer In Asia

TYZ3 deals at 110-05, +0-04+, a 0-06 range has been observed on volume of ~76k.

- Cash tsys sit 1-2bps richer across the major benchmarks, light bull flattening is apparent.

- Tsys firmed in early trade as local participants digested yesterday CPI print, there was little follow through on the early moves higher and tsys consolidated in a narrow range.

- TYZ3 has breached its post CPI highs, resistance comes in at 110-10, the 20-Day EMA.

- Flow wise a block buyer of TY (2,319 lots) was the highlight.

- In Europe today the latest monetary policy decision by the ECB headlines. Further out we have Initial Jobless Claims, Retail Sales and PPI.

JGBS: Futures Holding In Positive Territory But Off Post-20Y Auction Highs

JGB futures are maintaining a positive stance, +10 compared to settlement levels, albeit slightly off the session's peak reached in the afternoon session. JBZ3 initially gapped higher after the lunch break, hitting a new high for the Tokyo session at 145.75. This upward momentum followed a well-received 20-year bond auction.

- Several factors contributed to the success of this month's 20-year auction, including the near-highest outright yield since January, the steepest 10/20 yield curve since March, and the favourable pricing of the 20-year bonds relative to the 10/20/30-year butterfly.

- Outside of the previously outlined international investment flows and core machine orders data, the local calendar also saw July (F) data for industrial production and capacity utilisation. IP printed -1.8% m/m versus -2.0% prior, while capu showed -2.2% m/m versus +3.8% prior.

- The cash JGB curve has twist-flattened, pivoting at the 3s, with yields 0.4bp higher to 4.0bp lower. The benchmark 10-year yield is 0.6bp lower at 0.707%.

- The 20-year benchmark is 2.4bp lower on the day at 1.425% versus 1.443% prior to the auction results.

- The swaps curve bull flattens, with swap spreads generally wider beyond the 3-year.

- Tomorrow the local calendar is light with the Tertiary Industry Index as the sole release.

AUSSIE BONDS: Richer, At Sydney Session Bests, Despite Employment Beat

ACGBs (YMZ3 +4.0 & XMZ3 +5.5) sit at Sydney session highs despite employment data surpassing expectations (+64.9k jobs versus +25k est.). A contributing factor was the composition of the data that leaned towards the weaker side. Most of the increase in employment was part-time (+62.1k), with the unemployment rate unchanged at 3.7%.

- (AFR) A stronger-than-expected lift in employment has pushed labour force participation to a record high as the jobs market shows continued resilience in the face of high interest rates. (See link)

- ACGB strength was also assisted by US tsys and JGBs, which displayed strength during the Asia-Pac session. US tsys extended their post-CPI gains, resulting in benchmark yields decreasing by 1-2bps. JGBs also exhibited a robust performance, bolstered by a successful 20-year bond auction.

- Cash ACGBs are 4-5bp richer on the day, with the AU-US 10-year yield differential unchanged at -12bp.

- Swap rates are 3-5bp lower on the day, with 3-year EFP wider.

- The bills strip bull flattens, with pricing +1 to +5.

- RBA-dated OIS pricing is flat to 2bp softer across meetings, with terminal rate expectations unchanged at 4.19%.

- Tomorrow the local calendar is empty, with the next release of note being the RBA Minutes for the September meeting on Tuesday.

NZGBS: Closed At Best Levels, Tracking Richening In Global Bonds

NZGBs closed at the session’s best levels, with benchmark yields 2-5bp lower. Given the absence of significant domestic events, local market participants appeared to turn their attention overseas for guidance. US tsys, JGBs and ACGBs all displayed strength during the Asia-Pac session.

- US tsys extended their post-CPI gains, resulting in benchmark yields decreasing by 1-2bps. JGBs also exhibited a robust performance, bolstered by a successful 20-year bond auction.

- Meanwhile, ACGBs strengthened despite employment data surpassing expectations, with a contributing factor being data related to composition that leaned towards the weaker side.

- NZ-US and NZ-AU 10-year yield differentials closed largely unchanged on the day.

- Today’s weekly auction saw mixed results, with the May-31 bond seeing a cover ratio of around 3.00x, while the May-26 and May-41 bonds saw cover of around 2.00x.

- Swap rates are 1-4bp lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed flat to 1bp firmer across meetings, with terminal OCR expectations steady at 5.62%.

- The RBNZ’s total assets increased for a second month in August led by foreign currency investments and cash balances, according to an update on the central bank website. (See link)

- Tomorrow the local calendar sees BusinessNZ Manufacturing PMI for August.

EQUITIES: Mostly Positive Trends Post The US CPI Print

Regional Asia Pac equity market trends are mostly positive, with Hong Kong and China markets the main exceptions. US equity futures are tracking higher in the first part of Thursday trade. This follows modest gains for the S&P and Nasdaq in Wednesday trade post the US CPI print. Eminis are +0.30%, last near 4532, while Nasdaq futures are outperforming, +0.44%.

- Broader risk signals have aided the equity backdrop, with US yields -1 to -2.5bps lower across the curve today. The USD is also generally tracking softer (BBDXY -0.15%).

- In line with the firmer tone to US tech futures, Japan, Taiwan and South Korean markets are all outperforming. The Topix is 0.9%, Taiex +1.1% and Kospi +1.0% (with the Kosdaq outperforming, +1.60%). Offshore investors are modest buyers of South Korean shares (+$33mn).

- China and Hong Kong shares are bucking the broader positive trends. At the break, the HSI is down 0.22%, the CSI 300 off 0.09%. The HSI was +1% firmer in earlier trading. EV names have struggled after the EU opened an investigation into subsides provided by China for the sector.

- The HS mainland properties index is down 1.92%, as Country Garden approaches another bond vote deadline. HS banks are higher though providing some offset.

- In SEA markets are mostly firmer, with Malaysian stocks, down 0.20%, the only negative at this stage.

FOREX: Greenback Marginally Pressured In Asia

The USD has been marginally pressured in Asia, BBDXY has breached post CPI lows, as Asia digests yesterday inflation data from the US.

- The Yen is the strongest performer in the G-10 space; weaker US Tsy Yields have weighed on USD/JPY. The pair sits a touch above the ¥147 handle. Technically the trend condition remains bullish, resistance is at ¥147.87 high from Sep 7 and bull trigger. Support is at ¥145.91, low from Sep

- AUD/USD is firmer, the pair has not yet been able to breach the 20-Day EMA ($0.6445). The August Labor Market Report saw the Unemployment Rate hold steady as expected, there was an increase in the number of jobs and in the participation rate.

- Kiwi is firmer, NZD/USD is up ~0.2%. The pair was unable to sustain a break of the 20-Day EMA ($0.5936) and sits a touch below the measure.

- Elsewhere in G-10; EUR and GBP are both ~0.1% firmer.

- Cross asset wise; e-minis are up ~0.3% and BBDXY is down ~0.2%. 10 Year US Tsy Yields are 2bps lower.

- The latest monetary policy decision from the ECB provides the highlight in Europe.

OIL: Crude Continues Rally On Market Tightness But Overbought

Oil prices have risen further during APAC trading today on the back of the IEA report showing a 1.2mbd deficit in H2 2023. The market has looked through EIA data showing that US crude inventories rose strongly in the latest week. WTI is up 0.5% to $88.95/bbl but has failed to break above $89 with the peak at $88.99. Brent is also 0.5% higher at $92.33 and has traded above $92 throughout the session. The USD index is down 0.2%.

- While JP Morgan and RBC don’t expect prices to reach $100, ANZ said today that they do it will reach this level by year end given that the market is “decidedly tight” over the coming two to three quarters. ANZ expects a deficit of 2mbd in Q4 and that Saudi cuts will be extended into Q1 2024.

- In terms of LNG, Australian unions have said that there has been a “significant escalation” in industrial action at Chevron facilities today but whether to engage in full 24 hour strikes is being decided separately at each of the three facilities impacted. Chevron has said that it will manage the uncertainties the action is creating. Exports are yet to be affected.

- Later today the ECB decision is announced followed by a press conference. It is expected to be a close call (see MNI ECB Preview - September). August US retail sales print and excluding autos & gas are expected to fall slightly. There are also jobless claims, August PPI and July business inventories.

GOLD: Another Decline Despite Lower US Treasury Yields

Gold is little changed in the Asia-Pac session, after seeing further weakness, down -0.3% at $1908.12, on Wednesday. It appeared to be an outsized loss considering US Treasury yields pushed lower after US CPI with only minimal USD strength on balance.

- US tsys bull steepened, with yields 1-5bp lower, as market participants parsed the latest CPI data with details, bolstering the case for a pause at next week’s Fed policy meeting while keeping the door open to an increase in November. FOMC dated OIS was stable, a terminal rate of 5.45% was seen for December with ~50bps of cuts by July 2024.

- Headline CPI rose 3.7% on an annualised basis, up from 3.2% in July and the above consensus forecast of 3.6%. The increase was primarily driven by a 10.6% jump in gasoline prices. On a monthly basis, the core reading of +0.3% m/m was above the +0.2% consensus estimate.

- From a technical standpoint, bullion’s low of $1905.69 took another step closer to support at $1903.9 (Aug 25 low), according to MNI’s technicals team.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/09/2023 | 0600/0800 | *** |  | SE | Inflation Report |

| 14/09/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 14/09/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 14/09/2023 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 14/09/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 14/09/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/09/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 14/09/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 14/09/2023 | 1230/0830 | *** |  | US | PPI |

| 14/09/2023 | 1400/1000 | * |  | US | Business Inventories |

| 14/09/2023 | 1415/1615 |  | EU | ECB's Lagarde speaks at Podcast | |

| 14/09/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/09/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/09/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.